Why do debt reconciliation?

Reconciliation of debts and correction of errors are necessary for internal audit.

The parties are reconciled to identify errors in accounting and recording of transactions. Unfortunately, mechanical errors are inevitable, so reconciliation is needed to control and prevent them. If the data of the organization and the counterparty coincide, it means that the records are being kept correctly. If errors are found, the debt will be adjusted. Reconciliation can also be carried out in the following cases:

- when analyzing mutual settlements to prepare final reports for the year;

- upon completion of mutual settlements and closing of the contract with the supplier;

- in case of mutual offsets in a situation where the organization has concluded several contracts with the contractor, and under such agreements both receivables and payables have been formed;

- when identifying the amount of accumulated receivables or payables, for which it is planned to appeal to the courts for failure to comply with the requirements of the contract;

- in other cases determined by the organization itself.

Application of the document “Debt Adjustment” in 1C: Enterprise Accounting 8

Published 01/11/2018 22:45 Author: Administrator In this article I want to talk about the document “Debt Adjustment” and working with it in the 1C program: Enterprise Accounting 8. First of all, we will consider situations in which it is advisable to use it, and also talk about how to do it correctly. I hope that the article will help you understand the nuances of adjusting mutual settlements with counterparties in 1C and will reduce the number of manual operations in your databases.

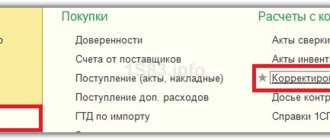

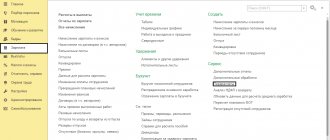

The document is located in the tabs Sales/Purchases - Settlements with counterparties - Debt adjustment.

It is intended for adjusting settlements with counterparties, i.e. if, when creating the SALT for 60, 62 or 76 accounts, we see an incorrect balance, advances not offset by mistake, overdue debt, then we do NOT create a document “Operation entered manually” (about , why this document should be used as little as possible, we described in detail in the article Manual entries - why does 8 “not like them”?, and the document “Debt Adjustment.” Let's look at some situations in more detail: 1) When posting a document, the document was selected incorrect agreement It often happens that when loading a bank statement, generating sales or receipts, the program automatically inserts the “Main Agreement”. If the contract is not chosen correctly, then in the SALT you can see the following picture:

When the period is closed, or it is not possible to change the contract and re-post the documents, you must use the “Debt Adjustment” document. We select the type of operation “Offset of advances”, offset the advance – “Supplier”, against the debt – “Our organization to the supplier”. If confusion with contracts occurred on account 62, then, accordingly, we choose to offset the advance payment - “Buyer”, against the debt - “Buyer to our organization”

Next, we move on to filling out the tabular part. You can use the “Fill in mutual settlement balances” button on both tabs (advances to the supplier/debt to the supplier) or the “Fill in” button located on the top panel of the document. After automatic filling, you need to check the amounts and accounting accounts. If it is necessary to offset part of the amount, we adjust the information on the appropriate tabs manually. After this we get transactions like:

2) Sales to one counterparty, and payment from another. Some companies split their business to carry out economic activities. Some find it convenient for each founder to have their own LLC or individual entrepreneur, while others separate wholesale/retail and types of services provided. Therefore, there are often situations when the shipment occurred to one counterparty, and payment came from another, for example, the account was blocked, there was not enough money, etc. Then in the SALT for invoice 62 you can see the following:

In this case, it is also worth using the “Debt Adjustment” document. Operation type “Other adjustments”. Debtor is our debtor, the counterparty to whom the goods were shipped or services were provided. Creditor - the counterparty who made the payment. To fill out the tabular part, use the “Fill” button and, if necessary, adjust the amounts (if the amount for one type of debt is less than for another, for example, there was a partial payment, then indicate a lower value on each tab).

After the transaction, we will receive the following movements on the accounts:

Sometimes it can be very difficult to choose the correct type of transaction in the “Debt Adjustment” document, but please remember that if you need offset between two counterparties, for example, payment for the sale of one went against the receipt of goods from the other, we paid one counterparty, and the receipt of goods and services came from someone else, then in such situations we select the type of operation “Other adjustments” and carefully indicate the debtor and creditor.

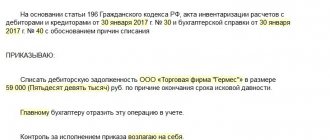

3) Writing off debt Before closing the year, most accountants analyze accounts with counterparties and periodically notice overdue debt. To write off bad debts, we will also use the “Debt Adjustment” document. For example, an overdue debt from a buyer was discovered on account 62.01. We create a document with the type of operation “Write-off of debt”, write off – “Buyer’s debt”, on the buyer’s debt tab we use the button “Fill in mutual settlement balances”, and on the “Write-off account” tab we indicate 91.02 and select subaccount.

After posting the document, the balances on the 62nd account will be closed:

The type of transaction “Write-off of debt” can also be used to write off advances from the buyer, debt and advances to the supplier.

In this article, we examined only some cases of using the “Debt Adjustment” document; we will be happy to answer any questions that arise in the comments.

Author of the article: Natalya Ukhova

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

+1 Elena 11/26/2020 11:39 Good afternoon. Please tell me, if you need to transfer the debt from the CUSTOMS supplier (OTHER contract type) to the contract with SUPPLIER AGENT (type of contract WITH COMMISSIONER AGENT FOR PURCHASE), can this be done by adjusting the debt? I select the type of adjustment, debt transfer, but when automatically filled in using the FILL button, the data is not pulled up...

Quote

+1 Marina Kiseleva 01/12/2020 01:25 Hello! Can anyone tell me what adjustment to make in 1C accounting in this situation: in the 1C population database there was an overpayment of 2 rubles on the subscriber’s personal account. as of 12/01/2019. At the end of December, this amount is written off as payment of the state duty, since this subscriber had previously filed a lawsuit for non-payment of fees. services. How to reflect this in 1C accounting???? ?

Quote

+2 Elena 11.21.2019 19:13 Hello. How can you make an adjustment if the payment is made under one contract, but the documents have been transferred to another? And all THIS is in the past period?

Quote

+4 Olga 09.19.2019 20:56 Hello! I used the document “debt adjustment” in 1C 8.3 ed. 2.0 in a situation where our buyer transferred funds to repay our loan to a third party. The document has been submitted. The wiring was formed correctly. Only the income from the buyer does not appear in the book of income and expenses. Maybe “debt adjustment” is not “suitable” for loan calculations, or do you need to manually adjust the KUDiR records in this case?

Quote

+3 Ekaterina 03/27/2019 00:38 Good afternoon! We sold the goods for 100 rubles to Berezka, but there was no payment for this sale. Afterwards, a tripartite agreement was concluded to transfer Berezok’s debt to another company. How to adjust the debt in 1 C 8.3 Accounting in this case?

Quote

0 Irina 09.26.2018 13:36 Hello. In the 1st quarter of 2018, the buyer was doubled in the directory of counterparties. It turned out that the shipment went through 1 code, and the payment went through another. As a result, I received a debit. and credit debt. An sf written out for an advance with all the ensuing consequences. An error was discovered in the 3rd quarter. Tell me, PLEASE, how to correct it correctly. And what to do with the sf advance. I'm new to 1C.Enterprise 8.3 (8.3.12.1616)

Quote

+1 Inessa 05/29/2018 17:47 Hello! How can the transfer of a counterparty's debt from a contract in foreign currency to a contract in rubles be accomplished? Thank you.

Quote

-2 Maria15 03/07/2018 13:48 Good afternoon, please tell me the postings 1. if our organization owes the buyer? 2. What if the supplier owes us?

Quote

Update list of comments

JComments

When?

The period and timing of the reconciliation are determined only by decision of the parties. The only exception is the reconciliation for the year for final reporting - here the period will be counted either from the start date to the expiration date of the contract, or from the beginning of the calendar year (January 1) to December 31.

As part of mutual settlements between the parties, more than one reconciliation may be carried out. Consequently, periods can follow one another - at the end of the date of the previous reconciliation, the next report is generated. If a debt is identified, it must be taken into account as a debt at the beginning of the next period.

(11) Document formatting option

Example: our debt to “Supplier 2” needs to be transferred to the counterparty “Romashka”, since we will pay the debt to him (Figure 26).

Rice. 26 Document “Debt adjustment” when transferring debt to a counterparty

As a result of the above example, the document “Debt Adjustment” in 1C: Holding Management 8 generates accounting entries (Figure 27).

Rice. 27 Postings when transferring debt to a counterparty

How to register

As a general rule, based on the results of the debt analysis, a reconciliation act for mutual settlements is prepared. There is no unified form of the document, so the parties can use any form or develop their own, enshrining it in the accounting policy.

The report is drawn up for a certain reporting period. The document indicates all transactions of the parties, notes the date of the actions and the amount for each transfer. It is recommended to refer to accompanying and supporting documentation.

After reflecting mutual settlements, the amount of debt resulting from the discrepancy between payments is given. The register is signed by authorized persons from both parties.

Debt write-off

If a situation arises where the debt has not been and will not be paid due to any circumstances, then the debt should be written off. To do this, in the document you should select the counterparty whose debt is to be written off, and indicate all debt obligations in the tabular section. Also, this type of operation can be used not only for buyers, but also for debtors, because not all suppliers return the advances transferred to them when terminating contracts or refusing services.

It is important to pay attention to the fact that after the “Fill”

the tabular part will include all debt obligations, even those that can still be paid, so they should be removed from the list, leaving only those that can be written off.

On the “Write-off account”

, you must specify the account to which the payables or receivables will be written off.

If none of the proposed options suits you, then you can use this type of operation as “Other adjustments”

. The main thing is that after posting the document, create a balance sheet to make sure that the selected operation is correct.

Why make an adjustment?

The adjustment is necessary for the correct reflection in the accounting of all transactions carried out with counterparties. Incorrect accounting entries and inaccurate amounts of mutual settlements can lead to errors in interim and final reporting and incorrect interpretation of information about the current financial condition by external and internal users of financial statements.

The organization can expect more serious consequences (penalties) if such accounting errors lead to incorrect calculations of the tax base, and, consequently, tax payments to the budget themselves.

(13), (14), (15), (16) Document formatting option

All four options for drawing up the document “Debt Adjustments” in 1C: Holding Management (13, 14, 15, 16) are the same, the difference will be that one of the four types of debt is filled out. The difference is also in the income/expense account to which the debt will be written off.

Example: it is necessary to write off the buyer’s debt, since it is recognized as uncollectible (Figure 30, Figure 31).

Rice. 30 Document “Debt adjustment” in 1C - example of filling

Rice. 31 Document “Debt adjustment” in 1C - sample

As a result of the above example, the “Debt Adjustment” document generates accounting entries (Figure 32). The type of operation in this case for debt adjustment is “Debt write-off”.

Rice. 32 Debt write-off in 1C:UH

How to fix

Accounting errors can be corrected. This is stated in PBU 22/2010. The order in which errors are corrected directly depends on whether they are significant or insignificant. Each organization determines the degree of materiality independently, not forgetting to reflect this in its accounting policies. Many organizations consider a significant error to be one that distorts reporting data by more than 5%.

Let's imagine the procedure for correcting errors in the table:

| Date of detection | Correction date | Legislative norm |

| Incorrect information was identified before December 31 of the reporting year | Corrections are made when an inaccuracy is detected | clause 5 PBU 22/2010 |

| Incorrect data detected on or after December 31st of the reporting year | The adjustment is made as of December 31 of the reporting year | clause 6 PBU 22/2010 |

| Minor error detected | Corrected upon discovery | clause 14 PBU 22/2010 |

To correct incorrect information, the accountant must correct erroneous accounting entries, create correct entries and draw up an accounting statement. It indicates the erroneous transaction, the date of its identification and the posting of debt adjustment according to the reconciliation report.

If incorrect accounting data does not affect the financial statements (balance sheet and income statement), then such inaccuracies are not corrected. If inaccuracies affected the indicators of retained and net profit in the final reporting, then the appropriate account corresponds with account 91 in the following order:

- Dt 02 Kt 91 - incorrectly calculated depreciation;

- Dt 91 Kt 02 - correct depreciation charges.

If any other balance values are affected, the erroneous transactions are reversed and the correct entries are made.

(5) Document formatting option

Example: the debt of the buyer “Romashka” under the agreement “Agreement 748” is repaid by our debt to him under the purchase agreement “Supply of components” (Figure 14).

Rice. 14 Debt repayment with the “Debt Adjustment” document

In this example, the “Debt Adjustment” document in 1C:UH is designed in such a way that the “Debt” tab of the buyer (accounts receivable) is filled in automatically with the document “Sales (act, invoice)”, and the “Debt to the buyer (accounts payable)” tab is filled in manually selecting a settlement agreement, filling in the amount to be offset and the settlement account.

As a result of the above example, the document generates accounting entries (Figure 15). Since the settlement document for receivables was not filled out, the “Debt Adjustment” document itself was filled in as a settlement document.

Rice. 15 Postings in 1C:UH

What wiring to use

Let's show it with an example. Let the results of the reconciliation reveal discrepancies in the recorded work in the report. The specialist reflected 10,000.00 rubles, but the work was performed for 15,000.00 rubles. Let's imagine the entries for adjusting data in the table:

| Wiring | Sum | Description |

| Dt 20 Kt 60 | 10 000,00 | Costs of work performed. This entry does not affect the financial result in any way, we do not adjust it |

| Dt 91 Kt 20 | 10 000,00 | Recognition of work costs as expenses. Affects the results of the report, correct the entry |

| Adjustment | ||

| Dt 20 Kt 60 | 10 000,00 | Wrong entry posted |

| Dt 20 Kt 60 | 15 000,00 | The correct transaction amount is indicated |

| Dt 20 Kt 91 | 10 000,00 | Recovery from expenses |

| Dt 91 Kt 20 | 15 000,00 | Accounting for the correct amount of costs for work performed |

(3) Document formatting option

Example: an advance payment to the supplier under the “Primary” agreement needs to cover the debt for the supply of goods (Figure 10).

Rice. 10 Document “Debt Adjustment” - an example of debt closure

As a result of this example, transactions were generated for writing off the advance from the “Primary” agreement against the debt under the “Additional” agreement of the same counterparty “Supplier” (Figure 11).

Rice. 11 Postings for writing off advance payments in 1C:UH

Downward Acquisition Adjustment: Regulatory Regulations

An adjustment invoice issued by the seller to the buyer when the cost of shipped goods (work performed, services rendered), transferred property rights changes downwards (including in the event of a decrease in price (tariff) and (or) a decrease in the quantity (volume) of goods shipped ( work performed, services provided), transferred property rights), is a document that serves as the basis for the seller to accept tax amounts for deduction (clause 1 of Article 169 of the Tax Code of the Russian Federation).

An adjustment invoice is issued no later than 5 calendar days from the date of drawing up documents (additional agreement, other primary document) confirming the consent (fact of notification) of the buyer to change the cost of shipped goods (work, services, property rights) (clause 3 of Article 168 Tax Code of the Russian Federation).

According to paragraph 8 of Article 169 of the Tax Code of the Russian Federation, the form of the adjustment invoice and the procedure for filling it out, as well as the forms and procedure for maintaining purchase books and sales books are established by the Government of the Russian Federation.

The Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax” approved the form of the adjustment invoice and the procedure for filling it out (Appendix No. 2 to the Decree).

Upon receipt from the supplier of an adjustment invoice to reduce the cost of goods, the buyer:

- performs VAT restoration on the difference between tax amounts calculated on the basis of the cost of goods shipped (work performed, services rendered) and transferred property rights before and after such a reduction. VAT restoration is carried out by the buyer in the tax period in which the earliest of the following dates falls: the date of receipt of primary documents for changes in the cost of goods (work, services, property rights) or the date of receipt of an adjustment invoice (clause 4, clause 3, article 170 Tax Code of the Russian Federation);

- records the adjustment invoice in the sales ledger.

At the same time, it should be taken into account that if, until the receipt of the adjustment invoice, the amount of input VAT was not claimed for deduction (i.e., the received invoice for purchased goods (work, services, property rights) was not registered in the purchase book), then the application to deduct the amount of tax taking into account the adjustment made (i.e., registration of the received invoice in the purchase book for the reduced (adjusted) amount of VAT) does not contradict current legislation. Obviously, in this case, the received adjustment invoice for the reduction in value will not be recorded in the sales book.

The Ministry of Finance of Russia recommended using a similar approach to registering invoices to buyers in case of short delivery of goods (letters of the Ministry of Finance of Russia dated May 12, 2012 No. 03-07-09/48, dated February 10, 2012 No. 03-07-09/05).

| 1C:ITS For more information on how a buyer can register invoices when the value of goods is reduced, see the answers from O.S. Duminskaya, Advisor to the State Civil Service of the Russian Federation, 2nd class of the Value Added Tax Department of the Department of Taxation of Legal Entities of the Federal Tax Service of Russia, in the section “Consultations on Legislation”. Note With the indicated answers O.S. Duminskaya (Federal Tax Service of Russia) can be found in the article “The Federal Tax Service used examples to tell how to correctly make entries in the purchase book and the sales book.” |