The presence of a book (or, as it is sometimes called, a journal) for recording strict reporting forms is necessary for those enterprises that accept financial funds from clients without the use of cash register equipment. This document is a kind of accounting register that is used both in government agencies and in commercial sector enterprises.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

Who has the right to work without using a cash register?

The legislation limits the range of organizations that have the right to operate without the use of cash register equipment, but it is still quite wide. In particular, the following can carry out activities without using a cash register:

- individual entrepreneurs,

- enterprises providing services to the population

- companies organizing meals in schools, trading in kiosks, accepting glass containers, selling non-food products at markets, exhibitions, fairs, etc.

If an organization has exercised the right to work without cash register equipment, it must use strict reporting forms.

Book of accounting of strict reporting forms (SSR)

Home / Strict reporting forms

| Table of contents: 1. BSO accounting book form 2. General requirements for the BSO accounting log 3. Instructions for filling out the book | 4. Sample of filling out the BSO accounting book 5. Penalty for lack of a BSO logbook |

The BSO accounting book is used by organizations and individual entrepreneurs that accept cash from the public for services rendered to record the movement of strict reporting forms.

The following information is entered in the book:

- the arrival of a new batch of forms from the printing house;

- issuing BSO to employees making cash payments;

- return of unused forms by responsible persons;

Note: the return of BSO is advisable if the responsible employee will not perform cash transactions in the near future (for example: he goes on vacation or goes on a business trip).

In cases where the department does not have the means to store BSO in accordance with the requirements of regulatory legislation, the return of unused forms is carried out daily at the end of the work shift.

- write-off of BSO.

Note: Blank, unused forms may sometimes be unsuitable for further use. For example: the details of the organization have changed. Such BSO are subject to write-off in accordance with the generally established procedure upon expiration of the storage period.

Information about forms issued to customers and the amounts of money received from customers is not reflected in the accounting book.

There is also no need to indicate information about damaged forms, but if a note about cancellation is made, this is not considered an error.

Download the BSO accounting book form

Download a sample book

BSO accounting book form

Order of the Ministry of Finance dated March 30, 2015 No. 52-approved a unified sample of the BSO accounting book in form 0504045, intended for use in budgetary institutions. However, there is no separate form for commercial organizations and entrepreneurs.

Legal entities and individual entrepreneurs have the right to develop an accounting journal independently. Most often, the above unified form is taken as a basis, which is adjusted by removing unnecessary details and entering additional information that takes into account the specifics of the activity.

In this case, the developed form must contain the following details:

- Document's name;

- Name of the organization (full name of the entrepreneur);

- Date of opening and closing of the magazine;

- Units of measurement and number of accounting objects;

- Positions, full name and signatures of the persons filling out the document.

General requirements for the BSO accounting log

Decree of the Government of the Russian Federation dated May 6, 2008 No. 359 provides for maintaining a BSO accounting book only when using printed forms. Consequently, organizations (IPs) that use automated systems for printing BSO (which switched to online cash registers ahead of schedule) do not issue a magazine.

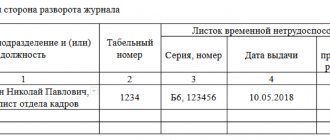

An employee appointed by the manager (IP) by order is responsible for maintaining the book, as well as receiving, storing and issuing strict reporting forms. A liability agreement must be concluded with such an employee.

The journal must be laced, numbered and signed by the head of the organization (IP) and the chief accountant (if there is one). There is no need to have the document certified by the tax authorities.

You can keep the book until you run out of stitched and numbered sheets. It does not need to be updated annually. The validity period, storage period and procedure for filling out the journal must be approved in local regulations.

In this case, the storage period of the document cannot be less than the storage period established for the spines (copies, tear-off parts) of the BSO and damaged forms. Therefore, the journal must be kept for at least 5 years from the date of the last entry.

It is not recommended to make blots or erasures in the accounting book. If corrections need to be made, proceed as follows: erroneous data is carefully crossed out, the correct information is written next to it, and the full name is entered. and signature of the responsible person.

Instructions for filling out the BSO accounting book

Hat shape

1. In the “Establishment” field you need to enter the name of the legal entity or full name. entrepreneur.

2. The name of the structural unit is filled in below. If the subject has no divisions, a dash is added.

3. In the “Conditional price per unit” cell, indicate the conditional cost in the amount of 1.00 rubles. or the actual cost of one form.

4. The following data is written on the right:

- opening date – the start date of journal keeping, which is usually the date of receipt of the BSO batch from the manufacturer;

- closing date – the date of the last entry in the accounting book;

- OKPO code of the organization (IP) based on the notification of Rosstat;

- account number – this field is intended only for organizations (individual entrepreneurs are not required to maintain accounting records) that indicate the off-balance sheet account code 006.

5. Next, write down the name of the strict reporting form: voucher, receipt, outfit, subscription, etc.

6. The form code (BSO code) is indicated on the right.

The code must be filled out only when using unified forms approved by government agencies; in other cases, a dash is added.

Main table

1. In the “Date” block, fill in the day, month and year:

- receipt of forms from the printing house;

- issuing BSO to responsible employees;

- return of unused forms;

- write-off of BSO.

2. In the “Received / Issued” column the following is indicated:

- name of the printing house-manufacturer - upon acceptance of the BSO;

- FULL NAME. the responsible employee conducting cash payments to the public upon receipt/return of BSO;

- FULL NAME. financially responsible person when writing off forms.

3. In the column “Base” the name and details of the document on the basis of which the BSO was accepted, issued, returned or written off were entered (for example: an invoice from the printing house, an act of transfer of the BSO to the responsible person, an act of return of unused forms, an act of write-off of the BSO).

4. The “Receipt” block is filled in based on the result of receipt of forms from the printing house or when returning unused BSO from the financially responsible person.

In this case, you should indicate the total number of forms, as well as the number and series of the first and last BSO (for example: AK 000001 - AK 000100).

5. The “Expense” block is filled in when forms are handed over to responsible employees, as well as when writing off BSO.

In this case, you should indicate the number of submitted forms, the number and series of the first and last BSO, as well as the signatures of the responsible persons.

Note: upon receipt of the BSO from the printing house, the financially responsible person who is responsible for filling out the accounting book signs in the “Signature” column.

6. The “Balance” block indicates the number of BSO that remains in the custody of the financially responsible person, taking into account the issued, returned or written off forms.

7. At the end of each page the total number of BSO received, issued and remaining in safekeeping is reflected.

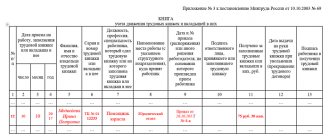

Sample of filling out the BSO accounting book (form 0504045)

Fine for lack of BSO accounting book

For the absence of a BSO accounting book in combination with other gross violations of accounting and storage of documents, resulting in incorrect reflection of income and expenses, business entities may be brought to tax and administrative liability.

The amount of penalties will be:

1. According to Article 11 of the Code of Administrative Offenses of the Russian Federation (only for legal entities):

- from 5,000 to 10,000 rubles. – for an official;

- from 10,000 to 20,000 rub. or disqualification for 1-2 years if the violation is committed by the official again.

2. According to Art. 120 Tax Code of the Russian Federation:

- 10,000 – for violations committed during one tax period;

- 30,000 – for the same acts lasting more than one period.

It should be noted that if the received BSO is received on the basis of an invoice from the printing house and is stored properly, customers are given correctly executed forms, and the proceeds from completed transactions are reflected in a timely manner in the cash book (KUDiR), then there are grounds for holding the organization (IP) liable for the lack of There is no log book.

Did you like the article? Share on social media networks:

- Related Posts

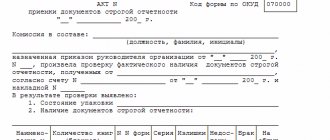

- Certificate of acceptance of strict reporting forms (SSR)

- Act on writing off strict reporting forms (SSR)

- Strict reporting forms (SSR) in 2022

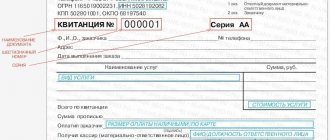

- Sample of a strict reporting form (SSR)

Leave a comment Cancel reply

What are forms and what are they for?

Strict reporting forms mean receipts that certify the receipt of funds from individuals. Each form always has two copies :

- one after filling is given to the client,

- the second remains in the organization.

The forms are relevant only for cash payments; for non-cash transfers, the use of such forms is impossible, as in relations between legal entities.

At their core, forms are an alternative to a cash receipt. At the same time, the use of forms is most interesting for small companies, since they allow them to save money spent on the purchase and maintenance of cash register equipment.

Forms are usually purchased in specialized stores, developed by organizations independently, or printed in printing houses in certain editions. All forms are included in the circulation in a certain chronology, numbered and registered in the accounting book.

How to store the BSO and the Accounting Book

When storing receipts and accounting journals, it is necessary to ensure that the documentation is protected from damage or loss. Only authorized persons have access to such documents. At the end of the working day, the place where the primary documentation is left is sealed and sealed.

For storing the Accounting Book and BSO for individual entrepreneurs, the following is suitable:

- separate office;

- safe.

There is a special procedure for storing used sheets and magazines. In accordance with the law, strict reporting forms are stored for at least 5 years. Consequently, the storage period for the Accounting Book will also be 5 years.

Documents transferred to the archive are stored in special sealed bags. When the 5-year period comes to an end, the papers must be destroyed. First, an act on their write-off is prepared. The document is drawn up in the presence of the appointed commission. After the forms are destroyed, a write-off entry is made in the Accounting Book.

What to put in the book

This document contains all information regarding the forms, including their receipt (purchased or printed) and consumption (used for their intended purpose or damaged, unreliable, written off).

Representatives of some organizations mistakenly believe that information on the receipt and expenditure of funds, including specific amounts, must be entered into the form book. This is wrong.

This includes only data on the movement of forms (receipt at the printing house, registration of printed internal templates, issuance to financially responsible employees, etc.) and their quantity.

And everything related to the money received from their use is entered into another document - a book of income and expenses.

How is BSO accounting kept?

If an entrepreneur uses strict reporting forms in his activities, he should maintain an Accounting Book. It is recommended to use form 0504045, a sample of which was discussed above. If necessary, the entrepreneur can supplement this table with other columns.

You can purchase a ready-made accounting journal at office supply stores. Some people make it themselves. To do this, you need to print out the sheets, number them and sew them into a brochure. The firmware is certified by the entrepreneur’s signature and seal (if any).

Regarding the maintenance of the Accounting Book, the following recommendations are given:

- There should be no blots in the document; fill out the fields carefully.

- Submit all forms accepted by the enterprise. Indicate their quantity, series and number.

- Incorrectly filled out sheets are crossed out and attached to the Accounting Book.

Important! Notes in the Accounting Book can only be made by a designated employee who has signed a liability agreement, or by the entrepreneur himself.

The accounting book is maintained to reflect the number of forms accepted and their transfer to the person working with clients. The amount of payment for services rendered is not reflected in the journal. For this purpose, a separate register of income and expenses is maintained.

Drawing up an accounting book

There is currently no single, mandatory form of book of accounting for strict reporting forms. Organizations have the right to develop it independently or use a unified template previously recommended for use (form 0504045). The second option is good because you don’t need to rack your brains over the structure and content of the book - all the necessary data is already included in it.

Filling out the accounting book and strict reporting forms

- The following are included in the document in order:

- date of book opening and closing (at the right time),

- name of company,

- its OKPO code,

- name of the form (receipt, sales receipt, etc.),

- conditional price per unit in rubles,

- account number through which the funds are transferred,

- form code.

- Next comes the main part, which contains a table of several columns and rows. It includes:

- date of data entry,

- from whom the forms were received or to whom they were issued (name of the organization or full name of the individual),

- the name of the document that served as the basis for their acceptance or issuance.

- Then there are the columns “receipt” and “expense” - information about the forms received by the organization, spent and written off is entered here, and the balance is entered at the end.

- Also, the person who handed over the forms or received them in their hands must put their signature in the book.

How to fill out form 0504045?

A company has the right to develop a template for a journal of strict reporting forms independently, but the recommended form 0504045 is mandatory for budgetary institutions.

It includes all the necessary information and does not require time to create a new document.

Filling out the title page

The title of the journal and the period for filling it out are indicated in the header of the document or on a separate title page. Below is the name of the organization or individual entrepreneur, the department responsible for compiling the book (accounting), and the name of the strict reporting form recorded in the form.

Tabular part

The main part of the journal is presented in the form of a table, which contains the following fields to fill out:

- day, month and year of registration of the form (a separate column is provided for each indicator);

- from whom the form was received and to whom it is issued (printing house, full name of the responsible person);

- name and details of the document that serves as the basis (consignment note, act);

- the number of incoming and outgoing forms, their numbers, series;

- signature of the responsible employee who received the strict reporting form.

The last columns contain the rest of the forms and their details.

The current legislation stipulates the following mandatory standards for book design:

- sheets are numbered and stitched;

- the chief accountant and the head of the company sign each section of the journal;

- The pages are sealed with the company seal.

The book is handwritten and has a thick cover.

As a rule, the document has a limited validity period - a calendar year, a specific tax period. This norm is established by the head of the economic entity. After closing the old period, you need to reopen the book.

Download free sample

BSO accounting books – excel.

filling out BSO accounting – word.