Let us pay attention to one of the key elements of accounting for the activities of an enterprise. Let's look at what cash transactions (CRs) are, what types they are and how to process them. We will provide samples of filling out RKO, PKO and other papers so that you understand how to work correctly.

This is relevant for any economic entity through which cash passes. He is obliged to use online cash register systems, and strictly in accordance with current standards, which are periodically updated.

Important changes to the law

The last of them were carried out on August 19, 2022. This was an editing of the instructions of the Central Bank of the Russian Federation 3210-U dated April 11, 2014. Let's see what they boil down to, as the following table clearly shows:

| Edit item | The essence of innovation |

| P 5.2 is irrelevant | PKO and RKO are filled out again after the corresponding cash transactions, guided by fiscal documents in accordance with paragraph 27 of Article 1.1 of Federal Law No. 54 of May 22, 2003. |

| P 5.1 | When the PQS is compiled electronically, the depositor of funds has the right to also request a receipt - to the email specified by him. |

| P 6.1 | Checking for signatures of all responsible persons is carried out when filling out the form on paper. |

| P 6.2 | The cash recipient must digitally sign if the cash settlement is carried out online. |

| P 6.3 | If the accountable person is acting on an order, there is no need to prepare a separate statement. |

| P 6.3 – loss of validity of paragraph No. 3 | It is permissible to issue an advance even when the previous debt has not yet been repaid. |

The latest revision of guidelines 3210-U has led to a major change in discipline.

How to correctly register a cash receipt order (example)

First, you need to pay attention that the cash receipt order has a 2-component form, since it contains the PKO itself and the receipt. They are drawn up in a general copy of the PKO signed by the chief accountant (accountant, cashier and director) and stored in the accounting department. The receipt is signed in the same way, then registered in the cash book and handed over to the person from whom the cash was received.

Electronic PKOs are signed with electronic signatures, and the accountant can send the receipt to the depositor by email (clause 5.1 of instruction No. 3210-U).

The cashier checks whether there are signatures of authorized persons on the PKO; signatures are checked against samples only if the document is drawn up on paper.

Find out how to create a card with sample signatures for a cashier in ConsultantPlus. Get trial access to the system and upgrade to the Ready Solution for free.

The rules for filling out a cash receipt order are as follows:

- In the “Organization” field, fill in the name of the company or individual entrepreneur.

- “Document number” and “Date of compilation” - number and date, respectively, according to the registration log.

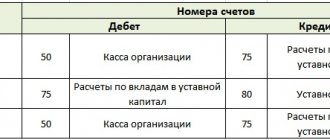

- “Debit - credit” - postings in accordance with the business transaction.

- “Accepted from” - indicate the name of the person from whom the money was received (from the accountant, customer, bank, founder, etc.).

- “Foundation” is the name of the business operation on the basis of which the money was received.

- “Amount” - the amount received is indicated in words.

- “Including” – the amount of VAT (if any).

- “Appendix” - we indicate the documents on the basis of which the money was received: advance report, agreement, etc.

The receipt for the PKO is drawn up by analogy with the cash receipt order.

Read more about the receipt for the PKO in the article “Receipt for the cash receipt order - form, sample” .

Since August 19, 2017, significant changes have occurred in the procedure for conducting cash transactions (directive of the Central Bank of the Russian Federation dated June 19, 2017 No. 4416-U). Regarding PKO, the main innovation is the following: the cashier can draw up a general CO-1 at the end of the day for the entire amount at the cash desk, which is confirmed by fiscal documents (cash receipts and BSO online cash register).

The procedure for planning and conducting cash transactions

Any company must transparently reflect the movement of funds to avoid problems with tax and other inspections. To do this, she just needs to act according to the following scheme:

- Appoint a cashier - a subordinate responsible for receiving and issuing money; Please note, this can only be a full-time employee (and not someone who is employed under a contract) who is familiar with the current rules for conducting KO.

- Set a limit - the maximum amount allowed for storage during the day, not counting the days of payment of salaries, bonuses, benefits; at other times, surpluses must be sent to a checking account.

- Record any transaction - every movement of currency must be supported by paper and recorded in a journal.

- Reflect KO in accounting - all postings are necessary and important, carry them out in accordance with accounting instructions.

- Regularly check compliance with standards - total control will be the best prevention of violations and protection from fines.

Ready-made solutions for all areas

Stores

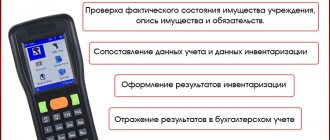

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Unified forms

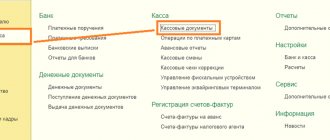

According to Resolution No. 88 of the State Statistics Committee of the Russian Federation dated August 18, 1998, regulating the preparation of documents for cash transactions, these are:

- orders - expenditure and receipt, abbreviated as RKO and PKO;

- book;

- payroll (if payments are made to employees via cash register).

Knowing their details will significantly simplify and speed up the preparation of business papers. There are also optional ones, including:

- meter data log;

- the testimony itself;

- certificates and calculations;

- acts - on the return and transfer of funds, on sending the cash register for repairs, and so on;

- statements about calling technical specialists.

An institution may not use exactly unified forms, but develop its own that meet current standards, but in any case it must fill out the required papers in a timely manner and present them at the request of the inspection authorities.

Features of issuing an order for cash expenditure:

- filled out in one copy

- recorded in a special journal ( form KO-3 )

- orders are numbered, with expenses and receipts having separate numbering

- numbering starts anew from January of each calendar year

As a general rule, conducting cash transactions is the responsibility of the cashier .

This process requires careful attention to the presence of the following items:

- Signature of the chief or ordinary accountant on the letterhead. If these staff positions are not available, the signature of the head of the enterprise is required. The signature must correspond to the sample (it is located at the cashier).

- The coincidence of the amounts entered in the document using numbers and in capital form.

- Providing documents confirming the authority of the person.

Identification of the recipient by the cashier:

- verification of the recipient's identity with the presented passport or other document

- request for a power of attorney allowing you to receive funds

- checking the correctness of the power of attorney

Important! Cash issuance is possible only to the person indicated in the company’s power of attorney or consumables.

Issuing money under a power of attorney from an enterprise requires the cashier to check the following data:

- verification of recipient documents

- reconciliation of his documents with the data specified in the power of attorney (last name, first name, patronymic are subject to verification)

- checking the documents of the person receiving money under a power of attorney

The power of attorney must be attached to the consumable. In the case when a document is issued for receiving not one, but several payments, or is required for presentation in different organizations, a copy is made of it. After this, the cashier assures her in the manner that she was accepted into the individual entrepreneur at the enterprise.

A certified copy of the document is attached to the order. The original is kept by the organization's cashier. At the end of the last operation, the original is applied to the cash register.

When the cashier has given out the money, he is required to sign the order. The electronic document is signed accordingly (this is regulated by clause 6.2 of Directive No. 3210-U). The cashier also signs the consumables.

You are allowed to fill out the consumable by hand or by printing. No corrections are made to the paper order.

An electronic order requires a special signature, this is regulated by the requirements of the Federal Law “On Electronic Signature” No. 63-FZ dated 04/06/2011. Changes can be made to an already issued order before it is signed.

Features of filling out an order

The expense cash order contains the following data:

- Supplier name

- details of the power of attorney with the surname, first name, patronymic, passport details of the representative

Not having all the data is dangerous. The presence of a power of attorney to receive funds without the signature of a cash receipt order by a representative of the supplier does not confirm the fact of receipt of money.

It is prohibited to do the following:

- receive a cash register receipt or a receipt for a receipt order from the supplier’s representative

- indicate the details of these documents in the lines “application”, “ground”

- attach the available documents to the consumables

These actions will not replace the signature of the person receiving the funds on the expenditure order. They do not replace giving the cashier a power of attorney.

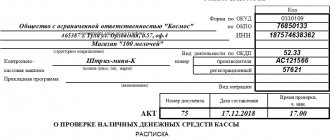

An example of filling out a cash receipt order

Information about the completed order must be entered into the cash book. In column 2, the cashier enters the last name, first name, patronymic of the representative, as well as power of attorney data and the name of the supplier. A note must be made indicating under which agreement, for which goods, and under which invoice the funds were transferred.

Package and rules for preparing cash documents in accounting

Everything that is approved in the already mentioned resolution No. 88 is also included in the All-Russian Classifier OK 011-93. We will look at the nuances below, but first we note that there are certain exceptions for individual entrepreneurs.

Thus, individual entrepreneurs are not required to draw up PKO and RKO - the Tax Code of the Russian Federation clearly states this - but they can fill them out at will, for their convenience. And practice shows that this is worth doing - for better control of the movement of finances within the company. In this case, they should comply with the same standards that are established by the Central Bank of the Russian Federation and are relevant for organizations of other public pension funds.

Now let's take a closer look at specific unified forms.

Cash register (CC) and its types

If incoming and outgoing transactions reflect the movement of funds, then it helps to record and systematize them. According to OKUD, its code is 0310004, it can be maintained in one of two options - below are their features.

Paper

Each sheet of it must be numbered by the chief accountant of the enterprise, and before starting to fill it out. The paper that holds its pages must bear the signatures of the director of the company and the same chief accountant, and in the case of an individual entrepreneur, also the seal of the company.

Electronic

It is important that it not only reflects transactions and the facts of their storage, but is also reliably protected from third-party access and data falsification. Therefore, each entry entered into it must be certified by responsible persons with their digital signatures (EDS).

Registration of cash and cash documents must also be carried out on physical media. Therefore, the head of the company should decide how often to print its sheets. Any interval is allowed, but usually 4 options are used: once a day, a week, a month and, accordingly, a quarter.

The resulting papers are filed in a specially designed folder in order to completely collect the annual QC. This does not have to be done only by individual entrepreneurs, but an individual entrepreneur should still periodically check whether his subordinates put their digital signatures where necessary. These details may not be available only if not a single transaction has been carried out in a day - then you just need to duplicate the previous balance amount.

How to register a CC

The general procedure for conducting it is as follows:

- The cashier enters into it all transactions with cash received on the company’s balance sheet; money received from counterparties is reflected in another document, which is filled out by the contributors themselves. He takes information from PKO and RKO and checks it with them at the end of the working day - to eliminate errors.

- The responsible person confirms the relevance of the information using a regular or digital signature, thereby recording the balance amount.

- The chief accountant or head of the company makes sure that the data matches and endorses this fact with his digital signature.

Both versions of the QC must have numbering, not just the paper version. In the electronic version, pages are counted automatically - they are entered chronologically by the program.

The responsibility for maintaining and preserving the book falls on the shoulders of the chief accountant. If he is temporarily absent - due to vacation, business trip, sick leave or for another reason - this responsibility passes to the director. If he is absent as a staff member, also to the manager.

PKO

Receipt cash transactions include all receipts of cash - this is what this order records, confirming that the responsible person has received the money and reflecting debit processes occurring during the working day. According to OKUD, it has the number 0310001. It must contain 4 required elements:

- Registration number;

- full name of the organization or its branch/department;

- date of creation;

- posting (offset account).

It can be compiled in paper or electronic form, whichever is more convenient. But it must be submitted strictly in its original form - any blots, typos, errors, corrections or adjustments are unacceptable.

RKO

Expenditure cash transactions include all cash debits from the company's balance sheet - this order records them. Its goal is to show the changes and help carry them out legally. According to OKUD, it has the number 0310002.

When issuing cash, the employee is obliged to ask for proof of identity and check the receipt from the buyer, and:

- a person must fill out this paper by hand;

- the amount should be indicated in words, and if it is in kopecks, then enter them in numbers;

- if finances are provided by power of attorney, the full name of the guarantor must be indicated in the RKO.

The details are entered by the responsible person, but only the chief accountant certifies, and the head of the company signs. The required elements of this form are the same as those of the PKO.

Cash book

It is the answer to the question of what documents are used to document cash transactions between subordinates and the senior cashier. The latter leads it, although in a small company its presence is not mandatory. But according to OKUD it has the number 0310005, and it needs to be filled out according to the following simple scheme:

- At the beginning of the day, the authorized person issues a certain amount of finance to his junior employees, which they confirm with signatures.

- At the end of the shift, the leftovers are returned, which is also reflected, but with the details of the person who provided them.

Usually, change is made in special envelopes, on the back of which employees indicate the exact amounts. Responsibility for monitoring and reconciling information lies with the chief accountant, although he has the right to delegate it to someone else, but with the permission of senior management. An individual entrepreneur can solve this problem personally or entrust it to some responsible specialist.

Payroll

Helps simplify documentation and maintenance procedures, accounting for cash transactions. Reflects the following indicators for each staff unit:

- hours worked;

- accruals due to the employee;

- amounts of deductions made.

According to OKUD, it has the number 0310009. It is intended for internal use, therefore it is compiled in a single copy, by the chief accountant. It should give an idea not only of salary, but also of bonuses, allowances, fines, and social benefits.

It is created as follows:

- the total amount is indicated on the title;

- Opposite the full name of those employees who did not manage to receive what they were owed is written o;

- in the final column - the amount of payments already made, for further filling out the cash register;

- a separate line – remaining debts.

Payment statement

Helps to follow the procedure for preparing cash documents and transferring funds to staff. According to OKUD, it has the number 0301011. It is compiled according to the same scheme as the previous one. The chief accountant is responsible for it, and in case of his temporary or permanent absence, the head of the organization. It should be submitted without any blots, errors, inaccuracies or corrections.

Current forms

With the transition to online cash registers, many, but not all, papers were eliminated. Those that remain are convenient, as they are unified and simplify the creation of reports when issuing finance for business trips, purchasing raw materials and other expenses.

RKO sample

Helps reflect costs for any needs.

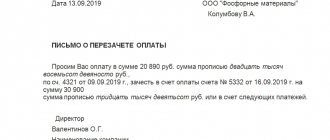

PKO example

Allows you to record receipts – both from the bank or counterparties, and from the company’s employees.

Fiscal documents

They somewhat expand the concept of cash transactions: these are the forms and checks that cash register creates in accordance with the format approved by Federal Law No. 54. These include:

- Reports - on registration and changes in its parameters, on opening and closing of a shift, on the purchase of goods and corrections, on blocking of the FN, on the current status.

- Confirmation from the OFD - it is no longer compiled by control machines, but by the operator himself, with his own technical means.

The working day is divided into shifts, each of which cannot last more than 24 hours (otherwise the details simply will not be entered correctly, which will lead to equipment errors). This is the only restriction imposed by Federal Law No. 54; no others are provided.

Shift closing report

A mandatory document for the standard procedure for cash services for individuals, as it is the basis for registering a PKO, one or more, and recording in the cash register. It provides all the data on receipts for which entries are made regarding full or partial repayment when selling products or services, as well as prepayments.

Decor

Errors and their correction are not allowed in the form. Therefore, if you make a mistake when filling out, you will have to start all over again. Several employees may be involved in entering information into the PKO, depending on the specific regulations established at the enterprise.

MARINE BANK offers to use trade acquiring services. Accept payments for goods and services by bank cards.

This:

- Supervisor. Often in small companies based on individual entrepreneurs, it is he who deals with all the accounting work related to the receipt of funds.

- Chief accountant. In larger organizations, the task of preparing such documentation falls on the shoulders of the chief accountant.

- An accounting employee who has received authority confirmed by a written order from the director. A specialist is involved in cases where the chief accountant is busy or cannot perform his duties for other reasons. Most large organizations use this practice all the time.

After the document is drawn up, a feature of the cash receipt order is that it must be signed by the chief accountant, and in his absence, by the deputy or other authorized accounting employee. And only if none of them is currently able to sign, the manager does this. If he is not present, then the responsibility passes to the cashier. He, in turn, must be competent to draw up the paper, as well as know all the legal aspects that relate to the task at hand.

Use of cash registers in 2022

There are those companies that have the right not to use them. Usually these are organizations located in rural or hard-to-reach areas, selling religious items, providing services in the field of education, sports, physical education, creativity, parking, and public utilities. Their complete list is given in Federal Law No. 54.

Other legal entities are required to connect online cash register systems to conduct business, understand the nuances of preparing primary documents for the cash register, and also:

- respond to requests from the Federal Tax Service within 3 days from the moment they are received in your personal account;

- report that they do not use the cash register and/or have identified a malfunction - within the same period;

- notify about detected violations and about your disagreement with the discrepancies found - during the work shift, no later.

All transmitted data should be confirmed with an enhanced qualified digital signature, making sure that the INFS received it and posted a receipt. Submission on physical media is also possible - it should be sent to the tax office.

What to do if the cash register is faulty

In case of mass failures, it is allowed to carry out sales without using control machines. If after restoration of functionality you create a correction check (CC), no sanctions will be imposed.

When the only device fails, you will have to issue each buyer a paper confirmation of payment, and when the situation normalizes:

- explain to the INFS in writing what happened;

- attach the OC for all transactions performed.

To protect your enterprise from breakdowns, it is permissible to buy a spare CCP.

General organization when conducting cash transactions

Proper discipline is a must. And the Central Bank of the Russian Federation establishes according to what scheme it should be implemented, using instructions No. 3210-U. In accordance with them, you need to consistently pay attention to a number of key points - let's look at them.

Balance limit

Before conducting transactions, you should determine the maximum amount that can be held at the close of the shift. You can set it yourself by selecting the size of the planned currency flows and confirming with an order. For branches and independent divisions, these limits are determined separately, after which the total is calculated.

It is prohibited to collect money in excess of this figure, except when working on holidays (weekends) or on days when salaries, bonuses, and benefits are issued.

Settlement types of cash transactions

Carried out by an authorized employee appointed by order and who knows his job descriptions (must confirm this with a signature). If the volume of tasks is large, there may be several such employees; if the volume of tasks is small, it is permissible for such issues to be resolved by the director of the enterprise, and accounting can be entrusted to outsourcers.

All transactions must be recorded using RKO and PKO, in CC, statements and other mandatory papers approved by Goskomstat and sent for verification both on physical media and in electronic form.

Issuance of small coins

There should be no residue at all at the beginning and end of the shift. Therefore, at the start of the working day, the senior responsible employee draws up a cash settlement for the appropriate amount and passes it through the CC, and at the end - a cash settlement with the return of all unused funds, down to the penny.

Incoming and outgoing cash transactions using an example

There is no doubt that an ordinary citizen can buy a car for cash without much hassle. Let's see if the merchant can also carry out this operation without any problems.

Premiere LLC is engaged in the construction of commercial real estate. Large customers pay non-cash for built offices and shopping centers, while small trade and retail merchants find it more convenient to pay in cash at the company’s cash desk.

When working with cash, it is necessary to comply with the requirements of Law No. 54-FZ on the use of cash registers for cash payments and comply with the Procedure for conducting cash transactions, approved by the Bank of Russia Directive No. 3210-U dated March 11, 2014.

The receipt of proceeds to the cash desk is formalized in the company by a cash receipt order (clauses 4.1–5.3 of instruction No. 3210-U), and the cashier punches a cash receipt (clause 1 of Article 2 of Law No. 54-FZ).

In order for the company's specialists to travel to construction sites, management decided to purchase a passenger car. To save money, they decided that a used car worth 350 thousand rubles, which was urgently put up for sale by one of the company’s contractors, would be suitable for such purposes.

In order not to miss out on a favorable price offer, a purchase and sale agreement was drawn up and the required amount was issued from the company's cash desk to the accountable person. The money was issued at the request of the accountable person - it indicated the amount of cash and the period for which it was issued (clause 6.3 of instruction No. 3210-U). The manager signed and dated the application.

We will talk about the consequences of this cash transaction further.

Several important psychological points for an accountant - in the recording of a rather interesting webinar, take it now

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Limits, spending goals

You already know what applies to cash transactions, but now please note that the proceeds received as a result of them are allowed to be used only for solving the following tasks:

- issuance of salaries and benefits;

- insurance premiums and reimbursements;

- payment for goods (except for securities) and services;

- refund for products or services not received (work not completed);

- transfer of funds to subordinates - against signature;

- sending finance to the bank agent.

In addition, individual entrepreneurs have the right to make expenses for personal needs.

There is a limit for such payments, and it is 100 thousand rubles within the framework of one agreement.

Control and accounting

The preparation and endorsement of all forms of papers is carried out by:

- authorized person;

- chief accountant;

- head of the company.

The first, as the direct executor of the orders of his superiors, must know the signatures and digital signatures of all superiors. He also bears financial responsibility for the money entrusted to him, which he enters into a contract at the time of appointment to the position. At the end of the shift, he is obliged to record the balance, check it with the actual amount, and enter his details.

The chief accountant should know exactly how to process cash transactions, because he will need to monitor the cash register on a daily basis for discrepancies with PKO and RKO, as well as certify advances and make postings, maintain sub-accounts, prepare for an audit, and much more. If there is no such specialist, and the manager does not have the time or skills, it is worth considering the option of outsourcing.

Why do you need a logbook for registration of PKO and RKO

The existing regulation on cash circulation (Law No. 86-FZ dated July 10, 2002) provides uniform rules that are mandatory for both organizations and banks.

According to Art. 34 of this law, the Bank of Russia establishes the procedure for conducting cash transactions by firms that must have a cash desk for receiving and issuing cash. Unused funds should be kept in a bank. When paying in cash for goods and services, the organization receiving the money must use a cash register to record the amount received. At the same time, a cash receipt order (PKO, form KO-1) is drawn up. If the amount received exceeds the cash balance limit, then the excess must be deposited at the bank. To do this, issue a cash receipt order (RKO, form KO-2). PKOs are also issued upon receipt of funds from the bank for the payment of salaries, accountable amounts, and travel expenses. RKOs are issued when money is issued for these purposes to specific employees of the company.

The procedure for conducting cash transactions is stipulated in the instruction of the Central Bank of the Russian Federation dated 03/11/14 No. 3210-U, which came into force on 06/01/2014. According to this instruction, all transactions for issuing or receiving money are recorded in primary documents (PKO and RKO), after which they must be reflected in the registration journal (form KO-3). All these forms are approved by the State Statistics Committee (Resolution No. 88 dated August 18, 1998). You can download the journal form for form KO-3 for free using the link below:

The requirements for primary documents can be found in the article “Primary document: requirements for the form and the consequences of its violation.”

If you have access to ConsultantPlus, check whether you are filling out the PKO and RKO registration log correctly. If you don't have access, get a free trial of online legal access.

Simplified requirements for small businesses and individual entrepreneurs

3210-U provide for certain relaxations in discipline for those individual entrepreneurs who are subject to Federal Law No. 209. They have the right to:

- do not set balance limits;

- do not maintain QC and optional papers;

- do not take into account profits, expenses and other clearly defined financial indicators when taxing.

We have examined in detail the operations being carried out and, as a conclusion, we would like to draw your attention to one point: primary cash receipts and expenditures are reflected in accounting.

This means that it is especially important to make it transparent so that it is as easy to manage as possible. And you will find suitable software for this in the Cleverens catalog: there is Mobile LOGISTICS for managing business processes, Warehouse 15 for automating TSD and other software. Number of impressions: 7822

I was in a hurry and got fined

The issuance of accountable money was formalized by an expenditure cash order (clause 6 of instruction No. 3210-U). Since the contractor's office was located in the same building, the transaction of payment for the car did not take much time for both parties.

However, the joy of both companies was short-lived - the tax inspector who came on the same day fined both companies under clause 1 of Art. 15.1 of the Code of Administrative Offenses of the Russian Federation for cash payments with other companies in excess of the established limit.

Important! In 2021-2022 There is a restriction on cash payments between merchants: no more than 100,000 rubles. under one agreement (clause 6 of the Bank of Russia Directive dated October 7, 2013 No. 3073-U “On cash payments”). For more information about who checks cash discipline and what fines may be imposed, see the material “Cash discipline and responsibility for its violation.”

Both companies were fined because they were liable for exceeding the limit of 100,000 rubles. provided for in Art. 15.1 Code of Administrative Offenses for participants in cash payments, which are both the seller and the buyer.

If companies were not in a hurry to pay in cash and had studied the legislative framework in advance, unforeseen penalties in the amount of 50,000 rubles would have been incurred. for each company and 5,000 rubles. – for their leaders could have been avoided. If the inspector came with an inspection 2 months later, there would be no fine, since a 2-month statute of limitations is established for such a violation (clause 1 of Article 4.5 of the Administrative Code).

If the contractor had not knocked out the cash receipt, the statute of limitations for prosecution for offenses related to the use of CCP would have been 1 year.

ConsultantPlus warns: This period begins to be calculated from the day the offense was committed, and in case of a continuing offense - from the day it was discovered by the inspector (Parts 1, 2 of Article 4.5 of the Code of Administrative Offenses of the Russian Federation). A continuing offense should be understood... Read more about the nuances of the limitation period for fines for cash register transactions in K+, having received a trial demo access to the legal reference system. This can be done for free.