Entitled payments upon dismissal

Upon termination of an employment contract, on the last day of work, the employer is obliged to make payments:

- on wages for hours worked;

- compensation for unused vacation;

- bonuses in accordance with the remuneration system adopted by the enterprise;

- severance pay in case of staff reduction or liquidation of the company;

- benefits due to an employee upon dismissal with a disability;

In case of late payment, compensation is due for each day of delay.

But what to do if the employer does not pay wages upon dismissal? Where to contact?

Before filing complaints with various authorities, you need to try to resolve the misunderstanding peacefully by talking with the employer and asking him to pay off debts on payments. If negotiations are unsuccessful, you should contact the regulatory authorities. Failure to comply with payment deadlines upon dismissal or evasion of payment to an employee entails administrative or criminal liability for the employer.

Financial liability of the employer for delay in payment

In accordance with Art. 236 of the Labor Code of the Russian Federation, the employer’s financial liability lies in the obligation imposed on him by the court to compensate the resigning person for the following amounts:

- Debt on mandatory payments, including, by virtue of Art. 236 of the Labor Code of the Russian Federation, include:

- salary;

payments upon dismissal (severance pay, compensation upon dismissal due to reduction, etc.);

- vacation pay (including compensation for unused vacation), etc.

- Cash compensation (interest on late payments).

According to paragraph 55 of the Supreme Court Resolution No. 2, the claim for the recovery of the amount of payments and compensation is satisfied by the court, regardless of whether the employer is at fault for the delay.

Interesting: as stated in paragraph 55 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2 (hereinafter referred to as the Supreme Court Resolution No. 2), the employee has the right to indexation of salary amounts, since during the delay it gradually depreciates due to inflation.

In practice, this looks, for example, like this: in the case when the Central Bank revokes the license of a bank serving an employer under Part 9 of Art. 20 of the Law “On Banks and Banking Activities” dated December 2, 1990 No. 395-1-FZ, the bank no longer has the right to transfer money based on customer payment orders. If the employer did not react on time and did not ensure that employees received their salaries in another way, then a delay will occur. Formally, the employer is not to blame for the delay in payments, but nevertheless he bears financial responsibility to his employees.

Labor Inspectorate

You need to start with the state labor inspectorate. The purpose of the GIT is to monitor companies’ compliance with the Labor Code and prevent violations of workers’ rights.

You can submit an application to the inspection in person, or through the service located on the inspection website:

- select the “Report a problem” service;

- find the “Salary” category;

- select the item “Salary withheld”;

- select the expected result from the application: conducting an inspection, consultation, holding the employer accountable;

- An application is drawn up on the government services website, the appropriate option is selected and an application is sent to the labor inspectorate.

The response from the labor inspectorate should come in a month.

Step-by-step instructions for appealing an employer's actions are available in Consultant Plus

Get free access to the system for 2 days and solve your questions

Forms of administrative responsibility

The administrative type of employer liability for delay in payment upon dismissal at one's own request is provided for in Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation. Methods of influencing the employer are issuing a warning or imposing a fine. Punishments are applied to the employer provided that there are facts confirming the guilt of the company management in late payments.

The warning must be given in writing. The amount of penalties depends on who is held accountable:

- if the punishment is intended for individual officials, then in a single case of failure to meet deadlines, the fine will be equal to 10,000 - 20,000 rubles; in case of repeated delay, the amount of the penalty increases to 20,000 - 30,000 rubles;

- Individual entrepreneurs are punished with fines in the range of 1,000 – 5,000 rubles. (for systematic offenses fines of 10,000 - 30,000 rubles are assessed);

- in relation to legal entities, a range of penalties is established in the amount of 30,000 - 50,000 rubles. (with their increase to 50,000 - 100,000 rubles in case of repeated delay).

Court

If the employer does not eliminate the violations, after contacting the labor inspectorate, you need to file an application with the court at the location of the organization. The statement of claim is filed within a month after the violation of the employee’s rights.

Copies of the following are attached to the application:

- dismissal order;

- employment contract;

- certificates of accrued and withheld income tax;

- accrued insurance premiums;

- work book.

You will have to write a statement, prepare documents and prove violations of your rights in court. You can hire an experienced lawyer and be prepared to pay for the services.

For more information, see “How to sue your employer.”

Answers to frequently asked questions

Question No. 1: Is an employee entitled to vacation compensation if he has a fixed-term employment contract for 2 months and what will happen to the employer if it is not paid?

Answer: An employee who has worked for less than two months in an organization is not entitled to compensation, therefore, if you have not paid it, no violations have arisen and nothing threatens you

Question No. 2: I am on maternity leave, my organization is being liquidated, what am I entitled to receive under the Law and what will the management expect for non-payment?

Answer: Unfortunately, those on parental leave also do not have benefits during the liquidation of the organization, therefore, if you have vacation days left that you did not take off before going on maternity leave, you should be compensated for it. Management for non-compliance with the law may face financial, administrative and criminal liability, depending on the violations committed, from a fine to suspension from work and imprisonment.

Prosecutor's office

It is also possible to contact the prosecutor's office if the above authorities do not help. To initiate an inspection of the employer, you need to correctly draw up an application, refer to Article 140 of the Labor Code of the Russian Federation, set out the requirements for the employer and attach copies of the documents:

- dismissal order;

- employment history;

- employment contract;

- certificate 2-NDFL.

If violations are detected, the employer may be subject to administrative or criminal liability.

Unfortunately, prosecutorial checks rarely yield positive results, therefore, in the event of a violation of rights, it is recommended to file complaints with all supervisory authorities.

What is the penalty for failure to pay worker compensation?

In case of violation of the employee's rights to receive compensation upon dismissal, the employer may be severely punished under the Law. He faces three types of liability:

- Material

- Administrative

- Criminal

Financial liability is provided for in case of untimely payment of compensation, its amount as a percentage is not less than one three hundredth of the refinancing rate of the CENTRAL BANK for each day of delay, starting from the next day after the delay, unless otherwise provided by the regulatory acts of the organization.

Unofficial employment

Many employers, wanting to reduce tax deductions, do not hire employees, do not draw up employment contracts and pay wages in an envelope. Before agreeing to work under such conditions, the employee must assess all the risks involved. Upon dismissal, the probability of not receiving a full payment is very high, and it will be problematic to prove your work at the enterprise to the authorities.

No income tax is withheld from unofficial payments and no contributions are made to the Pension Fund. The employer bears administrative and criminal liability for such violations. The employee does not earn insurance experience and points for calculating a pension. Some tax authorities even practice the possibility of holding the employee himself accountable for failure to pay personal income tax (but these are rare and strange cases).

You can apply to the appropriate authorities to protect your rights, but it is difficult to predict the reaction of government bodies. It is necessary to collect a large amount of evidence indicating work in the company, but restoring violated rights will be problematic, since it will require:

- attract witnesses;

- prove permission to work; signatures in journals, in primary accounting documents;

- CCTV Cameras.

It will be possible to demand payment of the final payment upon dismissal only after proof of the fact of work at the enterprise.

What are the consequences of such a violation for the employer?

For non-payment of wages upon dismissal, the employer will be held liable under the criminal and administrative legislation of our country. It is necessary for the employee himself to initiate proceedings and an inspection of the enterprise by filing a complaint against the actions of his management to the relevant departments.

Administrative penalty

As a rule, an employer who fails to pay wages on time is subject to administrative liability, which includes penalties in the form of a monetary penalty . The manager or owner of an enterprise of any type will be fined up to 100 thousand rubles. The final fine depends on the type of violation and its scale.

Administrative liability is provided for in Article 5.27 of the Code of Administrative Offenses of the Russian Federation for violations in the field of labor activity. A large enterprise or LLC faces a fine of up to 50 thousand rubles for non-payment of wages. If a violation is detected again, the amount of penalties will increase to one hundred thousand rubles. For individual entrepreneurs, the fine is up to 5 thousand rubles (up to 30 thousand rubles if brought to justice again).

You can read more about the fine for non-payment of wages in a special article prepared by our editors.

The employer, according to Article 3.4 of the Code of Administrative Offenses of the Russian Federation, can get off with a written warning if the delay in wages was not his fault. By the way, the management of the enterprise will receive a fine for its other violations. For example, for non-payment of taxes when refusing official employment to subordinates.

What will happen according to the Criminal Code of the Russian Federation?

More serious measures against an unscrupulous employer are provided for in the Criminal Code of our country. According to Article 145.1 of the Criminal Code of the Russian Federation, non-payment of wages threatens the manager with:

- Deprivation of the right to carry out activities;

- A large fine of up to 500 thousand rubles;

- Arrest for up to 3 years (in some cases the period is five years);

- Correctional work.

A special material has been prepared on the topic of criminal liability for non-payment of wages - we recommend that you read it.

The maximum period of arrest (5 years) is used in practice as a punishment for an employer extremely rarely. The basis for such a harsh court decision is the scale of the defendant’s actions, as well as the serious damage suffered by employees due to lack of wages.

Criminal prosecution under Article 145.1 of the Criminal Code of the Russian Federation arises only if the delay or non-payment of wages upon dismissal of an employee is associated with fraudulent or selfish actions of the employer aimed at obtaining personal gain.

Under the above article , a criminal case will be initiated if the delay in salary payment is two months . In case of partial non-payment of earnings, liability begins after three months. To punish the employer, it is necessary to submit an appeal to law enforcement agencies, which will initiate further inspection and proceedings.

Gray salary for official employment

When getting a job, a person is faced with a situation where, when registering labor relations in accordance with the Labor Code of the Russian Federation, part of the salary goes through the official accounting department, and part is paid in an envelope. Such wage payments are considered gray.

Employers, as in the previous case, save on tax payments. A person agreeing to such conditions during employment must understand the risks involved. Upon dismissal, there is a high probability that the amounts due will be paid based on the official salary, but the unofficial part will not be paid. Calculation of sick leave at the subsequent place of work will be based on small accruals.

Before dismissal, you should go to management and try to agree on a full settlement by recording the conversation on a voice recorder and collecting evidence of the existence of an employment relationship.

Evidence may include:

- audio recordings when applying for a job, discussion of conditions;

- witness's testimonies;

- vacancy, job offer received by email;

- referral to the employment center when searching for work through this service;

- envelopes, payment slips.

In case of non-receipt of the final payment, it is recommended to immediately go to court; the labor inspectorate is limited to a response; it is not part of its functionality to sort out cases of non-payment.

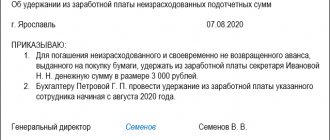

Deductions for final settlement

Workwear

When making final payments to the employee, the employer can withhold the cost of the workwear. According to the Labor Code of the Russian Federation, the employer is obliged to provide the employee with special clothing and shoes; In case of refusal to return the issued items, the company has the right to withhold the cost.

Shortage

When working with material assets, a financial liability agreement is concluded with the employee; full financial liability is provided for direct actual damage. The employer has the right to recover the shortage from persons occupying certain positions servicing material assets. If an employee recognizes a shortfall, it is better to agree to withhold and pay off the shortfall than to take part in a lawsuit; If you have doubts about the employer’s arguments, you should initiate legal proceedings yourself.

The company has the right to withhold from the final settlement in two cases:

- the amount of deduction is not more than the average monthly earnings;

- less than a month has passed since the day the damage was established.

If the employee does not agree to withhold the cost of workwear, the amount of the shortage or the withholding exceeds the average monthly earnings, the employer may go to court.

Criminal liability, who is assigned

Criminal liability for violations of employee rights is provided for in the Criminal Code of the Russian Federation. If an employer or official intends, in their own selfish interests, not to pay wages, various benefits, including compensation due for vacation for two months, the following is provided for this:

1.Fine up to one hundred twenty thousand rubles

2. May be deprived of the right to engage in this type of activity or hold a position for up to five years

2. Imprisonment for up to two years

If these actions lead to serious consequences, then the punishment may be different:

1.Fine from one hundred to five hundred thousand

2. Imprisonment for a term of three to seven years and disqualification from work and position for up to three years