What is an income statement

This is a form included in the financial statements along with the balance sheet and its annexes. The report form was approved by Order of the Ministry of Finance dated 07/02/10 No. 66n (hereinafter referred to as Order No. 66n).

IMPORTANT . The income statement format is not recommended. Using it is an obligation, not a right of organizations. But the company can set the level of detail itself. For example, decipher what business expenses consist of and enter an additional line “Including” for this.

By the way, previously this form was called “profit and loss statement” and “form No. 2”. The modern name was introduced more than eight years ago, but some accountants, auditors and other specialists still use the old name.

ASSESSMENT OF FINANCIAL INDICATORS OF THE ENTERPRISE

The assessment of the financial performance of an enterprise is determined on the basis of the method of financial ratios, which characterize both the financial stability of the company and the degree of efficiency of its business. This assessment is formed by calculating the financial ratios of the main management reports (balance sheet and income statement) and then interpreting the resulting values.

Financial ratios are divided into five main groups. The list of main financial ratios and formulas for their calculation are presented in table. 6.

When analyzing the financial condition of an enterprise, the calculated indicators are interpreted as follows:

- indicators of property status allow us to assess the degree of depreciation of the company’s non-current assets and the need to update them in the future;

- liquidity indicators characterize the company's ability to repay its current obligations to creditors;

- financial stability indicators determine the degree of financial risks of the company’s business;

- business performance indicators measure the efficiency of a company's operating activities;

- Profitability ratios measure a company's ability to generate profits through the use of its available resources.

Let's calculate financial ratios based on the data in Table. 1 and 4 using the formulas given in table. 6. The obtained calculated data are presented in table. 7.

Let us interpret the obtained calculations:

- the fixed asset renewal ratio increased at the end of 2022 to 0.18 (+0.6 compared to 2022). This coefficient does not have a standard value, but it is economically feasible to control its growth in comparison with the dynamics of the depreciation rate of fixed assets, since an excessively rapid renewal will lead to insufficiently efficient use of fixed assets in the company’s economic turnover;

- the depreciation coefficient of fixed assets at the end of 2019 was 0.23 versus 0.21 at the beginning of the year. Here we can conclude that the depreciation of fixed assets is growing at a slow pace, its indicator is below the standard of 0.5. This indicates sufficient provision of operating activities with non-current assets suitable for operation;

- The absolute liquidity ratio at the end of 2019 was fixed at 0.06, which is only 0.01 points higher than the same value at the beginning of the year. Since the standard value of the ratio is in the range from 0.2 to 0.5, we can conclude that the existing balance sheet structure does not ensure the achievement of the standard indicator of this financial ratio;

- the interim liquidity ratio at the end of 2022 was 0.35, which is 0.04 higher than the figure for 2022. However, this indicator for the company is much lower than the standard (from 0.7 to 1.0), therefore, the company is likely to periodically experience difficulties in paying off your current obligations;

- the current liquidity ratio for 2022 decreased from 0.75 to 0.74 with a standard value > 2. From here we conclude that the financial and economic service should pay more attention to increasing current liquidity;

- the autonomy coefficient at the end of 2022 is 0.40 (increased by 0.03 points since the beginning of the year). Based on the standard value, this indicator should be maintained at the level of 0.50–0.60. If business profitability in 2022 remains at the level of 2022, then it is quite likely that the autonomy coefficient will increase to the standard level;

- The financial dependence coefficient at the end of 2019 slightly exceeds the standard value of 0.50 and amounts to 0.60. This means that activity largely depends on the influx of borrowed funds. At the same time, the dynamics of growth of the company’s own funds for the period 2018–2019. allows us to predict that this coefficient will also come into line with the standard in 2022;

- the financial stability coefficient for 2022 did not change and amounted to 0.44, with the standard ranging from 0.8 to 0.9. From this we can conclude that the company’s financial position is not sufficiently stable;

- the coefficient of provision with own working capital both in 2022 and in 2022 has a negative value with a standard > 2. This fact indicates that a significant part of the company’s working capital is financed by borrowed funds. If business profitability decreases, the company will not be able to timely fulfill its obligations to creditors;

- the lack of own funds is evident from the values of the debt-to-equity ratio , which at the end of 2022 decreased from 1.71 to 1.47, but is still far from the standard of 1.0;

- the coefficient of maneuverability of own working capital with a standard of 0.5–0.6 at the end of 2022 was 0.35, which indicates a lack of the company’s own sources of financing;

- financial indicators of business activity at the end of 2022 showed negative dynamics. This means a slowdown in the turnover of all types of resources (fixed assets, current assets, inventories of goods and materials, receivables and payables), indicating the need to optimize the management of the company's cash flows and adjust the policy for managing receivables and payables in 2020;

- profitability indicators for 2022 changed slightly, however, it should be noted that return on equity fell over the year from 0.40 to 0.34. Since the profitability of sales and products decreased by only 0.01 points, economic activity in 2022 can be considered stable.

If we summarize the results of the analysis of financial indicators, then using the five-point system we can make the following assessments :

- indicators of property status - 5 points;

- liquidity indicators - 3 points;

- financial stability indicators - 3 points;

- business activity indicators - 4 points;

- profitability indicators - 5 points.

Where are Forms 2 of the financial results statement?

There is a form designed for all organizations (let's call it the general form). It is given in Appendix No. 1 to Order No. 66n. The filling rules given below relate specifically to the general form of the financial results report (on the active link you can use Form 2 of the financial results report).

Small businesses can use a special simplified form. It is given in Appendix No. 5 to Order No. 66n.

Fill out your income statement and other financial statements for free

Income from participation in other organizations

To separately reflect information on income from investments in other organizations in the financial results statement for 2021, line 2310 is highlighted.

Participation income includes and is included in line 2310 OFR (PBU 9/99):

- the amount of profit (dividends) distributed in favor of the reporting company;

- the value of property received upon leaving the organization or upon its liquidation.

Income from participation in the authorized capitals of other organizations is recognized when the conditions established by clause 12 of PBU 9/99 are met (according to the general rules for recognizing income). At the same time, in line 2310 of the OFR, these incomes are reflected if they are classified as other income (clause 4 of PBU 9/99). For example, if receiving income from participation is the main activity, then such income belongs in line 2110 “Revenue”.

The Ministry of Finance recommends recognizing dividends as income in the amount minus the tax withheld by the tax agent (letter dated December 19, 2006 No. 07-05-06/302).

Other income from participation in the authorized capitals of other organizations is reflected in accounting: Dt 76-3 Kt 91-1. This turnover should fall into line 2310 of the OFR.

How to fill out an income statement

The purpose of filling out is to show how the totals were calculated:

- Gross profit (loss);

- profit (loss) from sales;

- profit (loss) before tax;

- Net income (loss).

Each final value is obtained by adding or subtracting intermediate values. For example, to find gross profit, you first need to take two intermediate indicators: revenue and cost of sales. Then subtract the second from the first.

IMPORTANT. Intermediate values that participate in calculations with a minus sign (that is, are subtracted) must be indicated in parentheses. Some indicators are always in parentheses: business expenses, interest payable, etc. But there are also those that can be either in brackets or without them. This is, for example, profit (loss) before tax.

All lines have an “Explanation” column. It contains the number of explanations that disclose information on this line. If, for example, information about revenue is summarized in a certificate with number 15, then before the line “Revenue” you need to put “15”.

ATTENTION. Previously, financial statements could be filled out in both thousands and millions of rubles. But now there is only one option - in thousands of rubles. These amendments to order No. 66n were made by order of the Ministry of Finance dated 04/19/19 No. 61n.

Get a free sample accounting policy and do accounting in a web service for small LLCs and individual entrepreneurs

Gains or losses from sales

After generating the lines with information on administrative and commercial expenses, another interim total is summed up in the financial reporting department: line 2200 “Profit (loss) from sales.”

This line determines the result of ordinary activities - profit or loss.

The value of line 2200 is determined by subtracting the indicators of lines 2210 and 2220 from the indicator of line 2100. That is, the previously generated result of gross profit from sales is adjusted by the amount of commercial and administrative expenses incurred during the period. If, as a result of subtracting these indicators, a negative value (loss) is obtained, it is shown in the financial structure in parentheses.

The line value 2200 should match:

- the difference between the total turnover for the year according to Dt 90-9 and Kt 90-9;

- account balance is 99. In this case, a credit balance means that a profit was made from ordinary activities, and a debit balance means a loss was made.

Example of filling out a financial results report (sample)

In 2022, the trading organization's performance was as follows:

- revenue 12,000,000 rub. (including VAT 20% - RUB 2,000,000);

- purchase price of goods is 6,000,000 rubles. (including VAT 20% - RUB 1,000,000);

- commercial expenses (for warehousing goods and staff salaries) - RUB 1,500,000;

- interest payable (for using a bank loan) - 500,000 rubles;

- current income tax - 600,000 rubles.

The company did not apply PBU 18/02 and did not form ONA, ONO, PND and PNR.

The accountant found the totals.

Gross profit - 5,000,000 rubles ((12,000,000 - 2,000,000) - (6,000,000 - 1,000,000)).

Profit from sales - 3,500,000 rubles (5,000,000 - 1,500,000).

Profit before tax - 3,000,000 rubles (3,500,000 - 500,000).

Net profit - 2,400,000 rubles (3,000,000 - 600,000).

The accountant filled out the financial results report as shown in Table 2.

table 2

Report on financial results of a trading company for 2021 (thousand rubles)

| Explanations | Indicator name | For 2022 |

| Revenue | 10 000 | |

| Cost of sales | (5 000) | |

| Gross profit (loss) | 5 000 | |

| Business expenses | (1 500) | |

| Administrative expenses | ||

| Profit (loss) from sales | 3 500 | |

| Income from participation in other organizations | ||

| Interest receivable | ||

| Percentage to be paid | (500) | |

| Other income | ||

| other expenses | ||

| Profit (loss) before tax | 3 000 | |

| Income tax | (600) | |

| incl. Current income tax | (600) | |

| deferred income tax | ||

| Other | ||

| Net income (loss) | 2 400 |

Table 3

The relationship between the balance sheet and the income statement

| Balance indicator | Income statement indicator | Note |

| Line “Retained earnings (uncovered loss) (1370) The difference between the column “As of December 31 of the previous year” and the column “At the end of the reporting period” | Line “Net profit (loss)” (2400) Value at the end of the reporting period | Equal if there were no turnovers on account 84 in the reporting period (not counting balance sheet reformation) |

Fill out and print your balance sheet using the current form for free

Administrative expenses

To reflect expenses classified as management, line 2220 of the general financial structure is intended.

This line reflects information on expenses for ordinary activities related to the management of the company.

Let’s decipher this type of expense for correct inclusion in the financial results statement of a commercial organization for 2022. For such companies, management expenses include:

- maintenance of administrative and management personnel;

- maintenance of general business personnel not related to the production process;

- depreciation charges and expenses for the repair of operating systems for management and general economic purposes;

- rent for administrative and general business premises;

- payment for information, auditing, consulting, etc. services;

- taxes paid by the organization as a whole (property tax, transport tax, land tax);

- other expenses similar in purpose that arise in the process of managing the organization and are determined by its maintenance as a single financial and property complex.

In this case, administrative expenses included in general business expenses on account 26 can be:

- write off as conditionally constant directly to the cost of production Dt 90-2 Kt 26;

- include in the cost of production and work in progress Dt 20 (23,29, 43) Kt 26, only if they are directly related to the production of these products (works, services);

- include in the cost of acquired (created) inventories Dt 10 (41) Kt 26 only if they are directly related to their acquisition (creation).

Production and trading organizations on line 2220 of the general financial structure reflect the turnover of DT 90-2 CT 26/Administrative expenses. The remaining amount of debit turnover (for administrative expenses associated with production and included in the cost price) falls into the indicator in line 2120 “Cost of sales”.

We would like to separately mention the write-off of materials purchased for management needs. The company can recognize them as an expense in the period of their acquisition without preliminary accounting on account 10 (accordingly, in the financial statement for the period they immediately fall into line 2220). It is enough to provide for such a procedure in the accounting policy (clause 2 of FSBU 5/2019, clause 7 of PBU 1/2008).

The indicator for line 2220 also goes into the OFR in parentheses.

How to present

Until recently, companies could choose in what form to submit their financial statements: on paper or via the Internet.

But as of reporting for 2022, there is only one way left - to submit the balance sheet and other forms via the Internet (via telecommunication channels through an electronic document management operator).

An exception is not made even for small businesses. At the end of 2022 and later periods, they submit accounting reports online on a general basis. Such changes were made to the Accounting Law by Federal Law No. 444-FZ dated November 28, 2018.

How to fill out Form 2 for 2020?

The report includes an introductory (title) and main (tabular) part. When filling out Form 2, you should provide only relevant and correct information.

The introductory part of the FRA contains the following information:

- The name of the document itself.

- The reporting period is 2022.

- Date of presentation of the FRF in 2022.

- Name and necessary codes (details) of the organization - OKPO, INN, OKOPF, OKFS.

- The type of economic activity must be taken from OKVED 2.

- Unit of measurement. The template establishes that all indicators of the OFR are displayed exclusively in thousands of rubles (thousand rubles) - OKEI code 384 (previously it was possible to also indicate indicators in millions of rubles, but this is not possible in the new form).

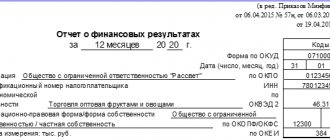

Example of filling out the title part of the report:

The main part of the report form generated for 2022 includes indicators that are presented for the reporting period (in this case, 2022) and for the previous period (in this case, 2019). At the same time, in the “Explanations” column, for each indicator presented in the corresponding line, the number of the appropriate explanation is indicated (small businesses have the right not to do this).

The table below shows the line-by-line completion of all lines of the financial results statement.

Symbols used in the table:

- DT – debit of the corresponding account

- CT – credit of the corresponding account.

- OD – debit turnover (debit turnover) of the corresponding account for a specific year.

- OK – credit turnover (loan turnover) of the corresponding account for a specific year.

Filling by lines

| Line number | What is indicated |

| Key Indicators of the Income Statement | |

| 2110 | Revenue. The amount of all income received by the organization from its ordinary activities is recorded, that is, the so-called sales revenue. Revenues from the sale (sale) of goods, provision of services, and performance of work are reflected here. In this case, revenue must be shown minus VAT and excise taxes. Indicator = OK 90 (revenue sub-account) – OD9 0 (excise tax sub-account, VAT). |

| 2120 | Cost of sales. The amount of the so-called selling cost is fixed. It is a negative indicator - reflected in characteristic brackets. Indicator = OD 90 (sub-account of cost of sales), which is taken into account in correspondence with KT 20, KT 23, KT 29, KT 41, KT 42, KT 43, KT 45. |

| 2100 | Gross profit of a legal entity (optionally, gross loss). Indicator = From the amount on line 2110, you need to subtract the amount on line 2120. |

| 2210 | Business expenses. Sales (marketing) costs are shown. A negative indicator is reflected in characteristic brackets. Business expenses may include costs for packaging, transportation, advertising, storage of finished products (for example, renting a warehouse), etc. Amount = OD 90 (sub-account of cost of sales), which is taken into account in correspondence with CT 44. |

| 2220 | Management expenses. This value is negative and is reflected in characteristic brackets. The costs of managing the entire organization are shown (for example, renting a top management office). Indicator = OD 90 (sub-account of cost of sales), which is taken into account in correspondence with CT 26. |

| 2200 | Profit of the legal entity from sales (as an option, loss of the legal entity from sales). Accordingly, it can be either positive (if there is a profit) or negative (if there is a loss). Indicator = From the amount on line 2100, you need to subtract the amount on line 2210 and the amount on line 2220. |

| 2310 | Income from participation in other organizations. This can be either dividends received, or the price (value) of assets seized upon exit from other legal entities. Moreover, such income should not be considered basic for this legal entity. Indicator = OK 91 (subaccount of other income), taken into account in the amount of income received by the legal entity from equity participation. |

| 2320 | Interest received. This line of the report shows interest income from deposits, special accounts, bonds, and loans issued. Indicator = OK 91 (subaccount of other income), taken into account in the amount of interest received for the corresponding period. |

| 2330 | Interest paid. Interest payments on issued bonds and attracted loans are shown. The value is negative and is reflected in characteristic brackets. Indicator = OD 91 (subaccount of other expenses), taken into account in the amount of interest payable by the legal entity. |

| 2340 | Other income. All other income is shown (that is, those that are not included in the previous lines of the income statement). Indicator = OK 91 (subaccount of other income), taken into account minus interest received. |

| 2350 | Other expenses. All other costs are recorded (that is, those that are not taken into account in the previous lines). This is a negative value and is always shown in parentheses in the report. Indicator = OD 91 (subaccount of other expenses), taken into account minus interest payable by the legal entity. |

| 2300 | Profit before tax (optionally, loss before tax). The value can be either positive (if the company has a profit) or negative (if it is a loss). Indicator = Sum of lines (2200; 2310; 2320; 2340) – Sum of lines (2330; 2350). |

| 2410 | Income tax. To be completed exclusively by the payer of this tax. Indicator = sum of line 2411 + sum of line 2412. |

| 2411 | including the amount of current income tax (filled in only by the payer of this tax). |

| 2412 | including the amount of deferred income tax (filled in only by the payer of this tax). |

| 2460 | Other. This line of the report records everything that is not taken into account by the other indicators listed above. This could be, for example, the amount of tax of the payer of the simplified tax system, fines for non-compliance by a legal entity with tax legislation. |

| 2400 | Net profit (optionally, net loss). Accordingly, the value can be either positive (if there is a profit) or negative (if there is a loss). Indicator = From the sum of line 2300, you need to subtract the sum of line 2410 and the sum of line 2460. |

| Background information | |

| 2510 | The result obtained from the revaluation of non-current assets, which is not included in the amount of net profit (loss) for a given period. |

| 2520 | The result obtained from other operations, which is not included in the amount of net profit (loss) for a given period. |

| 2530 | Tax on profits from transactions performed, the result of which is not included in the amount of net profit (loss) for a given period. |

| 2500 | The total financial result for a given period. Indicator = Sum of lines (2400; 2510; 2520) – Sum of line 2530. |

| 2900 | Basic earnings or loss per share. |

| 2910 | Diluted earnings or loss per share. |

An example of filling out the tabular part of the report, Form 2:

and completed sample for 2022

.

.

What are financial statements

A standard package of financial statements for a commercial organization includes a balance sheet, a statement of financial results, a statement of cash flows and changes in capital. These forms are based on accounting and are needed to analyze information about the organization’s activities and plan further development. They reflect information about the financial position of the company, the profitability or unprofitability of its activities, areas of expenses and sources of income, as well as capital flows.

Additionally, organizations prepare explanations and also submit an audit report along with the reporting if they are subject to a mandatory audit.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

Where and how to submit

The financial results report must be submitted as part of the annual financial statements to the following regulatory authorities:

- Inspectorate of the Federal Tax Service. The report is submitted to the tax office at the place of registration of the business entity. If an institution has various branches and divisions, consolidated reporting is submitted, that is, all division reports are combined into a single summary and submitted to the territorial Federal Tax Service Inspectorate at the place of registration of the parent company.

- Local statistical authorities. Rosstat requires submitting the form without fail. If the institution ignores this responsibility, the authority will impose serious fines.

- To the founders of the enterprise annually. The owners study, analyze, check and then approve the report.

A number of regulatory authorities have the right to request form 0710002 if necessary.

Reporting is requested by contractors when concluding agreements and contracts on a particularly large scale to confirm the financial solvency of the customer. The manager has the right to refuse the counterparty and not show them the amount of his profits and losses.

Reporting is submitted in various ways. The first is in person or through a representative on the basis of a power of attorney to the territorial bodies of the Federal Tax Service and Rosstat. To do this, the document is printed in two copies and signed by the manager or other responsible person. One copy is for the receiving party, the other remains with the reporting organization. A copy with the authority’s mark of acceptance is stitched together with the final balance sheet.

IMPORTANT!

Only those institutions whose number of employees does not exceed 100 people submit the report in person.

The second method is sending by mail or courier service. A letter with a report and a mandatory list of the postal attachment is sent to the regulatory authority.

The third method is with the Federal Tax Service and Rosstat using special programs for electronic document management. In this case, the report is signed with an enhanced electronic qualified signature and transmitted via communication channels to the appropriate authority. When using this method, the specialist must wait for information about the receipt of the file by the regulatory authority.

Which form to use: simplified or complete

The report is submitted in full format by all organizations that do not meet the parameters established for small businesses.

According to Part 4 of Art. 6 402-ФЗ simplified form of the report on financial results OKUD 0710002 applies to institutions that use simplified accounting methods. These include:

- small business representatives;

- non-profit companies;

- enterprises operating within the framework of 244-FZ dated September 28, 2010 and receiving the status of participants in a project to carry out research, development and commercialization of the results of such projects.

All these institutions have the right to use a simplified form. To use simplified reporting, they need to secure this option in their accounting policies.

The form according to OKUD 0710002 in full format is submitted by the following categories of business entities:

- institutions for which there is a legislative requirement to conduct mandatory analysis and audit of their reporting;

- enterprises whose activities are connected with housing and housing-construction cooperatives, with credit consumer cooperatives;

- microfinance firms;

- parties and party regional branches;

- law firms, bureaus and chambers, bar associations;

- legal advice and notaries;

- NPO.

How to fill out in a simplified form

The procedure for filling out a simplified report does not differ significantly from a full-format document. The main difference is the smaller number of lines characterizing the indicators of financial and economic activity. The algorithm for calculating indicators in simplified and full formats is similar. The following information is entered into the simplified form:

- revenue (line 2110);

- expenses for main activities (line 2120);

- interest on loans (p. 2330);

- other income (line 2340);

- other expenses (line 2350);

- income taxes (p. 2410);

- net profit (p. 2400).

Types of financial statements

Financial statements can be divided into the following types:

Annual and interim reporting

Interim reporting differs from annual reporting in that it covers a shorter period. It is compiled once a month, quarter or six months. There is no need to submit such reports to the tax office, since most organizations prepare them at their own discretion and for themselves or certain external users.

Interim reporting includes a balance sheet and income statement. Intermediate forms are not approved by law. An organization can take annual reports as a basis and modify them for interim ones.

Full and simplified reporting

Simplified reporting is available to organizations that can conduct accounting according to a simplified scheme. These are small businesses and Skolkovo residents.

The annual simplified reporting must include a balance sheet and a report on financial results. The need for other reporting forms depends on whether they contain information without which it is impossible to objectively assess the financial position and results of the organization’s activities. That is, it is not necessary to include them.

The forms of the balance sheet and financial results report differ from the standard ones. They include indicators only for groups of articles without detail.

Reporting of commercial and non-profit organizations

Commercial and non-profit organizations have different reporting compositions. Thus, commercial organizations usually report on all the forms listed above, but for non-profit organizations there are special features.

Non-profit organizations may not submit any reports to the tax authorities, except for the balance sheet and the report on the intended use of funds, if there is no information for other forms. However, it is recommended to additionally include a report on financial results in the reports in cases where the NPO received significant income from business activities and the data in the target report is not enough to form a reliable picture of the organization’s performance.

Primary and summary consolidated statements

The organization's primary reporting is compiled based on current accounting data. It includes data about one specific organization.

Consolidated reporting is prepared for a group of interrelated organizations. It presents capital, liabilities, income and expenses as total. Consolidated statements show the financial position and financial performance of the entire group rather than each individual organization.