Deflator coefficients for UTII, personal income tax and trade tax have become known. They are recorded in the draft order of the Ministry of Economic Development.

Let us recall that the deflator coefficient is annually set by the Russian Ministry of Economic Development for the next calendar year. The coefficient takes into account changes in consumer prices for goods, works and services in the previous period. Deflator coefficients are used to calculate some taxes.

For 2022 it is planned:

- deflator coefficient for personal income tax – 1.729;

- deflator coefficient for UTII – 1.915;

- deflator coefficient for the simplified tax system and PSN, as well as for calculating property tax for individuals, – 1.518;

- the deflator coefficient for the trade tax is 1.317.

As a result, in 2022, UTII and trade tax will increase by 2.5%, and the fixed advance payment for personal income tax will increase by 2.6%.

Indexation of income limits by the deflator coefficient for the simplified tax system has been suspended until 2022. Therefore, the deflator coefficient for the simplified tax system in 2022 is not applied to marginal incomes. Also see “Income limit under the simplified tax system in 2022“.

We will explain the new coefficients in more detail below.

What kind of indicator is this?

In simple terms, the deflator index is a certain economic coefficient that allows you to calculate the final cost of services, goods, products, and work.

For example, the deflator index for 2022 in construction, prices for food, utilities and household services, the cost of medicines and basic necessities. By approving the deflator index for 2020-2021, the Ministry of Economic Development determines what price values will be in the future. Such forecasts are necessary so that officials can timely adjust socio-economic policies. In simple words, to identify a number of measures that will improve the life of the Russian people and prevent the excessive influence of negative factors (impoverishment of the population, inflation, a sharp jump in unemployment, rising prices).

For comparison, the price index and deflator index - the meanings of the terms are quite similar. Only a price index indicates what specific value the price of a specific product will take in a specific period of time. And the deflator index, in turn, determines price values for a group of goods, works or services.

Areas and methods of application

As stated above, index deflators are most often used to calculate prices in the planning period, but this is not their only purpose. With their help, the state assesses the real level of income of the population, that is, it determines the amount of goods and services that each citizen with a certain income level can purchase. Based on this, state representatives formulate social policy to determine and future support for low-income and vulnerable segments of the population. Thus, deflator coefficients make it possible to detect the need for indexation of such social payments as pensions, benefits, compensation , etc.

But social policy is not the only area that the Ministry of Economic Development of the Russian Federation influences by issuing an order to change deflator coefficients. For example, the deflator index also affects the construction sector (services, building materials), which ultimately raises or lowers the cost of housing that is put into operation and ready for purchase.

The tax system also did not stand aside. Based on Order N595, which was mentioned above, we can conclude that deflators regulate the amount that each citizen contributes to the budget of the Russian Federation . For example, limits on insurance premiums change annually, the same applies to the limit for switching to the simplified tax system, which was frozen in order to support business.

We can conclude that absolutely every area of government activity would not be able to function fully without the use of deflators as a calculation tool.

The procedure for updating the index deflator does not stop at the stage of publication of the Order of the Ministry of Economic Development. After this, the state is faced with the task of analyzing all pricing and social policies for the entire year, that is, determining the criteria and values on price tags in subsequent periods. After this, it is necessary to estimate the income of each category of citizens, taking into account all their needs, especially pensioners and minors. And only at this stage does the adjustment of socio-economic policy begin, designed to improve the life of the Russian population.

How it works

When developing the deflator index for 2022, Order No. 190 of the Ministry of Economic Development dated April 1, 2020 is approved for several periods at once. The indices for 2022 were established by order of the Ministry of Economic Development No. 595 dated October 30, 2018. The values are used to forecast the development of the country, as well as to determine measures for social and economic support of the population.

The deflator index (calculation formula) is defined as the ratio of the nominal price indicator to the real price indicator, converted into a percentage.

For example, the key macroeconomic indicator, the GDP deflator index, formula:

It is worth considering that this indicator has a significant drawback. It understates the inflation rate. That is why a number of representatives of ministries and departments use deflator indices for economic forecasts. As a result, the results obtained show a systematic and stable improvement in the lives of the population, as well as an endless increase in citizens’ incomes. In reality, this does not happen, at least on the scale described.

After the deflator indices of the Ministry of Economic Development until 2022 have been approved, officials begin comprehensive analysis and forecasting. The main goal is to develop probable scenarios or, in simple terms, action plans that will be applied in case of favorable or negative development.

Deflator coefficient for UTII

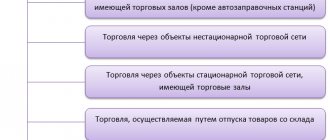

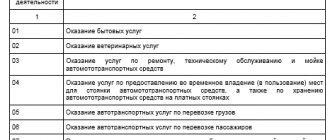

For individual entrepreneurs and organizations that pay UTII, they use a coefficient, or as it is also called K1, to adjust the value of the basic income of a particular type of activity.

The deflator coefficient for UTII for 2022 was 1.915. The increase compared to the 2022 value (1.868) was 2.5%. From which it follows that even if the value of the physical indicator by type of activity does not change and the local authorities leave the size of K2 at the same level, the tax payable to the budget in 2022 will increase. Let's consider calculating the amount of tax for a UTII payer in 2022. For the calculation, let's take a store with a sales area of 15 m2, a basic profitability of 1,500 rubles. per 1 m2, K2 in the region is set at level 1, and the UTII rate is 15%.

(1500 * 15 * 1,915 * 1 *15%) * 3 months. = 19,389 rub.

This is how much the payer will have to pay to the budget.

Deflator indices for the next three years

| Industry | 2020 | 2020 | 2021 |

| Industry (BCDE) | |||

| deflator | 103,3 | 102,9 | 103,0 |

| PPI | 103,4 | 103,0 | 103,0 |

| including without fuel and energy complex products (oil, petroleum products, coal, gas, energy) | 104,1 | 104,1 | 103,9 |

| Mining (Section B) | |||

| deflator | 101,2 | 100,6 | 101,0 |

| PPI | 101,4 | 101,2 | 101,1 |

| Extraction of fuel and energy minerals (05, 06+09) | |||

| deflator | 100,9 | 100,4 | 100,8 |

| PPI | 101,2 | 101,0 | 100,9 |

| Coal mining (05) | |||

| deflator | 104,5 | 104,0 | 103,7 |

| PPI | 104,3 | 104,1 | 103,9 |

| thermal coal | |||

| PPI | 104,6 | 104,1 | 104,1 |

| Crude oil and natural gas production (06+09) | |||

| deflator | 100,5 | 100,0 | 100,4 |

| PPI | 100,8 | 100,7 | 100,6 |

| Mining of metal ores and other minerals (07, 08) | |||

| deflator | 104,0 | 102,6 | 102,9 |

| PPI | 103,6 | 103,0 | 103,0 |

| Metal ore mining (07) | |||

| deflator | 104,2 | 102,5 | 102,7 |

| producer price index | 103,7 | 102,8 | 102,9 |

| Mining of other minerals (08) | |||

| deflator | 103,2 | 103,3 | 103,3 |

| PPI | 103,1 | 103,2 | 103,2 |

| Manufacturing (Section C) | |||

| deflator | 103,9 | 103,5 | 103,5 |

| PPI | 103,7 | 103,5 | 103,4 |

| Production of food products, beverages and tobacco products (10, 11, 12) | |||

| deflator | 103,1 | 103,2 | 103,5 |

| PPI | 102,9 | 103,2 | 103,4 |

| Textile production, clothing production, leather and leather goods production (13, 14, 15) | |||

| deflator | 104,2 | 103,8 | 103,5 |

| PPI | 104,1 | 103,8 | 103,6 |

| Wood processing and production of wood and cork products, except furniture, production of straw products and wicker materials (16) | |||

| deflator | 105,1 | 104,6 | 104,3 |

| PPI | 104,6 | 104,4 | 104,3 |

| Production of paper and paper products (17) | |||

| deflator | 105,2 | 104,7 | 104,4 |

| PPI | 104,7 | 104,5 | 104,3 |

| Production of petroleum products (19.2) | |||

| deflator | 101,3 | 100,1 | 100,6 |

| PPI | 100,9 | 99,8 | 100,3 |

| Production of chemicals and chemical products, production of medicines and materials used for medical purposes, production of rubber and plastic products (20, 21, 22) | |||

| deflator | 105,2 | 104,9 | 104,7 |

| PPI | 104,8 | 104,7 | 104,5 |

| Production of other non-metallic mineral products (23) | |||

| deflator | 103,9 | 103,7 | 103,6 |

| PPI | 103,9 | 103,8 | 103,7 |

| Ferrous metal production (24.1, 24.2, 24.3, 24.5) | |||

| deflator | 104,2 | 104,7 | 103,7 |

| PPI | 103,8 | 104,4 | 103,1 |

| Production of basic precious metals and other non-ferrous metals, production of nuclear fuel (24.4) | |||

| deflator | 106,0 | 104,5 | 104,1 |

| PPI | 105,6 | 104,3 | 103,7 |

| Production of finished metal products, except machinery and equipment (25) | |||

| deflator | 104,5 | 104,5 | 104,2 |

| PPI | 104,3 | 104,3 | 104,1 |

| Mechanical engineering products (26, 27, 28, 29, 30, 33) | |||

| deflator | 105,5 | 105,3 | 105,4 |

| PPI | 105,3 | 105,1 | 105,1 |

| Others | |||

| deflator | 102,8 | 102,9 | 103,2 |

| Providing electricity, gas and steam; air conditioning (35) | |||

| deflator | 105,0 | 104,2 | 104,0 |

| producer price index (PPI) | 105,0 | 104,2 | 104,0 |

| Water supply; water disposal, organization of waste collection and disposal, pollution control activities (Section E) | |||

| deflator | 104,0 | 104,0 | 104,0 |

| PPI | 104,0 | 104,0 | 104,0 |

| Agriculture | |||

| deflator | 103,5 | 103,1 | 103,3 |

| Producer price indices | |||

| Crop production | |||

| deflator | 103,7 | 102,9 | 102,9 |

| Livestock | |||

| deflator | 103,4 | 103,5 | 103,7 |

| price index for sales of products by agricultural producers | 103,5 | 103,8 | 103,9 |

| Transport incl. pipeline | |||

| deflator | 104,3 | 104,2 | 104,1 |

| PPI | 104,4 | 104,3 | 104,3 |

| PPI with the exception of pipelines. transport | 103,6 | 103,7 | 103,6 |

| Investments in fixed assets (capital investments) | |||

| deflator | 105,0 | 104,4 | 104,2 |

| price indices | |||

| Construction | |||

| deflator | 105,0 | 104,8 | 104,5 |

| PPI | 104,7 | 104,6 | 104,5 |

| Consumer market | |||

| retail trade turnover, deflator | 104,2 | 103,5 | 104,0 |

| CPI for goods | 104,0 | 103,3 | 103,9 |

| paid services to the population, deflator | 104,8 | 104,2 | 104,3 |

| CPI for services | 104,9 | 104,3 | 104,4 |

Development scenarios

Currently, the Ministry of Economic Development is developing three types of scenarios for the Russian economy:

- The basic plan, which implies that the indicators of the main factors of the Russian economy will remain at the base or current level. That is, they will not undergo any changes.

- The conservative scenario provides for a significant deterioration in socio-economic indicators. The plan takes into account not only internal but also external factors.

- A target plan under which the optimal development of events is expected for the Russian economy both in the domestic and foreign markets. For example, the lifting of sanctions, the reduction of fiscal duties and encumbrances, rising prices for raw materials, etc.

Not only internal development indicators (GDP, tax system, minimum wage, price indicators, size of the consumer basket) are analyzed. But also external factors. Currently, special attention is paid to the sanctions that were applied by the United States and the European Union.

How to calculate aggregate indices

This method allows you to take into account the actual volumes of products produced with changes and dynamics in the structure of goods, works and services produced. The Paasche aggregate index is used for calculation. Here is the formula for the deflator index using the Paasche method:

The advantages of the aggregate index are undeniable. The Paasche method allows you to analyze the dynamics of price indicators and determine the rise in price of a specific product or commodity or the reduction in price of any work or service.

The Paasche aggregate method allows you to determine the level of inflation and isolate it in the economic analysis of prices. For example, if the calculated result of the Paasche index is 1 or 100%, this indicates an increase in the level of inflation in the country. A value less than 1 or 100% reflects a decrease in inflation, a slowdown in its rate.

Basic scenario

This forecast plan provides the following values:

- Energy demand will increase. Prices for petroleum products will remain at current levels. Such values will be achieved by complying with the agreement on reducing oil production. Although some pressure from the United States will still remain due to increased shale oil production.

- Maintaining global economic growth at 2.8%. Countries with the most developed economies are expected to slow down their pace of development. The Chinese economy will slow down due to rising debt burden and trade tariffs. Developing countries will not be able to improve their performance due to lower prices in the commodity market.

- Exports of Russian oil products will increase. The reason will be the best price offers on the Russian market, in comparison with competing countries.

- The growth in the level of investment will be ensured by compliance with the standards of the federal program to support medium and small businesses (benefits for small businesses, tax holidays).

- The development of the import substitution sector will expand industrial areas, increase the number of jobs, and increase labor productivity.

The result of economic development under this scenario will be a reduction in the unemployment rate to 4.7%, as well as an increase in the real level of income of the population to 1.5%. Which will have a positive impact on increasing demand, as well as on the growth of consumer lending.

Target development plan

The deflator index for 2022 for estimates with positive development provides for similar indicators as the basic plan. However, officials provided additional (exceptional) factors:

- Demographic indicators according to Rosstat. Significant population growth is planned, which will be due not only to an increase in the birth rate, but also to migration growth.

- Increased production of petroleum products will increase the flow of investment, both domestic and external (foreign) capital. Growth will be ensured by the commissioning of new wells and improvement of production technologies.

- The Russian ruble will strengthen against foreign exchange rates. Namely in relation to the American dollar and the euro.

- The dynamics of growth of gross domestic product will reach at least 3.1% per year.

Let us note that the main lever for achieving indicators of positive economic development is strengthening positions in the commodity market, namely through the sale of oil products and gas.

Deflator coefficient for PSN

For individual entrepreneurs who use PSN, the deflator coefficient is used to calculate the maximum annual income by type of business activity. According to the law, the basic value of the maximum possible annual income of an individual entrepreneur is set at 1 million rubles. (clause 7 of article 346.43 of the Tax Code of the Russian Federation). In 2022 the coefficient was 1.481, in 2022 - 1.518. It follows from this that the maximum amount of potential annual income for an individual entrepreneur on a patent will be 1.518 million rubles. (RUB 1 million × 1.518). Having calculated the maximum possible cost of a patent for one month of 2019, we receive a payment of 7,590 rubles. (RUB 1.518 million × 6%: 12 months). But we should not forget that local authorities have the right to increase the amount of potential annual income for certain types of activities several times (Clause 8 of Article 346.43 of the Tax Code of the Russian Federation) and when calculating, it is necessary to take into account regional legislation.

Conservative plan

The forecast deflator indices of the Ministry of Economic Development until 2022 imply that the Russian economy will be affected by numerous negative factors. The main unfavorable criteria include:

- Tightening of the monetary economy of other countries.

- "Hard landing" of the Chinese economy.

- A sharp decline in the price of oil (below $35 per barrel).

- Weakening position of the ruble against the US dollar.

- Decrease in GDP growth rate to 0.8%.

- Inflation will reach 4.3% or higher.

Officials pay special attention to this development plan, since the impact of the global crisis cannot be ignored.

Where to find the current deflator value

Order No. 720 of the Ministry of Economic Development states what a deflator index is - this is a coefficient that is used for tax purposes. The value established for the financial year is applied in all areas of activity of both the entire state and Russian organizations and entrepreneurs.

Current indices are always available in ConsultantPlus.

Officials use a deflator when approving tax regimes and norms. Current coefficients for 2022 in accordance with the Tax Code of the Russian Federation:

| Type of tax liability | Link to normative act | Coefficient value |

| Personal income tax | Ch. 23 Tax Code of the Russian Federation | 1,864 |

| USNO | Ch. 26.2 Tax Code of the Russian Federation | 1,032 |

| PSN | Ch. 26.5 Tax Code of the Russian Federation | 1,637 |

| Trade fee | Ch. 33 Tax Code of the Russian Federation | 1,420 |

Indicator forecast for 2022

The planned deflator indices of the Ministry of Economic Development for 2022, taking into account the latest changes, were finally adjusted at the last moment. The main changing factors were: an increase in the retirement age, an increase in VAT, a tax maneuver in the oil industry, and an increase in excise taxes on fuel.

Taking into account these innovations in tax and social policy, the Ministry of Economic Development announces the following indicators:

- consumer goods - 104.4;

- goods of the industrial sector - 104.1;

- wholesale gas prices - 103.8;

- coal cost coefficient - 103.9;

- expected cost of fuel oil - 102.1;

- forecast prices for electricity (retail) - 109.1;

- utilities (water supply and heat supply) - 105.1;

- deflator index for 2022 of the Ministry of Economic Development (construction) - 105.0;

- The planned prices for cargo transportation by Russian Railways are 105.2.

Expected indicators for the base scenario in the table:

Forecast Consumer Price Index (CPI)

Initially, you need to familiarize yourself with what this index is and why it is calculated. The CPI is calculated using a simple formula; it is equal to the ratio of the nominal value of the indicator to its real value, i.e., if the consumer price index is 1.04, this means that inflation is projected to increase by 4%. This indicator is important for calculations in the social sphere. Inflation growth shows by what amount pensions for pensioners need to be increased and by how much payments to the poor need to be increased. The CPI reflects how much the cost of the consumer “basket” has increased for consumers. The main problem with all calculations is the constant underestimation of this indicator. This has a negative impact on the overall calculation.