What are indirect costs

According to FSBU 5/2019, indirect costs are costs that cannot be attributed to specific goods, work, or services. The company itself establishes the classification of direct and indirect costs and the mechanism for dividing indirect costs between types of goods, works, and services (clauses 23-25 of FSBU 5/2019).

Accordingly, the practice remains the same, but according to clause 26 of FSBU 5/2019 it is established that the following cannot be included in the actual cost of work in progress and finished products:

- costs that arise as a result of improper organization of the production process. For example, these include excess costs of goods and materials, electricity, labor, costs from defects, etc.;

- storage costs, with an exception if it is part of a technological process, for example, wood drying;

- administrative expenses, and an exception is if the costs are incurred for the manufacture of products, implementation of works and services.

According to the updated rules introduced on the basis of FSB 5/2019 in 1C: Accounting 8, starting from version 3.0.89, the settings for dividing indirect costs and closing cost accounts have changed (20, 23, 25, 26, 28).

Indirect costs included in the cost of finished products, work or services are reflected in the account. 20.01, 23 or 25. Count. 26 from the current year in the program is intended only for accounting for administrative expenses, for example, expenses for office supplies, communications, consulting services, audit, etc., that is, they are not included in the cost of work in progress and finished products. If earlier on the account. 26 took into account general business expenses associated with the production process as a whole, then accounting for such costs now needs to be kept on the account. 20, 23 or 25. And on the count. 28 takes into account defects in production.

To calculate income tax, all costs are divided into direct and indirect based on the list of direct expenses that the company sets in the income tax settings. To set up the list, you need to go to the “Main” menu, select “Taxes and reports”, go to the “Income Tax” tab and then “List of direct expenses”.

In this regard, the cost of production in accounting and tax accounting may not be the same, which leads to the appearance of temporary differences and deferred tax based on PBU 18/02, regulated by Order of the Ministry of Finance dated November 19, 2002 No. 114n.

Accounting for overhead costs

Manufacturing overhead and administrative expenses exist in companies that produce products. General economic ones take place in any organization. Accounting for general production and general business expenses is organized on the basis that they are indirect. Let's look at both in more detail. ConsultantPlus FREE for 3 days Get access

General production expenses include those costs that cannot be attributed to the cost of a specific product. For example, general production expenses include:

- salaries and deductions from them for employees serving production: foremen and shop managers, workers repairing technological equipment, etc.;

- depreciation of fixed assets and intangible assets used in production;

- payments for premises, machines, and equipment rented for production;

- security and cleaning of industrial premises;

- costs necessary to operate the equipment involved in production: gas, fuel, electricity, etc.

Other production costs include insurance payments, taxes, fees, warranty payments, shortages of valuables, production downtime, etc.

How are indirect costs distributed?

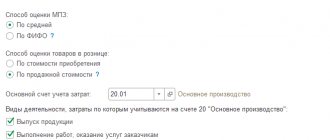

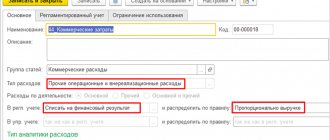

You need to set up the division of indirect costs in accounting in a special form - “Accounting Policy” in the “Main” menu. For this purpose, the “Indirect costs” group of details is used.

In the “Distribution base” column you need to indicate the base - it is selected from the drop-down list. In this case, it is possible to select output volume, planned production cost, wages, material costs, revenue or direct costs as the distribution base.

When the allocation base is selected, it will be used as the basic rule for dividing all types of indirect costs by product.

Some companies use different rules for dividing indirect costs, for example, for specific departments or for certain expenses. They can also be configured, but through a special form - “Cost distribution rules” via the “Special distribution rules” link.

When the user opens the form by clicking on the hyperlink, he can use the “Add” button to fill out the table, while adding a cost account, division or cost item for which special division rules will apply. You also need to indicate the distribution base, which differs from the main one.

The user applies special rules in a situation where the company uses a partition base that is not in the list of possible values for the main rule. For example, for a basic rule, it is not possible to select a split base based on a list of cost items. But as an exception, such a distribution can be used.

How are the costs recorded on the account distributed? 25

In the program on the account. 25 collects the costs of divisions that serve the main production, but do not produce products, do not perform work and do not provide production services. That is, they include costs that were previously taken into account on the account. 26 and distributed to the cost of finished products, work, services, for example, the costs of a boiler room or repair shop.

Costs collected on account 25 are automatically distributed during the routine operation “Closing accounts 20, 23, 25, 26”. It is used when closing the month through the “Operations” section.

Accordingly, count. 25 is now used more extensively, as a result of which the order of distribution of costs taken into account has changed. It is carried out in two steps:

- distribution of overhead costs of departments producing products, work or services. They are distributed within each specific division into product groups according to the accounting policy settings. In this order, count. 25 was distributed earlier;

- distribution of remaining costs (by service departments). They are distributed between production departments according to product groups. Accounts were previously distributed in this order. 26.

Example

The company produces textile products in two production divisions:

- workshop No. 1 produces women's dresses and bed linen;

- Workshop No. 2 produces pillows, blankets and soft toys.

On the account 25 “General production costs”, records are kept of the costs of production (shops), as well as the costs of the quality laboratory serving both shops.

On the account 26 “General expenses” records management costs, for example, administration expenses. The exception in this case is the cost of the salary of the deputy production director, who deals exclusively with production issues. His salary, together with accrued insurance zones, is taken into account in the account. 25.

In accordance with the company's accounting policy, the distribution base for indirect costs is direct production costs.

In January 2022, the amount of direct costs on the account. 20.01 “Main production” - 1.575 million rubles, incl. division by nomenclature groups:

- women's dresses - 225 thousand rubles;

- bed linen - 1.23 million rubles;

- soft toys - 20 thousand rubles;

- pillows and blankets - 100 thousand rubles.

The amount of indirect costs per account. 25 - 350,315.05 rubles, incl. division by divisions:

- administration - 130,200 rubles;

- laboratory - 50 thousand rubles;

- workshop No. 1 - 89,495.05 rubles;

- workshop No. 2 - 80,620 rubles.

When carrying out the routine operation “Closing accounts 20, 23, 25, 26”, indirect costs on the account. 25 are distributed in proportion to direct costs.

At the first step, the costs of workshops are distributed:

- workshop No. 1 - by groups: women's dresses and bed linen;

- Workshop No. 2 - by groups: soft toys and pillows/blankets.

The initial distribution is reflected in the first part of the calculation certificate “Distribution of indirect costs”.

At the second step, the remaining costs are distributed among production units by group. Further distribution is reflected in the second part of the calculation certificate “Distribution of indirect costs”.

When the distribution is made, correspondence is created taking into account the analytics:

Dt 20.01 Kt 25 - the amounts indicated in columns 9 of the presented calculation are carried out

When using such a combined method of distributing costs collected on the account. 25, errors can be avoided.

How are the costs recorded on the account distributed? 20

The rule for distributing indirect costs also applies to those costs that are included in the account. 20.01. This account can reflect indirect costs in situations where the costs are not directly attributable to a specific product, i.e. when the “Products” subaccount is not filled in. These costs are distributed by type of product within the product group.

If the distribution base used, which is specified in the settings, for some reason cannot be used for costs collected on the account. 20, then the program automatically distributes them. In this situation, the user is protected from errors in the form of errors that appear when setting up the distribution of indirect costs.

Distribution of costs collected on the account. 20, can be seen in the reference calculation “Cost of manufactured products and services”.

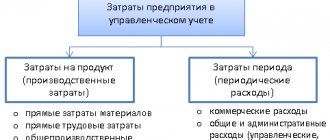

Stages and sequence of cost distribution

To describe the cost distribution technology, let us again turn to the Methodological Recommendations. Direct costs are determined for each cost center, which is also a revenue center or an auxiliary division, as the sum of costs for the specified items. Next, the direct costs of auxiliary divisions are distributed between income centers, that is, they are transferred to the direct costs of income centers. The distribution of costs of auxiliary departments between income centers is carried out in proportion to the volume of work, services (the number of studies, analyses, procedures, conventional units of labor intensity, bed days, surgical operations, transferred patients, etc.) performed by auxiliary departments for specific departments of income centers.

Indirect costs are distributed between income centers in proportion to the indicator chosen as the basis for attribution and (or) by the direct counting method.

The proportion of specific branches within a division operating in the same area can be determined:

– for a hospital – proportional to the number of beds; – for outpatient services – in proportion to the number of doctor positions; – for a day hospital – in proportion to the number of places in it.

Schematically, the cost allocation technology can be represented as follows:

Stages and sequence of cost distribution

How to close account 26

According to clause 26 of FSBU 5/2019, costs that are not related to production activities cannot be included in the cost of production. And now from 2022 on the account. 26 includes only management costs.

In the accounting policy settings, you do not need to select the order of distribution of general business expenses, since they are fully included in the expenses of the current period. However, the rules for writing off costs from the account. 26 differs for companies that use account. 20 or do not use it.

Distribution

The amount of overhead costs can significantly increase the cost of manufactured products, work performed, and services provided. At large industrial enterprises, pilot projects are planned and the concept of “consumption rate” is introduced; deviations of this indicator are carefully studied by the analytical department. In organizations engaged in the creation of one type of product, methods for distributing general production and general business expenses are not developed; the sum of all costs is fully included in the cost price. The presence of several production processes implies the need to include all types of costs in the calculation of each of them. The distribution of general production costs can occur in several ways:

- Proportional to the selected basic indicator, which optimally corresponds to the combination of ODA and the volume of output (volume of goods produced, wage funds, consumption of raw materials or supplies).

- Maintaining separate accounting of ODA for each type of product (costs are reflected in analytical sub-accounts opened to register No. 25).

In any option, methods for distributing indirect costs must be enshrined in the accounting policies of the enterprise and not contradict regulations (PBU 10/99).

We will set up any reports, even if they are not in 1C

We will make reports in the context of any data in 1C. We will correct errors in reports so that the data is displayed correctly. Let's set up automatic sending by email.

Examples of reports:

- According to the gross profit of the enterprise with other expenses;

- Balance sheet, DDS, statement of financial results (profits and losses);

- Sales report for retail and wholesale trade;

- Analysis of inventory efficiency;

- Sales plan implementation report;

- Checking of employees not included in the time sheet;

- Inventory inventory of intangible assets INV-1A;

- SALT for account 60, 62 with grouping by counterparty - Analysis of unclosed advances.

Order report customization

How are expenses written off to account 90.08

When in the program settings, in terms of accounting policy, the “Production of products” or “Performance of work, provision of services to customers” checkbox is selected, then the costs charged to the account. 26, at the end of the month they are written off to the account. 90.08 “Administrative expenses”. Previously, in 1C this method was called direct costing.

However, sometimes users need to allocate management costs, for example, under contracts with budgetary organizations or with government corporations. In this case, the contract price is calculated taking into account the contractor’s costs. He needs to report to the customer about the expenses incurred, incl. about the share of management costs that fall on a specific contract.

In this case, experts recommend using the 1C: Accounting 8 CORP program. In it, when closing the month, management expenses can be distributed among item groups in proportion to the distribution base, which is specified in the accounting policy. To do this, you need to open the “Nomenclature groups” subaccount for the account. 90.08.

If a company works with government contracts and at the same time applies special rules for the distribution of costs, then they must be indicated as for invoices. 25, and for count. 26.

How are expenses written off to the account? 90.02

If a company's activities are not related to production, it applies an account. 26 to summarize information about the costs incurred to conduct activities. For example, these include agents, brokers, dealers, commission agents, etc., i.e. companies that provide non-productive services. These do not include organizations that carry out trading activities (Order of the Ministry of Finance dated October 31, 2020 No. 94n).

In this case, companies that do not use account. 20, write off all expenses from the account. 26 on account 90.02 “Cost of sales”. If we attribute them to the account. 90.08, then the gross profit will be calculated incorrectly, because it will always be equal to revenue.

To correctly reflect information, it is necessary to set up the accounting policy so that the “Product release” and “Performance of work, provision of services to customers” checkboxes are not selected. When the user carries out a routine operation to close accounts, all expenses in accounting from the account. 26 will be written off to the account. 90.02.

In tax accounting, all indirect expenses taken into account on the account. 26, are always debited to the account. 90.08.

As for trading companies, it is recommended for them to keep records of expenses on their accounts. 44 “Sales expenses”.

Accounting for environmental protection

Accounting

General business expenses are accounted for on active account 26. At the end of the period, they are transferred to account 20 (23) or to account 90. Firms whose activities are non-productive in nature can collect basic expenses on account 26, and then transfer them to account 90 (except trading enterprises).

Postings:

- Dt 26 Kt 76, 70, 71, 68, 69, 60, 23, 29, 10, 05, 02, etc. - reflection of non-production costs. Accounts 23 and 29 are applied if the organization has auxiliary and service industries that provided non-production services for the AUP.

- Dt 20, 23 Kt 26 - write-off of chemical and chemical equipment for main and auxiliary production (if the latter is available in the organization).

- Posting Dt 20 Kt 26 is done by type of product based on the calculations made or in full amount if the company has one type of product. The distribution of chemical and chemical resources between main and auxiliary production can be done in proportion to their production costs for the period.

- When using account 90, the following posting is generated: Dt 90 Kt 26 for the corresponding subaccounts (2 if the company provides external services, 8 if direct costing is used).

Analytics for account 26 is organized by cost items and departments:

- Management expenses (AUP business trips, entertainment expenses, wages with AUP deductions, etc.).

- Business costs (wages and deductions for general business workers and personnel, labor protection, depreciation, etc.).

- Other maintenance costs (utilities, office expenses, postage, etc.).

The given accounting option is only one of the possible ones.

Tax accounting

Costs in NU related to production and sales are divided into direct and indirect (Article 318-1 of the Tax Code of the Russian Federation). At the same time, the list of non-operating expenses (Article 265 of the Tax Code of the Russian Federation) does not allow OCR to be included among them. An organization can independently choose the procedure for attributing certain expenses to one another and enshrine it in its accounting policy (Article 319-1 of the Tax Code of the Russian Federation). Consequently, OCR can be taken into account for NU purposes as both direct and indirect. The main difference is that indirect costs can be taken into account for the purposes of tax accounting in the current period, while direct costs are calculated taking into account the balance of work in progress.

Despite the relative freedom in the issue of dividing costs into categories, the fiscal authorities remind that classifying certain costs as indirect is legal only if there is no real opportunity to take them into account as direct (letter of the Federal Tax Service No. KE-4-3/2952 dated 24.02. 2011 and a number of similar documents).

Firms providing services can fully account for their costs in the current tax period.

Main

- General operating expenses do not relate directly to the production of products.

- Depending on the chosen method, they are either distributed in proportion to the selected basic indicator, by type of product, and then written off according to the nomenclature, or completely attributed to cost, or isolated and attributed to cost using the “direct costing” method.

- In accounting for industrial maintenance, account 26 is provided, which is closed to production accounts taking into account types of products or to account 90.

- In tax accounting, according to the accounting policy for NU purposes, OHR can be classified as both direct and indirect.

How to close an account 28

Account 28 is designed to account for costs that arise due to disruptions in the production process. For example, based on clause 26 of FSBU 5/2019, these include excess consumption of materials, losses in case of defects, downtime, accidents, etc.

Until 2022, 1C:Accounting 8 CORP did not have automation for closing accounts. 28. Starting from the current year in the program, at the end of the month, the costs of marriage are written off to the account. 90.02 in cost of sales. If they are indicated on the account. 28 without division into item groups, then they are distributed among groups in proportion to the distribution base, which is established by the accounting policy.

On the account 28, you can also keep records of losses that are included in the cost of production, i.e. those losses that are caused by the technological process. In this case, correspondence is generated manually:

Dt 20 Kt 28

Then, at the close of the month, the account balance amounts are written off to the cost of sales. 28 resulting from this correspondence.

You can purchase services that help you work as an accountant here.

Do you want to install, configure, modify or update 1C? Leave a request!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Distribution of overhead costs

The OPR accumulated during the month on account 25 on the last day of the month is debited to account 20 “Main production”, that is, recognized in the cost of production.

Dt 20 Kt 25 - general production expenses (posting) are written off to the cost of production.

Example of distribution of costs of auxiliary farms.

General production costs of two auxiliary workshops amounted to 100,000 rubles. Amount of direct costs for this period: RUB 300,000. - for workshop 1 (account 23-1) and 200,000 rubles. - for workshop 2 (account 23-2). The methodology adopted by the enterprise for distributing ODA among auxiliary farms is proportional to the amount of direct costs attributable to such farms:

- We determine the share (%) of each workshop in terms of direct costs in the total amount of direct costs:

- 60% (300,000 rubles / (300,000 + 200,000 rubles) - falls on auxiliary facilities 1;

- 40% (200,000 rub. / (300,000 + 200,000) rub.) - falls on auxiliary facilities 2.

- We determine the amount of ODA for each auxiliary farm:

- 60,000 rub. (60% × 100,000 rub.) - falls on auxiliary farm 1;

- 40,000 rub. (40% × 100,000 rub.) - falls on auxiliary facilities 2.

We reflect the received amounts with transactions:

| Debit | Credit | Amount, rub. | |

| Direct | |||

| On the shop floor 1 | 10, 70, 69, 60, 76 | 300 000 | |

| On the shop floor 2 | 10, 70, 69 | 200 000 | |

| Indirect | |||

| Related to workshop 1 | 60 000 | ||

| Related to workshop 2 | 40 000 | ||

Each company, as a rule, has its own base for the distribution of general production costs. What is common to all is that the indicator for distribution must be related to the volume of finished products. This indicator is used for the long term; the procedure for calculating it is an element of the accounting policy. When choosing a method, it is recommended to be guided by industry recommendations for accounting for product costs.

To plan production costs, companies usually develop an overhead budget, which includes planned indicators for expenses for general production purposes based on their changes in past periods and the current needs of the company.

1C

Currently, accounting for general production and general economic costs is carried out in accounting databases and programs of the 1C group. Methods for distributing indirect costs are regulated by special settings. When calculating the cost of experimental work and industrial maintenance, it is necessary to check the boxes opposite the approved base in the “production” tab. When writing off as deferred expenses, it is necessary to establish the period and amount. To include costs in the financial result, fill in the appropriate tab. When the “period closing” function is launched, general production and general business expenses accumulated in registers 25 and 26 are automatically written off to the debit of the specified accounts. This process forms the cost of the finished product.