Why is the complementary SZV-M needed?

The supplementary SZV-M allows the employer to clarify and supplement information about insured persons previously transferred to the Pension Fund (Article 15 of the Law of 01.04.1996 No. 27-FZ “On individual (personalized) accounting...").

Using the supplementary SZV-M, the employer submits to the Pension Fund:

- information that is not in the original report (for example, for a forgotten employee);

- correct data instead of erroneous ones (correction of errors in the employee’s full name, TIN or SNILS made in the original SZV-M).

The supplementary SZV-M allows you to generate complete and reliable personalized information on the personal accounts of insured persons.

How is SZV-M presented?

According to Art. 8 of the Federal Law of April 1, 1996 No. 27-FZ, information for individual (personalized) accounting submitted in accordance with this Federal Law to the bodies of the Pension Fund of the Russian Federation is presented in accordance with the procedure and instructions established by the Pension Fund of the Russian Federation.

This information may be presented as follows:

| Method of reporting | Conditions |

| In the form of written documents | Provided that the number of insured persons (including those who have entered into civil contracts for which insurance premiums are calculated in accordance with the legislation of the Russian Federation) does not exceed 25 people |

| In electronic form (on magnetic media or using public information and telecommunication networks, including the Internet, including a single portal of state and municipal services) with guarantees of their accuracy and protection from unauthorized access and distortion | The policyholder provides information on 25 or more insured persons working for him (including persons who have entered into civil contracts) for the previous reporting period in the form of an electronic document signed with an enhanced qualified electronic signature in the manner established by the Pension Fund of the Russian Federation. |

When submitting information in electronic form, the relevant body of the Pension Fund of the Russian Federation sends to the policyholder confirmation of receipt of the specified information in the form of an electronic document.

Each policyholder must submit monthly, before the 15th, to the Pension Fund of the Russian Federation information about each insured person working for him (including those who have entered into civil contracts for which insurance premiums are charged).

On what form should I fill out the supplementary SZV-M?

There is no separate form for the supplementary SZV-M. This report must be completed on the same form that was used for the original report.

In order for the Pension Fund to distinguish the original report from the corrective one, the reporting form contains a special Section 3 “Type of form (code)”.

For supplementary SZV-M, the code “additional” should be entered in this section:

How to fill out the supplementary SZV-M when correcting errors

To correct errors in the original report already submitted to the Pension Fund, it is not enough to issue only a supplementary SZV-M. You must first cancel the erroneous data.

Use the following procedure, if you made a mistake in the full name, INN or SNILS of an employee - fill out two SZV-M:

- with the “cancel” type - transfer into this form from the original SZV-M information about the employees (employee) for whom corrections are required;

- with the “additional” type - in it, indicate the correct data for these employees (employee).

Let us tell you in more detail how to fill out the SZV-M with type “o” when correcting errors in the original report:

Step 1. On the new SZV-M form, fill out Section 1 “Insured Details” and Section 2 “Reporting Period” exactly as you did in the original report.

Step 2. In Section 3 “Form type (code)” enter the code “cancel”.

Step 3 . In Section 4 “Information about insured persons”, transfer individual information from the original report only for the employee whose data contains an error.

Step 4. Send the SZV-M with the “cancel” type to the Pension Fund of Russia.

Step 5 . On the new SZV-M form, fill out Section 1 “Insured Details” and Section 2 “Reporting Period” exactly as you did in the original report.

Step 6. In section 3 “Form type (code)” enter the code “additional”.

Step 7 . In section 4 “Information about insured persons”, enter correct individual information (full name, INN and SNILS) only for the employee for whom erroneous information was reflected in the original report and was canceled in SZV-M with the “cancel” type.

Step 8 . Send the SZV-M with the “additional” type to the Pension Fund.

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

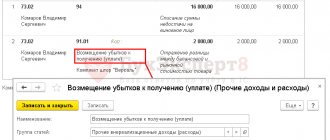

Example 1

When registering SZV-M for October 2022, the accountant of Veter LLC made a mistake in the SNILS number of one employee, Igor Yuryevich Kitaev. In his SNILS, two numbers were swapped and instead of the number 040-298-76 5 08, the report included the number 040-298-67 5 08.

In order for the employee’s personal account to reflect reliable information, two reports were sent to the Pension Fund of Russia in the SZV-M form: with the type “o. It reflected information about only one employee, whose individual information contained an error in the original report.

How the error in SZV-M was corrected, see the samples:

How to send a corrective report SZV-M

The supplementary and canceling form SZV-M can be submitted in person to the Pension Fund of Russia, sent by mail or electronically. The latter requires an electronic digital signature. Its registration will cost 2–5 thousand rubles, depending on the region.

It is important to comply with the document format requirements. Employers who employ 25 or more employees are allowed to provide SZV-M only in electronic form. In other cases, individual entrepreneurs and legal entities choose the method of filing at their own discretion (Article 8).

But sometimes exceptions are possible, since the format of the adjustment must match the original report.

For example, the accountant of Tsvetochek LLC sent SZV-M for September in paper form, since the company employed 24 people. Within a week, the company hired two workers and is now required to provide information on insured persons in electronic format.

Two weeks later, the accountant discovered an error in the original report. Despite the above circumstance, the specialist submits the adjustment in paper form in accordance with the first document.

To avoid getting confused by the abundance of rules, use the “My Business” service. It takes into account legal regulations and automatically checks the accuracy of information. With it, you can easily prepare reports even with minimal experience in accounting.

We issue a supplementary SZV-M for forgotten employees

Filling out the supplementary SZV-M for forgotten employees takes several steps:

Step 1. On the new SZV-M form, fill out Section 1 “Insured Details” and Section 2 “Reporting Period” exactly as you did in the original report.

Step 2. In section 3 “Form type (code)” enter the code “additional”.

Step 3 . In section 4 “Information about insured persons”, indicate individual information (full name, INN and SNILS) only for the employee (employees) whom you forgot to include in the original report. There is no need to duplicate individual information about employees already indicated in the original SZV-M.

Step 4 . Send the SZV-M with the “additional” type to the Pension Fund.

Example 2

Every month, the accountant of Master LLC submitted to the Pension Fund a report in the SZV-M form for 112 employees of the company. In October 2022, three individual contractors were registered to perform one-time work under the GPC agreement. When filling out the SZV-M for October, the accountant, out of habit, reflected all full-time employees, but forgot about the hired contractors. He noticed his mistake after submitting the initial report. He provided information on forgotten persons in the supplementary SZV-M.

How the accountant filled out the supplementary SZV-M for October 2022, see the sample:

What does the SZV-M report include?

In accordance with Art. 3 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system” the goals of individual (personalized) accounting are:

- creating conditions for the appointment of insurance and funded pensions in accordance with the labor results of each insured person;

- ensuring the reliability of information about length of service and earnings (income), which determine the size of insurance and funded pensions when they are assigned;

- creation of an information base for the implementation and improvement of the pension legislation of the Russian Federation, for the appointment of insurance and funded pensions based on the insurance length of the insured persons and their insurance contributions, as well as for the assessment of obligations to the insured persons for the payment of insurance and funded pensions, urgent pension payments, lump sum payments pension savings funds;

- developing the interest of insured persons in paying insurance contributions to the Pension Fund of the Russian Federation;

- creating conditions for monitoring the payment of insurance premiums by insured persons;

- information support for forecasting the costs of paying insurance and funded pensions, determining the tariff of insurance contributions to the Pension Fund of the Russian Federation, calculating macroeconomic indicators related to compulsory pension insurance;

- simplification of the procedure and acceleration of the procedure for assigning insurance and funded pensions to insured persons.

The SZV-M form was approved by Resolution of the Board of the Pension Fund of Russia dated February 1, 2016 No. 83p “On approval of the form “Information about insured persons”. The section “Information about insured persons” contains information about insured persons - employees with whom employment contracts, civil law contracts, the subject of which is the performance of work, the provision of services, author’s order contracts, contracts for alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements granting the right to use works of science, literature, art

| № p/p | Last name, first name, patronymic (if any) of the insured person (filled out in the nominative case) | Insurance number of an individual personal account (required to be filled in) | TIN (filled in if the policyholder has data on the individual’s TIN) |

Thus, in the SZV-M it is necessary to indicate information about employees, about contractors with whom an employment contract has been concluded, a contract agreement that is currently in force or has ceased to be valid in the reporting period. In this matter, it is necessary to be guided solely by the duration of the contract.

In what form should the supplementary SZV-M be presented?

As a general rule, companies with 25 or more employees can submit SZV-M exclusively in electronic form (Clause 2 of Article 8 of Law No. 27-FZ). If the number is smaller, the choice is up to the employer: you can report on paper or via the Internet.

If the initial report is sent based on the number of individuals in electronic form, the supplementary SZV-M should also be sent in the same form. It does not matter that it will provide information on only one or several employees.

Let us remind you that for submitting SZV-M in paper form instead of electronically, the fine is 1,000 rubles. (clause 2 of article 8, clause 4 of article 17 of Law No. 27-FZ, clause 41 of Instruction dated 04/22/2020 No. 211n).

Penalties for failure to submit the SZV-M form

The fine for failure to submit monthly reports on time will be 500 rubles. This amount will have to be paid for each employee about whom information has not been reported. So, for example, if the SZV-M form is submitted late, and the policyholder employs 20 people, then the fine will be 10,000 rubles (20 people × 500 rubles).

Also, this fine of 500 rubles can be punished for providing incomplete and (or) false information regarding each employee.

If an organization with more than 25 employees submits a report not in electronic format, but on paper, the fine will be 1,000 rubles (Article 17 of Law No. 27-FZ).

For violation of the procedure and deadlines for submitting information (documents) of personalized records to the Pension Fund of the Russian Federation, Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation also establishes administrative liability. Thus, officials of the policyholder may be held liable in the form of a fine in the amount of 300 to 500 rubles.

But keep in mind that it is impossible to prosecute simultaneously both under the Code of Administrative Offenses of the Russian Federation and under Federal Law No. 27-FZ for the same offense. Resolution of the Constitutional Court of the Russian Federation of February 4, 2022 No. 8-P.

When to submit a supplementary report

The deadline for submitting the supplementary SZV-M depends on who discovered the error - the employer or the Pension Fund:

The PFR notification must contain information about errors and (or) inconsistencies between the submitted individual information and the data available to the PFR (clause 38 of the Instructions, approved by Order of the Ministry of Labor No. 211n, Part 5 of Article 17 of Law No. 27-FZ).

Pension Fund specialists have the right to deliver the notice to the employer personally against signature, send it by registered mail, or send it electronically via TKS.

In order not to be late in submitting the supplementary form (if errors were identified by the Pension Fund) and not to earn a fine, it is important to count the deadline correctly (clause 38 of Instruction No. 211n):

- the notice was sent by registered mail - the date of delivery is considered to be the sixth day counting from the date of sending the registered letter;

- the notification was sent electronically via TKS - the date of receipt is the date indicated in the confirmation of receipt of the employer’s information system.

Instead of notifying that errors have been corrected, the Pension Fund of Russia may send the employer an SZV-M inspection protocol indicating the identified errors and (or) inconsistencies. Both of these documents are legally equivalent (Resolution of the Arbitration Court of the North-Western District of April 23, 2020 No. F07-4647/2020 in case No. A42-9736/2019).

Complementary SZV-M and coronavirus subsidy

During the coronavirus pandemic, SZV-M acquired a special status. Using data from this report, tax authorities determine whether the employer has the right to receive a subsidy from the federal budget.

What employers need to know about the supplementary SZV-M in order to receive a subsidy, tax officials told in the Federal Tax Service Letter No. BS-4-11 dated October 1, 2020 / [email protected]

A company loses the right to a subsidy if the number of its employees in the month for which the subsidy is paid is at least 90% of the number of employees in March 2022 or reduced by no more than 1 person in March 2022 (Rules for provision in 2020 from the federal budget subsidies, approved by Government Decree No. 576 dated April 24, 2020).

Tax officials recalled that small and medium-sized businesses that have reduced their staff by more than 10% (based on an analysis of SZV-M reporting) or by more than 1 person in relation to the number of employees in March 2022 cannot qualify for a subsidy. Moreover, the submission of the supplementary SZV-M for March 2022 after the deadline for sending applications to the tax authorities for the subsidy provided for by Resolution No. 576, for the purpose of formally implementing the provisions of the Rules, is not a basis for receiving a subsidy.

When will you be fined for supplementary SZV-M?

A fine cannot be avoided if you submitted the supplementary SZV-M for forgotten employees after the legally established deadline. Now this is directly provided for in Part 4, Clause 40 of Instruction No. 211n.

Previously, in such circumstances, it was possible to fight off a fine in court (Resolution of the AS SZO dated 04/06/2020 No. F07-2720/2020 in case No. A56-79354/2019, Determination of the RF Armed Forces dated 02/08/2019 No. 301-KG18-24864, dated 20.12 .2019 No. 306-ES19-23114).

The fine for submitting individual information after the established deadline is 500 rubles. in relation to each insured person (Article 17 of Law No. 27-FZ).

Examples:

- The company submitted the SZV-M for November on December 14, and on December 16 submitted the supplementary SZV-M with five forgotten employees. The fine was 2,500 rubles. (5 people x 500 rub.) - the report was submitted outside the period established by law.

- The company submitted the original SZV-M for November on December 14, and on December 15, 2020, sent the supplementary SZV-M to the Pension Fund for twenty forgotten employees. She will not be fined - the report is submitted before the end of the reporting campaign.

Let us remind you that SZV-M for the reporting month should be submitted no later than the 15th day of the month following the reporting period (clause 2.2 of Article 11 of Law No. 27-FZ).

The amount of the fine for supplementary SZV-M in court can be significantly reduced if the court takes into account mitigating circumstances (Resolutions of the AS TsO dated April 12, 2018 No. F10-760/2018, AS MO dated September 13, 2017 No. F05-12439/2017). Mitigating circumstances may include a slight delay in reporting and a lack of intent and negative consequences for the budget. And also the fact that the offense was committed for the first time and the employer admitted guilt.

When is it necessary to submit a corrective SZV-M?

Unlike the original SZV-M, which must be sent by the 15th day of the month following the reporting month, there are no strict submission deadlines for corrective report forms. However, you should not delay sending correction documents to reduce the likelihood of sanctions.

If the Pension Fund notices an error in the SZV-M before the accountant, the company will receive a notification with an error code. If you do not send an adjustment within 5 business days of receiving the request, the company will receive a fine.

Let's sum it up

Complementary SZV-M:

- drawn up on the same form as the original report, indicating the “additional” code in Section 3 “Form type (code)”;

- should contain information only on those employees whose information is missing in the original report or reflected with errors;

- is submitted together with the canceling SZV-M, if it is necessary to correct errors in the information already submitted to the fund;

- may result in a fine of 500 rubles. for each forgotten employee, if submitted to the Pension Fund later than the 15th day of the month following the reporting month.

Questions and answers

- Our employee is on maternity leave. If we don't turn it on, will we be fined?

Answer: Considering the fact that an employment contract has been concluded with the employee, it is necessary to provide his data to SZV-M. An employee being on maternity leave is not an exception to this rule.

- We didn’t have time to submit information about our employee who is on leave without pay? What to do?

Answer: For failure to provide information about the insured persons, the policyholder will be charged a fine of 500 rubles for each insured person.