A simple piecework wage system

With a simple piece-rate wage system, wages are calculated based on the piece rates established in the organization and the quantity of products (work, services) produced by the employee.

Salary can be calculated as follows:

Wage

= Piece price per unit of finished product x Quantity of manufactured products

The piece rate is determined by the formula:

Hourly (daily) rate / Hourly (daily) production rate = Piece rate

The production rate is the amount of products, work, and services that each worker must produce per unit of working time.

Production standards are determined by the management of the organization. The size of the hourly (daily) rate must be established in the Regulations on remuneration and staffing of the organization.

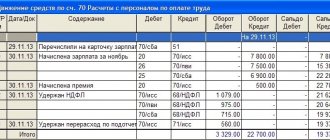

Example. Simple piecework wages

The hourly rate of A.N. Ivanov, an employee of Passiv LLC, is 200 rubles/hour. The production rate is two parts per hour. During April of the reporting year, Ivanov produced 95 parts. The piece price for one product is: 200 rubles.

: 2 pcs. = 100 rub./pcs. Ivanov’s salary for April of the reporting year will be:

100 rubles. × 95 pcs. = 9500 rub.

Piece wages in 1C: ZUP

Published 01/14/2020 05:16 Author: Administrator The most common form of remuneration remains time-based. But along with it, there are other calculation options. For example, piecework wages, in which the calculation is made not on the number of days or hours worked by the employee, but on the amount of work performed. For example, this could be the number of units produced or the size of the room in which the tiles were laid. There are also several types of piecework payment.

There are:

- direct piecework payment, in which the calculation is made by multiplying the amount of work performed by the corresponding prices;

— progressive piecework, in which several types of prices are established for the same type of work, which are applied depending on the amount of work performed. For example, the cost of producing one part is 100 rubles, and after fulfilling the monthly production plan - 150;

— indirect piecework wages, in which the wages of pieceworkers are calculated as a percentage of the wages of the main production workers they serve;

— lump sum payment implies that payment is calculated for the entire volume of work performed, and not for part of it. It should also be said that lump sum earnings are distributed among department employees based on the labor participation rate or any other indicator that is approved by the organization.

Let's look at how wages are calculated using piecework rates in 1C: ZUP using the example of simple piecework and piecework-progressive wages.

Direct piecework payment

Let's start by setting up the program. Go to the “Settings” section and select the “Payroll calculation” item. In the window that opens, click on the link “Setting up the composition of accruals and deductions” and on the “Other accruals” tab, set the “Piecework earnings” flag.

Save the settings by clicking on the “Apply and Close” button. Now let’s set the prices for piecework; to do this, in the “Settings” section, select the “Types of work” item. Using the “Create” button, we will enter several rates, filling in the name, payment amount and the date from which this rate is applied. Also, for accrual purposes, you can set the method of reflection in accounting and the division, if necessary.

The amount of work done is established using the document “Data for salary calculation”, located in the “Salary” section. It should be noted that all this data must be entered before calculating wages for the month. In the “Data for salary calculation” window, using the “Create” - “Piece work” button, enter the indicators for the month. If you plan to include piecework payment in the calculation of the advance for the first half of the month, then you must set the appropriate flag, and the document entry date must then be less than the advance calculation date. In the tabular section, it is possible to enter the daily volume of work performed, broken down by employee.

Now let's move on to calculating salaries for the month. To do this, select the item “Calculation of salaries and contributions” in the “Salary” section, create a new document, indicate the required period and click on the “Fill” button.

The program will calculate charges based on the amount of work performed and the corresponding prices.

Another important nuance is that an employee who is accrued wages on a piece-rate basis must have the appropriate type of accrual in the “Hiring”, “Personnel Transfer” or other document establishing planned accruals.

Piece-progressive payment

The basic settings of the program will be similar to those we looked at in the previous example, but in addition it is necessary to create a new type of accrual to calculate the bonus for exceeding the plan. Let's go to the "Settings" section and select the "Accruals" item. In the accruals “Piece earnings (for those working on an hourly rate)” and “Piece earnings (for those working on a salary basis)” that have already been created using the initial setup, you need to check how the indicators are accumulated within a month.

The switch set to the item “By correspondence of the registration date to the accrual interval” means that if an employee is absent from work, the program will not take into account production when calculating payment for these days. Therefore, if you want all days of the month in which there is registered output to be included in the calculation, then set the switch on the “All accumulated values for the month” item.

Now let's move on to creating a new accrual. We enter the name “Additional payment for piecework types of work”, the purpose “Time-based wages and allowances”, the accrual is carried out “Monthly” and check that the “Include in payroll” flag is set. If you plan to make an additional payment in a fixed amount when the production plan is exceeded, then select the appropriate switch. Or, in the case of a calculated premium, click on the “Edit Formula” button.

Let’s assume that if the plan is exceeded by up to 15%, we charge a premium of 10% of the basic piece rates. If you exceed 15%, the premium will be 20%. In this case, the formula will look like this:

Calculation base * ?(Piecework Earnings / (TariffRateHourly * TimeInHours) <=1, 0, ?(PieceworkEarnings / (TariffRateHourly * TimeInHours) <=1.15, 10, 20)) / 100

To put it simply, the formula can be read like this: If the piecework payment, calculated at the hourly rate, is less than 1 (meaning 100% of output), then the allowance is 0. If it is less than or equal to 1.15, then the additional payment is 10%. And if more than 1.15, then 20.

Since in the formula we indicated the “Calculation Base” indicator, it is also necessary to indicate what will be included in it. Go to the “Base calculation” tab and indicate the types of piecework accruals that will be taken as the basis for the calculation.

The “Time Tracking” tab should be filled out as follows:

On the “Dependencies” tab, specify the accruals and deductions that depend on this type of calculation. For example, a regional coefficient or deduction based on a writ of execution. The “Priority” tab will be automatically filled in with accruals whose priority is higher than the given accrual.

On the “Average Earnings” tab, you can only set or remove the flag on the indexation of this accrual. In this matter, you need to rely on accounting policies. The “Taxes, fees, accounting” tab is filled in automatically based on the completion of the previous tabs. We save the accrual using the “Record and close” button.

With the help of documents establishing the amount of remuneration for employees, and this can be either personnel appointments and transfers, or the assignment of planned accruals, we will indicate two types of accruals for the employee: piecework earnings and additional payments for piecework types of work. In our example, we will use the document “Change in wages” in the “Salary” section.

Then enter piece rates using the “Types of Work” document on the “Settings” tab. Let us assume that the production of 1 product according to the standard should take 2 hours. Based on the fact that the payment for an hour of work of an employee is 100 rubles, we will set the piece rate equal to 200 rubles.

We will register the amount of work performed using the document “Data for salary calculation” on the “Salary” tab.

And then we will calculate the salary using the document “Calculation of salaries and contributions”.

Let's check the calculation. In October there were 184 working hours, the product is produced in 2 hours. Accordingly, the rate of production of products per month is equal to: 184/2=92. And 150 products were produced, which exceeds the plan by 63%, which means that the bonus percentage should be equal to 20% of the salary: 30,000 rubles * 20% = 6,000 rubles.

Author of the article: Alina Kalendzhan

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

JComments

Piece-bonus wage system

With a piece-rate-bonus system of remuneration, the employee is awarded bonuses in addition to wages.

Bonuses can be set either in fixed amounts or as a percentage of wages at piece rates.

Wages under the piecework-bonus wage system are calculated in the same way as under a simple piecework wage system. The bonus amount is added to the employee's salary and paid along with the salary.

Buy a book

Salary 2021 with a detailed description of all remuneration systems, rules for calculating and paying taxes in 2022

Example. Salary calculation for piecework-bonus payment system

Turner 3rd category S.S. Petrov has a piecework wage system. The piece rate for a 3rd category turner is 80 rubles. for one finished product. According to the Regulations on bonuses, if there is no defect, employees of the main production are paid a monthly bonus of 3,000 rubles. In April, Petrov produced 100 products. Petrov’s basic salary for April of the reporting year will be: 80 rubles/piece.

× 100 pcs. = 8000 rub. The total amount of Petrov’s accrued wages for April of the reporting year will be:

8,000 rubles. + 3000 rub. = 11,000 rub.

Documents regulating the amount of salary

The salary amount is specified in the contract.

Such documents can safely include: internal regulations of the institution, charter, internal labor regulations, and so on.

Among other things, the established bonus system for employees must have clear boundaries, that is:

- a list of bonuses that can be paid to the employee must be indicated;

- the frequency of payment of such monetary incentives and incentives is also indicated - monthly, weekly, once a quarter, after the delivery of each object, and so on;

- the regulations on bonuses also prescribe norms that are considered overtime work or exceeding established work periods;

- the bonus system is also taken into account - the same amount for exceeding work standards and its high quality, or this amount is dynamic and depends on the timing and volume of work;

- the grounds on which bonus payments for an employee can be canceled or reduced;

- the procedure for challenging an employee’s wages and awarding bonuses based on work results.

Thus, by experimenting with standards and terms of work, penalties, management can choose the appropriate and most acceptable working conditions for both parties.

This not only allows the company to develop dynamically and steadily, but also stimulates employees to high quality work.

Piece-progressive wage system

With this remuneration system, piece rates depend on the quantity of products produced for a given period of time (for example, a month). The more products a worker produces, the higher the piece rate.

Example. Application of piecework-progressive forms of remuneration

The following piece rates are established:

| Number of products produced per month | Piece rate |

| up to 110 pcs. | 80 RUR/pcs. |

| over 110 pcs. | 85 RUR/pcs. |

During April of the reporting year, employee A. N. Somov produced 120 products.

Somov’s salary for April of the reporting year will be:

(110 pcs. × 80 rub.) + (10 pcs. × 85 rub.) = 9650 rub.

Indirect piecework wage system

The indirect piecework wage system is used, as a rule, to pay workers in service and auxiliary industries. Under such a system, the wages of workers in service industries depend on the earnings of workers in main production, who receive wages on a piece-rate basis.

With an indirect piecework wage system, the wages of workers in service industries are set as a percentage of the total earnings of workers in the production they serve.