The Murmansk region belongs to areas with harsh climatic conditions, therefore regional coefficients and percentage premiums are applied in the region. They are not included in the minimum wage (SMW) and are charged additionally. Therefore, for residents of the region, the minimum acceptable salary, although based on the federal minimum wage, is actually higher than in the country as a whole.

The cost of living (LW) in the region will also be higher than in more southern regions, since it is calculated taking into account local prices for goods and services. At the beginning of the year, the cost of living in the Murmansk region for 2022 had not yet been adjusted: from January 1, the value for the 3rd quarter of 2022 continues to apply. How the minimum wage and minimum wage indicators in the region will change in the future, read the article.

Legal assistance:

Free in Russia: 8

Dear readers!

The free legal assistance hotline is available for you 24 hours a day!

What is the cost of living and what is the minimum wage

The minimum set of food products, non-food products, and services necessary for life form the consumer basket. The subsistence minimum is the amount of money per person per month with which you can purchase goods included in the consumer basket and pay taxes (Federal Law No. 134-FZ of October 24, 1997).

The state guarantees working citizens a salary not lower than the minimum wage. Moreover, the “minimum wage” is established not only at the federal level (and is equal to the subsistence minimum wage of the working-age population for the 2nd quarter of the previous year), but also in each region, taking into account its characteristics.

How is the minimum wage set?

The indicator is established by federal legislation and applies to all Russian regions, including Murmansk. Subjects of the Russian Federation, guided by regional laws, can introduce a regional minimum wage, which all companies must follow, except for organizations financed from the state budget. The minimum wage must be indexed annually.

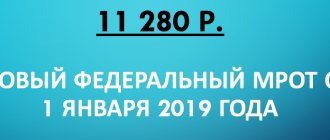

After amendments to the law that came into force on January 1, 2019, the minimum wage level is determined taking into account data from the second quarter of the previous year.

What do minimum wages and PM affect?

Citizens with an income per family member below the minimum subsistence minimum are recognized as low-income and receive various social support measures.

Recognition of a low-income family in the Murmansk region is the basis for:

- payment of monthly child benefit;

- assignment of benefits to the poor;

- receiving a monthly payment at the birth of the third and subsequent child until he reaches three years of age;

- targeted social assistance;

- a one-time benefit when a child enters first grade.

Minimum wage is the smallest amount below which wages cannot be set for full-time workers. In the amount of the minimum wage, citizens receive benefits for temporary disability, pregnancy and childbirth in the absence of earnings in the billing period.

What is the minimum wage (minimum wage) in St. Petersburg in 2019-2020?

PM value in the region for 2022

The size of the PM in the Murmansk region for the 3rd quarter of 2022 will be valid approximately until February 2022, when the PM for the 4th quarter of 2022 will be established. The current indicator was approved by the regional government decree of November 15, 2022 No. 515-PP and is:

- per capita - 16,886 rubles;

- for workers - 17,575 rubles;

- for pensioners - 14,040 rubles;

- for children - 16,900 rubles.

PM in Murmansk and the region for the 1st quarter of 2022 will become known only in the 2nd quarter.

From January 1, 2022, women who gave birth to (adopted) their 1st or 2nd child will be able to receive benefits until the child turns three years old.

The payment is provided if the income for each person in the family is below two monthly subsistence minimums for working-age citizens of the region of residence for the 2nd quarter of 2022. To receive benefits for a child under 3 years of age in the Murmansk region, the income of each family member must be less than 35,682 rubles (17,841 x 2).

Child benefit in this region in 2022 will be provided in the amount of 17,193 rubles. This is the value of the monthly subsistence minimum per child in the 2nd quarter of 2019 (in accordance with the decree of the regional government dated August 20, 2019 No. 386-PP).

Minimum wage from January 1, 2022

According to the current legislation (Federal Law No. 82 of June 19, 2000), from January 1, 2020, the minimum wage must be at least 12,130 rubles.

- Region Size

- Adygea (republic) - Not less than 12,130 for employees of regional organizations

- Altai (republic) - 12130

- Altai Territory - 13000

- Amur region - 12130

- Arkhangelsk region - Not less than 12,130 for employees of regional organizations

- Astrakhan region - Not less than 12,130 for employees of regional organizations

- Bashkortostan (republic) - 12130

- Belgorod region - Not lower than 12,130 for employees of regional organizations

- Bryansk region - Not lower than 12,130 for employees of regional organizations

- Buryatia (republic) - 12130 This amount is used to calculate regional coefficients and percentage bonuses for work experience in the Far North and equivalent areas (11,280)

- Vladimir region - Not less than 12,130 for employees of regional organizations

- Volgograd region - Not less than 12,130 for employees of regional organizations

- Vologda region - Not less than 12,130 for employees of regional organizations

- Voronezh region - Not less than 12,130 for employees of regional organizations

- Dagestan (republic) - 12130

- Jewish Autonomous Region - 12130

- Trans-Baikal Territory - 12130

- Ivanovo region - Not less than 12,130 for employees of regional organizations

- Ingushetia (republic) - 12130

- Irkutsk region - 12130

- Kabardino-Balkaria (republic) - 13079

- Kaliningrad region - Not less than 12,130 for employees of regional organizations

- Kalmykia (republic) - Not lower than 12,130 for employees of regional organizations

- Kaluga region - Not lower than 12,130 for employees of regional organizations

- Kamchatka Territory - 12130

- Karachay-Cherkessia (republic) - 12130

- Karelia (republic) - Not less than 12,130 for employees of regional organizations

- Kemerovo region - 19134

- Kirov region - 12130

- Komi (republic) - Not less than 12,130 for employees of regional organizations. This amount is calculated by regional coefficients and percentage bonuses for work experience in the regions of the Far North and equivalent areas

- Kostroma region - Not less than 12,130 for employees of regional organizations

- Krasnodar Territory - Not lower than 12,130 for employees of regional organizations

- Krasnoyarsk Territory - 12130

- Crimea (republic) - Not lower than 12,130 for employees of regional organizations

- Kurgan region - 12130

- Kursk region - Not lower than 12,130 for employees of regional organizations

- Leningrad region - Not less than 12,130 for employees of regional organizations

- Lipetsk region - Not less than 12,130 for employees of regional organizations

- Magadan region - 12130 Regional coefficients and percentage bonuses for work experience in the Far North regions are calculated on this amount

- Mari El (republic) - 12130

- Mordovia (republic) - 12130

- Moscow — 20 195

- Moscow region - for public sector organizations: 15,000 rubles; for extra-budgetary organizations (commercial organizations) and individual private entrepreneurs: 19,500 rubles

- Murmansk region - Not lower than 12,130 for employees of regional organizations

- Nenets Autonomous Okrug - Not lower than 12,130 for employees of regional organizations

- Nizhny Novgorod region - 12130

- Novgorod region - Not less than 12,130 for employees of regional organizations

- Novosibirsk region - 12130

- Omsk region - 12130 This amount is charged with the regional coefficient established in the region

- Orenburg region - 12130

- Oryol region - Not lower than 12,130 for employees of regional organizations

- Penza region - 12130

- Perm region - 12130

- Primorsky Krai - 12130

- Pskov region - Not lower than 12,130 for employees of regional organizations

- Rostov region - Not less than 12,130 for employees of regional organizations

- Ryazan region - Not less than 12,130 for employees of regional organizations

- Samara region - 12130

- St. Petersburg - 18,000

- Saratov region - 12130

- Sakha (republic) - 12130 Regional coefficients and percentage bonuses for work experience in the Far North regions are calculated on this amount

- Sakhalin region - 12130

- Sverdlovsk region - 12130

- Sevastopol - Not lower than 12,130 for employees of regional organizations

- North Ossetia (republic) - 12130

- Smolensk region - Not less than 12,130 for employees of regional organizations

- Stavropol Territory - 12130

- Tambov region - Not lower than 12,130 for employees of regional organizations

- Tatarstan (republic) - 12130

- Tver region - Not lower than 12,130 for employees of regional organizations

- Tomsk region - 12130

- Tula region - 14,100

- Tyva (republic) - 12130

- Tyumen region - 12130 This amount is subject to a regional coefficient and a percentage bonus for work experience in areas with special climatic conditions

- Udmurtia (republic) - 12130

- Ulyanovsk region - 12130

- Khabarovsk Territory - 12130

- Khakassia (republic) - 18048

- Khanty-Mansiysk Autonomous Okrug - 12130 This amount is used to accrue regional coefficients and percentage bonuses for work experience in the regions of the Far North and equivalent areas. The total amount must not be lower than the subsistence level of the working-age population established in the district (11,280)

- Chelyabinsk region - 12130

- Chechnya (republic) - 12130

- Chuvashia (republic) - 12130

- Chukotka Autonomous Okrug - 12130

- Yamalo-Nenets Autonomous Okrug - 12130 This amount is used to accrue regional coefficients and percentage bonuses for work experience in the regions of the Far North and equivalent areas. The total amount of minimum wage must not be lower than the subsistence level of the working-age population in the Yamalo-Nenets Autonomous Okrug for the second quarter of the previous year (11,280)

- Yaroslavl region - Not lower than 12,130 for employees of regional organizations

How to receive compensation and payments upon dismissal in Murmansk in 2022

PM for additional payment to pension

If a pensioner has a monthly income below the “pension” minimum wage in force in the region of residence, then he receives a federal social supplement to his pension. If the pensioner’s minimum wage in the region is higher than the federal one, then he receives a regional supplement in a portion that exceeds the national minimum wage.

The cost of living for pensioners in the Murmansk region in 2020 is 14,354 rubles (in accordance with regional law dated October 09, 2019 No. 2410-01-ZMO). The value of a similar indicator adopted for Russia as a whole is 9,311 rubles. (according to Federal Law dated December 2, 2019 No. 380-FZ).

Consequently, in the region there is a regional pension supplement for pensioners living there.

Minimum wage in Moscow from January 1, 2022 - what will be the minimum wage?

Federal significance

The minimum wage is set at the federal level. For 2022, its value is 12,130 rubles. This indicator is needed to ensure the regulation of income received by working citizens, as well as to determine the amount of benefits and insurance premiums. In no region can the minimum wage be less than the federally established value, i.e. 12,130 rubles. In 32 constituent entities of the Russian Federation, various bonuses, multipliers and coefficients are used to increase the minimum wage.

In Art. 133 of the Labor Code of the Russian Federation states that the source of financing for the minimum wage is primarily the employer’s own budget. If we talk about budget firms, the material base is provided by the local regional budget. At the state level, the indicator is determined within the framework of the federal assembly and then signed by the President of the Russian Federation. A tripartite agreement operates on a regional basis.

In the Russian Federation, the minimum wage is usually understood as the lowest wage offered for the work of an employee with a low level of qualifications. At the same time, he must work a full working day. The employer's task is to provide optimal conditions.

In Art. 129 of the Labor Code of the Russian Federation stipulates several elements included in the minimum wage:

- work performed taking into account the qualification level of the specialist;

- volume of production;

- additional incentive payments.

In accordance with the provisions of Art. 129 of the Labor Code of the Russian Federation, the minimum wage includes the following transfers made to the specialist:

- salary in a fixed amount, determined by the qualification level of the specialist and the complexity of his work activity;

- compensation payments for work in conditions harmful and unsafe for health and life;

- incentive amounts accrued for the year, quarter, month, etc.;

- other additional payments made by the employer.

If an employee is an internal part-time worker, i.e. he is responsible for a list of additional responsibilities, they are paid separately. The level of income of an external part-time worker depends on the agreements reached between the parties.