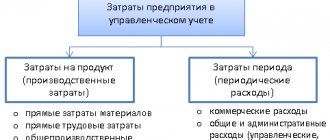

Methods for estimating reserves

In BU

Possible methods for valuing inventories upon disposal:

- at the cost of each unit;

- at average cost;

- FIFO at cost of the first units received in time.

Can:

- choose one method for all stocks;

- choose different methods for groups of stocks that have similar properties and patterns of use.

Attach

to UP according to BU

IN NU

similar methods (clause 8 of article 254 of the Tax Code of the Russian Federation).

Average cost calculation: not as simple as it seems at first glance

In this article we will not touch upon complex production processes, only trading operations, to understand the operation of configuration mechanisms.

When working in the accounting 3.0 and 2.0 configuration, when closing a month, we are often faced with the question of what kind of operation it is to adjust the cost of an item and why it is needed. Why, when calculating based on the average, does she add some additional transactions and change the cost of the Goods? Also, using an example, we will look at how the average cost is calculated in UT 10.3 and UT 11.4. What is their difference?

As an example, consider the following situation.

We will analyze the period November 2022. At the beginning of the period, as of November 1, 2019, the initial balance of goods was 10 pieces. costing 900 rubles.

There were 2 admissions during the period. From November 10, 10 pcs. at a price of 100 total cost 1000 and from November 20 10 pcs. at a price of 110, the total cost is 1100.

There were also 3 sales dated November 11, 11 units. from November 21, 11 pieces and from November 25, 5 pieces.

- Theoretical part.

I will take the description of the theory from the course /ut11/ut11-fast-start

There are 2 mechanisms for writing off cost by average - Weighted average cost estimate and moving average cost estimate. What is their difference:

Weighted average cost estimate.

In the case of weighted average cost. The program analyzes all initial balances and all receipts for the period, based on this, the amount of one disposal unit is calculated, multiplied by the number of disposals and the cost of disposal is obtained.

The formula will look like this: Cost =

For our example, the cost of disposal will be equal to

(11+11+5)= 2700

Moving average cost estimate

The program analyzes the amount and quantity of receipts not for the entire period, but for the period up to the date of the disposal document; a different cost estimate is obtained for different disposal documents.

Cost =

For the first disposal document dated November 11, the cost amount will be equal to

(11)= 1045

For the second disposal document dated November 21, the cost amount will be equal to

(11)= 1131,84

For the third disposal document dated November 25

(5)= 514,48

The total cost of disposal will be 2691.32

The difference between these two methods is 8.68 rubles.

- Practical part.

Using the example of the Enterprise Accounting 2.0 and 3.0 and Trade Management 10.3 and 11.4 configurations, let’s look at the settings and capabilities for calculating the average cost.

Let's start with the Enterprise Accounting 2.0 configuration

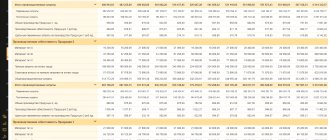

After entering documents and analyzing cost transactions, we receive the following data

| Period | |

| 11.11.2019 | 1 045,00 |

| 11,000 | |

| 21.11.2019 | 1 131,84 |

| 11,000 | |

| 25.11.2019 | 514,48 |

| 5,000 | |

| Total | 2691,32 |

| 27,000 |

Therefore, in accounting 2.0, when entering documents sequentially, a moving average calculation is used.

After the operation to close the month, the moving average cost is reduced to the weighted average cost

| Period | ||||||||||

| 11.11.2019 | 1 045,00 | |||||||||

| 11,000 | ||||||||||

| 21.11.2019 | 1 131,84 | |||||||||

| 11,000 | ||||||||||

| 25.11.2019 | 514,48 | |||||||||

| 5,000 | ||||||||||

| 30.11.2019 | 8,68 | |||||||||

| 0,000 | ||||||||||

| Total | 2700,00 | |||||||||

| 27,000 | ||||||||||

Consequently, in accounting 2.0, the cost price is initially calculated using the moving average method, then at the end of the month it is reduced to the weighted average method. If the accountant believes that the posting to bring the write-off cost to the weighted average cost is not necessary, then the operation “adjusting the cost of the item” when closing the month can be skipped.

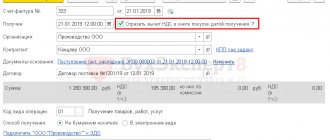

In the accounting 3.0 configuration, the cost calculation mechanisms are the same, but I would like to note one point. In the Administration menu – Posting documents. It is possible to choose the moment of cost calculation.

- “When closing the month” – when processing write-off documents, only the quantity of inventory will be written off, and their cost will be written off when processing “Closing the month” is performed at the weighted average cost.

- “When posting a document” - the write-off of inventory (quantity and cost) will be performed when posting the document at the moving average cost; at the end of the month, when performing the “Closing the month” operation, the write-off will be adjusted at the weighted average cost.

In the UT 10.3 configuration, after sequentially entering documents from the “Statement of batches of goods in warehouses” report, it turns out that the average cost is calculated using the moving average method.

| Posting document | Consumption | |

| Nomenclature | Quantity | Price |

| Period | ||

| 27,000 | 2 691,32 | |

| product | 27,000 | 2 691,32 |

| 11.11.2019 23:59:59 | 11,000 | 1 045,00 |

| 21.11.2019 23:41:06 | 11,000 | 1 131,84 |

| 25.11.2019 23:56:37 | 5,000 | 514,48 |

| Bottom line | 27,000 | 2 691,32 |

Usually in 10.3 trading, no one takes any additional actions. However, in the Documents – Inventory (Warehouse) section, there is a document “Adjustment of the cost of writing off goods”. We will conduct it for the month of November and reformat the report

| Consumption | ||

| Nomenclature | Quantity | Price |

| Period | ||

| 27,000 | 2 700,00 | |

| product | 27,000 | 2 700,00 |

| 11.11.2019 23:59:59 | 11,000 | 1 045,00 |

| 21.11.2019 23:41:06 | 11,000 | 1 131,84 |

| 25.11.2019 23:56:37 | 5,000 | 514,48 |

| 30.11.2019 23:59:59 | 8,68 | |

| Bottom line | 27,000 | 2 700,00 |

A line is added to the report with the write-off adjustment based on the weighted average cost.

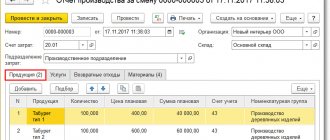

Let's consider this example in the Trade Management 11 configuration.

Let's enter receipt and sales documents. The cost price in this edition is calculated during the month-end closing operation. After analyzing the cost in the report “Statement of batches of goods of the enterprise”, we see that the cost is written off at the weighted average cost

| Period | Consumption | |||

| Quantity | Cost price | |||

| 11.11.2019 12:00:02 | 11,000 | 1 100,00 | ||

| 20.11.2019 12:00:02 | 11,000 | 1 100,00 | ||

| 25.11.2019 12:00:01 | 5,000 | 500,00 | ||

| Total | 27,000 | 2 700,00 | ||

From the above examples, the following conclusions can be drawn.

In configurations UT 10.3 BP 2.0 and BP 3.0, it is possible to calculate both the moving average and the weighted average cost - this depends on the settings and on the entered documents.

In the UT 11 configuration, only calculations based on the weighted average cost are possible.

Very often, when moving from the UT 10.3 edition to the UT 11 edition, customers ask to transfer documents for the last year or the last six months. In principle, it is not recommended to do this, so that all the jambs from the old program do not appear. However, if you still decide to do this, and inventory items are taken into account according to the average, you need to once again make sure that the cost in UT 10.3 is reduced to the weighted average, otherwise there will be discrepancies in the written-off cost in different releases. For a 1C specialist, this will be an extra argument to refuse to transfer documents for the period.

At the end of the article, I would like to note that from the point of view of PBU 18 5/01 paragraph 18, the weighted average cost is considered more correct

“The assessment of inventories at average cost is carried out for each group (type) of inventories by dividing the total cost of the group (type) of inventories by their quantity, consisting respectively of the cost price and the amount of balance at the beginning of the month and the inventory received during the given month.”

Which document should I use for releasing inventory?

Which document in 1C is used to document write-off of inventory from 2022 – Consumption of materials or Transfer of materials into operation ? How are these documents different and which one is better to use?

Material Consumption document replaced and expanded the Requirement invoice .

Warehouse - Material consumption

Accounting for materials and inventory issued to an employee

On March 15, the cleaning lady of the Sewing Shop was given materials and equipment for work that will be used within 12 months:

- Floor cleaner – 1 pc. worth 250 rubles;

- Floor cleaning rags - 2 pcs. worth 300 rubles;

- Mop - 1 pc. worth 200 rubles.

It is necessary to ensure control only over the inventory transferred to the employee.

Document Consumption of materials - Type of operation Use of materials

Document Material consumption - Type of operation Transfer to employee

Account by employee – Expenses and balances

Account by employee – Expense

How to account for inventory using FIFO

The name of this method comes from the English abbreviation FIFO, which means First In, First Out: first in, first out. It is in this order that we will take into account the cost of vacuum cleaners when selling: first, at the price of the vacuum cleaner in the first batch purchased, and when the batch runs out, at the price in the second batch.

This is what it looks like. Vacuum cleaners in the first batch cost 6,000 rubles each, and the total cost of the two batches was 1,623,300 rubles. If we sell one vacuum cleaner, we assume that it was from the first batch. This means that the total cost of inventory will decrease by 6,000 rubles.

If you sell 200 vacuum cleaners at once, it’s a little more complicated. The first batch of vacuum cleaners cost 6,000 rubles each, but there were only 100 of them. Let's take another 100 pieces from the second batch, they cost 5685 ₽.

| The consignment | Cost of 1 vacuum cleaner, ₽ | How many vacuum cleaners were sold? | Cost of vacuum cleaners sold, ₽ |

| Batch 1 | 6000 | 100 | 600 000 |

| Batch 2 | 5685 | 100 | 568 500 |

| Total | 200 | 1 168 500 |

Both lots cost 1,623,300 rubles, and we already sold for 1,168,500 rubles. This means that the cost of inventory in the warehouse is 1,623,300 − 1,168,500 = 454,800 rubles.

Product traceability

We write off materials at average cost. Is it necessary in 1C to change the method of assessing inventories upon disposal in connection with the introduction of goods traceability from 07/01/2021? Can't traceability be ensured without batch accounting?

In 1C, product traceability is implemented as a separate functionality with separate

parallel accounting according to registration numbers of the batch of goods (RNPT).

There is no need to switch to batch accounting and change the method of estimating inventories

for used and non-manufactured units for traceability purposes.

How to account for inventory

Let's say you sell vacuum cleaners: you buy them in batches from several suppliers, and then resell them at retail.

You bought 100 vacuum cleaners for 6,000 rubles each, and a stock of goods has appeared. Let's take it into account in quantity and cost.

| Product | Quantity | Price |

| Vacuum cleaner | 100 | 600 000 ₽ |

It looks nice and clear, but it is temporary. After all, inventory is constantly updated: you sell vacuum cleaners and buy new ones, and the cost per unit may vary. How then to account for inventories?

There are two options: accounting at average cost and using the FIFO method.

Food expenses not accepted at NU

Organization on OSNO. We wanted to simplify accounting and in the receipt document immediately include products in the office (tea, sweets) on 91.02 that are not accepted at NU. 91.02 Other expenses (accepted in NU) is automatically selected. We tried to make a manual adjustment, but then we needed to remove the amount from the NU. Previously they used 10, and then on 91.02. Is there another way?

For management reserves, account 10.21.1 is used. This account is convenient to use when you need to draw up a Material Write-off Certificate for an OU.

If expenses are not accepted into the NU, then reserves can be immediately taken into account in expenses according to Dt 91.02. To correctly reflect non-accepted costs in the NU in the Receipt document (act, invoice, UPD)

use the

Services

you cannot specify a Cost Account dimension on the

Products

How to account for inventory at average cost

Let's now buy not one, but two lots of vacuum cleaners. Moreover, the second batch will be larger, and the supplier will give a discount for this.

| The consignment | Quantity | Cost per piece, ₽ | Cost of the entire batch, ₽ |

| Batch 1 | 100 | 6000 | 600 000 |

| Batch 2 | 180 | 5685 | 1 023 300 |

| Total | 280 | ? | 1 623 300 |

How much does a vacuum cleaner cost on average? Let's divide the total cost by the total quantity: 1,623,300 / 280 = 5,797.5 rubles.

That is, if we sell one vacuum cleaner, then 279 vacuum cleaners will remain in inventory, and their cost will be equal to 279 * 5797.5 = 1,617,502.5 rubles. This way you can find out the cost of inventory, no matter how many vacuum cleaners remain in stock.

Inventory accounting by MOL

Is it possible to keep score 10.21 in the context of financially responsible persons (MRO)? We tried to do this, but adjustments are being made at the end of the month. And the amount for NU and BU does not match. We have a lot of inventory that we would like to take into account in the MOL context.

Account 10.21 “Low-valued equipment and supplies” is NOT

intended for accounting in the context of MOL

; three Sub-Contos are provided for it:

- Nomenclature , Lots , Warehouses .

There are no MOL analysts. You can make Warehouse = MOL, but this is inconvenient if there are a lot of MOLs.

Currently, you can control your MOL inventory on the off-balance sheet account MTs.04:

- issue the document Consumption of Materials – Transfer to Employee.

Let's compare what it looks like in different accounting models

| Operation | Quantity, pieces | Cost, ₽ | |

| Average method | FIFO method | ||

| Bought | 280 | 1 623 300 | 1 623 300 |

| Sold | 200 | 1 159 500 | 1 168 500 |

| Remaining in stock | 80 | 463 800 | 454 800 |

The result turned out to be different, but there is nothing strange in this: if, when using the average cost, it does not matter from which batch we sell the goods, then the cost of balances using the FIFO method is greatly influenced by which batch the product is sold and at what price we bought it.

When we sell all the remaining vacuum cleaners, then there will be no discrepancies in accounting - the cost of 280 vacuum cleaners in the amount of 1,623,300 rubles will be spent, and there will be 0 inventory left in the warehouse.

In general, no matter which method you choose, the result will be the same.

Write-off of MOS in NU

Is it possible to immediately write off both in BU and NU MOS, reflecting them on MTs.04? Or can this amount “hang” in NU for years?

FSBU 5/2019 defines rules ONLY for accounting

, NU is regulated by the Tax Code of the Russian Federation, in which material costs are included as expenses at the time (Article 254 of the Tax Code of the Russian Federation):

- commissioning of

workwear, tools, devices, equipment, devices.

In NU, the cost of MOS can be taken into account in expenses only at the time of their transfer to operation. From this moment on, they are accounted for off-balance sheet in account MTs.04. Whether to lead it or not is up to you:

- Off-balance sheet accounting is required only for those assets, information about which will be disclosed in the financial statements.

To access the section, log in to the site.

See also:

- Clarifications on the mandatory application of FSB 5/2019 “Inventories” from 2021

- Accounting policy for materials accounting

- Partition accounting in 1C 8.3 Accounting

- Average write-off of materials for general business needs

- [06/08/2021 entry] Practice of application of FSB 5/2019 Inventories in 1C - Part 3

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Evaluation upon recognition. Inventories received upon disposal of fixed assets You do not have access to view To gain access: Complete a commercial...

- Valuation of goods upon disposal You do not have access to view To gain access: Complete a commercial...

- Evaluation upon recognition. Assessment when paying in installments (with deferment) You do not have access to view To gain access: Complete a commercial…

- Evaluation after recognition. Valuation at original cost You do not have access to view To gain access: Complete a commercial…

The procedure for applying valuation methods in tax accounting

The Tax Code of the Russian Federation does not disclose the procedure for applying valuation methods, but their application is similar to the valuation methods adopted in accounting.

See also “The procedure for writing off materials in accounting (nuances).”

The valuation method based on the cost of a unit of inventory is usually used to account for single, unique, special inventories, the replacement of which may entail damage to the production process. This method can be used to evaluate objects of art, works of authorship, precious stones, etc.

If the volumes of materials and raw materials used are large, then it is advisable to use the estimation method based on the average cost. This method is the most common, because Regardless of fluctuations in purchase prices, inventories are written off at average cost.

The FIFO method involves writing off valuables according to the “first in, first out” rule, i.e. Inventories are written down at a price in the order in which they were purchased. This method is preferably used when prices for inventories are expected to decline.

If you have access to ConsultantPlus, check whether you are using the methods for writing off the cost of inventories correctly. If you don't have access, get a free trial of online legal access.