The meaning of the unified form T-9

The unified form of a business trip order (form T-9) has acquired special significance since 2015: since January, travel certificates and official assignments have been canceled (subclause E, clause 2 of Amendments to government acts approved by Decree of the Government of the Russian Federation of December 29, 2014 No. 1595), and Since August, keeping records of employees leaving and arriving on business trips has become optional (clause 3 of the Amendments to government acts approved by Decree of the Government of the Russian Federation dated July 29, 2015 No. 771).

Thus, the number of mandatory documents related to business trips has been reduced to 2:

- a written order (order) from the head of a company or individual entrepreneur, which defines the goals, duration and approximate start and end dates of the business trip;

- an advance report with accompanying travel documents, accommodation documents and other documents confirming the costs associated with the completion of the task.

How to influence an employee who submits expense reports late, read the article “The employee delayed the primary report again? . "

Due to the optional use of unified forms developed by the State Statistics Committee of the Russian Federation since 2013, a written order (order) for a business trip can have its own type for each employer. However, the use of the unified T-9 form remains relevant, which contains all the fields necessary to fill out and is a long-standing and well-known document.

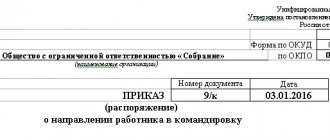

Download the business trip order (form T-9). Sample filling and form

.

Download samples of the organization's personnel documents : Form T-1 and T-1a. Employment orderForm T-2. Employee personal card Form T-3. Staffing table of the organizationForm T-6 and T6a. Vacation orderForm T-7. We draw up a vacation scheduleForm T-8. Order of dismissal Form T-10. Travel certificateForm T-10a. Business trip assignmentForm T-13. Working time sheetForm T-49. Payroll Form T-51. Payroll for calculating and calculating wagesForm T-53. Payroll for salary paymentsForm T-53a. Payroll register Form T-54. Employee's personal account Form T-60. Note-calculation on granting leaveForm T-61. Calculation note upon dismissal

How to fill out form T-9

Form T-9 can be downloaded on our website:

Form T-9 reflects the following information:

- Name of organization or individual entrepreneur, OKPO code.

- Order number and date.

- Full name of the traveler, his personnel number, position, and, if necessary, the name of the unit where he works.

- Place of assignment on a business trip: country, name of locality, name of organization.

- The number of days of the business trip, its start and end dates.

- The purpose of the trip (official assignment) must be indicated, because The accounting of travel expenses depends on this. For example, the cost of traveling to inspect equipment that a firm intends to purchase should increase the cost of that equipment. A trip to conclude an agreement with a supplier of the main raw materials used in production will be recorded as general business expenses, and support for the sold goods will be recorded as commercial expenses.

- The source of funds from which the business trip will be paid. Most often, these are funds from the sending organization or individual entrepreneur. But let’s say that if an auditor goes on a business trip from an audit firm, and the expenses for his trip under the terms of the audit agreement are borne by the audited organization, then this organization will be indicated as the source of funds. This point is also important for the accountant, because, say, in the above example, the expenses for the auditor’s trip cannot be attributed to the expenses of the sending company, but must be taken into account as re-billed to another legal entity.

- Reason for business trip. This item may be left blank if the decision to travel is made directly by the head of the company or individual entrepreneur. But if the initiator of the trip was the traveler himself or the head of the department in which he works, then in this regard the employees usually contact the management of the company with a memo, the details of which will be reflected in this line of the T-9 form.

- Position and signature (with transcript) of the head of the company or individual entrepreneur.

- Signature of the posted worker and the date of familiarization with the order.

If you have access to ConsultantPlus, check whether you have properly arranged your business trip and filled out the T-9 form. If you don't have access, get a free trial of online legal access.

To learn about what the amount of daily allowance may be and how this affects the accrual of personal income tax and insurance premiums, read the article “Amount of daily allowance for business trips (nuances).”

Example of filling out an order

Step 1. In the header of the form, fill in the fields provided to indicate the name of the employer and his OKPO (indicated in the registration documents, eight-digit for legal entities, ten-digit for individual entrepreneurs).

Step 2. Indicate the document number and date of preparation.

Step 3. Indicate which employee is traveling, what position he holds, and what his personnel number is.

Step 4. Write where the employee will go. It is necessary to specify the city and country, the name of the organization or individual entrepreneur who is the receiving party.

Step 5. Specify the duration of the business trip in calendar days, indicating the planned departure and arrival dates.

Step 6. Indicate the basis for the business trip in the order - justify the need to work in another area, briefly and clearly indicating the purpose of departure.

Step 7. Write who pays for the travel expenses. It is very important that a copy of such a document reaches the accounting department in a timely manner, otherwise the employee will not receive money for upcoming expenses.

Step 8. Provide information about the documents that became the basis for issuing the order. This may be an official or memorandum, a certificate for a business trip order, an official assignment, a business travel plan or another document provided for in local regulations.

Step 9. Confirm the order with the manager, and then familiarize the worker sent to perform work in another area with it. If the employee’s signature is not there, then in court he will always be able to prove that he did not know about the need to go somewhere.

This is what the finished document looks like.

Let’s show another sample of directions for a business trip for several people:

Please note that the unified form does not have a column to indicate the method of travel to the place of business trip. If an unmodified form is used, then upon returning from a trip the employee is obliged to provide information, a memo about the use of personal or work transport, and present documents that will prove this fact (for example, receipts for gasoline or paid parking).

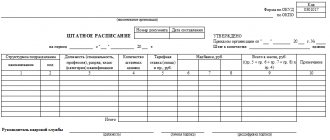

When to use the unified form T-9a

Form T-9a is an order of similar content drawn up for a group of workers. Moreover, each employee may have his own business trip location, duration, start date, purpose and source of funding. What unites them is the basis of the business trip, which will not always be filled out in this form.

This form can also be downloaded from our website:

See also “We arrange and pay for business trips.”

Procedure for sending on a business trip

At the moment, the main document that must be drawn up when an employee leaves on a business trip is a business trip order. It has become the main one since 2015, when companies were allowed not to prepare a job assignment, travel certificate and business trip report. However, if necessary, they can be formalized; however, this fact must be enshrined in the accounting policies or relevant local acts.

Large companies have the practice of drawing up a business travel schedule, which includes all planned employee trips for the current year. This document must be certified by the head of the company.

[ult_buttons btn_title=»Read more about how to send an employee on a business trip» btn_link=»url:http%3A%2F%2Finfportal.ru%2Fkadry%2Fkak-otpravit-sotrudnika-v-komandirovku.html||target:%20_blank|» btn_title_color=»#dd3333" btn_hover=»ubtn-fade-bg» btn_anim_effect=»ulta-shrink» icon=»Defaults-share-square-o» icon_size=»32" btn_icon_pos=»ubtn-sep-icon-right» btn_shadow =»shd-bottom» btn_shadow_size=»5" btn_shadow_click=»enable»]

If there is a need to perform any production tasks outside the enterprise, the manager decides to send the employee on a business trip. He can draw up an official assignment, or give a verbal order, and the personnel service will issue an order for a business trip. In this case, the purpose, place of travel, timing, as well as responsible persons must be clearly indicated. To do this, it is still recommended to draw up a written document that will contain all the specified information.

Based on the instructions received, the HR department employee draws up an order and delivers its contents to the employee against signature. This order, first of all, is necessary to properly document the absence of the business traveler from his workplace, as well as to finance future expenses. In the latter case, the employee usually draws up a memo addressed to the director justifying possible expenses during the trip, on the basis of which he is subsequently given money.

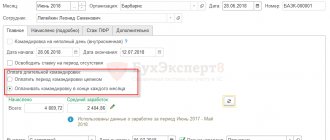

Business trip in the time sheet o or “06”. During the period of absence, the employee retains his average earnings and job.

If necessary, the organization can also issue a travel certificate for the employee. It needs to record your departure from the company, as well as your arrival at the place of business trip. In addition, the personnel employee can note the dates of arrival and departure of seconded workers in a special journal.

Related documents

When an order is drawn up to send an employee on a business trip, a personnel specialist can draw up additional documents along with it.

It is important to remember that some of them are no longer mandatory, but must be compiled if this is expressly stated in the accounting policies:

- Travel certificate. It is necessary to put marks in it in the form of seals of the receiving companies. It is not mandatory, but can be used by the employer at will.

- Service assignment. A document in the T-10 form, which contained a list of tasks that the employee had to complete during the trip. Currently also recognized as optional.

- Logbook for travel workers. A note must be made in it when the employee departs on a business trip and when he arrives at the company. Nowadays, journaling is not mandatory.

- Service note. Drawed up by the employee justifying the amount of the requested accountable amount for the duration of the business trip. Another note can be issued upon arrival from a business trip with a request to pay the costs of purchasing fuel and lubricants - if the employee used a personal car.

Nuances

If several people go on a business trip, then it is more advisable to issue an order in the T-9a form. It is designed in the form of a large table, in the columns of which the names of employees are written, and in the rows - data about the goals, duration, days of the start and end of the trip, etc.

As a rule, the sending party bears the costs of sending employees on a business trip. However, there are sometimes cases when monetary costs are shifted to another (usually receiving) organization. This includes, for example, work on calling a specialist for commissioning of new equipment. In this case, the name of this organization is written in the corresponding line of the order.