Types of employee incentives

It is allowed to encourage an employee not only in material form. The main types of incentives used in practice:

- announcement of gratitude;

- cash bonus;

- nomination for the title of the best in the profession;

- issuance of a valuable gift;

- awarding a certificate of honor.

IMPORTANT!

In accordance with Art. 191 of the Labor Code of the Russian Federation, the list of incentives is not closed. The bonus system is established for each specific enterprise in local regulations. For special achievements, a presentation for state awards may follow.

What documents are required to document the bonus?

The announcement of the payment of a bonus to an employee is made by an administrative document for the enterprise - about rewards for conscientious work, achievements in work, fulfillment of the plan, etc.

This document has several varieties:

- mass - imposed on an entire group of workers, the majority of the team;

- personal - issued in relation to a specific employee;

- scheduled - published at a certain frequency;

- unscheduled - published in connection with the occurrence of a specific event, outside the established periodicity;

- production - taken in connection with achieving results in production;

- organizational - published in gratitude for active participation in the public life of the enterprise, for example, for achievements at sporting events;

- festive - in connection with the onset of memorable dates, holidays, anniversaries.

This is what an example of an order to encourage Ivanov I.I. looks like. for Defender of the Fatherland Day, compiled in any form:

Memo about bonuses

The basis for issuing an administrative act on bonuses is a memo, presentation or petition from the employee’s immediate superior or the head of another service or department. This document must indicate the employee’s achievements or other grounds for bonuses. The payment amount is indicated by a specific figure or an indication of the percentage of the salary, etc. The head of the enterprise has the right to decide to increase or decrease the monetary reward.

ConsultantPlus experts discussed how to process and take into account bonuses for employees. Use these instructions for free.

Total cost and terms of service provision

The price for services for preparing an extract from the BTI varies depending on the type of document and region of residence. The period of legal preparation of the document and the time of its validity also depend on the exact type of specific certificate, as well as on the presence or unavailability of an inventory of a residential property.

The price and terms for obtaining a certificate are as follows:

- to obtain an extract for property recognition from 5 to 10 days, price – 136 rubles;

- technical passport of the premises - about 2 weeks, fee - 1,800 rubles (the amount is calculated based on the type of property and living space of the apartment);

- the description for the BTI certificate takes 10 days to produce, the cost of the service is 180 rubles;

- report on the estimated value of the apartment - no more than 10 days, service price - 540 rubles

- certificate in form No. 11 - produced within 10 days, price - 540 rubles;

- duplicate of the building's technical passport - up to 10 days, price - 1,250 rubles;

- information that verifies your residential address is prepared free of charge and will take up to five working days.

Orders in form T-11 and T-11a

The administrative document is drawn up either according to the standard form T-11, approved by the State Statistics Committee, or in free form. The unified form is currently not mandatory for use; the Organization has the right to develop its own sample. For convenience, standard forms are often used. There are two of them. Form T-11 is used if one employee needs to receive a bonus. This is what it looks like:

And if several employees are worthy of a bonus, then use the T-11a form. Here is an example of how to reward employees using such an administrative act:

It must be remembered that when issuing a collective order, there is a problem in familiarizing employees with it. Because by getting acquainted with the data about their bonus, they will inevitably gain access to the personal data of other people.

IMPORTANT!

According to Roskomnadzor, the amount of remuneration is personal data (Roskomnadzor letter No. 08KM-3681 dated 02/07/2014). The employer does not have the right to inform a third party without the written consent of the employee himself (Article 88 of the Labor Code of the Russian Federation; Articles 3, 7 of Law No. 152-FZ).

Which exit? If the bonuses are monthly, then in practice they are not familiar with such documents at all. Systems of additional payments and bonuses of an incentive nature are prescribed in collective agreements and labor regulations (Article 135 of the Labor Code of the Russian Federation). An employee is introduced to them when hired (Article 68 of the Labor Code of the Russian Federation). Additionally, it is not necessary to familiarize each time with the administrative act on the payment of bonuses, which is part of the remuneration system.

Such orders are drawn up according to the main activity, and not according to personnel, and the executor (chief accountant) is indicated in them. He is introduced to the document and signed.

Another question is when the rewards are one-time, which do not relate to regular payments. To avoid problems with regulatory authorities, it is preferable to issue personal orders rather than collective ones. But if the team is huge, and it is problematic to issue separate orders for everyone, it is necessary to provide a procedure for familiarizing the LNA with the procedure for transferring personal data of employees.

If we talk about an arbitrary type of document, then they compose it according to the following structure:

- a header containing the details of the organization and the document (name of the enterprise, number, date of issue of the order, its subject);

- the main part with written documentation of the employer’s order and its basis;

- final (signatures, their transcripts, be sure to put a mark on the employee’s familiarization).

In the main part, they must indicate who exactly is being rewarded. It is necessary to indicate the full last name, first name and patronymic, personnel number, department and position held. Then they clarify what the bonus is for: the wording of the basis for the bonus in the order is of great importance, since the employee has the right to know why he receives the bonus. The wording used is an indication of specific achievements and merits. For example, phrases are often used: “in connection with the anniversary”, “for production successes”, “for professionalism and processing”, etc. The exact amount of the remuneration (if it is supposed to be paid in cash) or the procedure for determining it are indicated. Then the period for which the premium is made is specified.

Sample order to reward employees for good work (in any form):

| Limited Liability Company "Ppt.ru" Order No. 11 St. Petersburg February 10, 2022 About one-time bonus Based on the memo of the deputy director dated 02/08/2022, presentation, bonus regulations, I ORDER: 1. For the implementation of the plan, good work, achievement of high performance indicators at the end of January 2022, pay a one-time cash bonus in the amount of 10,000 (Ten thousand) rubles to lawyer Petr Petrovich Pepetashin. 2. I entrust control over the implementation of this Order to myself. CEO Petrov Petrov P. P. I have read the order: Pepetashin Pepetashin P.P. 10.02.2022 |

What is this document for?

To carry out a legal transaction, you should prepare a package of documentation and other papers from the BTI. They differ in:

- Purposes of acquisition;

- The time of their action;

- Cost.

If the deadline for issuing documents from the BTI has been postponed, you need to come again.

A certificate from the BTI in form 11a is required in the following cases:

- Transfer of residential premises to non-residential premises;

- At the request of the court, bailiffs and other authorized bodies;

- Registration of a subsidy;

- Obtaining a mortgage loan;

- Privatization of state apartments;

- Carrying out redevelopment.

The BTI 11a certificate can be obtained from the technical inventory bureau at the location of the residential property. Upon receipt of this service, the document in the accounting department is signed by the boss, stamped and assigned a number. Contains the following information: presence of arrest and prohibitions, balance price, address, last name and first name of the owner, area of the apartment. This document is valid for 1 month.

Types of certificates issued by BTI:

- drawing of a plot of land;

- technical passport of a residential building;

- extraction from BTI;

- certificate in form No. 3 (required for registration of land plots), No. 11 (for owners of private properties);

- explication;

- original registration document;

- floor design;

- report on the descriptive value of the premises;

- report from the technical passport;

- original document certifying the condition of the residential premises (certificate in form No. 5);

- a report confirming the location of the property or the name of the owner.

Explication Example

Floor plan

From the presented list of references it is necessary to obtain an explication and floor plan of the premises. To find out the true list of documentation, consult a specialist in advance.

Order on monthly bonuses

Sometimes an employer, when determining the method of remuneration for labor at an enterprise, opts for a salary-bonus system. In this case, a general administrative document is issued in the form of an order to accrue bonuses for the month to all employees, which sets out the conditions for paying bonuses. To determine the grounds and procedure for awarding bonuses to employees, the employer has the right to adopt a separate local regulation. The regulations on bonuses define the grounds: a memo, a report, data on the implementation of the plan, describes the publication of an administrative act and other nuances, right down to the wording of how to write: to reward an employee with a cash bonus or to pay bonuses, etc.

Download the order on bonuses for employees. Sample and form

Download samples of the organization's personnel documents : Form T-1 and T-1a. Employment order Form T-3. Staffing table of the organizationForm T-6 and T6-a. Vacation orderForm T-7. We draw up a vacation scheduleForm T-8. Order of dismissalForm T-9 and T-9a. Business trip orderForm T-10. Travel certificateForm T-10a. Business trip assignmentForm T-13. Working time sheetForm T-49. Payroll Form T-51. Payroll for calculating and calculating wagesForm T-53. Payroll for salary paymentsForm T-53a. Payroll register Form T-54. Employee's personal account Form T-60. Note-calculation on granting leaveForm T-61. Calculation note upon dismissal

Order on the 13th salary

There is no such term in the current legislation; it is a relic of Soviet times. The 13th salary is a type of monetary incentive paid at the end of the year. The employer's obligation to calculate the 13th salary is not defined by law; this is his right, not an obligation. If a positive decision is made, an order is issued based on form T-11a.

An example of an end-of-year bonus order

The manager has the right to decide not to make the payment, cancel it, or award bonuses to only part of the employees. Exception: a situation where the obligation for purpose is enshrined in local regulations. In budgetary institutions, the internal documents most often establish the rule that such a bonus is assigned within the limits of budgetary allocations. The payment depends on the economic and financial capabilities of the enterprise. After receiving data for the year, the possibility of incentive measures for the workforce is determined.

This type of incentive, like a regular bonus, is formalized as an additional payment of a certain fixed amount or part of the salary. Employees are not entitled to count on such a bonus:

- having disciplinary sanctions for the year;

- not achieving certain indicators;

- those who made serious mistakes in their work, leading to a decrease in performance indicators;

- on parental leave.

IMPORTANT!

As judicial practice shows, dismissed employees have the right to claim a portion of the incentive.

The manager signs the order and determines the person responsible for its execution (who is introduced to the document upon signature). It is necessary to familiarize the employee himself with the act, since he has the right to have information about what he is being rewarded for. Section 1 of the instructions, approved. Resolution of the State Statistics Committee of Russia No. 1 of 01/05/2004 states that the worker is required to familiarize himself with the order of any incentive, including the 13th salary.

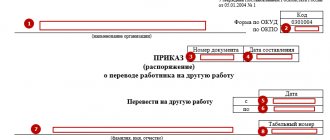

What sections do they consist of?

Title

At the beginning of the document, information about the organization (its originator) and initial information about the order are included.

The name of the organization is written in all official documents (and in the order on promotion too), according to the designation enshrined in the constituent documents (including foreign names and abbreviations).

In the presence of abbreviations, the full name comes first, followed by the abbreviation in brackets.

Meaningful

This is the main section of the document where the whole meaning and application is contained:

- The worker's full name is written in full in the nominative case.

- The order must include the employee’s personnel number (assigned to the person when applying for a job).

- The structural unit where the employee works is registered (when applying for a job in a structural unit). It is also written in the nominative case. If missing, this line is skipped.

- Name of position, profession, specialization in full (name).

- The motive for the award (when using the phrase “conscientious performance by the employee of labor duties,” you need to justify what exactly is meant by this).