Question No. 1

Sometimes, when sending an employee on a business trip, atypical situations occur.

What regulations should be followed when resolving issues that arise in these cases? According to Art. 167 of the Labor Code of the Russian Federation, when sending an employee on a business trip, he is guaranteed:

- maintaining your job (position) and average earnings. For all cases of determining the amount of average wages (average earnings) provided for by the Labor Code of the Russian Federation, a uniform procedure for its calculation is established by Regulation No. 922[1] (Article 139 of the Labor Code of the Russian Federation);

— reimbursement of expenses related to business travel. For example, the procedure and amount of reimbursement of expenses associated with business trips on the territory of the Russian Federation for employees of federal government institutions are established by Resolution No. 729[2].

The rules defined in Art. 167 of the Labor Code of the Russian Federation, are applied taking into account the specifics of the procedure for remuneration during the period the employee is on a business trip, established by Regulation No. 749[3].

If a business trip starts in one month and ends in another

If a business trip begins in one month and ends in another, then in the 1C: ZUP 3 program there are two options for paying for it:

- payment for the entire period of the trip at once in full. In this case, payment is fully calculated in the Business Trip ;

- monthly payment. In the case of monthly payment, payment is immediately accrued only for the month the business trip began; this occurs in the Business Trip . Payment based on the average for the next month/months of the business trip period is calculated automatically when calculating salaries for the month - in the documents Calculation of salaries and contributions .

The option is selected in the Business trip using the switch Payment for a long business trip :

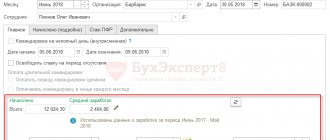

For example, if an employee is sent on a business trip for the period from June 28 to July 12, and the monthly payment option is selected, then in the Business Trip payment is accrued only for the period from June 28 to June 30:

Payment for the period from 01.07 to 12.07 is calculated when calculating salaries for July.

In this case, the same average earnings are used that were calculated in the Business Trip .

Typically, in practice, a monthly payment for a business trip is used. In order to use this default travel payment option, i.e. so that when creating a document, the option Pay for a business trip at the end of each month , it is necessary that in the settings for the composition of accruals and deductions (Settings - Salary calculation - Setting up the composition of accruals and deductions) on the Absence accounting , the Long business trips should be paid monthly checkbox is selected :

Question No. 2

In accordance with Art.

136 of the Labor Code of the Russian Federation, wages are paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued. When should an employee be paid his average salary when sent on a business trip?

The Ministry of Labor in Letter dated June 27, 2019 No. 14-1/OOG-4422 explains the following:

- in order to prevent the occurrence of labor disputes to the employer in accordance with Art. 8 of the Labor Code of the Russian Federation, it is necessary to stipulate in a local regulatory act (for example, regulations on business trips) the timing of payment of average earnings during a business trip.

— the timing of payment of average earnings during a business trip should be similar to the timing of payment of wages provided for in Art. 136 Labor Code of the Russian Federation.

Question No. 3

How to pay an employee if he went on a business trip after the end of his working day, but during the same day?

Is it possible to pay for days actually worked? The duration of the business trip is determined by the employer, taking into account the volume, complexity and other features of the official assignment.

The actual duration of an employee’s stay on a business trip is determined by travel documents presented by the employee upon returning from a business trip, and in their absence, on the basis of documents for the rental of residential premises or other documents confirming the conclusion of an agreement for the provision of hotel services at the place of business trip. Or the employee submits a memo and (or) other document about the actual duration of the employee’s stay on a business trip, containing confirmation of the party receiving the employee (organization or official) about the date of arrival (departure) of the employee to the place of business trip (from the place of business trip).

In accordance with clause 9 of Regulation No. 749, the average salary is maintained for all days of work according to the schedule established in the sending organization:

— during the period the employee is on a business trip;

— for days on the road, including during forced stops along the way.

In this case, it is necessary to take into account the following (clause 4 of Regulation No. 749):

— the day of departure on a business trip is the date of departure of a train, plane, bus or other vehicle from the place of permanent work of the business traveler;

— the day of arrival from a business trip is considered the date of arrival of the above vehicle at the place of permanent work;

- when a vehicle is sent before 24.00 inclusive, the current day is considered the day of departure on a business trip, and from 00.00 and later - the next day.

According to the norms of the legislation of the Russian Federation, the average salary of an employee is paid for all working days provided for by the work schedule of the sending organization.

Therefore, in cases where the Labor Code of the Russian Federation provides for the retention of average earnings for an employee, average earnings should be calculated rather than paying current wages.

For example, the Letter of Rostrud dated 02/05/2007 No. 275-6-0 contains an explanation according to which, even if in some cases the “current” salary may be higher than the average earnings calculated in the prescribed manner for payment to an employee sent on a business trip, wages for days on a business trip will contradict the provisions of the Labor Code of the Russian Federation.

Thus, if an employee went on a business trip on the day specified in the order to start the business trip, and this day is marked as a business trip in the time sheet, the designated day is subject to payment in the amount of average earnings, determined in the prescribed manner.

The issue of an employee’s attendance at work on the day of departure on a business trip and on the day of arrival from a business trip is resolved by agreement with the employer in accordance with clause 4 of Regulation No. 749.

Rationale

A business trip is a trip by an employee by order of the employer for a certain period of time to fulfill an official assignment outside the place of permanent work (Article 166, “Labor Code of the Russian Federation” dated December 30, 2001 N 197-FZ (as amended on June 28, 2021) {ConsultantPlus}) .

When an employee is sent on a business trip, he is guaranteed to retain his place of work (position) and average earnings, as well as reimbursement of expenses associated with a business trip (Article 167, “Labor Code of the Russian Federation” dated December 30, 2001 N 197-FZ (as amended by 06/28/2021) {ConsultantPlus}).

The specifics of sending employees on business trips are established in the Regulations approved by Decree of the Government of the Russian Federation dated October 13, 2008 N 749 “On the specifics of sending employees on business trips” (Resolution of the Government of the Russian Federation dated October 13, 2008 N 749 (as amended on July 29, 2015) “On peculiarities of sending employees on business trips" (together with the "Regulations on the peculiarities of sending employees on business trips") {ConsultantPlus}).

The average earnings for the period the employee is on a business trip (including days on the road, including the time of forced stopover) are retained for all days of work according to the schedule established by the sending organization (paragraph 1, clause 9 of the Regulations on business trips).

In other words, according to the average earnings, only workers according to the organization’s schedule are paid for the days the employee is on a business trip (for example, from Monday to Friday). Accordingly, days off that fall during a business trip, but on which the employee is not involved in work, are not subject to payment based on average earnings.

For all weekends or non-working holidays that fall during a business trip, the employee must be paid daily allowance (clause 11 of the Business Travel Regulations).

There is no need to pay for these days in the amount of average earnings (clause 9 of the Business Travel Regulations).

At the same time, remuneration for an employee if he is involved in work on weekends or non-working holidays is made in accordance with the labor legislation of the Russian Federation (clause 5 of Regulation No. 749).

The specific amount of payment for work on a day off or a non-working holiday can be established by a collective agreement, a local regulatory act adopted taking into account the opinion of the representative body of employees, or an employment contract (Part 2 of Article 153 of the Labor Code of the Russian Federation).

Additional materials on your question posted in SPS ConsultantPlus

Extract from: Ready-made solution: How to pay for days off on a business trip (ConsultantPlus, 2021)

How to pay for days off on a business trip

For work on a weekend on a business trip, pay either at least double the amount, or single pay, but then provide time off. The type of compensation is chosen by employees, except for those who have an employment contract of up to two months. They are only entitled to payment of at least double the amount.

If the business trip includes weekends, then pay travel expenses (for example, daily allowance, housing expenses) for these days as usual.

If the employee voluntarily decided to stay at the place of business for the weekend (instead of returning), then you are not obligated to reimburse expenses.

How to pay for work on a day off while on a business trip

For every hour of work on a weekend on a business trip, pay at least double the amount or single pay, but with time off. The type of compensation is chosen by the employee. The exception is those who have a fixed-term employment contract of up to two months: they are only entitled to at least double pay (Part 1, 4, Article 153, Part 2, Article 290 of the Labor Code of the Russian Federation, Clause 5 of the Regulations on Business Travel, Letter from Rostrud dated 01/24/2020 N PG/37602-6-1).

We recommend calculating pay for a day off based on the remuneration system that is established for the employee (salary, tariff rate, piece rate), and not on his average earnings. This follows from Part 1 of Art. 153 Labor Code of the Russian Federation, paragraph 5, Regulations on business trips, Letters of the Ministry of Labor of Russia dated 07/09/2019 N 14-2/B-527 and Rostrud dated 10/16/2019 N PG/26391-6-1.

Please note that the day of departure, arrival or travel on a business trip on a day off must be paid in the same way as work on that day. This follows from clause 5 of the Regulations on official business trips, Letters of the Ministry of Labor of Russia dated 02/21/2020 N 14-1/OOG-1110, dated 10/13/2017 N 14-2/В-921, dated 12/25/2013 N 14-2-337 .

We recommend establishing the procedure for paying for work on a day off while on a business trip in a local act, for example, in the regulations on remuneration (part 1 of article 8, part 2, 4 of article 135, art. 149, 153 of the Labor Code of the Russian Federation).

1.1. How is time off paid for working on a day off on a business trip?

Do not pay time off for working on a weekend on a business trip. If an employee chooses a day off, then he is paid only for work on a day off at a single rate (Part 4 of Article 153 of the Labor Code of the Russian Federation, Clause 5 of the Regulations on Business Travel).

Let us remind you that we recommend calculating pay for a day off based on the remuneration system that is established for the employee (salary, tariff rate, piece rate), and not on his average earnings. This follows from Part 1 of Art. 153 of the Labor Code of the Russian Federation, clause 5 of the Regulations on business trips.

How to pay for a day off on a business trip if the employee was on vacation

If an employee is resting on his day off on a business trip, then pay him only travel expenses for that day. In particular, these are the costs of renting housing, and also, as a rule, daily allowances. Do not pay the average salary, since it is saved only for working days (part 1 of article 168 of the Labor Code of the Russian Federation, clause 9, paragraph 1 - 6, clause 11 of the Regulations on business trips).

How to reimburse travel expenses if the employee stayed at the business trip location for the weekend

If the employee remains on a business trip for the weekend because it falls within its period (for example, if it lasts 10 days), then pay him travel expenses for these days. In particular, these are the costs of renting housing and, as a rule, daily allowances. If an employee voluntarily decides to stay at the place of business trip for the weekend, instead of returning, then you are not required to reimburse his expenses (for example, for rental housing). They are not related to a business trip (part 1, 4 of article 168 of the Labor Code of the Russian Federation, paragraph 1 - 6, clause 11, clause 20 of the Regulations on business trips).

We will tell you further about the amount of travel expenses paid.

3.1. How much should I pay for travel expenses on a day off?

Travel expenses (in particular, travel, accommodation, daily allowance) for weekends will be paid as usual. That is, in the amounts that are established, in particular, in your local regulatory act (for example, in the Regulations on business trips) (part 4 of article 168 of the Labor Code of the Russian Federation, clause 11 of the Regulations on business trips).

Travel reimbursement amounts may vary for different positions. For example, management can establish an increased amount of compensation for travel expenses compared to ordinary employees (Letter of the Ministry of Labor of Russia dated February 14, 2013 N 14-2-291).

There are no limits on travel expenses, so determine them based on your financial and economic capabilities, rates for accommodation, and travel. The law only provides a maximum daily allowance, which is not subject to personal income tax and insurance contributions: for each day of a business trip in Russia - 700 rubles, for each day of a business trip abroad - 2,500 rubles. (clause 1 of article 217, clause 2 of article 422 of the Tax Code of the Russian Federation).

3.1.1. Do I need to pay daily allowance for days off on a business trip?

Yes, it is necessary, except when the business trip is in Russia and the employee can return home every day. In other cases, pay the employee per diem for each day off on a business trip (including if such a day falls on the day of arrival, departure, or while on the road). And it doesn’t matter whether the employee was resting or working that day (paragraph 3, 4, paragraph 11 of the Regulations on business trips, Letter of the Ministry of Labor of Russia dated November 28, 2013 N 14-2-242).

For a one-day business trip abroad, pay the employee in foreign currency 50 percent of the daily allowance established by you (part 4 of article 168 of the Labor Code of the Russian Federation, paragraph 2, clause 11, clause 20 of the Regulations on business trips).

Risks of violating the procedure for paying for days off on a business trip

If you violate the procedure for paying for days off on a business trip, then, in particular, the following risks are possible:

- administrative liability under Parts 6, 7 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation (if the actions do not contain a criminal offense in accordance with Article 145.1 of the Criminal Code of the Russian Federation) - for example, if you do not pay at least double the amount for work on a business trip on a day off, when the employee has chosen such compensation;

- financial liability under Art. 236 Labor Code of the Russian Federation. So, if you do not pay in full for work on a business trip on a weekend (for example, in a single amount, while the employee chose double payment), then you will have to pay the remaining amount with interest on this item.

The document was provided by ConsultantPlus.

Publishing house "Glavnaya Kniga" | Current as of 08/27/2021:

Question No. 4

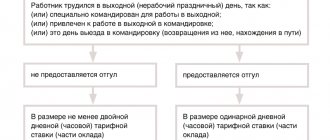

How much should I pay for an employee to go on a business trip on a day off?

If the day of departure (arrival) on a business trip (from a business trip) is a day off or a non-working holiday, then payment for work on this day is made based on the employee’s official salary, and not on the basis of average earnings.

According to clause 5 of Regulation No. 749, remuneration for an employee if he is involved in work on weekends or non-working holidays is made in accordance with the Labor Code of the Russian Federation. Therefore, to determine the amount of remuneration on specified days during a business trip, employers should be guided by Art. 153 of the Labor Code of the Russian Federation, which states that wages are paid at least double the amount.

The specific procedure for calculating it depends on the employee remuneration system used, in particular:

- employees receiving a salary (official salary) - in the amount of at least a single daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if work on a day off or a non-working holiday was carried out on within the monthly working hours;

- in the amount of no less than double the daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if the work was performed in excess of the monthly working time standard.

In addition, specific amounts of remuneration for work on a day off or a non-working holiday can be established by a collective agreement, a local regulatory act adopted taking into account the opinion of the representative body of employees, or an employment contract.

Increased payment is made to all employees for hours actually worked on a weekend or non-working holiday.

If part of the working day (shift) falls on a weekend or non-working holiday, the hours actually worked on the weekend or non-working holiday (from 00.00 to 24.00) are paid at an increased rate.

Similar explanations are given in letters of the Ministry of Labor of the Russian Federation dated July 9, 2019 No. 14-2/B-527, Rostrud dated October 16, 2019 No. PG/26391-6-1, dated October 16, 2019 No. TZ/5985-6-1.

At the same time, at the request of an employee who worked on a holiday, he may be given another day of rest. In this case, work on such a day is paid in a single amount, and a day of rest is not subject to payment.

Is it necessary to apply for employment on days off?

A business trip is a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work.

Business trips of employees whose permanent work is carried out on the road or has a traveling nature are not recognized as business trips (Article 166 of the Labor Code of the Russian Federation). note

The specifics of sending employees on business trips are established in the manner determined by the Government of the Russian Federation. Currently, there is a Regulation on the specifics of sending employees on business trips (hereinafter referred to as the Regulation), approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749.

In almost every company there are situations when it is necessary to work on a day off. And, perhaps, you had to go on a business trip, for example, on Sunday, in order to start work on Monday. However, it should be remembered that by sending an employee on a business trip on a day off, the employer not only entrusts him with performing an official task in pursuit of the goals of his business, but also deprives him of a well-deserved rest.

Accordingly, without any doubt, it is necessary to formalize employment on a day off if the day of departure on a business trip falls on the employee’s day off. Let us recall that by virtue of Part 8 of Art. 113 of the Labor Code of the Russian Federation, involvement in work on a day off in all situations is carried out by written order of the employer.

Some employers believe that by issuing an order to send them on a business trip and familiarizing the employee with it against signature, they have fulfilled the requirements of labor legislation regarding being required to work on a day off. This opinion is wrong: an order to be sent on a business trip is not enough. An additional order is required to be hired to work on a day off.