When are statements compiled?

Inventory reports are used to reflect the results of an inspection of fixed assets, intangible assets, inventories, finished products and other material assets for which deviations from accounting data have been identified. If, based on the results of the inspection, surpluses or shortages of the organization’s property are established, then in this case the following are used:

- form No. INV-18, if the inventory procedure is organized in relation to fixed assets (OKUD 0317016);

- form No. INV-19, if an inventory of inventory items was carried out (OKUD 0317017).

But such statements are prepared not only based on the results of a planned inventory. If evidence of property damage is detected, the organization is also obliged to carry out inventory measures. For unusable and damaged property identified during such an unscheduled inspection, appropriate acts are drawn up, for example, an act on damage, damage, scrap of inventory items in the TORG-15 form or an act on the write-off of goods in the TORG-16 form, approved by the Decree of the State Statistics Committee of Russia dated 25.12. .1998 No. 132.

Based on their purpose, comparison sheets are formed on the basis of other documents that accompany the inventory: first, the head of the organization signs an order (resolution, order) to carry out an inventory, then the commission directly checks the name, quantity of fixed assets and inventory, determines the quality the state of these objects. The commission enters the received data into comparison forms: for fixed assets an inventory is drawn up in form No. INV-1, for inventory items - an inventory is made in form No. INV-3 or an act in form INV-4, if the shipped inventory items were verified.

Only after the listed inventories and acts have been compiled, the data reflected in them is verified with accounting data. And if it turns out that some property is not reflected in the accounting records or, on the contrary, “extra” property is reflected, then this fact is recorded in the matching statements in form No. 18 and (or) No. 19. Consequently, if, according to the results of the audit, there are discrepancies between the actual If the presence of the organization's inventory assets and the data reflected in the accounting records is not identified, then comparative reports are not prepared.

What are the matching statements for inventory f. 0504092, INV-18 or INV-19?

A comparison sheet must be filled out if, at the end of the inventory procedure, a larger or smaller number of inventory objects is discovered.

There are 2 types of matching statements for commercial structures:

- statement of results of inventory of fixed assets and intangible assets (INV-18);

- statement of inventory inventory results (INV-19).

IMPORTANT! The company has the right to use independently developed forms of matching statements, taking into account the requirements for the preparation of primary documents in accordance with Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

In budgetary institutions, form 0504092 is used.

Read about the inventory procedure in the material “How to conduct an inventory before annual reporting .

The nuances and timing of the inventory were explained in detail by ConsultantPlus experts. Study the material by getting trial access to the K+ system for free.

What is reflected in the statements

Reports No. 18 and 19 include only those items of property for which deviations were identified. If an organization identifies discrepancies regarding property that does not belong to it (for example, leased property; property received for processing), then data on the results of the inspection for such property are reflected in separate forms.

The amounts of surplus and shortage of inventory items in the matching statements are indicated in accordance with their assessment in accounting. At the same time, if the shortage of inventory items is determined taking into account the norms of natural loss, then in this case it is imperative to attach a calculation of losses within the specified norms. The amounts of the final shortage, taking into account the calculation of losses, are reflected in columns 27-32 of INV-19. The loss of inventory within the established norms is determined after offsetting the shortages with surpluses based on re-grading.

When filling out a document on the results of the inventory of intangible assets, columns 3, 8, 10 are not filled in.

The documents are drawn up in 2 copies and signed by the accountant and the financially responsible person, who confirms with his signature that he agrees with the results. One copy remains in the accounting department, the second is transferred to the financially responsible person. The inventory record is kept for at least five years.

It very often happens that during inventory activities, misgrading is revealed - a simultaneous shortage and surplus of similar material assets. In this case, the shortage can be covered by surpluses. This operation is reflected in the matching statement as an offset. To do this, the financially responsible person must provide the commission with an explanation about the misgrading.

If surpluses and shortages arose due to accountant errors, then the difference between the accounting data and the results of inventory measures is reflected in the corresponding columns 12 to 17 of the column “Adjusted by clarifying accounting entries” of the INV-19 report.

When reflecting shortages and surpluses identified during the audit in accounting, one should be guided by the accounting regulations “Correcting Errors in Accounting and Reporting”, PBU 22/2010, approved by Order of the Ministry of Finance of Russia dated June 28, 2010 No. 63n.

Sample and blank form of INV-19 form

- Form and sample

- Online viewing

- Free download

- Safely

FILES

INV-19 covers both tangible and intangible assets, as well as raw materials. Items in safekeeping are entered into another form - INV-5. The INV-18 statement is intended for fixed assets. Rented items are not included in the form.

IMPORTANT! Form INV-19 requires double-sided printing in 2 copies. In our example, page #1 is the front side, and page #2 is the back side. You can fill out the form either manually or electronically. One of the certified copies is transferred to the accounting department, and the second is stored at the retail outlet or warehouse where the shortage, mismatch or surplus was discovered.

Correctness of design

Back in 1998, the State Statistics Committee of Russia issued Resolution No. 88, in which, after making some changes, it approved several unified forms. They were supposed to facilitate the process of maintaining primary accounting and increase production control at each stage. In this document, the form of the matching statement is presented in two different types:

- INV-18. It is compiled based on the final results of a preliminary inventory of the fixed assets of a given enterprise and its intangible assets.

- INV-19. It is used to keep comparative records of all inventory items.

The order of formation of both forms is almost the same. First, the responsible employee, in the presence of a commission specially created for this purpose, conducts an inventory. Then its results are compared with the data that is currently available in the accounting department. As a result, a new document is generated.

It contains a detailed description of all identified inconsistencies. Moreover, each position is described in detail, indicating the reason for the discrepancy. The forms are drawn up in 2 copies at once. One, as a rule, remains with the accountant, and the second is taken by the financially responsible person.

Why do the results differ?

It is obvious that the results of counting commodity units, materials, raw materials, products and other material assets may differ from those presented in accounting documents due to inattention. Moreover, an error can occur at several stages at once or at one of them:

- Errors during counting are the most likely and real reason.

- Errors when drawing up a particular document with balances.

Along with this, the reasons for the discrepancies may be related to the following factors:

- re-grading;

- theft;

- loss of an item (due to inattention);

- cashier error (the item was not punched and was simply “handed over” at the checkout).

Analyzing specific causes is always a complex process. As a rule, the results of only one inventory, presented in the reconciliation sheet, are not enough. It will be necessary to conduct a series of inspections (including unscheduled ones) to establish the specific reasons for the discrepancies.

Main purpose

Carrying out accounting is a mandatory procedure, during which discrepancies are almost always inevitably discovered:

- surplus;

- shortage.

All these discrepancies must be recorded in writing. The reporting procedure is necessary, first of all, for the company itself, because:

- Thanks to detailed accounting, you can correctly draw up accounting documents.

- It is possible to analyze the causes of shortages and reduce their volumes.

- You can see weaknesses in the storage system, transportation of goods within the enterprise, and in the work of employees, which leads to discrepancies in results.

NOTE. The statement is filled out in all cases during accounting - both scheduled and extraordinary (for example, after the dismissal of one financially responsible person and the transfer of his powers to a new employee).

Basic Concepts

Working with material assets is simple only at first glance. It has many features and pitfalls. This is what a document called a matching sheet is trying to detect. What is it and why is its importance rated so highly? To begin with, it should be noted that any enterprise constantly keeps records of all available types of valuables. These usually include:

- fixed assets;

- inventory items;

- finished products;

- intangible assets.

Each of these types has its own impact on the production process. Therefore, for proper organization of work, it is necessary to have a clear idea of their actual availability. For these purposes, inventories are constantly carried out, based on the results of which a matching statement is then formed.

Why is this done and what does such a document allow you to see? In practice, a comparison statement makes it possible to record the fact of a possible discrepancy between the actual availability of specific values obtained as a result of an inventory, and their quantitative indicator according to accounting data.

Form and sample document

If you use the most common form INV-19, you just need to fill out all the fields correctly. If you develop and use your own sample, then when drawing it up, it is important to take into account that the document contains the following information:

- Name of the organization, type of its activity, OKUD and OKPO codes.

- A link to the document that regulated the start of the inventory - usually a corresponding order is issued, which stipulates the timing of the procedure, the responsible persons and the chairman of the commission.

- The timing of the inventory is the start and end dates (sometimes they may coincide).

- Document number (consecutive numbering is used throughout the year or for other periods - at the discretion of the administration).

- Full name, full title of the position of the responsible person. This could be a warehouse manager, department manager, senior cashier/salesperson, administrator, etc.

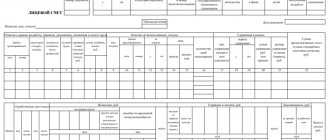

- The main part of the comparison sheet is presented in the form of a table in which the inventory results are recorded. It is necessary to indicate only those groups of goods for which a shortage and/or surplus was detected (including as a result of misgrading). The INV-19 form contains 32 columns, including:

- name of the product (or other value), its grade, type;

- labeling of goods in the form of a code that is accepted in the nomenclature system in a warehouse or store;

- accounting results - with discrepancies in quantities and in rubles (both in surplus and shortage);

- discrepancies in regrading;

- finally calculated discrepancies (taking into account additional final checks).

- At the end of the statement, the financially responsible person once again puts his signature, which means that he has become familiar with the results.

NOTE. Amounts are indicated to the nearest kopeck. If the value does not contain kopecks, you can specify it in a simple format, for example, 1000 (rubles), rather than 1000.00 (rubles).

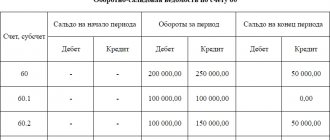

The INV-19 form is shown below.

Here's a finished example: