From 2022, sick leave benefits will be transferred to direct payments from the Social Insurance Fund

The government will change the procedure for paying benefits for temporary disability and pregnancy and childbirth from 2022.

All sick leave payments will be made by the Federal Social Insurance Fund of Russia, and not by employers. Prime Minister Mikhail Mishustin announced this at a government meeting. Now the Social Insurance Fund is already paying sick leave benefits directly as part of a pilot project in 77 constituent entities of the Russian Federation (as of November 2020). Without the participation of employers they pay:

- temporary disability benefits;

- maternity benefits;

- a one-time benefit for women who registered with medical organizations in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance;

- temporary disability benefits due to an accident at work or an occupational disease;

- compensation for sanatorium treatment in addition to annual paid leave and travel to the place of treatment for those injured at work.

As Mikhail Mishustin explained:

From 2022, we will extend this practice throughout the country. Moreover, we will switch to a proactive format of work: benefits for temporary disability, pregnancy and childbirth will be issued automatically on the basis of an electronic certificate of incapacity for work, there will be no need to write any applications.

Data on sick leave will be sent to the Social Insurance Fund automatically. Employers and employees will not have to take any additional actions. According to the Prime Minister:

This procedure for assigning payments will reduce the amount of paperwork for employers and speed up the transfer of funds. There will simply be no need to write any statements. And in general, obtaining information for the appointment of such benefits will take place electronically. This will help save a person time, energy, and - as often happened when preparing documents - nerves.

Organizations will no longer withdraw funds from circulation to pay for sick leave and then expect reimbursement from the Social Insurance Fund.

The procedure for assigning sick leave benefits in 2022

Temporary disability benefits are assigned on the basis of sick leave. The period for granting benefits is 10 calendar days from the date of application. The company must pay the benefit on the next day established for the payment of wages (Article 15 of the Federal Law of December 29, 2006 No. 255-FZ).

An employee can receive benefits no later than six months from the date of return to work (Article 12 of the Federal Law of December 29, 2006 No. 255-FZ).

You need to pay not only for working days when the employee is sick, but also for weekends and non-working holidays.

If sick leave was issued in connection with an illness or domestic injury, the first three days of incapacity for work are paid to the employee at the expense of the company, and from the fourth day - at the expense of the Federal Social Insurance Fund of the Russian Federation (clause 2 of article 3 of the Federal Law of December 29, 2006 No. 255-FZ ).

Read in the taker

Sick leave benefit: period of incapacity and amount according to length of service

Employer's obligation to pay

Every employer is responsible to employees for sick leave payments. When calculating the amount of temporary disability benefits, accounting must be guided by the norms that were adopted in the previous reporting period - this is 255-FZ; sick leave is calculated and paid strictly according to the rules of this law. Apply the provisions of Government Decree No. 375 of June 15, 2007 and Order of the Ministry of Social Development No. 624n of June 29, 2011, which determines the procedure for making such payments. Order No. 624n establishes a strict reporting form for a temporary disability sheet.

According to Part 1 of Art. 13 255-FZ the employer calculates and assigns temporary disability benefits. Then the territorial Social Insurance Fund reimburses the organization for the payment made, subtracting the first three days of the employee’s illness from the benefit amount. The procedure itself is as follows: upon completion of treatment, an employee who was absent from work due to illness is issued a certificate of temporary incapacity for work of the established form. Before starting work, the employee submits sick leave to the accounting department, and then the accountant checks that the form is filled out correctly.

The employer counts the amount of money, draws up and pays sick leave benefits. After the employee receives the funds, the accountant sends an application to the Social Insurance Fund to receive compensation for the benefits paid. Organizations must reimburse the transferred funds not in full, but with the exception of the first three days of illness, which, according to the rules, are paid at the expense of the employer.

IMPORTANT!

In many regions of the Russian Federation, there is a pilot project under which the Social Insurance Fund makes payments from the fourth to the last day of treatment. In 2022, more and more regions joined the pilot project. From 2022, the Ministry of Labor will oblige all constituent entities of the Russian Federation to work on a pilot project.

The territorial body of the Social Insurance Fund pays full benefits for pregnancy and childbirth and for caring for a disabled family member (Order of the Ministry of Health and Social Development No. 1021n). The basis for such payments is a correctly completed sick leave certificate.

What is important for state employees to remember in 2022

Budgetary organizations are obliged to pay their employees on time and make correct accruals. This also applies to the payment of temporary disability benefits. The main changes to the payment of sick leave in 2022 affected the calculation procedure. Here's what's changed since the new year:

- Minimum wage. From January 1, 2020, the minimum wage amounted to RUB 12,130. The minimum average daily earnings in 2022 is 398.79 rubles, the maximum is 2301.37 rubles.

- Billing period. When calculating social benefits, the two previous calendar years are taken. The limit of taxable insurance premiums for 2018 is RUB 815,000.00, for 2022 - RUB 865,000.00. For 2020, the limit on OSS is RUB 912,000.00.

- New KOSGU. Compensation for the first 3 days for temporary disability and maternity is reflected in subarticle 266 “Social benefits and compensation to personnel in cash.”

All social payments of budgetary institutions must be carried out within the established limits of budgetary obligations.

How to calculate sick leave in 2022

First of all, you need to determine your average daily earnings. The calculation procedure is given in paragraph 1 of Article 14 of Law No. 255-FZ.

| Payments taken into account when calculating temporary disability benefits | : | 730 days | = | Average daily earnings for calculating sick leave |

Regardless of whether the year is a leap year or not, the number of days in a year is always 730. The exception is maternity benefits. When calculating it, the number of days may be different.

Let's determine the maximum benefit amount. To calculate, we take the maximum size of the base for calculating insurance premiums for 2022 and 2018: this is 755,000 rubles. and 815,000 rub. respectively. In total this will be 1,570,000 rubles.

Next, the employee’s average daily earnings must be compared with the minimum. The minimum average daily earnings is 370.85 rubles. If an employee’s earnings are more than the minimum, we calculate sick leave benefits based on actual earnings. If the employee’s earnings are below the minimum of 370.85 rubles, for further calculations you need to take this figure.

Then we determine the amount of benefits for the employee per day, taking into account his insurance experience. To do this, we multiply the average daily earnings by a percentage. If the insurance period is:

- 8 years or more – 100%;

- from 5 to 8 years – 80%;

- less than 5 years – 60%.

To get the total benefit amount, you need to multiply the benefit amount for 1 day by the number of days the employee is sick.

EXAMPLE 1. SICKNESS BASED ON ACTUAL EARNINGS IN 2019 In

January 2022, a purchasing manager brought sick leave to the company’s accounting department. Number of days of her illness = 9 calendar days. Insurance length = 6 years. Actual earnings of the manager: - in 2017 = 500 000 rubles; - in 2022 = 580,000 rubles. Earnings for 2022 and 2022, that is, for the billing period will be: 1,080,000 rubles. We compare this amount with the maximum earnings for calculating benefits - 1,570,000 rubles. The manager's earnings in the amount of 1,080,000 rubles do not exceed the maximum limit of 1,570,000 rubles. Let's calculate the amount of daily allowance for the manager: (500,000 rubles + 580,000 rubles): 730 days. × 80% = 1183.56 rub. We multiplied by 80%, since the manager’s experience is from 5 to 8 years. This is the case when sick pay should be 80% of total earnings. The manager was sick for 9 days. Let’s calculate the amount of benefits for 9 days of illness. To do this, we multiply the manager’s actual daily allowance by the number of sick days: 1183.56 rubles. × 9 days = 10,652.04 rub.

Who is not paid sick leave

In some cases, employees are not entitled to claim social benefits:

- if the employee is contracted under a contract;

- if the treatment regimen prescribed by the doctor is violated;

- in the absence of entries and appointments in the patient’s outpatient record;

- when issuing a document on temporary disability by an unlicensed medical institution;

- if the document has been extended for more than 30 days and there is no conclusion from the medical advisory commission;

- when issuing sick leave without a doctor’s prescription;

- if the date of issue is falsified;

- if the employee is under arrest;

- when an employee is suspended from work without maintaining his salary;

- during downtime at the enterprise;

- if the temporary disability was the result of a criminal violation;

- when an employee undergoes a forensic medical examination.

The procedure for calculating average earnings to pay for sick time

In order for the employee to receive the compensation due to him, the accountant must correctly calculate the payment for temporary disability. The basic rules for calculating and paying for sick leave in 2022 are as follows.

Step 1. The accountant calculates the average earnings for the billing period, then calculates the average daily earnings and the amount of the disability benefit itself. It is necessary to calculate the average salary in accordance with Government Decree No. 922 of December 24, 2007.

Step 2. Average earnings are calculated as follows: wages are determined for the two-year period preceding the accrual. When calculating average earnings, all income that the employee received from official employers and from which insurance premiums were paid is taken into account. The resulting amount is divided by 730.

Accountable income includes (Article 421 of the Tax Code of the Russian Federation):

- income that an employee receives by agreement with the employer - wages, rewards and fees, allowances, bonuses, compensation and incentive payments;

- long service payments;

- payment for an academic degree, badge and certificate of honor;

- for working night shifts, weekends and holidays;

- payment for expanding service areas, for combining job responsibilities;

- remuneration for piece work according to orders;

- salary in kind;

- payments to state and municipal employees;

- allowances to tariff rates and established salaries;

- regional coefficients and northern allowances;

- additional payments for work in difficult climatic conditions, in hazardous industries, etc.;

- allowances for working with documents and information containing state secrets.

Step 3. The formula for calculating average earnings for sick leave is as follows:

SZ = income for the previous 2 years / 730 days.

If one of the calculation years is a leap year, then the total income for 2 years is divided by 731 days. To calculate maternity leave, we take 731 days.

When calculating average earnings, payments that are not subject to FSS insurance contributions are not taken into account. Chapter 34 of the Tax Code of the Russian Federation states that when calculating average earnings, the following amounts are not taken into account (Article 422 of the Tax Code of the Russian Federation):

- Maternity leave.

- A benefit paid during parental leave.

- For other sick leave.

- Travel allowances (daily allowances) paid for business trips both within the Russian Federation and abroad.

- Vacation pay during business trips.

- Financial assistance in the amount of up to 4000 rubles. per employee for a certain billing period.

- One-time financial assistance that is paid in connection with natural disasters or emergency situations, the death of employee family members, the birth of a child, or the establishment of guardianship.

- Year-end bonuses. The final bonus for the year is included in the calculation of average earnings in direct proportion to the number of months worked.

- Compensation payments upon dismissal of an employee. The exception is compensation for unused vacation, amounts of payments in the form of severance pay and average monthly earnings for the period of employment.

- Compensation for costs of professional retraining.

- Payment for employee training for basic and additional professional programs.

- Payments to individuals under GPC agreements.

- Public utilities.

- Compensations related to the employment of laid-off employees and the employee’s relocation to another area. The exception is benefits paid in connection with difficult, harmful working conditions.

Step 4. If the average earnings for each previous period exceed the limit (815,000 rubles in 2022 and 865,000 rubles in 2022), then the limit value is taken for calculation. For 2022, the maximum value of the insurance base for calculating benefits for temporary disability and maternity will be 912,000 rubles. The updated limit value of the base for calculating insurance contributions for compulsory pension insurance from 01/01/2020 is RUB 1,292,000.

There are no excluded periods for calculating average earnings for temporary disability certificates.

Step 5. The resulting calculated result of average earnings is compared with the current minimum wage at the time the minimum wage is calculated. From 01/01/2020, the official minimum wage will be 12,130 rubles. (until the end of 2022 - 11,163 rubles).

Sick leave pay for a new employee

Special rules also apply when calculating temporary disability benefits for recently hired employees. Correct payment for sick leave at a new place of work is made according to the average daily earnings for the previous two years on the basis of a certificate of income provided by the previous employer (Part 1 of Article 14 255-FZ, Clause 3 of the RF PP No. 375 of June 15, 2007). An employee has the right to receive temporary disability benefits from the first day of the employment contract (Part 5 of Article 2 255-FZ). If a citizen falls ill before the day on which he starts work in accordance with the employment contract, then sick leave is not paid.

The basis for calculating sick leave at a new place of work is a certificate in form 2-NDFL for the previous two years or a certificate of income from the previous place of work. The income certificate is filled out in free form. The document must include the following information:

- name of the previous employer's institution;

- employee registration information;

- average monthly salary;

- accrued and actually paid wages to the employee for the specified billing period.

All information from the certificate is certified by the manager and chief accountant of the previous employer.

The most correct basis for calculating benefits is a certificate in form No. 182n. In 2-NDFL there is no breakdown of amounts subject to and not subject to income tax; the register presents generalized values. The certificate of the amount of wages and other payments for the last two years of work No. 182n indicates all transfers for which insurance premiums are calculated for a certain period.

Certificate No. 182n must be issued to the employee upon dismissal. This document is provided to the new place of work along with personal documents. Based on the amounts recorded in the certificate, the average earnings are calculated, which is used to calculate compensation from the Social Insurance Fund - sick leave, maternity leave and child care benefits for children up to one and a half years old.

Right to postpone settlement periods for payment

If an employee does not have an income base, he has the right to write an application for calculating average earnings, taking into account the financial data of those time periods when his income was recorded (clause 1 of Article 14 255-FZ). The transfer can be made by persons who were on maternity leave or parental leave during the billing period.

A period transfer is made when such a replacement is beneficial to the employee due to the fact that his income in the billing period is lower than in the previous ones. For example, if an employee did not work for several years and got a job in an organization. Here is how sick leave is calculated at a new place of work with a postponement of the period:

- Replace either one accounting year of your choice or both periods.

- To carry out the transfer, you must submit a corresponding application to the accounting department.

- The application is drawn up in free form. Indicate the basis for the transfer, refer to the legislative norm - clause 1 of Art. 14 255-ФЗ - and indicate the periods to be replaced.

For example, Viktorova V.V. in 2022 and 2022 I was on maternity leave, and after that I couldn’t find a job. Thus, she has no income for these periods. In October 2022, she got a job. In January 2022, I provided my employer with sick leave. The duration of incapacity for work is 10 days. The employee has 15 years of experience, sick leave is paid in full.

The minimum wage for January 2022 is 12,130 rubles.

Minimum average daily earnings: 12,130 × 24 / 730 = 398.79 rubles. Sick leave based on the minimum wage is paid as follows: 398.79 × 10 = 3987.90 rubles.

The accountant raised the documents and saw that the total income of Viktorova V.V. for 2015 and 2016 equal to RUB 550,000.00.

If you calculate compensation based on income for the previous period, then the payment for a certificate of incapacity for work is as follows:

- 550,000 / 730 = 753.42 rubles;

- 753.42 × 10 = 7534.20 rub.

Accruals for the previous period from Viktorova V.V. much higher than current ones. The employee must fill out an application to postpone the pay periods.

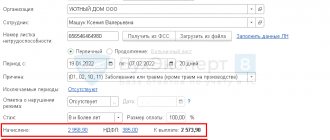

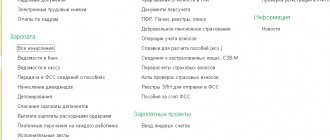

Examples of calculating sick leave in ZUP 3 according to the new scheme and algorithm until 04/01/2020.

The new algorithm for calculating sick leave, applied from April 1, 2020, has been implemented starting with ZUP versions 3.1.10.376 and 3.1.13.146 and is valid for the following cases of illness:

- (01, 02, 10, 11) Illness or injury (except work-related injuries)

- (03) Quarantine

- (09, 12, 13, 14, 15) Caring for a sick child

- (09) Caring for a sick adult family member

- (06) Inpatient prosthetics

A printed form for calculating benefits using the new algorithm has been implemented starting with versions 3.1.10.416 and 3.1.13.188 - a new indicator “Minimum daily benefit” has been added to it.

For all examples except the last one, we define the condition that the employees have no earnings for the two previous years.

Example 1. The insurance period is more than 6 months, but less than 5 years, the employee works for a salary

The employee joined the organization full-time on March 1, 2022. His insurance period at the time of admission is 7 months. He did not provide a certificate of earnings from his previous place of work. From April 1 to April 30, the employee fell ill.

The calculation in this case will be as follows:

- Determination of average daily earnings. Since the employee does not have information about earnings for the two previous years, the minimum average daily earnings will be calculated based on the minimum wage and will be equal to:

- 12,130 (minimum wage) * 24 months / 730 days = 398.79 rubles.

- The amount of daily benefits based on the average daily earnings and length of service of the employee:

- 398.79 (average daily earnings) * 60% (amount of benefits in %) = 239.27 rubles.

- Amount of daily benefit for April based on the minimum wage:

- 12,130 (minimum wage) / 30 (number of calendar days in April) = 404.33 rubles.

- Selecting the maximum of the two resulting daily benefits:

- 239.27 (daily allowance based on average daily earnings and length of service) < 404.33 (daily allowance based on the minimum wage).

- The total benefit amount will be obtained using the new algorithm:

- 404.33 (daily allowance) * 30 (number of sick days) = 12,129.90 rubles.

Under the old calculation scheme, the benefit amount would be:

- 239.27 (daily allowance) * 30 (number of sick days) = 7,178.10 rubles.

Example 2. The insurance period is more than 6 months, but less than 5 years, the employee works on a full-time basis, sick leave began before 04/01/2020 and continues in April

The employee joined the organization full-time on March 1, 2022. His insurance period at the time of admission is 7 months. He did not provide a certificate of earnings from his previous place of employment. From March 25 to April 3, the employee fell ill.

- Determination of average daily earnings. Since the employee does not have information about earnings for the two previous years, the minimum average daily earnings will be calculated based on the minimum wage and will be equal to:

- 12,130 (minimum wage) * 24 months / 730 days = 398.79 rubles.

- The amount of daily benefits based on the average daily earnings and length of service of the employee will in any case be used for calculation March parts of the manual:

- 398.79 (average daily earnings) * 60% (amount of benefits in %) = 239.27 rubles.

- Amount of daily benefit for April based on the minimum wage:

- 12,130 (minimum wage) / 30 (number of calendar days in April) = 404.33 rubles.

- Selecting the maximum of the two resulting daily benefits for calculation April parts of the manual:

- 239.27 (daily allowance based on average daily earnings and length of service) < 404.33 (daily allowance based on the minimum wage).

- The total benefit amount will be obtained according to the new algorithm: For the March part of sick leave:

- 239.27 (daily benefit until 04/01/2020) * 7 (number of sick days in March) = 1,674.89 rubles. For the April part of the sick leave:

- 404.33 (daily benefit from 04/01/2020) * 3 (number of sick days in April) = 1,212.99 rubles. Total benefit amount:

- 1,674.89 (March part of sick leave) + 1,212.99 (April part of sick leave) = 2,887.88 rubles.

Under the old calculation scheme, the benefit amount would be:

- 239.27 (daily allowance) * 10 (number of sick days) = 2,392.70 rubles.

Example 3. The insurance period is more than 6 months, but less than 5 years, the employee works part-time

The employee joined the organization from March 1, 2022 at 0.5 rates. His insurance period at the time of admission is 7 months. He did not provide a certificate of earnings from his previous place of employment. From April 1 to April 30, the employee fell ill.

The calculation in this case will be as follows:

- Determination of average daily earnings. Since the employee does not have information about earnings for the two previous years, the minimum average daily earnings will be calculated based on the minimum wage, taking into account the employee’s position and will be equal to:

- 12,130 (minimum wage) * 24 months / 730 days * 0.5 (number of rates) = 199.40 rubles.

- The amount of daily benefits based on the average daily earnings and length of service of the employee:

- 199.40 (average daily earnings) * 60% (amount of benefits in %) = 119.64 rubles.

- The amount of daily benefits for April based on the minimum wage is proportional to the length of working hours:

- 12,130 (minimum wage) / 30 (number of calendar days in April) * 0.5 (number of rates) = 202.17 rubles.

- Selecting the maximum of the two resulting daily benefits:

- 119.64 (daily allowance based on average daily earnings and length of service, taking into account the rate) < 202.17 (daily allowance based on the minimum wage, taking into account the rate).

- The total benefit amount will be obtained using the new algorithm:

- 202.17 (daily allowance) * 30 (number of sick days) = 6,065.10 rubles.

Under the old calculation scheme, the benefit amount would be:

- 119.64 (daily allowance) * 30 (number of sick days) = 3,589.20 rubles.

Example 4. Insurance experience is more than 6 months, but less than 5 years, the employee works as a full-time employee in an organization with the Republic of Kazakhstan

The employee joined the organization full-time on March 1, 2022. His insurance experience at the time of admission is 1 year. He did not provide a certificate of earnings from his previous place of work. The organization is located in an area with a regional coefficient of 1.2. From April 1 to April 30, the employee fell ill.

The calculation in this case will be as follows:

- Determination of average daily earnings. Since the employee does not have information about earnings for the two previous years, the minimum average daily earnings will be calculated based on the minimum wage, taking into account the employee’s position and will be equal to:

- 12,130 (minimum wage) * 24 months / 730 days = 398.79 rubles.

- The amount of daily benefits based on the average daily earnings and length of service of the employee, taking into account the Republic of Kazakhstan. Since the organization uses the Labor Code and the daily average is calculated based on the minimum wage, the amount of the daily allowance should be calculated taking into account the employee’s length of service and the Labor Code:

- 398.79 (average daily earnings) * 60% (amount of benefit in %) * 1.2 (RK) = 287.124 rubles.

- Amount of daily benefit for April based on the minimum wage, taking into account the Republic of Kazakhstan:

- 12,130 (minimum wage) * 1.2 (RK) / 30 (number of calendar days in April) = 485.20 rubles.

- Selecting the maximum of the two resulting daily benefits:

- 287.124 (daily allowance based on average daily earnings and length of service, taking into account the RK) < 485.20 (daily allowance based on the minimum wage, taking into account the RK).

- The total benefit amount will be obtained using the new algorithm:

- 485.20 (daily allowance) * 30 (number of sick days) = 14,556 rubles.

Under the old calculation scheme, the benefit amount would be:

- 287.124 (daily allowance) * 30 (number of sick days) = 8,613.72 rubles.

As of June 19, 2020, new rules for applying the regional coefficient when calculating benefits came into effect.

For more details see:

- New rules for applying the regional coefficient when calculating benefits based on the minimum wage

- New rules for applying the regional coefficient in 2022 when calculating based on the minimum wage for sick leave, maternity benefits, and parental leave

Example 5. The insurance period is less than 6 months, the employee works full-time in an organization with the Republic of Kazakhstan

The employee joined the organization full-time on March 1, 2022. The insurance period at the time of admission is 3 months. The employee provided a certificate from his previous place of work and the amount of earnings for 2022 amounted to 600,000 rubles. The organization is located in an area with a regional coefficient of 1.2. From April 1 to April 30, the employee fell ill.

The calculation in this case will be as follows:

- Determination of average daily earnings. Since the employee has earnings for the previous two years, the actual average daily earnings will be:

- 600,000 (earnings for the previous two years) / 730 days = 821.92 rubles. Minimum average daily earnings:

- 12,130 (minimum wage) * 24 months / 730 days = 398.79 rubles. Since the actual average daily earnings (RUB 821.92) is greater than the minimum daily average earnings (RUB 398.79), the actual daily average is selected.

- Daily allowance amount. The amount of daily benefits based on the average daily earnings and length of service of the employee will be:

- 821.92 (average daily earnings) * 60% (amount of benefit in %) = 493.15 rubles. However, because If the employee's insurance experience is less than 6 months, then the amount of daily benefits is limited above the minimum wage, taking into account the Republic of Kazakhstan, and is equal to:

- 12,130 (minimum wage) * 1.2 (RK) / 30 (number of calendar days in April) = 485.20 rubles. One of two minimum daily benefit values is selected. In our example, this will be a daily allowance, limited above the minimum wage, taking into account the Republic of Kazakhstan - 485.20 rubles.

- Not calculated, because at the previous step, the amount of daily benefits for the month was already calculated based on the minimum wage, taking into account the Republic of Kazakhstan.

- No comparison required.

- The total benefit amount under the new scheme and algorithm valid until 04/01/2020 will be the same:

- 485.20 (daily allowance) * 30 (number of sick days) = 14,556 rubles.

As of June 19, 2020, new rules for applying the regional coefficient when calculating benefits came into effect.

For more details see:

- New rules for applying the regional coefficient when calculating benefits based on the minimum wage

- New rules for applying the regional coefficient in 2022 when calculating based on the minimum wage for sick leave, maternity benefits, and parental leave

Payment of sick leave to a part-time worker

To calculate social compensation for an employee working part-time in an institution, it is necessary to request information about income from all of his jobs. Accrual is made at the main place of work.

Such an employee submits to the organization income certificates for the previous two years from all of his jobs.

IMPORTANT!

A part-time employee who has worked for more than two years in the same institutions receives temporary disability benefits at all enterprises. In such cases, each employer is provided with an original sick leave certificate.

If a part-time worker worked on a permanent basis in two organizations, but at the time of incapacity for work he was employed in several more organizations, he has the right to receive benefits only at one enterprise. The employee chooses the company at his own discretion.

In such cases, in addition to sick leave and a certificate of income, the part-time worker provides the employer with certificates stating that he did not receive temporary disability benefits in other organizations.

Example: Vlasov V.V. has been working at the NPO “Success” for 10 years. Also, for the last two years he has been working part-time in various organizations. Vlasov V.V. provided the main employer with sick leave for 5 days. The employee provided certificates of part-time income totaling RUB 120,000.00. over the past 2 years. The average salary at the main employer is RUB 50,000.00. per month.

The payment is calculated as follows:

- 50,000.00 × 24 + 120,000.00 = 1,320,000 rub. — total income for two years;

- 1,320,000 / 730 = 1808.22 rub. - average daily earnings.

The employee's length of service is 10 years, so the leave is paid in full.

Vlasov V.V. temporary disability benefits accrued: 1808.22 × 5 = 9041.10 rubles.

Payment of sick leave for epidemiological quarantine

In connection with the coronavirus epidemic, the Russian government has developed temporary rules for issuing and paying for sick leave for those people who are forced to be in quarantine (RF Government Regulation No. 294 of March 18, 2020). If you or your relatives with whom you live or constantly communicate have returned from countries with an unfavorable epidemiological situation, you must call a doctor at home, undergo an examination and remain in quarantine for 14 days. Two weeks is the incubation period during which symptoms of the disease may appear. For this period, you will be issued an electronic sick leave certificate.

Here's what quarantined people should do to apply for and receive temporary disability insurance:

- Log in to your ESIA personal account. Unregistered persons must obtain consent for a registered relative to submit an application on their behalf.

- Submit an application for an electronic sick leave. Attach to your application documents confirming your stay in a country with an epidemic (scanned copy of the relevant pages of your international passport, electronic plane ticket). If you live with a citizen who returned from countries with unfavorable conditions, attach the relevant documents.

- Check the issued electronic sick leave in the FSS information system. Notify the employer about the two-week quarantine and send him the details of the electronic certificate of incapacity for work.

Such sick leave is calculated according to general rules (depending on the employee’s length of service), but it is paid differently. You will receive the first payment from the Social Insurance Fund for the first 7 days of quarantine the next day after the employer transmits the information to the territorial body of the Social Insurance Fund. The maximum payment period is 7 calendar days. The second part of the quarantine (the remaining 7 days) will be paid on the next working day after its end, but no later than this date.

IMPORTANT!

The sooner you notify your employer of forced isolation, the sooner he will transmit the information to the territorial Social Insurance Fund and the sooner you will be paid the proper insurance benefits.

Maximum duration of sick leave after surgery in 2022

According to the new rules

The duration of treatment after surgery can be summarized in the following table:

| Type of operation | For how long is sick leave issued after surgery (in calendar days) |

| Appendectomy | 16-21 (depending on the type: catarrhal, purulent, phlegmous). |

| Uterus removal | 65-100 |

| Gallbladder removal | 48-55 (while the citizen is in hospital) + 10 days of rehabilitation at home. |

| Cyst removal | 20-28 |

| Tooth extraction (including under general anesthesia) | 3-10 |

Regardless of which organ was operated on, the human body needs recovery, during which the worker must be in an environment conducive to complete rehabilitation. This process occurs first in a hospital, then on an outpatient basis.

The amount of benefits is determined in accordance with the sick leave certificate. It is paid according to the general rules: the first three days after the operation are paid by the employer, all subsequent days are paid by the Social Insurance Fund.

Insurance period and sick leave payment

The insurance period is understood as the duration of work of an employee, during which income was recorded and insurance premiums were transferred.

The insurance period includes periods of work of the insured person on the territory of the Russian Federation or abroad on the basis of international treaties of the Russian Federation and in accordance with Russian legislation. The insurance period includes periods of temporary disability, the care of one of the parents for children, the time of receiving unemployment benefits, etc. To include these periods in the insurance period, they must be preceded or followed by periods of work.

The insurance period is not taken into account in the following cases:

- when working without registration;

- from individual entrepreneurs who have evaded paying fees to the social fund;

- during vacations not paid by the employer.

When calculating the insurance period for sick leave, all insurance periods are taken into account, regardless of work breaks.

The insurance period is calculated on a calendar basis based on a full year. Every 30 days of work and other periods are converted into months, and every 12 months - into full years.

The amount of sick leave payments directly depends on the length of insurance coverage. Here's how sick leave is calculated at a new place of work: if the employee's work experience is less than six months, then no more than one minimum wage is calculated for each month of incapacity for work.

Payment depending on length of service is made as follows:

- if the employee’s length of service is 8 years or more, then sick leave benefits are paid in full (100%);

- from 5 to 8 years - payment will be 80%;

- from 3 to 5 years - 60%.

When paying maternity benefits, the length of service coefficient is not taken into account; sick leave is paid in full.

How many days at least does the therapist give sick leave?

The minimum period of sick leave is not regulated

neither at the level of laws, nor departmental regulations.

The decision on the timing, depending on the patient’s condition,

can be made independently by the attending physician, dentist or paramedic. Current medical practice shows that sick leave is usually given for 3 days, whether the treatment is on an outpatient basis or in a hospital (including day care).

Duration of sick leave

Based on Art. 11 of Order No. 624n, the duration of one sick leave does not exceed 15 days. The maximum period of a certificate of incapacity for work is 10 months, but is extended to 12 months for the following diagnoses:

- injury requiring long healing;

- tuberculosis;

- postoperative period.

For citizens who have been recognized as disabled, the following maximum periods of sick leave are established (clause 3 of Article 6 255-FZ):

- continuously - 4 months;

- in total for the year - 5 months.

From April 10, 2018, sick leave for caring for a child under 7 years old is issued without a time limit; the same rule applies to caring for disabled children.

Sick leave for maternity leave is issued for a period of 140 days in the case of a singleton pregnancy, 156 days in the case of a complicated birth, and 194 days in the case of a multiple pregnancy.

Maximum period of stay on sick leave in 2022

The bulletin records

, how many days a person can be on sick leave without a break, that is, he has the right to

be absent from work

legally with pay, without fear of being fired or held accountable for absenteeism.

Maximum period of possible absence of an employee

illness is determined by several circumstances:

- type and type of disease;

- complications during the course of the disease;

- doctor's specialization;

- the physical condition of the patient.

Depending on these factors, the doctor may decide not to open the bulletin or, conversely, increase the treatment time, assessing the progress of the patient’s recovery, which for each person is individual and sometimes unpredictable.

The maximum number of days sick leave is issued is determined by the doctor in accordance with his specialization:

- The doctor conducting the treatment alone can determine this period of 15 days ( Order, Chapter II, Art. 11

).

Staying on treatment beyond this time, if it is necessary to continue treatment, can only be determined by the decision of the medical commission

(

Order, Chapter II, Art. 13; No. 323-FZ, Art. 59

). - The paramedic/dentist can set a maximum period of 10 calendar days inclusive ( Order, Chapter II, Art. 12

).

The certificate of incapacity for work determines how many days you can remain on sick leave continuously in 2022. This period remained unchanged and strictly regulated. Let's highlight some of the rules:

| Grounds for issuing sick leave | Maximum time (number of days, inclusive) | Article of the Order |

| Outpatient | 15 | |

| Stationary | Treatment period in hospital + 10 additional days | |

| Continuation of treatment in a sanatorium institution | 24 + travel time to the LU and back, if the disease is occupational | Ch. IV, art. 31, 32 |

| Pregnancy/birth | from 140 to 196 | Ch. VIII, art. 46 |

| Caring for a sick child | The entire period of illness (up to 7 years or a disabled child up to 15 years); | Ch. V, art. 35 |

Regulatory deadlines in each of the listed cases may be extended by decision of the medical commission.

Deadlines for payment of benefits and personal income tax

Temporary disability benefits are assigned only after the strict reporting form has been checked for authenticity and correct completion. The employer checks the sick leave and assigns temporary disability benefits. The deadline for paying sick leave in 2022 is 10 days from the date of receipt of the document from the employee. The transfer of funds is made in the next period of payment of advance payment or wages (Part 1 of Article 15 255-FZ).

In those subjects of the Russian Federation in which the certificate is paid directly by the Social Insurance Fund, different deadlines apply: after the timely submission (within 5 days) of a correctly completed certificate of incapacity for work to the Social Insurance Fund, the social insurance authorities review the document and make a decision. After a positive verdict, payment is made within 15 days (RF RF No. 294 dated April 21, 2011).

As a general rule, personal income tax of 13% is withheld from all sick leave without division into compensation from the employer and the Social Insurance Fund. But if there is a pilot project in the region, then the employer withholds personal income tax only for those three days that are accrued at his expense. The remaining part is retained and transferred by the territorial body of the FSS. Personal income tax is transferred no later than the last day of the month in which the benefit was paid (Article 226 of the Tax Code of the Russian Federation).

In accordance with paragraph 1 of Art. 217 of the Tax Code of the Russian Federation, maternity benefits are not subject to taxation. Income tax is not withheld from compensation for child care up to 1.5 and 3 years.

How many days a year can you take sick leave if you are sick?

Russian legislation does not limit

the maximum number of days of sick leave per year - this decision is made by the doctor and, in his direction, by the medical commission.

Throughout this entire time (if necessary, right up to disability), the working citizen retains his job, while the benefits

for disability must be paid

in full

in accordance with the standard.

Officially

By opening the newsletter, the employee receives a social guarantee and security, no matter how long his treatment and subsequent rehabilitation may be.

Maximum and minimum payment for sick leave

The minimum payment value is determined on the basis of the current minimum wage (Part 1.1 of Article 14 255-FZ). If necessary, the accountant determines an additional payment for the employee up to the average earnings.

IMPORTANT!

From 01/01/2020, the minimum wage in Russia increased and amounted to 12,130 rubles.

Accordingly, the minimum daily earnings will be:

(12 130 × 24) / 730 = 398,79.

In 2022, the minimum sick leave benefit is calculated as follows:

(12,130 × 24 months) / 730 × 60%.

It is 239.28 rubles.

The maximum value of temporary disability benefits is limited by a maximum value. According to the new limits, the maximum payment for sick leave in 2022 is calculated as follows:

(815,000 + 865,000) / 730 = 2301.37 rubles.

The minimum value of maternity benefits (according to the minimum wage) in 2020:

398.79 × 140 days = 55,830.60 rub.

Maximum value:

2,301.37 × 140 days. = 322,191.80 rub.

IMPORTANT!

Due to the spread of coronavirus infection, the procedure for calculating payments for temporary disability has temporarily changed. From 04/01/2020 to 12/31/2020, the slip is paid based on the minimum wage - 12,130 rubles. (Article 1 104-FZ dated 04/01/2020). The accountant is required to make two calculations: normal (using information about the employee’s income) and according to the minimum daily value according to the minimum wage (in 2022 - 398.79 rubles). All bets, odds and percentages based on length of service are applied to both amounts. The resulting values are multiplied by the number of days of illness. The results are compared - the employee is paid the largest benefit.

Table of lengths of time spent on sick leave for various diseases

The general picture of how many days an employee can be on sick leave continuously develops in accordance with the type of injury or illness, surgical intervention and general condition

based on the results of treatment.

Despite the fact that the decision on the duration of treatment in each specific case is the prerogative of the attending physician and a special commission, the most common diseases and cases of injury are approved by Order of the Ministry of Health of August 21, 2000 No. 2510/9362-34

. This order fixed the approximate (recommended) periods of stay on sick leave for diseases. A disability certificate is issued in accordance with these deadlines:

| Illness/injury | Duration of sick leave (in calendar days) |

| ARVI | 5-15 |

| Angina | 10-15 |

| All types of injuries, starting with a limb fracture and ending with trauma, which depends on the type of injury, the absence or presence of displacement, complications. | The entire period of rehabilitation until lost functions are restored, including:

|

| Brain concussion | 20-28 |

| Oncology | 120-180 (depending on the stage) 120-180 (infiltration period); |

| Tuberculosis | 240-300 (in other cases). |

| Chicken pox | 10-21 |

The diagnosis and type of disease are not recorded on the bulletin form; instead, the doctor records a special code

indicating the diagnosis in the form of

a digital record

:

- 01 - disease;

- 02 - injury;

- 03 - quarantine, etc.

The additional code indicates a diagnosis according to the International Classification of Diseases.

The deadline for submitting sick leave to the employer (to the accounting department) for calculating benefits is determined by Article 12, Part 1, Article 13

,

Part 5 No. 255-FZ

and is 6 months. Exceeding this period is grounds for refusal to accrue payments.

An example of calculating payment for caring for a sick child

Ezhova E.E. provided sick leave to care for a sick child from January 13 to January 20, 2022. The child’s age is 7 years. According to the new rules, such sick leave is paid in full for the entire duration of the child’s illness. The employee's experience is 15 years.

Income for 2022 - RUB 500,000.00.

Income for 2022—RUB 600,000.00.

SDZ = (500,000.00 + 600,000.00) / 730 = 1506.85.

The compensation will be: 1506.85 × 7 = 10,547.95 rubles.

An example of calculating maternity benefits

Alexandrova A.A. provided sick leave for pregnancy and childbirth. She is going on maternity leave on 02/05/2019. In Alexandrova A.A. singleton pregnancy, the leave for which is 140 days.

Total income for 2022 amounted to RUB 650,000.00, for 2022 - RUB 730,000.00. The employee did not take sick leave during this period. Alexandrova’s income does not exceed the maximum base.

Let's calculate the maternity benefit: (650,000.00 + 730,000.00) / 730 = 1890.41 rubles.

The benefit will be: 1,890.41 × 140 = 264,657.53 rubles.