A cash book is a special internal journal of enterprises and organizations, which records all transactions carried out using cash. That is, all legal entities and individual entrepreneurs using cash payments are required to use a cash book in their activities. At the same time, the volume of cash turnover does not matter; if at least one or two such transactions occur during the reporting period, this document must still be filled out. What form of taxation is used also does not matter.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

Who is responsible for maintaining the book?

Maintaining this document is the responsibility of the employee who is responsible for cash transactions at the enterprise (usually this is either a cashier or an accountant of the organization). Also, the company must organize control over the completion of the document, which is usually assigned to the chief accountant or directly to the head of the enterprise.

The cash book should be prepared in the most careful manner, since the information reflected in it is always carefully checked by tax specialists during on-site audits.

Any errors discovered may result in serious administrative penalties in the form of large fines.

Purpose of the unified form KO-4

Form KO-4, called a cash book, is a tool for keeping records of the following transactions at the cash desk of an enterprise:

- receipt of cash;

- cash issuance.

ATTENTION! From November 30, 2020, the rules for processing cash transactions have been simplified. For example, separate divisions of organizations have the right not to maintain a cash book if they hand over cash to the head branch.

Information about outgoing and incoming orders is entered into the fields of the form.

Read more about some of the nuances of cash management at an enterprise in the article “Cash discipline and responsibility for its violation.”

ConsultantPlus experts explained the rules for working with the cash book in various situations. If you don't have access to the system, get a free trial online.

Basic rules for registering a cash book

- The cash book is started annually and is maintained from the beginning to the end of the year. If it ends before the end of the reporting period, a second cash book is drawn up, entries in which continue to be made in chronological order.

- You can fill it out either handwritten or on the computer. All information must be entered in order, without gaps.

- The cash book consists of two parts:

- title page where information about the company is entered,

- main pages where data on cash financial transactions carried out for each day is indicated.

- Each sheet has two copies, one of which, after filling out, must be left in the book, and the second must be cut off and handed over to the accounting department specialists. All sheets of the cash book should be numbered in the usual order and laced together. The number of sheets in the book should be written on the last page and this information must be certified by the signature of the chief accountant, the director of the enterprise and the seal (if any).

- It is impossible to make mistakes, blots and inaccuracies in the document, but if they do happen, you should cross out the incorrect information and carefully enter the correct information next to it. The correction must be certified by the signature of the cashier and the chief accountant. You can fill out the cash book only with a ballpoint pen (pencils are not allowed).

- The cash book must be maintained daily, but if no cash transactions were carried out on a particular day, there is no need to fill out the sheets. At the end of each work shift, the cashier is required to submit the document to the accounting department, along with the rest of the “primary” documents. After checking the information entered in it, the accountant signs the book and returns it to the cashier.

- One enterprise cannot have two cash books, except in cases where a legal entity has representative offices and branches - they must have their own similar documents (in this case, copies of the cash book and payment documents must be regularly transferred to the head office).

KO-4 Cash book.

Cash book

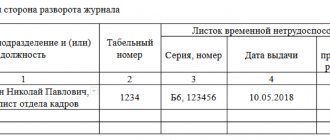

(form KO-4) - designed to record the receipt and issue of cash. It is used to record receipts and disbursements of cash from an organization at the cash desk. The cash book must be numbered, laced and sealed with a seal on the last page, where the entry “In this book there are ______ sheets numbered and laced.” The total number of laced sheets in the cash book is certified by the signatures of the head and chief accountant of the organization. Each sheet of the cash book consists of 2 equal parts: one of them (with a horizontal line) is filled out by the cashier as the first copy, the second (without horizontal lines) is filled out by the cashier as the second copy from the front and back through carbon paper with ink or a ballpoint pen. The first and second copies of sheets are numbered with the same numbers. The first copies of sheets remain in the cash book. The second copies of the sheets must be tear-off, they serve as the cashier’s report and are not torn off until the end of operations for the day.

Records of cash transactions begin on the front side of the continuous part of the sheet after the line “Balance at the beginning of the day.”

First, the sheet is folded along the cut line, placing the tear-off part of the sheet under the part of the sheet that remains in the book.

To keep records after the “Transfer”, the tear-off part of the sheet is placed on the front side of the continuous part of the sheet and records are continued along the horizontal rulers of the reverse side of the continuous part of the sheet. form cash book form KO-4 in Word and Excel format: Filling out and designing the cash book

Sheets of the cash book are formed in the form of a machine diagram “Loose sheet of the cash book”. At the same time, the “Cashier’s Report” machinegram is generated. Both machinograms must be drawn up by the beginning of the next working day, have the same content and include all the details provided for in the cash book form.

The numbering of the cash book sheets in these machine diagrams is carried out automatically in ascending order from the beginning of the year.

The cashier, after receiving the Cash Book Load Sheet and the Cashier's Report, must check the correctness of these documents, sign them and hand over the cashier's report along with receipts and expenditure documents against a signature on the cash book loose sheet.

In the machine diagram “Inset sheet of the cash book”, the last for each month should be printed the total number of sheets of the cash book for each month, and in the last for the calendar year - the total number of sheets of the cash book for the year.

For safety and ease of use, loose sheets of the cash book are kept by the cashier separately for each month throughout the year.

At the end of the calendar year (or as necessary), the cash book insert sheets are bound in chronological order. The total number of sheets for the year is certified by the signatures of the head and chief accountant of the enterprise and the book is sealed.

The company maintains only one cash book. The cash book is opened for a certain period, which can be a month, quarter, year or any other period established by the enterprise. The cash book must be numbered, laced and sealed with a wax or mastic seal. When sealing a book with a mastic seal, glue based on liquid glass (“Silicate”, “Clerical”, “Office”), tissue paper, stamp ink are used. The paper with the seal imprint is smeared on both sides with glue, after sealing the book, another layer of glue is applied .

Entries in the cash book are made in 2 copies using carbon paper using ink or a ballpoint pen. The first and second copies of sheets are numbered with the same numbers. The second copies of the sheets must be tear-off and serve as the cashier’s report along with the documents attached to them. The first copies of sheets remain in the cash book.

The recording of cash transactions begins on the front side of the continuous part of the sheet after the balance line at the beginning of the day. First, the sheet is folded in half along the cut line, placing the tear-off part of the sheet under the part that remains in the book. Copy paper is inserted between the parts of the sheet. After filling the front side of the permanent part, a “transfer” is carried out. In this case, the tear-off part of the sheet is placed on the front side of the non-tear-off part, carbon paper is inserted and notes are continued along the horizontal rulers of the reverse side of the non-tear-off part of the sheet. As a result, the tear-off part of the sheet, which is the report, is a copy of the entry in the cash book. The report form does not come off until the end of the day.

Erasures and unspecified corrections in the cash book are not permitted. The corrections made are certified by the signatures of the cashier, as well as the chief accountant of the enterprise or the person replacing him.

Entries in the cash book are made by the cashier immediately after receiving or issuing money for each order or other document replacing it. Every day at the end of the working day, the cashier calculates the results of transactions for the day, displays the balance of money in the cash register for the next date and transfers to the accounting department as a cashier’s report a second tear-off sheet (a copy of the entries in the cash book for the day) with receipts and expenses cash documents against receipt in the cash register book.

If cash transactions are not carried out at the enterprise every day, then a report is usually prepared once every 3-5 days, depending on the volume of records. In this case, instead of the report date, the period for registering cash transactions is indicated, for example, “Cash for January 02-06, 2006. Sheet ___.”

Download other forms on our website:

| Power of attorney for a car | Summary | Help 2-NDFL | Hotel form |

| Advance report JSC-1 | Invoice Torg-12 | Sales receipt | Invoice |

| Receipt cash order KO-1 | Travel certificate | Expense cash order KO-2 | Invoice |

Didn't find what you wanted - use the site map

Instructions for registering a cash book

At the beginning

- On the title page of the book, first write the full name of the company to which this document belongs, the structural unit (if necessary)

- The OKPO code is entered (located in the company’s constituent papers) and the year for which the cash book is opened is entered.

- On the last page of the document, it is necessary to indicate the number of sheets in it, the signature of the manager, chief accountant and the closing date of the cash book. The specified data is recorded on the first sheet of the cash book form.

Main part of the book

- On the required sheet you should indicate the date it was filled out, as well as the number (according to the order in which the cash book is maintained).

- Then the number of the primary document is entered into the table in the first column (receipt and expense order when “cash” is received, and cash order when it is issued).

- Then information is entered about from whom the funds were received or to whom the funds were issued (both legal entities and individuals can be indicated here), and the corresponding account number. The amount must be entered in the column to which it relates (either income or expense).

- After all the necessary lines have been filled in, the empty ones must be crossed out in the form of the letter Z or a cross, and at the end of the day the final amount in each column should be calculated and indicated in the “Total” cells.

- Below, in the appropriate line, you should enter the balance of cash in the cash register at the end of the day.

- In conclusion, the document must be signed by the cashier who filled out the document, as well as the chief accountant (with transcripts of the signatures).

The cash book must be kept for at least five years.

Features of filling out form KO-4

The cash book in form KO-4 consists of 2 elements - the main part and a copy. Moreover, their structure and relative position depend on how the document is filled out - on paper or on a computer.

In the first case, the copy of the KO-4 form is tear-off. It is filled in simultaneously with the main part when using carbon paper. When filling out the document in question on a computer, a copy of the form can be obtained by reprinting its main part on a printer.

The legislation also provides for the option of maintaining a cash book in completely electronic form, subject to the use of automated systems.

You can download the unified form KO-4 for free by clicking on the picture below:

You can find a completed sample cash book in the article “Procedure for maintaining and filling out a cash book - sample”

For whom is the use of the KO-4 form mandatory?

There is a misconception that Russian organizations are not required to fill out Form KO-4 from January 1, 2013 - due to the entry into force of the new accounting law and the appearance of corresponding clarifications in the letter of the Ministry of Finance of the Russian Federation No. PZ/10-2012, according to which organizations have the right not to use unified forms in your work.

The fact is that such preferences are established in relation only to those organizations that the legislator in certain legal acts does not directly require to use unified forms. A similar source of law operates in Russia - this is Bank of Russia Directive No. 3210-U, issued on March 11, 2014.

In accordance with paragraph 1 of the instructions, legal entities must unconditionally follow the rules contained in the provisions of the relevant act. In turn, individual entrepreneurs generally have the right not to keep a cash register, which means they are not required to use standardized forms, including document KO-4. At the same time, the practical need for registering incoming and outgoing transactions at the cash desk of an individual entrepreneur may well arise (for example, when issuing cash to employees on account), and in this case the KO-4 form should be used as a cash book.

Read the useful facts about cash transactions in the article “The concept and types of cash transactions (legal regulation).”