Who is a homeworker and what branch of law regulates labor relations with him?

The definition of the concept of “homeworker” is contained in the Labor Code of the Russian Federation.

They are considered a person who works from home, but has an employment contract with the employer (Article 310 of the Labor Code of the Russian Federation). The conclusion of an employment agreement automatically subjects the relationships arising under it to the requirements of labor law (Article 16 of the Labor Code of the Russian Federation) and, accordingly, to the main document of this law - the Labor Code, in which Chapter is devoted to the peculiarities of regulating the work of those working at home. 49. Since 2022, the Labor Code of the Russian Federation has turned out to be the only legal document in matters of regulation of home-based work in connection with the abolition of the Regulations on the working conditions of homeworkers, which was approved by the Decree of the State Committee for Labor of the USSR and the Secretariat of the All-Union Central Council of Trade Unions dated September 29, 1981 No. 275/17-99 (order of the Ministry of Labor of Russia dated 12/29/2016 No. 848). The provision was applied to the extent that did not contradict the Labor Code of the Russian Federation, and explained in detail many aspects of interaction between the parties.

According to ch. 49 of the Labor Code of the Russian Federation, the nature of home work is determined by:

- implementation at the employee’s place of residence, which will be indicated in the employment agreement as his place of work;

- made from materials and means of labor purchased either by the employer or the employee himself;

- the possibility of involving members of the employee’s family without the employer having an employment relationship with them.

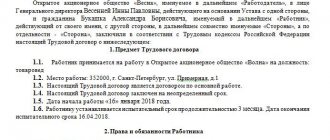

The established relationships do not require compliance with special rules when drawing up an employment contract (or changing it if the nature of the work for an already registered employee changes). However, in this document it is necessary to stipulate those points in which options for mutual obligations are allowed:

- selection of the party responsible for the acquisition of the necessary basic materials and labor tools, and the procedure for transferring them to the employee, if the employer is chosen as such party;

- the procedure for receiving production tasks, accepting the work performed and actually transferring it to the employer;

- the amount of compensation for labor equipment purchased by the employee and the procedure for its payment;

- the procedure for reimbursement of employee expenses for materials purchased by him independently, and for services arising at his place of residence in connection with the performance of work (electricity, water, telephone, Internet);

- prices per unit of work, algorithm for determining its total cost and calculation procedure;

- bonus conditions;

- the presence of additional grounds for dismissal in comparison with the norms of the Labor Code of the Russian Federation.

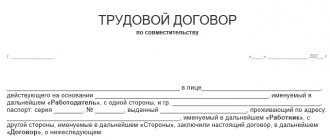

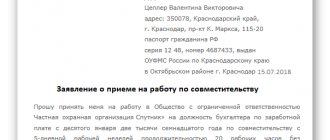

A sample employment contract with a homeworker can be downloaded for free by clicking on the picture below:

As with the employment of a regular employee, the hiring of a homeworker will be formalized by order of form T-1 or T-1a. In the line of this document that requires reflection of the conditions of employment and its nature, the home worker needs to make an entry that the work is carried out at home.

Read about the rules for issuing an employment order in the article.

Homeworker: the concept of home work

Recently, homeworkers have been in fairly wide demand, since they are more than beneficial for the employer and for the homeworker himself it is more than convenient.

Let's figure out who a homeworker is?

The procedure for carrying out the labor activities of homeworkers is regulated by Chapter 49 of the Labor Code of the Russian Federation.

In accordance with Art. 310 of the Labor Code of the Russian Federation homeworkers are persons who have entered into an employment contract to perform work at home using materials and using tools and mechanisms received from the employer or purchased at their own expense.

Today, the involvement of homeworkers is the most relevant, especially in the field of human intellectual activity. For example, translators, designers, accountants, programmers, etc.

It is necessary to mention the trend of development of homeworking occurs not only in Russia, but throughout the world as a whole. This method of activity is even regulated at the international level.

In particular, on June 20, 1996, at the General Conference of the International Labor Organization in Geneva, Convention No. 177 “On Wage Labor” was adopted.

According to Article 1 of this Convention, home work is the performance of work by a home worker:

- not at the employer’s location, this may be his place of residence or another location of the homeworker,

- for a certain reward,

- for the purpose of producing goods and services, according to the instructions of the employer.

The homeworker carries out his work at home, which can also involve members of his family. In this case, no legal relations arise with family members and the employer.

When using home work, the employer can organize conditions for the production of goods at the employee’s home. For example, provision of equipment, machinery, materials, etc.

If the employee uses his own equipment and purchases material at his own expense, then the employer is obliged to cover all the expenses of the homeworker, as well as compensate for the wear and tear of labor tools. As a rule, the procedure for compensation and payments is established by the employment contract.

The difference between the concepts of “place of work” and “workplace”

The concepts “workplace” and “place of work” are not synonymous. Both of them imply a direct connection with work, but the first of the places must be created and controlled by the employer (Article 209 of the Labor Code of the Russian Federation), and for the second the condition of creation and control is not necessary, but the connection to a specific region or locality is important (Article 57 of the Labor Code RF, “Review of the practice of considering cases by courts...”, approved by the Presidium of the Supreme Court of the Russian Federation on February 26, 2014).

This difference becomes significant when deciding whether the employer needs to register with the Federal Tax Service where the homeworker’s place of work belongs. More precisely, should this place be considered a separate division subject to registration.

From the text of paragraph 2 of Art. 11 of the Tax Code of the Russian Federation, which defines a separate unit, it follows that it arises where stationary workplaces are equipped (i.e., according to Article 209 of the Labor Code of the Russian Federation - places created and controlled by the employer). However, at the homeworker’s place of residence, the workplace is not equipped by the employer and is controlled by him to an extremely limited extent. That is, there is no reason to consider a workplace created at home as a separate unit, and, accordingly, the employer does not need to register with the Federal Tax Service in the region of its location. This logic is present in the letter of the Ministry of Finance of Russia dated May 24, 2006 No. 03-02-07/1-129.

But later documents of the same department (letters dated December 15, 2016 No. 03-02-07/1/75061, dated December 16, 2011 No. 03-04-06/3-346) recommend that the employer act in such a situation in accordance with the rule contained in clause 9 art. 83 Tax Code of the Russian Federation. This rule reserves the right of the Federal Tax Service to make a decision on the place of registration on the basis of documents submitted to the tax authority if the taxpayer has difficulties in determining this place. So the question of whether an employer needs to register with the Federal Tax Service to which the homeworker’s place of work belongs can be considered open.

Homeworkers are a special category of workers

Working from home during an economic crisis can be a lifeline for many organizations. Employers note that the crisis has hit the company’s finances hard and they are forced to save on everything, including renting premises and purchasing new equipment. A workplace equipped at the employee’s home can solve this problem. And for the employee himself, such an organization of his work can be very convenient. So what is work from home? How to formalize labor relations? What should be in an employment contract? How to terminate an employment relationship with a home worker? REGULATION OF HOME WORK

There are not many legal norms in labor legislation that would regulate the relationship between an employer and a home worker. The main ones are:

- ILO Convention No. 177 “On Home Work” (adopted on June 20, 1996 in Geneva);

- Labor Code of the Russian Federation (Chapter 49);

- Regulations on the working conditions of homeworkers (approved by the Resolution of the State Committee of Labor of the USSR and the Secretariat of the All-Union Central Council of Trade Unions dated September 29, 1981 No. 275/17-99; hereinafter referred to as the Regulations on Homeworkers).

According to Art. 310 of the Labor Code of the Russian Federation, homeworkers are considered to be persons who have entered into an employment contract to perform work at home using materials and using tools and mechanisms provided by the employer or purchased by the homeworker at his own expense.

When reading this definition, you may get the impression that this must be some kind of physical work, but if you analyze the norm of the article, it becomes clear that work can be both physical and mental.

For example, homeworkers can be engaged in sewing garments, assembling any items, producing software products (creating websites, etc.), washing workwear, editing texts, taking orders by phone, etc.

A homeworker can perform the work stipulated by an employment contract with the help of members of his family , while labor relations do not arise between members of the homeworker’s family and the employer.

Homeworkers are subject to labor legislation and other acts containing labor law norms, with the specifics established by the Labor Code of the Russian Federation.

Special requirements limiting home work in Ch. 49 of the Labor Code of the Russian Federation is not contained. Article 311 of the Labor Code of the Russian Federation establishes that work assigned to homeworkers cannot be contraindicated for them due to health reasons and must be performed under conditions that meet labor protection requirements.

Scientific Editor's Note. Compliance with labor safety requirements for homeworkers means not only the need for them to familiarize themselves with local regulations governing labor safety issues, conducting briefings and training in safe work methods, but also certification of home-based workplaces for working conditions, apparently on the basis of clause 41 of the Procedure carrying out certification of workplaces according to working conditions (approved by Order of the Ministry of Health and Social Development of Russia dated April 26, 2011 No. 342n) as non-stationary workplaces.

In accordance with paragraphs. 9 and 12 of the Regulations on Home Workers, the organization of labor processes in home conditions is permitted only for persons who have the necessary living conditions, as well as practical skills or can be trained in these skills to perform certain jobs.

It is prohibited to provide homeworkers with such types of work that create inconvenience for living neighbors (for example, with increased noise levels).

Certain types of home-based work, in accordance with the general rules of fire safety and sanitation, as well as the living conditions of homeworkers, may only be permitted with the permission of local fire and sanitary inspection authorities.

DESIGN FEATURES

The hiring of homeworkers is carried out according to the general rules provided for in Ch. 11 Labor Code of the Russian Federation. Thus, hiring for home work is formalized by an order (instruction) of the employer, issued on the basis of a concluded employment contract (Part 1 of Article 68 of the Labor Code of the Russian Federation). This order (instruction) is one of the mandatory personnel documents, the absence of which in itself is a violation of current legislation, responsibility for which is provided for in Art. 5.27 of the Code of the Russian Federation on Administrative Offences.

In the employment contract, in addition to the conditions established by Art. additional conditions due to the specifics of labor must also be recorded

1) an indication of the free use of tools and mechanisms provided by the employer (the transfer of the necessary funds is carried out on the basis of an act). If the tools for performing work are purchased by the employee at his own expense, the employment contract specifies the amount of compensation for their wear, the procedure and frequency of its payment;

2) a sufficiently detailed procedure and terms for providing the homeworker with raw materials, materials and semi-finished products, payments for manufactured products, reimbursement of the cost of materials belonging to the homeworker, the procedure and terms for the export of finished products;

3) an indication of the procedure for reimbursing the homeworker for other expenses associated with performing work at home (in particular, the cost of electricity, water, gas, telephone communications, and the Internet spent in the production of work).

Special conditions of work and rest for homeworkers have not been established; labor legislation applies to them in full.

It must be taken into account that the homeworker actually sets his own working hours. Since the employer is usually not able to control the employee’s compliance with the work schedule, it is necessary for the homeworker to establish such standards of work (output) that will allow him to exercise his right to rest (daily, weekly, annual).

In cases where, by agreement of the parties, the receipt of raw materials and materials, as well as the delivery of finished products, is carried out by the homeworker himself directly from the employer, the time spent on receipt and delivery is included in working hours (clause 16 of the Regulations on Homeworkers).

WORKPLACE OF A HOMEWORKER

Let's return to the issue of the homeworker's workplace now from the point of view of tax legislation.

Some employers may have a question: if an organization enters into an employment contract with an employee who works from home, does this result in an obligation for the organization to register with the tax authority?

In accordance with the Tax Code of the Russian Federation, a separate division of an organization is any territorially separate division from it, at the location of which stationary workplaces .

The very concept of a workplace is absent in the tax legislation of the Russian Federation. Clause 1 of Art. 11 of the Tax Code of the Russian Federation establishes that for tax purposes, institutions, concepts and terms of civil, family and other branches of legislation of the Russian Federation are applied in the meaning in which they are used in these branches of legislation, unless otherwise provided in the Tax Code of the Russian Federation.

In accordance with Part 6 of Art. 209 of the Labor Code of the Russian Federation, a workplace is a place where an employee must be or where he needs to arrive in connection with his work and which is directly or indirectly under the control of the employer.

Considering that the organization does not create a stationary workplace for the performance of labor functions by a homeworker and the employer cannot control him either directly or indirectly, the organization (employer) does not have an obligation to register with the tax authority at the place where such employee performs labor functions [*].

SALARY

According to Art. 135 of the Labor Code of the Russian Federation, an employee’s wages are established by an employment contract in accordance with the current remuneration systems of a given employer. The minimum wage cannot be lower than the minimum wage established by federal law.

The terms of remuneration determined by the employment contract cannot be worsened in comparison with those established by labor legislation and other regulatory legal acts containing labor law norms, collective agreements, agreements, and local regulations.

Homeworkers, like other employees, are fully covered by the bonus system established by the employer. According to Part 2 of Art. 132 of the Labor Code of the Russian Federation prohibits any kind of discrimination when establishing and changing wage conditions.

Note! The rules governing remuneration for overtime work, work on weekends and holidays, and night time do not apply to homeworkers. Considering that homeworkers distribute working time at their own discretion, all work performed by them is paid in a single amount.

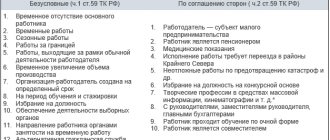

TERMINATION OF AN EMPLOYMENT CONTRACT

Article 312 of the Labor Code of the Russian Federation establishes that termination of an employment contract with a home worker is carried out on the grounds provided for in the employment contract .

However, if we proceed from this wording, then if there is no indication in the employment contract on the general grounds for dismissal, it turns out that the employee does not have the right to terminate the employment relationship, for example, on his own initiative. Or the employer will not be able to fire the employee due to the liquidation of the organization or reduction in staff. Naturally, this cannot be, and the wording of Art. 312 of the Labor Code of the Russian Federation, in our opinion, is incomplete. We believe that the legislator with this provision wanted to give the parties to the employment contract additional grounds for terminating their relationship.

We believe that parties to an employment relationship should be guided by general rules and make reference to them in the employment contract.

Let us note that not all the grounds provided for by the current labor legislation for terminating an employment contract can be applied to the category of workers we are considering. For example, a home worker cannot be fired for absenteeism.

You can ask the author of the article your questions on the website www.uristion.ru

[*] Letter of the Ministry of Finance of Russia dated May 24, 2006 No. 03-02-07/1-129.

Responsibilities of the employer related to the presence of persons working from home

In relations with a homeworker, Ch. 49 of the Labor Code of the Russian Federation requires the employer to comply with:

- all norms of labor legislation established by the Labor Code of the Russian Federation and other labor acts (Article 310);

- rules on the impossibility of assigning an employee work that is not suitable for him due to health reasons (Article 311);

- obligations to pay compensation for the costs of performing work carried out by the employee at his own expense (Article 310);

- procedures for monitoring compliance with labor protection requirements when performing work (Article 311).

Thus, an employer hiring a homeworker must:

- conclude an employment contract with him;

- familiarize the employee with all internal regulations that are significant to him;

- check the conditions under which the work will be carried out;

- provide the workplace with labor tools in accordance with safety requirements or monitor this process;

- conduct the necessary introductory training and repeat it periodically;

- provide the employee with personal protective equipment;

- establish a work standard that will allow the employee to maintain the required ratio of working time and rest time;

- ensure the timely provision of materials of the required quality necessary to perform the work, if such an obligation is assigned to the employer;

- make timely payment of wages;

- conduct an accident investigation if one occurs.

Read more about the responsibilities of the employer in the material “Art. 22 of the Labor Code of the Russian Federation: questions and answers.”

Home working conditions

In order to conclude an employment contract with a homeworker, the employer must adhere to certain criteria for organizing work in terms of worker safety, as well as taking into account the employee’s health status.

The employee’s labor function must comply with the recommendations of a medical and social examination and the medical conclusion of a medical commission.

A homeworker has every right to refuse to perform work that is contraindicated for him due to health reasons. Thus, in order to determine contraindications for performing specific types of work, homeworkers must undergo periodic medical examinations.

The work assigned to disabled people must comply with the individual rehabilitation program for the disabled person.

The employer is obliged to provide safe working conditions in accordance with labor protection requirements, that is, the use of personal protective equipment for the employee, compliance with the work and rest regime, etc.

In addition, the employer is obliged to monitor the state of working conditions and workplaces, which means he has the right to visit the homeworker’s place of residence for the purpose of conducting checks on the correct use of protective equipment by employees, technological processes and other working conditions.

The home worker has no right to interfere with the inspection of his home, which is carried out in order to monitor compliance with fire safety requirements.

After concluding an employment contract, before starting work with a homeworker, it is mandatory to conduct initial training on labor protection. The employer is required to conduct such briefings at least once every six months.

The working conditions of homeworkers should establish such requirements for work that do not create inconvenience for living neighbors. That is, the work should not be with increased levels of noise, vibration, or pollution.

Features of the work schedule and remuneration of a homeworker

Despite the extension of labor legislation to relationships with homeworkers, not all of these standards can be met for objective reasons due to the specifics of working conditions at home. This specificity leads to the fact that:

- the employee independently distributes his working time without adhering to the internal labor regulations established by the employer;

- the employee has the right to do the work (or part of it) not himself;

- the employer cannot control the labor process and keep a time sheet;

- the employee is deprived of the opportunity to receive additional payments for work beyond the normal working hours.

The listed features predetermine the preference for establishing remuneration for homeworkers at rates (tariffs), which involves paying a specified amount for performing work of a certain complexity, done in a certain volume over a certain period of time (i.e., piecework).

In this case, the total salary can, like that of an ordinary employee, consist of 3 components:

- payments for the work itself, assessed according to tariffs;

- additional payments for working conditions;

- bonuses paid in accordance with the employer’s regulatory act on bonuses.

ConsultantPlus experts explained what guarantees and compensations a homeworker is entitled to. Get free demo access to K+ and go to the Ready-made solution to find out all the details of calculating such payments.

Of the additional payments for working conditions carried out in residential premises and, accordingly, characterized by the absence of most harmful and dangerous influences, most often we are talking about the regional coefficient, which is valid in a certain area. The application of such a coefficient to the remuneration of a home-based worker, if his work is carried out in the corresponding region, is mandatory even if the employer himself (or his division) does not work in such a region (letter of the Ministry of Finance of Russia dated December 15, 2016 No. 03-02-07 /1/75061).

Working conditions for homeworkers

Work assigned to homeworkers must be performed under conditions that meet labor safety requirements.

Important! If the work performed requires the availability of personal protective equipment, the employer is obliged to provide employees with them in order to prevent occupational diseases.

Homeworkers can perform the required work only if they have the necessary housing conditions for this. In addition, the production of certain types of products may create inconvenience for the neighbors of the homeworker. For some work, you will need to obtain permission from the fire and sanitary inspectorate.

The employer’s responsibilities also include familiarizing homeworkers with local company documents regulating the process of labor protection, as well as training workers in safe working methods, including conducting briefings and certification of the homeworker’s workplace (Order of the Ministry of Health No. 342n).

Rights retained by a homeworker

But a homeworker can take full advantage of the rights provided by labor legislation. And among them, in particular, the opportunity to receive:

- annual paid leave;

- paid study leave;

- additional leave, provided, for example, to those working in the Far North;

- additional days of rest (for example, for donation);

- paid sick leave;

- children's benefits (letter from the Federal Social Insurance Fund of the Russian Federation dated August 10, 2010 No. 02-02-01/08-4003).

With regard to the taxation of accrued income, an employee working at home has the right to calculate:

- to receive all types of deductions provided at the place of work;

- for exemption from personal income tax on compensation paid for the use of personal property in work (clause 3 of Article 217 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated December 23, 2009 No. 03-04-07-01/387).

To exempt compensation payments from tax, the employee will have to document (letter of the Ministry of Finance of Russia dated December 31, 2004 No. 03-03-01-04/1/194):

- right of ownership of the relevant property;

- the fact of its use in work assigned by the employer;

- the amount of amounts to be compensated, including expenses that must be divided into those related to work and those intended for personal needs.

Read more about income not subject to personal income tax in the article “Art. 217 of the Tax Code of the Russian Federation: questions and answers.”

Working conditions under an employment contract with a home worker

According to Article 188 of the Labor Code of the Russian Federation, when a homeworker uses personal property with the consent or knowledge of the employer and in his interests, the homeworker is paid compensation for the use, wear and tear (depreciation) of tools, personal transport, equipment and other technical means and materials belonging to the homeworker, and is also reimbursed costs associated with their use. The amount of reimbursement of expenses is determined by agreement of the parties to the employment contract with the homeworker, expressed in writing.

The procedure and terms for providing homeworkers with raw materials, materials and semi-finished products, payments for manufactured products, reimbursement of the cost of materials belonging to homeworkers, the procedure and terms for the export of finished products are determined by the employment contract.

Homeworker and business travel

An employee working from home can, like any regular employee, be sent on a business trip by the employer. And the rules that are valid for a regular business trip will also be followed for this trip. The peculiarities will be reflected in the fact that a homeworker’s business trip will become possible (letters from the Ministry of Finance of Russia dated 03/20/2012 No. 03-03-06/1/135, dated 07/05/2011 No. 03-03-06/1/394, dated 06/02/2011 No. 03 -03-06/1/322):

- from the employee’s place of residence with return there;

- to the employer’s location and back.

Home and teleworkers

Homeworkers are understood as workers with whom they enter into an employment contract to perform work at home, using materials and tools from the employer, or purchased by the homeworker independently (Article 310 of the Labor Code of the Russian Federation).

Several years ago, a new concept appeared in labor legislation - remote worker. Remote workers are understood as workers who perform their work duties outside a specific workplace, being under the direct or indirect control of the employer, and their work activities take place using the Internet (Article 312.1 of the Labor Code of the Russian Federation).

These two concepts have virtually no differences between themselves; homeworkers can also use the Internet in their work. The division is carried out depending on the final result of labor, for example, homeworkers create some kind of material result (sewing products, parts, etc.). The result of remote work does not have a material result (programmer, designer, etc.).

Thus, the work performed by home workers includes:

- Sewing garments;

- Repair, cleaning, washing and sewing of workwear;

- Providing information online or by telephone;

- Manufacturing of consumer goods.

Important! The main difference between a home worker and a remote worker is the end result of their work. The work of a homeworker is aimed at obtaining a material result, but the work of a remote worker is not aimed at obtaining a material result.

Like any other employee, a homeworker has the right to annual paid leave (28 days), maternity or sickness benefits, etc. (

Features of dismissal of an employee working from home

With regard to dismissal for a home worker, all the usual grounds provided for by labor legislation are valid (Article 310 of the Labor Code of the Russian Federation). But additions to them are also possible, which should be included in the employment contract (Article 312 of the Labor Code of the Russian Federation). These may include the following:

- transferring the place of work to a place located at a different address;

- a one-time failure to deliver the agreed amount of work within the period established by the contract in the absence of a valid reason for this.

Dismissal on the grounds included in the employment agreement may be carried out by notification. But the employer will have to independently collect evidence confirming the occurrence of grounds for dismissal, and this can be quite difficult due to the impossibility of exercising real control over the homeworker’s place of work and his working hours.

Due to the lack of such control, in reality it causes difficulties and dismissal for a number of usual reasons. For example, it is impossible to fire a homeworker for violations of labor discipline such as absenteeism, tardiness, or showing up at work while intoxicated.

Just like regular workers, homeworkers are subject to rules prohibiting:

- establishment in the contract of grounds for dismissal of a discriminatory nature;

- dismissal during illness, sick leave and vacation;

- dismissal of pregnant women, women with young children and single parents.

All procedures related to dismissal in relation to a home worker are carried out as usual. When indicating the grounds for dismissal in the order, work book and personal card, there may be a reference to Art. 312 of the Labor Code of the Russian Federation, if the employment contract is terminated on the grounds provided for in its text.

Samples of drawing up personnel documents when terminating an employment contract with a home worker are available in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

For information on how to draw up a dismissal order, read the material “Drawing up a dismissal order (form, form, sample).”

Where and when is it issued?

The employer should remember that hiring a homeworker should be in accordance with Chapter 10 of the Labor Code. Employment is formalized by an appropriate order or decree. The absence of this document is a serious violation. The signing of the contract can take place either at the employer’s office or at the employee’s home. An employment contract for a home worker, preparation of documentation and a sample of a standard document for review is the task of a personnel employee.

Any citizen can become a homeworker, but preferential categories of citizens have a preferential right to such working conditions:

- disabled people and people of retirement age;

- mothers on maternity leave and leave to care for minor children;

- employees who have dependent seriously ill relatives who require constant care.

The employer can terminate such an agreement only on the grounds provided for in the agreement.

Results

The work of a homeworker is subject to the requirements of labor law, in which the Labor Code of the Russian Federation plays the main role.

However, due to the specific nature of such work, the provisions of the Labor Code of the Russian Federation are applied taking into account a number of features - both those specified in a special chapter of this code, and those arising from the objective impossibility of applying certain provisions of the law. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.