When the need for adjustment arises

There are quite a lot of situations in which it is necessary to adjust amounts after delivery in business practice. Here are some of them:

- Errors in shipping documents.

- Claims from the buyer about an inadequate range of goods, claims about the quality of the goods.

- Re-grading and, as a consequence, recalculation of the price and quantity of goods.

- Bonuses that reduce the price.

- Additional agreement concluded to an existing agreement, etc.

How to fill out an adjustment invoice when the cost of delivery is reduced ?

Situations in which an accountant has to adjust the implementation of a previous period can arise in any area of business, especially when it comes to large companies operating in several areas and types of activities; about large shipment volumes.

If changes occur within 5 days from the date of initial shipment, no special problems arise. For example, for tax accounting purposes, it is enough to issue a new invoice that takes into account the changes (Article 168 of the Tax Code of the Russian Federation, paragraph 3). However, this is not always the case. Let's consider situations of adjusting the implementation of the past period in one direction or another using examples.

How to take into account sales adjustments when prices change ?

How to reflect last year's losses in the income statement for the 1st quarter of the current period?

Appendix 4, which complements Sheet 02, displays losses from previous years. Using the instructions described above, open the declaration and find Appendix 4. In it you must enter the following information:

- In line 040, enter the amount of loss for previous periods (including for the year in which the loss was incurred);

- In line 150, enter the amount of loss by which you plan to reduce the tax base. This figure should not be more than 50% of the tax base for the 1st quarter, reflected in line 140.

In Appendix 4, fill in line 160 - the balance of the uncarried loss at the end of the tax period.

The loss entered in line 150 will be reflected automatically in line 110, located on sheet 02. The tax base for the 1st quarter will be reduced by it.

Appendix 4 to the profit declaration does not need to be submitted for six months and 9 months. Enter the loss indicators for these periods manually in line 110 of sheet 02 of the declaration. The stages of opening a declaration in the program have already been described above. In normal mode, income tax is calculated automatically in 1C.

Increase

Suppose that in the current period an error was identified in the mutual settlements of the previous period of Alpha LLC, after which Beta LLC transferred an additional amount to the company for the goods. The difference in sales volume was 12,000 rubles, including VAT. 12000 / 1.20 = 10000 rub. 12000 - 10000 = 2000 rub.

How is the VAT tax base adjusted when the sales price changes ?

Alfa LLC postings:

- Dt 62 Kt 90-1 12000 rub. — additional accrual of revenue (including VAT).

- Dt 51 Kt 62 12000 rub. — receipt of funds from Beta LLC.

- Dt 90-3 Kt 68 2000 rub. — the additional amount of VAT to the budget is reflected.

- Dt 68 Kt 51 2000 rub. — an additional amount of VAT is transferred to the budget.

On a note! According to the instructions for using the chart of accounts (pr. No. 94n dated October 31, 2000 of the Ministry of Finance) and depending on the features of the working chart of accounts approved by the accounting policy, accounts 91 (instead of 90-1), 76 (instead of 62) can be used in transactions, respectively , 60).

How to check the balance of uncarried loss at the end of the year?

In Appendix 4, line 160 indicates the balance of the untransferred loss at the end of the period. It is filled out exclusively for the year. In 1C 8.3, this line automatically reflects the difference between the two lines from Appendix 4 in addition to sheet 02 of the profit declaration - between lines 010 and 150. To ensure the accuracy of the calculations, it is better to additionally double-check the correctness of the amount received in the annual declaration on line 160 . In the example shown, the loss of previous years is written off to reduce the tax base for the year in full, therefore there is no balance.

When transferring a loss, it is important to remember that tax laws provide restrictions on this transaction. For example, it is not allowed to carry forward losses incurred when using a 0 income tax rate. You cannot carry forward these losses to the next year and reduce the tax base in the current period. In a situation where two tax rates are applied simultaneously (0 and 20%), then only the amount of loss received within the scope of activities taxed at a rate of 20% is transferred to the next year. There are restrictions relating to individual transactions that are carried out by the organization. For example, it is prohibited to carry forward losses from the activities of an investment partnership and the disposal of a certain type of securities to the next year.

You can purchase services that help you work as an accountant here.

Do you want to install, configure, modify or update 1C? Leave a request!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Decrease

Let us now assume that in March Beta LLC signed a certificate of completion of work with Pixel LLC in the amount of 24,000 rubles, including VAT, for installation and configuration of new software. In April, the installed software experienced malfunctions. The examination identified a fatal software defect. Pixel LLC fully agreed with the claim received from the counterparty and in February returned the money to Beta LLC. This transaction is reflected in the accounts of both companies. 24000 / 1.2 = 20000 rub. 24000-20000 = 4000 rub.

Pixel LLC (service provider)

March:

- Dt 62 Kt 90-1 24,000 rub. – revenue accrued (including VAT).

- Dt 90-3 Kt 68 4000 rub. – VAT has been charged.

- Dt 51 Kt 62 24,000 rub. – payment from Beta LLC according to the work completion certificate.

April (1st quarter data adjustment):

- Dt 91-2 Kt 62 20,000 rub. – loss, decrease in sales.

- Dt 68 Kt 62 4000 rub. – VAT reduction.

- Dt 62 Kt 51 24000 – return of previously transferred funds to Beta LLC.

In this case, it is also possible to post Dt 91-2 Kt 62 RUB 24,000. – the decrease is reflected together with VAT, Dt 68 Kt 91-1 4000 rub. – VAT is allocated on this amount, a tax deduction based on the adjustment invoice. However, the instructions for the chart of accounts do not indicate the connection of 91 accounts with VAT. At the same time, the accounting meaning of accounts 90 and 91 is certainly similar.

Beta LLC

March:

- Dt 20, 26 Kt 60 20,000 rub. – the cost of installing the software is included in the price.

- Dt 19 Kt 60 4000 rub.

- Dt 68 Kt 19 4000 rub. – VAT has been taken into account and accepted for deduction.

- Dt 60 Kt 51 RUB 24,000 – payment for the work of Pixel LLC.

April:

- Dt 76/2 (since there was a claim) Kt 91/1 20,000 rub. – other income is recorded.

- Dt 76/2 Kt 68 4000 rub. – VAT restoration for settlements with Pixel LLC.

- Dt 51 Kt 76/2 24,000 rub. – refund from Pixel LLC.

Significance of errors

All situations where corrections are made concern only significant errors. If an accountant finds a minor blemish or inaccuracy, then, regardless of the period of discovery, corrective entries are made for the current period. That is, the previous reporting period is not affected and new corrective financial reports are not compiled.

Therefore, is it possible to submit an adjustment to the annual financial statements if there is a minor blot? No you can not. Corrections are made only for significant errors.

PBU 22/2010 states that an error is considered significant if, individually or in combination with other errors for the same reporting period, it can affect the economic decisions of users made on the basis of the financial statements prepared for this reporting period. The significance of the error is determined by the organization independently, taking into account its magnitude and the nature of the relevant article (articles) of the financial statements.

The procedure for determining materiality is fixed in the accounting policy:

“An error is considered significant if its value distorts the indicator of any line of the report by more than 10%.”

To make adjustments to accounting data, a retrospective recalculation method is used. In other words, all financial statements indicators are subject to recalculation under the condition as if the identified error had never been committed. Entities maintaining simplified accounting have the right not to use the retrospective method of recalculation.

Nuances of tax accounting

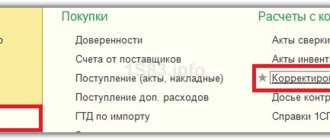

An invoice from the seller to reduce the cost of shipment, VAT for deduction is registered in the purchase book. This can be done no earlier than the buyer’s consent to the reduction has been received, and no later than 3 years from the date of registration of the adjustment invoice (Articles 171-13, 172-10 of the Tax Code of the Russian Federation).

If sales increased, the adjustment document is entered into the sales book in the same quarter in which it was drawn up (Article 154-10 of the Tax Code of the Russian Federation).

For income tax, when the sales volume changes, and therefore the tax base, an adjustment declaration is submitted. The information must be reflected in the period of initial recording of the business transaction. This is stated in a number of letters from the Ministry of Finance (for example, No. 03-03-06/1/44103 dated 12/07/17).

As implementation increases, this rule always works. If an adjustment has occurred downwards, it is possible to reflect this in the adjustment period, with one condition: in the period of initial shipment, income tax is calculated for payment. During the period of initial shipment there was a loss (or zero income) - which means an adjustment declaration is submitted (Article 54-1 of the Tax Code of the Russian Federation).

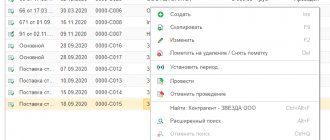

Correcting errors of previous years in “1C: Accounting 8”

1C experts tell how users can correct their own mistakes of past years made in accounting and tax accounting for income taxes.

To simplify income tax accounting, the 1C:Accounting 8 version 3.0 program implements the following mechanism for correcting errors of previous years related to the reflection of the receipt of goods (work, services). If errors (distortions):

- led to an underestimation of the amount of tax payable, then changes to the tax accounting data are made for the previous tax period;

- did not lead to an underestimation of the amount of tax payable, then changes to the tax accounting data are made in the current tax period.

If the taxpayer still wants to exercise his right and submit to the tax authority an updated income tax return for the previous period (in the case where errors (distortions) did not lead to an understatement of the tax amount), then the user will have to adjust the tax accounting data manually.

Example 1

A technical error made in the accounting of New Interior LLC and described in Example 1 was discovered after submitting the income tax return for 2015 and after signing the financial statements for 2015.

The organization makes the necessary changes to the accounting and tax records and submits updated tax returns to the tax authority: for VAT - for the third quarter of 2015; To correct errors in overestimating costs of the previous tax period, the document Adjustment of receipts with the operation type Correction in primary documents is also used. The difference is that the date of the foundation document and the date of the adjustment document refer to different years: in the field from the Receipt Adjustment document we indicate the date: 02/29/2016. After this, the document form Adjustment of receipts on the Main tab is modified: in the details area Reflection of income and expenses, the Item of other income and expenses field appears instead of the switches:. In this field you need to indicate the desired item - Profit (loss of previous years), selecting it from the directory Other income and expenses.

Please note that if the accounting system for the organization New Interior LLC has set a prohibition date for changing the data of the “closed” period (i.e., the period for which reporting is submitted to the regulatory authorities - for example, 12/31/2015), when trying to post a document on The screen will display a message stating that it is impossible to change data during the prohibited period. This happens because the document Adjustment of receipts in the described situation makes changes to tax accounting data (for income tax) for the previous tax period (for September 2015). In order to post the Receipt Adjustment document, the date of prohibition of data changes will have to be temporarily removed.

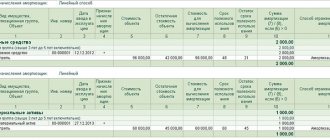

After posting the Receipt Adjustment document, accounting entries and records will be generated in special resources for tax accounting purposes for income tax (Fig. 1).

Rice. 1. Result of conducting the “Receipt Adjustment” document

In addition to entries in the accounting register, corrective entries are made in the accumulation registers of VAT presented and VAT purchases. All entries related to the VAT adjustment for the third quarter do not differ from the entries in Example 1 in the article “Correcting a reporting year error in 1C: Accounting 8”

, since in terms of VAT in this example the procedure for correction is no different. Let's take a closer look at how errors of previous years are corrected in accounting and tax accounting for income taxes.

According to paragraph 14 of PBU 22/2010, the profit resulting from a decrease in the inflated cost of rent in the amount of 30,000 rubles is reflected in accounting as part of other income of the current period (corrected by an entry in the credit of account 91.01 “Other income” in February 2016).

In tax accounting, in accordance with paragraph 1 of Article 54 of the Tax Code of the Russian Federation, the inflated cost of rent should increase the tax base for the period in which the specified error (distortion) was made. Therefore, the amount is 30,000 rubles. reflected in sales income and forms the financial result with records dated September 2015.

To account for the result of adjusting settlements with counterparties (if such an adjustment is made after the end of the reporting period), the program uses account 76.K “Adjustment of settlements of the previous period.” Account 76.K reflects the debt for settlements with counterparties, starting from the date of the transaction that is subject to adjustment, to the date of the correcting transaction (in our example, from September 2015 to February 2016).

Please note that the entry Amount NU DT 76.K Amount NU CT 90.01.1

- this is a conditional entry that serves only to adjust the tax base towards an increase and correct calculation of income tax.

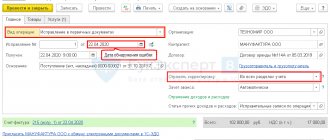

In our example, the tax base increased not due to an increase in sales revenue, but due to a decrease in indirect costs. Income and expenses in the updated declaration must be reflected correctly, so the user can choose one of the following options:

- manually adjust the indicators in Appendix No. 1 and Appendix No. 2 to Sheet 02 of the updated profit declaration for 9 months and for 2015 (reduce sales revenue and at the same time reduce indirect costs by 30,000 rubles);

- manually adjust the correspondence of accounts for tax accounting purposes as shown in Figure 2.

Rice. 2. Wiring adjustments

Since after the changes were made, the financial result for 2015 in tax accounting has changed, in December 2015 you need to re-perform the routine operation Balance sheet reformation, which is part of the Month Closing processing.

Now, when automatically filling out reports, the corrected tax accounting data will appear both in the updated income tax return for 9 months of 2015 and in the updated corporate income tax return for 2015.

At the same time, the user inevitably has questions that are directly related to accounting:

- How to adjust the balance of settlements with the budget for income tax, which will change after additional payment of the tax amount?

- Why, after adjusting the last period, is the key relationship BU = NU + PR + BP not fulfilled?

To additionally charge income tax from an increase in the tax base that occurred as a result of corrections made to tax accounting, during the period when the error was discovered (February 2016), you need to enter an accounting entry into the program using a manual Transaction:

Debit 99.02.1 Credit 68.04 .2

- in the amount of 6,000 rubles.

At the same time, it is necessary to distribute the tax payable according to budget levels:

Debit 68.04.2 Credit 68.04.1 with the second subaccount Federal Budget

- in the amount of 600 rubles;

Debit 68.04.2 Credit 68.04.1 with the second subaccount Regional budget

- in the amount of 5,400 rubles.

As for the equality BU = NU + PR + BP, indeed, after adjusting the previous period, it does not hold.

The report Analysis of the state of tax accounting for income tax (section Reports) for 2015 will also illustrate that the rule Valuation based on accounting data = Valuation based on tax accounting data + Permanent and temporary differences is not carried out for the Tax and Income sections. This situation arises due to discrepancies in the legislation on accounting and tax accounting and in this case is not an error. According to paragraph 1 of Article 81 of the Tax Code of the Russian Federation, the correction of an error that led to an understatement of the tax base must be reflected in the period of reflection of the original transaction, and in accounting, the correction of an error from previous years is made in the current period. Permanent and temporary differences are concepts related to accounting (“Regulations on accounting “Accounting for calculations of corporate income tax” PBU 18/02”, approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n). There is no reason to recognize differences in the previous period before making a corrective accounting entry.

After the correction of the error is reflected in the accounting records during the discovery period, the financial result for 2016, calculated according to accounting and tax accounting data, will differ by the amount of correction of the error - the profit in accounting will be greater. Therefore, as a result of posting the Receipt Adjustment document, a permanent difference is formed in the amount of the corrected error (see Fig. 3). After completing the regulatory operation Calculation of income tax in February 2016, a permanent tax asset (PTA) will be recognized.

Source: https://www.buh.ru

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up