In what cases does the right to compensation arise?

In the “pilot” regions where the “Direct Payments” project operates, the FSS makes all payments directly to insured individuals. Accordingly, the employer does not bear any additional costs. Therefore, the right to reimbursement of expenses from the Social Insurance Fund does not arise in this case.

In the constituent entities of the Russian Federation, where the credit system is still in effect, benefits are paid to employees by the employer (with the exception of sick leave issued in 2022 to employees over 65 years of age due to quarantine during the self-isolation period). The employer pays for the first 3 days of temporary disability from his own funds. Expenses incurred for the remaining period are taken into account when calculating social insurance contributions (Part 2, Article 4.6 of Law No. 255-FZ dated December 29, 2006, Clause 2, Article 431 of the Tax Code of the Russian Federation). If the amount of expenses exceeds the accrual, the employer has an overpayment, which can be:

- apply to future insurance premium payments;

- reimburse from the budget.

The Federal Tax Service is responsible for offsetting the overpayment for the following periods. To request a refund, you must contact the FSS branch at the place of registration of the policyholder.

How to submit an application for reimbursement of expenses for the Social Insurance Fund in 2022

There are no particular difficulties in filling out the form. In the header of the application, the company indicates the name of the department of the Social Insurance Fund and the name of the head of the department. In the main text you must put:

- registration number of the organization or individual entrepreneur;

- subordination code;

- INN and checkpoint of the company.

Next, enter the amount that the policyholder wants to return - that is, the difference that arose due to the excess of expenses over accruals. Below are the bank account details to which the Fund will transfer funds if the decision is positive.

The application is signed by the head and chief accountant of the company. The contact telephone numbers of officials and the date of completion are indicated. If there is a seal, the application is certified by its imprint.

The representative of the policyholder, in addition to the signature and transcript of the surname, enters in specially designated lines the details of documents confirming identity (for example, passports) and powers (usually a power of attorney).

If the policyholder decides to apply for compensation, reimbursement of expenses to the Social Insurance Fund can be found at the end of this article.

Documents for reimbursement of FSS expenses

Until December 31, 2016, data on accrued contributions for illness and maternity and expenses incurred were indicated in Form No. 4-FSS. Since 2022, the administration of contributions, with the exception of payments for “injuries,” has been transferred to the tax authorities, so these indicators began to be reflected in the DAM - “Calculation of Insurance Premiums,” which the policyholder is required to submit to the Federal Tax Service on a quarterly basis. The application form for reimbursement of expenses from the Social Insurance Fund in 2022 will depend on the moment the expenses arise:

- until 12/31/2016 – it is necessary to use form No. 23-FSS (approved by Order of the FSS of the Russian Federation dated 11/17/2016 No. 457, Appendix No. 3);

- after 01/01/2017 - an application is filled out according to the form from the FSS letter dated 12/07/2016 No. 02-09-11/04-03-27029.

Along with the application, the employer submits supporting documents to the Social Insurance Fund.

What documents are attached to the application?

To reimburse the costs of paying benefits from the Social Insurance Fund, the employer attaches to the application documents, the list of which is given in Order of the Ministry of Health and Social Development of Russia dated December 4, 2009 No. 951n (as amended on October 28, 2016). What you need to prepare:

- breakdown of expenses and a calculation certificate in the form from appendices 1 and 2 to the letter of the Social Insurance Fund No. 02-09-11/04-03-27029, if expenses were incurred after December 31, 2016;

- copies of documents on the basis of which benefits were assigned.

The full composition of the applications depends on the type of benefit. For example, when reimbursing expenses for sick leave, the Social Insurance Fund requires copies of:

- certificate of incapacity for work;

- work book or other documents confirming work experience;

- certificates in form No. 182n, if income from other employers was taken into account when calculating.

At the birth of a child:

- certificate from the registry office;

- a copy of the birth certificate;

- certificate of non-receipt of payment by the second parent.

The Fund’s specialists may also request other documents confirming the employee’s employment. Most often requested:

- a copy of the employment contract;

- report cards;

- staffing schedule;

- payslips;

- payment documents for the employee to receive funds;

Also, some branches of the Social Insurance Fund require you to submit a copy of the dismissal order if the employee has already received a payment, and the company does not have documents on his work experience.

The regional branch of the Foundation may develop its own list. For example, when reimbursing FSS expenses in St. Petersburg, you can be guided by the recommended list posted on the official website of the St. Petersburg regional branch of the Fund.

All copies are certified with the inscription “Copy is correct” indicating the date, signed by the manager or authorized representative. If available, a stamp is placed.

About the application form

Despite the fact that the Federal Tax Service administers contributions, you must contact the territorial office of the Social Insurance Fund for a refund. The composition of the submitted documents was approved by order of the Ministry of Health of the Russian Federation dated December 4, 2009 No. 951n (as amended on October 28, 2016). From 2022, the FSS expense reimbursement form is filled out according to the form from the appendix to the letter of the FSS of Russia dated December 7, 2016 No. 02-09-11/04-03-27029.

The FSS checks the information received with the data from the Federal Tax Service, reflected in the “Calculation of insurance premiums”.

Reimbursement period for FSS expenses

The policyholder can submit an application at any time. The period for consideration of the application by Social Insurance specialists is limited. The Fund is given 10 calendar days to transfer funds from the date of submission of the full set of documents (Part 3, Article 4.6 of Law No. 255-FZ of December 29, 2006). However, the FSS can make a decision faster.

The period may be extended if the Foundation’s specialists decide to conduct a desk or on-site inspection. In these cases, a decision must be made after summing up the results of the inspection (Part 4, Article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ). In this case, the duration of the inspection should not exceed 3 and 2 months, respectively (Part 1, Article 4.7 of the Law of December 29, 2006 No. 255-FZ, Clause 2 of Article 26.15, Clause 9 of Article 26.16 of the Law of July 24, 1998 No. 125-FZ Federal Law).

List of documents for submitting an application to the Social Insurance Fund for sick leave compensation

The necessary documents for the Social Insurance Fund for compensation for sick leave are listed in the order of the Ministry of Health and Social Development dated December 4, 2009 No. 951n. According to this regulatory document, in order to reimburse expenses incurred, the policyholder must submit:

- statement;

- certificate-calculation;

- a copy of the sick leave certificate.

For information on how to correctly fill out a certificate of incapacity for work, read the material “An example of filling out a sick leave certificate by an employer .

The same order establishes mandatory details for document forms. The application must contain:

- details of the policyholder (name for a legal entity or full name for an individual, as well as address);

- registration number in the Social Insurance Fund;

- amount required for reimbursement.

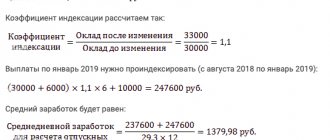

Before the transfer of insurance premiums to the tax authorities for reimbursement of social insurance expenses, the application could be submitted with a report drawn up at the end of the next quarter or an interim (generated for the required number of months of the year) report in Form 4-FSS, which confirmed the overpayment of payments to social insurance at the expense of the expenses. Now the calculation certificate is submitted only at the end of the quarters. It must contain the following information:

- the amount of debt or overpayment to the Social Insurance Fund at the beginning and end of the period;

- accrued contributions from the beginning of the period with breakdown for the previous 3 months;

- additional contributions;

- expenses not accepted for offset;

- amounts received from the Social Insurance Fund as compensation for sick leave expenses, as well as as a refund of overpayments;

- expenses at the expense of the Social Insurance Fund;

- payments to the Social Insurance Fund (with breakdown for the previous 3 months);

- written off debt.

The calculation certificate, which is recommended for use by letter No. 02-09-11/04-03-27029, is very similar to Table 1 of the old Form 4-FSS. The letter also contains a form for decoding expenses, which resembles Table 2 of the previous Form 4-FSS.

Reimbursement of FSS expenses: posting

Organizations must reflect the accrual and reimbursement of social benefits in their accounting records. The following wiring is used for this:

Dt 20 (25, 26, 44, etc.) / Kt 69.01 – insurance premiums are charged;

Dt 69.01 / Kt 70 – the employee received benefits at the expense of the Social Insurance Fund;

Dt 51 / Kt 69.01 - money was received from the Social Insurance Fund to reimburse the missing funds.

Funds received from the Social Insurance Fund are also reflected in the “Calculation of Insurance Premiums” - on page 080 of Appendix No. 2 to Section 1 (clause 10.14 of the Procedure for filling out the DAM, approved by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected ] ).

Attachments to the application

Since since January 1, 2017, reporting on contributions in connection with disability and maternity has been accepted by the Federal Tax Service, the Federal Tax Service does not have the necessary data to verify the accuracy of the information received from the policyholder. Therefore, to confirm expenses incurred after the specified date, you additionally need to fill out and submit to the Fund:

• certificate-calculation;

• breakdown of expenses.

The forms of these documents are given in the appendices to letter No. 02-09-11/04-03-27029.

If expenses were incurred no later than December 31, 2016, an application is submitted in Form 23-FSS.

The certificate indicates the accrual and payment of contributions for the reporting period (on an accrual basis), and displays the amount of debt. In the transcript, the data is duplicated from Appendix 3 to Section 1 “Calculations for Insurance Premiums”: the form contains detailed information about the benefits paid - the number of cases, the number of paid days and the accrued amount of expenses.

In addition, other documents confirming payments must be attached to the application - for example, copies of sick leave, certificates from other employers, etc. It is better to check the exact list with your FSS branch.

Reimbursement of funds for labor protection

In addition to amounts paid for social benefits, you can receive reimbursement from the Social Insurance Fund for labor protection costs.

Funds for preventive measures to reduce injuries and occupational diseases are allocated by the Fund based on the difference between the accrued contributions for “injuries” for the previous calendar year and the amounts used to pay sick leave for accidents and occupational diseases for the same period, but not more than 20% of the total amount contributions for the previous year (in some cases - up to 30%).

Insurance premiums can be used to reimburse expenses for special assessment of working conditions (special assessment of working conditions), training in labor protection, purchasing personal protective equipment for working in hazardous conditions, sanatorium and resort treatment for workers employed in hazardous industries, etc. (the full list is given in paragraph 3 of Order of the Ministry of Labor of Russia dated December 10, 2012 No. 580n).

The policyholder must fill out an application in the form approved.

By Order of the Social Insurance Fund dated May 7, 2019 No. 237, and draw up a Financial Support Plan (from the appendix to Order No. 580n). To receive security for 2022, documents must be sent to the Social Insurance Fund before August 1, 2022. More complete information on the topic can be found in ConsultantPlus. Free trial access to the system for 2 days.

How to return funds from the Social Insurance Fund

Key steps that an employer needs to take to compensate for funds spent on mandatory payments:

- Submitting a package of documents to the Social Insurance Fund office at the place of registration of the enterprise:

- Application indicating the amount for refund for 2022. Important! Filing your claim early increases your chances of receiving a refund.

- A copy of the calculations in accordance with Form 4 of the Federal Tax Service of the Russian Federation.

- Copies of documents justifying and confirming the correctness of payments.

- Waiting for approval from the Social Insurance Fund.

- Receiving funds from the Social Insurance Fund.

- Reflection of the received amount in the reporting.

A very important aspect of refunds is the deadline for submitting documents. Documents for reimbursement of funds from the Social Insurance Fund are submitted until July 31 of the current year, after which the acceptance of documents ends.

It is very important to start preparing a package of documents in advance

(even if your events are scheduled for the end of the year - a medical examination or a special assessment of working conditions) and submit it as early as possible - for example, May-June. This action is due to the possibility of collecting additional documents for the Social Insurance Fund and in this case you will have time to provide them.

Most employers assume that they should accrue benefits only after receiving funds from social insurance. Is their opinion wrong or not?

Payment terms

The periods of payment to employees of various types of benefits on the basis of supporting documents are regulated by federal legislation and are made:

- From the first day of payment of wages in the presence of sick leave.

- Within a ten-day period from the date of filing an application for payment of benefits, if there are documents indicating registration in the early stages of pregnancy, the birth of a child and disability due to pregnancy and childbirth.

- Every month on the day of salary payment if there is a child care application.

- On the day of application based on the application for burial.

These are mandatory payments that are made by the employer regardless of transfers to the Social Insurance Fund. The absence or untimely payment of these benefits entails the accrual of interest in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation on the total amount of benefits for daily delays, which are not reimbursed by the Fund.

Moreover, in accordance with Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation, such negligence may result in penalties and inspections by inspection bodies for the employer.

According to the order of the Ministry of Labor of Russia dated December 10, 2012 No. 580N, the employer has the right to return up to 20% of the amount remaining in the fund.

Documentary details

What are the main documents submitted by the employer to return money from the Social Insurance Fund:

- Application - filled out by the employer in any form and contains the desired refund amount, detailed for each individual type of benefit. Clearly defined expenses are convenient for both social insurance and the policyholder. An application form of a specific form is used if it is applied to the Social Insurance Fund at the place of registration of the enterprise.

- A copy of the calculations in accordance with Form 4 of the Federal Tax Service of the Russian Federation. The refund amount is entered in lines 9 and 10 of Table 1 of the first section. According to Art. 10 FZ-212, the calculation can be made on any day of the month at the time the expenses appear. In the case under consideration, an interim calculation is required in Form 4 of the Federal Tax Service of the Russian Federation, covering the period from the beginning of the year to the current date. To do this, enter the following into the “Reporting period” cell of the intermediate form:

- in the first two windows - tax period code;

- in the second two - the number of the application for reimbursement of the debt amount.

- Copies of documents justifying and confirming the correctness of benefit payments. The clause applies to enterprises receiving benefits that either do not pay contributions or pay them in the minimum amount.

- a register of expenses with details of the accrual of benefits;

- copies of payment slips indicating payment of contributions to the Social Insurance Fund for the period of refund.

Additional Documentation

In addition to basic documents, social insurance may require additional information:

Application forms for offset and compensation of funds

Order of the FSS No. 49 dated February 17, 2015 approved seven forms of applications for offset and reimbursement of funds (from 21-FSS to 27-FSS), each of which is filled out for a specific type of accrual, including:

- act of joint reconciliation of calculations for contributions, fines and penalties in the Social Insurance Fund;

- offset of funds paid in excess to the Fund;

- refund of the amount of excess social security contributions;

- reimbursement of excessively collected fees, fines or penalties;

- act on offset of excess paid amounts of contributions, fines or penalties;

- decision on compensation of excess amounts paid, penalties or fines;

- act on offset of excess collected amounts of contributions.

Results

Before applying to the Social Insurance Fund for reimbursement of expenses for sick leave, you should check with your regional office for the contents of the current application form, as well as the name of the manager. To confirm the correctness of the calculation of benefits, an audit may be scheduled, during which you will have to document all accruals and payments for sick leave or other social expenses.

Sources:

- Tax Code of the Russian Federation

- Law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 N 255-FZ

- Order of the Ministry of Health and Social Development dated December 4, 2009 No. 951n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.