Home • Blog • Blog for entrepreneurs • How to calculate the simplified tax system if you worked at a loss?

Maxim Demesh

November 19, 2021

963

An entrepreneur using the simplified tax system also pays tax when making losses, but it is calculated at the minimum rate. Even if at the end of the year you did not earn anything, this does not relieve you of financial responsibility to the state. Let's figure out how to calculate tax on losses, working in a "simplified" way.

Two types of simplified taxation system: features and differences

When registering the simplified tax system, an entrepreneur is offered a choice of two taxation objects:

- “Income” - tax is calculated at a rate of 6% of all profits;

- “Income minus expenses” - 15% of the amount of “net” income (minus expenses).

In the first case, everything is clear - there is nowhere for the loss to come from. But in the second the situation is ambiguous. If expenses exceed income, the entrepreneur goes into the red. There is no net profit, so you don’t need to pay anything? Unfortunately, it is not. Tax under the simplified tax system for losses is calculated at the minimum rate - 1% of the total amount of “dirty” income received during the tax period. Let's look at examples of how to do this.

What the law says

The Tax Code of the Russian Federation, as well as its norms devoted to simplifications, does not say whether state duty is accepted as expenses under the simplified tax system. At the same time, companies and individual entrepreneurs using the simplified tax system are faced with this mandatory payment everywhere: in court, in the tax service, and in other structures. That is, it can be argued that without paying state duties, activities under the simplified regime are virtually impossible.

However, we can safely conclude that the state duty under the simplified tax system is included in expenses on the basis of subclause. 22 clause 1 art. 346.16 Tax Code of the Russian Federation. This paragraph lists the costs that, in the final calculation, reduce the single tax on the simplified tax system.

This norm mentions only taxes and fees paid in accordance with tax legislation. So is the state duty an expense under the simplified tax system? Definitely - YES!

Issues related to state duty are regulated by Chapter 25.3 of the Tax Code of the Russian Federation. Based on paragraph 1 of Art. 333.16 of the Code, the state duty refers specifically to fees when applying to:

- Government structures.

- Local authorities.

- Other bodies and/or officials who are legally authorized to perform legally significant actions.

There should be no controversy as to whether state duty is taken into account in expenses under the simplified tax system when a document or a duplicate of it is issued to a simplifier for a fee. Yes, this is equated by law to legally significant actions.

As follows from the meaning of sub. 22 clause 1 art. 346.16 of the Tax Code of the Russian Federation, state duty is accepted as expenses under the simplified tax system in any amount upon its transfer to the treasury to the appropriate account.

Another important point: the state duty is taken into account in expenses under the simplified tax system also when calculating the advance payment.

Expenses for a simplifier arise only from the date of its state registration as an individual entrepreneur or legal entity. Therefore, up to this point, the state duty paid for the initial registration is the personal costs of the founder (owner). Therefore, it cannot be taken into account on the simplified tax system.

A simplifier can save a little when installing an advertising structure. The state duty is included in the costs of the simplified tax system if it is transferred for this service, permitted by local authorities. For 2022, its size is 5,000 rubles.

At the same time, the simplifiers have no right to attribute the fee for the right to install and operate an advertising structure as expenses. The Ministry of Finance and the Federal Tax Service believe there, since clause 1 of Art. 346.16 of the Tax Code of the Russian Federation there is no corresponding position (letters dated 09/01/2014 No. 03-11-06/2/43627 and dated 08/06/2014 No. GD-4-3/15322).

Quarterly zero reporting

We will prepare and submit a full set of reports for you for only 1000 ₽.

More details

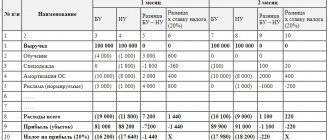

Let's look quarterly at how to pay the simplified tax system for losses:

- 1. In the first quarter, you earned nothing, and expenses amounted to 30,000 rubles. There is a clear loss. At the end of this quarter, you will not have to make an advance payment due to the lack of a tax base.

- 2. In the second quarter, we managed to earn 50,000 rubles. But another 30,000 rubles were spent. We begin to calculate the advance payment: we take income from the beginning of the year (that is, 50,000 rubles) and subtract all expenses for the same period: 30,000 + 30,000 = 60,000 rubles. As a result, we get: 50,000 - 60,000 = - 10,000 rubles. In the red again. No advance payment is required.

- 3. Business development is gaining momentum and in the third quarter we managed to earn 80,000 rubles. And the expenses amounted to 20,000 rubles. We calculate the advance payment. To do this, we first sum up the income received since the beginning of the year and subtract expenses (for the same period). We get: (50,000 + 80,000 – 30,000 – 30,000 – 20,000) = 50,000 rubles. There is a profit, so you will still have to make an advance payment in the third quarter. Multiply the resulting amount by the tax rate: 50,000 x 0.15 = 7,500 rubles.

- 4. In the last (fourth) quarter we managed to earn money again, but only 30,000 rubles. But the expenses amounted to 70,000 rubles. In the red again. We calculate the net income for the year: 50,000 + 80,000 + 30,000 - 30,000 - 30,000 - 20,000 - 70,000 = - 40,000 rubles.

There is no need to make an advance payment for the last quarter. At the end of the year, the final tax calculation occurs. At the end of the tax period, you earned nothing. In case of losses on the simplified tax system, the state provides for the concept of “minimum tax”. You will still have to pay, but at a different (preferential) rate. It is 1% of the total profit received during the year. Expenses in this case are not taken into account. According to the example, the calculation of the simplified tax system for a loss at the minimum rate is as follows: 50,000 + 80,000 + 30,000 = 170,000 * 0.01 = 1,700 rubles. It is this amount that must be paid at the end of the calendar year in favor of the Federal Tax Service.

At the end of the year, 5,800 ₽ (7,500 - 1,700) were overpaid. This difference can be compensated - included in expenses in the next tax period.

Classification of legal expenses

Legal expenses consist of state fees and legal costs associated with the consideration of the case by the arbitration court. This is stated in Article 101 of the Arbitration Procedure Code.

According to Article 106 of the Arbitration Procedure Code of the Russian Federation, these legal costs include:

- amounts of money to be paid to experts, witnesses, translators;

— costs associated with on-site inspection of evidence;

— payment for the services of lawyers and other persons providing legal assistance (representatives);

- other expenses incurred by the parties to the dispute in connection with the consideration of the case in the arbitration court.

Legal costs are not

:

— office and postal expenses;

— costs of organizing and conducting mobile court hearings;

— monetary payments to experts and translators for performing certain actions as part of their official assignment.

Let us consider in detail how to correctly take into account, for profit tax purposes, legal expenses that arise in various situations.

Costs of attorneys' and lawyers' fees

As a rule, a representative of an organization in court is required to have high legal qualifications. Small firms cannot always afford to have such specialists on staff and turn to law firms, legal or audit firms. The cost of services depends on the complexity of the dispute, the cost of the claim and the number of court hearings.

These legal costs are reflected in tax accounting by analogy with state duties, that is, as part of non-operating expenses. However, such expenses should be accepted for profit tax purposes, taking into account the requirements of Article 252 of the Tax Code. Namely: legal costs are taken into account as non-operating expenses in accordance with subparagraph 10 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation, if they are documented, incurred at the time of consideration of the dispute and are economically justified.

The justification of expenses is determined based on a number of circumstances. For example, such as the outcome of the dispute, prevailing prices for lawyers’ services in a particular region, the number of documents, the terms of reference of the representative in the court.

note

: if an organization is represented in court by its full-time employee, then his salary is not accepted as legal expenses. In such a situation, judicial practice proceeds from the fact that the salary of a full-time lawyer is paid regardless of the presence or absence of a legal dispute. For profit tax purposes, such costs will be qualified as labor costs under Article 255 of the Tax Code.

In order for the amounts paid to the in-house lawyer to be taken into account as legal expenses, a civil law agreement must be concluded with him for representation in court. The contract should provide for payment for participation in a specific case. But this will only help if the lawyer’s job description does not include such a duty.

The following situation is also possible: if there is a full-time lawyer, the organization attracts a third-party specialist to participate in the court. In this case, it is necessary to strictly distinguish between the tasks of in-house and outsourced lawyers. Those issues that will be resolved by a third-party lawyer must be clearly stated in the contract. The fact is that it is possible to economically justify payment for the services of a third-party specialist (and, accordingly, accept these expenses for profit tax purposes) only if the services he provided do not duplicate the job responsibilities of an in-house lawyer.

At what point are legal costs for legal services reflected in the tax accounting of an organization?

Let's say a taxpayer accounts for income and expenses on an accrual basis. In this case, the date of inclusion of the specified legal costs in non-operating expenses is the day of presentation of the act on the services rendered by the lawyer in accordance with the terms of the contract concluded with him (regardless of when the court makes its decision). This is indicated by subparagraph 3 of paragraph 7 of Article 272 of the Tax Code of the Russian Federation.

If the organization uses the cash method, then it writes off the corresponding expenses at the time of payment for the cost of services in accordance with the contract (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Expenses for witnesses, experts and translators

Amounts to be paid to witnesses and experts or necessary to pay the costs of an on-site examination shall be paid in advance by the party who made the corresponding request. If such a request was received from both parties, then they contribute the required amounts equally (Article 108 of the Arbitration Procedure Code of the Russian Federation).

When attracting experts and witnesses, the organization must transfer money to pay for their services to the deposit account of the arbitration court. Article 109 of the Arbitration Procedure Code of the Russian Federation determines that amounts of money due to experts and witnesses are paid after they have fulfilled their duties. This means that these amounts can be taken into account as non-operating expenses for tax purposes only after the expert presents an opinion and the witness gives testimony. That is, the moment of recognition of such expenses does not depend on what method the organization uses in tax accounting: accruals or cash.

The court must ensure the participation of an interpreter in cases established by law. Persons participating in the case have the right only to propose candidates for translator to the arbitration court (Clause 2 of Article 57 of the Arbitration Procedure Code of the Russian Federation). Payment for the services of an interpreter invited by the arbitration court to participate in the process, as well as payment of daily allowance and reimbursement of expenses in connection with his appearance in court, are made from the federal budget. This is stated in paragraph 3 of Article 109 of the Arbitration Procedure Code of the Russian Federation.

There is no loss, but the profit is scanty

Let's consider another situation. It happens that losses under the simplified tax system are not recorded, but the profit is very meager. In this case, the state provides a different calculation scheme. If the amount of tax determined according to the tariff for the simplified tax system (15%) turns out to be lower than the amount that is obtained when calculating at the minimum rate, you need to choose the second option. In an example it looks like this.

Let's say your annual income is 500,000 rubles. And the expenses are 200,000 rubles. (for the same period). When calculated according to the usual rules, the tax amount will be:

500,000 - 200,000 = 300,000 * 0.15 = 4,500 rubles.

If you calculate at the minimum rate, you get: 500,000 * 0.01 = 5,000 rubles.

It is not difficult to guess how much you will have to pay. Of course, the one that is higher is 5,000 rubles.

State duty: accounting entries

A state duty is a fee that is collected when applying to government agencies, local governments, other bodies or officials authorized by law to perform legally significant actions (clause 1 of Article 333.16 of the Tax Code of the Russian Federation).

State duty: accounting account

Accounting for state duties is kept on active-passive account 68 “Calculations for taxes and fees” (Order of the Ministry of Finance dated October 31, 2000 No. 94n). When calculating state duty, accounting in accounting means crediting account 68, and payment of the duty is reflected in the debit of account 68. We will describe below which accounts correspond with account 68.

State duty on property value

The procedure for reflecting state duty in accounting depends on what the payment of state duty is associated with and at what stage such payment is made.

If the state duty is paid in connection with the acquisition of property, then it is included in its original cost. However, if the duty is paid after the object has been accepted for accounting (put into operation), and the accounting rules do not provide for a change in the initial cost in such cases, the duty will be applied to expenses for ordinary activities or other expenses, depending on the to what type of activity the payment of this duty applies.

For example, the state duty paid for registering rights to real estate before the commissioning of the object is included in its initial cost (clauses 7, 8 PBU 6/01, Order of the Ministry of Finance dated October 31, 2000 No. 94n):

Debit of account 08 “Investments in non-current assets” - Credit of account 68.

How long can you write off a loss using the simplified tax system?

We found out that a simplifier can carry forward his loss to the next tax periods, taking it into account in expenses. This is possible within the next 10 years. For example, if a loss was incurred in 2020, it can be written off annually until 2030.

If losses are identified in more than one tax period, they are written off in the order in which they were received. This is set out in detail in paragraph. 5 paragraph 7 art. 346.18 Tax Code of the Russian Federation.

The important thing is that the individual entrepreneur or the head of the organization independently decides in what year and amount to take into account the loss. The main thing is not to miss the deadline set by the state. Federal Tax Service experts recommend doing this right away: in the tax period that follows the unprofitable year. The following condition must be met: (Income – Expenses – Loss) * Rate of the simplified tax system >= Income * 1%. In this case, maximum savings will be achieved - the loss will be evenly distributed over tax periods and will not be “lost.”

If the size of the loss allows, then the “=” sign in the specified calculation will provide the maximum effect. It is quite possible that a simplifier who received income in the current year will need to pay a minimum tax. In this case, only the difference between the amount of the minimum and the “standard” tax can be carried forward to the future.

Example

At the end of last year, a loss of 50,000 rubles was received.

In the next tax period, the entrepreneur earned 500,000 rubles. The expense amounted to 100,000 rubles. We calculate net income taking into account the loss for the previous year: 500,000 0 = 350,000 rubles. The tax amount is calculated using the formula: 350,000 * 0.15 = 52,500 rubles. Minimum tax: 500,000 * 0.01 = 5,000 rubles. The amount to be paid is 52,500 rubles. Video: How to pay the simplified tax system for small profits

Is state duty accepted as an expense under the simplified tax system for notary costs?

Separately, it is worth mentioning the costs associated with notarization of documents. Such state duty under the simplified tax system is included in expenses, taking into account certain specifics.

Firstly, the fact that the notary state fee is taken into account in the costs of the simplified tax system is dedicated to a separate paragraph 14 in the above-mentioned list of “simplified” costs. Secondly, in this case it is also important to remember about the maximum tariffs approved by law.

The point here is this. The services provided by a notary can be divided into actions that must be notarized without fail, and those that do not require mandatory notarization. According to the first, both public and private notaries charge state fees at rates in accordance with Article 333.24 of the Tax Code. Other operations are paid according to tariffs in accordance with Article 22.1 of the Law of February 11, 1993 No. 4462-1 “Fundamentals of the legislation of the Russian Federation on notaries.” It is in these amounts that notary state fees for the simplified tax system can be taken into account. If for some reason the notary’s services were more expensive, for example, due to the urgency of the registration, the excess amount cannot be taken into account in the tax base.

In both cases, the reflection of the paid amount in the company’s accounting occurs on the basis of a receipt issued by a notary office.

Conclusion

So, we found out the following:

- the business does not necessarily generate income, but may be unprofitable;

- a loss can only be obtained when using the taxation object “Income minus expenses”;

- The reporting period for the simplified tax system is a quarter, at the end of each advance payments are made;

- tax period is a calendar year, based on its results the final expenditure is made;

- if one or more advance payments in total exceed the minimum tax, a loss is calculated (the difference between the two components);

- the loss can be compensated (included in expenses) in current tax periods (within 10 years).

The conclusion is clear: you need to pay tax under the simplified tax system for losses.

| Expert Director of Development . More than 7 years of experience in the implementation of online cash registers, EGAIS accounting systems and product labeling for retail organizations and catering establishments. Maxim Demesh |

Need help with tax reporting?

Don’t waste time, we will provide a free consultation and help with accounting reporting for an LLC.

Tax rate and other indicators for calculating the simplified tax system “income minus expenses”

The rules for calculating the amounts of advance payments for organizations using the simplified tax system with the object of taxation “income minus expenses” are prescribed in the text of paragraph 4 of Art.

346.21 Tax Code of the Russian Federation. To accurately calculate tax, it is necessary to determine the following indicators:

- the tax base;

- advance payment attributable to the tax base;

- an advance payment due at the end of the reporting period.

The tax base is determined based on the results of the reporting periods: quarter, half year, 9 months. To calculate the tax base (TB), the following formula is used:

NB = Dx – Px,

Where:

Dx - actual income received from the beginning of the year to the end of the billing period (on an accrual basis);

Рх - expenses incurred, determined, like income, on an accrual basis from the beginning of the year to the end of the reporting period.

What expenses can be taken into account when calculating the simplified tax, read the article “List of expenses under the simplified tax system “income minus expenses””.

ATTENTION! Accounting for income and expenses under the simplified tax system is carried out in the book of income and expenses using the cash method, that is, the date of receipt of income (writing off costs) is the date of receipt (expense) of funds to the current account or to the taxpayer’s cash desk (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

The amount of the advance payment (AvPrasch), related to the tax base and calculated from the beginning of the year until the end of the reporting period, is calculated as the product of the tax base (NB) and the tax rate (C). The tax base is determined from the beginning of the year to the end of the reporting period on an accrual basis. This calculation can be represented as a formula:

AvPrasch. = NB × S.

In paragraph 2 of Art. 346.20 of the Tax Code of the Russian Federation determines the tax rate when calculating the simplified tax system - income minus expenses - in the amount of 15%. The legislation of the constituent entities of the Russian Federation may determine and establish other tax rates (Article 346.20 of the Tax Code of the Russian Federation):

- 0% for 2 years for newly registered individual entrepreneurs operating in the field of production, consumer services, social or scientific activities (until 2022);

- up to 3% in Crimea and Sevastopol (in relation to 2017–2021);

- up to 5% in the rest of the Russian Federation.

Differentiated tax rates under the simplified tax system are explained in great detail in the Guide from ConsultantPlus. Get free trial access to K+ and watch the full version of the explanation.

You can find out whether there are differentiated rates in the region by contacting the Federal Tax Service at your place of registration. These rates are not a benefit and do not require documentary confirmation from the Federal Tax Service (letter of the Ministry of Finance dated October 21, 2013 No. 03-11-11/43791).

Note! According to the simplified tax system “income minus expenses”, an increased rate of 20% is applied if the income exceeded 150 million rubles, but did not reach 200 million rubles. or if the number of employees is more than 100 people, but less than 130. Read about how to apply increased rates here .

At the end of the reporting period, an advance payment is made, which can be calculated using the formula:

AvP = AvPrasch – AvPpred.

AvPpre refers to advance payments calculated or payable for previous reporting periods (in the current reporting period). Thus, in accordance with paragraphs. 4, 5 tbsp. 346.21 of the Tax Code of the Russian Federation, the amount of the advance payment is reduced by the amount of advance payments already calculated.