Meaning of the terms gross and net

First, let's define what the words gross and net mean by themselves:

- gross - large, extensive, large, unrefined.

- net is the antonym of the word “gross”, something cleared of unnecessary things.

That is, “gross” and “no” are antonyms: unrefined and refined. In the context of the topic of our article, we are talking about unrefined salary (gross salary) and cleared salary (net salary). What can wages be cleared of? We are talking about taxes and various deductions.

In what situations can you meet the gross salary? Why do you need to know and be able to calculate gross and non-gross salaries? We will answer these questions and tell you in which cases it is important to know what the difference is between no and gross wages.

What is the difference?

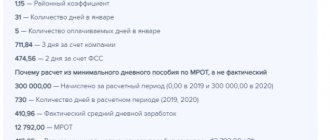

An accountant should know what the difference is between gross and net salaries. Gross payments are calculated according to the timesheet adopted by the enterprise. The actual number of days worked, vacation pay, sick leave, and so on are taken into account.

The last two types of payments depend on length of service and the average official salary.

The accounting employee must perform the appropriate calculations to arrive at the final amount. This will be the gross salary. From gross it is necessary to subtract all due payments; they are made to the following authorities:

- Federal Tax Service - 13% or 30%;

- Pension Fund - 22% (26% of the minimum wage for self-payment);

- FSS — 2,9%;

- FFOMS — 5,1%.

Thus, citizens pay an additional 43% of their salaries to various funds in the form of hidden taxes.

Therefore, many employers try to optimize costs by dividing wages into official and unofficial parts. After all transfers to the state have been made, the employee receives the remaining funds. This will be no salary.

Dear readers! To solve your problem right now, get a free consultation

— contact the on-duty lawyer in the online chat on the right or call:

+7

— Moscow and region.

+7

— St. Petersburg and region.

8

- Other regions of the Russian Federation

You will not need to waste your time and nerves

- an experienced lawyer will take care of solving all your problems!

Salary gross - unrefined

You can often hear about gross salary, that it is a “dirty” salary.

Gross salary is salary before deduction of all taxes and deductions. In this case, we are talking about white wages, reflected in all tax returns and calculations that the employer submits to the regulatory authority.

Sometimes an employee who gets a job does not realize that he is transferring taxes to the budget from his salary. He does not do this himself - according to the rules of the Tax Code, this is done for him by his employer, a tax agent, if we speak in terms of tax legislation. The employer cannot shift this responsibility to the employee; he himself is obliged to withhold tax from the salary and transfer it to the tax office. Let us repeat that here we mean conscientious employers paying white wages. We will list cases where the employee pays the salary tax themselves below in the article.

The employment contract must specify the salary amount. And there they indicate the gross salary. Therefore, when applying for employment, one must take into account the fact that the employee will receive less than the amount specified in the employment contract. This is not a mistake or a reason to argue with the employer. Sometimes they verbally set the salary amount “in hand”. Then the employer indicates in the employment contract an amount greater than what was agreed upon, since calculating the gross salary if you know the net salary (the one that was agreed upon in words) will not be difficult.

What does the concept of “gross” mean in simple words?

Gross or “dirty” wages are the amount of accruals before mandatory deductions that the employer plans for the earnings of a particular employee. It is more than what is ultimately given to a person.

The term "gross" was coined in Great Britain back in the 16th century. From English it is translated as “gross, gross, large.” You won’t find it in regulations, but employers and economists actively use it to characterize wages. Let's figure out what it means.

The employee and the employer look at wages differently: the first is concerned about how much the family budget will have to be formed from, and the second is concerned about how much money to include in labor costs. These will be different numbers. Employer wage costs include:

- official salary;

- bonuses;

- allowances (surcharges) according to legislation and (or) contract;

- personal income tax (NDFL);

- insurance and pension contributions;

- other expenses (payment for food, transportation, fitness classes, etc.)

The sum of the first three positions is the real money that the employee will receive for his work. The employer will withdraw the last three points from the gross salary for payment to the state, pension fund and other structures.

When viewing job advertisements, you need to pay attention to the type of remuneration for the work. Sometimes instead of the word “gross” they put the note “before taxes”. These concepts have the same meaning.

Salary net - cleared

It is already clear what the difference is between gross and net wages.

Let us express the ratio of gross and net wages with the formula:

You can also hear that the net salary is called “salary in hand”, that is, this is the amount that the employee will actually receive.

Let's give a simple example. The employment contract states the salary amount is 30,000 rubles. This is the gross salary. And at the end of the month, the employee will receive a net salary - the amount specified in the contract minus personal income tax, which the employer is obliged to withhold. 30,000 – 13% (3,900) = 26,100 rub.

In addition to tax, the employer has the right or obligation to make certain other deductions, if any. For example, this could be alimony that is withheld based on writs of execution. Another option is to deduct damages caused to the employer from wages if the employee is found guilty.

Check out a selection of our articles on child support withholding:

- “Calculation of alimony from wages and the procedure for their deduction”;

- “Do they withhold alimony from vacation pay or not?”;

- “Accounts for calculating and deducting alimony from wages”.

Here we note that it is impossible to withhold more than 20% (50% and 70% in some cases) from wages, according to Art. 138 Labor Code of the Russian Federation.

How to work with writs of execution and not receive a fine from regulatory authorities? Sign up for a free trial access to ConsultantPlus and receive an algorithm of actions for working with writs of execution, compiled by experts of the K+ system.

The employer, in addition to personal income tax, makes contributions for pension, medical and social insurance for the employee. How do contributions affect net salary? No way. Contributions are transferred to the employer's funds account.

Let's return to our example. For an employee's salary of 30,000 rubles. Contributions in the amount of 30.2% were assessed (in general). 30,000 × 30.2% = 9,060 rub. The employee will still receive 26,100 rubles. But the employer will transfer to the budget: 3,900 (personal income tax) + 9,060 (contributions) = 12,960 rubles.

General concepts

As stated in article No. 129 of the Labor Code of the Russian Federation, wages refer to an employee’s remuneration for work, the amount of which varies depending on the complexity, quality and other criteria of the work performed, as well as other payments.

The right of an employee to receive a salary not less than the minimum wage established in the Russian Federation is guaranteed by the Constitution of the Russian Federation.

The provisions on the form of payment, provided state guarantees and other conditions for making payments to employees are specified in Chapter 20 of the Labor Code (Articles 129-132).

Read our article about what wages are.

Details about the established minimum wage, calculation of wages, terms of payment, legality of deductions and other nuances related to wages are stated in Chapter 21 of the Labor Code (articles numbered 133-158).

Equality of gross salary and net salary for different workers

Let's consider an interesting situation. Can the same gross salary guarantee the same net salary for different workers? No, he can not. Even if two employees are given the same gross salary level, this does not mean that their salary will also be the same. The thing is that personal income tax, which is deducted from the salary gross and the salary is not received, can be calculated differently, depending on the circumstances of the taxpayer. For personal income tax, tax legislation provides for tax deductions that reduce the tax base. But not all individuals have the right to them. We are talking about deductions for children, social and property deductions. Employers can provide these deductions upon written application from the employee.

Here is a comparative analysis of the gross salary and the net salary with and without deductions.

We wrote about how to get the standard child tax credit in the article “Child Tax Credit in 2021.”

Read about the new rules for obtaining a personal income tax deduction in the article “Deduction of personal income tax in a simplified manner .

How to get a full gross salary

This can be done using deductions. The only deduction that allows you to return all personal income tax paid is the investment deduction. Let's look at how it works.

Let's say you paid 26,000 rubles in personal income tax during the year. And we decided to start investing.

You register on the website of one of the Russian brokers. The best brokers are listed in this rating of the Moscow Exchange. I recommend registering only with the first 12 companies - those with the largest trading turnover. They are reliable and proven.

Then you open an IIS with a broker. You can only have one. You cannot open two IIS, even with different brokers.

Now you need to deposit an amount into your IIS, 13% of which will be equal to the taxes you paid. In our case, this is 200,000 rubles. 13% of 200,000 will be exactly 26,000 rubles.

The next step is to request a tax deduction of category A. You request a deduction and the tax office returns 26,000 rubles to you.

Money cannot be withdrawn from an IIS for three years. If you withdraw, you will have to return the deduction back.

A must read

Be sure to read my article about IIS, where I explain in detail how it works. This is a great way to get your taxes back and get rich. Investments with IIS can be made in government bonds - then you won’t have to worry about money at all.

There are other ways to get some of your taxes back. For example, through social deductions. But you will not have a full refund, as is the case with IIS. We will discuss these methods later in separate articles.

Why might you need a gross salary and a non-gross salary?

As we have already said, the gross salary is written in the employment contract. And by and large it is believed that a person receives exactly this amount, this is his income. And the tax is its expense. But in addition to taxes, a person has a lot of expenses - paying for housing, food, clothing, other taxes, and so on. We do not subtract them when talking about the amount of our income, but say the amount received in hand. This is not entirely fair; it is still more logical to consider the gross salary as income. By the way, the state considers this exactly when allocating various benefits and subsidies. If the purpose of the benefit depends on the amount of income, then the income is the gross salary, not the net salary.

Net salary is needed primarily by the employee himself - the citizen who calculates his actual income and expenses.

How gross salary influences job choice

When you are looking for a job, be sure to check what the salary is stated in the vacancy.

Most often, employers indicate the gross salary. Because it is 13% larger and looks more tempting to a potential employee.

If your salary is gross, multiply it by 0.87 to determine your net income. And then compare different vacancies.

For example, one vacancy may have a lower salary, but the workplace will be located near your home. And you won't have to spend money on travel. Another vacancy may have a higher salary, but you will need to spend money and time on travel.

Please consider these criteria.

When does an employee receive gross salary in hand?

Let us immediately make a reservation that such a question is not entirely correct. But misinterpretation of terms can be found, so we will operate with them, but with explanations of what is wrong.

Often employers do not enter into employment contracts with their employees, but civil contracts. Sometimes such a move is just an evasion of taxes and compliance with labor laws. However, sometimes this is completely justified by the circumstances.

In this case, they also say that the employee receives wages. This is not true. Salaries can only be received within the framework of labor legislation, that is, if there is an employment contract. If the work is performed not under an employment contract, but under a civil law contract, then we are talking about remuneration under the contract.

If an employee (by the way, in this case he cannot be called an employee, he is a performer under a contract) is hired under the GPA and is an individual entrepreneur or self-employed, then he receives payments under the contract in full, that is, a gross salary, and then pays taxes on one's own.

If, according to the GPA, just an individual without a special status works, then under the contract he also receives payments minus personal income tax, that is, a net salary. Even according to the GPA with an individual, the employer (it is correct to call him the customer) must withhold personal income tax from payments under the agreement.

What else to read

Check out my selections with courses on remote work and courses for mothers on maternity leave. It describes good programs that will allow you to get a real profession for making money on the Internet and completely switch to remote work.

I advise you to sign up for the online marathon “How and where to invest in 2022.” The marathon takes place in the form of webinars that last for 10 days. During this time, you will learn what financial instruments you can invest money in and how to do it correctly. It also talks about individual investment accounts.

Take the “Financial Literacy” course from Skillbox, a well-known online university throughout Russia. This course contains all the knowledge about finance that an adult, independent person should have. You will learn how to choose the right bank accounts, you will know what to do with a mortgage if you have nothing to pay it with, and you will be able to protect yourself from a variety of types of fraud.

The course is held in the form of video lessons, after a series of videos in each of the blocks you need to take a test. Everything is explained in a very accessible and understandable way, without complicated terms. But even if something is unclear to you, you can ask questions to the teachers.

Subscribe to the YouTube channel of Ak Bars Bank. Very interesting videos on finance are periodically published there, as well as recordings of webinars on investments.

Watch all the videos about investments that Ak Bars has. It's free and educational at the same time. Here is an example of one such video - about investing through ETFs.

I also recommend these three books to you. They are free - download them for yourself and read them. These are not even books, but rather brochures. They are small and easy to read.

- How to become financially independent in 1 year. The author of the book explains the difference between people who strive for financial independence and those who do not think about it at all and simply “eat away” all their income.

- 5 ways to effectively invest 1000+ rubles. This is a book about how easy it is to start investing even with small amounts. It describes real examples of small investments, the author gives detailed comments on each example.

- 6 steps to financial security. This book will help you change your approach to finances a little so that you can begin to make a purposeful journey towards financial security and stability.

How to calculate them

Every employee can do this. “Gross” is prescribed in the employment contract during employment. Knowing the amount of income tax and the amount of other deductions or benefits (if they exist), you can make fairly simple calculations. The final result must coincide with what is written on the payslip.

Calculation example

In order to accurately understand the difference in concepts, it is necessary to give several examples.

Example 1. “Gross” is 35,000 rubles. There are no tax preferences or salary deductions. Calculation:

- 35,000 * 13% = 4,550 – the amount of personal income tax payable.

- 35,000 – 4,550 = 30,450 rubles – amount to be paid in person.

Income “no” is 30,450 rubles.

Example 2. “Gross” is 42,000 rubles. The employee has 2 minor children. They are entitled to deductions in the amount of 1,400 rubles each. Calculation:

- 1,400 + 1,4000 = 2,800 rubles – tax-free amount;

- 42,000 – 2,800 = 39,200 rubles – tax base for calculating personal income tax;

- 39,200 * 13% = 5,096 rubles – personal income tax;

- 42,000 – 5,096 = 36,904 rubles will be received by the employee.

Income “no” will be 36,094 rubles.

Example 3. The “gross” salary is 39,800 rubles. The employee has 2 children, for one of them he pays child support in the amount of 25% of his salary. Calculation:

- 1,400 + 1,400 = 2,800 rubles are not taxed.

- 39,800 – 2,800 = 37,000 rubles – tax base.

- 37,000 * 13% = 4,810 rubles – personal income tax.

- 39,800 – 4,810 = 34,990 – salary after tax.

- 34,990 * 25% = 8,747.5 rubles - this is the amount of child support.

- 34,990 – 8,747.5 = 26,242.5 rubles – will be received in hand.

Income “no” is 26,242.5 rubles.

Example 4. The advertisement indicates a “no” salary in the amount of 26,600 rubles. Calculation:

- 26,600 / 0.87 = 30,575 rubles – gross income.

Example 5. A woman has 2 minor children. She gets a job, chooses between advertisements that indicate:

- one states that the “gross” salary is 42,300 rubles;

- another states that “no” salaries amount to 39,150 rubles.

Which option is more profitable for this employee? Calculation:

- The “gross” income in the second case will be equal to 39,150 / 0.87 = 45,000 rubles.

- 2,800 rubles are not taxed in any of the cases.

Detailed calculation for each option. Option 1:

- 42,300 – 2,800 = 39,500 rubles is the tax base for calculating personal income tax.

- 39,500 * 13% = 5,135 rubles – income tax to be transferred to the budget.

- 42,300 – 5,135 = 37,165 rubles amount to be issued in person.

- “no” equals 37,165 rubles.

Detailed calculation for option 2:

- 45,000 – 2,800 = 42,200 rubles – tax will be calculated from this amount.

- 42,200 * 13% = 5,486 rubles – tax to be transferred to the budget.

- 45,000 – 5,486 = 39,514 rubles – the employee will receive in her hands.

According to the calculations made, the first advertisement indicated a “gross” of 42,300 rubles, in fact she will receive 37,165 rubles monthly (provided that she does not have sick leave and the month is worked in full). The second advertisement states “no” in the amount of 39,150 rubles; she will receive 39,514 rubles monthly (subject to the same conditions).

It is more profitable for a woman to get a job based on the second advertisement.

How to increase your net income

There are several legal ways to increase the amount that is handed out after final settlements. This:

- use the right to property deduction. For example, minor children provide the opportunity to exempt 1,400 rubles from taxes monthly;

- if there are 3 or more children, the deduction amount increases to 3 thousand rubles;

- if a child has a disability, then depending on the status of the taxpayer in relation to the minor (guardian or parent), the state does not tax 6 and 12 thousand rubles, respectively;

- property deduction. Sellers and buyers of real estate have the right to an income tax refund. This can be done with a one-time payment through the Federal Tax Service or without regularly paying tax at work.

Important! All tax deductions are provided on an application basis upon provision of supporting documents. The right to receive monthly tax preferences is granted until the amount of annual income exceeds 350 thousand rubles.

The employee must visit the accounting department and write a free-form application addressed to the head of the enterprise. Copies of the children's birth certificates are attached to the application. This information must be updated every calendar year.

How to calculate net salary

If you do not go into small details (the amount of insurance premiums, the personal income tax rate, which may differ by category of taxpayer, the amount of tax deductions), then you can calculate net earnings as follows:

Net income = Gross salary – income tax at the rate of 13%.

Example 1. During the interview, an income of 100,000 rubles was announced. This is gross income.

This means that the applicant can count on receiving in hand or on a card blank:

100,000 – 13,000 = 87,000 rubles. This is net earnings.

When calculating income tax, an individual may be provided with tax deductions. This means that a certain amount of his earnings will not be subject to income tax.

The full list of tax benefits is reflected in the Tax Code of the Russian Federation. The most common deductions:

- for disabled people, former military personnel (full list, Article 218);

- for the first and second child until they reach the age of 18;

- for the third and each subsequent minor child;

- for disabled children;

- liquidators of the accident at the Chernobyl nuclear power plant, etc.

Example 2. Upon hiring, the chief accountant was given a salary of 100,000 rubles. He has three minor children.

Net salary is calculated as follows:

- We determine the amount of non-income taxable amounts. The tax deduction for two children under 18 years of age is 1400 * 2 = 2800 rubles, for a third child – 3000 rubles. 5,800 rubles per month will not be subject to income tax;

- Let's calculate the amount of income tax for an individual: (100000-5800)*13% = 12246 rubles;

- net, the salary of the chief accountant will be 100,000 – 12,246 = 87,754 rubles.