No matter how strong the spirit of camaraderie and mutual assistance is in the company, almost always when asking a colleague for help, an employee formally has the right to say: “This is not my job.” It’s a completely different matter if the expansion of functionality is formalized. In the Rabota.ru material you will find step-by-step instructions for completing the combination and a warning about possible problems.

Combining positions often becomes inevitable to replace an important employee who has gone on vacation, especially maternity leave. It can also be useful for survival in difficult times for a company, especially in conditions of labor shortage. How to arrange a combination correctly?

Combination: legal status

Article 60.2 of the Labor Code of the Russian Federation refers to the combination of performing, during the established duration of the working day (shift), along with the work specified in the employment contract, additional work in another or the same profession (position) for additional pay.

This definition, in addition to combination, also includes expanding the service area, increasing the volume of work and fulfilling the duties of a temporarily absent employee. The difference between these phenomena lies largely in the language that will be used in the accompanying documents. The wording “combining professions” is used for blue-collar professions, and “combining positions” is used for employees, specialists and managers.

What is the additional payment?

The amount of payment is specified in the additional agreement. It is usually calculated for the amount of work actually completed or for the time worked by the employee.

There are two types of surcharge:

- fixed size, it is indicated in the additional agreement;

- as a percentage of the salary at the main place of work.

The law does not establish a threshold for the minimum or maximum amount of payment. In each case, the employer individually considers the request and sets the amount depending on the volume and complexity of the work, and the qualifications of the specialist. The amount of payment is usually specified in the collective agreement at the enterprise.

The amount of the additional payment cannot be higher than the salary of the position being filled, taking into account all allowances, even if the responsibilities are distributed among several people.

In addition, the following nuances need to be taken into account:

- new responsibilities and the amount of payment should not worsen the main points of the employee’s employment contract;

- for any performance of someone else’s duties, payment is required; it is indicated in the additional agreement;

- the additional payment is taken into account when calculating average earnings, accordingly the regional coefficient and other allowances are calculated on it;

- income tax is withheld from the accrued amount, since the payment is equivalent to compensation;

- the amount of the surcharge should not go beyond the payroll savings at the enterprise.

Performing duties while combining positions is unacceptable without drawing up an additional agreement or without payment; in this case, the employee may refuse to perform someone else’s work.

Supervisory authorities suppress any violations of the Labor Code of the Russian Federation.

How to calculate additional pay for combining positions

For clarity, we provide several examples of calculations in Table No. 2.

| Type of allowance | Situation and example |

| Fixed surcharge | Situation: The employee's salary is 25 thousand rubles. A fixed additional payment of 10 thousand rubles has been established. Calculation:

|

| Percentage of salary | Situation: The employee's salary is 20 thousand rubles. For combination work, you are entitled to a 40% bonus from your salary. Calculation:

|

If the employee did not perform his duties for a whole month, then the amount of compensation payment is calculated in proportion to the actual time worked.

Step-by-step instruction

Position preparation

If we are talking specifically about combining positions as such (as opposed to expanding the service area), then the following conditions must be met:

- the position must be included in the staffing table;

- the position must be vacant.

The last condition does not directly follow from the requirements of the Labor Code, but is often taken into account by courts and inspectors.

Sometimes a new position is introduced into the staffing table specifically for combination purposes. It is worth remembering that a temporarily unoccupied position is not vacant, that is, if the employee replacing it is on vacation, including maternity leave. To assign additional work for a temporarily unoccupied position, the wording “performing the duties of a temporarily absent employee” is used.

2. Written consent of the employee

In accordance with Article 60.2 of the Labor Code of the Russian Federation, additional work can be assigned to an employee only with his written consent. Such consent can be obtained in two ways:

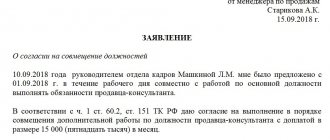

- At the employee’s request, he writes an application with a request to be assigned, in order to combine duties, for the desired position (Appendix 1). Alternatively: in order to expand the service area or in order to perform the duties of a temporarily absent employee. In the latter case, along with the position, the name of the temporarily absent employee is indicated. Then the head of the organization supplements the statement with his positive resolution, instructing the head of the personnel department to prepare drafts of the relevant documents.

- At the suggestion of management, a memorandum from the head of the department is drawn up with a request to assign the employee the duties of a combined position (Appendix 2). In turn, the employee supplements the memo with his written consent with the signature “I agree to combine positions.” Then the manager's resolution is imposed.

The application or memorandum may already contain an indication of the duration of the combination if it is issued for a specific period.

3. Additional agreement to the employment contract

The combination affects the employee’s labor functions, and they are the subject of the employment contract. Therefore, combination requires the conclusion of an additional agreement with the employee to the employment contract (Appendix 3). The agreement must include the following parameters:

- Type of additional work (part-time position, performing the duties of a temporarily absent employee or service area).

- Deadline for additional work.

- The content of additional work, that is, additional labor functions.

- If the basis for the preparation of an additional agreement was the employee’s statement, it is indicated that the responsibilities are assigned to the employee at his request.

4. Order on personnel

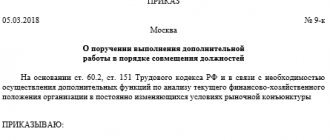

The basis for starting work on combining is the corresponding order on personnel (Appendix 4). It is drawn up on the basis of an additional agreement in free form on the form of orders for personnel. The order must contain a number of elements:

- Type of additional work (part-time position, performing the duties of a temporarily absent employee or service area).

- The position for which the combination is established (if additional work is assigned in the order of combination).

- Deadline for additional work.

- The content of additional work, that is, additional labor functions.

- Pre-agreed amount of remuneration for additional work.

- Special conditions (if required).

Special conditions are new responsibilities or new authorities required to perform additional functions. For example, for the position of a cashier - financial responsibility, for a HR specialist - responsibility for maintaining work books, for a managerial position - the right to sign and the right to make management decisions.

Building a bonus system based on KPIs

Get the video instructions “Implementation of the KPI system in the 1C:ZUP CORP program”

Thank you, #USERNAME#!

The information has been sent to the email you provided.

Let's look at the functionality of the buttons:

- After filling out all the fields, click “Submit”.

- By clicking “Print”, you can select the print object – Combine Order or Supplementary Agreement.

- “Create from” allows you to create a “Unregistration” document.

- “Remind” allows you to create a custom reminder (the function is available if Reminders are activated in the organizer, Administration section).

- “Attached files” allows you to attach files to a document, for example, scanned copies.

- The final action is “Post and Close”.

The “Combination of Positions” document allows you to assign several additional payments for combination at the same time. Subsequent charges will not change the previous one and will be assigned in addition to it.

Collective Agreement Provisions

The procedure for paying for part-time work must be reflected in the collective agreement between the employer and all personnel of the organization. Acceptable options for combining professions/positions are also indicated here. An analogue of a collective agreement is the provisions on remuneration, combination, and personnel regulations.

All these documents must reflect the following:

- Bonuses for the main job are calculated taking into account additional payments for combined work. To do this, the local regulatory document specifies a list of additional payments and allowances to the current tariff rates, official salaries, and bonuses.

- Regulating the procedure for calculating additional payment for the performance of official duties of an absent worker, determining its amount.

- Who is eligible to replace a colleague? Provisions are separate for operating personnel and for employees. This division is due to the fact that additional payments for replacement are made at the expense of savings in the salary fund. Therefore, the combination is formalized only in case of production necessity. And with the fact that there are savings in this fund. The list of employees who may be assigned to replace them is also displayed in the collective agreement.

- The specific amount of payment for combining positions at one enterprise is indicated in the company’s internal regulatory document in the form of a specific monetary amount or as a percentage of the tariff rate or official salary. It must be confirmed by signing the appropriate order for the organization.

- Payment for combining a colleague’s work during vacation, illness, or business trip must be included in the list of allowances to salaries and tariff rates approved by the given organization.

Now let's look at another important question.

Features of internal part-time work

Considering the differences between part-time and part-time work at one place of work, we can highlight the main features of internal part-time work. So, this is additional work performed in free time from the main one, in the same company. Since the employee is already registered with this employer, he does not need to provide documents to conclude a part-time employment contract. The exception is when a part-time worker takes on additional work that requires special qualifications. Then the personnel service may request a document confirming the competence of the part-time worker.

Question: Is it possible to formalize internal part-time work with an additional agreement to the employment contract, in particular, for several positions? View answer

As already noted, before starting part-time work, it is necessary to conclude a separate employment contract between the parties. To ignore this requirement of the legislator on the basis that the employee has already been signed up for one employment contract means to directly violate the provisions of Art. 282 Labor Code of the Russian Federation.

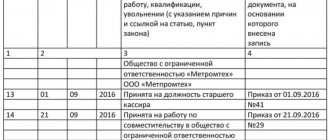

Based on the contract, an order for employment is issued. Both documents, as a prerequisite, must contain information about internal part-time work (Labor Code of the Russian Federation, Article 68). As a rule, a separate time sheet is kept for an internal part-time worker to control hours worked and prevent overtime (Labor Code of the Russian Federation, Article 91). An entry about additional part-time work is made in the work book only if the employee expresses such a desire (Labor Code of the Russian Federation, Article 66).

Part-time work is prohibited not only for minors and workers in hazardous (hazardous) areas, transport drivers, but also for employees of the state apparatus, municipal government apparatus, judges, prosecutors, and police officers due to a whole set of federal laws for each category.

Payment amount calculation

The difficulty here is that there is no specific unified formula by which the amount of additional payment for combination is calculated. In addition, the Labor Code of the Russian Federation does not prescribe a minimum and maximum size for it.

If we turn to practice, the amount of additional payment is established in the form of an agreement between the employer and his employee. It is influenced by the following factors:

- The complexity of the work being performed.

- Scope of activity.

- When working part-time in a combined position, the volume of actually completed tasks is taken into account in proportion to the time spent.

- The employer has the right to reduce or completely stop the additional payment in cases where the quality of the work performed, products produced or services provided has deteriorated.

- The employee is notified in writing about any change in the conditions of the combination (including its payment).

- With a time-based salary, the amount of additional payment for part-time work is usually associated with the amount of work performed and the tariff rate at which it is remunerated.

- For piecework wages, the additional payment for combined work is based on increased piecework prices.

- When combining a position for which time-based pay is applied, the bonus is calculated based on the percentage of the salary or the tariff rate for it.

Although there are no specific acts regulating the amount of additional payment, there is a rule: it should not be higher than the full rate for the combined profession or position. This is expressly stated in Art. 423 TK. Such a requirement is not new for the Russian Federation. A similar rule was established back in Soviet times.

If the employer ignores this instruction, this may result in a serious problem for him with the tax service.

Options for additional workload in an organization

Art. 60.2 of the Labor Code of the Russian Federation introduces possible options for additional workload:

- Execution of additional volume of work according to your position and specialty. For example, an accountant is asked to manage the affairs of a colleague who is going on vacation, both in his area and in the vacant one.

- Carrying out a certain amount of work for a temporarily absent worker (if the latter is absent for a long time - for example, he is prescribed long-term treatment).

- Combination of professions and positions (the engineer takes on the responsibilities of a labor protection specialist).

All of the above cases require a corresponding increase in wages.

How to apply

When combining positions, you do not need to enter into a new contract. The provisions of Article 57 of the Labor Code of the Russian Federation refer to the description of the labor function, i.e. tasks performed by the employee, to the mandatory terms of the contract.

Agreements between the parties on combining professions or positions must be formalized by an additional agreement in writing. Its obligatory condition is the amount of payment established for the combination.

After signing the agreement, the employer issues an organization order (or other administrative document) entrusting the employee with an increased amount of work. The employee confirms agreement with the order with a personal signature.

The additional agreement must reflect 4 points of agreement between the organization and the employee:

- the basis for performing the work (vacancy, temporary absence of a colleague, increase in the amount of work, etc.);

- content of the job (position, profession);

- description of duties (additional job function);

- work start date.

If additional work is assigned for a specific period, the agreement and order reflect both the start and end days of the combination period.

A form is possible.

Sample order:

An entry about the combination is not entered into the work book; during this period, the citizen is considered to be working at his main place of work, regardless of the assigned duties.

Professions or positions?

The article of the Labor Code, which addresses the issue of payment for combinations, is a logical continuation of Art. 149 of the same Labor Code. It addresses the question: what is considered a combination of professions, and what is considered a combination of positions?

Everything is quite simple here:

- Combination of professions - in relation to working specialties. Professions can be assigned in the Russian Federation on the basis of the ETKS of working professions. Or KS (qualification directory) for working positions not included in the ETKS.

- Combination of positions - in relation to employees.

It is advisable to carry out the combination within the category to which the employee belongs. Accordingly, the worker must replace the worker, and the employee must replace the employee.