Having purchased an organization (business), its new owner acquires not only a property complex, but also a set of other resources: a workforce, a trademark, a circle of regular customers and suppliers, an established sales market, etc. (Article 559 of the Civil Code of the Russian Federation). It is impossible to evaluate these resources separately and recognize them as tangible assets. Therefore, acquisitions of this kind are recognized in the aggregate and are called goodwill.

Business reputation as an object subject to assessment arises only if an organization (business) is acquired under a purchase and sale agreement. Business reputation can be positive or negative.

Determination of cost

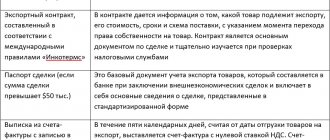

Calculate the value of business reputation using the formula:

| Positive (negative) business reputation | = | The amount paid to the seller for the organization (business) in accordance with the purchase and sale agreement (excluding VAT) | – | The sum of all assets (current and non-current) and liabilities (short-term and long-term) on the balance sheet of the acquired organization as of the date of its acquisition |

How else to confirm your business reputation

What is important for the customer is not the certificate, but the assessment of the procurement participant’s business reputation: his qualifications and positive reviews. Confirmation of trustworthiness are both certificates for the main activity of the contractor and letters of gratitude to the supplier, which will be sent by other clients indicating the customer’s contacts. All this is provided along with the application.

Good work is confirmed by the absence of violations, litigation and complaints to the FAS - this information is publicly available in the EIS contract register.

Accounting

To calculate the value of business reputation, use data from account 76 “Settlements with other debtors and creditors”, to which open, for example, the sub-account “Settlements for the acquisition of an enterprise”. This subaccount reflects information about the assets and liabilities of the purchased organization, as well as the cost of its acquisition.

The debit of this account shows the amount that was paid to the seller when purchasing the business, as well as the value of the liabilities (namely long-term and short-term accounts payable) that were transferred to the organization as a result of this transaction:

Debit 76 subaccount “Settlements for the acquisition of an enterprise” Credit 51

– reflects the amount paid to the seller for the organization (business) in accordance with the purchase and sale agreement;

Debit 76 subaccount “Settlements for the acquisition of an enterprise” Credit 60 (70, 68, 69, 66, 76...)

– the liabilities (accounts payable) of the acquired organization are taken into account.

On credit, account 76 shows the amount of input VAT charged by the seller of the organization, as well as the value of all assets (including accounts receivable) of this organization:

Debit 19 Credit 76 subaccount “Settlements for the acquisition of an enterprise”

– the amount of input VAT for the acquired organization is reflected;

Debit 08 (10, 20, 40, 41, 43, 62...) Credit 76 subaccount “Settlements for the acquisition of an enterprise”

– assets (non-current and current assets) of the acquired organization are taken into account.

This procedure follows from the provisions of paragraph 42 of PBU 14/2007 and the Instructions for the chart of accounts.

The legislation does not establish a unified form for calculating the value of business reputation. Therefore, such a calculation can be formalized, for example, with an accounting certificate (clauses 1, 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

In accounting, consider a positive business reputation as part of intangible assets in account 04 “Intangible assets”. In this case, make the following entries:

Debit 08 Credit 76 subaccount “Settlements for the acquisition of an enterprise”

– the emergence of a positive business reputation is reflected;

Debit 04 Credit 08

– positive business reputation is taken into account as part of intangible assets.

This procedure follows from paragraphs 4 and 43 of PBU 14/2007 and the Instructions for the chart of accounts (accounts 08, 04).

Simultaneously with the registration of positive business reputation as part of intangible assets (reflected on account 04), fill out the card according to form No. NMA-1, approved by Rosstat Resolution No. 71a of October 30, 1997.

Example of calculating the value of business reputation

CJSC Alpha acquired LLC Torgovaya. The purchase price of “Hermes” (including VAT) in accordance with the purchase and sale agreement amounted to RUB 110,970,698. The input VAT charged by the seller is RUB 10,970,698. In accordance with the transfer act, the book value of the property of the acquired organization amounted to RUB 50,000,000, including:

– cost of fixed assets – 20,000,000 rubles; – cost of intangible assets – 7,000,000 rubles; – cost of inventories – 1,900,000 rubles; – cost of finished products – 1,200,000 rubles; – cost of financial investments – 6,000,000 rubles; – amount of accounts receivable – 13,900,000 rubles.

The cost of short-term and long-term accounts payable of the acquired organization amounted to RUB 20,000,000.

The accountant reflected the acquisition of Hermes as a property complex as follows.

Debit 76 subaccount “Settlements for the acquisition of an enterprise” Credit 51 – 110,970,698 rubles. – reflects the amount paid for the organization in accordance with the purchase and sale agreement;

Debit 19 Credit 76 subaccount “Settlements for the acquisition of an enterprise” – 10,970,698 rubles. – the amount of input VAT for the acquired organization is reflected;

Debit 76 subaccount “Settlements for the acquisition of an enterprise” Credit 60 (76...) – 20,000,000 rubles. – the liabilities (accounts payable) of the acquired organization are taken into account;

Debit 08 Credit 76 subaccount “Settlements for the acquisition of an enterprise” – 27,000,000 rubles. (RUB 20,000,000 + RUB 7,000,000) – fixed assets and intangible assets of the acquired organization are taken into account;

Debit 10 (20, 41...) Credit 76 subaccount “Settlements for the acquisition of an enterprise” – 1,900,000 rubles. – the inventories of the acquired organization are taken into account;

Debit 43 Credit 76 subaccount “Settlements for the acquisition of an enterprise” – 1,200,000 rubles. – finished products of the acquired organization are accepted for accounting;

Debit 58 Credit 76 subaccount “Settlements for the acquisition of an enterprise” – 6,000,000 rubles. – financial investments of the acquired organization are taken into account;

Debit 62 Credit 76 subaccount “Settlements for the acquisition of an enterprise” – 13,900,000 rubles. – the receivables of the property complex are reflected.

After the accountant had recorded all of the assets and liabilities of the acquired Hermes, he calculated goodwill as the difference between the entity's acquisition price and the value of its assets minus its liabilities. It amounted to 70,000,000 rubles. (RUB 110,970,698 – RUB 10,970,698 – (RUB 50,000,000 – RUB 20,000,000)). Thus, with the acquisition of Hermes, a positive business reputation was formed. The accountant reflected its occurrence with the following posting:

Debit 08 Credit 76 – 70,000,000 rub. – reflects the emergence of a positive business reputation.

Reflect the negative business reputation as part of other income for the reporting period by posting:

Debit 76 subaccount “Settlements for the acquisition of an enterprise” Credit 91-1

– negative business reputation is taken into account as part of other income.

This procedure follows from paragraph 45 of PBU 14/2007 and the Instructions for the chart of accounts (account 91).

In all cases, make entries in the accounts as of the date of state registration of the purchase and sale agreement based on:

– deed of transfer;

– purchase and sale agreements;

- accounting certificate.

This follows from paragraph 1 of Article 9 of the Law of December 6, 2011 No. 402-FZ and Articles 561 and 563 of the Civil Code of the Russian Federation. A similar point of view is reflected in the letter of the Department of Tax Administration of Russia for Moscow dated May 16, 2003 No. 23-10/2/26257.

The concept of goodwill and depreciation

Valuation of intangible assets Read more: Accounting for depreciation and disposal of intangible assets

1.3 The concept of goodwill and depreciation

Business reputation is an intangible benefit that represents an assessment of a person’s activities in terms of his business qualities.

Business reputation is determined as the difference between the purchase price of an organization as an acquired property complex (as a whole or part thereof) and the value on the balance sheet of all its assets and liabilities on the date of its purchase (acquisition).

Business reputation is a kind of “good name” (goodwill) of a legal entity and is taken into account as part of its intangible assets. Business reputation can be positive or negative.

A positive business reputation is a premium to the price paid by the buyer when purchasing a property complex. A positive business reputation is associated with the positive attitude of counterparties towards its owner, with trust in him and confidence in the positive result of cooperation.

Negative business reputation of an organization is a price discount provided to the buyer due to the lack of stable buyers, reputation for quality, marketing and sales skills, business connections, management experience, level of personnel qualifications, which is subject to accounting as part of other expenses. A negative business reputation shows the instability of its owner’s position in economic turnover.

Depreciation charges for positive business reputation are determined on a straight-line basis and accrued over a period of 20 years (but not longer than the life of the organization).

Negative business reputation in full is included in the financial results of the organization as other income.

Chapter 2 Accounting for intangible assets

2.1 Accounting for receipt of intangible assets

Intangible assets enter the organization for the following reasons:

· acquisition of objects for a fee;

· creation of facilities by an organization with the involvement of third parties on a contractual basis;

· contribution of the founder to the authorized capital;

· free receipt;

· acquisition on exchange terms.

To account for the presence and movement of intangible assets, the basis is primary documents: acts of acceptance and transfer; minutes of founders' meetings; acts for writing off intangible assets. The primary documents must contain details defining: the procedure and useful life of the objects, their initial cost, the method of calculation and depreciation rate, the date of commissioning, the date and reason for disposal.

Synthetic accounting of the presence and movement of intangible assets is carried out in the following accounts:

04 “Intangible assets”;

05 “Amortization of intangible assets”;

08 “Investments in non-current assets”, sub-account “Acquisition of intangible assets”.

The main register of analytical accounting is inventory cards for recording intangible assets, which are opened separately for each inventory item. If the number of objects is insignificant, then an inventory book of intangible asset objects is kept.

Inventory lists of intangible asset objects are maintained at the sites where intangible assets are used.

Based on the data from inventory cards and depreciation calculation sheets, a monthly statement of the movement of intangible assets for individual objects is compiled, the results of which serve as the basis for filling out reports.

Accounting entries for accounting for the receipt of intangible assets are presented in the tables.

Table 1

Correspondence of accounts when accounting for the acquisition of intangible assets for a fee

| No. | Contents of the fact of economic activity | Debit | Credit |

| 1 | Supplier invoices for intangible assets accepted for payment: — purchase price of the object — VAT | 08 19 | 60 60 |

| 2 | Accounts of intermediary organizations accepted for payment: - for the cost of services — VAT | 08 19 | 60 60 |

| 3 | Payment was made from the current account: - cost of the object - cost of intermediary services | 60 60 | 51 51 |

| 4 | Intangible assets accepted for accounting | 04 | 08 |

| 5 | The amount of VAT is written off to reduce debt to the budget | 68 | 19 |

table 2

Correspondence of accounts when accounting for the creation of intangible assets by an organization

| No. | Contents of the fact of economic activity | Debit | Credit |

| 1 | The actual costs of creating intangible assets are reflected | 08 | 10, 60, 69, 70, 76 and others |

| 2 | Intangible assets are accepted for accounting at historical cost | 04 | 08 |

Table 3

Correspondence of accounts when accounting for the receipt of intangible assets on account of contributions to the authorized capital

| No. | Contents of the fact of economic activity | Debit | Credit |

| 1 | Repayment of the founders' debt on contributions to the authorized capital through the transfer of intangible assets is reflected | 08 | 75 |

| 2 | Additional costs are reflected to bring intangible assets to a state in which they are suitable for use. | 08 | 23.60 and others |

| 3 | Intangible assets received as a contribution to the authorized capital were accepted for accounting | 04 | 08 |

Table 4

Correspondence of accounts when accounting for gratuitous receipt of intangible assets

| No. | Contents of the fact of economic activity | Debit | Credit |

| 1 | Intangible assets received free of charge were capitalized at market value | 08 | 98 |

| 2 | Additional costs are reflected to bring intangible assets to a state in which they are suitable for use. | 08 | 23.60 and others |

| 3 | Intangible assets received free of charge have been accepted for accounting | 04 | 08 |

Valuation of intangible assets Read more: Accounting for depreciation and disposal of intangible assets

Information about the work “Accounting for intangible assets”

Section: Accounting and Auditing Number of characters with spaces: 50102 Number of tables: 27 Number of images: 0

Similar works

Accounting for intangible assets

94601

0

0

... the fact that the use of various types of civil contracts when acquiring copyright objects predetermines not only the legal regime of the acquired object, but also its subsequent accounting. Only rights to copyright objects acquired under copyright agreements, but not under sales contracts, will be considered intangible assets. Various agreements are...

Accounting for intangible assets using the example of OJSC Vympel, Omsk

110859

16

0

... it also has many similarities with relevant foreign accounting standards and practices. 3. Features of the organization of intangible assets in modern conditions at Vympel OJSC 3.1 Valuation of intangible assets and disclosure of information in financial statements 3.1.1 Characteristics of the enterprise Vympel OJSC, Omsk, is an open joint-stock company. The authorized capital of the enterprise is divided into...

Accounting for intangible assets. Amortization of intangible assets

59166

0

0

… depreciation of intangible assets When intangible assets are used, their cost is repaid through depreciation. Amortization of intangible assets is calculated in accounting regardless of the results of the organization's economic activities in the reporting period. There are 3 methods of calculating depreciation of intangible assets: 1) straight-line method...

Amortization of positive business reputation

The cost of positive business reputation accounted for as part of intangible assets is written off as expenses through depreciation. Calculate depreciation using the linear method based on:

– 20 years or the life of the organization (if its duration is less than 20 years);

– the value of positive business reputation (i.e. the value recorded on account 04).

Start calculating depreciation from the next month after reflecting positive business reputation on account 04. At the same time, make the following entry:

Debit 20 (25, 26…) Credit 05

– positive business reputation is taken into account as expenses.

This procedure follows from subparagraph “a” of paragraph 29, paragraphs 31 and 44 of PBU 14/2007 and the Instructions for the chart of accounts.

The procedure for accounting for business reputation (goodwill) when calculating taxes depends on what taxation system the organization uses.

Business reputation in accounting

The main feature of business reputation accounting in Russia is that the organization’s reporting does not reflect the value of its own business reputation. Business reputation is reflected in accounting only when purchasing an enterprise as a property complex, this is how acquired business reputation is formed. Often in practice, when purchasing a company, its selling price is not equal to the book value. This difference in price is business reputation.

Acquired business reputation, being an asset of an enterprise, not only affects the value of the organization, but also allows you to maintain a client and partner base, as well as attract new ones. Thus, business reputation serves as a certain guarantee of the enterprise, which ultimately can increase the company’s profit. A buyer who is willing to pay more for a business than what is reflected on the balance sheet hopes to acquire some economic benefits in the future from assets not reflected in the financial statements - positive business reputation. This difference in price for the acquired business reputation will subsequently be reflected in the organization’s balance sheet as an intangible asset.

However, in addition to positive business reputation, in accounting, as noted earlier, there is also negative business reputation. By reverse analogy, it arises when purchasing an enterprise in the form of a lower value than reflected on the balance sheet. Thus, negative business reputation is a price discount provided due to the presence of some negative factors that contribute to a decrease in the value of the enterprise.

In general, business reputation, both positive and negative, is reflected in accounting in accordance with PBU 14/2007, according to which the useful life of business reputation is 20 years from the date of recognition.

Thus, a positive business reputation (price premium) in accounting is reflected in the debit of account 04 “Intangible assets”, and a negative business reputation (price discount) is reflected in the credit of account 91 “Other income and expenses” (subaccount 91.1 “Other income” ) and to the debit of account 62 “Settlements with buyers and customers” in the full amount . In this case, business reputation as an intangible asset should be revalued no more than once a year.

Goodwill, as an intangible asset, is the difference between the acquisition price of an asset and its true market value. It is created when a reputational premium is paid for the acquisition of assets. Stock market research, management talent, skillful PR, and the ability to present statistical reporting data in the right light can create the necessary field for reputational development, which, in turn, increases the opportunity to receive both a premium price for your shares and loans on better terms.

Business reputation includes all intangible components of a business, namely brand, trademarks, own marketing developments, production technologies that allow the organization to receive additional income and encourage consumers to use the services of this company.

BASIC: income tax

The procedure for accounting for business reputation when calculating income tax depends on whether it is positive or negative.

Business reputation is not included in intangible assets in tax accounting. It does not satisfy the requirements of paragraph 3 of Article 257 of the Tax Code of the Russian Federation.

The excess of the value of net assets over the purchase price of the organization in tax accounting is considered a discount on the price (paragraph 3, paragraph 1, article 268.1 of the Tax Code of the Russian Federation). That is, the purchasing organization receives part of the property free of charge, and it gains economic benefit. Therefore, reflect the amount of negative business reputation as part of non-operating income when calculating income tax (paragraph 1 of Article 250 of the Tax Code of the Russian Federation). Such income is recognized in the month of registration of ownership of the acquired organization (subclause 2, clause 3, article 268.1 of the Tax Code of the Russian Federation). Do this regardless of which method of determining the tax base the organization uses - accrual or cash. This follows from paragraph 1 of Article 271 and paragraph 2 of Article 273 of the Tax Code of the Russian Federation.

An example of how negative business reputation is reflected in accounting and taxation

CJSC Alfa decided to acquire Torgovaya LLC. In August, a purchase and sale agreement was concluded, according to which the purchase price of Hermes (including VAT) was 44,097,218 rubles. The input VAT charged by the seller is RUB 4,097,218. In the same month, the organization was transferred to Alpha under a transfer deed signed by the parties. At the end of August, Alpha received a certificate certifying its ownership of the acquired organization. Alpha uses the accrual method and pays income tax monthly.

In accordance with the transfer act, the book value of the acquired organization’s property amounted to RUB 60,000,000, including:

– cost of fixed assets – 30,000,000 rubles; – cost of intangible assets – 7,000,000 rubles; – cost of inventories – 1,900,000 rubles; – cost of finished products – 1,200,000 rubles; – cost of financial investments – 6,000,000 rubles; – amount of accounts receivable – 13,900,000 rubles.

The cost of short-term and long-term debt of the acquired organization amounted to RUB 7,100,000.

The accountant reflected the acquisition of Hermes as a property complex as follows.

August:

Debit 76 subaccount “Settlements for the acquisition of an enterprise” Credit 51 – 44,097,218 rubles. – reflects the amount paid for the organization in accordance with the purchase and sale agreement;

Debit 19 Credit 76 subaccount “Settlements for the acquisition of an enterprise” – 4,097,218 rubles. – the amount of input VAT for the acquired organization is reflected;

Debit 76 subaccount “Settlements for the acquisition of an enterprise” Credit 60 (76...) – 7,100,000 rubles. – the liabilities (accounts payable) of the acquired organization are taken into account;

Debit 08 Credit 76 subaccount “Settlements for the acquisition of an enterprise” – 37,000,000 rubles. (RUB 30,000,000 + RUB 7,000,000) – fixed assets and intangible assets of the acquired organization are taken into account;

Debit 10 (20, 41...) Credit 76 subaccount “Settlements for the acquisition of an enterprise” – 1,900,000 rubles. – the inventories of the acquired organization are taken into account;

Debit 43 Credit 76 subaccount “Settlements for the acquisition of an enterprise” – 1,200,000 rubles. – finished products of the acquired organization are accepted for accounting;

Debit 58 Credit 76 subaccount “Settlements for the acquisition of an enterprise” – 6,000,000 rubles. – financial investments of the acquired organization are taken into account;

Debit 62 Credit 76 subaccount “Settlements for the acquisition of an enterprise” – 13,900,000 rubles. – the receivables of the property complex are reflected.

After the accountant had recorded all of the assets and liabilities of the acquired Hermes, he calculated the value of goodwill as the difference between the entity's acquisition price and the value of its assets minus its liabilities. It amounted to: 44,097,218 rubles. – 4,097,218 rub. – (60,000,000 rub. – 7,100,000 rub.) = -12,900,000 rub.

Thus, when acquiring Hermes, a negative business reputation was formed. The accountant included it in other income in August (i.e., on the date of state registration of ownership of the acquired organization). At the same time, he made the wiring:

Debit 76 subaccount “Settlements for the acquisition of an enterprise” Credit 91-1 – 12,900,000 rubles. – negative business reputation is taken into account as part of other income.

In tax accounting, a negative business reputation in the amount of RUB 12,900,000. The accountant took it into account as income at the time of acquisition of Hermes, that is, in August.

Positive business reputation, that is, the excess of the purchase price over the book value of the organization, in tax accounting is considered a premium to the price paid by the buyer in anticipation of future economic benefits (paragraph 2, paragraph 1, article 268.1 of the Tax Code of the Russian Federation). The buyer recognizes such an allowance as a non-operating expense evenly over a period of five years, starting from the month following the month of registration of ownership of the acquired organization. Such rules are established in subparagraph 1 of paragraph 3 of Article 268.1 and subparagraph 20 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation. Moreover, if the organization uses the cash method, these expenses must be paid to the seller (clause 3 of Article 273 of the Tax Code of the Russian Federation).

Since the procedure for including positive business reputation in expenses in accounting and tax accounting differs, a taxable temporary difference arises in accounting (clause 12 of PBU 18/02). This leads to the formation of a deferred tax liability (clause 15 of PBU 18/02), which is reflected by the following entries:

Debit 68 subaccount “Calculations for income tax” Credit 77

– a deferred tax liability has been accrued from positive business reputation during the first five years after the purchase of the enterprise;

Debit 77 Credit 68 subaccount “Calculations for income tax”

– the deferred tax liability was written off in the period from the sixth to the twentieth year after the purchase of the organization.

An example of how positive business reputation is reflected in accounting and taxation

CJSC Alfa decided to acquire Torgovaya LLC. In August, a purchase and sale agreement was concluded, according to which the purchase price of Hermes (including VAT) was 110,970,698 rubles. The input VAT charged by the seller is RUB 10,970,698,000. In the same month, the organization was transferred to Alpha under a transfer deed signed by the parties. At the end of August, Alpha received a certificate certifying its ownership of the acquired organization. Alpha uses the accrual method and pays income tax monthly.

In accordance with the transfer act, the book value of the property of the acquired organization amounted to 40,000,000 rubles. The cost of short-term and long-term debt of the acquired organization amounted to 10,000,000 rubles.

After the accountant had recorded all of the assets and liabilities of the acquired Hermes, he calculated the value of goodwill as the difference between the entity's acquisition price and the value of its assets minus its liabilities. She compiled:

RUB 110,970,698 – 10,970,698,000 rub. – (40,000,000 rub. – 10,000,000 rub.) = 70,000,000 rub.

Thus, with the acquisition of Hermes, a positive business reputation was formed. The accountant included it as an expense in August (i.e., on the date of state registration of ownership of the acquired organization). At the same time, he made the following entries:

Debit 08 Credit 76 subaccount “Settlements for the acquisition of an enterprise” – 70,000,000 rubles. – the emergence of a positive business reputation is reflected;

Debit 04 Credit 08 – 70,000,000 rub. – positive business reputation is taken into account as part of intangible assets.

Every month, starting in September, the accountant takes into account depreciation charges in equal installments over 20 years or 240 months (20 years × 12 months):

Debit 20 (25, 26...) Credit 05 – 291,667 rub. (RUB 70,000,000: 240 months) – positive business reputation is taken into account as expenses.

In tax accounting, the accountant takes into account a positive business reputation (70,000,000 rubles) as expenses evenly over five years or 60 months (5 years × 12 months). Depreciation is accrued starting from September in the amount of RUB 1,166,667. (RUB 70,000,000: 60 months). At the same time, the accountant reflects the deferred tax liability:

Debit 68 subaccount “Calculations for income tax” Credit 77 – 175,000 rubles. ((RUB 1,166,667 – RUB 291,667) × 20%) – a deferred tax liability with positive business reputation is reflected.

After five years (after the positive business reputation has been completely written off in tax accounting), the accountant will repay the deferred tax liability monthly by posting:

Debit 77 Credit 68 subaccount “Calculations for income tax” – 58,333 rubles. (RUB 291,667 × 20%) – part of the deferred tax liability was written off from positive business reputation.

Business reputation as an intangible asset

Home — Articles

Business reputation occupies a special place among intangible assets, since it differs from other intangible assets in the valuation method, acquisition method, and depreciation method. Business reputation, taken into account as part of intangible assets, according to the norms of accounting legislation, arises only in connection with the acquisition of an enterprise as a property complex (in whole or part thereof) . In this article we will talk about what business reputation is, how it is determined and how it is reflected in the organization’s accounting. Since, as we said, business reputation arises in connection with the acquisition of an enterprise as a property set, we will consider the main civil law aspects of such a transaction, for which we turn to the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation). An enterprise as an object of rights in accordance with paragraph 1 of Art. 132 of the Civil Code of the Russian Federation recognizes a property complex used for carrying out entrepreneurial activities. An enterprise can act as the subject of business transactions and, in general, as a property complex is recognized as real estate. The composition of an enterprise as a property complex includes all types of property intended for its activities, including land plots, buildings, structures, equipment, inventory, raw materials, products, rights of claim, debts, as well as rights to designations that individualize the enterprise, its products, and work and services (company name, trademarks, service marks) and other exclusive rights, unless otherwise provided by law or agreement, as established by clause 2 of Art. 132 of the Civil Code of the Russian Federation. The legal basis for the sale of an enterprise is determined by part two of the Civil Code of the Russian Federation, namely paragraph 8 “Sale of an enterprise” Ch. 30 “Purchase and sale” of the Civil Code of the Russian Federation. Under the agreement for the sale of the enterprise in accordance with Art. 559 of the Civil Code of the Russian Federation, the seller undertakes to transfer the ownership of the enterprise as a whole as a property complex to the buyer, with the exception of rights and obligations that the seller does not have the right to transfer to other persons. The seller cannot transfer to the buyer, as part of the property complex being sold, the right to conduct certain activities, which was obtained by the seller on the basis of a license. The rights to the company name, trademark, service mark and other means of individualization of the seller and his goods (works, services), as well as the rights to use such means of individualization belonging to him on the basis of a license are transferred to the buyer, unless otherwise provided by the contract. The contract for the sale of an enterprise is concluded in writing, and failure to comply with the form of the contract entails its invalidity, which follows from Art. 560 Civil Code of the Russian Federation. The agreement is subject to state registration and is considered concluded from the moment of such registration. The procedure for registering an agreement is determined by Federal Law No. 122-FZ of July 21, 1997 “On state registration of rights to real estate and transactions with it.” We remind you that registration of the agreement is carried out on a paid basis. The state fee for state registration of rights to an enterprise as a property complex, an agreement on the alienation of an enterprise as a property complex is charged in the amount of 0.1 percent of the value of the property, property and other rights included in the property complex, but not more than 30,000 rubles. The size of the state duty is established by Art. 333.33 ch. 25.3 “State duty” of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation). According to Art. 561 of the Civil Code of the Russian Federation, the contract for the sale of an enterprise must determine the composition and cost of the enterprise being sold on the basis of a complete inventory. Guidelines for the inventory of property and financial liabilities were approved by Order of the Ministry of Finance of Russia dated June 13, 1995 N 49 “On approval of the Guidelines for the inventory of property and financial liabilities.” Before signing a contract for the sale of an enterprise, the following documents must be drawn up and reviewed by the parties, which are a necessary appendix to the contract: - inventory act; - balance sheet; — conclusion of an independent auditor on the composition and value of the enterprise; — a list of all debts (liabilities) included in the enterprise, indicating the creditors, the nature, size and timing of their claims. Ownership of the enterprise in accordance with Art. 564 of the Civil Code of the Russian Federation passes to the buyer from the moment of state registration of this right. The fact that business reputation can relate to the intangible assets of an organization is stated, in particular, in paragraph 55 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n. A similar provision is established by the Accounting Regulations “Accounting for Intangible Assets” PBU 14/2007, approved by Order of the Ministry of Finance of Russia dated December 27, 2007 N 153n (hereinafter referred to as PBU 14/2007). As stated in paragraph 4 of PBU 14/2007, business reputation arising in connection with the acquisition of an enterprise as a property complex (in whole or part thereof) is taken into account as part of intangible assets. Unfortunately, PBU 14/2007 does not provide a definition of business reputation, but in Section. VIII “Business reputation” explains in great detail the procedure for determining it. So, for accounting purposes, the value of acquired business reputation is determined by calculation as the difference between the purchase price paid to the seller when acquiring an enterprise as a property complex (in whole or part thereof), and the sum of all assets and liabilities on the balance sheet on the date of its purchase (acquisition ). This procedure for determining business reputation is established in clause 42 of PBU 14/2007. Business reputation can be either positive or negative. Which of them can be accounted for as an intangible asset? Positive business reputation , guided by clause 43 of PBU 14/2007, should be considered as a premium to the price paid by the buyer in anticipation of future economic benefits in connection with acquired unidentifiable assets, and taken into account as a separate inventory item. Negative goodwill is treated as a price discount given to the buyer. Such a discount is provided due to the lack of factors of the presence of stable customers, reputation for quality, marketing and sales skills, business connections, management experience, level of personnel qualifications and other similar factors. Negative business reputation in full is included in the financial results of the organization as other expenses, which is established by clause 45 of PBU 14/2007. Thus, only positive business reputation can be taken into account as an intangible asset . The cost of intangible assets with a certain useful life, as you know, is repaid through depreciation accrued over the useful life. To calculate depreciation, clause 28 of PBU 14/2007, three methods are provided - linear, the reducing balance method and the method of writing off the cost proportional to the volume of production (work). But with regard to writing off the value of positive business reputation, special rules have been established. According to clause 44 of PBU 14/2007, acquired business reputation is depreciated over twenty years (but not more than the life of the organization), and depreciation charges for positive business reputation are determined only by the linear method; other methods for calculating depreciation for business reputation are not applicable. How to reflect in accounting transactions for the acquisition of an enterprise as a property complex? An analysis of the Chart of Accounts for accounting the financial and economic activities of organizations and the Instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, shows that in this document there is no mention at all of business reputation and the procedure for its accounting. Consequently, an organization, guided by the existing Chart of Accounts, must independently develop a methodology for accounting for transactions related to the acquisition of an enterprise as a property complex, and consolidate it in an order on accounting policies for accounting purposes.

Example (numbers are conditional). In January, the purchasing organization acquires the enterprise as a property complex by concluding a purchase and sale agreement with the selling organization. The contract price is 44,000,000 rubles. (without VAT). The parties to the agreement signed a transfer act in the same month, according to which the book value of assets is 40,000,000 rubles, including: fixed assets - 34,000,000 rubles. (residual value); materials - 4,000,000 rubles; work in progress - 1,500,000 rubles; accounts receivable - 500,000 rubles. State duty for registering rights to an enterprise as a property complex in the amount of 30,000 rubles. paid by the buyer in the month of purchase. State registration of the right to the enterprise as a property complex was carried out in February. The parties to the agreement stipulate that transactions for the acquisition (sale) of an enterprise will be reflected in the accounting records of the buyer and seller organizations on the date the parties sign the transfer deed. The buyer decided to reflect transactions using account 76 “Settlements with various debtors and creditors” on a separate sub-account. The issues of accounting for VAT and the amount of state duty paid are not considered in the example. Debit 08 “Investments in non-current assets”, subaccount 08-4 “Acquisition of fixed assets”, Credit 76 “Settlements with various debtors and creditors” - 34,000,000 - the acquisition of fixed assets is reflected; Debit 01 “Fixed assets” Credit 08 “Investments in non-current assets”, subaccount 08-4 “Acquisition of fixed assets” - 34,000,000 - fixed assets acquired as part of the property complex were taken into account; Debit 10 “Materials” Credit 76 “Settlements with various debtors and creditors” - 4,000,000 - materials were accepted for accounting; Debit 20 “Main production” Credit 76 “Settlements with various debtors and creditors” - 1,500,000 - costs are reflected in work in progress; Debit 62 “Settlements with buyers and customers” Credit 76 “Settlements with various debtors and creditors” - 500,000 - accounts receivable are reflected; Debit 76 “Settlements with various debtors and creditors” Credit 51 “Settlement accounts” - 44,000,000 - funds were transferred to the seller under the purchase and sale agreement of the enterprise; Debit 08 “Investments in non-current assets”, subaccount 08-5 “Purchase of intangible assets”, Credit 76 “Settlements with various debtors and creditors” - 4,000,000 - positive business reputation is reflected; Debit 04 “Intangible assets” Credit 08-5 “Acquisition of intangible assets” - 4,000,000 - positive business reputation is included in intangible assets; Debit 68 “Calculations for taxes and fees” Credit 51 “Settlement accounts” - 30,000 - state duty paid. Positive business reputation, recorded on account 04 “Intangible assets”, will be taken into account monthly as part of the organization’s expenses for 20 years, starting from the month following the month in which ownership of the acquired enterprise was registered, in the amount of 16,666.67 rubles. (RUB 4,000,000 / 20 years / 12 months).

How is business reputation taken into account for corporate profit tax purposes ? It should be noted that Ch. 25 “Organizational income tax” does not contain the concept of “business reputation”; it is used only for accounting purposes. At the same time, the Tax Code, and in particular Art. 268.1 of the Tax Code of the Russian Federation establishes the features of recognizing income and expenses when acquiring an enterprise. For the purpose of calculating income tax, the income of an organization when purchasing an enterprise is the amount of excess of the value of the net assets of the enterprise as a property complex over its purchase price. Net assets, as you know, are nothing more than the difference between the amount of a company's assets and the amount of its liabilities. Specialists of the Ministry of Finance of Russia in Letter dated June 5, 2008 N 03-03-06/1/352 reminded taxpayers that the Procedure for assessing the value of net assets of joint-stock companies was approved by Order of the Ministry of Finance of Russia and the Federal Commission for the Securities Market dated January 29, 2003 N 10n, 03-6/pz. In accordance with clause 1 of the approved Procedure, the value of the net assets of a joint-stock company is understood as the value determined by subtracting the amount of its liabilities accepted for calculation from the amount of the assets of the joint-stock company accepted for calculation. That is, the excess of the value of the net assets of an enterprise as a property complex over its purchase price must be considered as a discount on the price provided to the buyer due to the lack of factors of the presence of stable buyers, reputation for quality, marketing and sales skills, business connections, management experience, level of qualifications of personnel and taking into account other factors. According to paragraph 2 of Art. 268.1 of the Tax Code of the Russian Federation, the amount of the discount received upon acquisition of an enterprise is defined as the difference between the purchase price and the value of the net assets of the enterprise as a property complex, determined by the transfer deed. For profit tax purposes, the discount received by the buyer is recognized as income in the month in which state registration of the transfer of ownership of the enterprise as a property complex was carried out. The taxpayer's expenses for profit tax purposes in accordance with paragraph 1 of Art. 268.1 of the Tax Code of the Russian Federation recognizes the difference between the acquisition price of an enterprise and the value of its net assets. That is, the expense will be the excess of the purchase price of the enterprise as a property complex over the value of its net assets. The excess is considered to be a premium to the price paid by the buyer in anticipation of future economic benefits. The amount of the premium paid on the basis of clause 2 of Art. 268.1 of the Tax Code of the Russian Federation is defined as the difference between the purchase price and the value of the enterprise’s net assets, determined by the transfer deed. Price surcharge in accordance with paragraphs. 1 clause 3 art. 268.1 of the Tax Code of the Russian Federation is recognized evenly over a period of 5 years, starting from the month following the month of state registration of the buyer’s ownership of the enterprise as a property complex. In accounting, the allowance (positive business reputation), as we said above, is taken into account as an expense for 20 years, which leads to differences between accounting and tax accounting data, and, accordingly, to the need to apply the Accounting Regulations “Accounting” calculations for corporate income tax" PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n.

The procedure for accounting for R&D expenses and creating reserves for them

Accounting for research and development work (R&D)

Accounting and tax accounting of intellectual property under a license (sublicense) agreement

We fill out the balance sheet: Line 1120 “Results of research and development”

Filling out the balance sheet: Line 1110 “Intangible assets”

BASIS: VAT

The acquisition (formation) of business reputation does not affect VAT (no input tax is generated). This is due to the fact that business reputation is not acquired on its own, but only within the framework of a purchase and sale agreement for an organization (Article 559 of the Civil Code of the Russian Federation).

The sale of an organization is, in turn, subject to VAT. Consequently, the amount of input tax presented by the seller for this transaction can be deducted. Do this in the general manner after taking into account all types of property included in the property complex. This follows from the totality of the provisions of Article 158, subparagraph 1 of paragraph 2 of Article 171, paragraph 1 of Article 172 of the Tax Code of the Russian Federation.

How it is used in practice

Suppliers are not always required to demonstrate qualifications and reliability. A positive example for the customer of assessing the business reputation of an organization is in procurement under Law No. 223. The organization has the right to establish those requirements that are provided for in the procurement regulations. And if the provision allows for a request for a certificate, the customer includes such a requirement in the procurement documentation. In such cases, the supplier is required to provide confirmation along with the application.

The situation is different according to the norms of 44-FZ. The Federal Antimonopoly Service considers the requirement for an OODR certificate to be redundant. If the customer includes such a condition in the documentation, the supplier has the right to appeal this to the FAS. As a result, the customer will have to make changes to the documentation or cancel the public procurement.

According to the judicial authorities, the assessment of the experience and business reputation of construction organizations is legitimate (clause 33 of the review of judicial practice No. 1 of June 10, 2020). Construction is a complex type of work that requires the contractor to have sufficient experience and proper qualifications. Customers have the right to demand such a certificate from construction enterprises even in procurement under 44-FZ.

simplified tax system

If an organization pays a single tax on the difference between income and expenses, do not take into account positive business reputation as expenses. This is explained by the fact that this type of expense is not named in Article 346.16 of the Tax Code of the Russian Federation.

Situation: is it necessary to take into account negative business reputation when calculating the single tax?

Answer: yes, it is necessary.

When calculating the single tax, income provided for in Articles 249 and 250 of the Tax Code of the Russian Federation (Article 346.15 of the Tax Code of the Russian Federation) is taken into account. That is, income accepted when calculating income tax. At the same time, simplified organizations do not take into account when calculating the single tax the income specified in Article 251, as well as income taxed at the rates established by paragraphs 3 and 4 of Article 284 of the Tax Code of the Russian Federation.

Negative business reputation (goodwill) is taken into account when calculating income tax on the basis of paragraph 1 of Article 250 of the Tax Code of the Russian Federation (paragraph 3 of paragraph 1 of Article 268.1 of the Tax Code of the Russian Federation). This means that, regardless of the object of taxation that the organization has chosen, income in the form of negative business reputation will also increase the base for the single tax (Article 346.15 of the Tax Code of the Russian Federation).

Similar clarifications are contained in the letter of the Federal Tax Service of Russia dated January 31, 2013 No. ED-4-3/1357.

In this case, take into account the income at the time of acquisition of the organization (i.e. on the date of state registration of the transfer of ownership of the property complex (Article 564 of the Civil Code of the Russian Federation, subparagraph 2, paragraph 3, Article 268.1 and paragraph 1, Article 346.17 of the Tax Code of the Russian Federation)).

Organizations using the simplified procedure are required to keep accounting records, including fixed assets and intangible assets (Clause 1, Article 2 of Law No. 402-FZ of December 6, 2011). Its goal is to control the residual value of property, which in total for all objects should not exceed 100,000,000 rubles. (Subclause 16, Clause 3, Article 346.12 of the Tax Code of the Russian Federation).

When a legal entity can demand protection of its business reputation

Lawyer Antonov A.P.

You can demand protection if information is disseminated that is defamatory, unreliable and negatively affects the attitude of clients, counterparties and other persons towards you. In this case, it is necessary that they be transferred to at least one person. Defamatory information can be expressed as facts or events. They can be checked. For example, was the payment of wages really delayed? The situation is different when the defamatory information is judgments and opinions of individuals. Then you can count on protection only if it is an insult.

1. What is the business reputation of a legal entity? The Civil Code of the Russian Federation does not disclose the concept of “business reputation”, but uses this term (see, for example, Article 152, paragraph 2 of Article 1027, paragraph 1 of Article 1042 of the Civil Code of the Russian Federation). The business reputation of an organization can be understood as its professional reputation, which it has earned among similar professionals (for example, businessmen) and persons towards whom the organization’s activities are directed (for example, consumers). This definition is proposed by the Supreme Court of the Russian Federation (Definition of the Supreme Court of the Russian Federation dated October 26, 2015 in case No. 307-ES15-5345, A56-17708/2014). Business reputation includes, among other things, the assessment of the activities of managers, management bodies and other employees of a legal entity. Therefore, it can be violated, including by belittling the professional reputation of its leader (clause 12 of the Review on disputes regarding the protection of honor, dignity and business reputation, approved by the Presidium of the Supreme Court of the Russian Federation on March 16, 2016, Ruling of the Supreme Court of the Russian Federation dated October 26, 2015 in the case N 307-ES15-5345, A56-17708/2014). Please note: widespread information about the manager as an individual (his business qualities, personal economic interests, political activities) does not affect the business reputation of the legal entity (clause 4 of the Review approved by the Presidium of the Federal Antimonopoly Service of the Ural District on July 31, 2009).

2. What is defamation and how does it relate to the dissemination of defamatory information Defamation is the dissemination of information discrediting business reputation, that is, the transfer to third parties of false information about an organization that may negatively affect its business reputation (clause 1 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated February 24, 2005 No. 3).

3. What is the dissemination of information? This is their communication in one form or another, including oral, to at least one person, for example (clause 7 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated February 24, 2005 N 3): publication, broadcast or demonstration in the media (in print, on radio and television, in newsreels, etc.); distribution on the Internet, as well as using other means of telecommunications; presentation in job descriptions, public speeches, statements addressed to officials. Thus, the methods of disseminating information are very diverse. To make it easier to prove the fact and nature (form) of distribution in the future, we recommend recording it, for example, making a video recording of the speech, saving a copy of the newspaper, having pages from the Internet certified by a notary, etc.

What is public speaking? This is one way to spread the word. There is no specific definition in the legislation. Public can be understood as speaking at a meeting, rally, or in front of a large audience. A similar definition can be found in specialized literature (see, for example, “Commentary to the Criminal Code of the Russian Federation. In 4 volumes. Special part. Sections VII - VIII,” ed. V.M. Lebedev). This is an important point, because sometimes the form of dissemination of information matters for the qualification of the offense. For example, if slander is spread in a public speech, the fine for it is greater than for ordinary dissemination of slander without qualifying features (Parts 1, 2 of Article 128.1 of the Criminal Code of the Russian Federation).

3.1. What is not dissemination of information This is, in particular: an appeal to state or local government bodies, to law enforcement agencies with a request to conduct an investigation into alleged violations. In this case, you can demand protection of business reputation if the applicant contacted the authorities solely with the aim of causing harm to you or insulted you (clause 5 of the Review of Judicial Practice of the Supreme Court of the Russian Federation No. 3 (2019), clause 9 of the Review of Disputes on the Protection of Honor and Dignity and business reputation, approved by the Presidium of the Supreme Court of the Russian Federation on March 16, 2016); communicating them to the person to whom this information concerns, if sufficient measures have been taken to ensure that the information does not become available to third parties (clause 7 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated February 24, 2005 N 3); familiarization of editorial staff with this information before the publication (broadcast) of mass media products (clause 23 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 15, 2010 N 16); transfer of information to a lawyer (Resolution of the Arbitration Court of the Far Eastern District dated September 30, 2019 N F03-4266/2019).

4. What information is considered defamatory? Defamatory statements include, in particular, the following statements (clause 7 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated February 24, 2005 N 3): about violation of the law (non-payment of taxes, employee fraud, raider takeover, etc. ); committing a dishonest act, such as deceiving clients; dishonesty in the implementation of production, economic and entrepreneurial activities (about the sale of low-quality goods); the introduction of bankruptcy proceedings against a legal entity, the revocation of its license, the presence of significant debts; violation of business ethics or business customs. For example, the statement that employees are rude to customers. 5. How to determine whether information is true Information can only be defamatory if it is untrue, that is, if it represents false, inaccurate or distorted statements of fact. They must be distinguished from evaluative opinions. Factual information, unlike an evaluative opinion, can be verified, and if it does not correspond to reality, it may be the basis for filing a claim for the protection of business reputation. For example, you can check the presence of debt, the ownership of a share in the organization by a specific person, the quality of the product, etc. (clause 5 of the Review on disputes regarding the protection of honor, dignity and business reputation, approved by the Presidium of the Supreme Court of the Russian Federation on March 16, 2016, clause 20 of the Review of Judicial Practice of the Supreme Court of the Russian Federation No. 1 (2017)). In addition, statements about facts or events that did not take place at the time to which this information relates will not correspond to reality (Decision of the Supreme Court of the Russian Federation dated December 18, 2018 N 305-ES18-11112).

6. Is it possible to demand protection if the information does not defame you, but is unreliable or is a value judgment? You can count on judicial protection if: 1) the information does not defame you, but is simply unreliable - only if you yourself prove to the court that it is untrue ( paragraphs 10, 11 of Article 152 of the Civil Code of the Russian Federation, Review of disputes on the protection of honor, dignity and business reputation, approved by the Presidium of the Supreme Court of the Russian Federation on March 16, 2016); 2) value judgments are made against you, and: they are made in an offensive form that humiliates your business reputation, honor and dignity. For example, you were accused of illegal actions (clause 6 of the Review of Disputes on the Protection of Honor, Dignity and Business Reputation, approved by the Presidium of the Supreme Court of the Russian Federation on March 16, 2016, clause 20 of the Review of Judicial Practice of the Supreme Court of the Russian Federation No. 1 (2017)); or an opinion that affects your rights and interests was disseminated by the media. In such a situation, you may demand to publish your answer with a different assessment in the same media (clause 9 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated February 24, 2005 N 3).

Sincerely, lawyer Anatoly Antonov, managing partner of the law firm Antonov and Partners.

Still have questions for your lawyer?

Ask them right now here, or call us by phone in Moscow +7 (499) 288-34-32 or in Samara +7 (846) 212-99-71 (24 hours a day), or come to our office for a consultation (by pre-registration)!

UTII

The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, the value of business reputation (both positive and negative) does not affect the calculation of the tax base.

Organizations that pay UTII are required to keep accounting records and submit reports in full. Such rules are established in Article 2 of the Law of December 6, 2011 No. 402-FZ. Therefore, when reflecting business reputation in accounting, apply the same rules as under the general taxation system.