Benefit for registering a pregnant woman 2022

If an expectant mother registers with doctors before 12 weeks of pregnancy, she is entitled to an additional incentive payment - an allowance for registration in the early stages of pregnancy.

The payment is not large, but its size is indexed annually. Such indexation will also occur in 2022, but not from the beginning of the year, but from February 1, 2022.

The amount of the mother's benefit for registration in the early stages of pregnancy in January 2022 is 675.15 rubles. From February 1, 2021, the benefit amount will increase to 708.23 rubles.

What you need to know about this payment in 2022:

1. The registration allowance is assigned only to a woman - an expectant mother.

2. The benefit is not paid to everyone without exception:

3. The benefit is paid only together with maternity benefits (hereinafter also referred to as B&R benefits). As a rule, if there is a right to a B&R benefit and a certificate from a medical institution about registration for up to 12 weeks (inclusive), then the expectant mother only has to write an application for payment for registration in the early stages of pregnancy.

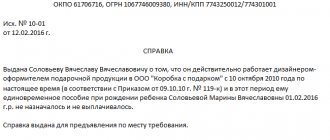

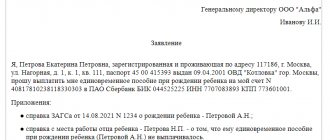

The employer (place of service, educational institution) needs to submit an application and documents for payment of benefits. Unemployed people eligible for benefits can contact the MFC or social security at their place of residence.

Compensation payments in Moscow and St. Petersburg 2022

In Moscow, the time frame for registering a pregnant woman has, in fact, been extended to 20 weeks of pregnancy. Expectant mothers who have permanent registration in the capital and are registered with a Moscow medical organization can apply for benefits with a certificate of registration for a period of up to 20 weeks.

When registering for pregnancy up to 20 weeks, a Muscovite will be paid 634 rubles. The amount of the benefit was approved by Decree of the Moscow Government dated November 27, 2007 No. 1005-PP as amended on May 20, 2020.

The Moscow benefit is not tied to the birth of a child. When a baby is born, parents can apply for other one-time payments and periodic benefits.

But in St. Petersburg the situation is a little different. Residents of the northern capital need to have a certificate of registration of the expectant mother for up to 20 weeks in order to receive a payment after the birth of a child of at least:

- 32,339 rubles - for the first;

- 43,122 rubles - for the second;

- 53,900 rubles - for the third and subsequent children.

In addition, the size of the payment in St. Petersburg is also affected by whether the pregnancy is multiple. If, for example, twins are born, then the children will be counted “in order”: first and second, and payment will be made for each (Social Code of St. Petersburg as amended from 10/07/2020).

Payments are often indexed. Therefore, at the time of publication of this article, we indicate “not less than.” The exact amount of payments for registration up to 20 weeks in St. Petersburg in 2022 may be higher.

Maternity benefit 2021

In 2022, most mothers will continue to receive B&R benefits. The conditions for its appointment are similar to those for assigning a federal benefit for registration.

If the expectant mother is an insured person 70 days before giving birth (she receives contributions to the Social Insurance Fund) or a student or unemployed due to the liquidation of her employer, she can take sick leave and count on benefits.

Let us remember that the amount of the benefit depends on the income of the mother in labor. As a general rule, income for the previous 2 years of work is taken into account. The amount of money received by the woman during this period is divided by the number of calendar days in these years and the “rate” of payment for each day of sick leave according to BiR is obtained. All that remains is to multiply the “rate” by the number of days on sick leave.

Regular sick leave according to BiR is issued for 140 days. However, if the mother has health problems, during multiple births, and in other similar cases, the number of days of sick leave according to the BiR may be increased.

If in previous periods there is not enough income or the mother worked for less than six months before going on maternity leave, the B&R benefit is calculated according to the current minimum wage.

When talking about the size of the BiR benefit in 2022, you should remember its maximum and minimum values. Both depend on the minimum wage, therefore changed from 01/01/2021:

- the maximum that can be received per day for sick leave according to BiR in 2021 is 2,434.25 rubles (accordingly, standard sick leave for 140 days cannot be paid in an amount greater than 340,795 rubles);

- minimum per day (those for whom benefits are calculated according to the minimum wage will receive) in 2021 - 420.56 rubles (for non-extended sick leave they will pay 58,878 rubles).

The general rules for calculating sick leave according to BiR do not apply to unemployed people who are entitled to receive benefits. They are calculated based on a fixed amount per month covered by sick leave. The “tariff” for a month is not very high: in January 2022 it is 675 rubles per month. From 02/01/2021 the size increased to 708 rubles.

Procedure for calculating benefits up to one and a half years

The actual benefit amount may differ significantly from both the minimum and maximum wages. Let's consider the procedure for its calculation.

The benefit amount is 40% of the estimated average monthly earnings, which is calculated as follows:

Average daily earnings x 30.4

Average daily earnings, in turn, are calculated as follows:

(Income for 1 year before parental leave + income for 2 years before parental leave): (730 - SD)

Where:

SD - insurance days:

- the mother being on sick leave on a previous maternity leave;

- releasing the mother from work while maintaining her salary, but without accruing insurance contributions to her.

The actual average daily earnings calculated using this formula are compared with the maximum (RUB 2,301.36986). If the actual one is greater than the maximum or equal to it, the benefit is calculated according to the maximum average earnings.

Example

A working woman receives benefits in 2022. Her income for the 2 years preceding the year in which she goes on maternity leave was: RUB 700,000. — in 2022, 800,000 rubles. - in 2022. In 2022, the woman went on sick leave for 10 days.

Let's calculate the actual average daily earnings:

(700,000 + 800,000) : (730 - 10) = 2,083.3333 rub.

The actual figure is less than the maximum figure (2,301.36986), so we calculate the average monthly earnings using it:

2,083.3333 x 30.4 = 63,333.33 rubles.

We calculate child care benefits:

(63,333.33: 100) x 40 = 25,333.33 rub. per month.

This benefit amount is paid for each full month a woman is on maternity leave.

If she was on maternity leave for less than a whole month, the benefit paid for it is calculated using the formula:

(P : Kdm) x Kdd

Where:

P - amount of benefit;

Kdm - the actual number of days in an incomplete month;

Kdd - the number of days of parental leave this month.

For each child, the benefit according to the formulas discussed above is calculated the same.

Pregnancy benefits for conscripts' wives 2022

This type of benefit is paid to pregnant spouses of men called up for military service.

The pregnancy of a spouse, if there are no children in the family, is not a reason for the spouse of conscription age to receive a deferment from compulsory conscription. At the same time, the state takes into account the peculiarity of the situation and pays additional benefits to such wives of conscripts.

Here's what you need to know about this benefit in 2022:

1. The payment is federal - that is, you can apply for it in any region of the Russian Federation.

2. Benefit - additional. Its receipt does not cancel the right to other maternity benefits, incl. regular B&R allowance.

3. The established amount of the benefit is subject to increase by the regional coefficient - wherever this is provided for by law for salary payments.

4. The basic benefit amount is indexed annually as of February 1, depending on the inflation rate in the previous year.

In January 2022, the basic amount of benefits for pregnant wives of military personnel is 28,511 rubles. From February 1, 2022 - increase to 29,908.04 rubles.

5. The spouse of a conscript with a pregnancy period of at least 180 days has the right to apply for benefits.

The benefit is assigned on an application basis. The application must be submitted with:

- a certificate from a doctor indicating the duration of pregnancy;

- a certificate from the husband about urgent military service (it can be obtained either from the commander of the military unit or from the military registration and enlistment office);

- passport and document confirming official marriage.

They submit everything to the social protection department or to the MFC (we recommend that you check in advance about submitting to the MFC, since sometimes such applications are not processed there).

How much pay

The monthly allowance for caring for one child is 40% of average earnings for the last two years. But those with high salaries will not be able to receive a lot of money on maternity leave; the law establishes a maximum child care benefit in 2022 - 29,600.48 rubles for a full calendar month. The benefit paid is increased by the regional coefficient where it is provided.

For two or more children, they pay up to a maximum of 100% of average earnings. The amount is determined by adding up the required payments in the amount of 40% of earnings for each child. For non-working parents or students, a minimum benefit of up to 1.5 years is provided in the amount of 7082 rubles 85 kopecks. The minimum payment is due for each child and does not change depending on the number of children. An increasing regional coefficient is applied to the minimum payment where it is established.

Every year on February 1, the government indexes social payments to the level of inflation (or higher) for the previous period. Thanks to this, the calculation of child care benefits in the maximum and minimum amounts is updated annually. In 2022, payments increased by 3%.

Additional regional benefits for pregnancy 2022

Additional support for expectant mothers is available in many regions of Russia. Moreover, its types differ, as do the final amounts of preferences in monetary terms.

For example, in Moscow there is an additional payment to the small federal B&R benefit for the unemployed who are entitled to it.

In many regions, instead of money, a pregnant woman is given something in kind: vitamins and medicines (as prescribed by a doctor), food.

To find out what else, in addition to the above, a pregnant woman can apply for, she needs to contact her regional social security department or health care institution.

One-time benefit for the birth of a child 2022

The birth of a baby in 2022 will mark the parents’ right to new social support measures from the federal and often regional budgets.

Federal lump sum benefit for the birth of a child 2021

Each newborn (adopted child) receives a one-time payment. Not only the mother, but also the father, as well as the person legally replacing them, can receive it.

At the beginning of 2022, payment is also expected to be indexed.

The one-time benefit for the birth of a child in January 2022 is 18,004.12 rubles. From 02/01/2021 - increase to 18,886.32 rubles.

Regional lump sum benefit at birth 2021

In addition to the federal payment, in various regions there are additional measures to support young parents.

We have already talked about the specifics of assigning payments at the birth of a child in St. Petersburg. There, the condition is that the expectant mother registers her pregnancy within a certain time frame.

In many regions, the condition for receiving additional payments when children are born is the low level of income of the family. To assign an additional payment, you must submit documents confirming your family’s income during the year prior to applying for benefits.

The amount of the assigned regional benefit depends on the region’s budget and local characteristics. The differences can be quite significant. Therefore, we will not dwell on this information in detail. We recommend that new parents consult their social security office or look up information on the regional government services website.

Child benefits

Child benefits are payments due to mothers or other guardians in order to provide the necessary minimum for the child. Also, these amounts are provided to compensate for part of the employee’s income during the period of caring for a newborn.

At the same time, several types of child benefits are paid. Each has its own specifics, conditions for receiving and amount. The amount of payments changes annually and is indexed. The procedure for calculating monetary allowance also changes taking into account the established calculation base.

Monthly allowance for child care up to 1.5 years

The monthly payment to a family member who actually cares for a child until he is 1.5 years old varies depending on the status of the caregiver.

Let us remind you that this benefit can be applied for by your mother or father or another close relative. But only one person. For example, you cannot receive payments to both mother and grandmother, even if in fact they are both caring for the child.

Childcare benefits for working people 2021

If a relative caring for a child is employed, then at work he needs to take parental leave for up to 1.5 years. In this case, the benefit will be calculated based on the average earnings in the 2 previous years of the caregiver.

The monthly benefit amount will be:

- 40% of average earnings - if the resulting amount exceeds the minimum wage;

- 40% of the minimum wage - if earnings for previous years were low.

For this benefit, there are minimum and maximum possible values:

- the maximum amount of child care benefits from January 1, 2021 is 29,600.48 rubles;

- the minimum calculated amount (according to the minimum wage) from January 1, 2022 is 4956.80 rubles, but not less than the benefit paid to unemployed caregivers.

Child care benefits for unemployed people

If a person caring for a child under 1.5 years old does not have a job at the time the benefit is issued, then he is still entitled to payments.

For such cases, the care allowance for up to 1.5 years is set at a fixed annual indexed amount.

Until 06/01/2020, the amount of benefits for non-working persons depended on whether it was the first child or the second and subsequent ones. From 06/01/2020, all persons caring for any child under 1.5 years old who are not employed will be paid 6,752 rubles.

The amount is subject to annual indexation in connection with inflation for the previous year as of February 1.

Child care benefit up to 1.5 years for those not working in January 2022 - 6,752 rubles.

The estimated value after indexation from February 1, 2022 is 7082.85 rubles.

Thus, employed citizens, for whom the amount of care benefits is calculated according to the minimum wage, must also receive at least 6,752 rubles in January 2021, and for the subsequent months of 2022 - at least 7,082.25 rubles.

Minimum benefit amount in 2020

Unemployed women and, in some cases, employed women receive a minimum child care benefit.

Minimum benefit for workers

The minimum amount of benefits is received (clause 1.1 of Article 14 of the Law of December 29, 2006 No. 255-FZ “On Compulsory Social Insurance...”):

- female employees who had no income for 2 years preceding maternity leave;

- workers who had income during this time, but small (not higher than the minimum wage).

The amount of the minimum benefit in 2022 for the first child for working women is 4,852 rubles. per month. It is calculated based on the minimum wage x 40%. The minimum wage is set annually (in 2022 it is 12,130 rubles ).

Minimum benefit in 2022 for a second child for working women :

- until 01/31/2020 - RUB 6,554.89. per month;

- from 01.02.2020 - 6,803.98 rub. per month (this is an estimated figure calculated using the formula: (6,554.89 x expected indexation factor 1.038)).

These amounts are calculated not from the minimum wage, but based on the nominal amount of the benefit for the second child of 3,000 rubles, enshrined in Art. 15 of Law No. 81-FZ “On State Benefits” (indexed since 2008, the benefit from 3,000 rubles increased by 2022 to 6,554.89 rubles).

Minimum benefit for non-workers

The basic amount of the minimum benefit for the first child for the unemployed is 1,500 rubles. (Article 15 of the Law of May 19, 1995 No. 81-FZ). This amount is indexed annually, as a result, by 2022 it increased from 1,500 rubles. up to RUB 3,277.45 The minimum wage for non-workers is not linked to the minimum wage.

Thus, if a woman is unemployed, the minimum wage for the first child will be:

- until 01/31/2020 - RUB 3,277.45. per month;

- from 02/01/2020 - RUB 3,401.99. per month (this is an estimated figure calculated using the formula: (3,277.45 x expected indexation ratio of 1.038)).

The benefit for a second child for a non-working woman is the same as for a working woman:

- until 01/31/2020 - RUB 6,554.89. per month;

- from 01.02.2020 - 6,803.98 rub. per month.

How the benefit amount was indexed by year can be seen from the table:

Monthly allowance for a child of a parent undergoing military service for conscription 2021

The monthly allowance for the child of a soldier undergoing military service upon conscription is paid to:

- the child's mother or a relative caring for him, if there is no mother. Officially appointed guardians are also entitled to this benefit. If there are actually several carers, the benefit is due to one person;

- from the day of the child’s birth, but not earlier than the day the child’s father begins military service;

- until the earlier of the dates - the day the child reaches the age of 3 years or the day the child’s father completes military service under conscription.

Receiving a monthly allowance for the child of a conscript does not cancel the right to other child benefits and does not depend on them.

The amount of the benefit is subject to annual indexation as of February 1.

The monthly allowance for a child undergoing conscription service in January 2022 is 12,219.17 rubles.

The expected benefit amount from February 1, 2022 is 12,817.91 rubles.

Where to apply for benefits

Since 2022, benefits are paid by the Social Insurance Fund directly to the employee or, in some cases, by the social protection authorities (for uninsured citizens). But you should contact your employer to receive the payment, regardless of who pays the child care benefit, if the parent or other relative is employed. Students and unemployed people contact:

- at the MFC at your place of residence;

- to social security authorities;

- through the State Services portal.

The period for application is from the moment of birth until the child reaches the age of 2 years (6 months after the child reaches the age of 1.5 years (Part 2.1 of Article 12 of Law No. 255-FZ)).

Monthly benefits for children under 3 years old 2022

The right to receive child benefits up to 3 years of age depends on several parameters:

- level of family poverty;

- age and order of appearance of the child (children);

- region of residence of the family.

Payments for the first and second child 2021

The first and second children born from 01/01/2018 are entitled to a monthly payment until the child reaches the age of three years.

What you need to know:

1. The payment is assigned if the income per person in a family (including children) is less than 2 subsistence minimums for the working population (hereinafter referred to as PMTN) established in the region of residence. The minimum for comparison is taken for the 2nd quarter of the year preceding the year the benefit was assigned.

EXAMPLE

PMTN in Moscow in the 2nd quarter. 2022 was 20,361 rubles. The family has two adults and two children aged 7 and 1. The monthly income is made up of the husband’s salary (100,000 rubles) and the wife’s care allowance for up to 1.5 years - 10,000 rubles. So, per capita income:

110,000 / 4 = 27,500 rubles.

This is less than double the PMTN in the region. A family can apply for benefits for a child under 3 years of age.

2. The payment is received by the woman who gave birth (adopted) a child. And only if something happened to her (she died, was deprived of parental rights), the payment can be made by the father or guardian.

3. The amount of the assigned payment is equal to the subsistence minimum established for children in the region of residence of the family. The minimum value is also taken for the 2nd quarter of the previous year.

EXAMPLE (CONTINUED)

When a payment is assigned for a child under 3 years of age in 2022, the mother will receive 15,450 rubles (children's cost of living in Moscow in the 2nd quarter of 2022).

4. The payment is scheduled for a year. If you have the right to receive it in the future, you must submit a separate application for renewal. The general order has been changed due to coronavirus in 2022. If government agencies do not have information about a change in the situation in the family (for example, moving to another region), the due payments are automatically extended. This procedure will remain in effect until March 1, 2021.

ADVICE

To determine your right to payment, you can use a special calculator on the Pension Fund website.

Maximum benefit amount in 2020

Only working women are entitled to receive the maximum wage. It is calculated based on the maximum monthly earnings taken into account for calculating benefits in 2022: RUB 69,961.64. x 40%. Thus, in 2022 the maximum child care benefit will be RUB 27,984.66. per month.

If there are two or more children, the total amount of benefits for the month should not exceed the maximum monthly earnings - 69,961.64 rubles. (Article 15 of Law No. 81-FZ, paragraph 2 of Article 11.2 of Law dated December 29, 2006 No. 255-FZ).

Why in 2022 exactly 69,961.64 rubles is taken for the maximum monthly earnings? The fact is that it is determined by the formula:

Mdz x Kd

Where:

Mdz - the maximum average daily earnings taken into account when calculating benefits in 2022 (2,301.36986 rubles - you will see how it is calculated a little lower);

Kd - estimated number of days in a month (30.4).

In turn, the maximum average daily earnings is calculated as follows:

St/730

Where:

St - the sum of the maximum values of the base for calculating contributions to the Social Insurance Fund for the previous 2 years (for a vacation starting in 2022, we take the bases for 2022 and 2022: 815,000 rubles and 865,000 rubles);

730 is the number of days in the two years preceding parental leave (if one year is a leap year, then we use the value 731 in the formula).

Therefore, in 2022, the maximum average daily earnings for benefits up to 1.5 years will be 2,301.36986 rubles. ((815,000 + 865,000) : 730). And the maximum monthly earnings are 69,961.64 rubles. (2301.36986 x 30.4).

Payments for children from 3 to 7 years old 2022

This payment is like a continuation of the previous one. However, it is only available to even less wealthy families.

If families where the income per member does not exceed 2 times the minimum subsistence level can count on payment for a child up to 3 years of age, then after the child is 3 years old, the income should be invested only in 1 subsistence minimum.

Otherwise, the calculation rules are the same as for benefits for a child under 3 years of age. In the same way, the PMTN value is taken for the 2nd quarter of the previous year. If the family's per capita income is less than 1st monthly wage in the region, then for each child from 3 to 7 years old a payment is due in the amount of ½ of the child's subsistence level.

From 01/01/2021, some families will have the right to a double benefit from 3 to 7. That is, the full cost of living in the region.

To receive double benefits, you need to calculate your family income again. But already taking into account the amounts received after the previous appeal. If the income per family member, even taking into account half the benefit, does not exceed the MTSI, the child benefit will be increased.

EXAMPLE

PMTN in St. Petersburg in the 2nd quarter. 2022 was 12,796.90 rubles. The family has two adults and two children aged 8 and 4 years. The monthly income consists of the husband’s salary (35,000 rubles) and the wife’s salary (working part-time) - 8,000 rubles. So, per capita income:

43,000/4 = 10,750 rubles

This is less than the PMTN in the region. A family can apply for benefits for a 4-year-old child.

The child minimum in St. Petersburg in the 2nd quarter of 2022 was 11,366.10 rubles. The usual benefit amount will be equal to half the child minimum - 5,683 rubles.

That is, the new income per family member, taking into account benefits, will be:

(43,000 5683) / 4 = 12,170 rubles

Which is still less than the subsistence level of 12,796.90 rubles. That is, in 2022, a family can qualify for a payment per child in the amount of the full child subsistence level of 11,366 rubles.

To determine your right to payment, use the calculator on the State Services website.

In 2022, benefits for children from 3 to 7 years old were not paid to guardians. However, the Ministry of Labor has already submitted a bill to legislators for consideration that would allow low-income custodial families to apply for benefits in 2022.

Maternity capital in 2021

In 2022, the amount of maternity capital will be increased:

- those whose right to it arose before 01/01/2020, as well as for those whose first child was born (adopted) from 01/01/2021, the maternity capital will be 483,881.83 rubles. (Federal Law dated December 8, 2020 No. 385-FZ);

- those who have the right to this measure of support in connection with the birth (adoption) of their first child will receive an increase of 155,550 rubles upon the birth of the second from 2021;

- for persons whose right to maternity capital arose in connection with the appearance of a second or third and subsequent children in the family, starting from 01/01/2020, if such a payment was not previously made, the amount of maternity capital in 2022 will immediately amount to 639,431.83 rubles.