The most common benefits compensated by the Social Insurance Fund are benefits for temporary disability, care for a family member, maternity benefits, as well as monthly child care benefits for children under 1.5 years of age. They all have their own differences in calculation. This also applies to the billing period. In the article we will tell you about the days excluded from the calculation of sick leave and give examples of calculation.

For some benefits there are so-called non-insurance periods. Below, for comparison, calculations by type of benefits will be given in order to consider the differences between them regarding the non-inclusion of certain days when calculating average earnings. Below, for convenience, it will be abbreviated as SDZ. And the average salary is SZ.

How to apply for sick leave

The certificate of incapacity for work confirms that the person was absent from the workplace for a valid reason.

Temporary disability or maternity benefits are calculated on the basis of sick leave. Sick leave certificates are issued by medical institutions that have the appropriate license.

Until 2022, a ballot could be issued in one of two ways:

- On paper.

- Electronic.

In 2022 and beyond, it is permissible to generate certificates of incapacity for work only in electronic form (Part 6, Article 13 of Federal Law No. 255-FZ of December 29, 2006; see “Starting 2022, electronic sick leave will be generated without the patient’s consent”). At the same time, ballots issued on paper in 2022, and presented in 2022, will be accepted and paid for (see “The FSS reported whether paper sick leave issued last year will be accepted for payment”).

Work with electronic sick leave and submit all related reporting through Kontur.Extern

Doctors create an electronic certificate of incapacity for work (ELN) in the unified integrated information system “Social Insurance” online. FSS employees inform the employer about the closure of the bulletin, and he sends the information necessary to calculate the benefit, and also pays for the first 3 days of illness.

IMPORTANT. To work with electronic electronic signature, an organization must complete the following steps: enter into an appropriate agreement with the regional office of the Social Insurance Fund, purchase an enhanced qualified electronic signature and install the necessary software.

Receive an enhanced qualified electronic signature certificate in an hour

Comparative table of charges relating to non-insurance periods

Accruals relating to non-insurance periods:

| Disability category | Withdrawals from the insurance period | Who pays |

| The worker himself | No | 3 days – enterprise, others – Social Insurance Fund |

| Caring for a family member | No | FSS |

| Pregnancy and childbirth | sick days; child care up to 1.5 years old; decree; exemption from work with pay | FSS |

| Child care up to 1.5 years old | Same | FSS |

Filling out a sick leave certificate

The sick leave form was approved by order of the Ministry of Health and Social Development dated April 26, 2011 No. 347n. It consists of two sections.

Information for the first section is entered into the system by doctors.

The information for the second section is provided by the employer. This must be done according to the rules approved by Decree of the Government of the Russian Federation dated November 23, 2021 No. 2010. In particular, it is necessary to indicate the insurance period; the amount of payments included in the base for calculating insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity; data on working hours (with a part-time schedule), etc.

How to transfer this information to the fund? Place it in the Social Insurance system and verify it with an enhanced qualified electronic signature. These actions must be completed no later than 3 business days from the date of receipt of data on the closed electronic insurance policy (Part 8 of Art. Law No. 255-FZ; see “Information about insured persons: what data and when will have to be submitted to the Social Insurance Fund in 2022” ). Next, the information will automatically be sent to the FSS.

Calculation of average earnings for sick leave in 2022

The rules for calculating sick leave are set out in the regulation on the specifics of the procedure for calculating benefits for temporary disability and pregnancy and childbirth (approved by the Decree of the Government of the Russian Federation, Decree of the Government of the Russian Federation dated September 11, 2021 No. 1540; see “New rules for calculating sick leave, maternity and child benefits have been approved”) . To correctly calculate benefits, you first need to calculate the employee's average earnings. To do this you will need to perform a number of actions.

Free calculation of average earnings according to current rules

Determine the billing period

As a general rule, the calculation period includes two calendar years preceding the year in which the illness occurred or maternity leave began. For a ballot opened in 2022, the calculation period is 2022 and 2022.

An exception is provided for women who were on maternity leave or maternity leave during the billing period. They are allowed to carry forward one or two years. The basis is a written statement from the employee.

Example 1.

Let's assume the employee gets sick in February 2022. The calculation period for it is the period of time from January 1, 2022 to December 31, 2022 inclusive. But since the woman was on maternity leave in 2022, and on maternity leave in 2022, she wrote a request for a transfer. As a result, the new calculation period included the years 2022 and 2022.

Calculate average earnings

It consists of the amounts that the employee received in the billing period and from which contributions to compulsory social insurance were transferred.

Calculate your salary and benefits taking into account the annual increase in the minimum wage Calculate for free

Compare with the maximum permissible base value

The average earnings for calculating benefits cannot be as large as desired. It is permissible to take it into account only in the part that does not exceed the maximum value of the base for contributions in case of temporary disability and in connection with maternity. This value is approved by the Government of the Russian Federation every year.

IMPORTANT. It is necessary to compare the average earnings in the billing period with the base limits in force at that time. It is necessary to compare not the total figure, but data for each year separately (example in Table 1).

Table 1

An example of comparing average earnings with the base limits

| Indicators | Billing period | |

| 2020 | 2021 | |

| Limit value of the base for the corresponding year | 912,000 rub. | RUB 966,000 |

| Average earnings | 880,000 rub. (does not exceed) | 990,000 rub. (exceeds) |

| Amount taken into account when calculating sick leave Total: | 880,000 rub. | RUB 966,000 |

| RUB 1,846,000 (880 000 + 966 000) | ||

Compare with minimum wage

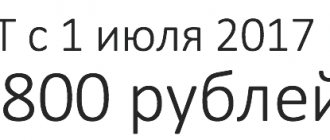

Average earnings must be greater than or equal to the minimum wage that was in effect on the date of the onset of illness or maternity leave. Otherwise, the benefit should be calculated based on the minimum wage.

The FSS, in letter dated 03/01/11 No. 14-03-18/05-2129, recommends comparing two values of average daily earnings: actual and based on the minimum wage. You need to do the following:

- Divide actual average earnings by 730 days.

- The minimum wage on the date of onset of illness or maternity leave is multiplied by 24 months and divided by 730 days.

- If the first value is greater than or equal to the second, calculate sick leave based on the first value. If the first value is less than the second, calculate the benefit based on the second value (example in Table 2).

table 2

An example of comparing two values of average daily earnings (actual and based on the minimum wage)

| Date of onset of illness | January 25, 2022 |

| Average earnings for the billing period (2020 and 2022) | 83,000 rub. |

| Minimum wage for 2022 | RUB 13,890 |

| Actual average daily earnings | RUB 113.7 (RUB 83,000: 730 days) |

| Average daily earnings based on the minimum wage | RUB 456.66 (RUB 13,890 x 24 months: 730 days) |

| Conclusion: | Since the actual average daily earnings are less than this figure calculated based on the minimum wage, the benefit must be calculated according to the minimum wage |

REFERENCE. In some cases, the benefit cannot exceed the minimum wage for a full calendar month, multiplied by the regional coefficient (if any), even if the actual average earnings exceed the minimum wage. This rule applies in the following situations: the employee’s insurance period is less than 6 months; the patient violated the regime prescribed by the doctor, or did not show up for examination, etc.

Find average daily earnings

For temporary disability benefits, in the general case, it is equal to the average earnings for the billing period (taking into account the maximum value of the base), divided by 730 days.

For maternity benefit (BIR) it is generally a fraction. The numerator is the average earnings for the billing period (taking into account the maximum value of the base). The denominator is the number of calendar days in the billing period minus the number of calendar days falling within the excluded period.

The excluded period includes days of illness, maternity leave, maternity leave for children up to one and a half years old, and days when a woman was released from work according to Russian laws with full or partial retention of wages (if contributions were not paid from the payments in case of temporary disability and in connection with motherhood).

Example 2 . The average salary of an employee in the billing period is 950,000 rubles, the base limit has not been exceeded. The number of calendar days of the billing period is 730. Of these, the employee was on sick leave for 20 calendar days (excluded period). The average daily earnings is 1,338.03 rubles (950,000 rubles: (730 days - 20 days)).

If the benefit is calculated based on the minimum wage, then the average daily earnings are equal to the minimum wage (as of the start date of the bulletin), multiplied by 24 months and divided by 730 days. For part-time work, a coefficient corresponding to the length of working time is added to the formula.

Calculate your salary and benefits taking into account the increase in the minimum wage in 2022 Calculate for free

Replacing the billing period

If during the billing period the employee was on maternity leave or child care leave, she can replace the corresponding calendar years (year) from the billing period with the previous calendar years (year) by submitting the appropriate application. Provided that this will lead to an increase in the benefit amount. This is stated in Part 1 of Article 14 of the Law of December 29, 2006 No. 255-FZ and paragraph 11 of the regulations approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375.

The billing period can only be replaced by those years (year) that immediately precede the occurrence of the insured event. For example, a woman was on maternity leave or child care leave in 2014–2015, and a new insured event occurred in 2016. Then 2014 and (or) 2015 can only be replaced by 2013 and (or) 2012. You cannot take any years that were before 2014–2015.

Such clarifications are given in the letter of the Ministry of Labor of Russia dated August 3, 2015 No. 17-1/OOG-1105.

What if the employee was first on maternity leave and then on parental leave for up to three years in the period from 2012 to 2015? Then, to calculate the benefit, you can take 2011 and 2010. At the same time, there is no need to recalculate benefits that were assigned and paid before the release of the letter of the Ministry of Labor of Russia dated August 3, 2015 No. 17-1/OOG-1105.

Such clarifications are given in letters of the FSS of Russia dated November 11, 2015 No. 02-09-14/15-19989 and No. 02-09-14/15-19937, dated November 9, 2015 No. 02-09-14/15- 18677.

When replacing a pay period, benefits must be calculated based on the actual number of calendar days in the replacement years. Their number can be 730, 731 (if one of the replacement years is a leap year) or 732 (if both replacement years are leap years).

This conclusion follows from Part 3.1 of Article 14 of the Law of December 29, 2006 No. 255-FZ and is confirmed by information from the Federal Social Insurance Fund of Russia.

An example of determining the calculation period for paying maternity benefits if the employee was on maternity leave two years before the start of maternity leave

Secretary E.V. Ivanova has been working in the organization for five years. During 2014 and 2015, she was on maternity leave and then on parental leave.

Ivanova started working in March 2016. And from September 2, 2016, she again goes on maternity leave. During the billing period, Ivanova received only maternity benefits and child care benefits. These benefits are not subject to contributions to the Russian Social Insurance Fund. Consequently, Ivanova does not have earnings in the billing period for calculating maternity benefits. In such a situation, the accountant needs to calculate benefits based on average monthly earnings in the amount of the minimum wage.

However, Ivanova can receive maternity benefits, calculated based on earnings not for 2014 and 2015, but for previous periods (for 2013 and 2012). For this she wrote a statement.

Thus, the calendar years included in the calculation period (2014 and 2015) were replaced by the previous calendar years (2013 and 2012).

Percentage of length of service when calculating sick leave

When calculating temporary disability benefits, the average daily earnings must be multiplied by the percentage of length of service:

- if the experience is less than 5 years - by 60%;

- if the experience is from 5 to 8 years - by 80%;

- if the experience is 8 years or more - 100%.

REFERENCE. The length of service is determined by the work book (paper or electronic). If it is not there, use employment contracts and certificates from previous places of work. This is stated in paragraph 9 of the Rules for calculating and confirming insurance experience (approved by order of the Ministry of Labor dated 09.09.20 No. 585n).

When paying BIR benefits, the average daily earnings are always multiplied by 100%.

Payment for common illness

Performed during illness or injury, including:

- termination of pregnancy;

- in vitro fertilization.

In these cases, the FSS issues compensation starting from the 4th day of illness. From 1st to 3rd costs are borne by the company. When calculating payments, the insurance period is taken into account. This is the period of time during which insurance premiums were paid for the employee. How accruals depend on the number of years of experience is shown below.

| Number of years of experience | Percent | Base |

| Up to 5 | 60% | SDZ |

| 5-8 | 80% | SDZ |

| After 8 | 100% | SDZ |

The calculation of sick leave benefits is carried out in accordance with an algorithm by which the values are multiplied:

- SDZ.

- Percentage of experience.

- Calendar days during incapacity.

| ★ Best-selling book “Calculating sick leave and insurance premiums in 2018” for dummies (understand how to calculate insurance premiums in 72 hours) 3000+ books purchased |

Rules and procedure for calculating sick leave in 2022

The amount of the benefit is equal to the average daily earnings (taking into account the percentage of length of service) multiplied by the number of calendar days of illness according to the certificate of incapacity for work. If the bulletin was issued in connection with pregnancy and childbirth, then the number of calendar days of sick leave is generally 140.

There is an additional limitation. It applies to a situation where the temporary disability benefit, calculated on the basis of average daily earnings and length of service, does not reach the minimum wage calculated for a full calendar month (in 2022 it is equal to 13,890 rubles). Then sick leave should be paid in the amount of the minimum wage for a full calendar month. In this case, the amount of the daily benefit is equal to the minimum wage divided by the number of calendar days of the month in which the illness occurs. The total benefit is the daily benefit multiplied by the number of calendar days of sickness in each calendar month. If a regional coefficient is introduced, then the minimum wage is determined taking into account this coefficient (for more details, see: “Sick leave in 2022: the temporary procedure for calculating benefits was made permanent”).

In case of illness or injury, the organization pays for the first three days of the bulletin, the remaining days are paid for by the fund. In case of BIR, quarantine and in a number of other cases, the FSS pays for all days (Article 3 of the Federal Law of December 29, 2006 No. 255-FZ).

Calculate salary and personal income tax with standard deductions in the web service

Monthly assistance provided when caring for a child up to 1.5 years old

Paid to any family member actually caring for the child. Its size is 40% of the NW.

The benefit is calculated according to the following algorithm:

SDZ is calculated. SZ for 2 years is divided by the number of calendar days, excluding periods of stay:

- on a sick leave;

- on maternity leave;

- on vacation with a child under 1.5 years old;

- during the period of release from work while maintaining payment.

SDZ is multiplied by 30.4 and 40%.

Example 3. Manager Kolesnikova I.K. plans leave to care for a child up to 1.5 years old in May 2022. Her working career began in December 2014. In 2015, she was on maternity leave.

- The sum of days for calculation is 365+366 = 731. 140 days must be subtracted from this period. 731 – 140 = 591

- Earnings 2015 – 425,000.55 rubles, 2016 – 331,551.76 rubles.

- 425000.55 + 331551.76 = 765552.31 rub.

- SDZ = 756552.31: 591 = 1280.12*60% = 768.07 rub.

- The benefit is equal to: 768.07 x 30.4 x 40%. = 9339.73 rub.

When calculating the SDZ for child care benefits up to 1.5 years old, the days that fell on maternity leave were subtracted from the number of people actually worked. The entire benefit amount comes from social insurance.

Minimum and maximum disability benefits in 2022

The maximum average daily earnings is 2,572.6 rubles ((912,000 rubles + 966,000 rubles): 730 days).

The maximum benefit for BIR in the general case is 360,164 rubles ((912,000 rubles + 966,000 rubles): 730 days × 140 days).

Temporary disability benefit, calculated based on the minimum wage (provided that the work experience is more than 8 years) - 456.66 rubles. per day (RUB 13,890 × 24 months: 730 days).

The BIR benefit, calculated based on the minimum wage in the general case, is 63,932.4 rubles (13,890 rubles × 24 months: 730 days × 140 days).

Temporary disability benefit based on the minimum wage for a full month:

in April, June, September, November - 463 rubles. per day (RUB 13,890: 30 cal days);

in January, March, May, July, August, October, December - 448.06 rubles. per day (RUB 13,890: 31 cal days);

in February - 496.07 rubles. per day (RUB 13,890: 28 cal days).

Reference data for calculating sick leave in 2022. Table.

| Indicator for calculating sick leave in 2022 | Indicator value in 2022 |

| Billing period | 2016 and 2022 |

| Number of days in the billing period | 730 days |

| Minimum wage | 9489 rub. |

| Limit earnings for calculating sick leave | 2016 – 718,000 rubles. 2022 – RUB 755,000. Amount: 2016 + 2022 = RUB 1,473,000. |

| Maximum average daily earnings | 2017.81 rub. |

| Minimum average daily earnings | RUR 311.97 |

Examples of calculations

Example 3

The employee was sick from March 1 to March 11, 2022, and was in the hospital. On March 6, he violated the regime, and the doctor made a note about this on the sick leave. The period from March 6 to March 11 was paid based on the minimum wage.

The employee's length of service is 13 years, the actual average daily earnings are 1,900 rubles.

The amount of the benefit was:

- for the period from March 1 to March 5 - 9,500 rubles (1,900 rubles × 5 days), incl. at the expense of the employer - 5,700 rubles (1,900 rubles x 3 days);

- for the period from March 6 to March 11 - 2,558.4 rubles (426.4 rubles × 6 days).

The total benefit amounted to 12,058.4 rubles (9,500 + 2,558.4).

Example 4

The woman was issued a certificate of incapacity for work according to the BIR. The start of maternity leave is February 18, 2022. As of this date, the insurance period is 5 months.

The benefit is calculated based on the minimum wage in the amount of 63,932.4 rubles

Work with electronic sick leave with a “complicated” salary with bonuses and coefficients

Are weekends included in sick pay?

The question of whether weekends are included in sick leave can be answered unequivocally: yes, these days are paid in the same way as workers included in sick leave. The calculation of average earnings is the same for them, however, there are periods during which sick days are not paid (neither workdays nor weekends). According to Art. 9 of Law No. 255-FZ, such time periods include:

- detention of an employee;

- vacation at your own expense;

- administrative arrest;

- downtime, if the illness occurred during this period;

- period of forensic medical examination;

- the period of suspension of an employee from work, provided that no salary was accrued to him.

The FSS explains: “Should I pay benefits if a person gets sick on vacation at his own expense?” .

Limitation of the paid period

There are exceptions when not all sick days are paid. One of them is provided for people working under a fixed-term employment contract concluded for less than six months. In general, benefits can be accrued to such employees for no more than 75 calendar days under this agreement.

There are exceptions for people who have taken out a ballot to care for relatives. For example, when caring for a child from 7 to 15 years old, one sick leave is paid for no more than 15 calendar days, and in a total year it is permissible to pay no more than 45 calendar days (Article 6 of Law No. 255-FZ).

Typical errors when calculating

Mistake #1. Payment of benefits related to the illness of relatives.

As can be seen from Tables 5 and 6, the time during which a worker can count on receiving compensation for caring for sick relatives is limited. But the issuance of sick leave as such does not depend on these restrictions. The accounting service should be responsible for keeping track of the days that need to be paid. Although absences on restricted days will be considered excused absences, they will not be paid. It is a mistake to pay in full for the period corresponding to the sick leave.

Mistake #2. The benefit for a dismissed employee must be calculated at 60%.

If an employee quits and during the following thirty calendar days an illness or injury occurs, then the enterprise is obliged to pay him for the days of absence. In this case, his insurance experience is not taken into account; he can only claim 60% of the SZ. In this case, the period of working capacity is not limited. It is a mistake to pay sick leave in full.

Deadlines for sick pay in 2022

Starting from 2022, the following system will apply in all regions. The employee receives temporary disability benefits for the first 3 days from the employer, for all other days - directly from the Social Insurance Fund. The BIR benefit in full is directly from the FSS (see “Starting from 2021, in all regions of Russia, benefits will be paid directly from the FSS”).

The Fund is obliged to assign and pay its part of the benefit within 10 working days from the moment the policyholder entered the necessary information into the Social Insurance system (Part 1, Article 15 of Law No. 255-FZ). Employers typically provide their portion of the benefit along with the salary or advance payment.

Documents for applying for child benefit

The benefit is assigned if a written application for its appointment is made no later than 6 months from the date the child reaches the age of 1.5 years.

Citizens subject to compulsory social insurance in the Social Insurance Fund must apply for benefits at their place of work (service) in case of taking parental leave to care for a child under 3 years of age.

It is important to understand here that care leave is given up to 3 years , and benefits are paid only until the child reaches the age of one and a half years .

Citizens who are not subject to compulsory social insurance (i.e., unemployed) apply for the assignment of this benefit to the social protection authorities at their place of residence.

When applying for benefits at your place of work, you need the following documents:

- Information about the insured person. They can be filled out once, and if there are no changes in them, then used for each subsequent assignment of benefits from the Social Insurance Fund;

- application for benefits - in free form;

- birth (adoption) certificates - for all children of the applicant;

- certificate of non-receipt of benefits by the second parent (issued at the place of work or at the social security department);

- a certificate of the amount of salary for calculating benefits from the previous place of work (if you have been working for this employer for less than 2 years);

- certificate of non-receipt of benefits at the second place of work (for part-time workers).

When applying for benefits to social security authorities, you may need the following documents:

- parents' passports;

- birth certificates of all children;

- work record (certificate, diploma, military ID);

- an extract from the work book about the last place of work (certified by a specialist upon presentation of the work book);

- certificate of non-receipt of benefits and non-use of care leave by the second parent;

- a document confirming the fact that the child lives together with one of the parents;

- a certificate from the employment center about non-receipt of payments;

- bank details addressed to the applicant - for transferring benefits;

- an order for the appointment of parental leave at the place of former work and a certificate of payment and period of assignment of benefits (if the child’s mother was dismissed due to the liquidation of the organization during parental leave or while on sick leave for pregnancy and childbirth);

- certificate of study and certificate of granting (non-granting) maternity leave at the place of study (if the applicant is a full-time student);

- certificate of registration as an individual entrepreneur and a certificate from the Social Insurance Fund confirming the absence of registration with the Social Insurance Fund as an insurer and the non-receipt of the monthly benefit of the individual entrepreneur at the expense of compulsory insurance funds (individual entrepreneurs not registered with the Social Insurance Fund as an insurer);

- other additional documents.

It is better to clarify the list of documents for social protection before applying directly, as it may differ.

Example 6. Calculation of sick leave if the company has a part-time working day

Secretary of the director Marinina I.P. works 4 hours a day, 5 days a week. She was sick in January. After returning to work, I brought sick leave for 5 calendar days to the accounting department. Her earnings in the billing period were: - in 2016 - 50,000 rubles, - in 2017 - 65,000 rubles. The insurance experience is just over 5 years. The average daily earnings from actual payments will be: (50,000 rubles +65,000 rubles): 730 days. = 157.53 rub. We compare with the average daily earnings calculated from the minimum wage - 311.97 rubles. The amount we calculated is 157.53 rubles. less than the amount calculated from the minimum wage. Next, to calculate, we take the amount that is larger. This is the amount calculated from the minimum wage: 311.97 rubles. We adjust the average daily earnings by the part-time factor: 311.97: 8 hours × 4 hours = 155.98 rubles. We will calculate the benefit taking into account the length of service: 155.98 rubles. × 80% × 5 days. = 623.92 rub.

Example 3. Calculation of sick leave 2022 from the minimum wage

A new employee has joined the company.

Due to the difficult economic situation in his region, he could not find work for a long time and did not work in 2016 and 2022. After working for about a month, he fell ill. A week later, he brought sick leave for 5 calendar days. Since the employee did not receive wages in the billing period (2016-2017), the accounting department must calculate sick leave benefits based on the minimum wage. First, we determine the average earnings: 9,489 rubles. × 24 months : 730 days = 311.97 rubles. The employee’s work experience is 4 years 3 months, so his benefit will be 60% (up to 5 years) of average earnings. The benefit calculation looks like this: 311.97 × 5 × 60% = 936, 91 rub. A similar situation in which there is no earnings in the billing period will occur for employees returning from maternity leave. If there was no income, you need to calculate sick leave benefits from the minimum wage, taking into account your length of service.