Under what circumstances is financial assistance exempt from insurance premiums?

Financial assistance is exempt from insurance premiums in the following cases:

- If one employee is provided with financial assistance in the amount of up to 4,000 rubles within the billing period (subclause 11, clause 1, article 422 of the Tax Code of the Russian Federation).

- If financial assistance is issued at a time as compensation for material damage resulting from emergency circumstances, natural disasters, as well as if individuals suffered from terrorist attacks (subclause 3, clause 1, article 422 of the Tax Code of the Russian Federation).

- If financial assistance is allocated as a lump sum due to the death of an employee’s family member (subclause 3, clause 1, article 422 of the Tax Code of the Russian Federation).

- If financial assistance is allocated to an employee of the organization due to the birth or adoption of a child (subclause 3, clause 1, article 422). Amounts of such assistance must be allocated in the first year after birth or adoption, and the non-taxable limit is set at RUB 50,000. Each parent has the right to receive the above amount (letters from the Ministry of Finance dated May 16, 2017 No. 03-15-06/29546, dated November 16, 2016 No. 03-04-12/67082, Ministry of Labor dated October 27, 2015 No. 17-3/B-521 , dated January 21, 2015 No. 17-3/B-18 (clause 1), dated November 20, 2013 No. 17-3/1926).

For information about what documents are required to receive financial assistance in connection with the birth of a child, read the article “How to apply for financial assistance to an employee?”

At the birth of a child

In this case, a limit of RUB 50,000 applies. in year. Each parent has the right to receive funds in connection with the birth or adoption of a child (letter of the Ministry of Finance No. 03-15-06/29546 dated May 16, 2017). If the income was paid in the first year after the occurrence of the event, then personal income tax and insurance contributions for financial assistance at the birth of a child in 2022 are not charged in the amount of 50,000 rubles. (clause 8 of article 217, subclause 3 of clause 1 of article 422 of the Tax Code of the Russian Federation). Amounts above this limit are taxed in accordance with the generally established procedure.

How is the allocation of financial assistance in an organization formalized?

To allocate financial assistance, the manager must issue a special order. An application written in any form is required from the employee who needs help. Supporting documents should be attached to it, which can be a birth or adoption certificate of a child, a death certificate of a family member, etc.

In the payment document, in the column “Base of payment”, the accounting department must indicate the number and date of the manager’s order to allocate financial assistance. If payments are made in tranches rather than in a lump sum, such a link should be included in each payment document.

When financial assistance is subject to insurance premiums

In all other cases not specified in the previous paragraph, financial assistance, if provided to employees, becomes subject to insurance contributions. This norm is contained in subsection. 11 clause 1 art. 422 of the Tax Code of the Russian Federation.

The deadlines for making contributions are as follows: according to clause 3 of Art. 431 of the Tax Code of the Russian Federation, the payer of insurance premiums is obliged to transfer them to the budget no later than the 15th day of the month following the month of accrual.

Example:

The collective agreement of Omega LLC contains a provision according to which employees of the organization have the right to receive financial assistance. The decision to allocate it is the prerogative of the manager, whose order indicates the corresponding amounts.

In February 20XX, an employee of the enterprise, A.S. Chizhikov, in accordance with his application, was provided with financial assistance in the amount of 29,000 rubles. for paid treatment of the spouse during pregnancy.

In May 2020, another financial assistance was allocated to him, but in connection with the birth of a child - in the amount of 30,000 rubles.

As a result, contributions to compulsory social insurance will be charged only from 25,000 rubles. (29,000 – 4,000), since the non-taxable amount in the first case is 4,000 rubles. And financial assistance issued at the birth of a child is not subject to contributions at all, if it does not exceed 50,000 rubles. In this case, it is equal to 30,000 rubles.

For more information about whether financial assistance is subject to tax, and whether there is a chance of not paying insurance premiums with such assistance, see the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Is it necessary to subject insurance premiums to payments made to employees who have already resigned?

In some cases, an organization needs to pay financial assistance to former employees, for example, due to difficult life circumstances. In this case, there is no need to accrue insurance premiums, because the base for calculating insurance premiums includes remunerations paid in favor of individuals subject to compulsory insurance under employment contracts or civil contracts (clause 1 of Article 420 of the Tax Code of the Russian Federation). Since there are no of the above agreements between the former employees and the organization, there are also no grounds for calculating contributions.

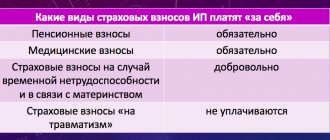

Under what conditions are insurance premiums for work-related injuries calculated?

The objects for taxation of contributions for injuries are payments if they are in accordance with paragraph 1 of Art. 20.1 of the Law “On Compulsory Social Insurance against Industrial Accidents and Occupational Diseases” dated July 24, 1998 No. 125-FZ:

- when carrying out labor relations;

- execution of civil contracts, if they contain a clause on the payment of such contributions.

In sub. 3, 12 p. 1 art. 20.2 of Law No. 125-FZ defines the nature of material assistance, which is exempt from contributions for injuries. Contributions are not accrued:

- if financial assistance is issued at a time as compensation for material damage resulting from emergency circumstances, natural disasters, as well as if individuals suffered from terrorist acts (paragraph 2, subparagraph 3, paragraph 1, article 20.2 of Law No. 125-FZ);

- if financial assistance is allocated as a lump sum due to the death of an employee’s family member (paragraph 3, subparagraph 3, paragraph 1, article 20.2 of Law No. 125-FZ);

- if financial assistance is allocated to an employee of the organization due to the birth of a child or his adoption (paragraph 4, subparagraph 3, paragraph 1, article 20.2 of Law No. 125-FZ); the amounts of such assistance should be allocated in the first year after birth or adoption and should not exceed 50,000 rubles;

- if financial assistance was issued for other needs and its amount did not exceed 4,000 rubles. per employee for the billing period (subclause 12, clause 1, article 20.2 of law No. 125-FZ).

Thus, insurance premiums for injuries to employees will not be assessed on medical assistance in the same situations in which other insurance premiums are not charged on it.

Read about the rules for calculating and transferring injury contributions for payments subject to such contributions in this material.

Personal income tax

The subject of personal income tax taxation is the taxpayer’s income received both in cash and in kind (Article 209 and paragraph 1 of Article 210 of the Tax Code of the Russian Federation). The amount of financial assistance that is paid to a non-employee will be fully subject to personal income tax.

However, there are exceptions that are prescribed in Article 217 of the Tax Code of the Russian Federation, namely:

- Amounts of one-time financial assistance by employers to family members of a deceased former employee, a retired employee, or an employee, a retired former employee, in connection with the death of a member (members) of his family (clause 8 of Article 217 of the Tax Code of the Russian Federation)

- Amounts of financial assistance to former employees who resigned due to retirement due to disability or age in an amount that does not exceed 4,000 rubles (clause 28 of Article 217 of the Tax Code of the Russian Federation)

- Amounts of financial assistance paid to victims and members of their families from terrorist attacks on the territory of the Russian Federation, natural disasters or other emergency circumstances (clause 46 of Article 217 of the Tax Code of the Russian Federation)

Financial assistance in connection with the death of a close relative in 2022

Separately, it is necessary to say about financial assistance in connection with the death of a close relative in 2022.

The fact is that the employer can list in the salary regulations the immediate relatives of employees, in the event of whose death the employee is paid financial assistance. For example, this could be a spouse, children, parents, grandparents, parents-in-law, brothers/sisters. However, the procedure for assessing financial assistance with insurance premiums depends on whether the deceased relative was a family member or not.

Financial assistance in connection with the death of a close relative in 2022 is not subject to insurance premiums only if these close relatives are family members within the meaning of Art. 2 of the Family Code of the Russian Federation (see letter of the Ministry of Labor of Russia dated November 9, 2015 No. 17-3/B-538). In this article of the Family Code, only the spouse, parents (including adoptive parents) and children (including adopted children) are considered family members. So if an employer pays financial assistance in connection with the death of, for example, a grandmother or parents of a spouse or brother/sister, then this financial assistance will be subject to insurance premiums in the general manner.

Legislative regulation

Taxation of financial assistance with insurance premiums is carried out in the manner established by law.

Let's start with the fact that the employer has the right to provide financial assistance to the employee. Such assistance is one-time financial support, which is not remuneration for work or fees. That is, it is not related to the official duties of a citizen, but is aimed at solving social problems. For example, an employee may need support in the event of force majeure, as well as in connection with difficult life situations. When paying financial assistance, the employee generates income, so the question of whether financial assistance is subject to insurance contributions must be answered in the affirmative.

Let us not forget that the authority to administer these payments has been transferred to the Federal Tax Service. Deductions are made specifically to the Federal Tax Service, reporting is also submitted to the tax office, which also controls the correctness and timeliness of all payments, except for deductions for injuries. Thus, payments for insurance against industrial accidents and occupational diseases remain outside the competence of the Federal Tax Service. They are still produced at FSS.

Is financial assistance subject to contributions - both those that go to the Federal Tax Service and “for injuries”? In both cases, as we have already said, this is exactly the case; in both departments the rules are the same. But there are also types of payments for which these deductions are not made. A list of them is contained in Part 3 of Art. 422 of the Tax Code of the Russian Federation. It is also duplicated in Part 3 of Art. 20.2 of the Federal Law No. 125 on insurance against accidents at work and occupational diseases, that is, it also applies to deductions for “injuries”. Thus, the answer to the question: is financial assistance subject to insurance premiums or not is not so clear-cut. There are exceptions and these must be taken into account.

Financial assistance 4000 rubles: taxation 2022

And a few more words about the taxation of material assistance up to 4,000 rubles. Financial assistance 4000 rub. — taxation in 2022 does not provide for its inclusion as part of the income taken into account when determining the tax base for personal income tax (clause 28 of article 217 of the Tax Code of the Russian Federation).

Find out more about in which cases financial assistance is subject to personal income tax and in which it is not, in ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

For the purposes of calculating income tax, material assistance to employees does not reduce the tax base (clause 23, article 270 of the Tax Code of the Russian Federation). At the same time, the Russian Ministry of Finance allows the accounting of financial assistance paid for vacation as part of labor costs. For income tax purposes and under the simplified tax system:

- financial assistance paid for vacation is taken into account in labor costs if its payment is provided for in an employment (collective) agreement or local regulation and is related to the employee’s performance of his job duties (clause 25 of article 255 of the Tax Code of the Russian Federation, subclause 6, clause 1 , clause 2 of Article 346.16 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated September 2, 2014 No. 03-03-06/1/43912, dated October 22, 2013 No. 03-03-06/4/44144, dated September 24, 2012 No. 03- 11-06/2/129);

- financial assistance paid for other reasons is not taken into account in tax expenses (clause 23 of article 270, clause 2 of article 346.16 of the Tax Code of the Russian Federation).

Read more about this relationship in the article “How does financial assistance to employees affect income tax?”

Financial assistance due to employee illness: cases of payment

Cases of payment of financial assistance due to illness may concern not only the employee of the company directly, but also his close relatives, including parents, spouses, natural and adopted children. Such cases include:

- receipt by the employee or other specified persons of paid medical services;

- their acquisition of medications necessary to treat the disease in accordance with the doctor’s prescription;

- other cases involving the need to incur expenses for health improvement and treatment.

Important! Payment of compensation for medicines in accordance with paragraph. 5 paragraph 28 art. 217 of the Tax Code, in order to avoid income tax, requires a prescription from the attending physician confirming the validity of their purchase and use.

See also “Financial assistance for the birth of a child from the employer.”

Results

Both the Tax Code of the Russian Federation and Law No. 125-FZ include a number of types of financial assistance in the list of payments not subject to insurance contributions. Among non-contributory financial assistance to employees, there are 2 groups:

- not taxed in full - these include payments made in connection with the occurrence of emergency situations (such as a natural disaster, terrorist attack, death of a family member);

- non-taxable until a certain amount is reached - this is financial assistance for the birth of a child (up to 50,000 rubles) and issued for other reasons (up to 4,000 rubles).

Financial assistance paid to people who are not in an employment relationship with the person making the payment will also not be subject to contributions.

And the obligation to charge contributions for injuries on the income of employees registered under a GPC agreement (subject to contributions for pension and health insurance) will arise for the employer only if such an obligation is provided for by the agreement.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.