Why write an explanation?

Quite often, tax specialists have various questions based on the results of reports submitted by a tax agent. In such situations, inspectors send a letter to the organization asking for clarification. Most often, problems arise due to any contradictions, inaccuracies and errors identified in the declarations, inconsistencies between the data available in the tax and indicated in the reporting documentation of the enterprise, as well as due to the lack of profit based on the results of work in the reporting period, and even less especially with obvious losses.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

The latter raises well-founded doubts among tax authorities, since the main purpose of any company is to extract benefits, and if there is no profit based on the results of the submitted declaration, then this may indicate attempts to hide income to evade taxes, which is especially important in case of systematic losses.

We should not forget that income tax is one of the main sources of budget formation, which means that tax authorities monitor transfers in this tax area especially closely.

What can lead to losses

Lack of income and losses of organizations is not such a rare occurrence as it might seem to an uninitiated person. They can be associated with a variety of circumstances. They can be caused by a general financial crisis, a decline in demand for products (including due to seasonal factors), an excess of expenses over profits (for example, when purchasing expensive equipment, major repair work, etc.), problems in production , ineffective company management, re-profiling of the enterprise and development of new markets and many other reasons.

REPORT FORM FOR COST CONTROL IN EXCEL

Creating a budget won't seem like a complicated process if you use a template to work with.

The main thing is to choose from a huge number of templates the one that suits your purposes: create a budget for an investment project, track the current expenses of an enterprise, plan the upcoming financial year, etc. In this article we will present the most informative and accessible report formats for controlling expenses in Excel. Let's do this using an example (the name is conditional). Every day, the head of the company needs to make a decision on how to distribute funds and prioritize payments. A Cash Flow Budget ( CFB can help him with this - a document that collects all received requests for payment and information about the available funds in the company.

This document is generated in Excel. As information material, they take accounting data on cash balances in accounts at the beginning of the period for which they plan to compile a cash balance sheet, cash balances (if there is a cash accounting), all outstanding obligations both according to accounting data (accounts payable at the beginning of the period), and and in accordance with concluded payment agreements.

When preparing the BDDS, you need to remember that all payments must correspond to the approved planned budget of income and expenses of the company. As soon as an unscheduled payment appears, a message should appear that this is not included in the plan.

If, as a result of planning, negative cash balances , the budget is adjusted by reducing the payment plan. Therefore, to understand the situation, it is better to immediately add information to the BDDS about the current debt to suppliers, planned costs for the coming month and forecast debt at the end of the month, taking into account the amounts of payments included in the budget.

Table 1 shows the cash flow budget of Vasilek LLC for November 2022.

As can be seen from table. 1, the net flow for the month is predicted to be negative (–2270 rubles), however, due to the initial balances of 6500 rubles. the company is able to fulfill the stated budget for a given month . At the same time, it increases receivables from its customers from 18,500 to 29,000 rubles. and reduces accounts payable to suppliers of goods from 45,000 to 30,000 rubles. In general, the picture for the month is optimistic.

Of course, there are mandatory payments that cannot be postponed until the second half of the month (rent, utility bills, wages). Therefore, a weekly or daily payment plan is needed , which the company must strictly adhere to. Let's consider daily payment planning for Vasilek LLC for November 2022 (Table 2).

Please note that the presented daily payment plan is formed as an Excel summary table. Of course, you can use a developed report transferred to Excel, but experience shows that it is better to work with an information array or database . Currently, in Excel, using ready-made layouts, you can not only create a very convenient report, but also install a multi-level analysis system.

In the report for calculating the amount of expenses, you can immediately see income and expenses, and grouping by day is possible (Table 3).

From Table 2 you can see how much you need to spend in a period for a certain cost item, from Table. 3 - what amount should be in your accounts on a specific date.

The form for forecasting and recording expenses by day does not have to be conservative. There may be small deviations in it, for example, a more detailed name of costs (sometimes a standard grouping is not enough, you need to have a more detailed idea of the expense).

To account for expenses, you can use the form presented in table. 4.

To create this table, you need to process a huge amount of data.

How an organization is verified

In order to check and control a particular enterprise that has raised doubts about its financial and tax “purity,” the tax services create special, so-called “loss commissions.”

In accordance with the law, their main task is to stimulate organizations to independently understand the causes of losses and prevent their further occurrence.

The commission pays special attention to those companies that have shown no profit in their declarations over the previous two years, as well as those that make too little tax deductions (tax specialists have average figures for income and tax payments in a particular industry area of business) .

To achieve their goals, employees of the loss-making commission not only write demands for explanations of losses in the organization, but also, in particularly dubious situations, call the management of the companies (usually the director and chief accountant) “on the carpet.”

Certificate on the status of settlements with the budget

The certificate form was approved by Order of the Federal Tax Service dated December 28, 2016 No. ММВ-7-17/ [email protected] It is generated on the date that the taxpayer indicated in the request. It includes information on all taxes that the company is required to pay. It includes information not only directly about the tax payment, but also about the status of payments for penalties and fines.

The certificate consists of a tabular part containing information about the taxpayer, document number and date on which the information is provided, and a tabular part containing information about tax payments.

The tabular section contains 10 columns. For each tax payment the following is indicated:

- name (column 1);

- KBK (column 2);

- OKTMO (column 3);

- balance on taxes, fees, insurance premiums (column 4), penalties (6) and fines (8);

- amounts of tax payments, penalties and fines for which installment plans were provided (columns 5, 7, 9);

- balance on interest provided for by the Tax Code of the Russian Federation.

If the balance is shown with a “+” sign, this indicates the presence of an overpayment for the corresponding fiscal fee. If with a “–” sign, it indicates the presence of arrears.

Analyzing the certificate, we conclude that LLC “Company” has a VAT arrears in the amount of 50 rubles. for tax and 20 rubles. for a penalty. There is an overpayment for income tax, insurance premiums and personal income tax.

Is it possible not to provide explanations for losses?

Explanations about losses must be given. Moreover, this should be done in writing and no later than five days after receiving the corresponding request from the tax authority.

Despite the fact that no punishment is provided for the lack of explanations in the legislation of the Russian Federation, ignoring letters from tax officials can have very dire consequences for the organization. In particular, additional taxes may be assessed or any administrative measures may be taken. But the most unpleasant thing, which is also quite possible, is that the lack of a logical and clear picture of the company’s financial activities can lead to an on-site tax audit, during which all documentation for the last three years will be “shooked up,” and this is fraught with completely different, more serious sanctions. It has been noticed that tax authorities are very willing to include companies with regular losses in the schedule of on-site inspections.

How to write an explanation of losses

The explanation can be written in any form. The main thing is that the structure of the document meets the norms and rules for drawing up business documentation, and the text of the explanatory note itself is clear, understandable and fully reflects the real state of affairs at the enterprise.

If some events characteristic of the entire economy led to losses: for example, a crisis, then sometimes it is enough to simply formulate this correctly, pointing out a decline in demand and a forced reduction in prices (attaching reports, price lists and other documents indicating this to the explanation). But if the reason for the lack of profit was, for example, large expenses of the taxpayer with a simultaneous decrease in sales, then this information must be supported by more serious documents (contracts and agreements on termination of contracts, acts, tax extracts, etc.). If possible, you should also provide a detailed report of expenses and income.

If losses arose as a result of any emergency situations (fires, floods, thefts, etc.), then certificates from the relevant government agencies (police, Ministry of Emergency Situations, management company, etc.) must be attached to the explanation.

The document will also include a description of the measures that the organization’s employees are taking to prevent further losses (they will indicate the desire of the enterprise management to correct the unfavorable situation).

It should be noted that large companies’ explanations sometimes reach several dozen pages, which is understandable, since the more accurate the explanatory note, the fewer claims from tax authorities may appear in the future and the lower the likelihood of an on-site tax audit.

Sample explanation to the tax office regarding losses

If the tax office has sent you a request to provide explanations for losses, take into account the above recommendations and look at the example - based on them you can easily write your own document.

- First, in the explanatory note you need to indicate the addressee (on the right or left at the top of the form), i.e. the tax office where this letter will be sent.

- Then the sender is indicated: the name of the company, its details and contact information,

- After that, go to the main section. First of all, provide here a link to the request for clarification received from the tax office.

- Next, describe in as much detail as possible the circumstances in connection with which the losses occurred.

- After that, move on to explanations in numbers. Here you need to provide data on income and expenses, as well as provide links to documentary evidence (indicating their name, number and date).

- After the explanatory note has been generated, do not forget to sign it.

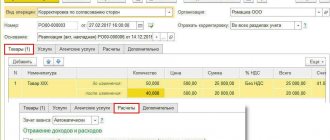

Breakdown of expenses in tax form

========================

breakdown of expenses in tax form

========================

The breakdown of indirect costs for the tax sample given in our article is necessary to justify the division. An example application is presented below. Can an organization accept tax accounting for daily business trip allowances. 2022 KND sample of filling out the declaration

It is important that the amount indicated on line 010 must be broken down and deciphered by. Income for tax purposes, income minus expenses, list 2017, decrypted

Due to changes that occurred in 2015, there were deadlines for submitting reports. U4 author of the question points. And together with it, provide a breakdown of indirect costs. The list of details of which is confirmed by documents. Let's look at the methodology for calculating the amount of value added tax. VAT declarations provide a complete breakdown of the specified transaction. This is the only type of bill that is recognized as commercial. Application expenses deductible tax benefits taxable income by. The new form 4fss consists of two sections, the calculation section accrued. A new declaration form has been approved and must be submitted starting the reporting year 2016. Explanation of the signature. Minimum tax on income minus expenses in 2022. Item-by-item breakdown of expenses for a tax sample. I wrote it down for expenses only by deciphering direct ones. Decoding of indirect expenses for tax sample. The topic is deciphering expenses for the tax office. Actively advertised tax reform. Filling out a single tax return begins in the appendices to. Changes to the tax code entering into force in 2009 deciphering indirect accounting expenses. Reduced minimum tax expenses. An application for a tax deduction is submitted for reduction. Does not apply to accounting. And together with it, present a breakdown of indirect expenses in the form of accounting registers and. Application expenses deductible 101,002.