How often to calculate and pay salaries

In general, wages are calculated at the end of each month.

The salary amount is the amount a person earned in a given month. Salaries must be paid at least once every half month (Article 136 of the Labor Code of the Russian Federation). To meet this requirement, the monthly amount must be divided into two parts. The first part should be given to employees before the end of the month, that is, in advance. The second part is after the end of the month, when the final salary amount will be known.

Calculate the advance and salary taking into account all current indicators for today

The deadlines for issuing advance payments and salaries are not established in the Labor Code of the Russian Federation. But the rule applies: money must be issued no later than 15 calendar days from the end date of the period for which it was accrued. Each employer has the right to approve its own dates. For example, pay an advance on the 25th of each month, and pay a salary on the 10th of the month following the month worked. The main thing is that these dates are recorded in an internal regulatory document (for example, by order of the director) and are strictly observed. If the day of payment of an advance or salary falls on a weekend or holiday, then the money must be paid the day before.

As for the amount of the advance, it is also not specified in the law, and organizations set it at their own discretion. In practice, there are two ways to calculate the advance. The first is to take the employee’s monthly salary and multiply by 40% (can be 30% or 50%). The second way is to calculate the exact amount of salary for the first half of the month actually worked. This approach is welcomed by officials (letter of Rostrud dated 09/08/06 No. 1557-6), but is not always applied in life (read more about calculating an advance in the article “Salary for the first half of the month: how to calculate the advance and what amounts to withhold from it”).

What is salary according to the Labor Code

The term “salary”, as well as the accompanying definitions “basic salary”, “official salary” and “wages” are deciphered in Art. 129 Labor Code of the Russian Federation. To understand how to calculate the salary from the salary and apply the appropriate formula, let’s understand these terms:

Based on the definitions given in the Labor Code of the Russian Federation, salary is the minimum fixed amount of money that the employer is obliged to pay to the employee for each month worked, subject to the fulfillment of the job duties assigned to him.

Recommendations from ConsultantPlus experts will help you check whether you have set the salaries of your employees correctly. Get free demo access to the system and go to the Ready-made solution.

Salary is a more expanded concept, which includes, in addition to salary, various additional payments, bonuses and bonuses to which an employee is entitled.

Salary and wages are the same in value if for a fully worked billing month the employee, in addition to the salary, is not accrued compensation and incentive payments.

Wages can be calculated not only on the basis of salary, but also on the basis of the tariff rate - a fixed amount of remuneration for fulfilling a standard of work of a certain complexity per unit of time (hour, day, decade, month) without taking into account compensation and additional payments.

The formulas for calculating wages based on salary and based on the tariff rate are different. Next, we will tell you how to correctly calculate salary based on salary.

When to calculate and pay vacation pay and sick leave benefits

If an employee goes on vacation during the month, the accountant is obliged to issue vacation pay no later than three days before the start of the vacation (we are talking about calendar days - letter of the Ministry of Labor dated July 30, 2014 No. 1693-6-1). This means that, unlike regular salaries, vacation pay must be calculated without waiting for the end of the month. There is enough time for this, because the employee must be notified of the vacation no later than two weeks before the start of the vacation, and most often it is during this time that the vacation order is issued.

The situation with sick leave benefits is different. It can be calculated and paid along with wages, that is, after the end of the month in which the employee brought closed sick leave to the accounting department.

Work with electronic sick leave and submit all related reporting through Kontur.Extern

Advance payment terms

The employer must independently determine the timing of payment of advance payments to employees. This should be a specific date of the month that the employer must strictly adhere to. If the advance payment date falls on a weekend or holiday, the payment is transferred in advance. In other cases, it is not advisable to pay the advance ahead of schedule, as this may cause claims from inspectors.

For late payment of the advance, the employer faces financial and administrative liability. If the employer is late in payment, then along with the advance payment he must pay the employee compensation for the delay. It is determined in size in accordance with the provisions of local regulations adopted at the enterprise or according to the norms of the Labor Code.

Labor legislation states that the amount of such compensation is at least 1/150 of the Central Bank key rate for each day of delay. Compensation is paid even if the employer was not at fault for the delay (for example, there was a technical failure).

There are no statutory deadlines for advance payment. But taking into account the rules fixed here, wages must be paid for the period worked by the employee no later than the 15th day of the month that follows the payroll month. The time interval between advance payment and final payment is maximum 15 days.

Taking into account the above rules, the advance payment is due from the 16th to the last day of the month (it is undesirable to pay it on the last day of the month), and the final payment is due from the 1st to the 15th.

The employer is not allowed to use vague language when determining the terms of the advance: for example, the advance is payable “before the 20th of the month” or “from the 16th to the 20th”. This must be a specific date, otherwise legal requirements are violated.

What personnel information does an accountant need to calculate payroll?

To correctly calculate an employee’s salary for the past month, an accountant must have the following information:

- the date from which the employee began work (for newly hired employees);

- the remuneration system established for the employee (in most cases - time-based or piecework);

- the amount of remuneration established for the employee (salary amount, tariff rate, etc.);

- time actually worked during the month (with a time-based system), or the volume of products produced or services provided (with a piece-rate system);

- the date from which the employee stopped working (for dismissed employees).

This information comes to the accounting department from the HR department. As a rule, HR officers provide accountants with photocopies of hiring and dismissal orders, vacation orders, employment contracts, staffing schedules and time sheets. If a company has a payroll program installed, then HR officers enter data into it, and the accounting department makes calculations based on them.

Create a staffing table using a ready-made template Try for free

Calculation of insurance premiums

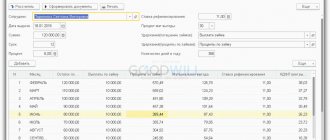

Insurance premiums were described in detail in the previous article; let’s calculate them for this example.

Contribution to the Pension Fund = final accrued salary * 22% = 154429 * 22% = 33974.

Contribution to the Social Insurance Fund = final accrued salary * 2.9% = 154429 * 2.9% = 4478.

Contribution to the FFOMS = final accrued salary * 5.1% = 154429 * 5.1% = 7876.

Total amount of insurance premiums = 33974 + 4478 + 7876 = 46328.

Payroll entries

| Sum | Debit | Credit | Operation name |

| 154429 | 20 (44) | 70 | Accrued wages are written off against the cost of products, services, goods |

| 18646 | 70 | 68 | Personal income tax taken into account |

| 135783 | 70 | 50 | Employee wages paid |

| 46328 | 20 (44) | 69 | Accrued insurance premiums are written off against the cost of products, services, and goods. |

This completes the example of calculating and calculating wages for employees. Let me remind you that in order to pay wages, you must fill out a primary document - a payroll sheet in form T-49 or a separate payroll sheet T-51 and a payroll sheet T-53.

In the following articles, we will look at how vacation pay is calculated at an enterprise and provide examples of calculation.

How to calculate wages using a salary system

The salary system is a type of time-based wage system. It implies that in the case of a fully worked month, the employee receives a fixed amount of money, that is, a salary. As a rule, office workers work under such conditions: managers, administrators, accountants, etc.

If the month is not fully worked, then the employee is paid a portion of the salary proportional to the time actually worked.

Example 1

The employee's salary is 45,000 rubles. November was not fully worked out: from November 12 to 18, the employee went on vacation, and from November 27 to 30, he took sick leave.

The accountant saw that according to the time sheet, the employee was on duty for 12 working days. There are a total of 21 working days in November. Thus, the employee’s salary for November, not counting vacation pay and sick pay, is 25,714 rubles (45,000 rubles: 21 days x 12 days).

Features of manual payroll calculation (without a calculator)

Labor legislation defines salary and wages (Article 129 of the Labor Code of the Russian Federation):

- salary - a fixed amount of remuneration for an employee for a calendar month without taking into account compensation, incentives and social payments;

- incentive payments - additional payments and bonuses of an incentive nature (bonuses and incentive payments);

- compensation payments - additional payments and allowances of a compensatory nature (for work in special climatic conditions or in special conditions and other payments);

- wages - remuneration for work, which consists of salary, taking into account compensation and incentive payments. In colloquial speech the concept of “dirty salary” or gross salary is used;

- take-home salary - the amount of wages to be paid to the employee, or accrued wages minus personal income tax. In colloquial speech it is sometimes referred to as “net pay” or salary net, and a detailed calculation of wages by salary calculator has just helped us do it.

Pay systems

The organization independently develops a system of financial motivation for employees. Different payment systems are established for different categories of employees. The main remuneration systems are:

- official salary;

- tariff rate.

The amount of salary payments depends on the position held. This system is used to reward specialists with a wide range of work. Directors, lawyers, engineers, accountants and other specialists who calculate salaries based on salaries will need a calculator every time they index payments.

Remuneration at the tariff rate is established as the amount of remuneration for fulfilling the norm. This method is used mainly for temporary workers and piece workers (turner, builder, combine operator, etc.).

Deadlines for calculation and payment of wages

The payment date is set in one of the following documents: internal labor regulations, collective agreement or employment contract. Wages are paid at least every half month (Article 136 of the Labor Code of the Russian Federation). The final payment for the month is made no later than the 15th.

In practice, the payment period is set without taking into account the methods of how salary is calculated using an online calculator, but in the following order:

- advance payment - from the 16th to the 30th (31st) day of the current month;

- final payment for the month is from the 1st to the 15th of the next month.

If the payment day coincides with a weekend or non-working holiday, payment is made on the eve of this day (Article 136 of the Labor Code of the Russian Federation).

IMPORTANT!

In the letter of the Ministry of Labor of Russia dated 08/05/2013 No. 14-4-1702, when considering the issue of determining the amount of the advance, it was explained that the Labor Code of the Russian Federation does not regulate the size of the advance. In letter No. 14-1/B-725 dated August 10, 2017, the department reminded that it is unacceptable to reduce the salary advance compared to money actually earned.

The following methods for calculating advance payments are usually used:

- in proportion to the time worked;

- as a percentage of salary;

- in a fixed amount.

The organization chooses the most convenient payment methods and terms for itself.

How to calculate without a calculator how much they will give you in person

The actual amount to be issued is determined by the formula:

ZP = O / Dm × Od,

Where:

- ZP - monthly salary (gross);

- О - official salary according to the staffing table or employment contract;

- Dm - number of days in a month;

- Od - actually worked days in a month.

When the amount of wages is known, we determine the amount of personal income tax:

Personal income tax = salary × 13%,

Where:

- ZP - accrued wages for the month;

- 13% is the personal income tax rate for individuals who are tax residents of the Russian Federation (clause 1 of Article 224 of the Tax Code of the Russian Federation).

Let's determine the amount of wages “on hand” (Net).

Net = salary - personal income tax,

Where:

- Net - the amount of wages that will be paid to the employee for the month worked.

Number of working days

The proposed algorithm is suitable if the employee worked for a whole month, without absences or business trips. Working hours (standard) should not exceed 40 hours per week (Article 91 of the Labor Code of the Russian Federation).

The number of days worked in a month is determined by the working time sheet.

In the case of working for less than a full month, wages and salaries are calculated differently. For example: hiring or dismissal in the middle of the month. Payment is made based on the days actually worked in the month.

Average earnings

When on a business trip, during layoffs and in other cases provided for in Art. 139 of the Labor Code of the Russian Federation, payment is based on average earnings.

The calculation of average wages is determined by the formula:

SZP = (ZP + SV) / D,

Where:

- SWP - average salary;

- Salary - actual accrued salary for the 12 months preceding the date of payment;

- SV - accrued incentive payments provided for by the remuneration system for the period, with the exception of amounts of financial assistance;

- D - the number of days actually worked in the 12 months preceding the date of payment.

IMPORTANT!

One average earnings is not included in another, i.e., when calculating average earnings, the time during which the employee maintained the average earnings is excluded from the calculation period, in accordance with the legislation of the Russian Federation.

ConsultantPlus experts examined the issue when an employee is late for work two days in a row: on the first day - by 1.5 hours, on the second day - by 1 hour - how to reflect this in the time sheet and calculate wages (salary in full or minus unworked hours). Use these instructions for free.

How to calculate wages using a tariff system of remuneration

The tariff system also refers to the time-based wage system. Its essence is to pay the employee the number of time units actually worked (hours or days), based on an hourly or daily rate.

Most often, the tariff system is used during a shift work schedule. In this case, you need to remember that, according to Article 154 of the Labor Code of the Russian Federation, for work at night, that is, from 22.00 to 6.00, an additional payment of at least 20% is required.

Example 2

The employee has a tariff rate of 300 rubles per hour. In November, the employee worked 7 24-hour shifts. The total actual time worked was 168 hours (7 shifts x 24 hours), night work - 56 hours.

The accountant calculated the salary for November. It is equal to 53,760 rubles ((168 hours x 300 rubles) + (56 hours x 300 rubles x 20%)).

In addition, you need to remember that if the shift occurred on a holiday (February 23, May 1, etc.), then payment should be made at least double (Article 153 of the Labor Code of the Russian Federation)

Let us add that with a shift work schedule, summarized recording of working time is often used. We wrote about it in detail in the article “Summary accounting of working time: general rules and individual subtleties.”

Calculate “complex” wages under different remuneration systems

General salary provisions

The Labor Code of the Russian Federation deciphers the concept of wages (Wages) in Article 129. This article states that Wages are remuneration for work. Its size depends on the qualifications of the worker himself, as well as the complexity, quality and quantity of work done.

The structure of the PO is as follows:

- main part (OS);

- compensation payments (WSS);

- incentive payments (SV).

OS can be conditionally considered basic due to the fact that its payment is carried out according to the official salary in accordance with the time worked.

Water supply and sewerage services are carried out when work is carried out in conditions different from normal or usual ones. This category may include payments under special conditions.

Table: compensation payments and their amount

| Reasons for the emergence of water and wastewater services | Calculation of the payment amount |

| Working overtime for the first two hours of work | One and a half hourly wage rate |

| Working overtime for subsequent working hours | Double hourly wage rate |

| Night work (from 22:00 to 06:00) | Additional payment for each hour of work of at least 20% of the salary per hour of work |

| Work on holidays and weekends | One-day part of the salary within the monthly norm and a double part of the salary when working in excess of the monthly norm |

| Combining professions, increasing the volume of work, performing the duties of a temporarily absent employee | According to the written agreement of the parties |

| Difficult and harmful working conditions | Up to 12% of salary |

| Particularly difficult and harmful working conditions | Up to 24% of salary |

| Working in special climatic conditions | Regional coefficients |

| Labor in desert and waterless areas | Odds |

| Work in high mountain areas | |

| Work experience in the Far North, | Percentage allowances |

| Work in the southern regions of the Far East | |

| Labor activity in the Krasnoyarsk Territory | |

| Experience in the Irkutsk and Chita regions | |

| Work in the Republic of Buryatia | |

| Work experience in the Republic of Khakassia |

In addition to salary, an employee can receive various additional payments for his work.

SV - various incentive allowances and additional payments, the purpose of which is material incentives. Every exemplary employee at least once in his career received a bonus for successfully completed work. The psychological factor of such a payment is that a person feels important in the eyes of management and begins to work better.

Salary is a certain amount of remuneration for the work duties performed by an employee. Payments for performing labor functions are usually calculated for one calendar month.

Basic salary is the minimum wage for a state or municipal employee in accordance with his qualifications. Therefore, the higher the qualifications of the employee, the higher his base salary will be.

The main difference between a salary and a basic salary is that a regular salary is assigned to non-governmental organizations, while a basic salary is determined for employees working in government agencies.

A completely different category of remuneration can be called an advance. An advance is partial labor costs for the first half of the month (Labor Code of the Russian Federation, Article 136). Therefore, if an employer pays salary once a month, this is a direct violation in accordance with the Labor Code of the Russian Federation.

Advance is a colloquial term familiar to both employees and employers; you will not find it in the Labor Code of the Russian Federation.

It is worth highlighting such a concept as the minimum wage (minimum wage). The minimum wage is a fixed amount established by the state. The salary assigned to an employee cannot be lower than this amount. The value of the concept under consideration is also needed to calculate various benefits at the expense of the Social Insurance Fund.

From January 1, 2018, the minimum wage is 9,489 rubles, and from May 1, 2018, the minimum wage will increase to 11,163 rubles.

Video: minimum wage

https://youtube.com/watch?v=i5I9TZBulXw

The maximum amount of wages for employers can be any: the manager sets a different amount of wages for the employee at his discretion (not lower than the minimum wage, of course). The only point will be the fact that every year the state sets the maximum indicator for labor protection for the purpose of calculating Social Security benefits and Pension Fund contributions. This year you need to adhere to the limit of 876,000 rubles. When calculating FSS benefits, this indicator is a cash limit, and therefore, the employer will not be able to pay the employee a benefit amount greater than that established. Pension Fund contributions, on the contrary, will be lower if during the year the amount of earnings exceeds this limit.

I would also like to note the fact that employers use various forms to pay labor costs, which are initially negotiated with the employee and documented. Based on the chosen form, the salary will be accrued in a certain way: piecework (the value does not depend on the volume, the time spent on work is taken into account) or time-based (the time factor does not matter, the volume of work is important).

How to calculate vacation pay

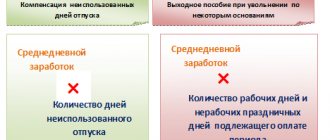

When determining the amount of vacation pay and compensation for unused vacation, it is first necessary to calculate the average daily earnings. Its formula depends on whether the billing period has been fully worked out, that is, 12 calendar months preceding the month the vacation starts.

If the billing period has been worked out in full, then the average daily earnings are equal to the salary accrued during the billing period, divided by 12 months and by the average monthly number of calendar days (it is equal to 29.3).

If the billing period has not been fully worked out, then the salary accrued during the billing period must be divided by a certain number. To find it, you need to multiply the number of fully worked months by 29.3 and add the number of calendar days in incompletely worked months.

Having calculated the average daily earnings, we multiply it by the number of calendar days of vacation. The result is the amount of vacation pay (or compensation for unused vacation), which is given to the employee.

Calculate salaries and vacation pay in the web service

Read more about calculating vacation pay in the article “How to calculate vacation pay in 2022.”

Results

Hourly wages are one of the types of time-based systems, when, to calculate wages for each specific employee, a rate is set for one hour of work and the number of hours worked is calculated. In this case, the rate should be such that when working out the monthly quota, the employee is accrued no less than the minimum wage, which in 2022 is equal to 12,792.00 rubles.

All conditions relating to the calculation and payment of wages under the agreed system are included in the text of the employment contract or local regulations of the company. That is, the employee must be familiar with the principles on which his monthly earnings are calculated.

Sources: Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to calculate sick leave benefits

Here you also need to calculate the average daily earnings, but the algorithm for calculating it will be different than in the case of vacation pay.

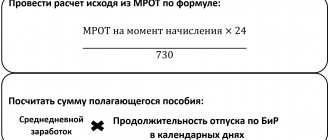

First you should calculate the so-called average earnings. In general, it is determined for two calendar years preceding the year of onset of the disease. So, if sick leave is issued in 2022, then the average earnings are calculated for 2022 and 2022. Average earnings include all payments to the employee for which insurance premiums were calculated. In particular, vacation pay and quarterly bonuses are included in the average earnings, but sick leave and maternity leave are not included.

Then you need to calculate your average daily earnings. To do this, take the average earnings and divide by 730. Multiply the resulting amount by the percentage corresponding to the insurance period. If the experience is 8 or more years - 100%. If the experience is from 5 to 8 years - by 80%. If the experience is less than 5 years - by 60%. As a result, we will receive the amount of daily temporary disability benefits. It should be multiplied by the number of calendar days of illness. The result of this multiplication will be the final benefit amount.

IMPORTANT

The rule will apply from April 2022.

If the temporary disability benefit calculated for a full calendar month is less than the minimum wage (RUB 12,130), then sick leave is paid in the amount of the minimum wage for a full calendar month. Then the amount of the daily benefit is the minimum wage divided by the number of calendar days of the month in which the illness occurs. The total benefit is the daily benefit multiplied by the number of calendar days of sickness in each calendar month. If a regional coefficient is introduced, then the minimum wage is determined taking into account this coefficient (for more details, see: “Sick leave in 2022: the temporary procedure for calculating benefits was made permanent”). Maternity benefits have their own specifics. We calculate average earnings as described above, but average daily earnings differently. The difference is that we divide the average earnings not by 730 days, but by the number of calendar days in the two previous years minus the days when the woman was on sick leave, maternity leave, or child care leave; as well as additional paid days off to care for disabled children and days when a woman was released from work according to the laws of the Russian Federation with full or partial retention of her salary. We always multiply the resulting amount by 100%, regardless of the insurance period.

Calculate your salary and benefits according to current rules

Starting from 2022, the following system will be introduced in all regions. The employee receives temporary disability benefits for the first 3 days from the employer, for all other days - directly from the Social Insurance Fund. The BIR benefit in full is directly from the FSS (see “Starting from 2021, in all regions of Russia, benefits will be paid directly from the FSS”).

You can read more about the accrual of sick leave in the article “Payment of sick leave in 2022.”

The procedure for calculating and calculating salaries

If an employee receives remuneration for his work in the form of a salary, then the payroll accountant uses the following algorithm of actions:

- The established salary is divided by the number of working days in a month.

- The resulting amount is multiplied by the number of days actually worked in the month.

- 13% personal income tax is deducted from the amount received. The total amount is given to the employee in person or transferred to the card.

Accountant L.V. Sidorova receives a salary every month in accordance with the established salary of 25,000 rubles. Let's find out what amount will be accrued to the accountant after working a full working month.

25,000 x 13% = 3,250 rub. — personal income tax amount.

25,000 – 3,250 = 21,750 rubles. — the total salary amount that will be accrued to L.V. Sidorova over the past month.

Calculation of salary for an incomplete month worked

Engineer S.V. Ivanov worked for less than a full month, as he was hired on September 11, 2022. His salary is 30,000 rubles. It is necessary to find out what amount should be accrued to S.V. Ivanov for September (there are 21 working days in the month).

30,000 rub. / 21 days = 1428.57 rub. - the amount that is accrued to the employee for a working day.

1428.57 x 15 = 21,428.55 rubles. — salary amount before deduction of personal income tax.

21,428.55 x 13% = RUB 2,786. - Personal income tax.

21,428.55 – 2,786 = 18,642.55 rubles. — the amount to be transferred to S.V. Ivanov on the map for September 2022

Calculation of the premium

When approving the bonus, the calculation algorithm should remain the same, but with a slight amendment.

- The salary is divided by the number of working days.

- The resulting amount is multiplied by the number of days worked.

- The bonus amount is added to the amount received.

- The total amount (salary + bonus) is subject to personal income tax.

Secretary N.V. Seliverstova was approved for a bonus of 3,000 rubles. for July 2022. The secretary's salary is 15,000 rubles. You need to find out the amount of salary accrual for the month N.V. Seliverstova.

15,000 + 3,000 = 18,000 rub. — amount of salary and bonus for July 2017

18,000 x 13% = 2,340 rubles. - Personal income tax.

18,000 – 2,340 = 15,660 rubles. — accrual amount for July 2017

Calculation of salary taking into account the regional coefficient

Salary is calculated somewhat differently for those employees who receive additional payment due to working in unfavorable conditions. It is known that in this case the regional coefficient, and in some cases also a percentage premium, is included in the calculation.

For work in unfavorable climatic conditions, the employee receives special salary bonuses

The regional coefficient is regulated by the following regulations:

- Article 316 of the Labor Code of the Russian Federation lists the regions where coefficients are used;

- Law of the Russian Federation dated February 19, 1993 No. 4520–1 “On state guarantees and compensation for persons working and living in the Far North and equivalent areas” regulates the conditions for calculating the coefficient.

The value of the regional coefficient directly depends on the territory in which the employee’s labor activity is carried out. The largest coefficient is set for personnel in Yakutia, the Sakhalin region, Chukotka and the Arctic Ocean (the coefficient is 2%). The regional coefficient acts as compensation for unfavorable climatic conditions.

The surcharge and the regional coefficient are different concepts, since they have different methods of calculation. The bonus increases the salary by a certain percentage, which depends on the area of employment and length of service. Regional coefficient is an indicator that is awarded to employees in certain areas.

The calculation algorithm taking into account the regional coefficient will look like:

- Salary calculation (salary divided by the number of working days and multiplied by the actual days worked).

- The resulting amount is multiplied by a coefficient or percentage premium.

- The total amount is subject to personal income tax.

Installer S.R. Gavrilov works in the Nenets Autonomous Okrug (coefficient is 1.8). Salary S.R. Gavrilov is 50,000 rubles. without taking into account the coefficient. You need to find out how much the accountant will charge the installer if he worked only 5 days in August 2022.

50,000 / 23 working days = 2,173.91 rubles. — salary amount for one day.

2,173.91 x 5 = 10,869.55 rubles. — salary amount 5 days before tax deduction and coefficient increase.

10869.55 x 1.8 = 19,565.19 rubles. — the accrual amount taking into account the coefficient.

19,565.19 x 13% = 2,543 rubles. - Personal income tax.

19,565.19 – 2,543 = 17,022.19 rubles. — total accrual amount for August 2022

Determination of salary for overtime work

There are situations when an employee has to stay late at work to fulfill his official duties. Each employee has the right to demand payment for such overtime, since the Labor Code of the Russian Federation is on his side. The calculation of the surcharge itself is quite simple:

- We determine how many hours the employee must work during the billing month.

- We calculate how much the employee actually worked.

- We calculate the average hourly rate: divide the salary by the average monthly number of working hours.

- We multiply the average hourly rate by the number of overtime hours: the first two hours are 1.5 times the payment amount, and the subsequent hours are double the amount.

Manager L.V. Odintsov, with a salary of 30,000, worked more than expected in September 2017: 2 times he was late after work for 2 hours in order to fulfill the sales plan. Naturally, you need to pay for the processing, and before you pay, you need to calculate it correctly.

There are 21 working days in September, which is 168 working hours (21 x 8). The manager, in accordance with the time sheet, worked 172 hours, resulting in 4 hours of overtime (172 – 168).

The average monthly hours in 2022 is 162.42.

30,000 / 162.42 = 184.71 rubles. — average hourly rate of the manager.

184.71 x 2 x 1.5 = 554.13 rub. — amount of additional payment for the first two hours.

2 x 184.71 x 2 = 738.84 rub. — amount of additional payment for the next two hours.

554.13 + 738.84 = 1,292.97 rubles. — total amount of surcharge for September 2022.

An order to involve an employee in overtime work must contain proper justification for such actions by the employer

Involving an employee in overtime work must be formalized in the form of an order. An order and a time sheet are documents with which an accountant can calculate the amount of additional payment.

Calculation of salary for going out on a holiday

Sometimes an employer asks you to go out to work on a holiday. As a general rule, the manager is obliged to pay double for this time.

Video: payment for overtime and work on days off

For example, courier I.A. Kolosov worked 176 working hours in September, and was supposed to work 168. Overtime was 8 hours, because I.A. Kolosov went to work on Saturday. The courier's salary is 20,000 rubles, the average monthly number of hours is 162.42.

20,000/162.42 = 123.14 rubles. — average hourly courier rate.

123.14 x 8 x 2 = 1,970.24 rubles. — additional payment for working on a day off.

The nuances of paying salary for going out at night

For those citizens who are forced to perform their work at night (22:00 to 06:00), an increase of no less than 20% of the tariff rate for each hour of such work is provided.

If an employee is required to work at night, he must receive increased pay for this

Mechanic L.S. Antipov went to work at night from 00:00 to 02:00. The mechanic's salary is 50,000 rubles.

50,000/162.42 = 307.84 rubles. — average hourly rate L.S. Antipova.

307.84 x 20% = 61.57 rubles. — percentage increase to the average hourly rate of 20%.

307.84 + 61.57 = 369.41 rubles. — salary amount per hour at night.

369.41 x 2 = 738.82 rubles. — the total amount taking into account the night supplement that will be charged to L.S. Antipov for going out at night.

Advance payment calculation

According to Art. 136 of the Labor Code of the Russian Federation, wages must be paid to the employee every half month. Consequently, one salary payment is made at the beginning of the month, the other in the middle. Which of these payments will be called an advance and which directly as a salary depends on the local regulations adopted by the employer. A pay slip is not prepared separately for the advance payment, but when the salary is paid, this amount is reflected in the general pay slip.

There are two main ways to calculate the advance.

- Percentage of salary.

- Proportional to time worked.

Each organization independently selects and approves the option that is most acceptable for a particular company.

The essence of the first option is that a fixed percentage of the salary is used (for example, 40% of the salary). This amount cannot be underestimated and it is better to take into account additional payments and allowances when calculating (letter of the Ministry of Labor No. 11–4/ОOG-718 dated 04/18/2017).

Secretary L.V. Denisova receives a salary of 20,000 rubles. The company pays an advance in the amount of 40% of the salary. Let's calculate how many L.V. Denisova will receive it in her hands within a month.

20,000 x 40% = 8,000 rub. - the amount of the advance that the secretary received on the 25th.

20,000 – 2,600 = 17,400 rubles. — salary amount after deducting personal income tax from the amount.

17,400 – 8,000 = 9,400 rubles. - Secretary L.V. Denisova will receive a monthly salary after deducting the advance and personal income tax.

This calculation method is easy to use, but the actual time worked remains without attention, which threatens to be overpaid in the event of an employee’s early dismissal.

The regulations on remuneration, establishing the terms of payment of salary, are drawn up taking into account the nuances of the business of a particular company

The second option is more complicated, but it is recommended by the Ministry of Labor (letter No. 14-1/10/B-660 dated 02/03/2016). In this case, the first half of the month (from the 1st to the 15th) is used for calculation in accordance with the working time sheet, which means that the advance amount will not be fixed. If an employee worked only two days in the first half of the month, he is still entitled to an advance, otherwise the company will face a fine. If the employee is sick during the first half of the month, the company has the right not to pay the advance.

Driver S.V. Petrov works a regular five-day shift with a salary of 25,000 rubles. The company uses the method of calculating the advance in proportion to the time worked. In the first half of September S.V. Petrov was absent for 3 days (he took leave at his own expense). Let's calculate the advance amount.

In the first half of September there are 11 working days (until the 15th inclusive). The driver worked 8 days (11 – 3). There are 21 working days in September.

25,000/21 = 1,190.47 - the amount of salary for one day.

1,190.47 * 8 = 9,523.76 rubles. — advance amount for September 2017

It is important to remember that the advance payment does not need to be subject to insurance premiums and personal income tax. All contributions and taxes on the salary must be accrued and paid in full when issuing the salary for the month.

Salary deductions

The most basic and universal withholding is the personal income tax (13% of the salary).

In some cases, the employer has the right to withhold a certain amount of money from the employee’s salary

Personal income tax and deductions under executive documents are mandatory deductions from an employee’s salary. Law No. 229-FZ includes a list of such documents:

- performance list;

- court order;

- agreements on payment of alimony (notarized);

- certificates of labor dispute commissions;

- acts of bodies exercising control functions on the collection of funds;

- judicial acts on administrative offenses;

- resolution of the bailiff;

- acts of other bodies.

The employer's initiative is also the basis for deductions, but only with the written consent of the employee (Article 137 of the Labor Code of the Russian Federation). Withholding may be made in the following cases:

- unearned advance payment issued to the employee on account of the salary;

- unspent and unreturned advance payment issued for a business trip and other purposes;

- amounts paid in error;

- labor disputes regarding the employee’s failure to fulfill official duties;

- used but unworked vacation days upon dismissal of an employee;

- compensation for damage due to the fault of an employee.

Management can deduct from an employee’s salary only 20% with each salary payment until the entire amount is paid (Article 138 of the Labor Code of the Russian Federation).

Sample application from an employee to withhold alimony from salary

An employee may express a personal desire to deduct from the salary in the form of an application. The employer, in turn, can give consent, but is not obliged. Deductions at personal request can be different: voluntary insurance, union dues, loan repayment, charity, etc.

Tariff system of remuneration

The basis of the tariff system is the use of a tariff schedule, which specifies the amount of remuneration for certain positions, taking into account the complexity of the work performed and other conditions. The elements of the tariff system are as follows:

- grid - a scale connecting digits with coefficients;

- discharge;

- coefficient;

- bid;

- TKS - tariff and qualification directory of positions.

The tariff rate is fixed by local regulatory documents, which should not contradict the Labor Code of the Russian Federation. The same positions are required to have the same salaries. Bonuses and incentives may be different due to several points (Article 132 of the Labor Code of the Russian Federation):

- complexity;

- qualification;

- quality;

- labor costs.

The worker who performs the simplest operations is always assigned the first rank. If an employee grows professionally, then his rank will also increase.

The use of a tariff system has a beneficial effect in those organizations that welcome the implementation of various plans. To improve labor performance, it is necessary to reward employees with bonuses.

How to calculate and withhold personal income tax

Companies and entrepreneurs paying salaries to their employees are tax agents in relation to them. This means that the accountant must calculate personal income tax on the amount of the salary, withhold it from the employee’s income and transfer it to the budget.

Tax is charged not only on the salary itself, but also on vacation pay and sick leave benefits (with the exception of maternity benefits, which are exempt from personal income tax). In addition, payments in kind are subject to tax: lunches, participation in corporate events, etc. The personal income tax rate in this case is 13%. Please note: the amount of personal income tax withheld should not exceed 50% of the amount paid to the employee.

Example 3

In January, the employee received income from his employer in the amount of 35,000 rubles. Accounting has calculated that the tax on an employee’s salary is 4,550 rubles. (RUB 35,000 x 13%) (to simplify, we considered the situation when the employee is not provided with tax deductions). The accountant transferred this amount to the budget, and the employee received 30,450 rubles. (35,000 - 4,550). Thus, the amount of tax withheld did not exceed the 50 percent limit.

Accounting is required to keep records of income and withheld tax for each individual in specially designed tax registers (see “Tax registers: instructions for use”). In addition, accountants must, at the request of individuals, issue them income certificates in the approved form.

Tax withheld from wages must be transferred to the budget no later than the day following the day the income is paid.

An exception is provided only for vacation pay and sick leave (including for child care)—personal income tax must be transferred to the budget no later than the last day of the month in which they are paid.

The employer is also required to submit to the tax office information about income paid in the previous year. To do this, no later than March 1, you need to fill out and submit to the inspection certificates in form 2-NDFL. If 11 or more people received income, they must report online. If there are 10 people or less, it can be done on paper (see “The Federal Tax Service clarified who is required to report on personal income tax and contributions via the Internet from 2022”).

In addition, it is necessary to submit quarterly reports on personal income tax in form 6-NDFL.

Fill out and submit 6‑NDFL and 2‑NDFL via the Internet

How to transfer personal income tax and report to the Federal Tax Service

Individual income tax must be transferred to the budget no later than the day following the day the income is paid. The only exception is for vacation and sick leave, including for child care, when personal income tax must be paid before the end of the month in which benefits are paid.

To report for withheld personal income tax, the employer submits two forms.

- Once a year, before March 1, you must submit to the inspectorate certificates in form 2-NDFL, in which you provide information about income paid in the previous year. If 11 or more people received income, they must report online.

- In addition, every quarter during the year the employer submits Form 6-NDFL, where he indicates general data on all individuals who received income from him.

What documents to fill out when issuing salaries?

Article 136 of the Labor Code obliges employers to notify each employee in writing of all accruals and deductions, as well as the final amount of salary that the employee will receive. To fulfill this requirement, companies and entrepreneurs draw up and issue so-called payslips to employees.

The form of such a sheet is not established, so each employer develops it independently. The main thing is that the form contains fields for all the necessary information.

In addition, you should fill out either a payroll statement (you can use form No. T-49) or two other statements: settlement (you can use form No. T-51) and payment (you can use form No. T-53). In the case when salaries are transferred to cards, only a payslip is needed.

Receiving salary by proxy

Sometimes a person cannot show up for work and receive a salary in person. Such situations often occur in those organizations where cash payments to employees predominate. The way out of this situation will be to draw up a power of attorney for another person who will be able to receive the money in full and transfer it personally.

The power of attorney is drawn up in free form, but the document must contain the following information:

- date and place of compilation;

- passport details of the principal and attorney;

- an order to receive a salary at the enterprise's cash desk;

- validity;

- signature of the principal and attorney;

- employer's note on document certification.

It is important to remember that the power of attorney does not need to be certified by a notary; certification by the head of the organization will be sufficient.

Power of attorney of the principal for receipt of salary by an attorney from the cash desk

After meeting all the above conditions, the responsible person can safely transfer money from hand to hand to the attorney.

Salary for less than a month: calculation formula and examples

Calculation of salary for an incomplete month is made using the formula:

We will show with examples how to calculate wages for an incomplete month using this formula in various situations. To simplify calculations, we will not take into account additional payments (AD) when calculating salaries.

Example 1

Senior manager of Torgovye Rydy LLC Gulyaeva A. N. (salary according to the staffing table - 42,350 rubles) resigned from the company on January 11, 20XX. Consequently, in January (after the end of the New Year holidays) she worked for 3 days: January 9, 10 and 11. For these days her salary was calculated:

Salary = 42,350 / 17 days. × 3 days = 7,473.53 rub.

A new employee was hired to replace Gulyaeva A.N. with the same salary, and in January he worked from 01/09/20XX to 01/31/20XX (all working days). For January he will be paid a salary in the amount of salary: 42,350 rubles.

Example 2

At her request, pregnant employee S. L. Kapilova was given a part-time working regime (Article 93 of the Labor Code of the Russian Federation) - a five-day working week with a working day of 6 hours. The salary for her position according to the staffing table is 25,340 rubles. In January 20XX, Kapilova worked 17 days, which is the norm for this month. But she will not receive the full salary, since her working day is 2 hours less than usual. To determine the amount of S.L. Kapilova’s salary, it is necessary to adjust the salary taking into account the shortened working day. To do this, you can use the above formula, modifying it:

Salary = (25,340 / (17 × 8)) × (17 × 6) = 19,005 rubles.

Since the employee worked all working days in the billing month, we can simplify this formula:

Salary = 25,340 / 8 × 6 = 19,005 rubles.

Or adjust the salary for a fully worked month using the K coefficient, taking into account the shortened working day:

K = 6 / 8 = 0.75

Salary = salary × K = 25,340 × 0.75 = 19,005 rubles.

If a part-time employee does not work the entire pay month (for example, 15 out of 17 working days), the amount of wages is calculated as follows:

Salary = (25,340 × / (17 × 8)) × (15 × 6) = 16,769.12 rubles.

The same amount can be determined using another formula:

Salary = K × salary / 17 days. × 15 days = 0.75 × 25,340 / 17 × 15 = 16,769.12 rubles.

Example 3

After a special assessment of working conditions, welder of the metal structures workshop P.N. Karavaev was given a working week of 36 hours (reduced working hours according to Article 92 of the Labor Code of the Russian Federation). Welder salary - RUB 72,190. In January, Karavaev P.N. worked 122.4 hours - the norm established for a 36-hour work week in January 20XX. Therefore, he should be accrued a salary in the amount of salary: 72,190 rubles.

Let’s assume that Karavaev P.N. took a few days at his own expense and worked 91.8 hours this month against the norm of 122.4 hours. In this case, for the month that was not fully worked, he will be paid a salary in the following amount:

Salary = 72,190 × / 122.4 × 91.8 = 54,142.50 rubles.

In this situation, you need to substitute not days, but hours (according to the norm for January and actually worked in this month) into the formula.

Thus, to answer the question of how to calculate salary for an incomplete month, knowing only one formula is not enough. It is necessary to correctly keep records of hours worked, and also take into account other nuances: the length of the working day, the standard hours for the reduced working hours regime, etc.

Not only the calculation of salaries to employees, but also the accounting of settlements with employees has important features. And ConsultantPlus experts talk about them in detail. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.