An employee fell ill while on annual paid leave

If an employee falls ill during the next annual leave, then he is entitled to temporary disability benefits, and the leave will be extended or postponed (Article 124 of the Labor Code of the Russian Federation, Article 6 of the Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity").

If an employee receives sick leave during vacation, he is obliged to immediately notify the employer about this in any convenient way - by mail, telephone, telegram, etc. (Clause 18 of the Rules on regular and additional leaves, approved by the People's Commissariat of the USSR on April 30, 1930 N 169). If an employee, for good reasons, did not immediately notify the employer of illness during vacation, or untimely submitted a certificate of incapacity for work and independently extended the vacation, this cannot be regarded as an abuse of right (Review of judicial practice of the Supreme Court of the Russian Federation for the third quarter of 2013, approved by the Presidium of the Supreme Court RF 02/05/2014).

Payment of sick leave during regular vacation

If the employee himself falls ill during annual leave (main or additional), then this time is subject to payment, Art. 183 TK. Payment of sick leave during vacation, among other things, is described in detail in Law 255-FZ. First of all, you need to understand when payment will be refused:

- If the injury or illness was the result of excessive alcoholic libations or other intoxication.

- The disability occurred as a result of self-harm or an attempt to take one's own life.

- If a criminal act has been committed.

In the event that a sick leave certificate is nevertheless issued and the doctor does not make notes on it leading to a refusal to accrue social benefits, then such a document must first be submitted to the personnel department and then transferred to accountants for payment. Sometimes an employee may wonder whether sick leave is paid during vacation and whether this will negatively affect his financial condition? Calculation of financial support for the entire duration of the illness is carried out in the same way as for sick leave during work. To do this, define:

- The length of the insurance period, since the amount of the benefit depends on this. If the length of service is more than 8 years, then only in this case the payment for sick days will be 100% of the accrued amount.

- Period of work at the current enterprise. If it is more than 2 years in a row, then the calculation will be carried out in a short time without additional certificates and requests to the Social Insurance Fund.

- Months in a two-year period when there was no income or it was less than the minimum wage.

- The number of days on the calendar that must be paid. The first three of them are at the expense of the employer, the rest are at the expense of the Social Insurance Fund.

- Average income per day. To do this, divide the total income for 24 months by 730 or 731.

- Final benefit amount. To do this, we multiply the average rate by the total number of days.

As you can see, the fact of receiving sick leave during work leave will not entail a reduction in the amount of benefits. But this may affect the amount of vacation pay itself.

Annual paid leave: extend or postpone

Annual paid leave must be extended or postponed to another period determined by the employer taking into account the wishes of the employee, in the event of temporary disability of the employee (according to Article 124 of the Labor Code of the Russian Federation).

| Situation: According to the vacation schedule, an employee is entitled to a vacation of 10 days. He went on vacation, but a day later he fell ill and was on sick leave for 7 days. This means that the employee either leaves vacation 7 days later than originally expected, or leaves on time, but still has 7 days of vacation left. An employee can go to work exactly when, according to the order for granting leave, his leave should have ended. In this case, the working time sheet will contain the code “OT” (annual leave) not for 10 days, but only for 3 days. And in 7 days - code “B” (temporary disability). During these days he will receive disability benefits. |

The period for which the vacation will be postponed (the remaining part of the vacation) is determined by the employer, taking into account the wishes of the employee expressed in the application (Part 1 of Article 124 of the Labor Code of the Russian Federation). Accordingly, the employer is obliged to postpone the vacation at the request of the employee. But the transfer date is determined not only based on the wishes of the employee, but also taking into account the capabilities of the employer. After the employee and employer agree on the date of the new vacation, it is necessary to issue an order to postpone the vacation. And based on the order, make changes to the vacation schedule.

| Important! What should an accountant do with vacation pay? For example, in the situation discussed above, vacation pay was paid for 10 days, but in fact 3 days of vacation were used. Is it possible to deduct vacation pay from an employee for unused vacation days? Article 137 of the Labor Code clearly states cases when certain amounts can be withheld from an employee’s salary. This list is exhaustive and is not subject to broad interpretation. The current situation is not on this list. This means that vacation pay for 7 days cannot be withheld from the employee. |

Despite the fact that the mechanism for such recalculation is not specified directly in the Labor Code of the Russian Federation, it is necessary to do so. After all, vacation pay accruing during the period of vacation actually not used due to illness is, in fact, no longer the average earnings saved for vacation days. For the days that the employee was ill, his lost earnings are compensated by paying temporary disability benefits. In practice, they do this: accountants recalculate and spend vacation pay for sick days as an advance to the employee towards his salary, which he will begin to earn after returning from vacation. And such actions are legal, the prohibition of the Labor Code of the Russian Federation on withholding is observed - no amounts are withheld from the employee. When the employee goes on vacation, it will be necessary to issue a new vacation order and accrue vacation pay to him again, calculating the average earnings.

| Important! But if an employee is delayed in returning to work for exactly the same number of days as the sick leave was issued for, it means that he decided to extend his vacation. And he should not write any applications to extend his vacation. There is no need to draw up an order to extend vacation or make changes to the vacation schedule. The only document that the employee must provide and which obliges the employer to extend the leave is a certificate of temporary incapacity for work. In such a situation, there is no need to recalculate vacation pay. The employee must be paid sickness benefits (Clause 1, Article 15 of Law No. 255-FZ of December 29, 2006). |

| Situation: In practice, employees determine the date of return from vacation in case of illness independently, counting the number of days of incapacity from the last day of vacation. However, the number of sick days and the number of vacation days that an employee has taken is not always the same. For example, if a non-working holiday falls during the period of illness, there is no need to extend vacation for it - it no longer falls within the vacation period, but is excluded from it along with days of illness (Part 1 of Article 120 of the Labor Code of the Russian Federation). Or the number of sick days may be greater than the number of vacation days not used because of it. Vacation is extended specifically for vacation days not used due to illness, and not for sick days. |

If an employee falls ill before the start of the vacation and does not have time to recover by the time it begins, the vacation must be rescheduled for another date.

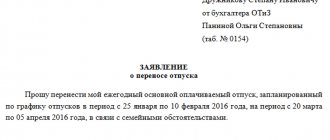

What information must be included in an application to postpone leave due to illness?

An application for transferring leave due to sick leave must contain all the facts that served as the reason for such transfer:

- initial vacation dates according to the approved vacation schedule;

- period of incapacity for work and details of sick leave;

- desired dates to which you want to reschedule your vacation.

A sample application for transferring leave due to sick leave can be downloaded from the link below.

Based on the employee’s application, the employer, if he agrees with the terms of the transfer, issues an order to amend the vacation schedule and recalculate vacation pay. To avoid having to rewrite the application several times, it is advisable to first agree on the period of the new vacation with the employer.

A sample vacation order can be downloaded from the material “How to arrange a transfer of vacation at the request of an employee.”

If production needs do not allow the employee to go on vacation, then the planned dates will have to be changed. The same situation will occur if the desired transfer dates coincide with the vacation dates in the approved vacation schedule for the employee who must replace the employee requesting the transfer. Priority in this situation goes to the one whose vacation is approved by the schedule.

In the case where an employee wishes to extend leave due to illness, it is not necessary to write a statement, but some personnel services still require the desire to change the end date of the leave to be recorded in writing.

A child or family member falls ill during annual leave

Please note: if a member of the employee’s family falls ill during the period of annual paid leave, this circumstance does not affect the extension of the said leave (Decision of the Supreme Court of the Russian Federation dated 02.28.2013 N APL13-18, decision of the Supreme Court of the Russian Federation dated 03.12.2012 N AKPI12-1459). Accordingly, if your employee takes sick leave to care for a child during his paid leave, then the leave is not extended or transferred, and sick leave is not paid. Such sick leave was issued in violation of clause 41 of the Procedure for issuing certificates of incapacity for work, approved. By Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n.

An employee fell ill while on unpaid leave

If an employee falls ill during a vacation without pay, then for days of illness coinciding with such vacation, he should not be issued a sick leave certificate (clause 22 of the Procedure for issuing certificates of incapacity for work, approved by Order No. 624n). For the days of such leave, temporary disability benefits are not paid (clause 1, part 1, article 9 of the Federal Law of December 29, 2006 N 255-FZ).

The employee's benefits must be paid from the day he was supposed to start working at the end of his vacation at his own expense.

To help the accountant

When adjusting the duration of vacation due to illness, it becomes necessary to recalculate vacation pay. The actions of the accountant depend on which option the sick employee chose.

| Vacation is extended | Vacation is postponed |

| If the employee continues to rest, there is no need to recalculate vacation pay. The accountant calculates sick leave in the generally established manner, prepares documents for the payment of temporary disability benefits within the time limits provided for by law (FSS Letter No. 02-13/07-4830 dated 06/05/2007) | If an employee postpones his vacation to another date, the accountant recalculates vacation pay based on the number of days actually taken. Then he calculates disability benefits, comparing the resulting amount with previously accrued vacation pay. When a debt is incurred by the organization, the employee is paid the resulting difference. |

If a debt has arisen from an employee, you cannot simply withhold money from him (Article 137 of the Labor Code of the Russian Federation).

The difference is repaid in any way:

- the employee voluntarily deposits excess funds into the cash register;

- The accountant, with the written consent of the employee, offsets the amounts of disability benefits and vacation pay, then withholds the overpayment from the next salary.

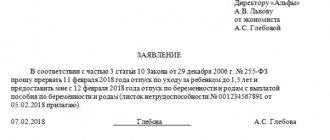

An employee fell ill while on maternity leave

If an employee is on parental leave and does not work, temporary disability benefits are not paid (clause 1, part 1, article 9 of Law No. 255-FZ of December 29, 2006).

An employee who is on parental leave and works part-time must be paid sick leave benefits in both cases (clause 23, Procedure for issuing sick leave, approved by Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n) : when the employee himself is ill and when caring for a sick child or other family member.

Normative base

Based on the provisions of Part 1 of Art. 124 of the Labor Code of the Russian Federation, the employer must extend or postpone the period of annual paid rest if the employee falls ill during it. Adjusting the duration of vacation is possible in two cases:

- The employee's health has deteriorated.

- A pregnant employee on maternity leave experienced a complicated birth. If an appropriate certificate of incapacity for work is provided, the leave is extended.

The above norms of the Labor Code of the Russian Federation do not apply to situations where:

- the employee’s child or another family member was sick (sick leave was issued with a disability reason code of 09);

- The employee was granted study leave.

An employee fell ill on vacation and was subsequently dismissed

When granting leave with subsequent dismissal in accordance with Part 4 of Art. 127 of the Labor Code of the Russian Federation, an employee has the right to withdraw his resignation letter before the start of his vacation. Consequently, the employment relationship with such an employee is terminated on the last working day before the start of the vacation, and therefore the vacation is not extended by the number of sick days.

During illness during the period of vacation followed by dismissal, the employee is paid temporary disability benefits in the usual amount, which depends on the length of insurance (part one of Articles 6, 7, 9 of the Law of December 29, 2006 N 255-FZ, Letter of Rostrud of December 24, 2007 N 5277-6-1).

Calculating the number of days of vacation extension

According to the explanations given by Rostrud in Letter No. 5339-6-1 dated December 27, 2007, leave for a sick employee is extended by the number of calendar days of incapacity. At the same time, the FSS believes that the rest period should be increased by the number of calendar days of incapacity, taking into account holidays and weekends (Letter No. 02-13/07-4830 dated 06/05/2007).

If we take into account that vacation provides the employee with the opportunity to restore physical and mental strength (according to ILO Recommendation No. 47 of June 24, 1936 on annual paid vacations), and at the same time equality of rights of personnel must be observed (Article 2 of the Labor Code of the Russian Federation), vacation is extended by the number of working days during the period of incapacity, minus the holidays listed in Art. 112 Labor Code of the Russian Federation.

Example 1

An employee works for the company on a 5-day workweek with an 8-hour workday. According to the order, he was sent on another paid leave from April 29 to May 26, 2022. During the rest (from May 6 to May 15), the employee fell ill, which is confirmed by a certificate of incapacity for work. How to extend your vacation correctly?

In this case, sick leave was issued for 10 calendar days, 1 of which - May 9 - is a non-working holiday. Consequently, annual leave is extended by 9 days, and the employee will have to return to work not on May 27, but on June 5, 2022.

Example 2

Let's change the conditions: suppose that the employee was sick for 18 calendar days: from May 6 to May 23, 2022. The extended vacation days, in addition to May 9, include another holiday - June 12, which is not included in the number of calendar days when calculating the duration of rest (Art. 120 Labor Code of the Russian Federation). Consequently, the specialist will begin duties only on June 14.