What is basic paid leave according to the Labor Code of the Russian Federation, the order of leave and the right to leave

Vacation is an annual period when an employee may not work, but at the same time retains his place of work and average earnings.

The Labor Code classifies vacation as the employee's rest time, that is, during this period he does not perform work duties and uses it as he deems necessary (Articles 106, 107 of the Labor Code of the Russian Federation).

When does the right to leave arise?

For the first time, an employee can count on being granted leave if he has worked in one place for six months without being fired. All employers are required to pay for this rest time - both organizations and individuals engaged in individual entrepreneurial activities.

At the same time, all employees who have entered into an employment contract can take leave. These include:

- combining their main place of employment with other paid work (Part 2 of Article 287 of the Labor Code of the Russian Federation);

- performing work during a specific season (Article 295 of the Labor Code of the Russian Federation);

- those who have concluded an employment agreement for no more than two months (Article 291 of the Labor Code of the Russian Federation);

- performing duties under an employment contract at home (Part 4 of Article 310 of the Labor Code of the Russian Federation);

- performing their labor functions outside the location of the employer, that is, remotely (Article 312.4 of the Labor Code of the Russian Federation).

Thus, the exercise of the right to leave does not depend on what position the employee holds, where he performs his duties, what working hours he has and what validity period is specified in his employment contract.

However, these rules do not apply to those who were employed under a civil contract. This category of employees does not have the right to leave (paragraph 4, part 8, article 11 of the Labor Code of the Russian Federation).

An employee must receive basic paid leave annually on the basis of Part 1 of Art. 122 Labor Code of the Russian Federation. In this case, it is not the calendar year that is taken into account, but the so-called working year. It consists of 12 months and is calculated not from January 1, but from the date of hiring (similar wording is contained in the letter of Rostrud dated December 8, 2008 No. 2742-6-1).

How is the priority of vacations established?

The sequence of vacations is established by drawing up a schedule based on the wishes of the employees and taking into account the interests of the employer. Art. 123 of the Labor Code of the Russian Federation indicates that the vacation schedule must be published no later than two weeks before the start of the new year.

Important! When drawing up a vacation schedule, the employer should take into account that a number of categories of employees have the right to take annual vacation at any time convenient for them.

These include, in particular:

- persons who did not take vacation due to recall from it (Article 125 of the Labor Code of the Russian Federation);

- students receiving their first higher education (Article 177 of the Labor Code of the Russian Federation);

- part-time workers to whom the employer is obliged to provide leave simultaneously with leave from their main job (Article 286 of the Labor Code of the Russian Federation);

- employees affected by radiation in Chernobyl (Article 14 of the Law “On Social Protection of Citizens Exposed to Radiation...” dated May 15, 1991 No. 1244-1);

- disabled war veterans, participants and veterans of the Great Patriotic War, combat veterans (Articles 14–17 of the Law “On Veterans” dated January 12, 1995 No. 5-FZ);

- Heroes of the USSR and Russia, holders of the Order of Glory of all three degrees (Article 8 of the Law “On the Status of Heroes...” dated January 15, 1993 No. 4301-1);

- Heroes of socialist labor and holders of the Order of Labor Glory of three degrees (Article 6 of the Law “On Providing Social Guarantees to Heroes...” dated 01/09/1997 No. 5-FZ);

- wives and husbands of military personnel who, at their own request, have the right to receive leave at the same time as their spouse (Article 11 of the Law “On the Status of Military Personnel” dated May 27, 1998 No. 76-FZ;

- minors (Article 267 of the Labor Code of the Russian Federation), etc.

The employee has the right to receive vacation days for previous working periods that were not used in accordance with the vacation schedule for the next year or use it in another way by agreement with management (Rostrud letter No. 473-6-0 dated March 1, 2007).

Is it possible to go on vacation earlier or later than the deadline established by law?

According to Part 2 of Art. 122 of the Labor Code of the Russian Federation, the manager has the right to put an employee on vacation before six months have elapsed from the date of his employment.

To provide annual paid leave in this case, it is enough to write a corresponding application addressed to the employer. Based on this document, he makes a decision and affixes the appropriate visa to it. If the decision is positive, an order is issued to grant the employee leave on the dates specified by him.

However, Part 3 of Art. 122 of the Labor Code of the Russian Federation contains a list of persons who are required to be granted leave before the expiration of the due period at their request. These include:

- employees who intend to use annual leave before or after maternity leave;

- employees under 18 years of age;

- adoptive parents of an infant under three months of age.

In addition, some categories of employed citizens can receive leave at any time convenient for them, regardless of their length of service with a particular employer. In particular, the following have the right:

- a husband while his wife is on maternity leave (Part 4 of Article 123 of the Labor Code of the Russian Federation);

- a person raising a disabled child under 18 years of age (Article 262.1 of the Labor Code of the Russian Federation);

- employees with three or more children under the age of 12 (Article 262.1 of the Labor Code of the Russian Federation).

When granted leave at their main place of work, part-time employees have the right to receive leave in advance, that is, in advance, if they have not worked for the required six months (Article 286 of the Labor Code of the Russian Federation).

If an employee extends his leave due to illness

When an employee on vacation falls ill, he is forced to extend it for the period of illness. In such a situation, sick time should be excluded from the calculation period. That is, initially, when calculating vacation pay, the billing period is calculated based on the employee’s time working in the organization. And then sick days are excluded from this period.

More details with an example:

The accountant of Continent LLC wrote an application for leave from October 17 to October 31, 2022. She was sick all the days of her vacation and rescheduled it for the period from November 1 to November 15, 2022. The billing period will be as follows:

From November 1, 2016 to October 16, 2022, while days from October 17 to October 31, 2022 should be excluded from the calculation period.

How many days is annual regular leave according to the Labor Code of the Russian Federation?

The duration of annual paid leave according to the Labor Code of the Russian Federation is 28 calendar days (Article 115). That's the minimum. There are categories of workers whose period of paid rest exceeds 28 days, for example doctors, employees of the Ministry of Internal Affairs and others (you will find the list below). For them, the duration of regular vacations and the procedure for their provision are approved by the relevant federal laws.

In addition to the basic federal legislation, the employer’s “salary” provisions or employment contracts may provide for additional paid leave. Some allow them along with the main one, others provide them separately. These points are determined by the management of the organization.

When taking annual leave, you should consider whether its duration covers non-working days. Art. 120 of the Labor Code of the Russian Federation states that vacation is calculated in calendar days, not in working days, therefore days that fall on weekends are included in this rest time and are paid.

However, non-working holidays, the list of which is contained in Art. 112 of the Labor Code of the Russian Federation, are not included in the number of vacation days and are not subject to payment.

For example, an employee asked for 14 days of leave from April 20 to May 3, 2022. Since May 1, which falls within this period, is a holiday, only 13 days of vacation will be counted and paid (including the weekends of April 25, 26, May 2, 3).

Who is entitled to extended paid leave?

As mentioned earlier, for certain categories of employees the legislation provides for basic leave exceeding the standard duration. Let's take a closer look at who belongs to them and how many days of vacation they can count on:

- Minor employees under 18 years of age - 31 calendar days, can be provided at any time (Article 267 of the Labor Code of the Russian Federation).

- Disabled people - at least 30 calendar days.

- Teachers - the number of days varies from 42 to 56 depending on the position and type of educational institution.

- Scientists, if they work in a budget scientific organization - 48 days for doctors of science, for candidates - 36 days.

- Those working with chemical weapons - 49-56 days, depending on the degree of danger of the work performed.

- Rescue service employees - 30, 35, 40 days depending on length of service.

- Medical workers who, due to their activities, are at risk of contracting HIV infection - 36 days.

- Civil servants - 30 days.

- Prosecutor's office employees - 30 days, not taking into account the time on the road to the place of rest and back.

- Investigative Committee employees - 30 days. For this category, during the vacation period, travel time to the vacation spot and back is counted.

Additional leave for northerners

Labor legislation establishes some privileges for those citizens who work in harsh climatic conditions. Such employees, in addition to the standard basic leave, have the right to receive additional rest time on the basis of Art. 321 Labor Code of the Russian Federation.

The duration of such additional leave is 24 calendar days for workers in the Far North and 16 days in equivalent areas.

In other regions of the North that do not fall into these categories, if they have a regional coefficient and a percentage of wages, employees can count on an additional 8 days of vacation on the basis of Art. 14 of the Law “On State Guarantees...” dated February 19, 1993 No. 4520-1.

In addition, by virtue of Art. 122 of the Labor Code of the Russian Federation, workers of the North can take out basic and additional annual leave, regardless of the period of continuous work, in advance.

Payments taken into account when calculating

One of the key factors in the process of determining compensation for mandatory rest (both during regular leave and during dismissal) is the employee’s income level. Here it is important to take into account the cash accruals included when determining average earnings.

This includes all monetary remunerations provided for by the company’s employee remuneration system, consisting of:

- Basic salary.

- Bonuses awarded for work.

- All kinds of additional payments, due allowances, constant compensation payments.

- Production one-time remuneration.

- Other payments (for example, for loyalty to the company, for the quarter, for the year), stipulated by the collective agreement.

It should be noted that not all payments provided for by the collective agreement are considered when calculating the average income level. In particular, it is necessary to subtract monetary amounts that fall within the periods that must be excluded from the calculation. This included:

- all accruals that were paid for the periods that were excluded from the calculation. For example, average income during a business trip, various social benefits;

- social assistance from other sources of income, which is not regulated by the salary regulations. Here they will count financial assistance, compensation for housing, gifts, recreation, treatment;

- remunerations and bonuses paid not according to a salary document.

To calculate the average daily income, use the following formula:

You need to divide your earnings for the period (here we take annual income) by 12 months and divide by 29.3 (averaging the number of days). This way you will receive the employee's daily income.

For example, a worker was calculated to have an annual income of 356,000 rubles; he did not go on business trips, did not get sick, did not take free “time off” in excess of the norm, and worked a full year. Has a prescribed relaxation period of 28 days.

His average daily income will be:

Сз = 356,000 / (12 x 29.3) = 1012.51 rubles.

Now, in order to receive compensation (vacation pay), the amount received must be multiplied by the days required by law:

K = 1012.51 x 28 = 28350.28 rubles.

Thus, our virtual employee will have 28 days of rest, for which he will be paid 28,350.28 rubles.

Remember, during the calculation process, accounting will take into account all periods of your work and rest, and the number of individual types of additional leave will be calculated based on the time actually worked.

Vacation pay

To find out how much money you will receive from your employer when you go on vacation, you need to refer to the Regulations on Average Earnings, approved by the Decree of the Government of the Russian Federation “On the specifics of the procedure for calculating the average salary” dated December 24, 2007 No. 922.

According to this document, in order to determine the amount of vacation pay, the employee’s average daily earnings must be multiplied by the number of vacation days (clause 9 of the Regulations). Average daily earnings are calculated by dividing the base for vacation pay for the 12 months preceding the month the vacation began by the number of days actually worked during this period, including weekends and holidays (clause 4 of the Regulations).

Periods when the employee was on a business trip, on vacation or on sick leave are not included in the number of days worked (clause 5 of the Regulations).

The vacation pay base includes all types of payments received by the employee during the performance of labor functions, excluding vacation pay, travel allowance and sick leave pay.

If the month is fully worked, the average monthly number of days is taken into account - 29.3.

To calculate the number of days worked for an incompletely worked month, you need to divide the number of days worked in a month by the number of calendar days in that month and multiply by the average monthly number of days (clause 10 of the Regulations).

What to exclude from the billing period

The following days should be excluded from the calculation period when:

- The employee was paid the average salary. By such days I mean periods of paid vacation, business trips (with the exception of the period of feeding a child);

- The employee was on sick leave or maternity leave;

- The employee took leave at his own expense (without pay);

- The employee took additional paid time off to care for people with disabilities;

- The employee, for reasons beyond the control of the employer or the employee himself, did not work. For example, days of power outages;

- The employee was released from work.

| ★ Collection and directory of all personnel documents (forms and documents in word format) > 1200 books purchased |

To organize personnel records in a company, beginner HR officers and accountants are perfectly suited to the author’s course by Olga Likina (accountant M.Video management) ⇓

| ★ Author's course “Automation of personnel records using 1C Enterprise 8” (more than 30 step-by-step video lessons for beginners with instructions) purchased > 2000 practical courses |

How is annual paid leave divided into parts?

Often, circumstances are such that it is impossible to take the next vacation completely at one time, for example, this may be due to the peculiarities of the production process. Then the rest has to be divided.

Such a division can be immediately provided for by the schedule. It is also requested at the request of the employee. In any case, this must be agreed upon by the employee and the employer.

The Labor Code establishes that one part of vacation should not be less than 14 calendar days. The remainder can be divided in any way, but again by agreement of the parties.

How to calculate vacation days in 2020-2021 (example)

Let's give an example of calculating the days of the billing period for vacation in 2021, taking into account the subtleties and nuances outlined above.

Let’s say an employee got a job at the company on June 17, 2018.

During his work period he:

On January 15, 2021, he decided to quit, having first taken off all the days that he did not use during his work.

Let's see how many vacation days are due per year if the company has a standard vacation duration of 28 days.

Step 1. Determine the length of service

The total length of service from 06/17/2018 to 01/15/2021 will be 2 years 6 months and 29 days.

We do not touch periods of illness and vacation. They are taken into account in the length of service that gives the right to leave, as non-working periods during which the employee’s place of work is retained.

Vacation at your own expense can be included in the length of service within 14 calendar days per working year. We have 2 such periods:

The second period does not fit within the 14-day limit, which means that 7 days of excess will have to be excluded from the length of service.

Thus, the vacation period is 2 years 6 months and 22 days. Round up to full months, discarding 7 days, and we get 2 years and 7 months.

Step 2. Calculate the number of vacation days that the employee is entitled to for the specified period

This is 56 days for 2 full years and another 17 days for an incomplete year of work (28 days / 12 months × 7 months = 16.33 days. Rounding was done according to the rules adopted by the organization (in accordance with the recommendations set out in the letter of the Ministry of Health and Social Development of the Russian Federation dated 07.12 .2005 No. 4334-17) in favor of the employee. Total 73 days.

Step 3. Determine the number of unused vacation days

During his work, the employee took leave three times:

A total of 18 days remain unused (73 – 20 – 21 – 14). Their employee can take time off immediately before dismissal - from 12/21/2020 to 01/15/2021 (including New Year holidays). So, the calculation of vacation in 2022 - an example with a detailed description, has been made.

Rules for extending and postponing the next paid leave

Part 1 art. 124 of the Labor Code of the Russian Federation determines the conditions under which an employee has the right to extend annual basic leave. Such circumstances include:

- An employee is on sick leave during the holiday period;

- performing government duties that require release from work, for example, serving as a juror or member of an election commission;

- other cases that are stipulated in labor legislation or adopted in local acts, for example, the employer in the leave regulations may provide for the extension of leave for a parent due to the illness of a child.

A mandatory postponement of the vacation date specified in the vacation schedule, at the initiative of the employee, is possible only in special cases provided for in Part 2 of Art. 124 Labor Code of the Russian Federation:

- if the employee was not notified that he was granted leave two weeks before it began;

- the employer did not pay for the vacation within the established time frame (at least three days).

In these cases, an application to postpone the vacation is sent to the employer, and its new period is agreed upon with the employee.

In addition, vacation is transferred if an employee who has the right to annual leave at any time convenient for him requests it (we indicated the list of such citizens above).

Also, the circumstances under which postponement of vacation is permissible may be provided for by the employer’s local regulations.

In other cases, transferring vacation to a date different from that specified in the vacation schedule is the employer’s right, not an obligation.

At the same time, Part 3 of Art. 124 of the Labor Code of the Russian Federation gives the employer the opportunity, on his own initiative, to reschedule an employee’s vacation, but only with his consent, if the employee’s departure will negatively affect the progress of the organization’s work.

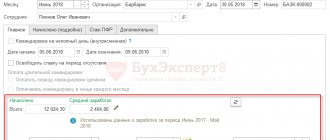

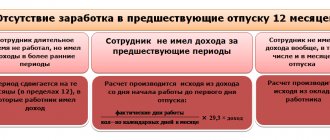

When all days are excluded from the billing period

There are also frequent cases when all days need to be excluded from the billing period. In this case, the calculation period must be replaced by the one that precedes the excluded one.

The calculation also takes a period of a full 12 months.

If the employee also did not have days worked before the required billing period, then the days that the employee worked in the month of going on vacation, immediately before its onset, are taken into account. The same is done if the employee is given vacation in advance during the month of employment (Read also the article ⇒ When to pay personal income tax on vacation pay 2022).

Let's take a closer look at an example:

Accountant Petrova O.P. has been working at Continent LLC since July 24, 2017. Petrova wrote her leave application on November 6, 2017.

Since Petrova worked in the organization for less than a year before her leave, we take the following as the billing period:

July 24, 2022 – October 31, 2022.

The following days should be excluded from this period:

- Business trip days – July 24 – 31, 2022;

- Study leave – August 1, 2022 – December 31, 2017.

Since Petrova’s entire payroll period consists of excluded time, and the preceding payroll period Petrova has not yet worked in the organization, then to calculate vacation pay we will take the days of the month of going on vacation, that is:

November 1 – 5, 2022.

Taxation of vacation payments with taxes and contributions

From vacation pay, as from any other income of an individual, personal income tax is calculated and withheld by the employer, acting as a tax agent. For residents, the tax is calculated at a rate of 13%, for non-residents - at a rate of 30%.

The employer himself pays contributions to the Social Insurance Fund for the entire amount of vacation pay, including for injuries. At the same time, the organization must take into account that these contributions relate to other expenses associated with production and sales and are taken into account in the period of their accrual (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation).

Based on paragraph 1 of Art. 346.14 of the Tax Code of the Russian Federation for organizations on the simplified tax system with the object “income”, when calculating the tax, the amount of vacation pay does not affect the calculation of the single tax, however, the tax itself can be reduced by the amount of insurance premiums paid from vacation payments (subclause 1, clause 3.1, article 346.21 of the Tax Code of the Russian Federation) .

Calculation of vacation in 2020-2021: total amount of vacation pay

Vacation pay is calculated using the formula:

SDZ - average daily earnings;

NDO - number of vacation days.

From March 21, 2021 to April 17, 2021, the employee was granted 28 days of vacation. The period from 03/01/2020 to 02/28/2021 has been fully worked out. An employee receives a monthly salary of 32,000 rubles. In December 2022, he was awarded a bonus of 5,500 rubles. based on the results of work for November 2020.

Salary = 32,000 × 12 + 5,500 = 389,500 rubles.

SDZ = 389,500 / 12 / 29.3 = 1,107.79 rubles.

OTP = 1,107.79 × 28 = 31,018.12 rubles.

Note! If errors are identified in the calculation of vacation pay, they should be recalculated. If you overpay, you must deduct it from the employee’s salary strictly with his consent. If you underpay, pay extra.