I have been a practical HR specialist since 1992, I had to work in different organizations, start work from scratch and rake through dense thickets. By the way, for an experienced HR manager starting from scratch is the best option. The main thing is to get carte blanche from the organization's management. In new companies, I often encountered not only problems in organizing documents, but even the lack of safes for storing work books! Usually, the actual state of affairs in the department differs greatly from what you imagine at all stages of interviews with the management of the new company.

What to do first

Keep calm.

Start by clearing out your desk and closet shelves.

Take a few dozen cardboard recorders

"Crown" type.

Sign them

for starters - in pencil, in accordance with the list of personnel documents that should be in any organization (I give it below).

Make a checklist from this list

and start sorting documents into folders; if you find the required ones, mark them in the checklist.

For each violation of labor legislation, the Code of Administrative Offenses of the Russian Federation provides for penalties:

- For officials - 1000–5000 rubles.

- For entrepreneurs - 1000–5000 rubles.

- For legal entities - 30,000–50,000 rubles.

Mandatory personnel documents

First of all, check the availability of mandatory personnel documents.

Order on the appointment of those responsible for accounting, storage and maintenance of work books

Some personnel officers may argue that there is no such duty in the job descriptions. I am only in favor of every job description spelling out everything in detail, but we are obliged to comply not only with all labor laws, but also with Government Decrees, Orders of the Ministry of Labor and other regulations. Article 45 of the Decree of the Government of the Russian Federation dated April 16, 2003 No. 225 states that such an order for the main activity must be in any form (for absence - a fine of 30,000 rubles). There may not be such an order in an organization only in one case - if everything related to work books (accounting, storage, filling out) is in the hands of the manager. He can work with any documents without additional orders by virtue of his statutory powers.

Advice: it will be better if our leaders do not touch work books. Let everyone mind their own business.

Internal labor regulations (Articles 68, 189, 190 of the Labor Code of the Russian Federation)

Regulations on remuneration and bonuses (Article 135 of the Labor Code of the Russian Federation)

Regulations on the protection of personal data (Chapter 14, paragraph 8 of Article 86 of the Labor Code of the Russian Federation)

Attention! Internal labor regulations, regulations on wages and bonuses and regulations on the protection of personal data are mandatory local regulations (LNA), which any organization must have, regardless of the number of employees and form of ownership. For each absence - a fine of 30,000 rubles.

Staffing table

The debate about whether this document is mandatory continues. I believe that if there is such a term in the Labor Code of the Russian Federation (it is mentioned in Articles 8, 57 of the Labor Code of the Russian Federation), then there is no need to discuss this topic. He must be.

Vacation schedule (Articles 122, 123 of the Labor Code of the Russian Federation)

The vacation schedule according to the nomenclature of cases is stored for only one year. Therefore, the main thing is to look at the date of approval of the document. It must be dated no later than two weeks before the year for which it was compiled. The countdown of all personnel deadlines begins the next day. In relation to the vacation schedule, this is December 17th.

Don't forget to check the calendar! For example, in 2016, December 17 fell on a Saturday. Any GIT inspector in such a situation will ask if you have an order from the head of the company to hire you to work on a day off with appropriate compensation? That year, only companies were “saved” where the manager had an irregular working day - “I went out on Saturday only to approve the vacation schedule.” All others paid fines of 30,000 rubles.

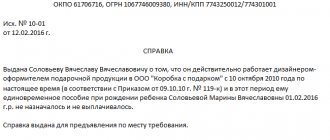

Employment contracts (Articles 56, 57, 67 of the Labor Code of the Russian Federation) and additional agreements to them (Articles 72, 72.1 of the Labor Code of the Russian Federation)

This is a separate topic, clearly regulated by the Labor Code of the Russian Federation.

Labor books (Articles 65, 66 of the Labor Code of the Russian Federation)

We are talking about work books that the personnel officer filled out and took for safekeeping in accordance with the order appointing those responsible for recording, storing and maintaining work books (see above). I strongly recommend, even if there is no one to take over the business, to draw up an act with the numbers of work books that you find. This way you can argue for the possible loss of books.

Forms of work books and inserts for them (Order of the Ministry of Finance of the Russian Federation dated December 22, 2003 No. 117n “On work books”)

And also “The procedure for providing employers with work book forms and inserts in the work book.” Blank forms must be stored in the accounting department along with the receipt and expenditure book (Article 41 of the Decree of the Government of the Russian Federation of April 16, 2003 No. 225). Often forms and the receipt and expense book are stored in the personnel department because the accounting department refuses to take them. And this is a violation of the Decree of the Government of the Russian Federation. For the absence of forms of work books and forms of inserts in work books, you face a penalty of 30,000 rubles. fines. The number of forms in storage depends on the number of employees and staff turnover.

Receipt and expense book for accounting forms of work books and inserts for them

Stored in the accounting department.

Book of accounting of the movement of work books and inserts for them

The receipt and expenditure book for recording forms of work books and inserts for them and the book for recording the movement of work books and inserts for them must be stitched, numbered, sealed with a wax seal or sealed (Articles 40, 41 of the Resolution of April 16, 2003 No. 225). Now Rostrud is considering the issue of abolishing sealing wax or sealing. But for now, their absence in two books will result in a fine of 30,000 rubles.

Labor relations orders with a shelf life of 50 years

Admission, transfer, termination of employment (dismissal), maternity leave, child care leave without pay, annual additional paid, business trips abroad and to the Far North, change of personal data.

Attention! Orders issued before January 1, 2003 must be kept for 75 years (No. 43-FZ dated March 2, 2016).

Labor relations orders with a shelf life of 5 years

Annual vacations, educational vacations, business trips around the Russian Federation.

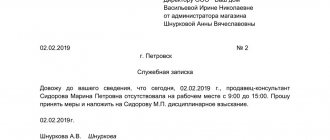

Grounds for orders on labor relations

Any personnel orders must have written reasons. For example:

- applications (vacation, dismissal),

- notifications (in case of reduction, liquidation),

- agreements (upon termination of employment relations by agreement of the parties),

- orders (for vacation orders, business trips to the head of the company in return for ridiculous statements that the director writes to himself on his own behalf),

- employment contracts (to the employment order),

- additional agreements (to the order to change the terms of the employment contract - transfer).

Important! In accordance with Article 68 of the Labor Code of the Russian Federation, employment is formalized by an order issued on the basis of a concluded employment contract. And there is not a word about the statement, although many organizations use it.

Personal cards of employees (T-2)

Time sheets T-13, T-12 (Articles 91, 99 of the Labor Code of the Russian Federation)

Notes - calculation (T-60, T-61)

Materials on labor protection (Article 212 of the Labor Code of the Russian Federation)

Depending on the type of activity of the organization, their number may vary.

Permissions to process personal data of employees

For their absence, Roskomnadzor can fine you in the amount of 15,000 rubles. up to 75,000 rub.

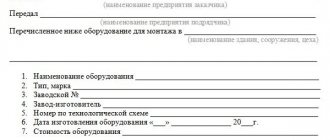

How to apply

In the work of a company, unified forms can be used to create orders, schedules, personal cards, acts, etc. So, if a person goes to work, then an order is drawn up to hire the employee to the company. For this purpose, form T-1 is used.

Also see “Order for employment under a fixed-term employment contract: sample.”

Each document is prepared by the personnel department. Use the form that was approved by the manager and the official responsible for maintaining records. Each document is completed as needed.

The filling itself is quick, because they use a ready-made sample. Only data needs to be entered into the document. The HR employee must have a good understanding of when to use one or another unified form.

Additional list of personnel documents

These documents become mandatory under certain conditions.

Collective agreement (Chapters 6, 7 of the Labor Code of the Russian Federation)

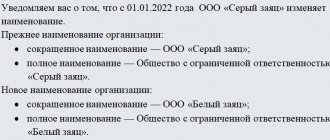

Regulations on commercial, official or state secrets

It will become mandatory if employment contracts include a clause on the need to comply with them (Article 57 of the Labor Code of the Russian Federation) or the employee has signed an obligation of non-disclosure.

Regulations on certification

We are talking only about internal certification of the organization’s employees. It should be regulated by a local regulatory act indicating the goals, objectives, procedure for conducting and reporting the results.

Job Descriptions

As an alternative, you can create only job descriptions (JO). Approve them and either write them down in employment contracts, or familiarize employees with them against signature. Rostrud recommends DO (Letter of Rostrud dated 08/09/2007 No. 3042-6-0, 10/31/2007 No. 4412-6). But the term “job descriptions” is not mentioned in the Labor Code of the Russian Federation.

Shift schedules

Shift schedules must be in place in organizations whose employees in individual positions work according to schedules. Work schedules must be communicated to the staff against signature no later than a month before the period for which they are drawn up. The form of the schedules is not approved by law.

Civil contracts

A very serious topic and GIT has always been biased towards them. During the period from 01/01/2005 to 12/31/2014, the decision of the labor inspectorate to reclassify GPC contracts as labor contracts was advisory, and only the court could say that it was a labor contract, then from 01/01/2015 the rights of the State Labor Inspectorate were returned and now their decision on this issue has become mandatory.

Agreements on financial liability of employees

Regulated by Decree of the Government of the Russian Federation of November 14, 2002 No. 823 “On the procedure for approving the list of positions and works with which the employer can enter into agreements on financial liability.” These contracts can only be concluded with employees whose work is directly related to the receipt or issuance of material or monetary assets.

We checked only the presence of the necessary documents, conducted an initial audit, and put what we found into folders. Now you need to analyze the contents of the documents in detail, correct errors and prepare missing papers. This and other aspects of working with personnel can be learned in courses at the Russian School of Management.

Find out more and register →

Tatyana Kalugina Expert practitioner in the field of personnel records management, personnel management, teacher at the Russian School of Management.

is an ideal solution for companies with a modest staff and little document flow. The main clients of this service are individual entrepreneurs and small and medium-sized businesses. Large companies also use it from time to time. This happens when there is a need to replace a sick specialist or during maternity leave, as well as annual planned vacations or in the process of forming a staff of permanent employees.

Pros of use

are that:

- A visiting accountant works somewhere on the side (at home or in another office) and comes to the company when the need arises

, which eliminates additional financial expenses for a workplace, computer, office and other work supplies. - The relationship with the visiting accountant is determined by the contract, which reflects all the important points, including payment for the work. This means that there are no obligations to pay salaries

and it is possible, when calculating taxes, to accept expenses to reduce the tax base. - Organizations providing such services employ professional and qualified specialists

, which indicates high quality and responsibility in the performance of work. - According to the contract, payment is for a specifically agreed amount of work

, and not for “sitting” in the office, numerous “tea parties” and “smoking breaks,” which again saves the hiring company’s finances.

The above confirms that it is one of the most accessible and in demand tax and accounting services on the market.

We offer you on favorable terms. A visit to your office by our specialist is included in the cost of services for our regular clients. We can come to your office when necessary. This usually happens 1-2 times a month. Together we sign the necessary documents, reports, and analyze current tasks.

We also resolve the following issues at the client’s site:

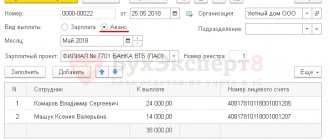

- maintaining the 1C 7.7, 8.2 database - any consultation on the operation of the program, reporting;

- maintaining and archiving documentation for accounting purposes

For new clients, the service is paid, calculated based on labor costs in man-hours based on the work performed and consulting services provided.

If you are an individual, an accountant, and need high-quality advice on reporting issues or want to get help with working with 1C 7.7 or 8.2 programs, then our specialist can help you. Call or write to us and we will be happy to answer your questions.