Types of financial assistance in connection with death

Current legislation guarantees every person a funeral, and financial support for those involved in funerals.

The conditions under which it is provided are regulated by Federal Law No. 8 of January 12, 1996. One-time financial assistance consists of:

- social benefit for funeral at the expense of the Social Insurance Fund (clause 6, clause 1, article 1.4 of the law of December 29, 2006 No. 255-FZ);

- financial assistance from the employer in connection with the death of a close relative;

- financial assistance from the employer in connection with the death of a relative with whom the employee is not closely related.

Close relatives are considered to be spouses, parents and children, grandparents, sisters, brothers, adoptive parents and guardians (Article 2 of the Family Code of the Russian Federation).

It is necessary to distinguish that financial assistance in connection with the death of an employee, which is assigned by the employer, and state funeral benefits are provided from different sources, so these concepts cannot be mixed. The employer provides financial assistance from the organization's budget and if funds are available for these purposes, and state benefits are paid in a fixed amount from extra-budgetary funds (if the deceased is registered in them).

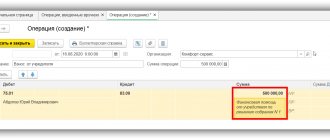

Postings for “funeral” payments

The accounting entries reflect the recipient of the payment. If a relative of a deceased employee (or another citizen who took on funeral expenses) applied for benefits, make the entry Dt 69/FSS Kt 76.

The same posting is used if the organization compensates the expenses of the funeral company. Payment of benefits will be reflected in the entry Dt 76 Kt 51(50).

If an employee applied for benefits due to the death of a minor, make an entry Dt 69/FSS Kt 73. The payment of benefits will be reflected in the entry Dt 73 Kt 51(50).

Note that, in addition to benefits, the company has the right to pay additional financial assistance in connection with the funeral. She will not be compensated by the Social Insurance Fund.

Example. Employee of the company Ivanov A.A. died. He worked under an employment contract. His wife applied for funeral benefits. In addition to benefits, the company paid her financial assistance in the amount of 3,000 rubles.

Postings:

- Dt 69 Kt 76 - 5946.47 rub. — benefits accrued;

- Dt 91/2 Kt 76 - 3000.00 rub. - swearing was accrued. help;

- Dt 76 Kt 51 - 8946.47 rub. - the mat is listed. assistance and benefits to the applicant’s account.

Payments mat. assistance in excess of the benefit is not taken into account in the costs of NU, but must be recorded in accounting. In this regard, PNO arises: 3000 * 20% = 600. Dt 99 Kt 68 / income tax - 600.00 rubles.

Question: Is the amount of funeral expenses that the heir - the organizer of the testator's funeral demands for reimbursement from other heirs subject to recalculation if they received a funeral benefit and were also provided with a free place in the cemetery? View answer

Amount of financial assistance in connection with death

The amount of financial assistance varies depending on its type. For example, financial assistance provided by an employer for a funeral in 2020 depends only on its financial capabilities.

Social benefits for funerals are paid at the expense of the Social Insurance Fund and until 02/01/2020 amounted to 5946.47 rubles (RF Government Decree No. 32 dated 01/24/2019). From 02/01/200, indexation was carried out by 3%, and the amount of payment for funeral was 6124.86 rubles.

IMPORTANT!

The benefit from the Social Insurance Fund in 2022 is 6124.86 rubles!

Some constituent entities of the Russian Federation, at the expense of their budgets, have approved additional payments to this benefit. In Moscow - 11,000 rubles. In addition, in regions where the regional coefficient is applied to wages, funeral benefits at the expense of the Social Insurance Fund are also paid taking into account this coefficient.

Tax accounting

Funeral benefits are not taxed (Article 217-1, 422-1-1 of the Tax Code of the Russian Federation, Article 20.2-1-1 Federal Law No. 125 dated 07/24/98):

- personal income tax;

- FSS insurance premiums;

- health insurance premiums;

- contributions to the Pension Fund.

The benefit goes towards the FSS insurance premiums (FSS post No. 16, clause 13).

The payment is not included in costs when calculating income tax, as well as simplified tax (Chapter 25, 26.2 of the Tax Code of the Russian Federation).

On a note! Benefits are not paid to an employee registered under a GPC agreement: remuneration for them is not subject to contributions “for injuries” and for temporary disability. The benefit is issued only by an organization that is the insurer of the deceased or the applicant - a family member of a minor deceased in the Social Insurance Fund (Article 10-2, paragraph 2 of Federal Law No. 8, Article 422-3, paragraph 2 of the Tax Code of the Russian Federation).

Briefly

- The funeral benefit is paid by the organization at the expense of the Social Insurance Fund by reducing the debt on contributions.

- The accrual is recorded on account 69 in the corresponding subaccount.

- The accountant calculates benefits on the basis of a death certificate and an application from the citizen who organized the funeral, or, if the services were provided to the benefit recipient by a funeral company, on the basis of a certificate and invoice from it.

- The benefit is not included in the costs of income tax or simplified tax. Payments are not subject to insurance premiums and personal income tax.

- Accounting for additional financial assistance in the event of death is kept separately, on account 91/2. This amount is not compensated by the Social Insurance Fund.

Where to get financial assistance in connection with death

Who makes the payment depends on the social status of the deceased. Relatives who have taken on the costs of the funeral have the right to apply for financial assistance and social benefits for burial (clause 2 of article 10 No. 8-FZ):

- at the place of work of the deceased, if he worked (was insured by the Social Insurance Fund);

- in the Pension Fund of the Russian Federation, if the deceased is a pensioner;

- at the Social Security Administration, if the deceased did not work and is not a pensioner, and in the case of a stillbirth after 154 days of pregnancy.

You can apply for payment no later than 6 months from the date of death (Clause 3, Article 10 of Law No. 8-FZ of January 12, 1996).

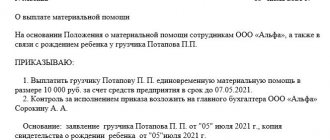

Making payments to relatives of a deceased employee

The accountant pays wages, as well as compensation for unused vacation days, to the relatives of the deceased employee or his dependents, as stated in Article 141 of the Labor Code of the Russian Federation. If there is more than one such applicant, then the entire amount must be given to the first applicant.

Please note that payment must be made no later than 7 days from the date the family member submits the relevant documents (Article 141 of the Labor Code of the Russian Federation).

The deceased employee receives the same payments as for normal dismissal . This number includes: salary, sick leave (if it was on sick leave before death), compensation for unused vacation, bonuses and allowances.

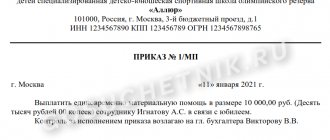

How to apply for financial assistance in connection with the death of a relative

The basis for receiving financial assistance and benefits is an application from the person who is involved in the burial. Depending on your life situation, the packages of documents that will have to be attached to such an application are different.

On the occasion of the death of an employee's close relatives:

- death certificate;

- marriage certificate (for husband, wife);

- birth certificate (for children).

In the event of the death of the employee himself:

- applicant's passport;

- death certificate;

- marriage certificate (for husband, wife) or birth certificate (for children);

- if the deceased has no relatives and a stranger is involved in the funeral, then you will have to attach payment documents confirming the costs of the funeral, and an order from the head of the institution to allocate funds indicating who took on the responsibility to carry out the burial.

Personal income tax and insurance premiums in 2022

Financial assistance provided by an employer in connection with the death of a family member or family members of a deceased employee is not subject to personal income tax (clause 8 of Article 217 of the Tax Code of the Russian Federation). Therefore, there is no need to reflect such income in certificate 2-NDFL and form 6-NDFL. This is confirmed by letter of the Ministry of Finance dated April 18, 2012 No. 03-04-06/8-118.

If, for example, an employee’s distant relative (for example, a cousin) has died, and the employee, as a funeral organizer, asks the employer for financial assistance, then the amounts received are not subject to personal income tax only up to 4,000 rubles. (clause 28 of article 217 of the Tax Code of the Russian Federation). Any amount above this limit is subject to tax. The point of view of the Ministry of Finance is defined in the letter dated December 15, 2016 No. BS-4-11/ [email protected]

Order of the Federal Tax Service of the Russian Federation dated September 10, 2015 No. ММВ-7-11/ [email protected] establishes special codes for income and deductions reflected in personal income tax reporting forms:

- income code 2760 - financial assistance provided by employers to their employees;

- deduction code 503 - deduction from the amount of financial assistance provided by employers to their employees.

These codes are indicated in the following reporting forms: certificate 2-NDFL and form 6-NDFL.

Reimbursement of funeral expenses from inheritance

Article 1174 of the Civil Code determines the procedure for reimbursement of expenses associated with the death of the testator. And this is not only the burial, but also the period of caring for the sick, as well as the period of opening the inheritance. The last period includes the protection and management of the inheritance, as well as the execution of the will. These are the expenses that are paid from the estate first of all, even if the deceased had debts.

If the organization of this case is carried out by someone who is not part of the circle of heirs, this person can demand compensation either from the executor of the will (before accepting the inheritance) or from the heirs (after accepting the inheritance).

An executor of a will or executor is someone who is appointed as such by the testator. Usually they choose a person who has no interest in the issue of a specific inheritance.

Paragraph 3 of the article says that compensation for funeral expenses can be taken from any inherited property, including bank accounts and deposits. To withdraw money from a bank account, the notary must draw up a decree indicating the amount and the name of the person to whom the funds should be issued.

The heir may, within six months, request withdrawal of funds from the account to compensate for funeral expenses. This also applies to those funds that are bequeathed by testamentary disposition (if the testator gave it in writing to the bank branch where his account is opened). Since 2016, you can request from the bank an amount up to 100,000 rubles.

Insurance premiums

Insurance premiums are levied on payments and other remuneration that are made in favor of individuals who are subject to compulsory insurance (Article 20.1 of Law No. 125-FZ of July 24, 1998 and Article 420 of the Tax Code of the Russian Federation). But the targeted nature of material assistance provided to an employee in connection with the death of his family members allows such income to be excluded from the taxable base for contributions (clause 3, clause 1, article 20.2 No. 125-FZ and subclause 3, clause 1, article 422 of the Tax Code RF).

Terms of payment of financial aid

The employer pays financial assistance as soon as possible - with a salary in the next month after the application. When paying benefits, the employer does not expect compensation from the state, but is obliged to find a way to ensure that the money is paid as quickly as possible. Then he submits documents for reimbursement of expenses to the Social Insurance Fund.

Please note: the benefit will only be paid if you apply for it within six months of the death of a loved one.

Read more: The Social Insurance Fund has developed 17 new forms to compensate employers for expenses and pay sick leave to employees.