The dangers of incorrect entries

Incorrectly compiled invoices and incorrect entries in the purchase and sales books lead to VAT gaps (discrepancies).

They are identified by the tax authorities during a desk audit using the ASK VAT-2 PC system, which automatically compares the declarations of counterparties. Errors in accounting for advances lead to requests from the Federal Tax Service to explain the overstatement of the amount to be deducted. Gaps appear if the information about the transaction that the taxpayer reflected in Section 8 of the VAT return (purchase book) to confirm the right to apply a tax deduction does not coincide with the information that the taxpayer's supplier should have reflected in Section 9 of the VAT return (sales book). ). This could be an error in the details, submission of a zero declaration, or failure to submit at all. Another gap may be due to a discrepancy between the data in the taxpayer’s declaration and applications, including those from other periods.

Submit your VAT return online for free

Account 60 in advance payments: examples in 1C

According to the current Order of the Ministry of Finance No. 94n, purchases of goods, works or services of a company should be reflected in a special active-passive account 60 “Settlements with suppliers and contractors” broken down by subaccounts. However, during mutual settlements with suppliers, due to the large document flow and the presence of advances, as well as postpayments, there are often cases of incorrect formation of transactions, which prevents the correct offset of debt, including in accounting programs.

Let's look at typical examples of settlements with suppliers for advances, as well as checking mutual settlements with counterparties using the example of the 1C: Accounting 8 program, ed. 3.0.

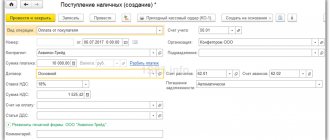

If an advance is transferred to a supplier, a document “Write-off from current account” is drawn up in the database with the transaction type “Payment to supplier”. The business transaction itself is simple, but some users encounter incorrect correspondence of accounts in the information base, which causes errors in the subsequent offset of the advance.

It is important to take into account the fact that settlements for advances with suppliers are accounted for in account 60.02 “Settlements for advances issued”; accordingly, the debit account is automatically selected by the program when posting a document, since there is no debt to the supplier under the selected agreement at the time of posting the document. When reflecting this operation, the program creates correspondence between account 60.02 “Settlements for advances issued” with account 51 “Current accounts”.

In the future, for example, when drawing up the document “Receipt of goods and services”, the advance will be credited (Dt 60.01 Kt 60.02 - credit of advance to the supplier).

The user also needs to take into account the fact that the advance payment is offset in accordance with one of three methods specified in the “Receipt of goods and services” document: automatically, according to the document, or not offset at all.

If the user sets the advance payment method to “Automatic”, the program analyzes the balances of advances under the agreement specified in the document and offsets the advance amounts in the order of their payment. Advance payments will be offset sequentially for each payment document, starting with the earliest one. This option is most convenient when working with a large number of payments and deliveries.

When setting the “By document” method, you must additionally indicate the specific payment document against which the advance payment should be offset. In this case, the advance payment will be credited against the specified document. Advances on other documents will not be counted. This option is suitable if the organization makes payments based on a specific delivery document.

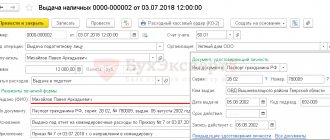

And finally, if you select the “Do not offset” method, the program will not analyze and offset advances under the contract under any circumstances. This option may be considered if the advance will be used to pay for other transactions. Such an advance can be offset in the future using the document “Adjustment of debt” through the section “Purchases” - “Adjustment of debt” with the type of operation “Offset of advances”. In the “Credit the advance payment” field, select the value “To the Supplier”, and in the “On account of the debt” field, you must select “Our organization to the supplier” or “Our organization to a third party”.

The status of mutual settlements between the parties can be checked using the “Act of Reconciliation of Mutual Settlements”. Before its formation, you can check the balance and turnover of settlements with the supplier. In this case, you can use the “Turnover balance sheet” report for account 60 “Settlements with suppliers and contractors” broken down by subaccounts, which can be opened from the “Reports” section.

We create the document “Act of reconciliation of settlements with the counterparty” in the “Purchases” section - block “Settlements with counterparties” - “Acts of reconciliation of settlements”.

In the document we indicate the counterparty for whom we are checking the calculations; if necessary, you can indicate a specific agreement. The “Settlements Accounts” tab contains by default a list of accounting accounts that can be used for reconciliation; you need to uncheck the boxes for all accounts except 60 “Settlements with suppliers and contractors”.

At the bottom of the tabs “According to the organization” and “According to the counterparty”, data on balances at the beginning and at the end of the period of reconciliation of mutual settlements is displayed, and the amounts of discrepancies with the counterparty’s data are also reflected.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

When is an advance invoice issued?

The seller issues an advance invoice only upon receipt of advance payment. The algorithm is like this:

- The seller receives the advance and records the advance invoice in the sales ledger.

- Transfers the advance invoice to the buyer no later than five calendar days from the date of receipt of money (services/work on account of shipment).

- At the time of transfer of goods (performance of services), issues a shipment invoice for the full cost of goods or services, regardless of the size of the advance payment.

- Restores the advance amount in the purchase ledger.

If amounts are received from the customer more than once, then an invoice must be issued separately for each amount received.

Example . If the seller received an advance on the 10th and 13th, and the service was provided on the 28th of the same month, then the invoice must be issued twice when the amounts are received on the 10th and 13th, as well as when shipping on account this advance for the full cost.

The buyer, on the basis of any invoice for an advance payment, can exercise the right to deduct VAT.

Exchange invoices electronically

An advance invoice may not be issued in four cases:

- The supplier company receives money for goods whose production takes more than 6 months (Clause 13, Article 167 of the Tax Code of the Russian Federation);

- The buyer is not a VAT payer or is exempt from paying this tax (clause 3 of Article 169 of the Tax Code of the Russian Federation);

- Export of goods taxed at a zero rate (Letter of the Ministry of Finance dated January 10, 2018 No. 03-07-08/142);

- The advance and shipment occurred in the same quarter, and the break between them did not exceed five calendar days (Letter of the Ministry of Finance dated November 10, 2016 No. 03-07-14/65759).

In cases where an advance payment was received in one tax period (for example, December 31), and shipment against this advance took place in another tax period within five calendar days from the date of receipt of the advance payment (for example, January 2), the seller registers an invoice on the advance payment is in the sales book for the fourth quarter, and the invoice issued upon shipment is in the sales book for the first quarter.

How to issue a check for advance payment

The Federal Tax Service explained all the features of generating checks for prepayments and advances in a letter dated February 20, 2019 N ED-4-20/ [email protected]

The check must contain all the standard details: name, TIN of the seller, shift number, date, time and place of payment. Organizations and entrepreneurs on OSNO additionally indicate in the check the estimated VAT rate (tag 1199) and the amount of tax (tag 1106 or 1107).

The buyer's details are usually not indicated on the receipt. This is only necessary when making payments to organizations and individual entrepreneurs by card or cash.

The check also contains several details that vary depending on the form of payment. The prepayment receipt shall indicate the following:

The sign of payment when receiving an advance payment or advance payment is “RECEIVING”.

The indication of the payment method depends on the type of prepayment received:

- for full prepayment - “ADVANCE PAYMENT 100%” or “1”;

- for partial prepayment - “ADVANCE PAYMENT” or “2”;

- for an advance (the list of paid goods is not known) - “ADVANCE” or “3”.

The name of the subject of payment is indicated only for full or partial prepayment. Since when receiving an advance, the seller cannot determine what the buyer transferred the money for, the name is not indicated.

The unit price and the cost of the calculation item are filled in with the prepayment amount. Therefore, these amounts will be equal to the price of the goods according to the price list only if full advance payment has been received. When receiving an advance payment for several goods, the amount of the advance payment must be divided between them in proportion to their cost.

The settlement amount will always be equal to the amount received from the buyer.

VAT is included in all of the above indicators, therefore in tag 1199 the estimated rate of “20/120” or “10/110” is indicated. Of course, this does not apply to sellers who do not pay VAT; they do not include this tag in the receipt.

Samples of checks for prepayment and advance payment

The seller punches the check at the time of payment and transfers it to the buyer. Different payment methods have their own nuances, for example, for non-cash payments, the check must be punched no later than the day following the day of payment.

How can a seller reflect advances?

The seller is obliged to register an invoice in the period in which he received the advance payment (clause 3 of the Rules for maintaining the sales book, approved by Resolution No. 1137 of December 26, 2011).

| Prepaid expense | Shipment of goods/services | Settlement of advance payment | |

| Book (registration SF) | Sales book | Sales book | Book of purchases |

| Mandatory registration of the Federation Council | Mandatory | Mandatory | Mandatory |

| Moment of registration of the Federation Council | On the day of receiving the advance | On the day of shipment | On the day of shipment or any day within three years |

| KVO for Northern Fleet (most used) | 02 | 01 | 22 |

| Indication of the counterparty in the Federation Council | Buyer | Buyer | Themselves |

| Section and line of VAT amounts in the declaration | Section 3, page 070 | Section 3, pp. 010-050 | Section 3, page 170 |

We have prepared an overview of common mistakes when preparing advance invoices

Invoice for advance payment under the contract: sample with additional elements

Additional attributes can clarify delivery conditions, limit the time frame for shipment of goods or pickup, and focus on fixing the price for a certain period of time. You can include in a separate paragraph or in the form of a footnote the possibility of returning goods or money in certain situations.

An invoice for prepayment under a contract may contain individual elements from the contract documentation. This form can be used to notify the recipient of valuables that the person to whom the authority to accept goods will be delegated must have a power of attorney.

How can a buyer reflect advances?

Unlike the seller, the buyer is not obliged to register an invoice for the advance payment and accept VAT for deduction (Article 171 and Article 172 of the Tax Code of the Russian Federation). To take advantage of the deduction, the buyer must have supporting documents: an invoice, a payment document and an agreement that states the prepayment condition.

| Prepaid expense | Receiving goods/services | Settlement of advance payment | |

| Book (registration SF) | Book of purchases | Book of purchases | Sales book |

| Mandatory registration of the Federation Council | Not required | Not required | If there is no registration of the SF for the advance, there is no restoration |

| Moment of registration of the Federation Council | At the time of receipt of the SF for advance | Any day for three years | At the time of registration of the Federation Council upon receipt of goods (services) |

| KVO for Northern Fleet (most used) | 02 | 01 | 21 |

| Indication of the counterparty in the Federation Council | Salesman | Salesman | Themselves |

| Section and line of VAT amounts in the declaration | Section 3, page 130 | Section 3, page 120 | Section 3, page 080 |

How to terminate a transaction and return the advance payment

When the buyer and seller terminate the contract under which an advance payment was previously made, the seller returns the advance payment to the buyer.

The seller needs to register an advance invoice in the purchase book with KVO 22. In column 7 “Number and date of the document confirming payment of tax,” he should indicate the details of the documents that confirm the return of the advance payment. Then the seller has the right to deduct the VAT accrued upon receipt of the advance payment (clause 4 of Article 172 of the Tax Code of the Russian Federation).

The buyer is obliged to recover and pay VAT to the budget if the advance payment was accepted for deduction. At the same time, he must register an advance invoice in the sales book with KVO 21.

Author: Svetlana Ognevskaya, Kontur.Externa VAT expert Prepared by Elizaveta Kobrina, editor

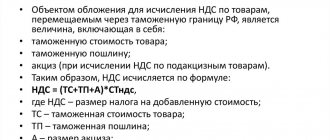

Recovering VAT from advance payment

To recover VAT from an advance, the supplier's invoice for the advance must be registered in the Sales Book. The regulated document for each quarter (month) is the document “Creation of sales book entries”

.

When auto-filling using the “Fill”

, the program analyzes closed advances issued.

If the advance payment was offset during the quarter, then a VAT recovery entry will be generated, and an invoice for the advance payment will be registered in the Sales Book with transaction code 02 “Advances issued”

.

Another option for registering the “Invoice received” document for an advance payment in the Sales Ledger is to enter based on the document “Registration of a sales ledger line”

with the registration option

“Register in the sales book”

:

Dt 2.210.13.560 – Kt 2.303.04.730 – 458 rub.

note

This accounting entry is not in Instruction No. 174n, but it must be created on the basis of paragraphs.

3 clause 3 of Article 170 of the Tax Code of the Russian Federation : “tax amounts accepted for deduction by the taxpayer on goods, works or services, including fixed assets and intangible assets, property rights in the manner prescribed by this chapter, are subject to restoration by the taxpayer in the event of transfer by the buyer amounts of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.”

It is important to note that the deduction of VAT from the listed prepayment/advance payment is the buyer’s right, not an obligation. If the buyer decides not to deduct “advance” VAT, then there is no need to register an invoice for the advance payment issued by the supplier in the Purchase Book. In this case, then no obligation to restore the VAT calculated on the advance amount paid will arise. “Input” VAT on purchased goods, works or services will be deducted in the generally established manner.