Whatever the form of remuneration, it can always happen that the employee did not fulfill the stipulated standard for hours of work. This situation is revealed when summing up the results of the accounting period. Responsibility for shortcomings may lie with both the employer and the employee himself.

How will the lack of hours worked affect remuneration for work? How is money accrued for shortfalls during a shift schedule or with cumulative accounting? Let's consider these nuances.

Is a negative difference between the standard working time and the working hours according to the schedule always a “shortcoming” with payment in accordance with Art. 155 Labor Code of the Russian Federation ?

Labor Code and shortcomings

The concept of “defect” is not legally defined. There are no specific rules in the Labor Code of the Russian Federation dedicated to identifying and paying for unworked time.

In fact, we can give the following definition of underwork: this is the number of hours recorded for a certain period of time that is missing from the norm of work determined by law for a specific employee.

The Labor Code of the Russian Federation provides for various nuances related to shortcomings in the following articles:

- Art. 91 – determination of working time and its standard duration;

- Art. 93 – on establishing a part-time working day for an employee;

- Art. 102 – on the employer’s obligation to provide the employee with the standard number of working hours;

- Art. 104 – on reducing the norm for part-time workers (shifts, weeks);

- Art. 155, 157 – about downtime and its payment;

- Art. 156 – about failure to comply with standards due to defective products.

Question: During the accounting period, an employee was unable to work the standard working hours due to an incorrect work schedule. How should I pay for the time actually worked? View answer

Working time calculation

In addition to the number of working hours in a shift, the employer must also take into account the work activities of employees that deviate from the norm. In accordance with Art. 149 of the Labor Code of the Russian Federation, this concept includes overtime work, night work, as well as work on weekends and holidays. If an employee works in these circumstances, then the employee has the right to count on additional payments. When calculating working hours, those working hours during which the employee did not work, but his position was retained (including all types of vacations, as well as business trip time), are not taken into account. In addition, the hour by which working hours are reduced before the holiday weekend is also not taken into account.

Less pay for less work

The general rule and the logic of payment for shortcomings indicate that an employee who has worked fewer hours than prescribed by the norm should receive less remuneration than his busier colleague who has worked his norm.

But there are exceptions when shortcomings do not necessarily lead to a decrease in the amount of money given to the employee. The employer can provide for them in the organization’s accounting policies and record them in internal regulations. For a number of reasons for shortcomings, management has the right to offer to pay the employee the amount missing from the salary or average earnings, having written this provision in the employment or collective agreement or the Regulations on wages.

How to pay an employee with a flexible schedule for shortfalls due to incorrect recording of working hours?

Why is there a gap in the shift schedule?

Before the employer correctly calculates the payment, the cause of the deficiency must be established. The reasons for the shortcomings include the following:

| Reasons for the defect | More details |

| Employee's fault | Deficiencies may arise due to the fact that the employee is absent from work for valid reasons (all types of vacations). In addition, there are also unexcused reasons for shortcomings (absenteeism, downtime due to the fault of the employee). |

| Employer's fault | The employer can change the work schedule, which entails the occurrence of shortcomings. In addition, shortcomings may also arise as a result of incorrect preparation of the work schedule, which does not allow employees to work the required number of hours in the reporting period. |

| Circumstances beyond the control of the parties | Deficiencies may arise as a result of force majeure situations, natural or man-made disasters, or as a result of employees mastering new equipment and technology. |

Possible reasons for the defect

According to the law, the employer must provide the employee with work within the established employment standards.

NOTE! Working time standards may differ for different categories of employees and different working modes. The most common option is to work 5 days a week with two days off, when in total you need to work 40 hours per week. You can choose another accounting period - ten days, month, quarter.

Possible reasons that may violate the prescribed number of hours for work:

- breakdown of equipment and untimely bringing it into working condition;

- mastering new technological operations;

- a large percentage of defective products (for the piecework wage system);

- vacation at your own expense;

- absenteeism;

- accident, catastrophe or other emergency situation, etc.

REFERENCE! Being on a business trip is equivalent to working time, so the norm is reduced by the corresponding number of hours. But official sick leave and annual leave are excluded from the working time norm (Letter of the Ministry of Labor of the Russian Federation dated December 25, 2013 No. 14-2-337).

All probable reasons can be divided into three groups, which is why, in most cases, payment for the defects that have arisen depends:

- Shortcomings due to the fault of the employee: time off, absenteeism, tardiness, failure to fulfill the norm due to marriage, etc.

- Flaw caused by the employer: mostly simple.

- Defects due to reasons beyond the control of the parties: various force majeure circumstances.

A separate point can be considered a decrease in earnings due to part-time work or a week. But this is not exactly a situation of underperformance, since here there is a reduction in the standard working hours, and not a failure to fulfill it.

The employer is to blame for the shortcomings

If an employee is forced to temporarily suspend work for economic, technological or organizational reasons that the employer was unable to eliminate in time, as a result the employee will end up with a shortfall to the norm due to forced downtime.

This can happen, for example, in the following cases:

- the warehouse is out of raw materials, and timely delivery is not organized;

- equipment broke down and was not repaired by the start of the work shift;

- wage payment was delayed for more than 15 days.

IMPORTANT! If a downtime situation is caused by equipment breakdown or shortage of raw materials, the employee who discovers this fact must immediately report this to immediate management for possible timely action.

Since it is not the employee’s fault for the lack of work, he should receive payment for the time spent, even if it was not work. Some nuances are observed:

- For time not worked through no fault of his own, the employee will not receive the entire amount due for the norm, but 2/3 of the average earnings.

- If the downtime was not documented, but the employer admits his guilt in the shortcomings, then the employee must be compensated for the financial loss in proportion to the hours actually worked.

Question: How is an employee paid for shortfalls in a shift work schedule with cumulative accounting of working hours that arose due to incorrect scheduling by the employer? View answer

Failure to comply with the norm is the employee's fault

If the standard is not met due to the efforts (or insufficient efforts) of the employee, the situation with payment for the deficiency will be somewhat different. In most cases, such a defect is not subject to payment: downtime due to the employee’s fault is not paid in any way.

ATTENTION! When a defect arose due to the inexperience of workers in mastering a new technological line or changing the range of products, payment will depend on the will of the employer, enshrined in the company's accounting policy. It is recommended that employees maintain their average earnings for this period.

When it's no one's fault

If the cause of the shortcomings turned out to be insurmountable circumstances, and not the employee or the employer, the law guarantees employees payment in the amount of 2/3 of their average earnings, calculated in the usual manner.

Remuneration for summarized accounting of working hours - examples of calculation

As a general rule, when considering time worked, a time-based wage system is used. There are two commonly used payroll calculation methods:

- The base value is the monthly official salary;

- The base rate is the hourly tariff rate.

The method of calculating the amount of wages, when the salary is taken as the base value, is convenient for an accounting period of 1 month. As you know, the salary is set for performing work during a month of normal working hours. Within an accounting period equal to a month, the time worked for each working week may be more or less than the established norm of 40 hours (in general), but in general, during the accounting period, the total duration of work performed corresponds to the norm of hours according to the production calendar of that month.

When the duration of the accounting period is more or less than one month, using the salary calculation method based on the monthly salary is inconvenient and incorrect. If the reference period is, for example, several months, the length of working time is very likely to differ from normal in each month. But in general, during the period under review, the duration of working hours actually worked is equal to the norm. If salary is taken as the basis of calculation, then a situation arises where remuneration for labor in the same identical amount, equal to the salary, is paid for a different amount of labor, which is proportional to the amount of working time.

Therefore, to calculate wages for an accounting period other than a month, the hourly tariff rate is used. It is calculated based on the normal (according to the production calendar) number of hours in a particular month or year, subject to a 5-day working week (Order of the Ministry of Health and Social Development of the Russian Federation dated August 13, 2009 No. 588n).

As an example, let’s calculate the standard working time for a 5-day, 40-hour week in June 2022, which has 21 working days:

40 : 5 × 21 – 1 = 167,

where “-1” is a 1-hour reduction in the working day on the pre-holiday June 11th.

The norm in June will be 167 working hours.

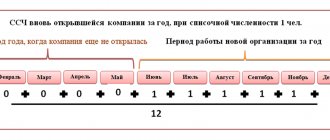

The standard working time for the year is calculated similarly . In 2022 this is 1979 hours. When using the annual working time indicator to calculate the average monthly rate, we obtain:

1,979 hours: 12 = 164.92 hours, i.e. the monthly rate in June (as in any other month) will be 164.92.

Summarized accounting of working time - examples of calculating wages from an hourly rate calculated at (1) the standard monthly working time and (2) the average monthly standard for the year are given below.

The salary is 40,000 rubles per month. The work schedule is shifts with summarized recording of working hours, the recording period is 2 months. The standard working time for the accounting period (May and June 2020) is 302 hours: May - 135 hours, June - 167. In May of the year 129 hours were worked, in June - 172. We calculate wages.

- When using the monthly working time standard:

May 2022 - 40,000: 135 × 129 = 38,222.22 rubles.

June 2022 - 40,000: 167 × 173 = 41,437.13 rubles.

- When using the annual working time standard:

May 2022 - 40,000: (1,979 / 12) × 129 = RUB 31,288.53

June 2022 - 40,000: (1,979 / 12) × 173 = 41,960.59 rubles.

The rules for calculating the hourly rate for the purposes of calculating wages are determined by the employer and must be recorded in the local regulatory legal acts. This is mandatory because different calculation methods give different results for the amount of income an employee receives in a particular month.

It seems appropriate to set an hourly rate calculated on the basis of the monthly norm for an accounting period other than 1 month, but less than 1 year, and for an annual accounting period - an hourly rate calculated on the basis of the annual working time norm.

As for the payment of overtime work when recording working hours in aggregate, such a mechanism is not defined by the legislation of the Russian Federation. K+ experts cited the opinion of the Russian Ministry of Health and Social Development, as well as the Supreme Court of the Russian Federation. Get trial access to the system for free and proceed to the explanations.

Payment for shortfalls in different work modes

The specifics of calculating payment for non-compliance with standard working hours also depend on the wage regime adopted at the enterprise.

Shift schedule (total wages) and shortfalls

For employees working shifts, a specific schedule is established. The standard working hours should be included in this schedule; it’s just that the calculation of its implementation will not necessarily be carried out by week. You can choose any convenient accounting period, the main thing is that the total number of working hours coincides with the norm. This mode of working time recording is called “summed”.

With such a system, shortcomings may arise if the drawn up schedule does not “collect” the required number of hours according to the norm.

As we see, in fact, this is a defect due to the fault of the employer, since providing an adequate schedule is his responsibility. In this case, payment must be made in an amount not lower than average earnings in proportion to the time worked.

Piece work: what about the flaw?

With piecework wages, time is calculated based not on time, but on the results of labor. The principles of payment for deficiencies will remain the same, the concept of the norm will change. It will be expressed in the number of products manufactured, and not in hours worked.

If products are manufactured in sufficient quantity, but of inadequate quality, such defects are paid based on the following principles:

- if an employee makes a complete defect in his work, the unsuitable products will not be paid for;

- partial defects, the fault of which is assigned to the employee, will be paid at a reduced cost (depending on the degree of suitability of the product);

- if, as a result of the employer’s fault, an employee made a defect in his work, then even the unsuitable products must be paid for in full.

Difficulties in determining the norm with an incomplete month

The question of how to calculate the standard time for calculating defects is not regulated anywhere. Let's use the method that is used to calculate processing and consider several examples.

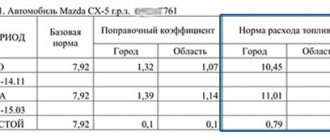

The organization uses the following working hours for a 40-hour workweek:

There are several months in which the time norm does not correspond to the production calendar norm.

Let's look at a few examples for February 2022.

- If the employee has worked for a full month:

There will be a shortfall due to the fault of the employer equal to 5 hours (159 hours - 154 hours).

- If an employee was sick during the period from 18.02 to 22.02, and worked the rest of the time in accordance with the schedule:

There is no shortage, since the norm for days according to the production calendar is 120 hours and the time worked according to the schedule is 120 hours.

- If an employee was sick in the period from February 18 to February 21, and worked the rest of the time according to the schedule:

Overtime occurs with cumulative accounting, since the norm for the worked period according to the production calendar is 127 hours, and 132 hours were worked. In total, the employee receives 5 hours of overtime.

Similarly, there may be a shortage in a month where more hours are planned than normal. For example, in March 2022, an employee was sick from March 22 to March 31, and worked the rest of the time according to the schedule:

There is a shortfall of 1 hour. However, the employer does not have to pay for it, since it is not his fault - the schedule was drawn up correctly.

Thus, we will automatically calculate payment for shortfalls only if the employee has worked in full for the month. Because only in this case is the employer’s guilt obvious.

Payment procedure for shortcomings in the shift schedule

If a company calculates time summarily, then wages are calculated in one of the following ways:

- Using an hourly rate. With this method, the employee is paid a salary based on the results of the month by multiplying the established rate by the number of hours worked.

- By establishing the official salary. The employee is set an official salary and if he fulfills the norm established in the schedule, the employee is paid the full salary.

Failure by an employee to complete the number of hours in accordance with the established norm is revealed only at the end of the reporting period, when the employer calculates the number of hours worked by each employee.

Important! Before deciding whether to accrue additional payment to an employee, or the lack thereof, the reasons for the shortfall will be important.

Accounting for hours worked when working on a shift schedule

When an organization imposes a shift schedule on the work team for performing job duties, methods for calculating actual time worked become of great importance.

Since a workday in this format may not meet the legally established maximum allowable limit, it is necessary to find an accounting method that ensures compliance with these laws.

This is exactly the way the summarized method of accounting is regulated by Art. 104 of the Labor Code of the Russian Federation. It provides the ability to select either a separate month or quarter, or a half-year or year as the reporting point for calculating the time of work.

If employees work in hazardous production or in other conditions that imply a danger to life or health, the reporting period for them is limited to three months. But there is a way to increase this period of time to 12 months.

Calculation of working hours for a specific period

On August 13, 2009, the Ministry of Health and Social Development of the Russian Federation issued Order No. 558-, in which it explained the typical standards for calculating working hours:

- The number of hours worked per week for a particular employee is divided by 5 and then multiplied by the sum of days worked. Under the condition of a 40-hour normalized work week, the following is obtained: 40 / 5 * 21 = 168 hours per month (in which there are 21 working days);

- The hours that the employee did not spend at work together due to shortened working days (due to holidays or other circumstances) are deducted from the amount.

The same should be done when calculating the time standard in different reporting periods.

Basic moments

In addition to the above, this article contains information about the standards governing the maximum amount of time that an employee must work (40 hours per week).

Also, specialists and employers are aware that for some groups of workers a shortened schedule has been introduced, which allows them to spend less time at work. In each individual case, it may happen that the actual time worked does not coincide with that which should be, taking into account the standards defined by the legislation of the Russian Federation. In this case, we observe a deficiency or overwork. It is important to understand that you do not have to work 8 hours every day to comply with the rules. There are different options for calculating time worked and different work schedules.

If time recording occurs daily, this indicates an even distribution of 40 working hours. Such employees work 5 times a week, 8 hours a day. Weekends may be variable.

Shortcomings in the shift schedule due to the fault of the employee

If the employee is to blame for the shortfall, then he will not be paid for these hours. In this case, the calculation will be made based on the amount of time worked. If the salary is calculated based on the tariff rate, then the tariff rate is multiplied by the hours worked by the employee.

If the calculation is made based on the official salary, then the tariff rate is also calculated. In this case, the calculation can be made in different ways. The employer independently chooses the most suitable one for himself. When calculating, the amount of the tariff rate is obtained, which is then multiplied by the number of hours worked by the employee.