Issues of recording time worked are always relevant - both for the employer and for the employee himself. Any person should know a few basic figures regarding his rights and responsibilities in the field of production. One of these indicators - perhaps one of the most important - can be considered the amount of working time that an employee is obliged to devote to the performance of official duties.

The working week in our country is 40 hours. According to the laws of the Russian Federation, this figure is decisive; the time norm for any week must fit into this amount. Based on it, the duration of day shifts is calculated. Since they must be equal in time to each other, there is one eight-hour shift for each of the five working days of the week.

How many working days should there be in a month?

But work schedules vary, which the employer informs the candidate about when hiring. All enterprises establish their own options based on production needs, but within the framework of current legislation.

The number of holidays determines how many working days there are in each month. Record holders in our country are January and May. We only have to work in them for about 17 - 18 working days. For comparison, in a typical month there are most often about 23 of them.

How to calculate how many working days are in 1 month? Subtract the number of weekends and holidays from 31 (or 30). The Labor Code regulates the maximum possible number of working days in each week. It is equal to 6.

That is, workers must be given at least one day off per week; working without any rest is prohibited.

Calculation of vacation pay in 2022: calculation examples

Let's look at how vacation pay is calculated in 2022 in different cases.

Situation 1. If the calculation includes holidays, non-working days for all employees

The employee took 2 weeks of vacation from June 7, 2022. This period includes a non-working holiday - June 12 (Russia Day). The average daily earnings of an employee, calculated for the period from June 2020 to May 2022, amounted to 2,035 rubles.

There is no need to pay for a non-working holiday; it is not included in the number of vacation days (Article 120 of the Labor Code of the Russian Federation). In this case, the employee will actually have a rest period of not 14, but 15 calendar days - the vacation will last one day, and he will need to go to work not on June 21, but on June 22. Vacation pay should be calculated on the basis of 14 calendar days: 2,035 x 14 = 28,490 rubles.

Situation 2. If the vacation starts in one month and ends in another

The employee took leave for 2 weeks - from May 24 to June 6, 2021. The average daily earnings of an employee for the billing period from May 2020 to April 2022 amounted to 2,985 rubles.

In accordance with Art. 136 of the Labor Code of the Russian Federation, the employer must pay the employee vacation pay no later than 3 days before the start of the vacation. This means that even if the leave is transferable, i.e. starts in one month and ends in another, vacation pay must be paid in a lump sum in the month when the employee goes on vacation - in May 2021. In this case, the average earnings for the calculation period preceding the month in which the vacation is taken are used for calculation begins – in this case for May 2022 – April 2021.

The employer will calculate vacation pay in the usual manner: 2,985 x 14 = 41,790 rubles.

Situation 3. If an employee gets sick on vacation

The employee went on vacation for 2 weeks - from May 17 to May 30, 2022, but from May 18 he fell ill and issued a sick leave, which was closed only on May 25.

If an employee falls ill on vacation, then the days of vacation during which the period of temporary incapacity occurred may be (Article 124 of the Labor Code of the Russian Federation):

- extended;

- postponed to another date (taking into account the wishes of the employee).

In this example, there are two possible options:

- the employee starts work not on May 31, but on June 8 - the vacation is extended by the number of days during which the employee was sick (8 days);

- the employee starts work on May 31, and takes off the remaining days of vacation at another time convenient for him and for the employer, while there is no need to withhold paid vacation pay from the employee (Article 137 of the Labor Code of the Russian Federation).

If an employee went on sick leave because his child or another family member was sick, there would be no need to extend the leave - he would return to work in accordance with the existing order on May 31 (Rostrud letter dated 06/01/2012 No. PG/4629- 6-1).

If the employee is a minor

Article 51 of the Labor Code determines the norm for the duration of work shifts. Variations are possible in the form of a difference of several hours in its duration. This depends on the conditions of the specific production and the age of the employees.

What is meant by working age? A person has the right to get a job from the moment he turns 14 years old. But at this age there are restrictions on the length of working time during the week.

If the employee is under 16 years of age, it cannot be more than 24 hours. Children are allowed to work only during the holidays; their main job is to study.

Young people aged 16-18 have the right to work up to 36 hours weekly. And if we are talking about work during school hours (sometimes such exceptional circumstances occur), then minors are allowed even less - up to 12 hours at the age of 14-16 years and no more than 18 for those aged 16 to 18.

When are options still possible?

If production is officially considered hazardous, the law requires a reduction in working hours. Weekly it cannot exceed 36 hours. This figure is used to determine how many working days per month are required to be worked in such cases.

A number of professions, according to the specifics of their work, actually work in irregular hours. Therefore, officially their operating hours are somewhat shorter. This applies, for example, to doctors or teachers. How many working days they have on average per month is not so easy to calculate. Representatives of the mentioned professions are forced to seriously overwork part of the time during the year - doctors during periods of epidemics, teachers during exam days. There are other reasons that force teachers and doctors to devote more time to work than expected.

The administration of the enterprise can accommodate female workers - mothers of children under 14 years of age and officially approve a shortened week for them. Benefits are also provided to caregivers of disabled children.

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Pravo-info » Articles from magazines » WE PROVIDE AND PAY LEAVE FOR PART-TIME WORK

Based on materials from the magazine "Glavnaya Ledger"

June 20

SHAPOVAL E.

Employees who work part-time, of course, receive a salary depending on the number of hours worked or work completed <1>.

How do you calculate vacation time for such employees? How to determine the duration of their vacation? Is it necessary to recalculate the average monthly number of calendar days for them - 29.3, since they work less?

Vacation experience

The vacation period of employees with part-time work and (or) part-time work week is calculated in exactly the same way as for ordinary employees <1>. That is, it must include all the same periods as other employees. In this case, working days, including part-time ones, and all weekend days in case of a part-time work week are counted towards the time of actual work <2>.

For example, if an employee works 4 hours 3 days a week - Tuesday, Wednesday, Thursday, then he must include in his vacation experience:

- days worked - Tuesday, Wednesday, Thursday - as full days;

- Weekends - Monday, Friday, Saturday and Sunday.

And if the working year of such an employee began on 06/01/2013 and he did not have periods not taken into account in the vacation record (for example, vacation at his own expense for more than 14 calendar days), then this year will end on 05/31/2014.

And the establishment of part-time work may affect the length of service required for leave “for harm”. After all, this length of service includes only the time actually worked by the employee in harmful conditions <3>. Moreover, <4> are counted towards such length of service:

<if> in the List of hazardous industries <5> in relation to the position (profession) of the employee there is an entry “permanently employed” or “permanently working” - days on which the employee was actually employed in hazardous conditions full time;

<if> there is no such entry in the List - days on which the employee was employed in hazardous conditions for at least half of the working day.

This means that if an employee worked in hazardous conditions for less than the established time, then such a day does not need to be taken into account in the length of service for leave for hazardous work.

Duration of vacation

The duration of the main annual leave for those who work part-time, as well as for other employees (excluding temporary and seasonal workers), cannot be less than 28 calendar days <6>.

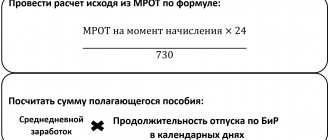

Vacation pay calculation

If an employee, unlike other employees, works part-time, this does not mean that he has not worked the entire pay period. And if he did not have sick leave, vacations, or other periods excluded from the payroll, then it means that he worked the payout period in full <7>.

It happens that in some month of the billing period, an employee with part-time work only has weekends during the counting period. They must be included in the calculation <8>. Of course, this will increase the number of calendar days per pay period into which the employee’s earnings are divided, which will slightly reduce the amount of vacation pay.

Also, due to the fact that the employee works part-time and therefore has more days off, there is no need to reduce the average monthly number of calendar days 29.3 <9> in proportion to the increase in the number of days off for full months of the billing period.

Thus, the average daily earnings for calculating vacation pay for a part-time employee must be calculated in the same way as for other employees <9>.

Let's look at this with a specific example.

Example. Calculation of vacation pay if the employee is assigned part-time work

CONDITION

A.I. Petrova works 4 hours 3 days a week - Tuesday, Wednesday, Thursday. The employee’s salary is calculated in proportion to the time worked based on a salary of 30,000 rubles. with full working hours.

From July 7, 2014, she was granted annual leave of 28 calendar days. In the billing period July 2013 - June 2014:

— from July 1 to July 28, 2013 A.I. Petrova was on annual paid leave;

— from January 9 to January 30, 2014, she was on sick leave.

Salary of A.I. Petrova for the time worked in the billing period is presented in the table.

SOLUTION

The algorithm for calculating vacation pay for an employee working part-time is as follows.

1. We determine the number of full calendar months of the billing period, as well as the number of calendar days in incomplete calendar months of the billing period attributable to the time worked.

Legend

<and> - days excluded from the billing period

<о> - actual part-time working days worked (included in the calculation)

<в> - weekends and non-working holidays falling during a time not excluded from the calculation period (included in the calculation)

<н> - incomplete calendar months of the billing period

<п> - full calendar months of the billing period

2. Determine the estimated number of calendar days in each of the incomplete calendar months of the billing period <10>:

— in July 2013:

29.3 days / 31 days x 3 days = 2.8 days;

— in January 2014:

29.3 days / 31 days x 9 days = 8.5 days

3. Determine the total number of calendar days in the billing period:

10 months x 29.3 days + 2.8 days + 8.5 days = 304.3 days.

4. We calculate the employee’s vacation pay <11>:

RUB 91,687.46 / 304.3 days x 28 days = 301.31 rub/day. x 28 days = 8436.68 rub.

* * *

Due to the fact that employees who are assigned part-time working hours work less, neither the leave period nor the duration of leave is reduced. But they will receive less vacation pay than employees working full-time in the same positions. After all, vacation pay is the average earnings for the 12 months before the vacation.

———————————

<1> art. 93 Labor Code of the Russian Federation

<2> Articles 93, 121 of the Labor Code of the Russian Federation

<3> art. 121 Labor Code of the Russian Federation

<4> clause 12 of the Instructions, approved. Resolution of the State Committee for Labor of the USSR, All-Union Central Council of Trade Unions dated November 21, 1975 N 273/P-20

<5> approved Resolution of the State Committee for Labor of the USSR, the Presidium of the All-Union Central Council of Trade Unions dated October 25, 1974 N 298/P-22

<6> Articles 93, 115 of the Labor Code of the Russian Federation

<7> pp. 4, 5 Regulations, approved. Government Decree No. 922 dated December 24, 2007 (hereinafter referred to as the Regulations)

<8> clause 10 of the Regulations

<9> art. 139 Labor Code of the Russian Federation; clause 10 of the Regulations

<10> art. 139 Labor Code of the Russian Federation; clause 10 of the Regulations

<11> clause 10 of the Regulations

First published in the journal "Glavnaya Ledger" 2014, N 13

We take into account holidays and weekends

Data on how many working days there are in a month, as well as the number of hours, is the basis for accounting operations. Article 112 of the Labor Code lists the days officially called holidays, i.e. non-working days. These are January 1-8, February 23, March 8, May 1, May 9, June 12, November 4.

If any of the listed dates coincides with a Sunday, the day immediately following it is declared an additional day off. This provision does not apply to the New Year holidays.

Salaries are calculated based on the number of days worked per month. This indicator (how many working days in a month on average), depending on the ratio of working days and weekends (including holidays), is used as a guide when calculating the amount of material remuneration. Such data is used, among other things, in statistics and analytics.

An example of calculating vacation pay for an incomplete month

The norm enshrined in paragraph 35 of the Rules predetermines the features of calculating leave in the third scenario: when a person takes leave without working a full month at the company (this is theoretically possible with the consent of the employer), or goes on leave with subsequent dismissal (or receives compensation for unused leave) .

In accordance with this norm, a person who has worked for the company for less than half a month is not entitled to paid leave in the scenario under consideration. Half a month should be considered 15 calendar days (clause 4 of the Rules). If an employee has worked for the company for more than 15 days, then he has the right to leave, the duration (D) of which is calculated as follows:

OD = 1 × 28 / 12 = 2.33 days.

We round up in favor of the employee, it turns out to be 3 days.

Example:

For all days of work before vacation, the employee was paid 30,000 rubles. The period worked is 20 calendar days - from June 1 to June 20, 2021.

The estimated duration of work (RD) will be:

RD = (20 / 30) × 29.3 = 19.5 days.

We calculate vacation pay for an incomplete month (VO):

VO = (30,000 / 19.5) × 3 = 4615 rub. 38 kop.

Would you like to have a complete selection of forms available for applying for annual paid leave? If you have access to K+, you will always find it here. If you don't have access, get a free trial access and go to the Vacation Documents Guide.

What is a man-day

The basic unit for recording working time is the man-day. It is considered worked in the event of a conscientious attendance at work and full performance of official duties. At the same time, we are not talking about the quality of work - only about its quantitative side.

Man-days are considered worked even if the employee is on business trips (if this is provided for by his job responsibilities). The same applies to situations where an employee, on behalf of his superiors, works on the territory of another company.

The influence of the size of the coefficient on vacation pay

The coefficient 29.3 is used when calculating vacation pay and shows the average number of days excluding federal holidays. It is on this and the number of months worked in full that the employee’s earnings are divided.

Taking into account the fact that the coefficient has decreased, the calculation has become more profitable for employees: they have the right to count on larger vacation pay.

Thus, the change in the coefficient was fully justified by the changed realities.

Reasons for absences - good and not so

In case of absenteeism or actual failure to perform work duties, this day is not counted as worked, but is equated to downtime. Accounting for how many working days a particular employee has in a month is made in the form of a special report card, where each day is marked by attendance or non-appearance.

The main reasons for absences are different types of leave (annual, educational - for part-time students to take exams, without pay, etc.). In addition - absence due to illness, performance of certain public duties. Unexcused reasons for absences include absenteeism.

Not just a five-day week

The Labor Code allows the employer to establish, if necessary, a shift work schedule. Objective prerequisites for this can be a production cycle longer than the daily working hours required by law and the optimal use of working capacity. An example would be a conveyor line operating in a continuous cycle.

These types of work require a different - shift schedule. It is assumed that several groups of workers will be occupied in turn servicing the production cycle, each within the standard working hours. How many working days each month has depends on the specific schedule adopted.

February

Any month has 30 or 31 days, except February with its 28 (leap years are beyond the scope of this task). Currently, according to our formula, it has 30 days, so it would be nice to subtract the expression equal to 2 at . The best I could come up with is this, which applies the mask to all months after February:

| x | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 2 mod x | 0 | 0 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 |

Changing the base constant to 28 and adding 2 to the remaining months, we get the formula:

| x | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| f(x) | 29 | 28 | 31 | 30 | 31 | 30 | 31 | 31 | 30 | 31 | 30 | 31 |

Unfortunately, January is now 2 days shorter. But, fortunately, it is very easy to get an expression that will only apply to the first month: it is the inverse of the number rounded down. Multiplying it by 2 we get the final formula:

| x | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| f(x) | 31 | 28 | 31 | 30 | 31 | 30 | 31 | 31 | 30 | 31 | 30 | 31 |

Norm hours for shift schedules

Due to the specific nature of production, many employers find it difficult, and sometimes impossible, to fit a shift schedule into the normal length of the working week (40 hours). In this case, a summary option for recording time worked is provided.

The base (accounting) period is a month, quarter or year. The total time an employee spends performing production duties for the entire accounting period should not exceed the number of standard hours that is a multiple of the number of working weeks. The accounting period cannot be longer than one year.

Knowing the standard hours, you can easily calculate, for example, how many working days there are in 9 months (or for another period).

The schedule called “in three days” raises many questions. Some consider it shiftable (after all, workers replace each other in the same place). In fact, the change does not occur within a day - we are talking about longer periods. And such a schedule would be more correctly called a flexible work schedule.

Working hours are recorded here over an extended period. The total number of hours worked during the year corresponds to the norm.