Despite the fact that today it is possible to contact another division of the company or another enterprise via the Internet or by telephone, employers have to send employees on business trips. Often, the help of a highly qualified specialist is required not only at the main place of work, but also in other branches and divisions of the company. The purposes of travel may involve a short-term or long-term stay on a business trip. Previously, the duration of a business trip was strictly limited by law, but today the maximum duration of a business trip is not regulated.

How to determine the duration of a business trip

A business trip is considered the usual execution of instructions from the employer, but involves the performance of labor functions not at the main place of work, but at the enterprise of the receiving party, located in another area.

Before sending an employee on a business trip, the employer is obliged to determine the purpose of the trip and, depending on the complexity of the tasks assigned to the employee, set a date for the business trip. The first day of a business trip is always taken to be the day of departure indicated on the travel ticket for the selected transport. The same applies to the day the trip ends - the date will be indicated on the ticket as the day of arrival at the locality in which the employer’s organization is located.

Changes in the timing of a business trip must be reported by issuing a special order. The time that the employee will spend on the road (including the time of forced stops, for example, due to flight delays/cancellations) should also be taken into account when indicating the travel dates, since these days are also recognized as working days and are subject to payment.

You also need to take into account the time it takes to check in for your flight. For example, even if the plane's departure is scheduled for 2 a.m. on November 15, you need to indicate November 14 as the first day of travel, because you need to arrive at the airport at least 3 hours before departure.

What is the maximum duration of a business trip?

To correctly determine the estimated duration of a business trip, you need to take into account the following factors:

- place of arrival (within Russia or abroad);

- the complexity of the tasks assigned to the employee;

- scope of proposed work;

- features of instructions related to the specifics of the company’s activities.

Previously, there were clear regulations regarding the maximum duration of an employee's stay on a trip, but today the norms have been abolished. That is, the managers of subordinates have the right to set the duration of a business trip at their discretion, based on the complexity of completing the tasks assigned to the employee.

Despite the relaxations regarding the duration of the trip, the legislator did not cancel the procedure for paying for business trips - the employee must receive a salary, compensation for the costs of purchasing travel tickets, daily allowances to pay for housing and food, as well as other payments designed to reimburse him for expenses during the trip (as agreed with the employer).

If, contrary to the employer’s decision, the employee went on a trip earlier than expected, the employer has the right not to pay for the extra days.

How to change the timing of a business trip

At the legislative level, the procedure for changing the timing of business trips is not approved, but company managers are required to draw up certain documents. If the company's activities involve frequent organization of business trips, it would be more convenient to develop a local regulation that would fully regulate the issues of business trips, including a clause on changing their dates.

Registration of changes in the duration of a business trip begins with the issuance of an appropriate order, both in the case of increasing the duration of the trip and reducing its duration. In this case, there is no need to make changes to the previously issued order and official assignment.

Apart from drawing up an order, no action needs to be taken - the order is a sufficient basis for adjusting payments to a posted employee and for taking into account the costs of making these payments as expenses when calculating the taxable base for income tax.

Maximum duration of a business trip: the employee returned later

It happens that an employee, for certain reasons, returns to the company at his main place of work later than expected. Such changes entail additional payments; in addition, the HR department will be forced to document the end of the trip later than the previously approved date. The document should indicate the basis for extending the trip, this could be:

- impossibility of fulfilling the employer’s instructions within the time determined before the business trip;

- assigning an employee an additional amount of work;

- the presence of the employer’s interest in extending the business trip or the interest of the host company;

- delay/cancellation of an airplane flight or train departure;

- lack of travel tickets at the box office;

- an employee’s illness acquired during the trip or injury.

In any case, the employee is required to provide documentary evidence that the extension of the business trip was necessary if the trip was delayed due to his fault or due to the lack of travel tickets. As soon as the employee arrives, he must report within 3 days on the reasons for the delay.

If, before departure, the employee received money intended to pay for travel and accommodation during the business trip, and it was extended, the employer is obliged to instruct an accountant to recalculate the amount issued. When paying travel money, it is necessary to generate pay slips.

Business travel restrictions

Who should not be sent on business trips

It is prohibited to send on business trips:

- Pregnant women (Article 259 of the Labor Code of the Russian Federation);

- Workers under the age of 18 (Article 268 of the Labor Code of the Russian Federation);

- Persons with whom an apprenticeship agreement has been concluded - on business trips not related to apprenticeship (Article 203 of the Labor Code of the Russian Federation).

In what cases is the employee’s written consent required?

The following circle of persons may be sent on a business trip only with their written consent:

- Women with children under three years of age (Article 259 of the Labor Code of the Russian Federation);

- Mothers and fathers raising children under the age of five without a spouse (Article 259 of the Labor Code of the Russian Federation);

- Employees with disabled children (Article 259 of the Labor Code of the Russian Federation);

- Workers caring for sick members of their families in accordance with a medical report (Article 259 of the Labor Code of the Russian Federation);

- Fathers raising children without a mother, as well as guardians (trustees) of minors (Article 264 of the Labor Code of the Russian Federation)

Restrictions for foreign workers

Temporarily residing and temporarily staying foreigners do not have the right to carry out labor activities outside the boundaries of the constituent entities of the Russian Federation , on the territory of which they were issued a work permit or patent or were allowed temporary residence (clauses 4.2 and 5 of Article 13 of the Federal Law of July 25, 2002 N 115-FZ ).

The maximum total duration of work for foreigners of certain professions outside the constituent entity of the Russian Federation on the territory of which he was issued a work permit when sent on a business trip is established by Order of the Ministry of Health and Social Development of the Russian Federation dated July 28, 2010 N 564n:

- for temporary stayers - a maximum of 10 calendar days during the period of validity of the work permit;

- for temporary residents – a maximum of 40 calendar days within 12 calendar months;

- for highly qualified specialists – 30 calendar days annually during the period of validity of the work permit.

Common mistakes

Error: The employer, when calculating the duration of a business trip, did not take into account weekends.

Comment: Weekends are necessarily taken into account in the duration of a business trip. Even if an employee does not work on a day off, he is entitled to be paid a daily allowance.

Error: The employer set the duration of the business trip to 1 year, since this is the maximum period for which the law allows a construction worker to be sent on a business trip.

Comment: Current legislation does not establish a maximum duration of a business trip - it can be any, depending on the complexity of the tasks assigned to the employee.

Results

The Labor Code of the Russian Federation defines a business trip as a trip by an employee to a place remote from regular work, carried out in accordance with the employer’s order. The legislation does not establish minimum or maximum travel periods. Verified employer expenses for such travel may reduce the tax base.

You can learn more about the specifics of legislative regulation of employee business trips in the following articles:

- “How is a business trip for one day paid?”;

- “Order for a business trip - sample in 2017”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Answers to common questions about the maximum duration of a business trip

Question No. 1: The employer arranged a business trip for an employee, which should begin on January 13. But the employee took the initiative, exchanged a plane ticket and flew to his destination 3 days earlier. Should the manager pay for these 3 days?

Answer: If the initiative to change the timing of a business trip did not come from the employer, he is not obliged to pay wages and daily allowances on those days that were not included in the travel period.

Question No. 2: Should weekends and holidays be taken into account when determining the timing of a business trip?

Answer: Yes, weekends and holidays are also taken into account in the total duration of the business trip. If an employee is on vacation on a day off, he is entitled to a daily allowance; if he was working, he is entitled to double daily allowance and the average salary (or single amount, if the employee wishes to take time off upon returning from a trip).

Article 166 of the Labor Code of the Russian Federation. The concept of a business trip (current edition)

1. A business trip is recognized as sending an employee to perform a production task not only to an organization located in another location, but also to an organization located in the same location.

2. Sending an employee for retraining and advanced training courses is not a business trip.

The relocation of an employee for a certain period to another structural unit of the organization located in the same area, if this does not entail a change in the terms of the employment contract determined by the parties, is not a business trip. The difference between a business trip and a temporary transfer to another job is that the temporary transfer takes place with the same employer (see Article 72.2 of the Labor Code).

3. Employees who have an employment relationship with the employer are sent on a business trip. The term of the concluded employment contract cannot serve as a restriction on sending an employee on a business trip, for example, concluding an employment contract for the duration of temporary (up to two months) work.

4. The specifics of the procedure for sending employees on business trips both on the territory of the Russian Federation and on the territory of foreign states are determined by the Regulations on business trips.

5. The place of permanent work should be considered the location of the organization (a separate structural unit of the organization), the work in which is stipulated by the employment contract (paragraph 1, paragraph 3 of the Regulations on business trips).

A trip by an employee sent on a business trip by order of the employer or a person authorized by him to a separate unit of the sending organization (representative office, branch) located outside the place of permanent work is also recognized as a business trip (paragraph 2, clause 3 of the Regulations on business trips).

6. Employees are sent on business trips by order of the employer for a certain period of time to fulfill an official assignment outside their place of permanent work. An employee is sent on a business trip by the head of the organization and is formalized by an order (instruction).

7. According to the Regulations on official business trips (paragraph 1, paragraph 4), the duration of the business trip is determined by the employer, taking into account the volume, complexity and other features of the official assignment. In this regard, it should be recognized that currently the duration of the business trip is set solely by the employer.

The purpose of the employee’s business trip is determined by the head of the sending organization and is indicated in the official assignment, which is approved by the employer (clause 6 of the Regulations on Business Travel).

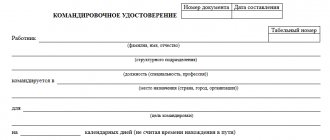

Based on the job assignment, the organization's personnel service issues an order to send the employee on a business trip.

8. The day of departure on a business trip is the date of departure of a train, plane, bus or other vehicle from the place of permanent work of the business traveler, and the day of arrival from a business trip is the date of arrival of the specified vehicle at the place of permanent work. When a vehicle is sent before 24 o'clock inclusive, the day of departure for a business trip is considered the current day, and from 0 o'clock and later - the next day.

If a station, pier or airport is located outside a populated area, the time required to travel to the station, pier or airport is taken into account.

The day the employee arrives at his place of permanent work is determined similarly.

The issue of an employee’s attendance at work on the day of departure on a business trip and on the day of arrival from a business trip is resolved by agreement with the employer (clause 4 of the Regulations on Business Travel).

9. Employees seconded to the organization undergo induction training in accordance with the established procedure. Before starting independent work, they are given initial instruction at the workplace (clauses 2.1.2, 2.1.4 of the Procedure for training in labor protection and testing knowledge of labor protection requirements for employees of the organization, approved by joint Resolution of the Ministry of Labor of Russia No. 1 of January 13, 2003 and Ministry of Education of Russia N 29).

10. Employees on a business trip are subject to the working hours and rest hours of the organization to which they are sent. Rest days not used during a business trip are not provided upon return from it.

Payment for an employee if he is involved in work on weekends or non-working holidays is made in accordance with Art. 153 TK.

When an employee is sent (by order of the employer) on a business trip on a day off, upon returning from the business trip, at his request, he is given another day of rest.

11. Accidents that occurred to employees during a business trip, incl. when traveling to and from the place of a business trip, they are subject to investigation and recording (see commentary to Article 227).

12. Upon returning from a business trip, the employee is obliged to submit to the employer within three working days:

- an advance report on the amounts spent in connection with the business trip and make a final payment for the cash advance for travel expenses issued to him before leaving for the business trip. Attached to the advance report is a duly executed travel certificate, documents on the rental of accommodation, actual travel expenses (including payment for services for issuing travel documents and providing bedding on trains) and other expenses associated with the business trip;

— a report on the work performed on a business trip, agreed upon with the head of the employer’s structural unit, in writing (clause 26 of the Regulations on business trips).

13. If permanent work is carried out on the road or has a traveling nature (for example, the work of drivers, conductors), then such business trips are not business trips. For reimbursement of expenses associated with such business trips of employees, see comment. to Art. 168.1.

Comment source:

Rep. ed. Yu.P. Orlovsky “COMMENTARY ON THE LABOR CODE OF THE RUSSIAN FEDERATION”, 6th edition ACTUALIZATION

ORLOVSKY Y.P., CHIKANOVA L.A., NURTDINOVA A.F., KORSHUNOVA T.YU., SEREGINA L.V., GAVRILINA A.K., BOCHARNIKOVA M.A., VINOGRADOVA Z.D., 2014