Home articles

12/21/2009 print

There is no need to say that “their majesty’s documents” are of great importance for every organization. All of them must meet certain requirements. For some documents, such as powers of attorney, one of the essential requirements from the point of view of their legal force is the requirement of notarization. Particularly significant transactions, either due to legal requirements or to avoid unforeseen situations, are also certified by a notary. How to reflect the expenses “for a notary” in accounting and tax accounting?

Notaries working in a state notary office or engaged in private practice have equal rights and bear the same responsibilities when performing notarial acts (Fundamentals of the legislation of the Russian Federation on notaries, approved by Resolution of the Supreme Council of the Russian Federation of February 11, 1993 No. 4463-1, hereinafter - Basics about notaries). Notarial actions can be performed by officials of executive authorities if there are no notary offices in the region, as well as consular offices of the Russian Federation. The notary performs notarial acts, which, we note, are not a service in the generally accepted sense. Depending on whether the law requires a notarial form of a document or not, notarial actions are divided into mandatory under the law and optional. Notaries charge a state fee or tariff for them. At the same time, private notaries, as a rule, overestimate the established sizes.

| State duty is a fee levied on its payers when they apply to state bodies, local governments, other bodies or officials who are authorized in accordance with the legislative acts of the Russian Federation to carry out legally significant actions in relation to these persons, provided for by Chapter 25.3 of the Tax Code, with the exception of actions performed by consular offices of the Russian Federation (Article 333.16 of the Tax Code of the Russian Federation). |

Mandatory actions

Mandatory certification is required in cases expressly specified in the legislation. For example, Article 12 of Law No. 129-FZ of August 8, 2001 “On State Registration of Legal Entities and Individual Entrepreneurs” states that during state registration, the tax service must submit originals and copies of constituent documents certified by a notary. The cases provided for by the Civil Code are determined by the names of the articles: 185 “Power of Attorney”, 187 “Assignment of Trust”, 339 “Pledge Agreement, its form and registration”, 349 “Procedure for foreclosure on pledged property”, 389 “Form of assignment of the right of claim”. The pledge agreement is also mentioned in Article 10 of the Law of the Russian Federation of May 29, 1992 No. 2872-1 “On Pledge”. It should be remembered that if a transaction is made for which a mandatory notarial form is not provided, but the parties have provided for it in the agreement, certification of such a transaction also falls into the category of mandatory. For performing notarial acts for which a mandatory notarial form is provided, a state notary is obliged to collect a state duty at the rates established in Article 333.24 of Chapter 25.3 “State Duty” of the Tax Code, and a private notary is obliged to collect not a state duty, but a tariff in the amount corresponding to the specified state duty (Art. 22 Fundamentals about notaries). For your convenience, we present the amounts of the state fee: - for certification of powers of attorney to carry out transactions, other powers of attorney and powers of attorney issued by way of delegation - 200 rubles; - for certification of mortgage agreements: - to ensure repayment of a loan (loan) provided for the purchase or construction of a residential building, apartment - 200 rubles; - other real estate, with the exception of ships and aircraft, as well as inland navigation vessels - 0.3 percent of the contract amount, but not more than 3,000 rubles; - ships and aircraft, as well as inland navigation vessels - 0.3 percent of the contract amount, but not more than 30,000 rubles; - for certification of other contracts, the subject of which is subject to assessment - 0.5 percent of the contract amount, but not less than 300 rubles and not more than 20,000 rubles; - for certification of transactions the subject of which is not subject to assessment - 500 rubles; - for certification of agreements for the assignment of claims under an agreement on a residential mortgage, as well as under a credit agreement and a loan agreement secured by a residential mortgage - 300 rubles; — for certification of constituent documents (copies of constituent documents) of organizations – 500 rubles; - for certification of surety agreements - 0.5 percent of the amount for which the obligation is accepted, but not less than 200 rubles and not more than 20,000 rubles; - for certifying an agreement to amend or terminate a notarized contract - 200 rubles; - for attesting to the accuracy of the translation of a document from one language to another - 100 rubles per page of document translation; - for making a writ of execution - 0.5 percent of the amount collected, but not more than 20,000 rubles; - for accepting deposits of money or securities, if such acceptance of deposit is mandatory in accordance with the legislation of the Russian Federation, - 0.5 percent of the accepted amount of money or the market value of securities, but not less than 20 rubles and not more than 20,000 rubles; - for certifying the authenticity of a signature: - on documents and applications, with the exception of bank cards and applications for registration of legal entities - 100 rubles; — on bank cards and on applications for registration of legal entities (for each person, on each document) – 200 rubles; - for making a protest against a bill for non-payment, non-acceptance and undated acceptance and for certifying non-payment of a check - 1 percent of the unpaid amount, but not more than 20,000 rubles; - for issuing duplicate documents stored in the files of state notary offices and executive authorities - 100 rubles; - for performing other notarial acts for which the legislation of the Russian Federation provides for a mandatory notarial form - 100 rubles.

What is included in item 290 of expenses for 2019

In accordance with Art. Its dimensions are established by Art. In accordance with the Directions.

approved For the performance of notarial acts for which the law provides for a mandatory notarial form, a notary engaged in private practice charges a notarial fee. Its size corresponds to the amount of the state duty provided for performing similar actions in a state notary office.

Answer: Mail and notary Magazine "Glavbukh" No. 20, October 2009 How to write off in tax accounting all funds spent on notary services tax consultant, general director How this article will help: In practice, the total cost of notary services exceeds the tariffs and state fees established by law . However, for “extra” amounts, you can find explanations that will allow you to write off expenses in tax accounting.

Russian Federation; – payment for legal and advocacy services, including those related to representing the interests of the Russian Federation in international litigation and other legal disputes; – services provided under the commission agreement; – fee for using a floating bridge (pontoon crossing), a toll road; – payment of remuneration to authors or legal successors who have exclusive rights to works used in the creation of theatrical productions; – services for the production of non-financial asset objects from customer materials; – payment for the use of the radio frequency spectrum; other similar expenses.

>Kosgu notary services

Optional Actions

There are cases for which the law does not require a mandatory notarial form, but it is provided for by the so-called “business customs.” In other words, in order to protect themselves, for example, from unauthorized corrections of signed documents, the parties have them certified by a notary. For this, both public and private notaries charge a notarial fee, the amounts of which are established by Article 22.1 of the Fundamentals of Notaries, in particular: - for certification of contracts for the alienation of real estate (land plots, residential buildings, apartments, dachas, structures and other real estate) , depending on the amount of the contract: - up to 1,000,000 rubles - 1 percent of the contract amount, but not less than 300 rubles; - from 1,000,001 rubles to 10,000,000 rubles inclusive - 10,000 rubles plus 0.75 percent of the contract amount exceeding 1,000,000 rubles; - over 10,000,000 rubles - 77,500 rubles plus 0.5 percent of the contract amount exceeding 10,000,000 rubles; - for certification of financial lease agreements (leasing) of aircraft, river and sea vessels - 0.5 percent of the agreement amount; - for certification of other contracts, the subject of which is subject to assessment, - depending on the amount of the contract: - up to 1,000,000 rubles - 0.5 percent of the contract amount, but not less than 300 rubles; - from 1,000,001 rubles to 10,000,000 rubles inclusive - 5,000 rubles plus 0.3 percent of the contract amount exceeding 1,000,000 rubles; - over 10,000,000 rubles - 32,000 rubles plus 0.15 percent of the contract amount exceeding 10,000,000 rubles; - for certification of transactions the subject of which is not subject to assessment - 500 rubles; - for certification of powers of attorney - 200 rubles; - for certifying the authenticity of protocols of governing bodies of organizations - 2,000 rubles for the first day of the notary’s presence at a meeting of the relevant body and 1,000 rubles for each subsequent day; - for accepting deposits of money or securities - 0.5 percent of the accepted amount of money or the market value of securities, but not less than 20 rubles; - for attesting to the accuracy of copies of documents, as well as extracts from documents - 10 rubles per page of copies of documents or extracts from them; - for certifying the authenticity of a signature: on applications and other documents (with the exception of bank cards and applications for registration of legal entities) - 100 rubles; on bank cards and on applications for registration of a legal entity (for each person, on each document) – 200 rubles; — for storing documents – 20 rubles for each day of storage; - for performing other notarial acts - 100 rubles.

To which kosga should notary services be attributed?

In this regard, the institution needs to amend the charter, open a new personal account in the OFK in its name, change the seal, make changes to the All-Russian State Register of Taxpayers (OGRN), as well as notarize the following documents and pay the state fee in accordance with Art. 333.24 Tax Code of the Russian Federation:

sample signature card - 200 rubles. (clause 21 clause 1);

Payment of notary fees is made in cash. In accounting, these transactions will be reflected as follows: Contents of the transaction Debit Credit Amount, rub.

Thus, in accordance with the procedure for applying the classification of operations of the general government sector, approved by Order of the Ministry of Finance of Russia dated December 25, 2008 N 145n “On approval of the Instructions on the procedure for applying the budget classification of the Russian Federation,” the costs of paying the notarial fee charged for performing notarial acts should be reflect under subarticle 226 “Other works, services” of the classification of operations of the public administration sector. If a state fee is paid for notarial acts, then the costs of its payment should be reflected under article 290 “Other expenses” of the classification of operations of the public administration sector. I.Yu .KuzminAdvisor of the State Civil Service of the Russian Federation, 3rd class 07.27.2009 Question: The government body of a constituent entity of the Russian Federation is holding a gala reception in honor of the anniversary date of the formation of a constituent entity of the Russian Federation.

Cost accounting in accounting

In accounting, the costs “for a notary” can be taken into account in other expenses, attributed to management expenses or to sales expenses if it is a trading organization (clause 5, 11 PBU 10/99 “Organization expenses”, approved by order of the Ministry of Finance of Russia dated 6 May 1999 No. 33n). These expenses are taken into account in full, and the posting depends on which (public or private) notary and for what (mandatory or optional) actions the money was paid. So, if you paid for the notarial actions of a state notary, the entry will be as follows: Debit 26 (44, 91) Credit 68. If you paid for the actions of a private notary, then the following: Debit 26 (44, 91) Credit 76.

| Example |

| The Cactus trade organization used the services of a state notary and certified 10 copies of certificates of conformity. The accountable person was given funds from the cash register to pay the state duty in the amount of 1000 rubles. The following entries must be made in the organization's accounting: Debit 71 Credit 50 - 1000 rubles. – funds were issued for reporting for payment of state duty. This operation is formalized by a cash receipt order; Debit 68 Credit 71 – 1000 rub. – the accountable person has paid the state duty. An advance report is drawn up based on primary documents; Debit 44 Credit 68 – 1000 rub. – the paid state duty is recognized as a sales expense. An accounting certificate is prepared. |

Expenses for notarial actions associated with the acquisition of fixed assets in accounting are included in their initial cost (clause 8 of PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance of Russia dated October 16, 2000 No. 91n). In this case, they are first recorded on account 08 “Investments in non-current assets”, and after putting the facility into operation, along with other expenses, they are transferred to account 01 “Fixed Assets” and written off through depreciation.

| note |

| If an organization invites a notary to perform notarial acts on its territory, he has the right to increase the fee by one and a half times (subclause 1, clause 1, article 333.25 of the Tax Code of the Russian Federation, clause 2, article 22.1 of the Fundamentals of Notaries). |

Results

Thus, excess notary fees are not taken into account for tax purposes:

- if a notary charges a tariff in excess of the state duty for carrying out mandatory actions;

- if for optional actions they charge a tariff higher than established by art. 22.1 Basics about notaries.

However, amounts in excess of legal norms, subject to proper execution of supporting papers and provided that they meet the criteria of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, can be taken into account as expenses such as, for example, legal services and some others.

The answer to the question on which accounting account the state duty is accounted for depends on its type and the reasons for which it is paid.

Sources:

- Tax Code of the Russian Federation

- Law “On Accounting” dated December 6, 2011 N 402-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What to recognize as tax expenses?

Under the accrual method, expenses for payment of notarial actions are recognized in the reporting (tax) period to which they relate, regardless of the time of actual payment of funds and (or) other form of payment (clause 1 of Article 272 of the Tax Code of the Russian Federation). For tax accounting, it does not matter whether the notary is public or private. But only the payment amount within the established tariffs can be taken into account in expenses (subclause 16, clause 1, article 264 of the Tax Code of the Russian Federation). At the same time, paragraph 39 of Article 270 of the Tax Code establishes that when determining the tax base, expenses in the form of fees to a notary (public or private) for notarial registration in excess of the established tariffs are not taken into account. This is also indicated by the regulatory authorities (letter of the Ministry of Finance of Russia dated May 20, 2005 No. 03-03-01-04/2/91).

| Example |

| To certify the translation of documents from a foreign language into Russian by a private notary, the accountable person was given funds from the cash register. For five pages of certified translation, the notary was paid 1,500 rubles. The following entries are made in accounting: Debit 71 Credit 50 – 1500 rub. – funds were issued on account for notary services; Debit 26 Credit 71 – 1500 rub. – expenses associated with notarial actions are taken into account. For certification of the accuracy of the translation of a document from one language to another, a fee is set at 100 rubles. for one page of translation (subclause 18, clause 1, article 333.24 of the Tax Code of the Russian Federation). Based on this, the organization has the right to take into account only 500 rubles in tax accounting. (100 rub. x 5). |

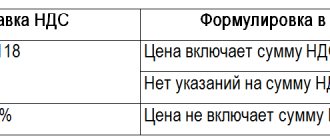

Features of tax accounting of services provided by notaries

Depending on whether a notarial form is required for a document, notarial acts are divided into mandatory and optional. For mandatory services, a notary from a state office will charge the client a fee in the amount specified in Art. 333.24 Tax Code of the Russian Federation. For exactly the same actions, a private notary will charge a tariff in the manner set out in Chapter. 25.3 of the Tax Code of the Russian Federation and Art. 22 Fundamentals of the legislation of the Russian Federation on notaries dated 02/11/1993 N 4462-1.

But for actions for which the law does not establish a mandatory notarial form, a notary (it does not matter whether private or public) charges tariffs, as required by the Fundamentals of Notaries.

In tax accounting, services for the implementation of notarial actions are taken into account exclusively at the tariffs approved by law (subclause 16, clause 1, article 264 of the Tax Code of the Russian Federation). Expenses in excess of these amounts are not taken into account in the calculation of income tax (Clause 39, Article 270 of the Tax Code of the Russian Federation).

What notary services are not notarial acts

As part of their activities, notaries have the right to draw up draft transactions, powers of attorney, statements and other documents, make copies of documents and extracts from them, perform other technical work, and also give explanations on issues of performing notarial acts. There is no state duty or tariff for this. Therefore, when providing these services or performing work, the notary charges a “regular” fee, which is established by agreement of the parties. Such expenses are not notary fees. They are qualified as legal, informational or consulting and are taken into account in the tax base for income tax in full.

| Example |

| The Cactus organization turned to a private notary to develop and certify a power of attorney requiring a notarized form. The fee for developing the form was 500 rubles, and for notarization - 200 rubles. (in the amount of the tariff). In tax accounting, an organization can accept in full both the notarization of a power of attorney and the development of its form by a notary. When calculating income tax, all expenses are classified as other expenses, but certification costs are based on subparagraph 16 (“payment to a public or private notary for notarization”), and costs for developing the form are based on subparagraph 14 (“costs for legal and information services ") paragraph 1 of Article 264 of the Tax Code. |

Classification of professional notary services

The services provided by a notary are heterogeneous and are divided into notarial, legal and technical services.

State tariffs have been developed for notarial ones, the rest are on a contractual basis, their cost is set directly by the notary. When contacting a notary, depending on the issue being resolved, the following may be charged:

- State duty (or notary fee). They are paid in the amount determined by law when the action is performed directly in the notary’s office (Article 333.24 of the Tax Code). If the notary travels by agreement with the client and carries out the necessary actions outside the notary’s office, then the amount of the notary fee/state duty increases by 1.5 times (clause 1, clause 1, article 333.25 of the Tax Code);

- Payment for the provision of legal or technical services. For example, for drafting agreements, other documents or copying them;

- Reimbursement of transportation costs when performing services on-site to the client.

Upon completion of notarial (other) actions, the notary is obliged to issue the client a document confirming the amount of payment for all types of services provided. As a rule, money for this type of expense is issued on account to the financially responsible person. He pays the notary, and subsequently attaches a document confirming the expenses to the advance report.

Stock up on documents

Now let's touch on the documentation of notary expenses.

In accordance with the provisions of Article 252 of the Tax Code, expenses must be economically justified and documented. Documentary evidence of expenses for notarial actions are: - a receipt for the cash receipt order, certified by the signature and seal of a notary, indicating the amount paid; — a document about the actions performed. The best option is an extract from the register certified by the signature and seal of a notary, which includes: a list of notarial actions, the name and number of copies of documents “processed” by the notary, and the amount of the charged fee. Some require acts of acceptance and transfer of services or performance of work from the notary. Note that such documents are intended to confirm the fact of provision of services (performance of work) of a production nature (clause 2 of Article 272 of the Tax Code of the Russian Federation). Notarial actions do not apply to them (subclause 6, clause 1, article 254 of the Tax Code of the Russian Federation). This means that the notary is not obliged to issue them. The amounts that you have to pay to the notary themselves can be quite large. And it is important to track inflated amounts in a timely manner. To do this, you need to know the rates of government duties and tariffs and what actions they are charged for. The correct qualification of expenses depends on this. S. Shestakova, expert (Material provided by the magazine “Practical Accounting”)

Required supporting documents

The citizen of the Russian Federation who has received the appropriate license has the right to engage in notarial activities - such rules are enshrined in Art. 3 Basics about notaries. However, a company that seeks help from a notary is not required to attach a copy of this license to the supporting documents received from him.

As a rule, a company representative pays the notary immediately as soon as he certifies the required document or performs other work according to his competence. In this case, the notary will issue the client with documents indicating the provision of services and their payment.

Let us note that at the moment, no special unified form of primary document issued by a notary to confirm the facts of the provision and payment of his services has been approved. Typically, in such cases, receipts are issued to the recipients and transcripts of the services provided. All of them are certified by the personal signature of a notary (or his authorized representative) and seal.

But often such papers contain only general phrases: for example, “paid for certification of the accuracy of copies” or “state duty collected for notarial acts.” Of course, such vague wording will not be enough to justify the expenses required by law in paragraph 1 of Art. 252 of the Tax Code of the Russian Federation.

For proper acceptance of services for accounting, the document received from the notary must contain all the mandatory details specified in Art. 9 of the Law of December 6, 2011 No. 402-FZ “On Accounting”. It must certainly list the specific actions performed by the notary and indicate the fees charged for each of them.

When receiving documents at a notary's office, also keep in mind the following possibility: in accordance with Art. 50 Fundamentals of Notaries, all notarial actions are recorded in a special register, the form of which is approved by Order of the Ministry of Justice of the Russian Federation dated April 10, 2002 No. 99. An extract from such a register, issued and certified by a notary, can confirm the client’s expenses.

And, of course, you can draw up an act in the usual manner, which lists in detail all the actions performed, indicating the prices for them.

Registration by a notary, what to remember

The materials were prepared by a group of consultants and methodologists of JSC "BKR-Intercom-Audit"

(things to remember)

Today, organizations are unthinkable without concluding contracts and certifying transactions. It’s good if counterparties are confident in you and do not ask for notarized statutory documents of the company.

What to do if a client enters into an agreement with an organization for the first time? This is where it is worth resorting to the services of a notary. If you have already encountered such a situation in the course of your work, then you have noticed that there are many notary offices and their number is increasing. From a legal point of view, it makes no difference whether the documents are registered with a private or a public notary, but from a tax and accounting point of view, this can cause complications.

Let's consider accounting and tax accounting of notary expenses.

Accounting

From an accounting point of view, expenses for paying for notary services (Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n “Accounting Regulations “Organization Expenses”” PBU 10/99) relate to expenses for ordinary activities and are reflected in cost accounts - 20 “Main production”, 26 “General business expenses”, 44 “Sales expenses”.

According to paragraph 18 of Order No. 33n, these expenses are recognized for accounting purposes in the period in which they occurred, regardless of the time of actual payment to the notary who certified the transaction.

Tax accounting

The costs of notary registration are reflected in tax accounting in a completely different way. When preparing documents, attention is not paid to which particular notary certified the transaction or registered copies of documents. But depending on which notary performed the corresponding actions, in the future it depends wholly or partially the costs can be attributed to notary expenses in tax accounting. For tax accounting purposes, the costs of paying for notary registration are taken into account as part of other expenses, but according to subparagraph 16 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation “within the limits of tariffs approved in the prescribed manner.”

Reflection of enterprise expenses for notary services in accounting

For mandatory notary service procedures, an enterprise must pay a state fee (to a specialist working in a government agency) or a tariff fee to a private notary (its amount will be identical to the state fee). Tariff payments are provided for an optional group of services. In tax accounting, transfers in favor of notaries are accepted in the amount of legally established tariffs; all funds paid in excess of the norm are not taken into account in the calculation of income tax.

BY THE WAY! The cost of services of a public notary is paid into the budget, and payment of the private notary's bill is made by transferring money to his current account.

Primary documentation for reflecting notary services in accounting

The fact that the notary has received money from the client must be confirmed by primary documentation. There are no unified forms provided for by law. Payment forms are certified by a notary's signature and seal. The text of the document must contain language about the purpose of payment that accurately characterizes the essence of the service provided.

The Supreme Court allowed not to overpay at the notary

“Why are notary services so expensive? One piece of paper, 5 minutes of work and shell out 1000 rubles,” they are outraged on the Internet. For example, the minimum state duty for certifying an inheritance agreement is 300 rubles, and for legal and technical services you need to pay another 12,000 rubles. From time to time, Russian courts have to figure out when a “markup” for additional services is legal and when it is not.

Dispute between a notary and a father of many children

In February 2022, Maxim Shilov* turned to notary Evgeniy Terekhov to certify copies of the birth certificates of his four children. Shilov made the copies himself, so he wanted to pay only the notary fee - 10 rubles. for one copy. But the notary said that it costs 100 rubles. per copy: 10 rub. according to the tariff and 90 rubles. for legal and technical services. Shilov did not want to overpay, and Terekhov did not certify the copies.

The Penza District Court of the Penza Region declared the notary's refusal illegal. Terekhov refused the notarial act due to the fact that the client did not pay for technical and legal services, but did not explain what services were required in this case. In court, the notary could not say what exactly he was going to do (case No. 2-280 /2020).

The Penza Regional Court, on the contrary, decided that the notary was right. From August 2022 Art. 22 of the Fundamentals of Legislation on Notaries has been supplemented with part seven [in court decisions erroneously called part six – Pravo.ru]. It states that a private notary is paid for legal and technical services (case No. 33-1849/2020). The First Cassation Union also agreed with this, so Shilov went to the Supreme Court.

The board, chaired by Alexander Klikushin, recalled the position of the Constitutional Court in the ruling of April 9, 2022 No. 815-0 and others. The Constitutional Court has repeatedly repeated that during notarial acts, legal and technical services are not always provided. The courts cannot approach disputes between notaries and their failed clients formally. It is necessary to find out each time whether legal and technical services are needed in this particular case.

If it is impossible to do without them, then the client must pay. If he refuses, the notary may not perform the notarial act. If legal and technical services are not needed, it is illegal to demand payment for them, the Supreme Court explained (case No. 29-КГ21-1-К1). When the case was reconsidered, the regional court had to figure out what legal and technical services Terekhov was going to provide to the citizen when certifying the copies that he made himself. On May 25, the appeal upheld the first instance decision. That is, she agreed that the notary refused illegally (case No. 33-1519/2021).

How the practice of the Supreme Court on additional services of notaries developed

Vasily Malinin, head of the “Commercial disputes” department of the Law Firm Rustam Kurmaev and partners Rustam Kurmaev and partners Federal rating. group Arbitration proceedings (major disputes - high market) group Criminal law group Bankruptcy (including disputes) (high market) group Dispute resolution in courts of general jurisdiction 1st place by revenue per lawyer (less than 30 lawyers) 5th place by revenue Company profile, says that the Supreme the court clearly separated the cost of notarial actions and prices for legal and technical services back in 2022 (case No. AKPI17-193).

The Supreme Court forced notaries to work only for a state fee

In part seven of Art. 22 of the Fundamentals of Legislation on Notaries, which the courts applied in the Shilov case, enshrines the right of privately practicing notaries to pay for legal and technical services. It came into force on August 4, 2022. This norm names certain types of services (for example, legal analysis, consultations on the application of legislation, production of documents and copies), but does not distinguish between technical and legal. Before the amendment to Art. 22 legal and technical services were also paid. They are mentioned in Art. 23 Fundamentals of legislation on notaries since the adoption of this act - since 1993.

Every year, the Federal Notary Chamber sets the maximum possible fee for such services for all regions. The price of legal and technical services may vary significantly even in neighboring regions. For example, in 2022, the cost of a power of attorney on behalf of individuals in St. Petersburg cannot be more than 1,404 rubles, and in the Leningrad region - more than 1,893 rubles. An additional state fee is paid, most often it is 200 rubles.

Failed clients and dissatisfied notaries periodically reach the Supreme Court. They argue about additional services in inheritance cases, when certifying powers of attorney and documents for the tax authorities.

1

Certification of signature on the tax form

Yuriy Siropov* asked the notary Valentina Bespalova to certify the signature on the application for amendments to the Unified State Register of Legal Entities (form No. P14001). The notary would not work without payment for legal and technical services. The courts reacted differently to this: the first instance recognized the refusal as legal, the appeal overturned this decision, and the cassation “demolished” the appeal ruling and “overpowered” the decision of the first instance. Siropov reached the Supreme Court. There, the troika, chaired by Klikushin, sided with the citizen. In this case, additional services were not required, she decided (case No. 14-KG20-24-K1, see BC allowed not to pay the notary for additional services).

Another case, No. 4-KG20-29-K1, was considered based on a complaint from a notary. Antonina Voronova* planned to certify the signature on the Federal Tax Service form No. R38001 (objections regarding state registration of changes to the charter of a legal entity or entering information into the Unified State Register of Legal Entities) at the price of the notary fee - 100 rubles. Notary Nadezhda Kutishcheva wanted to receive another 900 rubles. for your services. She believed that after amendments were made to Art. 22 of the Fundamentals of Notary Legislation, such a fee is mandatory for any notarial act. The courts declared the notary's refusal to work only for a tariff to be illegal, and the Supreme Court agreed with them. The main argument is still the same: in this case, additional services were not needed.

2

Made it yourself - no need to pay?

In July 2022, a dispute between Chelyabinsk lawyer Ilya Kaletin and notary Tanzilya Buzykaeva reached the Supreme Court. The man himself prepared a judicial power of attorney and therefore did not want to pay for additional services. The district court sided with the lawyer, and the appeal supported the notary. The Supreme Court agreed with the first instance: the lawyer himself formulated the powers in the power of attorney and even printed the necessary identification inscription. Additional services of a notary are not an integral element of all notarial actions, the court emphasized then (case No. 48-КГ18-13).

At the same time, at the end of 2022, the Federal Tax Service directed notaries to the fact that it is possible to charge a fee for additional services, even if the client himself prepared the draft document (letter dated December 21, 2022).

Sergey Uchitel, partner at Pen & Paper, reminds that a notary performs a public function of certifying a transaction and bears full financial responsibility for this.

At a minimum, the notary must conduct a legal examination of the transaction, check the legal purity of the alienated object, for example, by requesting data from the Unified State Register of Legal Entities or Unified State Register of Legal Entities. It is mandatory to establish the identity of the applicants, check their legal capacity, and conduct a face-to-face conversation with the parties to the transaction.

Sergey Uchitel, partner at Pen & Paper

In such a conversation, the “awareness of the actions of the parties” and the compliance of their will with the terms of the contract being concluded are checked, and the legal consequences of the transaction are explained, says Uchitel.

3

11,000 rub. for services and state duty 500 rubles.

Cheboksary notary Larisa Rybina did not issue inheritance documents to Igor Pavlov*. The man refused to pay 11,000 rubles. for technical and legal services. But the notary did not work for 500 rubles. state duties. The client’s arguments were heard only in the Supreme Court; lower authorities agreed with the notary. As in the case of the Chelyabinsk lawyer, the Supreme Court emphasized that the additional services of a notary are not an integral part of the notarial act (case No. 31-KG18-3, see the Supreme Court forced notaries to work only for a state fee).

This case was included in paragraph 9 of the review of the practice of the Supreme Court No. 3 for 2022. As the Supreme Court pointed out, it is unacceptable to impose additional services of a legal or technical nature on citizens. But the next review (No. 4) for 2018 excluded this item due to the introduction of the same changes to Art. 22 Fundamentals of legislation on notaries.

The legislator directly stated that the cost of a notarial act consists of two elements: the notarial tariff and the price of legal and technical services. Therefore, it is unacceptable to separate them.

Vasily Malinin, head of the “Commercial disputes” department of the Law Firm Rustam Kurmaev and partners Rustam Kurmaev and partners Federal rating. group Arbitration proceedings (major disputes - high market) group Criminal law group Bankruptcy (including disputes) (high market) group Dispute resolution in courts of general jurisdiction 1st place By revenue per lawyer (less than 30 lawyers) 5th place By revenue Company profile,

Lawyers: what to do with dishonest notaries and when the courts side with them

Neither the Constitutional Court nor the Supreme Court prohibits charging for legal and technical services, emphasizes Anna Kholobudovskaya, head of the International Trademark Registration practice INTELLECT INTELLECT Federal rating. Digital Economy group Intellectual Property group (Rights Protection and Litigation) Intellectual Property group (Registration) TMT group (telecommunications, media and technology) 15th place By number of lawyers 24th place By revenue per lawyer (more than 30 lawyers) 40th place By revenue Company profile. The point is only that sometimes such services are objectively not needed for basic notarial actions - for example, if a notary confirms the accuracy of a signature or a copy of a document, that is, does not certify the facts.

In other cases, additional services (analysis of documents, preparation of their drafts, explanations regarding notarial actions) can be justified, Kholobudovskaya believes.

When it comes to a draft power of attorney prepared by the applicant, additional services include identifying and correcting inconsistencies. The need to provide legal and technical services can be justified in the case of certification of any transaction. Their cost in this case is regulated by the Federal Chamber of Notaries.

Anna Kholobudovskaya, head of practice “International registration of trademarks” INTELLECT (INTELLECT) INTELLECT (INTELLIGENCE) Federal rating. group Digital economy group Intellectual property (Protection of rights and litigation) group Intellectual property (Registration) TMT group (telecommunications, media and technology) 15th place By number of lawyers 24th place By revenue per lawyer (more than 30 lawyers) 40th place By revenue Company profile

Unfortunately, Uchitel admits, many notaries often behave in bad faith: they demand payment for legal and technical services even when they are not provided. They take advantage of the fact that sometimes it is impossible to do without a notary, and to appeal the refusal you need to go to court.

It is necessary to establish in the law a mandatory list of actions that notaries perform in almost any notarial act (for example, consulting, making copies of documents, scanned images, displaying images of electronic documents on paper) and include them in the cost of a single tariff for notary services.

Sergey Uchitel, partner at Pen & Paper

Malinin says that in many cases in 2019–2020, judges supported notaries who refused to perform notarial acts without paying additional fees.

Thus, in case No. 33-29054, the Moscow City Court agreed with the Simonovsky District Court. Even if the citizen himself has drawn up a power of attorney, the notary must verify it, and these are legal services. In case No. 33-411605/2020, the Moscow City Court came to similar conclusions in relation to the marriage contract. “Even if the client independently prepares the text of the marriage contract, which fully meets the requirements of the law, the notary has the right to make changes to the contract and check its content as a whole,” Malinin explains the approach of the appeal and the Lyublinsky District Court.

The Supreme Court's ruling in the Shilov case smooths out this formal approach a little and turns it towards citizens, Malinin believes. He suggests that lower-level practices could change “in the very near future.”

*Names and surnames have been changed by the editors.

- Ekaterina Korobka

- Supreme Court of the Russian Federation

- Civil process

How to write off notary expenses that exceed the norm?

Quite often situations arise when the amount paid to a notary exceeds legal norms. And what to do with those expenses that do not fit into the legal framework? In some cases, they can be taken into account in expenses for other reasons.

Let's try to take advantage of the fact that in addition to direct notarial services, notary offices also provide some others: legal, informational, consulting, etc., and their list is open (subclauses 14 and 15 of clause 1 of article 264 of the Tax Code of the Russian Federation). The company's expenses for providing these services by a notary can be taken into account in other production and sales expenses (letter of the Ministry of Finance of the Russian Federation dated August 26, 2013 N 03-03-06/2/34843).

For example, the performance of technical work by notaries is provided for in Art. 23 Basics about notaries. There is no state duty (or tariff) for such services - the notary has the right to set prices for them at his own discretion. The Tax Code of the Russian Federation also does not provide for any restrictions on these expenses. Therefore, they can be fully accepted when calculating income tax as legal services.

However, in doing so, you should agree with the notary so that in his decryption certificate he divides the full amount into two components: directly for the notarization and for information (consulting, legal) services. Then it will be possible to fully recognize amounts in excess of the norms in tax accounting, such as, for example, the costs of legal advice.