What affects the amount of transport tax? Transport tax refers to local taxes, so the amount

Calculation of the tax burden To calculate the tax burden, you need to perform the following steps: Determine the total amount of taxes

Leasing is a convenient form of purchasing a car, which is the purchase of a car through its rental.

Minimum wage (minimum wage) is the minimum possible wage that an enterprise

An electronic signature is convenient. It allows you to submit reports to the tax office and funds and

When INV-4 is needed The form is used to inventory two types of inventory items. The first one is unpaid

When registering as an individual entrepreneur, many businessmen expect to work independently. After the lapse of

The essence of the company’s net assets and authorized capital According to clause 4 of the order of the Ministry of Finance of the Russian Federation “On

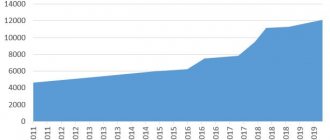

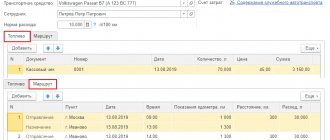

The rules for accounting for fuels and lubricants have been updated. Methodological guidelines have been updated by Order of the Ministry of Transport dated 04/06/2022 No. NA-51-r.

Essential terms of the transaction for the purchase and sale of goods with postpayment The contract is not concluded if not agreed upon