It just so happens in the Russian business world that there are two concepts - “legal” and “actual” addresses. The legal address is considered to be the one indicated in the Unified State Register of Legal Entities and such a term exists (see “Modern Economic Dictionary” by R.A. Raizberg, 6th edition, INFRA-M, 2011). This cannot be said about the term “actual address,” which was created colloquially for convenience, because the offices of many companies are located far from where the Federal Tax Service sends them correspondence. Interesting fact: Federal Law No. 129-FZ of 08.08.2001 “On State Registration of Legal Entities and Individual Entrepreneurs” allows for the possibility for companies to be located at a location other than their place of registration. The question arises: What difference does it make where the company is located? The law hasn't been broken. Formally, yes, but in fact, the lack of your connection with the official place of registration can lead to a number of difficulties in contacts with authorized bodies and your clients. Which ones? Now we'll tell you.

Consequence No. 1 “Important correspondence will not reach the recipient”

The company address indicated in the Unified State Register of Legal Entities is perceived by the Tax Service, the Pension Fund, banks and other official organizations as a postal address at which someone is obliged to check correspondence and promptly respond to it. Moreover, from the point of view of the same Federal Tax Service, any letter sent to this address is a priori considered read. Consequently, if disagreements arise with the authorized body on this issue, the truth will not be on your side. In this situation, we recommend that when registering or re-registering a company, you indicate the address of the permanent location of one of the LLC members or the address of the director directly. As a result, the law has not been violated and there should be no problems with letters and notices either.

Procedure for changing legal address

The Civil Code of the Russian Federation, with adopted amendments and additions, distinguishes between the concepts of “address of a legal entity” and “location of a legal entity.”

Location is the name of the locality, and the legal address is the full address of the company indicated in the Unified State Register of Legal Entities. In this case, the address of the legal entity must be within its location (Civil Code of the Russian Federation, Article 54, clause 3). Change of legal address within one locality

If only a locality is indicated in the organization’s Charter, then the procedure for changing data occurs in a simplified mode - you will need to fill out form P14001.

In particular, within three working days after changing the legal address, it is necessary to submit a package of documents to the Federal Tax Service at the old legal address, including:

- Form P14001, certified by a notary.

- Documents confirming the right to register at the new legal address (lease agreement, certificate of ownership or letter of guarantee).

- Minutes of the meeting of participants (decision of the sole participant) on a change of address.

If the company’s Charter specifies the full address of the organization, then in this case it is necessary to amend the Charter and fill out form P13001. In this case, to the Federal Tax Service at the previous registration address, in addition to the documents indicated above (clauses 2-3), you must submit:

- Form P13001, sealed by a notary.

- A receipt confirming payment of the state duty.

- The amended Charter of the organization or annex to it (in 2 copies).

Within 5 working days after receiving the documents, the inspector will issue an entry sheet in the Unified State Register of Legal Entities with the updated address of the company.

Changing the legal address when the company moves to another location

The procedure for changing the address of a legal entity when moving to another locality takes more than a month and takes place in two stages (until 2016, changing the legal address took place according to the principle described above).

The procedure for changing the address is carried out on the basis of the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs” No. 129-FZ and a number of other legislative acts of the Russian Federation.

Stage I. Informing the registering Federal Tax Service with the presentation of the P14001 form certified by a notary and the minutes of the meeting of participants (decision of the sole participant) about the change of address.

Based on the documents received, the auditors will, within 5 working days, make an entry in the Unified State Register of Legal Entities indicating that the company has made a decision to change its legal address.

Stage II. Contact the registering Federal Tax Service at the new address. The director of the organization must contact the Federal Tax Service at the new address (no earlier than 20 working days from the date of entering the relevant data into the Unified State Register of Legal Entities) and submit the following documents:

- Form P13001, certified by a notary.

- Receipt for payment of state duty (according to the details of the new Federal Tax Service).

- Documents confirming the right to register at the new address.

- The Charter as amended or an appendix to it (2 copies).

- Minutes of the meeting of participants (decision of the sole participant) on a change of address.

5 working days after submitting the documents, the Federal Tax Service will issue the organization a Unified State Register of Legal Entities with a new address.

Consequence No. 2 “Providing knowingly false information to the Unified State Register of Legal Entities”

The concept of “knowingly false information” means information or data that does not correspond to reality and the applicant himself knows about it. In our case, it may turn out that the director, when registering or re-registering a company, reported completely incorrect data to the authorized body. These may include: a) a non-existent address; b) at this address there is a building that is unsuitable for locating an office, production, warehouse, etc.; c) under no circumstances can a company be located in this place (for example, it is a military unit). Also, Tax Service employees have the full ability to send “their person” to this place to check whether the corresponding company is actually located there. If the fact of giving false information is confirmed, then the head of the organization will have to, at best, pay a fine in the amount of 5,000 to 10,000 rubles, and in the worst case, by a court decision, be disqualified from management work for a period of 1 or 3 years. This rule applies in several cases:

- If at least a year has passed since the address was registered;

- If the fact of address mismatch has been confirmed several times. This problem refers us to consequence No. 1 and this means that the above procedures can begin from the moment when none of the responsible persons respond to important correspondence.

What situations happen with clients?

In Russian realities, medium and small businesses rarely operate at the same address for a long time. Cost savings, optimization and other processes force a legal entity to sometimes look for better offers for renting office space, selling property, etc., resulting in a change of legal address. There is also a common situation in which a legal entity has declared one address as its location, but actually conducts its activities at a different address. However, not everyone wants to inform the bank or tax authority that the legal and actual addresses do not match.

Consequence No. 3 “Problems with the servicing bank”

The commercial activities of legal entities in Russia are based on close cooperation between organizations and banks. This important component of business can cause a lot of trouble if the bank discovers discrepancies in the service agreement with your organization. When concluding a service agreement, the real or “actual” address of your location is indicated. It may turn out that the company, when opening, worked at the address indicated in the Unified State Register of Legal Entities, and then decided to change the office without making the appropriate changes to the Register. In this situation, the bank remains with old information. The Federal Tax Service works closely with financial organizations and can rightfully provide information compromising you to the bank, thereby violating the latter’s trust in you. At this stage, a lot depends on the policy of the financial authority itself - it may demand to re-conclude the contract, which will be the best scenario, or it may unilaterally terminate the contract with you, which in itself does not lead to anything good. In this case, we advise firms to, where possible, communicate information about the actual location to all authorities in contact with you. There is nothing to hide here, because the law is not being broken.

What does the law require if the actual and legal addresses do not match?

If you follow the norms of the Civil Code of the Russian Federation, then Article 859 provides grounds for termination of a bank account agreement. The list of these grounds is exhaustive:

- The bank has the right to refuse to fulfill the bank account agreement by notifying the client in writing if there are no funds in the client’s account and no transactions on this account for two years (unless otherwise provided by the agreement between the bank and the client).

- The bank has the right to terminate the bank account agreement in cases established by law, with mandatory written notification to the client.

- At the request of the bank, the bank account agreement may be terminated by the court in the following cases:

- the amount of funds stored in the client’s account will be below the minimum amount provided for by banking rules or agreement, if such amount is not restored within a month from the date the bank warned about this;

in the absence of transactions on this account during the year, unless otherwise provided by the agreement.

What laws are discussed in paragraph 2? In this case, the direct right of the bank to unilaterally terminate the bank account agreement is provided for in two Federal laws: Federal Law dated June 28, 2014 No. 173-FZ “On the specifics of financial transactions with foreign citizens and legal entities, on amendments to the Code of the Russian Federation on administrative offenses and invalidation of certain provisions of legislative acts of the Russian Federation" and the Federal Law of August 7, 2001 No. 115-FZ "On combating the legalization (laundering) of proceeds from crime and the financing of terrorism."

From the point of view of the topic under consideration, we are interested in the second law. In accordance with clause 5.2. Art. 7 of Federal Law No. 115-FZ, a credit institution has the right to terminate a bank account (deposit) agreement with a client if two or more decisions are made during a calendar year to refuse to carry out the client’s orders to carry out a transaction on the basis of paragraph 11 of this article.

Thus, in the legislation there is no direct right of the bank to terminate the bank account agreement if the bank discovers the absence of the client at his stated registration address.

If the bank does not have up-to-date information about the client (including the current address) necessary for identification, and if there are suspicions that the operation is being carried out for the purpose of legalizing (laundering) proceeds from crime or financing terrorism, the bank has the right to refuse to perform client's instructions to perform a transaction. And only after two such refusals does the bank have the right to unilaterally terminate the contract.

Consequence No. 4 “Your counterparties will refuse to cooperate”

This is an extreme but still real problem that can arise. The mechanism is very simple: the Federal Tax Service sends letters to a non-existent address and receives after some time a notification that the letter has been returned marked “after the expiration of the storage period.” Further, the Tax Service has the right to place in open sources information that your organization is not located at the address specified in the Unified State Register of Legal Entities. This fact harms the company’s reputation, because your future, and maybe even current clients, will not want to deal with an organization that is under the “suspicion” of the fiscal authority. Of course, the management of the two companies can have not only business, but also, if you like, friendly relations. This means that the discrepancy between the legal address and the actual address will have absolutely no meaning for them. However, remember that participation in auctions and government procurement will require maximum transparency from your form. Isn't it worth it to provide reliable information about yourself?

Registration of a legal address at the director’s place of residence

In the event that you urgently need to change your legal address, you can register a new one at the address of the director or participant of the organization, but provided that his share in the authorized capital is more than 50 percent.

Registration of a new address occurs in a simplified manner and takes only 5 working days. The director of the organization must contact the INFS at the new address, submitting the following documents:

- Form P13001, certified by a notary.

- Receipt for payment of state duty.

- Minutes of the meeting of participants (decision of the sole participant) on amendments to the Charter.

- Updated Charter or appendix to it (2 copies).

Documents confirming the right to register at the new address will not be required, however, the registration in the passport of the head (participant) must match the data specified in the application.

Consequence No. 5 “Fine for violating the procedure for using cash register systems”

Amendments introduced in 2016 and 2022 in the field of rules for the use of cash register equipment also affect the issue we are discussing. Thus, a cash register must be installed at the address of its use (Clause 2 of Article 4.2 of the Law of May 22, 2003 N 54-FZ). The tax authority may carry out appropriate checks to determine the compliance of its application. If the inspection reveals violations, inspectors can issue a fine of 5,000 to 10,000 rubles per legal entity, as well as a fine of 1,000 to 1,500 rubles for the head of the company (Part 4 of Article 14.5 of the Code of Administrative Offenses of the Russian Federation). To avoid this, you should re-register the cash register to your real address (more details about this are written in Subparagraph “b”, paragraph 76 of the Regulations, approved by Order of the Ministry of Finance of Russia dated June 29, 2012 N 94n.). However, practice shows that for the first violation a company can avoid punishment by receiving only a warning. In any case, you certainly shouldn’t hope for chance in this matter.

Legal and actual address

02/10/2016 The modern realities of doing business are such that it is still quite common for a legal entity to be registered at one address, but actually located in another district of Moscow. At this actual address, for example, rental space is located - an office and warehouses, and a cash register is used. But there is no registration at the actual location. And we are often asked the same questions:

- What are the risks if an organization does not re-register with the Federal Tax Service at its actual location?

- Is it necessary to register a separate division?

We answer!

As a general rule, the location of a legal entity is determined by the place of its state registration. State registration of a legal entity is carried out at the location of its permanent executive body, and in the absence of a permanent executive body - another body or person having the right to act on behalf of the legal entity without a power of attorney (Clause 2 of Article 54 of the Civil Code of the Russian Federation).

However, organizations are not prohibited from having other addresses, which may relate to its branches (representative offices), separate divisions, retail facilities, etc.

Currently, the Supreme Arbitration Court of the Russian Federation (hereinafter referred to as the Supreme Arbitration Court of the Russian Federation) has formulated its opinion on issues of judicial practice that are related to the reliability of the addresses of legal entities (Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 61 of July 30, 2013 “On some issues in the practice of considering disputes related to authenticity of the address of the legal entity"):

- the organization bears the risk of the consequences of failure to receive legally significant messages received at its address indicated in the Unified State Register of Legal Entities, as well as the risk of the absence of its representative at this address;

- inaccuracy of the address may become a reason for the forced liquidation of the organization in court. The legal entity must first be given the opportunity to provide reliable information about the address.

The Supreme Arbitration Court of the Russian Federation states that the location of a legal entity, reflected in its constituent documents, is determined by indicating the name of the locality (municipal entity). In this regard, changing the information of the Unified State Register of Legal Entities regarding the address of a legal entity within its location specified in the constituent documents does not require amendments to the constituent documents, regardless of whether such an address was previously indicated in them, unless otherwise expressly provided for by the constituent documents documents of a legal entity.

If the Federal Tax Service has repeatedly sent postal correspondence to the company at its legal address, but the letters were returned to the inspectorate with the notes “the addressee has left”, “not listed at the address”, “beyond the storage period”, etc. In such a situation, the tax authorities may consider that the person indicated in the The Unified State Register of Legal Entities address is invalid and this will be reported to the bank in which the company has accounts (paragraph 4 of the letter of the Federal Tax Service of Russia dated June 25, 2014 No. SA-4-14/12088). The danger is that failure to inform the bank about a change of address, in turn, may become grounds for termination of the bank account agreement by a court decision (letter of the Federal Tax Service of Russia dated December 23, 2011 No. AS-4-2/22130).

In addition, when identifying unreliable addresses, the Federal Tax Service of Russia recommends that inspections take the following measures:

- enter information about the unreliability of the address in the Unified State Register of Legal Entities (after updating the software);

- send to the address of the legal entity, its founders, a person who has the right to act on behalf of the legal entity without a power of attorney, a notification about the need to provide within a month from the date of receipt of the notification reliable information about the address of the organization’s location (letter of the Federal Tax Service of Russia dated June 25, 2014 No. SA- 4-14/12088).

Are there any risks for an organization if it does not re-register with the Federal Tax Service at its actual location? Certainly.

What are they? Read further:

1. Fines:

If it is discovered that an organization does not exist at its place of registration, the violator may be brought to administrative liability:

- according to Part 3 of Art. 14.25 of the Code of Administrative Offenses of the Russian Federation, according to which untimely submission of information about a legal entity to the body carrying out state registration of legal entities (its functions are performed by the Federal Tax Service), if such submission is provided for by law, entails a warning or the imposition of an administrative fine on officials in the amount of 5,000 rubles.

- according to Part 4 of Art. 14.25 of the Code of Administrative Offenses of the Russian Federation , failure to provide or provision of false information about a legal entity may result in a fine for officials in the amount of 5,000 to 10,000 rubles.

It should also be noted that founders (participants) can now also be held administratively liable (for violations under Article 14.25 of the Code of Administrative Offenses of the Russian Federation they are held liable as officials). This addition is included in the note to Art. 2.4 Code of Administrative Offenses of the Russian Federation.

Important! According to Art. 4.5 of the Code of Administrative Offenses of the Russian Federation, a resolution in a case of an administrative offense on state registration of legal entities and individual entrepreneurs cannot be made after one year from the date of commission of the administrative offense. But in case of a continuing administrative offense (expressed in long-term continuous failure or improper performance of the duties assigned to the violator by law), the specified period begins to be calculated from the day the administrative offense is discovered.

In addition, carrying out activities in any division territorially isolated from the organization, at the location of which stationary workplaces are equipped, leads to the formation of separate divisions. If the taxpayer does not notify the tax authority about this in writing within one month from the date of their creation, liability may arise:

- according to paragraph 1 of Art. 126 of the Tax Code of the Russian Federation in the form of a fine of 200 rubles. for each document not submitted;

- according to Part 1 of Art. 15.6 of the Code of Administrative Offenses of the Russian Federation for failure to submit on time information necessary for tax control, in the form of a fine for officials in the amount of 300 to 500 rubles.

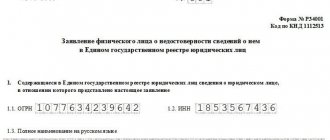

2. Making a record in the Unified State Register of Legal Entities about the unreliability of information

From 01/01/2016, the registration authority can make entries about the unreliability of information about a legal entity independently without statements from the legal entity and the issuance of judicial acts.

A record of unreliability of information about a legal entity may be made in relation to information about a legal entity provided for in subparagraphs “c”, “e” and (or) “l” of paragraph 1 of Article 5 of the Federal Law Federal Law of August 8, 2001 N 129-FZ “On state registration of legal entities and individual entrepreneurs” (that is, in relation to information about the address, location of the legal entity, director and (or) founder (participant) of the legal entity).

3. Liquidation

From 01/01/2016, a legal entity that has decided to change its location, before submitting documents for state registration of the change of location, must ensure that information about the upcoming change of location appears in the Unified State Register of Legal Entities. To do this, within three working days from the date of making the decision to change the location, you should submit a corresponding application to the Federal Tax Service at the current location, attaching to it the decision and documents confirming the existence of the right of use, for example, from a legal entity, in relation to the property located at the address related to the new location. Only 20 days after information appears in the Unified State Register of Legal Entities that a legal entity has made a decision to change its location, it will be possible to submit documents to the tax office to indicate the new location of the organization in the register.

Important! Legal entities are required to report this to the tax office at their location within three working days from the date of changes in the information contained in the Unified State Register of Legal Entities (clause 5 of Article 5 of Law No. 129-FZ). Therefore, it is advisable, at a minimum, to inform the inspectorate in writing about the real address of the company. Moreover, it is logical to take measures to amend the constituent documents.

If there is no response to the notification, then the Federal Tax Service of Russia advises the inspectorates to go to court with a demand to liquidate the “silent man” (clause 5 of the letter of the Federal Tax Service of Russia dated June 25, 2014 No. SA-4-14/12088).

We advise you not to wait for sanctions, but to contact our lawyers in a timely manner!

Contact us in any way

- Call us: +7 (495) 22-888-38

- Back call

- Submit your request

- Quality control

Consequence No. 6 “Fine for conducting illegal commercial activities”

The definition of “illegal commercial activity” includes the activities of a company that is not registered in official sources. In our case, this means a “bifurcated” organization and a separate division. From the point of view of the Federal Tax Service, the head office is located at the legal address of the company, and the OP is located at the actual address. This formulation is inherently incorrect, because, firstly, the Tax Service must first prove the location of the company’s offices at two addresses, and then “raise” the registration documents of the OP, if any exist at all. Apparently the law is read in selfish interests, however, a company can easily avoid this kind of misunderstanding if the Federal Tax Service is aware of its actual address in advance. Otherwise, an unknown address may be an argument in favor of the fact that you have an unregistered separate division for which you need to register with the Federal Tax Service. If you didn’t defend your rights, please pay a fine of 40,000 rubles (Clause 2 of Article 116 of the Tax Code of the Russian Federation).

One of the recommendations that the Federal Tax Service of Russia formulates for tax inspectorates is the initiation of a set of procedures that are aimed at liquidating those firms and companies that are not located where they should be according to the Unified State Register of Legal Entities.

This recommendation was given rise to an interesting situation that has developed in Russia today: the bulk of various organizations are in fact located not at all where, according to their legal addresses, they should be located. Tax authorities are increasingly focusing their attention on identifying such fictitious address data, which has led to calls for the liquidation of organizations and firms of this type.

The information in this article tells what else can become a problem for companies whose official “legal” address entered in the Unified State Register of Legal Entities does not have them in principle, and for whom it makes sense to promptly clarify such data in the current register. When a new organization, company or firm is just being created, in its application for the need for registration and the legally significant documents drawn up, an absolutely mandatory condition is the exact indication of its address location. Moreover, employees of tax organizations must check this data, which is subsequently entered into the Unified State Register of Legal Entities (Clause 3, Article 51 of the Civil Code of the Russian Federation). Revealing as a result of such a check that the address declared by an organization or company is unreliable leads to a natural refusal to register for it (subparagraph “r”, paragraph 1, article 23 of the Federal Law of 08.08.2001 No. 129-FZ). And it should be remembered that such a “targeted” problem can manifest itself not only in newly formed companies, but also in those that are already operating.

The situation of discrepancy between the actual and legal address data of companies and organizations

It is generally accepted that the address data for a company or firm that was registered in the Unified State Register of Legal Entities are the same address data with which you can contact this company or firm without much hassle (subparagraph “c”, paragraph 1, article 5 of the Law No. 129-FZ). It is also significant because correspondence from the tax service must be sent to this address (clause 5 of Article 31 of the Tax Code of the Russian Federation). This means that a different location for such a company leads to a risk for it - the required document may not be received. This point is firmly established in the legislative system: the place where the organization is located and the place where it is registered at the state level must be absolutely identical, as indicated by the information in Article 54 of the Civil Code of the Russian Federation in the second paragraph. But at the same time, the exact definitions of such concepts as legal address or actual address are not exactly disclosed. Typically, the content of these conceptual definitions is perceived as follows: - the legal address data of a company, firm or organization - this is exactly its address, which is recorded in absolutely all its documents from its constituent package, and in addition to this - the Unified State Register of Legal Entities is registered as the place in which this a specific organization, firm or company and takes place in fact. And there must be permanently located either any functioning executive body of this firm or organization, or such persons or bodies that are legally authorized to perform actions on behalf of this particular firm or company; - addresses of a factual nature are those address data at which this very company, firm or organization is directly located. And in practice, it is quite acceptable that it does not coincide with the legal address, but only if the requirements for this legal address are met - for example, it is quite acceptable and rational to store documents important for the organization’s activities using the actual address data, or the governing body of the company can be located at it.

It is useful to remember the fact that any differences in “actual” and “legal” addresses are a source of risk for the activities of any company, and responsibility for them rests only with the company itself. An example is a situation of risk of complete non-reception of absolutely any legally significant documentation sent to the address data recorded in the Unified State Register of Legal Entities - with all the numerous consequences of such non-receipt, or a risk situation associated with the absence of a representative or authorized person at the coordinates of the legal address (clause 3 of Art. 54 Civil Code of the Russian Federation).

Consequences of returning sent correspondence back to tax officials

Let's consider a situation in which employees of the Federal Tax Service repeatedly sent absolutely any significant mail or important correspondence to any legal address data of a company, company or organization. However, the sent parcels were invariably returned, and they were marked with notes stating that such an addressee simply did not exist in this place. The conclusion that the tax officer makes is quite logical - the address indicated by such a company and registered in the Unified State Register of Legal Entities is no longer considered valid. This means that the tax service, based on this conclusion, sends a message to the bank where such a company keeps its accounts (paragraph 4 of the letter of the Federal Tax Service of Russia dated June 25, 2014 No. SA-4-14/12088). And for such a company, a new risk opportunity arises - if you do not inform the bank that the address of the company or organization has changed, then the bank considers this a sufficient reason for the agreement on bank accounts for this company to be terminated through a court decision (letter from the Federal Tax Service of Russia dated December 23. 2011 No. AS-4-2/ [email protected] ).

In addition, the Federal Tax Service of Russia has formulated several recommended measures that inspections can take in such situations of unreliable addresses: - data that the address information is unreliable can be entered into the Unified State Register of Legal Entities, which will become possible after the software is modified accordingly ; - a notification is sent to the legal entity itself, as well as all its founders, all persons who have the right, without any power of attorney, to freely act on behalf of this legal entity. This notification stipulates the need within one month from the moment it was received, provide truly reliable information about the location of the company and its address (letter of the Federal Tax Service of Russia dated June 25, 2014 No. SA-4-14/12088). When a company receives such notices from tax officials, ignoring them is not the most rational choice. If a legal entity has changed any parameters that are registered for it in the Unified State Register of Legal Entities, then its duty is to report such changes to the local tax office, and the period for such notification is three days (clause 5 of Article 5 of Law No. 129-FZ). Therefore, the most minimal reaction would be to inform the local tax office in writing about which address is the real address data of this company. And the logical next step should be to make appropriate amendments and changes to all documents of the constituent package of this company or organization. If any useful reaction is absent at all, then the recommendation of the Federal Tax Service of Russia is simple - going to court with a more than legal demand to eliminate such a “homeless silent person” (clause 5 of the letter of the Federal Tax Service of Russia dated June 25, 2014 No. SA-4-14/12088). And this will fully comply with modern legislation. With a small caveat - it is necessary to recognize the state registration as absolutely invalid, and among the grounds for this are gross and irreparable violations that were committed during its creation.

To put it another way, in order to initiate such liquidation of an organization, the tax authority must provide evidence that during the creation of such an organization information about its address data was provided with absolutely unreliable information, which means that such registration cannot in any way be considered invalid, in full in accordance with sub. 1 clause 3 art. 61 of the Civil Code of the Russian Federation as amended, which came into force on September 1, 2014. But the difficulty of such actions lies in the difficulty of collecting the evidence base, because at the time of registration activities, the address data of this very organization could well correspond to the real ones. However, the introductory recommendations formulated by the Federal Tax Service significantly increase the likelihood of such a scheme of action by the tax authorities.

What conditions determine the possibility of liquidation of a company?

It is rational to file a statement of claim from the tax authorities regarding the need for the legal liquidation of a company only if significant conditions are met, which were clearly and in detail described by the Federal Tax Service in the corresponding Letter No. SA-4-14/12088 dated June 25, 2014. There are only three of these conditions. The first condition: at the legal address registered in the Unified State Register of Legal Entities there are no representatives of the firm, company or organization, all correspondence sent to its address is returned, which means there is no connection with this organization or firm; The second condition: the company was sent an appropriate notice, which clearly articulated the real need to provide reliable information about its legal and actual address data. Such a notification was sent to absolutely the entire composition of the founders of the company or organization, and to the entire composition of persons who have the right, without any power of attorney, to carry out actions on behalf of this legal entity; Third condition: a simple version of the procedure for quickly excluding such a company or company organization from the Unified State Register of Legal Entities based on a decision of any tax authority is not applicable to this particular company. Tax authorities can exclude a company from the Unified State Register of Legal Entities, provided that during twelve months of its existence such a company has not submitted a single report or carried out a single banking transaction and a court decision is not required for this (clause 2 of Article 64.2 of the Civil Code of the Russian Federation).

A few points to note for company owners

In a situation where this particular company is not at all available at the officially registered legal address provided by it, and there is a possibility that this may become known to tax officials, we can recommend focusing on several very useful conclusions from the article for the situation: 1. If, according to the address data registered in the Unified State Register of Legal Entities, both the organization, firm or company itself and any of its representatives are missing, this will not at all be a basis for liquidating such an organization. 2. Such absence of employees or any representatives of an organization, firm or company according to official legal address data is a violation, but from the category of removable ones, as evidenced by the determination of the Supreme Arbitration Court of the Russian Federation dated March 16, 2010 No. VAS-2903/10. 3. Cases in which the provided information about address data is recognized as unreliable are not at all explained precisely and directly by the current legislation of the Russian Federation. The judicial opinion is formulated as follows: if the provision of address data was made without any intention of using it in the future for any types of contacts with this specific legal entity, then such address data will be unreliable (clause 2 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 61 ). 4. Repeated disregard by a firm, company or organization of any requests from tax system employees to provide truly real address data is a reason for a court decision on an absolutely legal liquidation. 5. Among the evidence of the unreliability of the company’s address, defined in the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 61, the judges themselves directly note the use of address data, which records the massive scale of such registrations.

If you need to select or change a legal address, the use of which will allow you to carry out commercial activities without much hassle, then competent lawyers are guaranteed to provide this opportunity.

Consequence No. 7 “Forced liquidation of the company”

We would like to clarify right away that this measure on the part of the Federal Tax Service is not something out of science fiction, but is actually applied in practice. Again, it all comes down to letters. Let's give an example: many letters were sent to the company with a “request” to respond to them, but no feedback was received. The tax service, at its discretion, may file a lawsuit against this legal entity with a demand to liquidate the organization that is “silent.” The most unpleasant thing here is that courts often satisfy such claims, for which we recommend studying the judicial practice of arbitration courts in your region. Before this decision, it should be noted that the Federal Tax Service sends correspondence to addresses known to it, contacting the general director or founders of the LLC with a demand to respond. This example once again emphasizes the need to have contact with inspection authorities.

Consequences for failure by legal entities to provide reliable information about their location.

By virtue of Article 54 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), the location of a legal entity is determined by the place of its state registration on the territory of the Russian Federation by indicating the name of the locality (municipal entity). State registration of a legal entity is carried out at the location of its permanent executive body, and in the absence of a permanent executive body - another body or person authorized to act on behalf of the legal entity by virtue of the law, another legal act or constituent document, unless otherwise provided by law. on state registration of legal entities.

The unified state register of legal entities must indicate the address of the legal entity within the location of the legal entity. Accordingly, the legal address is indicated in the constituent documents of the organization and is its location. The actual address is the address at which the permanent executive body of the legal entity is actually located. The legal and actual addresses of the organization may not coincide.

At the same time, there are cases when legal entities change the address of their actual location in order to evade obligations, for example, to pay wage arrears or other debts, as well as to avoid liability.

In this case, legal entities do not fulfill the obligation provided for by paragraph 5 of Article 5 of the Federal Law of August 8, 2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs” to report within three working days from the date of change in the location of information about this to the registration authority at its location.

Failure of a legal entity to fulfill the obligation to notify the registration authority of a change in location entails administrative liability provided for in paragraph 4 of Article 14.25 of the Code of the Russian Federation on Administrative Offenses (hereinafter referred to as the Code of Administrative Offenses of the Russian Federation) (responsibility for failure to provide or provision of false information about a legal entity to the body implementing state registration of legal entities and individual entrepreneurs, in cases where such submission is provided for by law, in the form of a fine on officials in the amount of five thousand to ten thousand rubles).

It should also be indicated that failure to notify the registration authority of a change in the location of a legal entity may be considered as

grounds for applying to court for liquidation of a legal entity in accordance with Article 61 of the Civil Code of the Russian Federation.

The Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 61 “On some issues in the practice of resolving disputes related to the accuracy of the address of a legal entity” clarified that if there is information that communication with a legal entity at the address reflected in the Unified State Register of Legal Entities is impossible (representatives of the legal entity are not located at the address and correspondence is returned marked “the organization has left”, “beyond the expiration of the storage period”, etc.), the registering authority after sending it to this legal entity (including to the address of its founders (participants) and the person having the right to act on behalf of a legal entity without a power of attorney) notification of the need to provide reliable information about its address to the registration authority and, in the event of failure to provide such information within a reasonable time, may apply to the arbitration court with a demand for the liquidation of this legal entity.

When establishing the fact of the absence of a legal entity at its location, the relevant information is sent by the prosecutor's office to the tax authorities to take measures to bring to administrative responsibility under paragraph 4 of Article 14.25 of the Code of Administrative Offenses of the Russian Federation.