The main industry event of the fall can be considered the adoption of Federal Law No. 325-FZ on September 29, 2019, which introduced large-scale amendments to the Tax Code. One of these amendments, a change in the procedure for offset and return of overpayments, has become the subject of consideration of a current topic. What new the new law has brought to the procedure for offset or refund of taxes, as well as what difficulties an organization may encounter when tax authorities refuse to offset or refund overpaid taxes, is set out in our material. The given examples of judicial practice will help to optimally manage overpayments, taking into account the experience of other taxpayers.

Four innovations in the procedure for offset or refund of overpayments

Article 78 of the Tax Code of the Russian Federation on the offset or return of amounts of overpaid taxes, fees, insurance premiums, penalties, and fines has been amended.

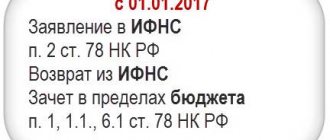

So, from 01.10.2020 the following amendments come into force. The provision that the offset of overpayments is made exclusively against a tax of the same type: federal against the federal, regional against the regional, local against the local, is completely invalidated. This innovation will allow taxpayers to rationally manage their funds.

It turns out that from October 1, 2020, it will be possible to offset, for example, an overpayment of income tax against the arrears of transport tax, despite the fact that the transport tax is regional, and the overpayment arose for federal tax. That is, it will be possible to offset overpayments of taxes of any type. It can also be offset against penalties and fines related to any type of tax.

Another positive innovation is the amendment that allows offset or refund of overpayments by any tax authority, and not just at the taxpayer’s place of registration (subclause “b”, paragraph 22, article 1 of the law). This innovation will simplify the offset procedure, however, the application for offset and return will have to be submitted, as before, to the inspectorate at the place of registration, clause 22 of Art. 1 law).

The listed positive innovations entailed stricter requirements for tax refunds. It will be possible if there is no arrears of any tax and corresponding penalties and fines. Today, it is sufficient that there is no arrears for a tax of the same type (subclause “e”, paragraph 22, article 1 of the law). Thus, with the adoption of the amendment, it will become even more difficult to return overpayments from the budget.

In addition, as of October 29, 2019, a new provision came into effect regarding the deadline for making a decision on offset or refund of overpayments during a desk audit. This period will depend on:

- from the completion date of the inspection;

- from the entry into force of the decision on it.

This period will be counted:

- after 10 days have passed from the day following the day the inspection was completed, or the day on which it should have ended;

- from the day following the day of entry into force of the decision on the inspection that revealed violations (subparagraphs “and” paragraph 22 of Article 1 of the law).

Federal Law of September 29, 2019 No. 325-FZ “On amendments to parts one and two of the Tax Code of the Russian Federation” Subparagraphs “a”, “b”, “g”, “e”, “i”, paragraph 22, art. 1

What appeared in the new version of Art. 78 of the Tax Code of the Russian Federation with comments?

The latest innovations that have changed Art.

78 of the Tax Code of the Russian Federation are associated with the inclusion, starting in 2022, of a new chapter in the text of the code, which describes the rules for working with insurance premiums, which were previously subject to the Law “On Insurance Premiums...” dated July 24, 2009 No. 212-FZ. Inclusion in the Tax Code of the Russian Federation equated insurance premiums to tax payments and forced them to comply with all other requirements of the code. In this regard, additions were made to the general provisions of the Tax Code of the Russian Federation, reflected in Part 1, indicating that their application is mandatory in relation to insurance premiums. Art. was no exception. 78 of the Tax Code of the Russian Federation, in which not only there were indications that it is applicable to insurance premiums, but also new provisions appeared related to the rules for the return of precisely such payments as insurance premiums:

- overpayment of contributions intended for a specific fund is counted against payments to the same fund or returned to the payer (clause 1.1);

- overpayments on payments to the OPS may not be returned if the Pension Fund reports that it is reflected in the reporting and posted to individual personal accounts (clause 6.1).

Additionally, the article includes provisions that:

- amounts paid when repaying debts on payments resulting from evasion of their payment are not considered an overpayment (clause 13.1);

- the rules established by the article are also applicable to interest accrued in favor of the budget when recognizing the amount of VAT that was unlawfully reimbursed in a declarative manner based on the results of a desk audit (clause 14);

- the rules established by the article are also applicable when returning VAT to foreign legal entities (clause 16).

In 2022, only some points of this article have been updated:

- Clause 8.1 has been added, according to which the offset periods begin to be calculated after 10 days after the end of the desk audit, and if a violation is detected, the terms are calculated from the day following the date of entry into force of the decision.

- Added a link to international acts in paragraph 7.

In October 2022, the 2nd paragraph of paragraph 1, which stated that the tax can only be offset against the payment of another tax at the corresponding budget level, became invalid. That is, now the overpayment can be offset against the payment of taxes at any budget level.

In addition, in order to return the overpayment, you cannot have arrears on any taxes (penalties, fines). Read more about the October innovations here.

Find out how recent judicial practice is developing on the application of Art. 78 of the Tax Code of the Russian Federation, available from the analytical selection from ConsultantPlus. If you don't have access to the system, get a free trial online.

Overpayment: how to return or offset

For both offset and refund of tax, you must contact the Federal Tax Service with an application.

If the reason for the overpayment was an error in the declaration, then you must first submit an updated declaration with the corrected error. Only after this can you apply for a refund or offset of the overpayment. There is a general deadline for submitting applications. It is three years from the date of payment or overpayment of tax. If we are talking about the return of an overpayment due to the excess of advance payments to the amount of tax for the year, three years are counted from the date of filing the annual declaration - clause 7 of Art. 78 Tax Code of the Russian Federation.

The deadline for making a decision on both a refund and a tax offset is 10 working days from the date of receipt of the application or the end of the desk audit of the updated declaration - clause 8 of Art. 78 Tax Code of the Russian Federation. If the inspection offers to undergo a reconciliation of calculations, then from the date of signing the reconciliation act. The Federal Tax Service must notify the Inspectorate of the Federal Tax Service about the decision made on a refund or offset within five days - clause 9 of Art. 78 Tax Code of the Russian Federation.

The refund period for the overpayment is one month from the date of receipt of the application, even if the calculations are reconciled. If the overpayment is revealed according to the updated declarations - a month after the end of the “camera chamber” - clause 6 of Art. 78 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated February 21, 2017 No. 03-04-05/9949.

Violation of the deadline for returning the overpayment threatens the Federal Tax Service with payment of interest - clause 10 of Art.

78 Tax Code of the Russian Federation. As for untimely offsets, no interest is charged on the offset amount. The only thing that remains is to appeal the inaction of the inspectorate. If the inspectorate refuses to refund the overcharged tax, it will inform about its decision, indicating the reason for the refusal.

A refusal to return or offset can be appealed first to a higher tax authority, and then in court (Article 137, paragraphs 1, 2 of Article 138 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated December 21, 2017 No. GD-3-8 / [email protected ] ). The period for appeal is one year from the moment the taxpayer learned or should have learned about the violation of his rights.

The deadline for filing a claim in court for the refund of excessively collected tax is three years from the day the taxpayer learned or should have learned of a violation of his right to a refund or offset (clause 1 of Article 196, clause 1 of Article 200 of the Civil Code of the Russian Federation). Such a day could be, for example, the date when the inspection announced the decision to refuse a return (Resolution of the AS of the North-Western District dated July 27, 2017 No. F07-6490/2017).

In court, it is necessary to prove that the three-year period has not yet expired, and also that the organization actually has amounts of excessively collected taxes. Otherwise, the return will be refused.

How is the application deadline determined?

The deadline for filing an application, in accordance with clause 7 of Art. 78 of the Tax Code of the Russian Federation , is equal to 3 years from the date of payment of the corresponding amount. However, for some cases this approach is not applicable. For example, when:

- The tax is paid in advance payments, and its total amount for the tax period is determined only according to the declaration data, the period must be counted from the date of submission of the declaration for the tax (non-reporting) period (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 28, 2011 No. 17750/10, information of the Federal Tax Service of Russia dated 09/07/2015).

- The overpayment was the result of transferring tax amounts using several payment documents. In this case, the period can be determined in two ways: for each payment separately (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 29, 2004 No. 2046/04, FAS Moscow District dated November 1, 2008 No. KA-A40/10257-08) or by the date of the last payment ( Resolution of the Federal Antimonopoly Service of the Volga District dated October 6, 2009 No. A55-16617/2008).

- For the amount claimed for reimbursement, the application for which was not submitted by the taxpayer before the Federal Tax Service Inspectorate’s decision to return the money (clause 14 of Article 78 and clause 11.1 of Article 176 of the Tax Code of the Russian Federation), the period is counted from the date of the Federal Tax Service Inspectorate’s decision.

For information on filling out an application for a VAT refund, read the material “How to draw up an application for a VAT refund (sample, form)” .

Personal income tax can be offset against future payments, but only for other types of taxes

The Ministry of Finance spoke about the possibility of offsetting the erroneously transferred amount using personal income tax details to pay off the debt under the simplified tax system.

The Department, referring to Art. 78 of the Tax Code of the Russian Federation, confirmed that such an offset is possible, but for taxes of the corresponding type, that is, federal taxes. In this case – against the simplified tax system.

Letter of the Ministry of Finance of the Russian Federation dated August 28, 2019 No. 03-02-07/1/66024

Editor's note:

Thus, the amount of overpayment for personal income tax can be offset against the payment of other federal taxes. This includes VAT and income tax. The same conclusion follows from the letter of the Federal Tax Service of the Russian Federation dated 02/06/2017 No. GD-4-8 / [email protected] , which states that the offset of personal income tax is feasible:

- to pay off debt - for taxes of the corresponding type (federal);

- against future payments - for other taxes.

Summary: returning or crediting personal income tax is difficult, but possible. First you need to determine how the overpayment arose; further actions will depend on this. If it was formed due to an overpayment, for example, as a result of an error in a payment slip, you can either return it from the budget or offset it against arrears or future payments for other federal taxes. To do this, you must submit an application for return or offset to the inspectorate. Refunds are made in the following cases:

- if the tax is withheld, transferred and the company’s own funds are not enough to return it.

- The tax was withheld correctly, but transferred to the budget in a larger amount.

Credit can be made to:

- shortfalls or future payments of other federal taxes;

- arrears of interest on federal taxes, as well as tax penalties.

The impossibility of offsetting overpaid personal income tax against future payments is explained by the fact that payment of this tax must occur exclusively at the expense of individuals, and not the company as a tax agent (clauses 1, 14, article 78, clause 9, article 226 of the Tax Code of the Russian Federation) .

From 01/01/2020, an exception to this rule applies in a situation where tax is additionally assessed (collected) based on the results of a tax audit, if personal income tax is not withheld unlawfully (not fully withheld) (clause “c” of paragraph 16 of Article 2 of the Federal Law of September 29. 2019 No. 325-FZ). So, starting next year, additional personal income tax can be paid using your own funds. This will make it possible to reduce the size of penalties. If the overpayment was due to the withholding of tax from an individual in a larger amount than necessary, it can only be returned in a special manner.

In addition, you need to remember that it is possible to return or offset the overpayment of personal income tax within three years after it was transferred to the budget.

The reconciliation report does not oblige the tax authority to return the overpayment

On March 15, 2018, an individual entrepreneur applied to the Federal Tax Service with an application for a refund of overpaid tax for 2013.

The overpayment was discovered based on the results of submitting an updated declaration on August 14, 2017 and subsequent reconciliation of settlements with the tax authority. Referring to the missed three-year deadline for filing an application from the date of payment of the tax, the Federal Tax Service refused to refund. The court recognized this decision as lawful. The fact is that nothing prevented the taxpayer from assessing his tax obligations in a timely manner. The disputed amount of overpaid tax was paid by the entrepreneur in 2014, that is, four years passed from the moment of payment to the filing of the application for a refund.

The court rejected the applicant's reference to the reconciliation report as the moment from which he learned about the fact of the overpayment. Signing a reconciliation report is not an act of acknowledging a debt to the taxpayer, since the taxpayer can apply for a reconciliation report after any period of time, and the tax authority will be required to draw up and sign the corresponding act. The reconciliation act does not indicate the unconditional obligation of the tax authority to return the overpayment, and the date of its preparation is not the moment when the statute of limitations for going to court begins to count.

Resolution of the Arbitration Court of the Volga District dated April 12, 2019 No. F06-45362/2019

Is the 3-year period interrupted by a reconciliation report with the Federal Tax Service?

Art. 203 of the Civil Code of the Russian Federation contains a rule on the termination of the limitation period in the event of actions that are assessed as recognition of a debt. One of these actions is the signing of a reconciliation report.

There are no official explanations from the Ministry of Finance or the Federal Tax Service regarding the reconciliation report with the Federal Tax Service. And the courts have 2 points of view:

- signing a reconciliation report with the Federal Tax Service does not affect the statute of limitations (resolutions of the Federal Antimonopoly Service of the Moscow District dated December 30, 2013 No. F05-16324/2013, the Central District dated December 19, 2013 No. A23-1227/2013, the Ural District dated August 16, 2013 No. F09-8107 /13, Volga District dated 08/07/2013 No. A55-30105/2012);

- the date of signing the reconciliation report with the Federal Tax Service is recognized as the day when it became known about the presence of an overpayment (resolution of the Federal Antimonopoly Service of the Moscow District dated December 25, 2013 No. F05-16362/2012, West Siberian District dated October 30, 2013 No. A75-10138/2012, Central District dated July 11 .2013 No. A48-1772/2012, North-Western District dated 05/13/2013 No. A56-33073/20).

What happens to the unrefunded overpayment after the 3-year period? The answer to this question is in ConsultantPlus: Such an overpayment can only be returned (offset) through the court. The inspectorate will refuse you. You can go to court if three years have not yet elapsed from the moment you learned or should have known about the overpayment. In court, you need to prove that you learned (should have known) about the overpayment less than three years ago. Before going to court, you must first submit an application for a refund (offset) to the inspectorate and appeal the refusal or inaction of the tax authorities in court. Read more about overpayment of taxes older than 3 years in K+. Trial access to the system is free.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

A certificate of the status of settlements with the budget is insufficient evidence of overpayment

The Federal Tax Service refused to refund the company's overpayment of taxes. The courts supported this position for the following reasons:

- the applicant did not provide documents confirming the existence of an overpayment;

- The tax periods for which the disputed overpayment of taxes arose have not been identified.

The court indicated that the right to a refund is directly related to the presence of overpayment of tax amounts to this budget and the absence of debt on taxes credited to the same budget, which is confirmed by certain evidence:

- payment orders of the taxpayer;

- collection orders (instructions) of the Federal Tax Service;

- information on the taxpayer’s fulfillment of the obligation to pay taxes contained in the tax authority’s database.

The presence of an overpayment is revealed by comparing the tax amounts payable for a certain tax period with payment documents relating to the same period, taking into account information about the taxpayer’s settlements with budgets.

Submission of a certificate on the status of settlements with the budget cannot be considered as sufficient evidence that the taxpayer has overpaid taxes.

Ruling of the Supreme Court of the Russian Federation dated February 11, 2019 No. 309-KG18-25158

Reorganization does not increase the period for returning overpayments

Chemical Engineering Plant LLC applied to the arbitration court to declare illegal the decision of the Federal Tax Service on the refusal to offset the overpayment of corporate income tax in the amount of 3.6 million and the obligation to offset the specified overpayment of income tax against the payment of current payments.

The taxpayer was supported by the first instance. The appeal and the district court overturned the decision. The Supreme Court found no grounds for reviewing the verdict of its colleagues. The fact is that the overpayment went to the plant from another organization as a result of succession as a result of reorganization. The reason for the refusal was the missed three-year deadline for filing an application for a credit (refund) of the amount of overpaid tax.

The specified period is calculated from the day the legal predecessor of the company filed the income tax return for 2013. At the same time, the subsequent transfer to the company as a legal successor of the right to offset (refund) the overpaid tax did not affect the procedure for calculating the period.

The court rejected the plant’s arguments that before the reorganization it did not know about the existence of an overpayment and could not declare a refund until the completion of the merger process, indicating that the period should be calculated from the day when the legal predecessor filed the declaration. The transfer of the right to offset or refund during reorganization does not affect the Determination of the term.

Ruling of the Supreme Court of the Russian Federation dated August 5, 2019 No. 309-ES19-11479

Is it possible to return an overpayment that is more than 3 years old?

Article 78 of the Tax Code of the Russian Federation is devoted to the procedure for out-of-court settlement of issues of overpayment to the budget, when the fact of its existence is established quite easily and corresponds to the limitation period calculated from the date officially recognized by the Federal Tax Service as the day from which such a calculation is possible.

However, quite often situations arise when the taxpayer learns about the existence of an overpayment late. In this case, he can take advantage of the opportunity to calculate the statute of limitations from the day when he became aware of the violation of his rights (Clause 1 of Article 200 of the Civil Code of the Russian Federation) and file a claim in court (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 25, 2009 No. 12882/ 08, letter of the Ministry of Finance of Russia dated March 17, 2011 No. 03-02-08/27).

The collection of all evidence confirming the reality of the late receipt of information about the presence of an overpayment will fall on the taxpayer.

Overpayment does not occur if it is paid through a problematic bank

The Supreme Court of the Russian Federation refused to reconsider the dispute in which the company demanded the return of an overpayment of personal income tax.

The organization had to pay the tax twice because the first payment did not go through due to a lack of funds in the bank's correspondent account. The second payment was successfully credited to the budget.

The lower courts agreed with the inspectorate that there was no reason to return the funds, because the money did not actually go to the budget the first time. And if so, then there is no overpayment.

The courts indicated that the organization should have known about the bank’s problems.

Moreover, even in situations where the courts recognize the obligation to pay as fulfilled, it is very difficult to return the overpayment.

Ruling of the Supreme Court of the Russian Federation dated February 12, 2019 No. 305-KG18-24960

Editor's note:

Since in such a situation it will not be possible to return or offset the overpayment, the only way to get the money back is to contact the problematic bank with an application for the return of the missing amounts and, in case of refusal, to file a lawsuit.

The moment of reporting is not the starting point for counting the tax refund period

The Federal Tax Service did not return the excessively transferred personal income tax to the LLC due to the expiration of the deadline for filing an application for a tax refund.

In the opinion of the company, the tax authority refused unlawfully, since the final tax base is formed precisely at the moment of filling out forms 2-NDFL and therefore the deadline should be counted from there, and not from the moment of transfer of funds.

The court stated that the transfer to the budget of an amount that actually exceeds the amount of personal income tax withheld is not a payment of personal income tax at all, but is considered as an erroneously transferred amount. This circumstance is confirmed by the calculation of the amount of withheld and transferred tax presented by the tax agent. Therefore, in this case, the return of the erroneously transferred amount is carried out according to the general rules of Art. 78 Tax Code of the Russian Federation.

Since the deadline for filing an application for the return of the disputed amount by the company was missed, the court recognized the tax authority’s refusal to return part of the amount as lawful.

Resolution of the Arbitration Court of the North-Western District dated January 28, 2019 No. F07-17595/2018

Late return

Another very important element that you should know is described in paragraph 10 of Art. 78 Tax Code of the Russian Federation. This is a clause that clarifies the information given in clause number six of the same article of the law. As far as you remember, the sixth point talks about exactly when the returned funds are credited. However, there are cases when this does not happen, that is, there is a delay in payment. What does the legislation say about this? This paragraph of this article of the Tax Code states that such a situation is possible, and if it does happen, then for each day of delay (that is, after the expiration of the month indicated in the sixth paragraph), the taxpayer is charged interest. The interest rate on this payment is equal to the refinancing rate current at the time of the late payment.

The results of checking the countdown of the three-year period for the return of overpayments do not change

An on-site tax audit of JSC Khlebozavod in August 2014 revealed an overpayment of personal income tax in the amount of 2 million rubles.

Reflecting this fact in the act, the inspectors pointed to specific payment orders for January 2012. In addition, the company was asked to apply for a refund. Moreover, the wording of the refund was qualified not as a tax, but as an amount that was not personal income tax and was mistakenly transferred to the budget. The organization challenged the decision on the audit, made on September 30, 2014, on a matter unrelated to the tax refund, in court (03/23/2016), but lost. And only after this, already on April 1, 2016, the company applied to the Federal Tax Service with an application for the return of 2 million rubles of overpayment for personal income tax. The inspectorate refunded part of the tax and credited part; the return of the balance in the amount of 1.6 million rubles was denied to the company on April 13, 2016 due to the expiration of the 3-year period from the date of transfer of the tax.

The society failed to challenge the refusal. The fact is that the deadline for going to court has expired. The payments were made in January 2012, the application was submitted to the court on March 23, 2017, that is, five years later.

The company’s arguments that it knew reliably about the amount of the overpayment from the on-site tax audit report (in September 2014) and from the court decision (03/23/2016), the court rejected - three years must be counted from the date of payment orders.

Resolution of the Arbitration Court of the Central District dated June 27, 2019 No. F10-2476/2019

The inspector’s silence about the overpayment does not affect the three-year period for its return

According to the certificate on the status of settlements with the budget dated December 6, 2017, the entrepreneur had an overpayment of taxes in the amount of 434 thousand rubles.

By decisions of the tax authority dated December 15, 2017, the individual entrepreneur was denied a tax refund due to the expiration of the three-year period from the date of payment, provided for in clause 7 of Art. 78 Tax Code of the Russian Federation. The overpayment arose in connection with the submission by the entrepreneur of an updated VAT return for the second quarter of 2011, according to which the taxpayer adjusted the previously accrued tax amounts in the amount of 434 thousand rubles.

The court came to the conclusion that the applicant missed the three-year deadline for applying for a refund of the overpaid tax, since the applicant learned (should have known) about the excessive payment of tax in 2011, at the time of its transfer to the budget.

The norm of paragraph 3 of Art. 78 of the Tax Code of the Russian Federation on the obligation of the inspectorate to report each fact of excessive tax payment within 10 days from the date of its discovery does not apply in this case. The fact is that the taxpayer knew about the overpayment. This confirms the fact that he submitted an initial and updated declaration and voluntarily paid the tax.

Thus, failure to inform the taxpayer by the tax authorities during the three-year period for the return of the overpayment does not affect.

Ruling of the Supreme Court of the Russian Federation dated March 19, 2019 No. 304-ES19-1659

How does an overpayment occur?

There are many ways in which a real overpayment can occur. It can be:

- the excess of the total amount of tax paid in advance payments over its amount reflected in the declaration for the tax period (profit, property, transport, land, excise taxes, simplified tax system);

- filing a return for reimbursement (VAT);

- submission of an updated declaration (calculation) with a decrease in the total amount after paying the tax according to the previous reporting option;

- recalculation towards a decrease in personal income tax withheld from an individual;

- erroneous payment of a larger amount of tax or contribution;

- recalculation to reduce the amount of paid penalties after submitting two clarifications, the first of which increases, and the second reduces the amount of the accrued payment;

- a court decision, the conclusion of which is a statement of the fact of excessive payment of tax payments;

- changes in legislation, as a result of which the tax (contribution) begins to be considered overpaid.

Overpayment of insurance premiums to the Pension Fund can be returned if the individual entrepreneur paid them for himself

An individual entrepreneur managed to challenge the pension fund’s refusal to return the overpayment of insurance contributions to the Pension Fund for 2014 and 2015 in the amount of 59 thousand rubles.

The court rejected the fund's argument that a refund of overpaid insurance premiums is not made if information about the contributions is already reflected in the accounting data and posted to the individual personal account of the insured person. The reason is that, based on the provisions of clause 6.1 of Art. 78 of the Tax Code of the Russian Federation, as well as the provisions of the Law of April 1, 1996 No. 27-FZ “On Persuchet”, restrictions on the return of overpayments of insurance premiums are established in relation to insurance premiums recorded in relation to individuals who are employees of the entrepreneur. In the situation under consideration, we were talking about contributions paid by the entrepreneur for himself personally. Therefore, the restriction does not apply in this case.

Resolution of the Arbitration Court of the Ural District dated March 26, 2019 No. F09-9193/18

The three-year period is not missed if the reason for the delay is the settlement of disagreements with counterparties

The company managed to challenge the Federal Tax Service's refusal to offset (refund) the tax amount and oblige the overpayment of income tax for 2013 to be returned.

In December 2016 and March 2022, the company submitted an updated income tax return for 2013, in which the amount of tax payable was reduced. In December 2022, the company applied for a refund of the resulting overpayment of taxes for 2013. The inspectorate, citing the company's omission of the three-year deadline for tax refund established by clause 7 of Art. 78 of the Tax Code of the Russian Federation, refused to return the overpayment. In connection with this, the organization went to court.

The society supported all three authorities. The fact is that the question of the procedure for calculating the deadline for filing an application for the return of the overpayment to the court must be resolved in accordance with paragraph 2 of Art. 79 Tax Code of the Russian Federation. That is, taking into account that such an application must be filed within three years from the day the person learned or should have learned about the fact of overpaid tax.

The company overpaid income tax due to a decrease in the previously declared amount of income for the following reasons:

- settlement of disagreements with counterparties in court and pre-trial procedures;

- obtaining compensation for losses;

- refund of state duty;

- increase in previously stated costs for services of third parties.

These circumstances became known to the public after the initial declaration was submitted and taxes were paid, and the validity of the application to reduce the amount of tax payable was confirmed by the Federal Tax Service upon completion of a desk audit of the last updated tax return.

Therefore, the company actually learned about the overpayment only in December 2016 and March 2022, therefore, the company did not miss the three-year deadline for filing a claim for the return of the overpayment in court. Resolution of the Arbitration Court of the Central District dated February 12, 2019 No. F10-6024/2018

Making a return decision

If you have decided that you want to return those funds that turned out to be unnecessary when paying a particular tax, then you, as you already understand, need to write a corresponding application and send it to the desired tax authority. However, it was not stated above how long you need to wait for a verdict on your application. It turns out that there are no deviations from the standard. A decision on your application for the return of these funds will be made within ten days from the date of receipt of this application. So, if you want to return the money that turned out to be excessive when paying taxes, then you will have to wait up to ten days until you are notified of the availability of such an amount, and you will also need to wait up to ten days after sending the application, and if your requirements are satisfied , then the wait for the refund of the amount will be added up to thirty days. In total, the entire operation takes no more than two months. You should also pay attention to the fact that Art. 78 and 79 of the Tax Code of the Russian Federation are closely related to each other, so if you do not find answers to the questions you are interested in in this article, then you should take a look at the next article in order.

From what point does interest accrue for late repayment of overpayments?

In April 2022, the company applied to the Pension Fund for a refund of the overpayment of contributions, but did not receive a response to its application.

The court ordered officials to return the money to the company, which they did in January 2022.

The company demanded to collect interest from the offenders for the time that passed from the month following the application to the fund until the transfer was made. Officials countered that since there was no decision to refuse the return, interest should be accrued from the entry into force of the court verdict.

Three authorities, including the district cassation, recognized the company’s calculation as justified. Themis indicated that relations with insurance premiums for periods before 01/01/2017 are regulated by Federal Law No. 212-FZ dated 07/24/2009. According to its provisions, the overpayment is refunded within one month from the date of receipt of the policyholder’s application, and if this period is violated, interest is charged. Therefore, the date of the judgment in this matter is not relevant.

Resolution of the Arbitration Court of the Volga District dated August 28, 2019 No. F06-51354/2019

Editor's note:

From 01/01/2017, the administration of insurance premiums is carried out in accordance with the norms of the Tax Code of the Russian Federation.

Article 78 of the code contains provisions similar to those applied by the judges in the decision under review. According to paragraph 1.1 of this article, they also apply to the return of overpayments on insurance premiums. Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up