Tax burden calculation

To calculate NV you need to perform the following steps:

- Determine the total amount of taxes and fees accrued for the calendar year according to declarations submitted to the Federal Tax Service.

- Take the revenue indicator from the Profit and Loss Statement for the same period.

- Divide item 1 by item 2, multiply the resulting quotient by 100%.

The obtained value must be compared with the industry indicator of taxable income, published annually by the Federal Tax Service. If the organization’s workload turns out to be lower than according to the Federal Tax Service, this may be a reason for inspection.

How is the tax burden calculated?

The tax burden is the ratio of the amount of taxes paid by the company to the revenue according to the financial statements, multiplied by 100%.

Any company can calculate its tax burden on the Federal Tax Service website using the Tax Calculator.

Formula for calculating the tax burden

The tax burden coefficient is calculated using the formula: Tax burden = Amount of taxes paid / Income × 100.

Worth reading:

Accounting for income and expenses: annual report 2021

Primary expenditure for 2022: what's new

Low tax burden

Let's consider an explanation (example), taking as a basis an educational organization that provides additional education services (OKVED 85.11).

The amount of accrued taxes for 2022 is 2,169,066 rubles.

Revenue for 2022 according to the income statement is 20,557,770 rubles.

NI will be 10.6% (2,169,066 / 20,557,770 × 100%).

We compare the resulting tax value with the corresponding indicator in the Federal Tax Service document “Tax burden by type of economic activity in percent” for 2022. In the Federal Tax Service document, the indicators are presented in aggregate; you need to find your section according to the OKVED classifier, and if it is not there, then use the NN value in the “Total” line.

The Federal Tax Service did not highlight the “Education” section; we compare the organization’s tax return with the general indicator in the “Total” line, which for 2022 is 10.8%.

The organization’s NI is 0.2% below the average (10.8–10.6%). If there are higher deviations of the organization's tax base from the industry average, the Federal Tax Service usually sends a letter with a recommendation to revise the tax base and pay additional taxes.

In this case, you will have to prepare an updated declaration explaining how the low tax burden arose; an explanation (see sample below) is attached to the updated declaration. The form of the explanatory note is given in Appendix No. 5 to the Order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06 / [email protected]

Indicators for assessing the tax burden

The company's tax burden should not be less than a certain percentage. The exact indicator depends on the specific type of activity.

and 2022

Tax authorities use a traffic light system to assess risk levels. Green level – no risks. The other two colors - yellow and red - are medium and high risk levels, respectively.

| Index | Tolerance (yellow level) | Dangerous deviation (red level) |

| Total tax burden, including insurance premiums administered by the tax authorities | 5-7% | 10% |

| Profitability of goods, products, works, services sold and return on assets of organizations | 5-7% | 10% |

Reasons for low tax burden: explanation

In some cases, situations are possible when an organization objectively bears tax burden below the industry average and does not have the opportunity to recalculate taxes upward.

The reasons for a decrease in the tax base may be an increase in expenses, a decrease in revenue, writing off large amounts of doubtful debts, production downtime or force majeure.

In this case, the Federal Tax Service should provide explanations as to why the amount of deductions is lower than the calculated value.

The document is drawn up in free form and can be titled as Statement, Information, Message or Explanatory Note.

Explanations to the tax office about the low tax burden can be formulated in this way.

How to explain the low tax burden

The low tax burden is easy to explain to a new company. If a company has just started operating, its tax burden will naturally be lower than the industry average.

It is much more difficult to explain a low tax burden to companies with a history. Although, in the explanations for 2022, one can refer to “Covid” restrictions on doing business.

The reasons for a decrease in the amount of taxes paid may be an increase in expenses, a drop in revenue, writing off doubtful debts, downtime or force majeure.

Explanations are drawn up in free form.

Interesting:

For whom taxes may rise by 60%

The high share of VAT deductions for trade enterprises can be justified by an increase in inventories and a drop in demand for products. Manufacturing companies may refer to increased purchase prices for raw materials, fuels and lubricants, etc. Service companies face increased administrative costs.

Bank checks

Banks monitor the minimum tax indicator, the value of which is set at 0.5% of receipts to the current account by the Methodological Recommendations, approved. Bank of Russia 04/13/2016 No. 10-MR.

If the total amount of payments for taxes, fees and charges is less, the bank may request explanations, declarations, financial statements, contracts and other documents.

It is also recommended to accompany the submission of documents to the bank with an explanatory note explaining the situation.

This is what an explanation about a low tax burden might look like: a sample for a bank.

Low tax burden on profits

Before submitting a tax return, each organization should compare the level of calculated tax with the average burden for the region and industry. An unreasonably low indicator may become one of the decisive criteria for ordering an on-site tax audit.

The level of tax burden for income tax is determined as a percentage as the ratio of the amount of tax to the amount of income (from sales and non-sales) for the corresponding period, multiplied by 100.

If the tax payable is greatly underestimated relative to the revenue received, its value should be adjusted upward. However, what should you do if the declaration has already been submitted and the tax inspector asks for clarification?

Formula for calculating the tax burden for income tax

In order to know how to give explanations to the declaration, you need to understand what the tax burden is. This is the ratio of the amount of taxes that an organization pays to the profit that is indicated in the documents, expressed as a percentage:

Low is the load that is below the industry average.

There is a second version of the load calculation formula:

In this case, it is considered low at the following values: 1% for trade organizations, 3% for all others.

It is important to understand that a low load cannot be considered complete evidence of hiding taxes from the state. Therefore, until a full investigation and evidence base is presented, the tax office does not have the right to fine the company.

Tax burden coefficient

What is the tax burden, how to calculate it and what is its role in business? We'll tell you in the article.

Tax burden coefficient: what is it and how is it calculated

The tax burden is one of the indicators of a company's financial stability. The tax burden can be an absolute value - this is an exact figure, the burden of paying taxes. It can also be relative - this is the percentage of funds that the company allocates from its revenue to pay taxes. To calculate the relative burden, you need to divide the amount of company taxes for the year by the amount of revenue for the year. It is the relative indicator that the Federal Tax Service uses when drawing up a plan for on-site inspections. Companies whose tax burden is lower than the industry average risk ending up on the “suspect list.” First of all, such taxpayers are asked for clarification, and if they do not clarify the situation, an on-site inspection is arranged.

Banks use tax burden indicators when analyzing risks. Of course, the tax burden is not the only criterion when checking solvency (there are about 80 other indicators), but it is an important one. The Central Bank has established that the safe minimum tax burden is 0.9% of the debit turnover on the account. A large tax burden usually means that a company may have low profitability. To calculate this ratio, revenue data must be taken from the financial statements (line 2110), taxes for the year - from tax reporting.

Tax burden level = the amount of your taxes for the year / revenue for the year × 100%

It is useful to calculate the tax burden at different levels of the economy:

- for the state or regions;

- by type of industry;

- by groups of enterprises that have a similar type of activity to you;

- for specific economic entities;

- for one person.

Depending on the level, the calculation base may change: it can be revenue with or without VAT, enterprise income, costs or profit, planned income/profit.

Tax burden coefficient and industry average

The tax burden coefficient depends on the type of economic activity of the company: for each type, a specific average value is determined individually at the legal level. It may happen that your company's ERR is lower than the industry average. This is not always good: the tax authorities may come to you. “Below average” means that there is a very real possibility that you pay less in taxes than other players in the industry. Or you have errors in your calculations.

To find out the industry average, you don’t need to go or call the tax office - all the information is posted on the Federal Tax Service website, and tax officials post it annually until May 5 of the following year.

Tax burden for income tax and VAT

The income tax burden can be determined based on the tax return data.

Income tax burden = (all calculated tax / (revenue + income from non-operating activities)) × 100%

A figure of less than 2-3% means your tax burden is low.

VAT burden = (VAT deductions / VAT accrued) × 100%

The values for deductions and accrued VAT must be taken for the previous four quarters. The amount of deductions that does not exceed 89% is considered normal. Another method that the tax office uses is to calculate the safe share of deductions based on the declaration data for the quarter and compare it with the average share of deductions in the region.

VAT burden = VAT / Tax base for the domestic market × 100%

The tax base for the domestic market can be obtained from the sum of lines 010, 020, 030, 040, 050, 060, 070, column 3 of section 3 of the VAT return. For trading companies, the ratio of the VAT amount to the tax base should be more than 1%, for others - from 3%.

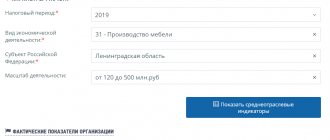

The Federal Tax Service website has a tax calculator for calculating the tax burden. Organizations on OSNO can use it. Now, with its help, it is easy to calculate your tax burden for the period 2016–2019 and compare it with the industry average. In case of discrepancies, it is worth preparing explanations in advance to provide them to the tax authorities upon request.

What's changed in 2022

The tax burden indicators for 2022, which will be relevant for scheduling audits in 2022, are established in Appendix No. 3 to the order of the Federal Tax Service of Russia dated May 30, 2007 No. MM-3-06 / [email protected] A different load indicator is established for each type of activity according to OKVED2 . But it happens that a company cannot find its type of activity in the list. For such a situation, the Federal Tax Service has provided a special procedure for action, described in letter dated August 22, 2018 No. GD-3-1 / [email protected] - for comparison, you should take the level of the tax burden in the Russian Federation, and not in the industry.

This year, the tax office has the right to check your data for the previous three years, so you need to carefully compare the current load indicators with previous years. If there is a strong deviation, you will probably be asked to explain the reason or ordered to check.

Do you want to quickly calculate and pay taxes?

The cloud web service Kontur.Accounting allows you to conduct all necessary operations via the Internet. Get acquainted with the capabilities of the service for free for 14 days, keep records, calculate salaries, report online and work in the service together with colleagues. Try for free

What is meant by the tax burden on an enterprise?

Various taxes have their own objects of taxation. For example, VAT is levied on added value, profit tax on the difference between revenue excluding VAT and economically justified expenses, and property tax on the value of taxable property.

Accordingly, each enterprise has its own objects of taxation and its own amounts of charges for each tax.

Modern tax legislation (primarily the Tax Code of the Russian Federation) defines the concepts of tax and fee.

The tax burden is understood as the totality of taxes and fees of both a specific taxpayer and a certain sample of persons that arises in the process of functioning of the taxpayer.

Note!

Tax charges may also arise for an economic entity that, for some reason, temporarily or permanently does not carry out business activities. In this case, there may be no VAT, income tax, or insurance premiums, but property tax and transport tax continue to be charged (of course, if there are appropriate taxable objects).

Tax burden is an important economic concept. It allows the financier and economist of the enterprise to assess the total amount of taxes and fees paid to the budget by the enterprise, choose the optimal taxation system, the most attractive investment project, and make a correct comparison with the tax obligations of other enterprises.

Important!

Calculation of the tax burden indicator has now also become an important tool for assessing the potential problematic situation in an enterprise with the tax authorities. A low tax burden may attract the close attention of tax authorities to the company and initiate an on-site tax audit.

Remember

- Study tax systems and make comparative tax calculations. The simplified tax system is not a panacea;

- If you have chosen the simplified tax system, then you may be entitled to a benefit in paying social insurance contributions - clause 2 of Art. 427 of the Tax Code of the Russian Federation on the possibility of using a reduced tariff of insurance premiums;

- If you work for OSNO, you can minimize the cost of management salaries by transferring management to a management company and establishing it on a more favorable tax system. This is possible on the basis of Art. 42 Federal Law No. 14-FZ dated 02/08/1998 on the transfer of powers of the sole executive body of the company to the manager;

- Outsource some of your tasks: accounting, lawyers, system administrators, cleaning services, HR and others. Sometimes it is cheaper to simply pay for their services, without taxes and fees;

- Take an inventory of personnel costs: you can save on taxes and contributions by paying part of the salary to employees in the form of compensation or scholarships - paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation on amounts not subject to insurance premiums;

- Optimize income taxes and insurance premiums through VHI - this way you can reduce the amount of taxes and contributions to 6% of labor costs - clause 16 of Art. 255 of the Tax Code of the Russian Federation on the specifics of determining the tax base for insurance contracts;

- Study the Concept of the planning system for on-site tax audits (Order of the Federal Tax Service dated May 30, 2007 No. MM-3-06/ [email protected] ) and reduce the risk of an on-site tax audit;

- If you are a starting individual entrepreneur, read our article about tax holidays for individual entrepreneurs.

What does low tax burden mean?

The Federal Tax Service itself will help you see yourself through the eyes of tax officials and understand that the company has a low tax burden. For such cases, the service has released Information “On calculating the tax burden using a special calculator on the website of the Federal Tax Service of Russia.”

About the tax calculator

In general, the requirements for the log load are presented in the table below. It is designed like “traffic lights” in a client bank (a built-in program that “highlights” counterparties in different colors: green, yellow, red).

Table. "Traffic light" of tax burden

| Index | What to compare with (green level) | Tolerance (yellow level) | Dangerous deviation (red level) |

| Total tax burden, including insurance premiums administered by the tax authorities | File Industry average indicators characterizing the financial and economic activities of taxpayers for 2018 | ||

| Excel file page “Load”, column 3 of the table | 5-7% | 10% | |

| Two types of profitability in which profit is included in the calculation | Excel file page “Profitability”, columns 3 and 4 of the table | 5-7% | 10% |

| Various VAT indicators, the most important of which are deductions | On the nalog.ru website page, search for the 1-VAT report or find paragraph 5 of the subsection “Reports on the accrual and receipt of taxes, fees and other obligatory payments” of the section “Reports generated by the Federal Tax Service of Russia for the constituent entity of the Russian Federation” | No deviations allowed |

Note that if a company operates on a simplified tax system of 15% (pays tax on the difference between income and expenses), it applies an accounting policy based on the “on payment” method (i.e., registers revenue at the time of receipt of payment and expenses in the same way) , then two types of profitability indirectly affect the size of the single tax under this special regime.

How to understand that the tax burden is low

To understand whether your workload is normal or not, you need to compare it with the average in Russia for the type of activity that is your main one.

To do this, you need to select the most suitable type of activity in the application and look at the value in the column with the desired year. This will be the standard with which you need to compare your workload for this year.

Appendix No. 3 to the Order of the Federal Tax Service of Russia dated May 30, 2007 N MM-3-06/333

For example, the average load for the type of activity “Wholesale trade” in 2015 was 2.4%, and for construction - 12.7%.

Every year at the beginning of May, the Federal Tax Service of Russia publishes data on the tax burden for the past year. That is, in 2022, load data for 2016 and earlier will be available.

If you separately calculate the income tax burden, then the following standards are: no less than 1% for trade organizations and no less than 3% for all others.

Those payers whose workload is below the average for Russia are included in a special list with whom specialists work to plan on-site inspections.

I also recommend reading this article

Why did the tax audit come: selection criteria

Tsunami, landslide, tornado... The sudden arrival of tax authorities for many companies is comparable to a natural disaster. Is it possible to prevent a “tax cataclysm”? Or will the threat of an on-site inspection continue to hang over your company like a sword of Damocles? Senior partner of Rykov Group Pavel Penkin is sure that the usual scenarios for communicating with tax authorities are outdated. Therefore, in his new project he talks about ways to reduce

Continue reading

Tax burden: what is it and why?

The tax burden in its own words is the tax burden, i.e. the amount of taxes and contributions to the state treasury paid by the enterprise.

Its level is controlled by the tax service. Once a company starts paying less taxes, it may first be called to the tax office for a conversation. We believe it is important to monitor and be guided by the established criteria. When talking about the tax burden, we mean the ratio between the amount of taxes paid and revenue.

Example. For the year the organization has the following indicators. Revenue - 30 million rubles. The absolute tax burden (the sum of all taxes without duties) is 4 million rubles. The relative tax burden is 13% (4 million/30 million). Thus, the company pays 13% of its revenue to the budget.

What regulates

- Concept of inspection planning system;

- On the work of tax authority commissions (Canceled 07/07/2020);

- How to calculate the tax burden;

- The official tax burden calculator from the Federal Tax Service.

How the Federal Tax Service checks the tax burden

Tax officials calculate the tax burden by industry. After that, an analysis of the enterprises is carried out. The analysis includes the following steps:

- calculation of the taxpayer’s tax burden by tax period depending on the applied taxation system;

- identification of similar taxpayers (tax agents, tax payers) registered with the tax authority;

- calculation of their tax burden (in the absence of information, study industry average tax burden values);

- determination of a similar taxpayer (tax agent, tax payer) with the maximum tax burden;

- analysis of the deviation of the level of tax burden of the taxpayer (tax agent, tax payer) from the maximum value.

If a low level of tax burden is established, an analysis of the taxpayer’s financial flows is carried out and explanations are requested. An example of a letter from the Federal Tax Service requesting clarification on the tax burden.

Next, the taxpayer is summoned to the tax commission (summon letter) and forced to pay taxes (protocol). If ignored, the Federal Tax Service conducts an on-site tax audit and assesses additional taxes.

How to calculate the tax burden

The load is calculated as a percentage separately for each year using the formula:

Tax burden = ((Amount of accrued taxes for the year)/(Amount of revenue for the year))?100%

For the calculation, it is the taxes accrued and not paid for the year that are taken. This is because the accrual can be in one year, and the payment goes to the next. If you count by payment, the load may turn out to be less than it actually is.

Data on accrued taxes must be taken from declarations.

Taxes that are assessed as a tax agent, for example, personal income tax, are also taken into account. But insurance premiums for employees are not included in the calculation.

The amount of the organization’s revenue is taken from line 2110 “Revenue” of the annual report on financial results.

Entrepreneurs take revenue (income) from the 3-NDFL declaration or according to the simplified tax system.

The tax office can separately check the income tax burden. It is calculated according to the formula:

Income tax burden = ((Amount of accrued income tax)/(Amount of revenue and non-operating income))? 100%

The data must be taken from the income tax return.

Take a survey on the likelihood of a tax audit

What is the VAT tax burden used for?

The concept of “Tax burden for VAT” is mentioned in the letter of the Federal Tax Service of Russia “On the work of the commission for the legalization of the tax base and the base for insurance premiums” dated July 25, 2017 No. ED-4-15 / [email protected] , which regulates the work procedure of the relevant commissions conducting In the course of this work, an analysis of the dynamics of those indicators of the economic activity of taxpayers, on which the level of their tax burden depends. Formulas for calculating the tax burden, similar to those contained in letter No. AS-4-2/12722, are also given here (in Appendix 7). In comparison with letter No. AS-4-2/12722, provisions have been added to letter No. ED-4-15/ [email protected] regarding the analysis of data received in connection with reporting on insurance premiums submitted to the Federal Tax Service from 2022.

So, with regard to VAT, the letter discusses 2 calculation indicators:

- the share of deductions in the tax calculated from the taxable base. Let us remind you that the Federal Tax Service publishes quarterly on its website indicators for calculating the safe share of deductions by region;

The article “What is the safe percentage of VAT deductions in your region in 2019-2020?” will help you assess the safe share of deductions for your company.

- tax burden for VAT, which is the ratio of the tax accrued for payment according to the declaration to the tax base.

Appendix 4 to this document provides algorithms for calculating both indicators.

The indicator of the tax burden for VAT, along with the indicator of the share of deductions in the tax calculated from the taxable base, is one of the main criteria for selecting candidates for an in-depth audit of their reporting documents, accounting data, providing additional explanations and for calling the taxpayer to a commission of the tax authority on legalization of the tax base.

The criteria for classifying VAT tax burden indicators as a “low tax burden” are not specified in the document. By analogy with the figures given for income tax, the following indicators can be considered a low tax burden for VAT: less than 3% for manufacturers of products (goods, works, services) and less than 1% for trade organizations.

See also: “Calculation of the tax burden in 2019-2020 (formula).”

In what cases is it necessary to explain to the tax authorities about the low tax burden on profits?

The law clearly states that a tax officer has the right to request an explanatory note for the submitted return. This need arises in case of suspicion that the tax amount is significantly underestimated. This may mean that the taxpayer is hiding his income from the state.

Another reason is considered to be incorrect filling out of the declaration and making mistakes. A decrease in business turnover, sales volumes, and salary increases also have a strong impact.

The tax office can request an explanatory note only in cases provided for by law. These are on-site or desk checks. Otherwise, such a requirement is considered a violation of the law. But we must remember that there are no specific requirements or explanations in the law about reducing the tax burden, but it is better for the company to provide an explanation. In this case, checks can be avoided.

Inspectors require justification for reducing the tax burden during the crisis. How to answer them so that they leave behind

Another demand from tax authorities. They are required to explain the reasons for reducing the tax burden for income tax and VAT. Apparently they are not aware that there is a crisis in the country.

They ask at the “Red Corner of an Accountant”.

“We received this demand... What do they want? Yes, the load has dropped, the declarations are correct... What should I write? Maybe it’s already happened, then poke your nose in, please.”

Here's the requirement itself:

Here's what they write in the comments:

“Forgive me for God’s sake, but when people bother me with such stupidity, I answer in a mirror way. “Everyone was appreciated, hooked, all the tests were collected. Actually, there is a crisis in the world, but in the Russian Federation it is constant. I thought you were aware :-). Well, I’m exaggerating a little, but I wrote the phrase “I assumed that you knew about the crisis” :-) How can you respond to stupidity?”

Here's another:

“Sometimes I also write to them: we will be grateful if you teach us how to run a business correctly and so that everything is correct and good for everyone :-). We will be extremely grateful :-).”

I wonder how much they will be offended by this? Or don't they read at all?

Here's what they also suggest:

“Most likely, this is not a requirement, and a centaur who came in a simple mailing may not respond at all.”

And others who received similar “masterpieces” share:

“They also want us to spell out what measures we are taking to comply with the charter and make a profit, that’s what we’re thinking about...”

They also explain what the tax authorities really want:

“For information... in any words. Previously, there was a time when they had just opened and there was no profit. Simple and clear, there are samples on the Internet if needed.”

And to this they answer:

“Exactly! But they are very interested in the profit from where we will get it. Some kind of events... Write advertising or delivery trade, something like that.”

Here's some more advice:

“Write that there are no errors in the reporting, no clarifications will be submitted. But you also saw this situation, and that in order to increase profits and, accordingly, increase the tax burden, you will look for a new type of activity that can attract customers and accordingly increase performance.”

And one more tip:

“Well, write - due to the difficult economic situation, the closure of enterprises, the decrease in the purchasing power of the population, the organization’s revenue is decreasing and expenses are increasing due to rising prices, etc. We do not have government funding.”

In general, whatever the requirement, that will be the answer.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up