Rules for accounting for fuels and lubricants have been updated

By order of the Ministry of Transport dated 04/06/2022 No. NA-51-r, methodological recommendations on fuel and lubricant consumption standards for certain brands of cars produced in 2008 and later were updated. It is recommended to use consumption standards not only when making calculations, but also when writing off the costs of fuels and lubricants (but this is a right, not an obligation of enterprises).

The updates affected the following sections:

- “Domestic and CIS vans manufactured since 2008”;

- “Domestic and CIS passenger cars produced since 2008” (for Lada Granta, Lada Priora, Lada Kalina, Lada Vesta, etc.);

- “Domestic and CIS flatbed trucks produced since 2008”;

- “Domestic and CIS buses since 2008.”

The maximum values of winter surcharges to fuel consumption standards in Sevastopol and Crimea were also approved. These indicators are necessary for calculating the cost of transportation and other types of transport work, making payments to vehicle drivers and users, and planning the needs of companies for the provision of fuel and lubricants.

simplified tax system

When calculating the single tax on the difference between income and expenses, documented and paid expenses for the purchase of fuel and lubricants can be included in the costs (depending on the nature of the use of transport) (subclause 12, 5 clause 1, clause 2 of Article 346.16 of the Tax Code of the Russian Federation) .

The VAT amounts on these expenses also reduce the tax base for the single tax (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation). When calculating the single income tax, expenses for fuel and lubricants cannot be taken into account (Clause 1, Article 346.18 of the Tax Code of the Russian Federation).

Situation: when can the cost of fuels and lubricants purchased in cash be included in expenses for calculating a single tax? An organization (entrepreneur) applies a simplified tax system and pays a single tax on the difference between income and expenses.

Organizations and entrepreneurs who apply the simplification and pay a single tax on the difference between income and expenses can include the costs of purchasing fuel and lubricants as part of the costs of maintaining official vehicles (subclause 12, clause 1, article 346.16 of the Tax Code of the Russian Federation) or as part of material costs ( subparagraph 5, paragraph 1, article 346.16 of the Tax Code of the Russian Federation).

When simplified, expenses are accounted for on a cash basis. Therefore, in the situation under consideration, the costs of fuel and lubricants included in the cost of maintaining transport can be recognized if the following conditions are simultaneously met:

- Fuel and lubricants purchased;

- expenses paid.

This follows from the provisions of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation.

When calculating the single tax, take into account material expenses in the manner prescribed for calculating income tax (clause 2 of article 346.16, article 254 of the Tax Code of the Russian Federation). An exception to this rule is the cost of purchasing raw materials and materials. After payment, the cost of such valuables can be included in the calculation of the tax base, without waiting for them to be written off for production (subclause 1, clause 3, article 273, subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation). Therefore, based on the literal interpretation of paragraph 2 of paragraph 2 of Article 346.16 and paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation, when calculating the single tax, the cost of purchased fuels and lubricants can be taken into account immediately after payment, regardless of when the fuel was written off. The same conclusion can be drawn from letters from the Ministry of Finance of Russia dated December 23, 2009 No. 03-11-09/413 and the Federal Tax Service of Russia for Moscow dated January 30, 2009 No. 19-12/007413.

Such expenses can be taken into account in full when calculating the single tax, but provided that they are economically justified and documented.

In particular, you will need documents confirming:

- cost of purchased materials (invoices, invoices, sales receipts);

- payment for purchased materials (payment orders, cash receipts, receipts);

- the amount of materials consumed during the operation of the vehicle (waybills).

This conclusion follows from the provisions of paragraph 2 of Article 346.16, paragraph 1 of Article 252 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of Russia dated November 22, 2010 No. ShS-37-3/15988, Federal Tax Service of Russia for Moscow dated January 30, 2009 No. 19 -12/007413 and is confirmed by arbitration practice (see, for example, the decision of the Supreme Arbitration Court of the Russian Federation dated August 25, 2008 No. 10353/08, the resolution of the Federal Antimonopoly Service of the Central District dated April 18, 2008 No. A36-3124/2006, the West Siberian District dated March 17, 2009 No. F04-1471/2009(2200-A03-19)).

Samples of waybills were approved by Decree of the Goskomstat of Russia dated November 28, 1997 No. 78. The forms given in it are mandatory only for organizations engaged in motor transport activities (clause 2 of Decree of the Goskomstat of Russia dated November 28, 1997 No. 78). However, in practice they can also be used by entrepreneurs. In addition, entrepreneurs can use a form developed independently. At the same time, the details of waybills, which are required to be filled out by entrepreneurs, were approved by Order of the Ministry of Transport of Russia dated September 18, 2008 No. 152.

The amount of expenses for fuel and lubricants, which are included in the calculation of the tax base for the single tax, is indicated in section I of the book of accounting for income expenses (clauses 2.1–2.3, 2.5 of the Procedure approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n).

An example of reflecting expenses for fuel and lubricants in the book of income and expenses. The entrepreneur applies a simplification; the single tax is calculated from the difference between income and expenses

An entrepreneur registered in Moscow uses a Skoda Fabia car in his activities (total mileage - 55,000 km).

On February 5, he set off in this car to deliver information materials to his clients.

To refuel the car, the entrepreneur purchased 25 liters of AI-95 gasoline for a total of 800 rubles. VAT is not mentioned on the cash receipt.

The waybill for February 5 reflects the following data:

- the remaining fuel in the tank upon departure is 5 liters;

- the remaining fuel in the tank upon return is 7 liters;

- vehicle mileage during a business trip is 200 km.

The entrepreneur decided to write off expenses for fuel and lubricants in accordance with the standards approved by the order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r. Based on this, he established:

- basic fuel consumption rate - 7.7 l/100 km;

- bonus for working in a city with a population of over 3 million people – 25 percent;

- bonus for work in winter – 10 percent;

- surcharge for using air conditioning in a car – 7 percent.

When calculating standard fuel consumption, he used the formula (clause 2.1 of section 2 of the Methodological Recommendations, approved by order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r):

| Standard fuel consumption, l | = | 0,01 | × | Basic fuel consumption (l/100 km) | × | Vehicle mileage, km | × | 1 + 0.01 × correction factor, % |

The entrepreneur calculated the correction factor necessary to determine standard fuel consumption as follows: 25% + 10% + 7% = 42%.

Standard fuel consumption was: 0.01 × 7.7 l/100 km × 200 km × (1 + 0.01 × 42) = 21.87 l.

The amount of expenses for fuels and lubricants (within the norms) that an entrepreneur takes into account when calculating the single tax is equal to: 21.87 l × 800 rubles. : 25 l = 699.84 rub.

The entrepreneur formalized the calculation made in the form of a certificate. The entrepreneur reflected expenses for fuel and lubricants within the norms in the book of income and expenses.

Rules for accounting for fuels and lubricants - standards

Companies have the right to approve their own fuel consumption limit:

- borrow information about the consumption of fuel and lubricants from the technical documentation for the machine;

- They collect a commission and take measurements.

Gasoline consumption is measured according to the following scheme (separately for an empty and loaded vehicle, for summer and winter trips, for idle time with the engine running, etc.):

- Gasoline is poured into an empty tank and its volume is recorded.

- The car drives until the gas tank is completely empty.

- The speedometer determines how many kilometers the car has traveled before the tank is empty.

- It is determined how much fuel is required to travel 1 kilometer (the number of liters divided by the number of kilometers).

- An act of the commission is drawn up with the signatures of all its members.

Important!

Periodically, it is necessary to reconcile the data reflected in the accounting records with the actual balances. As for determining the standard for gasoline consumption, it is allowed to set a basic standard and increasing coefficients for trips on congested highways, for trips in winter, etc.

Rules for accounting for fuels and lubricants: postings

Accounting for purchased fuels and lubricants will depend on how they were purchased:

| Operation | DEBIT | CREDIT |

| Purchase of fuel and lubricants using fuel cards and coupons | ||

| Reflection of funds transferred for cards/coupons as an advance issued | 60, subaccount “advances issued” | 51 |

| Acceptance for deduction of VAT on advance payments issued | 68, subaccount “VAT calculations” | 76 |

| Acceptance for accounting of fuels and lubricants issued using coupons or cards (based on a report from the company issuing coupons or cards, or coupon stubs from drivers). | 10 | 60 |

| Reflection of VAT on fuel and lubricants | 19 | 60 |

| Acceptance for deduction of VAT on fuel and lubricants | 68, subaccount “VAT calculations” | 19 |

| Restoration of VAT accepted for deduction from the transferred advance payment | 76 | 68, subaccount “VAT calculations” |

| Purchase of fuel and lubricants for cash | ||

| Issuance of money against a report for the purchase of fuels and lubricants | 71 | 50 |

| Capitalization of fuel and lubricants based on an advance report from the driver | 10 | 71 |

| Reflection of VAT on purchased fuels and lubricants | 19 | 71 |

| Acceptance for deduction of “input” VAT on fuel and lubricants | 68, subaccount “VAT calculations” | 19 |

The cost of fuel and lubricants consumed per month is calculated using waybills or reports from mileage and fuel consumption monitoring systems. Write-offs are made to expenses on the last day of the month:

| Operation | DEBIT | CREDIT |

| Including the cost of fuel and lubricants in costs (only if there is a seller’s invoice) | 20 (26, 44) | 10 |

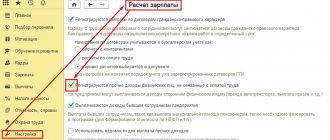

Simplification of accounting for fuel costs in 1C: Accounting 8

Starting from version 3.0.74 in “1C: Accounting 8” you can keep track of fuel using waybills. In order for the new feature to become available to the user, you will need to enable the corresponding functionality (section Main - Settings - Functionality). On the Inventory tab, you must set the Waybills flag (see Fig. 1). After enabling this setting, a new document appears in the program - Waybill.

Rice. 1. Setting up the program functionality

A waybill is issued for each vehicle. This document is used to substantiate fuel expenses for income tax purposes. The Waybill also indicates the amount of fuel that was purchased and consumed during the flight. In the full interface, the document is available in the Purchases section. In a simple interface - in the Documents section. Let's take a closer look at the new document.

Features of the new document “Waybill”

Using the Waybill document (Fig. 2) of the program, the user can:

- take into account information about the route of a passenger car that is used for business purposes. Moreover, this can be either the organization’s own car or a rented one, as well as personal transport belonging to an employee of the organization;

- reflect the purchase of fuel in cash or using a fuel card;

- take into account fuel consumption in the vehicle tank;

- take into account fuel costs in accounting and tax accounting (for profit tax purposes, when applying the simplified tax system with the object “income reduced by the amount of expenses”, as well as for the professional deduction of an individual entrepreneur when paying personal income tax).

- print the waybill according to the standard intersectoral form No. 3 (approved by Resolution No. 78) or in a simplified form;

- print an advance report in form AO-1 (approved by Resolution of the State Statistics Committee of the Russian Federation dated August 1, 2001 No. 55) - when purchasing fuel for cash.

Rice. 2. Document “Waybill”. Purchasing fuel using a cash receipt

Please note that the Waybill document has limitations: it can only be used by enterprises that are not transport companies and for which transportation is not their main activity. In addition, the Waybill does not support fuel accounting using coupons for fuel and lubricants. If the organization’s activities do not use passenger cars, refueling “in a can” is practiced, coupons for fuels and lubricants are used, and the fuel is stored in different warehouses, then accounting for fuels and lubricants should be carried out according to the previous (“traditional”) scenario. The methodology for accounting for fuel using waybills required changes to the program.

Changes in 1C:Accounting 8 to automate cost accounting for waybills

As part of the automation of accounting for fuel costs using waybills in 1C: Accounting 8, starting from version 3.0.74, the following changes have occurred:

- Third order subaccounts have been added to account 10.03 “Fuel”:

- 10.03.1 “Fuel in warehouse”;

- 10.03.2 “Fuel in the tank.”

Subaccount 10.03.1 takes into account the availability and movement of petroleum products and lubricants intended for the operation of vehicles, technological needs of production, energy generation and heating, solid and gaseous fuels. Analytical accounting is maintained by item, storage location and batch (receipt document). Each name is an element of the Nomenclature directory. Each storage location is an element of the Warehouses directory. To maintain analytical accounting for warehouses and batches, you must make the appropriate settings for accounting parameters (section Main - Chart of Accounts - Setting up a chart of accounts - Inventory accounting). Subaccount 10.03.1 is the “successor” of account 10.03, used in previous versions of the program, and is used in “traditional” scenarios for working with fuels and lubricants. Subaccount 10.03.2 takes into account the presence and movement of petroleum products in the vehicle tank. Analytical accounting is carried out by fuel types and vehicles. Each name is an element of the Nomenclature directory. Each car is an element of the Vehicles directory.

- A new subaccount 76.15 “Purchases using fuel cards” has been added to account 76 “Settlements with various debtors and creditors”. This sub-account is intended for quantitative accounting of payments for fuel purchased by an organization using fuel cards in the currency of the Russian Federation. Analytical accounting is carried out for individual types of fuel (subconto Nomenclature) and cars (subconto Vehicles).

- A new program object has appeared - Vehicle (an element of the Vehicles directory), which can be accessed from the Directories - OS and Intangible Materials section. If a car is accounted for in an organization as a fixed asset (FPE), then the Vehicle (Fig. 3) is created automatically when the vehicle is registered with the Federal Tax Service (fixed asset card - link Register), since the Register entry of a vehicle contains all necessary information. Rented cars and personal vehicles of employees used for business purposes should be entered manually in the Vehicles directory;

- For the document Receipt (act, invoice), a new type of operation Fuel has appeared.

Rice. 3. Vehicle card

Rules for accounting for fuel and lubricants received when purchasing a car

When you buy a car, there is usually a certain amount of gasoline left in the tank. If the volume of gasoline is specified in the purchase and sale agreement, fuel and lubricants can be capitalized; if not, there are options:

- when there is very little gasoline in the tank, it is not taken into account, and the accountant notes the receipt and write-off of gasoline from the moment of the first refueling;

- if the tank is almost completely full, you need to find out the volume of fuel and arrange a free receipt (this will be taxable income, the cost of fuel and lubricants is posted to DEBIT 10 CREDIT 98, when writing off, entries are made to DEBIT account 20 (26, 44) and CREDIT 10, as well as DEBIT 98 CREDIT 91) or identify surpluses (they are included in income and posted to DEBIT 10 CREDIT 91, income is generated in tax accounting).

Rules for accounting for fuel and lubricants - accounting for compensation

If personal cars of employees are used in the production process (with the consent and knowledge of the employer), they may be paid monetary compensation without restrictions. According to Article 188 of the Labor Code of the Russian Federation, the employer is obliged to pay such compensation, and their amount must be stipulated in the employment contract or in an additional agreement. The amount of compensation is not limited, but must be justified. Funds are paid at the end of the calendar month.

It is recommended to draw up an additional agreement to the employment contract (with a vehicle registration certificate and a copy of the operating manual attached), which would provide for the following points:

- the employee must keep records of business trips in travel vouchers;

- waybills and documents evidencing travel expenses incurred are submitted to the accounting department on the last working day of the month;

- the employer undertakes to pay compensation for the use of an employee’s car;

- an employee from ... (date) in the performance of work duties uses a car belonging to him for business purposes (information about the car);

- compensation is calculated according to the fuel consumption standard specified in the vehicle’s operating manual and mileage.

Compensation is calculated in proportion to the number of days worked by the employee, during vacation, business trip, etc. no payment is made.

For tax purposes, compensation for the use of an employee’s personal car is rationed:

- reimbursement of the cost of fuel, separate from the payment of compensation, is an excess payment that cannot be taken into account when calculating the tax base for income tax (Letter of the Ministry of Finance of the Russian Federation dated August 23, 2013 No. 03-03-06/1/39239);

- expenses for payment of compensation are taken into account in expenses (as of the date of actual payment to the employee) within the limits approved by Decree of the Government of the Russian Federation dated 02/08/2002 No. 92.

An example of accounting for compensation for the use of a personal car

The employer paid the employee 5,500 rubles for the use of an employee’s passenger car with an engine capacity of less than 2 thousand cubic meters for production purposes. see. It will be possible to reduce the tax base for income tax only by 1,200 rubles according to the norm. Postings on the date of payment of compensation:

| Operation | DEBIT | CREDIT | Amount (rub.) |

| Reflection of the amount of compensation in expenses (with the attachment of a certificate calculating the amount for the month of using the car) | 20 | 73 | 3000 |

| Transfer of compensation amount to an employee | 73 | 51 | 3000 |

| Reflection of permanent tax liability | 99 | 68 | 360 (RUR 3,000 – RUR 1,200) x 20% |

USN. Accounting for fuel and lubricant expenses using fuel cards

An individual entrepreneur using the simplified tax system (income minus expenses) is engaged in the wholesale trade of food products: using his own vehicles he delivers products to customers under a supply agreement. According to the agreement with the fuel supplier, he makes an advance payment for fuel of 100,000 rubles. Drivers fill up at gas stations using cards within 1–2 months.

How should an accountant make an entry in the Income and Expense Book: with one entry (payment for fuel = 100,000 rubles) or daily record the amount of fuel consumption based on waybills?

When paying for petroleum products with payment (bank) cards, when releasing petroleum products, funds are debited from the client’s bank account, that is, at the time of the transaction, payment is made for the goods received.

Plastic fuel cards are not payment cards

.

When using fuel cards at gas stations, payments for petroleum products are not made.

.

Moment of payment for petroleum products

either

precedes the transaction

(

prepayment

) or follows after (deferred payment).

The form of payment in this case is the transfer of funds to a current account.

Fuel cards serve only as a means of accounting for goods

, that is, the amount of petroleum product supplied.

The remaining fuel supply limit on the card is reduced by the cost of the supplied fuel.

According to arbitration courts, the fuel card is used as a means of strict reporting

, allowing the card holder to receive a certain amount of goods on behalf of the buyer (Resolution of

the Federal Antimonopoly Service of the Volga Region

dated June 5, 2008 No. A12-987/08-C22).

When refueling using a card, the driver receives a receipt indicating

, in particular, the date of sale (purchase), time of sale (purchase),

amount of fuel

, card number for non-cash payment, amount of sale (purchase) (except for indirect non-cash payment).

This is established by paragraph 35 of Protocol No. 14 of November 10, 1994, Technical Requirements

to electronic cash registers (KKM) for carrying out cash settlements with the population in the field of trade in petroleum products and gas fuels, approved by GMOC.

As explained by the Federal Tax Service for Moscow in a letter dated November 29, 2004 No. 29-12/76348, indirect non-cash payment

is considered a form of payment for petroleum products at gas stations using magnetic and chip cards, coupons and other documents that are equivalent to

pre-paid

certain amount of petroleum product.

Thus, when paying non-cash, an organization has the right to issue a cash receipt without indicating the cost, but indicating the number of liters of petroleum product

.

At the end of the month, the fuel supplier issues

to the buyer

shipping documents

(act of delivery (waybill),

invoice

)

for fuel shipped during the month

.

Based on these documents, you will know how much fuel was purchased per month, what brand and cost.

In accordance with paragraph 2 of Art. 346.17 Tax Code of the Russian Federation expenses

for a taxpayer using the simplified tax system, expenses are recognized

after they are actually paid

.

Payment for goods

(works, services) and (or) property rights, the

termination of the obligation of the taxpayer - the purchaser of

goods (works, services) and (or) property rights to the seller, which is directly related to the supply of these goods (performance of work, provision of services) and (or) is recognized. transfer of property rights.

That is, termination of the counter-obligation

.

In accordance with Art. 307 of the Civil Code of the Russian Federation by virtue of an obligation

one person (debtor) is obliged to perform a certain action in favor of another person (creditor), such as: transfer property, perform work, pay money, etc., or refrain from a certain action, and the creditor has the right to demand that the debtor perform it responsibilities.

If each party to a contract bears an obligation in favor of the other party

, she is considered the debtor of the other party in what she is obliged to do in her favor, and at the same time her creditor in what she has the right to demand from her.

Counter is recognized

fulfillment of an obligation by one of the parties, which, in accordance with the contract, is conditioned by the fulfillment of its obligations by the other party (

Article 328 of the Civil Code of the Russian Federation

).

That is, until the second party to the contract fulfills its obligation to supply goods

(materials) (in your case, the fuel supplier),

the prepayment amount cannot be recognized as an expense

.

The Ministry of Finance also clarifies that the amounts of advance payments made by the taxpayer towards future deliveries

goods (works, services), including taking into account VAT amounts on paid goods (works, services),

when determining the tax base for the tax paid in connection with the application of the simplified tax system, are not taken into account as expenses

.

The above expenses will be taken into account as expenses

when determining the object of taxation for tax paid in connection with the application of the simplified tax system,

after the delivery of goods

(performance of work, provision of services) (letter dated 04/03/2015 No. 03-11-11/18801).

Expenses for the purchase of fuels and lubricants

can be taken into account as expenses for the maintenance of official transport (

clause 12, clause 1, article 346.16 of the Tax Code of the Russian Federation

) or as material expenses (

clause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation

).

Material costs

(including expenses for the purchase of raw materials and materials)

are taken into account as expenses at the time of repayment of the debt by writing off

funds from the taxpayer’s current account, payments from the cash register, and if there is another method of repaying the debt - at the time of such repayment.

In a letter dated November 22, 2010 No. ШС-37-3/ [email protected] the Federal Tax Service of the Russian Federation explained that for recognition

In order to tax

expenses on fuel and lubricants, two conditions must be met simultaneously

:

payment for

the specified materials (fuel and lubricants)

and the actual write-off of fuel

for official vehicles.

At the same time, expenses for fuel and lubricants must meet the requirements of paragraph 1 of Art. 252 Tax Code of the Russian Federation

.

One of the primary documents confirming expenses incurred for fuel and lubricants is a waybill

.

Therefore, a waybill may be one of the documents confirming

for tax purposes,

expenses for the purchase of fuel and lubricants

.

Material costs

are accepted in relation to the procedure provided for calculating corporate income tax

Art. 254 Tax Code of the Russian Federation

.

According to paragraphs

5 p. 1 art. 254 of the Tax Code of the Russian Federation

, material expenses, in particular, include

the taxpayer’s expenses for the purchase of fuel

.

The Ministry of Finance of the Russian Federation, in letter No. 03-11-09/413 dated December 23, 2009, stated that expenses for the purchase of fuel and lubricants are recognized after payment, regardless of the date they are written off for production

.

Thus, until the supplier fulfills its obligation to supply fuel, which is confirmed by monthly acts, the prepayment amount cannot be recognized as an expense

, and, therefore, cannot be reflected as an expense in the Accounting Book...

Therefore, in your situation, you can recognize expenses in the form of an advance payment for fuel

in those months

(

reporting, tax period

)

in which the act was signed

.

Rules for accounting for fuel and lubricants - confirmation of fuel costs

Waybill forms are required for use only by professional carriers. Non-core companies have the right to develop their own forms and reflect them as an appendix with a sample in their accounting policies. You should remember these points:

- a separate waybill must be issued for each vehicle;

- The maximum validity period of the sheet is 1 month;

- The waybill reflects the exact route of the trip and fuel consumption.

If the company has more than two vehicles, it will be easier to account for fuel costs if you maintain internal reporting.

Reporting forms, deadlines for preparation, list of responsible persons - everything is approved by management in the order. Useful reporting forms include:

- A report on the movement of fuels and lubricants, drawn up by the employee financially responsible for the issuance of fuels and lubricants on the basis of acts, requirements, invoices, cards for recording fuel consumption, and a sheet for recording the return of coupons. The document contains information about the employee who received the fuel, types of fuel and lubricants, units of measurement, purpose of issue, balance at the beginning/end of the reporting period, receipt, disposal.

- Record sheet for the issuance of fuels and lubricants. The document indicates the fuel issued to all employees. Drivers present a waybill or other document, the total amount of fuel and lubricants is summarized at the end of the statement, along with the name and brand of fuel and lubricants, information about the car (registration number, model, make), information about the driver (full name, day of fuel issue, personnel number), information about fuels and lubricants required during the period of vehicle maintenance and repair (based on invoices and limit cards).

Personal car of an individual entrepreneur: how to take into account expenses

Any commercial activity is aimed at making a profit, and according to the principle “the more, the better.” And the activities of an individual entrepreneur are no exception; he also strives to get maximum profit by increasing income and optimizing his expenses. In this article we will consider the possibility of an entrepreneur taking into account the costs of maintaining a personal car when calculating taxes. Sometimes an individual entrepreneur really needs a car for business, and not for show-offs and personal travel. Is it possible to defend such expenses?

Car as a main means

The first point when an individual entrepreneur can take into account “car” costs in expenses is its inclusion in fixed assets. After all, then it becomes possible to either charge depreciation monthly (under the simplified tax system), or include the cost of the machine as an expense in the first year of its use (under the simplified tax system).

But not every individual entrepreneur has the right to include his personal car in fixed assets. Officials believe that only those vehicles that are directly involved in the entrepreneur’s income generation, for example, when carrying out freight or passenger transportation, can be recognized as the main means of transport. If a businessman uses a car as an auxiliary means (for example, for trips to the bank), then it cannot be recognized as an OS (letter of the Ministry of Finance of Russia dated March 26, 2008 No. 03-04-05-01/79).

But even if the businessman’s activities are directly related to the use of this vehicle, a new question arises - is it possible to take into account the cost of a car purchased before the owner registered as an individual entrepreneur? The Ministry of Finance dispelled doubts in its letter dated 06/06/2013. No. 03-11-11/164. It says that an individual entrepreneur who is on a simplified taxation system has the right to take into account the costs of purchasing a car during the first three years of applying the simplified tax system.

Please note that the letter discussed a situation where three circumstances occurred at once: the acquisition of a vehicle (fuel tanker) by an individual who subsequently registered as an individual entrepreneur and used this vehicle in his activities. Officials qualified the purchase of a fuel tanker as an operation carried out for the purposes of entrepreneurial activity, and recognized the right of an individual entrepreneur to take this asset into account as fixed assets with the subsequent inclusion of the costs of its acquisition in the calculation of the single tax under the simplified tax system.

Including a car as a fixed asset for an entrepreneur will not be particularly difficult - it is enough to have documents confirming the costs of its purchase, and an order or order recognizing it as a fixed asset. But if, during the audit, the tax authorities do not agree with this decision, the businessman will have to defend his position in court.

We take fuel and lubricants into account

When an entrepreneur does not want to take risks and decides not to include the cost of the car in expenses, how else can he reduce tax using “car” expenses? The easiest way is to factor in the cost of gasoline into your expenses. But here, too, there is a controversial question: should fuel costs be rationed or not?

Historically, there was an opinion that costs for fuel and lubricants must be rationed. There are Methodological recommendations of the Ministry of Transport of Russia dated March 14, 2008. No. AM-23-r, containing fuel consumption standards, as well as coefficients for various territories, seasons, etc. These standards were originally developed for motor transport enterprises, but tax authorities consider their application necessary for all taxpayers.

If you do not find standards for your car in the Recommendations, you can use the manufacturer’s data or develop fuel consumption standards yourself. But, please note, the Tax Code of the Russian Federation does not contain any provisions on rationing costs for fuels and lubricants, so you can refuse it. Only in this case, be prepared for legal proceedings with tax authorities.

The Ministry of Finance confirms the opinion that it is not necessary to standardize gasoline costs, nor to use the standards established by the Ministry of Transport (letter of the Ministry of Finance of Russia dated January 27, 2014 No. 03-03-06/1/2875).

The courts also side with taxpayers in disputes with tax authorities and allow the full cost of fuel to be written off as expenses (resolution of the Federal Antimonopoly Service of the Central District dated April 4, 2008 in case No. A09-3658/0729, resolution of the Federal Antimonopoly Service of the Moscow District dated September 25, 2007, September 28. 2007 in case No. KAA41/986607).

Regardless of whether you will normalize gasoline costs or not, you should draw up a decision with a list of personal property used in business activities. By including a car in it, you will have the right to take into account for tax purposes all economically justified expenses associated with its operation.

Documentary confirmation

In the case of justifying fuel costs, gas station receipts alone will not do; you will also have to draw up a document such as a waybill. It contains all the information about the trip route, departure and return times, as well as odometer readings. You can develop the form of the waybill yourself, indicating the mandatory details approved by the order of the Ministry of Transport dated September 18, 2008. No. 152. The procedure for filling out waybills is also specified in this regulatory act.

An important detail: if you use a personal car in business, then in contracts, invoices, letters and other documents indicate the fact that, for example, the delivery is carried out by the individual entrepreneur himself or that negotiations are being conducted on the territory of the partner, etc. Of course, this will not replace waybills, but will be additional confirmation of the economic feasibility of expenses.

Operating costs

Unlike the cost of fuel and lubricants, the cost of operating a car is not so easy to take into account. If the entrepreneur’s activities are directly related to the use of a personal vehicle, then operating costs will be justified. But if the car is used to travel to the office or to the bank, then tax inspectors will definitely not accept the costs of its maintenance as reducing the tax base.

In judicial practice, too, not all decisions are made in favor of the individual entrepreneur. For example, the Federal Antimonopoly Service of the West Siberian District did not agree with the entrepreneur’s decision to include in expenses the costs of paying for parking, technical inspection, compulsory motor insurance, purchase of fuels and lubricants (gasoline, oil, coolant), etc. (resolution dated February 26, 2008 No. F04-1130/2008 (973-A45-34)).

The judges based their decision on the fact that the businessman’s activities were related to the provision of legal services, and his personal car was used to travel to the office. Consequently, the costs of its maintenance were in no way related to the entrepreneur’s receipt of income from the provision of legal services, and therefore could not be included in expenses.

Determining the type of cost

So, “car” costs can be included in expenses and thereby reduce taxes. In particular, an entrepreneur who is on a simplified tax regime has his single tax reduced, and an individual entrepreneur who applies the general taxation regime can include these expenses as part of the professional deduction for personal income tax.

The “safest” expense for a businessman is the purchase of fuel and lubricants, since tax authorities pay virtually no attention to it (if everything is done correctly, of course). But you need to decide what type of cost to classify it as.

The purchase of fuel for a personal car used in business activities related to transportation can be classified as material expenses (clause 5, clause 1, article 254 of the Tax Code of the Russian Federation). If the activity of an individual entrepreneur is far from transportation, but the businessman actively uses his car to deliver orders, business trips, etc., then the cost of gasoline is included in other expenses associated with production and sales (clauses 11, 12, clause 1 Article 264 of the Tax Code of the Russian Federation).

In the simplified taxation system, these types of costs are also included in the closed list of expenses. Therefore, “simplified” workers, depending on the type of activity, can take into account the costs of purchasing fuel and lubricants both as material (clause 5, clause 1, Article 346.16 of the Tax Code of the Russian Federation), and as expenses for the maintenance of official vehicles (clause 12, clause 1, Article 346.16 of the Tax Code RF).

Read about business travel expenses for individual entrepreneurs here. Is it possible to take into account the expenses of individual entrepreneurs incurred before state registration, see here.

You might be interested in:

Answers to common questions about fuel and lubricants accounting rules

Question #1:

How to write off gasoline based on its consumption if it is impossible to understand how much fuel is left in the tank of a filled car?

Answer:

As a rule, for these purposes, actual fuel consumption is determined as the number of kilometers on the speedometer multiplied by the standard adopted by the company.

Question #2:

The company applies fuel consumption standards established by the Ministry of Transport for tax accounting purposes. Is it possible to apply similar standards in accounting?

Answer:

Yes. The same limit value (according to the standards of the Ministry of Transport or independently developed standards) can be used when calculating the gasoline consumed and when reducing the tax base.