When registering as an individual entrepreneur, many businessmen expect to work independently. After some time, an understanding appears that it will be easier to hire a couple of employees to perform certain duties, and deal with the further development of the business yourself. Sometimes you can't do without workers from the very beginning. These could be salespeople at retail outlets, drivers, production workers - all those who ensure the functioning of your business.

An automatic online service will help you document this important part in the life of an entrepreneur.

Content

- What happens if you don’t formally register employees?

- Thinking over a strategy

- Search for colleagues

- We conclude an employment contract

- Register as an employer

- Organization of storage of personnel documents

- Explore information about labor relations

- Selection of a specialist for HR work

When you make a decision to attract hired employees, it is important to understand its consequences - you are moving to a new status as an individual entrepreneur. This entails a bunch of responsibilities and not very pleasant consequences: concluding employment contracts, ensuring personnel records, paying wages, transferring personal income tax and insurance premiums for employees, as well as fines for non-compliance with labor laws and additional communication with government agencies.

Registration of individual entrepreneurs without employees in the Pension Fund of Russia in 2021

To register with the Pension Fund, you only need to register with the Federal Tax Service - register an individual entrepreneur. All other actions will be performed by tax officials based on the documents submitted for registration of individual entrepreneurs. There is no need to provide any additional documents. This also applies to heads of peasant (farm) households and private practice specialists.

The Pension Fund of Russia will register the entrepreneur within three days after receiving information from the Unified State Register of Individual Entrepreneurs (USRIP) from the registration authority. In turn, the tax office transmits this data to the Pension Fund no later than the working day following the registration of the individual entrepreneur.

Keep records, pay taxes, pay salaries, report via the Internet in Kontur.Accounting. The first 14 days of work are free for all newbies.

What happens if you don’t formally register employees?

In life, it very often happens that an individual entrepreneur has employees, they perform the work assigned to them, but are not officially registered, because this is beneficial to the employer. He doesn’t have to worry about transferring personal income tax from their salaries, paying insurance premiums, or filing a bunch of paperwork for personnel. Sometimes workers themselves agree to such conditions because they are afraid of losing their income and being left without any income at all. But lately the trend has been changing in the other direction.

The workers themselves and the state are interested in the official hiring of employees. In this case, the employee will be protected by the employment contract and current legislation: contributions for pension and health insurance will be paid for him, he can go on sick leave or maternity leave, or on due vacation. For the state, the benefit lies in the collection of personal income tax - issuing a “white” salary means that individual entrepreneurs (or LLCs) as tax agents will transfer tax on the employee’s income to the budget plus replenish the treasury of social funds. The fight against unofficial employment is being waged quite actively. Previously, there was repeated talk about increasing fines for non-compliance with the provisions of labor legislation; for 2022 for individual entrepreneurs the picture is as follows:

- violation of federal legislation regarding requirements relating to labor protection is subject to a fine in the amount of 2-5 thousand rubles;

- violation of the special assessment procedure or the absence of the fact of its implementation at all entails a fine of 5-10 thousand rubles;

- for allowing an employee to work without organizing preliminary training and testing knowledge related to labor protection, you will have to pay from 15-25 thousand rubles;

- failure to provide employees with personal protective equipment entails sanctions in the amount of 20-30 thousand rubles;

- committing an offense, if a fine has already been imposed for a similar one, will provide you with a fine of 30-40 thousand rubles. or suspension of activities for up to 90 days.

- It is important for an individual entrepreneur to remember that failure to register an employee can be considered a violation of four codes at once - Labor, Tax, Code of Administrative Offenses and Criminal. In case of serious violations, the liability will be quite serious.

Another trend is the punishment of the employee himself as an accomplice to the crime, because he agreed to a “black” salary and hides his income from the state. Both fines (up to 5 thousand rubles) and social advertising are used - I think many have noticed commercials and banners on the streets telling that “black” wages are bad.

As a result, it turns out that formal labor relations are beneficial to all parties. The employee receives guarantees from labor legislation, and the employer eliminates problems with government agencies. An official employment contract, in fact, becomes one of the competitive advantages of an individual entrepreneur over other employers.

So, have you decided to hire employees and formalize them? Let us list the main points of starting an individual entrepreneur’s work as an employer.

Registration Notice

After completing the registration procedure, you will be given a notice of your registration in the Pension Fund with a registration number. The document is sent by email in electronic format, signed with an enhanced qualified electronic signature. You can receive paper documents within three days if you leave the appropriate application.

You will also receive a receipt with details for payment of fees. On the official website of the Pension Fund of Russia you can create a personal account and track all transactions in it.

Thinking over a strategy

What strategy should you consider? You must formulate for yourself and, accordingly, for your future employees certain “rules of the game” - let’s call them that. What does this include? There are quite a few points:

- How will the selection and hiring of employees be carried out (interview, registration, probationary period, etc.);

- For what period will the employment contract be concluded (it is good to make a sample contract, having thought through its provisions);

- What duties will each employee perform;

- What type of work schedule to set (strict schedule, flexible schedule, full day, etc.);

- How the remuneration system will be formed (salaries, bonuses, etc.);

- How will the employee motivation system be formed;

- How will the salary be paid (bank cards, cash; within what time frame);

- How will work with personal data be organized?

In fact, at the initial stage, this is most necessary for the individual entrepreneur himself, in order to understand how your future relationships with employees will be organized. The result of this work should be several internal regulations: labor regulations, regulations on the protection of personal data, bonus standards (if required), job descriptions. It is not recommended to compose them “at random”; take this issue seriously. All provisions of these acts should be important to your business (or company).

How to register with the FSS

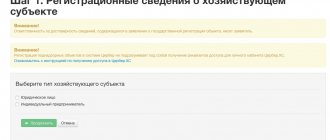

The procedure for registering an individual entrepreneur with the Social Insurance Fund as an employer involves the following steps:

Step 1. Collection of necessary documents, including:

- the applicant’s passport, if the documents are submitted by his representative - the representative’s passport and power of attorney;

- copies of employee work books or employment contracts;

- copies of GPC agreements, if the individual entrepreneur does not hire employees, but contractors.

These are required documents. If desired, it is also possible to provide a certificate of registration with the tax authority and a certificate of registration as an individual entrepreneur. If the entrepreneur does not bring these documents, he does not have the right to refuse registration - the FSS is obliged to independently request information through an interdepartmental request.

Step 2. Fill out an application to register as an insured. Its form was approved by Order of the Federal Social Insurance Fund of the Russian Federation dated April 22, 2019 No. 215 - for individual entrepreneurs who have entered into an employment contract, and by Order of the Social Insurance Fund of the Russian Federation dated April 22, 2019 No. 214 - for those who hired a contractor under a GPC agreement and are therefore required to pay contributions.

Step 3. Submit an application and document to the FSS office, send it by mail or transfer it using the MFC.

Step 4. Wait for registration and issuance of the corresponding notification. The deadline for the Fund to make a decision is 3 working days. At the request of the applicant, the notification is issued in paper form or sent by email. This notification is a reliable way to check whether an individual entrepreneur is registered as an employer - if it is issued, the entrepreneur is registered.

Having received registration, the individual entrepreneur is required to pay insurance premiums for employees and submit regular reports. Additionally, the employer is not required to separately register the employee with the Social Insurance Fund.

Use a free sample employment contract with individual entrepreneurs from ConsultantPlus experts to register a new employee.

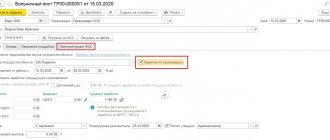

We conclude an employment contract

A suitable employee has been found, now he needs to be hired. The main task is to correctly draw up an employment contract. Here you can. Do not forget that relationships with an employee can be formalized not only by an employment contract, but also by a civil law contract (contractor agreement, paid services agreement, agency agreement, agency agreement or commission agreement). How to choose which one is more suitable, what their features and differences are, we will consider separately, devoting separate articles to them.

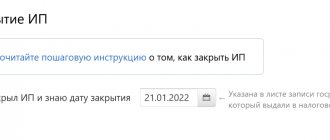

Registration of an individual entrepreneur with the Pension Fund of Russia as an employer

While insurance premiums were administered by the Pension Fund (until 2022), the individual entrepreneur, after concluding an agreement with an employee, had to register with the fund as an employer within 30 days and provide documents for this. He received another registration number from the Pension Fund of Russia as an insured.

Since the beginning of 2022, the Federal Tax Service has been in charge of insurance premiums; now individual entrepreneurs do not need to register independently; this happens without its participation. The tax office receives data on hired personnel from the reports on insurance premiums submitted by the entrepreneur. Since information interaction has been established between the tax office and the funds, the tax office electronically sends data from calculations of insurance premiums to the Pension Fund.

As for the policyholder number: use the only registration number that was assigned to you by the Pension Fund during initial registration (after registration as an individual entrepreneur). This number is required when submitting reports to the Pension Fund of Russia (SZV-M, SZV-STAZH, SZV-TD and others).

Selection of a specialist for HR work

The individual entrepreneur himself is unlikely to be a specialist in personnel and accounting, but here both knowledge is needed! If you have a certain staff of employees, it will be very difficult to cope with everything yourself, especially since legislation changes frequently. Therefore, you should consider adding an accountant to your staff or contact a consulting firm that will provide you with accounting, tax calculations, and personnel records.

What else does a new entrepreneur need to remember? If you use a special taxation regime, then the number of your employees should not exceed a certain number (for example, for UTII - 100 people). If your average number is greater than even by 1 person, then you will simply be thrown out of the special regime. Read more about how to calculate the average number of employees and whether it is possible to conclude a contract for the season.

The procedure for paying individual entrepreneurs’ contributions to the Pension Fund for themselves

You can pay your own contributions to the Pension Fund every month, quarterly or for the whole year at once. If an individual entrepreneur has a current account, he can pay insurance premiums from it. December 31 is the last day of payment. We recommend that you make the payment before the 20th so that the money reaches the fund on time.

Even if you do not make a profit, it is mandatory to make payments to the Pension Fund. Payment to the Pension Fund of individual entrepreneurs without employees depends on 3 factors:

- IP registration date;

- the amount of contributions established for the current year;

- IP income for the year: if it exceeds 300 thousand rubles, the amount of contributions will be higher.

In 2022, the individual entrepreneur pays 32,448 rubles to the pension fund, and with income over 300,000 rubles - another 1% of the excess amount. In this case, the amount of all payments cannot exceed 259,584 rubles.

Here we talked in detail about calculating contributions for yourself, and you can also use our free calculator to calculate contributions using the link.

Results

If you are required to submit reports to the Pension Fund electronically, then you should enter into an agreement on electronic document management with the fund. To do this, you need to write an application to the Pension Fund with a request to connect your company to the electronic document management system. The form for such an application can be downloaded from the Pension Fund website.

Sources: Law “On individual (personalized) registration in the compulsory pension insurance system” dated April 1, 1996 No. 27-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.