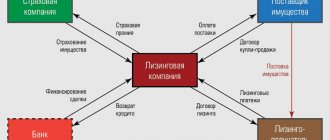

Leasing is a convenient form of purchasing a car, which is the purchase of a car through its lease with payment of the cost of the vehicle in monthly lease payments. Car leasing is convenient for most categories of motorists and, in many cases, more profitable than a car loan: you can use the car right away, the rental rate is lower than the credit percentage, the conditions are softer, and the size of the package of documents is smaller.

However, car leasing is not an ideal financial solution, and, like a loan, can become burdensome for the lessee for a number of reasons. A car owner cannot refuse a car leasing agreement, but he can use a convenient legal instrument - the assignment of rights to the leased item. What is it, what are the advantages of assignment, and how can you use it?

Accounting under a lease agreement

For clarity, let’s look at the accounting of operations to replace the lessee if there is a debt on lease payments using a numerical example.

example

Under the lease agreement, the rights and obligations of the old lessee are transferred to the new lessee, including the debt on lease payments in the amount of 144,000 rubles. The re-lease agreement states that this debt is repaid by the new lessee in equal amounts within 12 months from the date of re-lease.

For the new lessee to assume the debt, the old lessee pays him a lump sum of 100,000 rubles.

The amount of payments under the leasing agreement, the term of which has not occurred on the date of re-lease, is 1,180,000 rubles, including VAT 18%. The monthly lease payment amount is 21,240 rubles, including VAT 3,240 rubles.

Accounting with the new lessee

Let's consider what entries the new lessee will have to make upon entering into the leasing agreement, taking into account the acceptance of the debt of the old lessee. The accounting of this operation will depend on whose balance sheet the leased property is taken into account.

The property is recorded on the lessor's balance sheet. In this case, the accountant will make the following entries.

Debit 97 Credit 76

— 144,000 rub. — reflected in deferred expenses is the amount of transferred debt for lease payments, including VAT.

In the future, this amount will be written off from account 97 as part of current expenses within 12 months (accounts 20, 26, 44). Reason - clause 65 of the Regulations on maintaining accounting and financial statements in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n, clause 19 PBU 10/99 “Organization expenses”.

Account debit 76 Credit 91

— 100,000 rub. — reflects the amount that the new lessee must receive from the old lessee for assuming his debt under the leasing agreement.

Debit 51 Credit 76

— 100,000 rub. - the amount was received from the previous lessee.

The accrual and payment of current lease payments are reflected in the accounting of the new lessee in the general manner (clause 9 of the Instructions on the reflection in accounting of transactions under a leasing agreement, approved by Order of the Ministry of Finance of Russia dated February 17, 1997 No. 15):

Debit 76 Credit 51

— 12,000 rub. (RUB 144,000: 12 months) - for the amount of debt repaid in the current month under the leasing agreement;

Debit 20 (25, 26, 44) Credit 76

— 18,000 rub. — the current lease payment has been accrued;

Debit 19 Credit 76

— 3240 rub. — VAT is charged on the current lease payment;

Debit 68 Credit 19

— 3240 rub. — accepted for deduction of VAT on the current lease payment;

Debit 76 Credit 51

— 21,240 rub. — the current lease payment is listed.

The property is recorded on the lessee's balance sheet. With this wiring option, the wiring will be as follows:

Debit account 08 Credit 76, subaccount “Upcoming lease payments”

— 1,144,000 rub. (1,180,000 rub. – –180,000 rub. + 144,000 rub.) - reflects the amount of lease payments to be paid under the leasing agreement without VAT, as well as the amount of debt transferred to the new lessee;

Debit 19 Credit 76, subaccount “Upcoming lease payments”

— 180,000 rub. — the amount of VAT is taken into account as part of leasing payments to be paid under the leasing agreement;

Debit 01 Credit 08

— 1,144,000 rub. — the leased asset is put into operation;

Account debit 76 Credit 91

— 100,000 rub. — reflects the amount that the new lessee must receive from the old lessee for assuming his debt under the leasing agreement;

Debit 51 Credit 76

— 100,000 rub. - the amount was received from the previous lessee.

The accrual and payment of current lease payments are reflected in the accounting of the new lessee in the general manner:

Debit 76, subaccount “Upcoming lease payments” Credit 76, subaccount “Current lease payments”

— 33,240 rub. (RUB 21,240 + RUB 12,000) - the current lease payment and part of the debt payable in the current month have been accrued;

Debit 68 Credit 19

— 3240 rub. — accepted for deduction of VAT on the current lease payment;

Debit 76, subaccount “Current lease payments” Credit 51

— 33,240 rub. — the current lease payment and part of the debt have been paid;

Debit 20 (25, 26, 44) Credit 02

— depreciation has been calculated on the leased property.

The last posting is made from the month following the month the leased asset was put into operation. Depreciation is calculated using the useful life chosen by the lessee, the depreciation method and an increasing factor not exceeding 3 (clause 8 of the Instructions on reflecting transactions under a leasing agreement in accounting, Resolution of the Federal Antimonopoly Service of the Ural District dated December 28, 2009 No. A71-4088/2008-A28 ).

Accounting with the previous lessee

Now let’s figure out how the old lessee should reflect the operation in question in the accounting records. Here, too, accounting will depend on whose balance sheet the leased property was recorded on.

The property is recorded on the lessor's balance sheet. In this case, the following entries will be made:

Debit 76, subaccount “Current lease payments” Credit 76

— 144,000 rub. — the debt on leasing payments, including VAT, was transferred to the new lessee;

Debit 76 Credit 91

— 44,000 rub. — reflects the amount of debt under the leasing agreement, including VAT, which is transferred to the new lessee without payment from the old lessee;

Debit 76 Credit 51

— 100,000 rub. — reflects the amount of debt that, according to the lease agreement, the old lessee pays to the new one.

The property is recorded on the lessee's balance sheet. In such a situation, the accountant will make the following entries:

Debit 76, subaccount “Calculations for current lease payments” Credit 76

— 144,000 rub. — the amount of transferred debt for lease payments is taken into account, including VAT;

Debit 76 Credit 51

— 100,000 rub. — the amount was transferred to the new lessee in accordance with the lease agreement;

Debit 76 Credit 91

— 44,000 rub. — the amount of debt under the leasing agreement is written off, including VAT, which is transferred to the new lessee without payment from the old lessee;

Debit 76, subaccount “Calculations for upcoming lease payments” Credit 91

—1,180,000 rub. — the amount of lease payments that were not due on the date of re-lease is written off;

Debit 91 Credit 19

— 180,000 rub. — the amount of VAT is taken into account as part of leasing payments, the term of which did not occur on the date of re-lease;

Debit 91 Credit 01

— the initial cost of the leased asset is written off;

Debit 02 Credit 91

— reflects the amount of depreciation accrued on the leased asset.

Capitalization of property from a new lessee in the event of transfer of leasing rights to him

| How to reflect the operation of changing the lessee (for a new lessee) in accounting and tax accounting? How is the initial cost of the property formed in this case? |

Accounting

The lessee always credits the leased property to the balance sheet for the total amount of payments under the leasing agreement for the entire term of the leasing agreement, excluding VAT. For the new lessee, the total amount under the leasing agreement is the amount that he (the new lessee) is obliged to pay to the lessor.

Generated wiring:

Dt 20.01 (or other cost accounting account) Kt 76. settlements with the old lessee - reflects the debt of the new lessee to the old one for obtaining rights under the leasing agreement (if, by agreement of the parties, such a debt arose). Dt 19 Kt 76. settlements with the old lessee - the amount of VAT presented by the old lessee (if any) is reflected. Dt 08.04 Kt 76. lease obligations - reflects the cost of fixed assets received under a leasing agreement. Dt 19.01 Kt 76. lease obligations - VAT allocated in accordance with the primary documents. Dt 01.01 Kt 08.04 - fixed assets received under a leasing agreement are accepted for accounting. Dt 76. lease obligations Kt 76. debt on leasing payments - the current payment under the leasing agreement is accrued. Dt 20.01 (another cost account) Kt 02.01 - depreciation was accrued on fixed assets received under lease. Dt68.02 Kt 19.01 - the part of the VAT corresponding to the accrued payment is presented for deduction. Dt 76. debt on leasing payments Kt 51 - payment under the leasing agreement is transferred.

Tax accounting

The new lessee accepts the leased asset for tax accounting at its residual value, determined according to the tax accounting data of the original lessee (or the lessor, if before the change of lessee the property was recorded on the lessor’s balance sheet).

The residual book value formed by the old lessee is not taken into account in any way in the accounting of the new lessee.

You can get recommendations on concluding a leasing agreement, as well as learn more about what tax consequences arise for the lessor and lessee in the “Agreements” Directory in the “Legal Support” section on ITS

You can get acquainted with numerical examples on accounting for leasing payments and on accounting for transactions when the lessee changes in the “Leasing” directory in the “Accounting and Tax Accounting” section on ITS

| Users of ITS versions of PROF can receive free consultations from auditors on accounting and taxation issues, as well as consultations from labor law specialists on personnel issues. You can send your questions to: The letter must indicate the registration number of the program for which the 1C:ITS contract is issued and describe in detail the situation requiring consultation. You can read other responses from auditors to user questions You can enter into an information technology support agreement with a recommended partner. |

Change of lessee under a leasing agreement

A prerequisite for the transfer of debt to a third party, in accordance with paragraph 2 of Art. 391 of the Civil Code of the Russian Federation, is the presence of the written consent of the creditor. If it is missing, the concluded transaction will be considered void. The legislator does not establish the exact form and content of such a document, so the lessor can draw it up independently.

The sequence of actions aimed at completing the documentation accompanying the change of lessee is as follows:

- The recipient of property under a leasing agreement applies to the lessor with a written request to obtain permission to transfer the object of the agreement, as well as related rights and obligations to a third party under the terms of a financial lease.

- The lessor reviews the proposal received and gives a written response, which can be either positive or negative. If the answer is negative, the lessee is deprived of the opportunity to make the assignment.

- Based on the permission received, the old and new lessors, as well as the lessee, enter into a tripartite agreement, the provisions of which regulate the procedure for transferring property to the new recipient and making payments to the accounts of counterparties, as well as other issues that the parties to the transaction consider significant.

In the event that the property leased was registered in the name of the original lessee under the agreement, it, in accordance with Art. 20 Federal Law No. 164, it is necessary to re-register with a new lessee.

We give the leased item for re-rental

The article from the magazine "MAIN BOOK" is current as of October 2, 2015.

Contents of the magazine No. 20 for 2015 L.A. Elina, economist-accountant

Tax accounting for the lessee in the last month of use of the leased property

A leasing agreement is usually concluded for several years. However, the plans or capabilities of the lessee may change - the equipment will no longer be needed or leasing payments will become too high. You can terminate the leasing contract, but this is often fraught with the payment of a penalty or other losses. Therefore, it is better to find a replacement - to enter into a re-lease agreement/agreement, under which another company will become the lessee (there will be a change of party in the original leasing agreement). Of course, if the lessor agrees to such a replacement. 2 tbsp. 615, paragraph 1, art. 389, para. 1, 2 tbsp. 391, art. 392.3 Civil Code of the Russian Federation; clause 1 art. 18 of the Law of October 29, 1998 No. 164-FZ.

After a change of lessee has occurred, accounting issues arise. We will consider the features of “profitable” tax accounting of the operations of the former lessee if the leased asset was taken into account on his balance sheet.

Assignment under a leasing agreement

Assignment under a leasing agreement means the transfer by the lessee of the right to use the leased property to a third party under the conditions established by the provisions of the concluded leasing agreement.

The need to assign rights arises if the lessee is unable to independently fulfill its financial obligations or no longer needs the property leased. Termination of a previously concluded agreement is fraught with various sanctions for the party that put forward such an initiative (including the emergence of an obligation to pay fines and penalties). That is why most lessees seek to find a company that can assume the rights and obligations that arise when concluding a leasing agreement.

According to paragraph 2 of Art. 615 of the Civil Code of the Russian Federation, the replacement of the lessee can be qualified as a re-lease. In this case, the new participant in the legal relationship that arose during the transfer of property assumes all the rights and obligations of its previous recipient.

The assignment procedure should be distinguished from the transfer of property for subleasing, which, according to clause 1 of Art. 8 Federal Law No. 164, is a type of sublease of property received under lease, in which the recipient under a leasing agreement transfers it for possession and use to third parties on the basis of a concluded agreement establishing the amount of payment for the use of such property, as well as the terms for which it is transferred to the recipient under the subleasing agreement. In this case, the sublessee does not acquire any rights and obligations to the main lessor - he has legal relations only with the lessee.

We deal with advances to the lessor

Often, the lessee transfers to the lessor, in addition to payments for the use of the leased asset, also advance payments.

If the amount of the advance payment remains unaccounted for on the date of change of lessee (that is, on the date of signing the contract/release agreement), you need to decide what to do with this amount. Under the terms of the re-lease agreement, the new lessee becomes responsible to the lessor: not only all obligations, but also all rights under the leasing agreement are transferred to him. Therefore, the original lessee cannot demand that the lessor return the advance; he also transferred this right to the new lessee. You can receive this money from the new lessee if this was agreed upon in the agreement.

Income tax. The original lessee must include in its income the amounts due to be received from the new lessee. 1 tbsp. 249 of the Tax Code of the Russian Federation.

Often, the new lessee will be charged a rehire fee or rental/leasing fee. In some cases, it is expected to cover all costs of the original lessee, including the advance payment made to the lessor. In other cases, the money intended to reimburse the advance payment transferred to the lessor must be transferred by the new lessee separately from the re-rental fee. In any case, all money due to you (except for VAT) must be taken into account in income.

In this case, the amount of the advance, reduced by VAT, the rights to which are assigned to the new lessee, can be taken into account in tax expenses.

FROM AUTHENTIC SOURCES

NOVOSELOV Konstantin Viktorovich State Councilor of the Russian Federation, 2nd class, Ph.D. n.

“For the purpose of calculating income tax, the payment under the re-lease agreement for the leased asset (excluding VAT) is recognized as income from sales on the date of signing the re-lease agreement. 1 tbsp. 248, paragraph 1, art. 249, paragraph 3 of Art. 271 Tax Code of the Russian Federation.

For profit tax purposes, transactions related to the reimbursement of the advance paid to the lessor between the old and new lessee are taken into account in the manner established for transactions on the assignment of a claim. In this case, the creditor can reduce the income received for the costs of acquiring the right of claim. 2 tbsp. 279 Tax Code of the Russian Federation.

On the date of signing the re-lease agreement, the original lessee recognizes in income the amount received from the new lessee as reimbursement of the advance. And the expenses take into account the amount of the advance itself (excluding VAT).”

What to do if the amount to be received from the new lessee does not fully cover the amount of the advance payment transferred to the lessor?

“The taxpayer has the right to reduce the income received from the sale of the right of claim by the amount of expenses for acquiring the specified right to claim the debt. When exercising a property right, which represents the right to claim a debt, the tax base is determined taking into account the provisions of Art. 279 Tax Code of the Russian Federation subp. 2.1 clause 1 art. 268 Tax Code of the Russian Federation.

The negative difference between the income received from the sale of the right to claim a debt and the amount of expenses for the acquisition of the specified right to claim a debt, including the purchase price of this property right and the costs associated with its acquisition and sale, is recognized as a loss under the transaction of assignment of the right to claim a debt, which taken into account when forming the tax base for corporate income tax, sub. 2.1 clause 1 art. 268; clause 2 art. 279 Tax Code of the Russian Federation; Letter of the Federal Tax Service dated November 11, 2011 No. ED-4-3/ [email protected]

If the original lessee, under the terms of the re-lease agreement, must receive from the new lessee an amount less than the amount of the advance to the lessor, the rights to which are transferred under the re-lease agreement, then:

- the amount of the advance to the lessor can be fully taken into account in expenses when calculating income tax;

- the amount of the resulting loss from such an operation is fully taken into account when calculating the income tax base.”

NOVOSELOV Konstantin Viktorovich State Councilor of the Russian Federation, 2nd class, Ph.D. n.

VAT. Do not forget that the amounts due for payment by the new lessee must be subject to VAT. 1 clause 1 art. 146, paragraph 5 of Art. 155, paragraph 1, art. 154 Tax Code of the Russian Federation. So you need to issue an invoice to the new lessee.

Moreover, the VAT base should be determined on the date of signing the rehire agreement. 8 tbsp. 167 Tax Code of the Russian Federation; Art. 389 Civil Code of the Russian Federation; Letter of the Federal Tax Service dated 08/01/2011 No. ED-4-3/ [email protected]

Here another question arises: is it necessary to restore VAT from the advance payment to the lessor, which was previously accepted for deduction? Let us remind you that it is necessary to recover VAT from advances. 3 p. 3 art. 170 Tax Code of the Russian Federation:

- <or>in the period in which VAT amounts on purchased goods (works, services) are subject to deduction;

- <or>in the period in which there was a change in conditions or termination of the contract and the return of the advance.

In our case, the lessor does not return the advance payment. Therefore, there is no need to restore the tax from the advance payment.

DUMINSKAYA Olga Sergeevna Advisor to the State Civil Service of the Russian Federation, 2nd class

“When the lessee transfers rights under a leasing agreement to a new lessee, property rights are transferred, which is subject to VAT. 1 clause 1 art. 146 of the Tax Code of the Russian Federation. Since the specifics of determining the tax base in these cases in Ch. 21 of the Tax Code of the Russian Federation is not established; the tax base is determined in the general manner - as the value of the transferred property rights, calculated on the basis of the contract price without including VAT. 1 tbsp. 153, paragraph 1, art. 154, paragraph 5 of Art. 155 Tax Code of the Russian Federation.

Thus, the original lessee must include in the VAT base the entire value of the transferred rights.

If the rights to an advance transferred to the lessor by the original lessee are transferred to the new lessee, the latter does not restore VAT on such advance as of the date of transfer of property rights. After all, the conditions under which such restoration is required are not met. 3 p. 3 art. 170 of the Tax Code of the Russian Federation.”

Checking depreciation charges

All tax expenses must be real and economically justified. Moreover, their repeated inclusion in the tax base is unacceptable. 1.5 tbsp. 252 of the Tax Code of the Russian Federation. When exiting a leasing agreement early, it is especially important to take this rule into account.

So, for the entire term of the leasing agreement - while your organization was still a lessee - you can recognize as full expenses the amount that is equal to the amount of current lease payments to the lessor. Of course, with the exception of that part of them that should be taken into account as an advance.

Often the leasing agreement provides for a condition for the purchase of the property by the lessee. Sometimes the redemption price is paid by the lessee evenly - monthly as part of the lease payments. In this case, the part that goes into payment

redemption price will form the initial cost of the leased asset after its redemption. It can be recognized as an expense only at the end of the leasing agreement - either through depreciation or at a time (if the former leased asset is not taken into account as a fixed asset) Letter from the Ministry of Finance dated 06/02/2010 No. 03-03-06/1/368; Federal Tax Service dated May 26, 2010 No. ШС-37-3/ [email protected] ; Federal Tax Service for Moscow dated May 16, 2011 No. 16-15/ [email protected]

Thus, it is safer not to include redemption payments paid during the term of the leasing agreement as part of the lessee's expenses.

Since the leased asset was on the balance sheet of the lessee, the organization had the right to calculate depreciation. And current leasing payments could be taken into account as an independent expense only if they exceeded the depreciation accrued in a particular month. 10 p. 1 art. 264 Tax Code of the Russian Federation.

Let us recall that the initial tax value of the leased asset, on the basis of which depreciation should be calculated, is determined as the amount of the lessor's actual costs for the acquisition of this fixed asset, even if it is taken into account on the lessee's balance sheet. 1 tbsp. 257 Tax Code of the Russian Federation; Letter of the Ministry of Finance dated 02/03/2012 No. 03-03-06/1/64. The total amount of lease payments is higher than the original cost of the leased asset. However, the lessee can apply a special depreciation rate of no higher than 3 (which must be enshrined in the accounting policy for tax purposes) if the leased asset belongs to depreciation groups 4-10, sub. 1 item 2 art. 259.3 Tax Code of the Russian Federation. And it is precisely accelerated depreciation that can lead to the fact that in case of early exit from the leasing agreement, the lessee’s tax accounting will write off more as expenses than accrued current lease payments in accordance with their schedule.

Despite the fact that depreciation was calculated correctly, in the event of early termination of the leasing agreement or (in our case) a change of lessee, you will have to:

- <or reduce your expenses in the form of accrued depreciation by the amount of excess depreciation over current leasing payments;

- <or include such amount in income.

Therefore, calculate how much was included in expenses during the lease agreement and how many current lease payments were actually accrued under the terms of the agreement. Of course, following the safe accounting option, we take into account only that part of the lease payments that does not include the redemption price.

If more expenses are recognized than accrued current payments to the lessor, restore the difference using one of the methods indicated above.

This difference is calculated using the following formula.

There is no need to submit any updated declarations for previous periods: everything was previously calculated correctly.

Example. Accounting by the lessee of expenses in the form of depreciation and current payments

/ condition / The initial cost of leasing equipment in tax accounting is RUB 300,000. Under the terms of the leasing agreement, the lessee, company A, must pay 6,250 rubles monthly for 6 years (the duration of the leasing agreement and the useful life of the equipment). excluding VAT. The total amount of leasing payments excluding VAT is RUB 450,000.

Company A records the leased asset on its balance sheet and calculates depreciation taking into account a special increasing factor equal to 3. The amount of monthly depreciation is 12,500 rubles. (RUB 300,000 / 6 years / 12 months x 3).

The leased asset is depreciated over 11 months.

/ decision / For 11 months of the lease agreement with company A:

- depreciation charges in the total amount of 137,500 rubles are taken into account in expenses. (RUB 12,500 x 11 months);

- under the terms of the leasing agreement, the amount of current payments amounted to 68,750 rubles. (RUB 6,250 x 11 months). Which is two times less than the amount of accrued depreciation. Current lease payments were not taken into account as independent expenses.

If a re-lease agreement is concluded, Company A will have to restore part of the previously recognized expenses in tax accounting.

If monthly depreciation charges were less than or equal to the current payments, nothing will have to be restored.

Expenses of the original lessee in the month of rehire

Depreciation and current payments. Some lessees have a question: should they charge depreciation for the last month of the lease agreement or not? And is it still possible to apply the special leasing coefficient?

As a general rule, depreciation stops starting from the month following the month of disposal of the fixed asset. 5 tbsp. 259.1 Tax Code of the Russian Federation. Consequently, the lessee can charge depreciation, including in the month in which he transfers the leased asset to his successor - the new lessee.

And there are no restrictions on the use of the leasing coefficient in the last month. Resolution of the AS UO dated June 29, 2015 No. F09-4307/15.

“Taxpayers have the right to apply a special coefficient to the basic depreciation rate (but not higher than 3) in relation to depreciable fixed assets that are the subject of a leasing agreement (if they do not belong to depreciation groups 1-3) sub. 1 item 2 art. 259.3 Tax Code of the Russian Federation.

Thus, when calculating depreciation in the month of transfer of the leased asset to a new lessee, the original lessee has the right to apply a special coefficient. 5 tbsp. 259.1 of the Tax Code of the Russian Federation.”

NOVOSELOV Konstantin Viktorovich State Councilor of the Russian Federation, 2nd class, Ph.D. n.

However, as we have already said, the amount of expenses that the lessee can take into account when calculating income tax for the entire term of the leasing agreement is limited to the amount of current leasing payments. And if the previously accrued depreciation is greater than the total amount of current payments, then there is no point in taking anything into account in the expenses of the month of rehiring. You will still have to recover expenses. So, if in the example above, a re-lease agreement was concluded in the 12th month, then on the last day of the 12th month of the leasing agreement:

- the amount of current leasing payments payable by company A to the lessor will be 75,000 rubles for 12 months;

- if you do not accrue depreciation in the month of rehire, then you will need to restore expenses in the amount of 62,500 rubles. - the difference between the amount of depreciation charges for 11 months and current payments for 12 months (137,500 rubles - 75,000 rubles);

- if you calculate depreciation for the 12th month with a coefficient of 3 in the same amount - 12,500 rubles, then you will need to restore expenses in the amount of 75,000 rubles. ((RUB 137,500 + RUB 12,500) – RUB 75,000);

- if you calculate depreciation for the 12th month without factor 3 in the amount of 4,167 rubles, then you will have to recover 66,667 rubles. ((RUB 137,500 + RUB 4,167) – RUB 75,000).

In any of the options, the income tax base in the month of rehiring after adjusting expenses should increase by 62,500 rubles.

Underwritten expenses associated with obtaining the leased asset. As we have already said, the initial cost of the leased asset is formed based on the lessor’s information about its costs. But the lessee could have his own expenses, for example, those associated with the delivery of the leased property and bringing it to working condition. They cannot be taken into account in the initial cost. The Ministry of Finance recommends recognizing such expenses on a straight-line basis over the term of the leasing agreement. 3 p. 1 art. 272 Tax Code of the Russian Federation; Letter of the Ministry of Finance dated 02/03/2012 No. 03-03-06/1/64.

In case of early repurchase, the lessee can simultaneously take into account in the “profitable” base part of the unaccounted expenses for delivering the object and bringing it to a condition suitable for use. Letter of the Ministry of Finance dated 01.02.2011 No. 03-03-06/1/49. It would seem logical to do the same in the case of signing a rental agreement. However, not everything is so simple.

“The costs underwritten by the original lessee for delivering the leased asset and bringing it to working condition can be taken into account when determining the tax base for income tax only if they are reimbursed by the new lessee. Otherwise, they can be considered as expenses in the form of the cost of gratuitously transferred property (work, services, property rights), which do not reduce the tax base on the basis of clause 16 of Art. 270 Tax Code of the Russian Federation.

For example, the original lessee leased a car for 3,000,000 rubles and paid 200,000 rubles to have it driven from Moscow to Khabarovsk. Perhaps the car was leased for some time - in this case, during the period of validity of the contract, he takes into account both leasing payments and the costs of delivering this car in equal parts, calculated based on the term of the contract. After some time, the leased asset is re-leasing by a new lessee, and he receives 3,000,000 rubles. However, the real costs of the original lessee are RUB 3,200,000. It turns out that he spent 200,000 rubles, which no one compensates for him, and, from the point of view of the Tax Code, this is a gratuitous transfer.

There are different points of view on the issue of accounting for the unwritten portion of delivery costs. I am closer to the position according to which the old lessee can take into account such costs only in the part that is compensated by the new lessee. Or if such compensation is not provided for in the contract, it does not take them into account.”

NOVOSELOV Konstantin Viktorovich State Councilor of the Russian Federation, 2nd class, Ph.D. n.

***

In the tax accounting of a lessee who has entered into a re-lease agreement with a new lessee, the residual value of the leased asset cannot be taken into account as expenses. After all, the owner of the property was and remains the lessor. 1 tbsp. 11 of the Law of October 29, 1998 No. 164-FZ.

Tax risks of a leasing agreement. Review of arbitration practice

Leaseback

Let's start with leaseback, since traditionally it is this type of relationship within the framework of a financial lease that attracts the closest attention of tax authorities.

Let us recall that leaseback refers to the sale of property to a leasing company with the subsequent registration of the same property under financial lease. Moreover, the same person acts as the lessee and the seller. Such legal relations are not prohibited by law. Moreover, they are directly provided for in paragraph 1 of Article 4 of the Law of October 29, 1998 No. 164-FZ “On financial lease (leasing)”. And companies are actively using this opportunity. Since such deals are quite profitable. And that's why. The fact is that through leaseback the company can replenish its working capital. Let's give an example. The plant has equipment, but does not have enough funds to develop production. An enterprise, having sold the assets of a leasing company, gets the opportunity to invest the money received in the business and does not lose the right to use its equipment. In essence, it is very similar to bank lending, but has a number of significant advantages. Firstly, leasing payments minus accrued depreciation on leased property reduce the tax base for profits. This is stated in subparagraph 10 of paragraph 1 of Article 264 of the Tax Code. While interest on a loan can be written off as expenses, subject to the restrictions established by Article 269 of the Code, since interest on a debt obligation for profit tax purposes is included in the category of standardized expenses.

Secondly, if the property is accounted for on the lessee's balance sheet, he can accelerate its depreciation in tax accounting. After all, paragraph 7 of Article 259 of the Tax Code allows the use of an accelerated depreciation rate - but not higher than 3. Thus, depreciation deductions more than the basic norm can be taken into account in expenses. But there is one exception here. These provisions do not apply to fixed assets of the first, second and third depreciation groups, if depreciation on such objects is calculated using a non-linear method.

And thirdly, the lessee can save on property taxes. This is possible if the leased asset is recorded on the lessor’s balance sheet.

As mentioned above, tax authorities regard leaseback operations as a tax evasion scheme. This is clearly visible when analyzing arbitration practice. Fortunately, the courts are more lenient. They indicate that such transactions fully comply with the law, and do not find in the actions of taxpayers a desire to obtain an unjustified tax benefit. This conclusion follows, in particular, from the resolution of the Presidium of the Supreme Arbitration Court of September 11, 2007 No. 16609/06.

Another example is the resolution of the Federal Antimonopoly Service of the Moscow District dated April 5, 2007 No. KA-40/1692-07-1,2, in which the judges also emphasized that leaseback is permitted by law. And if an enterprise lacks working capital, but has the necessary equipment for production, the leaseback transaction is due to economic reasons. Thus, it is quite possible to defend the right to a transaction in court, provided that it is economically justified and the business transactions are real.

Leaseback transactions may attract the attention of inspectors even if the parties make non-monetary payments for them. For example, bills or offset of mutual claims. Also, when the parties are interdependent, although this fact in itself does not indicate the company’s dishonesty. This is stated in the resolution of the Plenum of the Supreme Arbitration Court dated October 12, 2006 No. 53. Remember, the responsibility to prove that the interdependence of the parties to the transaction affects their tax obligations lies with the inspectors.

Change of persons in the leasing agreement

Quite often in leasing practice, re-leasing occurs. That is, a replacement of the lessee. These relations are regulated by paragraph 2 of Article 615 of the Civil Code, which provides that the tenant has the right, with the consent of the landlord, to transfer his rights and obligations to another person.

Replacing the lessee is possible only with the permission of the lessor. After all, such actions are nothing more than a transfer of debt. And in accordance with Part 1 of Article 391 of the Civil Code, this is allowed only with the consent of the creditor, which is also reflected in arbitration practice - Resolution of the Federal Antimonopoly Service of the Moscow District dated March 21, 2006 No. KG-A41/1606-06.

In such a situation, it is important to determine the tax obligations of all parties to the transaction: the lessor, the new lessee and the previous one. So, when there is a change of persons in the obligation, the contract does not lose its force. Thus, all benefits are transferred to the new lessee. That is, he has the right to apply an accelerated depreciation rate. He will charge it on the residual value formed by the old tenant at the time of transfer of the property to the new one. That is, the initial cost of the leased property does not change in this situation. After all, the owner remains the same - the lessor. And even if the residual value formed at the time of transfer is less than 20,000 rubles, the new lessee has no reason to recognize the property as non-depreciable and include it in expenses at a time. This conclusion is confirmed by the Ministry of Finance in letters dated July 19, 2005 No. 03-03-04/1/91 and dated October 15, 2005 No. 03-03-02/114.

The opposite situation is also possible - replacement of the lessor. This is directly provided for in paragraph 1 of Article 18 of the Law “On Financial Lease (Leasing)”. According to this rule, the lessor may assign to a third party all or part of its rights under the agreement. In this case, the consent of the lessee

not required by law. However, in order to avoid claims from the parties, it is better to formalize it in writing, according to the rules of Article 391 of the Civil Code. And from the moment the full assignment of rights and obligations under the leasing agreement occurs, the lessee is obliged to transfer payments to the new lessor (Resolution of the Federal Antimonopoly Service of the Moscow District dated May 30, 2006 No. KG-A40/4202-06).

Please note that the transfer of ownership of the leased property does not entail termination of the contract or revision of its terms. This also applies to the amount of payments. Therefore, if the new landlord wants to increase the rent, then it is worth going to court. In such situations, the arbitrators take the side of the lessee (resolutions of the FAS Volga-Vyatka District dated October 10, 2005 No. A79-10625/2004-SK2-9987, FAS West Siberian District dated August 1, 2005 No. F04-4851/2005 ( 13466-A27-24).

Note that if a leasing agreement requires state registration, then if the lessor changes, the assignment must also be registered in the manner established for registration of this type of agreement.

Tax aspects

Let's consider several problematic aspects in leasing transactions related to value added tax. The first is that if, under the terms of the agreement, the property is listed on the lessor’s balance sheet and he has not yet received ownership of it, the lessee may have problems with deducting VAT on lease payments. When refusing deductions, officials appeal to paragraph 1 of Article 172 of the Tax Code, according to which deductions can be applied only after the property is registered. This is the official position of the financial department - letter of the Ministry of Finance dated November 22, 2004 No. 03-03-01-04/1/128.

However, an analysis of arbitration practice allows us to find arguments against this approach. Leasing is the same rent, that is, a service (Resolution of the Federal Antimonopoly Service of the Moscow District dated August 2, 2004 No. KA-A40/6332-04). It is consumed as it is provided. And when the lessee displays an invoice indicating the fact of provision of the service and drawn up on the basis of the payment schedule, he fulfills all the conditions in order to apply a VAT deduction. Namely: the service for the corresponding month was purchased, registered (reflected in accounting), and there is a properly executed invoice for the service. This conclusion is confirmed by the resolution of the Federal Antimonopoly Service of the Moscow District dated June 23, 2004 No. KA-A41/5172-04. It states that the VAT amounts were paid not on acquired fixed assets, but on leasing services. And this is an independent object of taxation. And since services are registered in the process of their consumption, then the payer has complied with the requirements of Article 172 of the Tax Code on the procedure for applying tax deductions. Thus, the comments of the tax authorities “about the moment of transfer of ownership of the leased asset, although consistent with the legislation on leasing and civil legislation, have no relation to this case.”

The second aspect is that claims for VAT deductions are possible even if property that requires state registration is leased. For example, special equipment. The opinion of officials is this: until its state registration, deduction of VAT paid as part of leasing payments is impossible. This position is based on the fact that until special equipment has been registered and a registration certificate has been received for it, it cannot be registered as a fixed asset, and, thus, it is not involved in activities subject to VAT.

The court decided otherwise. In the decisions of the FAS Volga-Vyatka District dated March 2, 2006 No. A29-10504/2005a, the FAS Central District dated February 16, 2005 No. A36-182/2-04, the arbitrators recalled that the necessary conditions for the application of tax deductions are: acquisition goods (works, services) for production purposes or for resale; capitalization, that is, registration, and the availability of an invoice drawn up according to the rules of Article 169 of the Tax Code. And Articles 171 and 172 of the Code do not make the right of a company to apply tax deductions dependent on the absence or availability of technical passports for equipment.

Unfortunately, arbitration practice in the Moscow region on this issue has not developed. But, given the convincingness of the arguments, we consider it possible in a dispute with tax authorities to appeal to the practice of arbitration courts in other regions.

The third aspect concerns VAT on major repairs and inseparable improvements to leased property. The position of the tax authorities is that the lessee is obliged to charge VAT to the budget when transferring inseparable improvements to the leased property to the owner, and it does not matter whether the latter compensates for the cost of the improvements or not. The difference in this case will be in determining the tax base. If the cost is compensated, then VAT must be charged on the amount received from the lessor. If not, then for the amount of improvements reflected in the lessee’s accounting.

Let us note that the latter’s right to deduct VAT should not be called into question. Since the requirements of Articles 171 and 172 of the Tax Code have been met.

If we talk about the repair of leased property, then usually, under the contract, both major repairs and routine repairs are carried out by the lessee. And such expenses should be reflected in the same way as the procedure for recording repairs of your own property. Thus, in this situation, VAT deduction is also legal.

According to financiers, if the recipient of the property has already begun to transfer lease payments, but the objects received under the contract have not yet been put into operation, then to take them into account in profit expenses, you need to keep in mind the following. If the delay in commissioning is caused by the need to bring the facility to a condition suitable for use, then you have every right to include leasing payments in expenses. This is what the Ministry of Finance explained in a letter dated March 7, 2008 No. 03-03-06/1/160.

Income tax

What about income tax payments for improvements? Is it possible to apply an accelerated depreciation rate to them if the property is on the lessee’s balance sheet? Here we must proceed from the fact that improvements can be separable and inseparable.

If, according to the agreement, separable improvements are made at the expense of the lessee and are his property, then the tax authorities are against accelerated depreciation. The main argument: they are not the subject of a leasing agreement. They are the property of the “tenant” and cannot have any relation to paragraph 7 of Article 259 of the Tax Code. They can be depreciated as usual. This position is reflected in the letter of the Ministry of Finance dated March 29, 2004 No. 04-02-05/1/6.

And the company that receives the property takes into account inseparable improvements, depending on the situation, in different ways. Usually they are produced with the written consent of the lessor, and the latter compensates the lessee for their cost. Then it “is recognized as an expense by the latter as income from the compensation received, taking into account Articles 268 and 323 of the Code” (letter of the Ministry of Finance dated September 13, 2007 No. 20-12/087480). Moreover, the owner’s consent to improvement and compensation of expenses is better reflected in the leasing agreement, and not in any form, in the form of, for example, a letter. Since the tax authorities insist on this in a letter from the Ministry of Taxes and Duties dated June 21, 2004 No. 02-4-07/229.

If the cost of capital investments is not reimbursed, then the lessee will depreciate it over the term of the contract based on depreciation amounts calculated taking into account the useful life.

Note that officials allow the lessee to take into account the costs of capital investments in the form of inseparable improvements to the leased asset only after state registration has either already been carried out or documents have been submitted for it (letter of the Ministry of Finance dated April 2, 2008 No. 03-11-04/3 /168).

Marina Antoshina , tax lawyer

a comment

Group legal advisor Vera Potekhinskaya :

Among the individual problematic situations when the parties to a leasing agreement have tax risks, the author of the article includes the conclusion by the parties of a leaseback agreement, a change of persons in the leasing agreement, the lessor’s lack of ownership rights to the leased asset at the time of its transfer to the lessee, the transfer of property requiring registering it, making separable and inseparable improvements to the leased asset by the lessee.

Tax authorities tend to see taxpayers receiving an unjustified tax benefit in these cases, and the courts often support the other side. In Resolution No. 53 of October 12, 2006, the Supreme Arbitration Court understands tax benefit as a reduction in tax liability, in particular, receipt of tax deductions and tax refunds. If obtaining a tax benefit is an independent business goal, there are no reasonable motives for the economic activity of the parties to the leasing agreement, the actions of the taxpayer are recognized as unfair, and the tax benefit is considered unjustified. Economic justification is not equivalent to economic efficiency (resolution of the Federal Antimonopoly Service of the Volga Region dated October 2, 2007 in case No. A72-6677/06-12/228).

In addition to the judicial act named by the author of the article, a similar position on the issue of recognizing the transfer of leasing of property that is not depreciable as a service of the lessor to the lessee, takes place in the decisions of the Federal Antimonopoly Service of the Moscow Court dated November 15, 2007 No. KA-A40/11969-07, dated 5 July 2007, June 28, 2007 No. KA-A40/5976-07.

electronic edition of 100 ACCOUNTING QUESTIONS AND ANSWERS BY EXPERTS

A useful publication with questions from your colleagues and detailed answers from our experts. Don't make other people's mistakes in your work! The latest issue of the publication is available to berator subscribers for free.

Get the edition