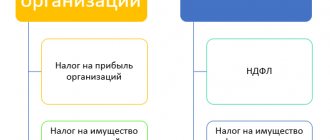

The patent system (remember the abbreviation PSN) is one of the special regimes for entrepreneurs. Unlike the simplified tax system, it is available only to individual entrepreneurs and has a number of concessions, for example, the lack of reporting. A patent replaces taxes on property, value added and income of individuals.

The patent system has existed since 2013. Before this, entrepreneurs were on the simplified tax system on a patent basis.

The essence of this system is that the individual entrepreneur receives a patent and does not pay part of the taxes. If, for example, you received a patent for the provision of logistics services, then you do not need to pay income tax on this activity. For other types of activities (if any), a different taxation system is applied. PSN is described in detail in Chapter. 26.5 Tax Code of the Russian Federation.

Attention! The patent applies to business only in the territory where the individual entrepreneur is registered. To work on a patent at the place of business, you need to submit an application to the local patent department of the Federal Tax Service.

Who can apply the patent tax system?

Only individual entrepreneurs who bought a patent or several patents in the prescribed manner. The patent system is available for different types of activities.

Who is the patent tax system suitable for:

- software developers;

- to retailers in areas not exceeding 150 m2;

- catering representatives;

- owners of beauty salons and hairdressers;

- landlords;

- workshops for repairing/sewing clothes, shoes or household appliances;

- parking lot owners;

- private tutors who receive official payment;

- language schools and translators, etc.

All types of activities are described in Art. 346.43 Tax Code of the Russian Federation. But constituent entities of the Russian Federation have the right to expand this list, so also read the regional legislation on PSN.

There are also restrictions on the use of a patent. Entrepreneurs who conduct business under a partnership agreement or under a property trust agreement, are engaged in wholesale trade, provide credit and financial services, or make transactions with securities will not be able to switch to the PSN. There are also a number of restrictions on physical indicators:

- for retail trade - the sales floor area should not exceed 150 m² for each facility;

- for catering - the area of the service hall should not be more than 150 m²;

- for cargo and passenger transportation - the individual entrepreneur should not own more than 20 cars.

Regions may introduce additional restrictions on physical indicators. For example, individual entrepreneurs who have 15 vehicles for transporting goods should not be allowed to buy a patent.

Excise goods listed in paragraphs cannot be sold on a patent. 6-10 p. 1 tbsp. 181 of the Tax Code of the Russian Federation, and some types of goods subject to mandatory labeling: medicines, shoes and fur products. Beer and cigarettes can be sold.

How to switch to a patent tax system?

The procedure for switching to a patent is as follows:

- Submit an application to the Federal Tax Service at the place of registration of the individual entrepreneur 10 or more working days before you start using the PSN. You can submit your application by mail or electronically. The application form was approved by order dated December 9, 2020 No. KCh-7-3/ [email protected]

2. Five working days after receiving the application, the Federal Tax Service must issue you a patent or notify you of the refusal against receipt.

Why they may refuse:

- A type of activity is indicated that is not included in the list of eligible patents.

- Incorrect patent expiration date.

- You already lost the right to enforce the patent this year, and this is your re-application.

- You have patent tax debts.

How long does a patent last?

You can be on this tax system from a month to a year, but within one calendar year. That is, you cannot obtain a patent from March 10, 2022 to March 10, 2022, until a maximum of December 31, 2022. Then you need to get a new patent. As you probably guessed, you can get a patent for less than a month.

How to renew a patent

As we have already said, a patent is a document that allows you to engage in one type of activity for several months in a row. Sometimes entrepreneurs decide to temporarily try out this taxation option, so a patent is issued for a short period, assuming that it can be extended later.

This would be convenient, but, unfortunately, the Tax Code does not provide for the extension of an individual entrepreneur’s patent for the next tax period. If you work for PSN and you are satisfied with this regime, then you need to submit a new patent application for individual entrepreneurs for 2022 on time. Moreover, it is better to choose the maximum possible period, i.e. 12 months.

If you applied for a shorter period, do not forget to apply for a new patent in time, otherwise activities on the PSN will have to be suspended. The deadline for filing an application for a new patent is the same as for its initial receipt - no later than 10 working days before the start of validity.

How to calculate the value of a patent?

There is a certain formula for calculation. 346.51 Tax Code of the Russian Federation:

Patent cost = potential income (PI) per year / 365 (366) × number of days for which the patent was obtained × 6%.

6% is the tax rate for a patent, according to Art. 346.50 Tax Code of the Russian Federation. In Crimea and Sevastopol, the patent rate cannot be higher than 4% until 2022. And the constituent entities of the Russian Federation can establish a tax rate of 0% for newly registered individual entrepreneurs working in the fields of production, science, social and consumer services.

Potential income is determined by the subject of the Russian Federation. There are currently no restrictions on its amounts, so in different regions the potential income may differ significantly. The period for which potential income is established is 1 year. If there have been no changes, then the previous year's limit applies by default. Previously, the Tax Code of the Russian Federation limited potential income to 1 million rubles, and regions could increase it, but now this rule has been removed - there are no restrictions.

The cost of a patent can be calculated on the tax service website.

Example . Pyshka LLC is a cafe in Yekaterinburg. Its area is 50 m². Regional authorities have established the potential income per 1 m² of the visitor service hall in the amount of 29,137 rubles per year. To calculate the cost of a patent for March-December 2022, we use the formula given above:

Potential income for the year = 29,137 rubles × 50 m² = 1,456,850 rubles.

The cost of a patent per year = 1,456,850 / 365 × 306 × 6% = 73,282 rubles.

From 2022, the cost of a patent can be reduced by a deduction similar to that existing on the simplified tax system “income” and UTII. Entrepreneurs will be able to reduce the cost of a patent by:

- the amount of insurance premiums for yourself and your employees,

- the amount of sick leave for the first three days of employee illness;

- the amount of contributions for voluntary personal insurance of employees.

At the same time, there is a limitation for individual entrepreneurs with employees - they reduce the patent by a maximum of 50%, even if the amount of the deduction exceeds the cost of the patent. Entrepreneurs without employees can reduce the cost of a patent down to zero if the deduction amount is sufficient for this.

PSN rate for 2022

This year, the tax rate on the patent taxation system for entrepreneurs will be 6%.

Only such regions as Crimea and Sevastopol were allowed to set a lower rate (according to Part 2 of Article No. 346.50 and 7 of Article No. 12 of the Tax Code of Russia). In these regions, the rate is reduced to four percent.

At the same time, the authorities of any entity have the right to set a zero rate for individual entrepreneurs on a patent, that is, to provide temporary tax holidays. However, those individual entrepreneurs who meet a number of conditions receive such benefits.

A businessman can apply a tax rate of 0% immediately after registration, and then during two tax periods (in total, no more than two years).

Also, in the event of termination and subsequent resumption of activities by an entrepreneur, he can take advantage of a deferment in the payment of taxes - tax holidays.

An important condition for using a rate equal to 0% is the start of work of an individual entrepreneur after the entry into force of the law introducing such a measure of support for SMEs as tax holidays.

According to paragraph 2 of Article 346.50 and paragraph 7 of Article 12 of the Tax Code, if the conditions for applying the zero rate are violated, the businessman must pay tax contributions at the full rate of his region.

It is also worth considering that if one or more patents fall under the zero rate, an entrepreneur in this tax system needs to organize separate accounting of income.

How to reduce the patent on contributions

To reduce the tax on contributions under the simplified tax system, we submit a tax return, but the patent does not provide for declarations. To enable patent holders to reduce their tax, the Federal Tax Service has developed a special notification form - Federal Tax Service letter dated January 26, 2021 No. SD-4-3/ [email protected] The notification consists of a title page and two sections. Submit one notification at once for all patents from one inspection whose value you want to reduce.

The submission deadline has not been confirmed. If you have already paid for the patent and did not take into account the deduction, the overpayment of tax will be returned or counted against future payments. Send the notification to the tax office where you are registered as a patent payer and to which you pay this tax.

How to submit

The appeal is submitted to the tax office no later than ten days before the application of the taxation system in the following order.

- If business activity is carried out at the place of residence, the application is submitted to the inspectorate at the place of tax registration.

- If you are operating in a tax territory where you are not registered, the application must be submitted to the inspectorate at the place where you carry out your activities.

Form 26.5-1 may be submitted in writing or electronically. An entrepreneur has the right to submit an appeal personally or through his representative by proxy.

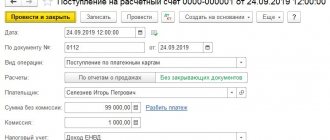

How can I pay for a patent?

To pay, you need to know the details of the tax office that issued your patent. The payment method depends on the patent term:

- Less than six months. If you have received a patent and it will be valid from 1 to 6 months, then you need to pay for it in full before its expiration date.

- From six months to a year. If you are allowed to remain on a patent for 6–12 months, then you can pay for it in two tranches: you pay a third within up to 90 days, and the rest until the end of the patent.

What is an IP patent

If you want to apply for a patent for individual entrepreneurs for 2022, we recommend that you read the brief information about this tax regime.

A patent is issued only to individual entrepreneurs who operate within the framework of the patent tax system. There are no complex reports or declarations on the PSN, because the actual income received is not taken into account for tax calculations. Instead, the concept of “potential annual income” is used, which is established by municipal authorities.

For example, the Kurgan Regional Duma by Law No. 3 dated February 26, 2021 established that the potential income of an individual entrepreneur without employees engaged in the repair and sewing of clothing, fur and leather products is 300,000 rubles per year, and an increasing factor of 1.637 is applied to this figure. In reality, an entrepreneur can earn more or less, but will only pay tax on this established income.

The tax rate on PSN is 6%, so a seamstress in Kurgan must pay 2,519 rubles per month for her patent. The patent taxation system exempts you from paying other taxes, with some exceptions (for example, VAT when importing goods into the territory of the Russian Federation). If the individual entrepreneur from this example takes advantage of the opportunity to reduce the tax by the amount of contributions transferred for himself, then he will not have to pay for the patent at all.

It is the low tax burden that is the main advantage of the patent system, but not in all cities a patent is so cheap. Therefore, you need to apply for a patent for an individual entrepreneur for 2022 only when you have found out its cost from the tax office or from the Federal Tax Service calculator.

The procedure for paying for a patent depends on the period of its validity. If the patent is issued for a period of up to six months, then the entire amount must be paid before its expiration. For a patent with a term of six to twelve months, you must first pay 1/3 of the amount (no later than 90 days), and 2/3 of the cost before the termination date.

There are a number of restrictions on PSN:

- the maximum number of employees of an individual entrepreneur should not exceed 15 people;

- allowable income cannot exceed 60 million rubles per year (although real income is not used when calculating tax, but is reflected in the Individual Entrepreneur Income Book on PSN);

- the issued permit is valid only in the territory of one municipality, except for the patent for road transport and distribution/distribution retail trade (here the territory is the entire subject of the Russian Federation);

- if an individual entrepreneur plans to engage in several types of patent activities, then a separate permit is issued for each of them;

- insurance premiums that an individual entrepreneur pays for himself and for his employees reduce the cost of the patent.

Given the above, the decision to switch to a patent system should be made only after you have compared the expected tax burden under different regimes. If you find it difficult to do this on your own, we recommend that you seek a free tax consultation.

When does the right to use PSN lose in 2021?

An individual entrepreneur will lose the right to be in the patent tax system when he:

- will increase the average number of employees engaged in patent activities to 16 people;

- will receive an income of more than 60 million rubles - this is the maximum permissible income for applying PSN. If for other types of activity you are on the simplified tax system or, for example, on OSNO, then the total income for all types should not be more than 60 million rubles;

- will sell excisable goods, furs, shoes or medicines;

- will violate the patent payment deadlines established by Art. 346.51 Tax Code of the Russian Federation.

If you lose the right to be on the PSN within one calendar year, you can switch to the PSN again only in the next year. After you have lost the right to PSN, you need to write a corresponding application to the Federal Tax Service in the patent department. Deadline: no later than 10 calendar days. Rights to a patent cease from the moment the tax period begins, that is, from the beginning of the patent.

If you lose your right to PSN, you do not automatically switch to the general system. That is, if you had an Unified Agricultural Tax or simplified tax system before the PSN, then you will apply it in the future, and you need to calculate the tax for the period of the patent according to the rules of the Unified Agricultural Tax or simplified tax system.

Transition to PSN: deadlines and documents

The legally established deadline for filing an application to switch to a patent in 2022 is no later than 10 working days before the start of its application (clause 2 of article 346.45, clause 6 of article 6.1 of the Tax Code of the Russian Federation). Payers of the single tax or simplified tax system begin to use the patent system only from the beginning of the year - from 01/01/2021. Entrepreneurs on the common system have the right to switch to a patent at any time during the year. By what date do those individual entrepreneurs who intend to apply this taxation system in 2022 need to switch from UTII to a patent - no later than December 17, 2020 (letter of the Federal Tax Service No. SD-4-3 / [email protected] dated November 20, 2020).

How to go

The procedure for transferring and applying PSN step by step:

- Let's submit an application.

- We receive a patent.

- We pay the tax.

- We maintain tax records.

Let's look at all the steps in detail.

Application and registration

In accordance with Art. 346.44 of the Tax Code of the Russian Federation, the transition to the use of a patent taxation system is carried out only on a voluntary basis. The taxpayer only needs to submit an application for a patent to the territorial body of the Federal Tax Service of Russia. The form was approved in letter No. SD-4-3/ [email protected] dated 02/18/2020.

The application is submitted to the Federal Tax Service at the place of registration no later than 10 working days before the start of activities on the basis of PSN.

An application to the tax office can be submitted in several ways:

- personally or through a representative;

- by mail in a valuable letter with an inventory of the contents;

- in electronic form via the Internet.

Apart from the statement, what documents are needed to obtain a patent for an individual entrepreneur in 2022 - none. Tax authorities will receive all the necessary information from the reports and data contained in the Unified State Register of Individual Entrepreneurs. The application is the only document drawn up by the entrepreneur himself.

Obtaining a patent and its validity period

Article 346.45 of the Tax Code of the Russian Federation determines that the individual entrepreneur himself makes the decision to switch to PSN and submits an application at a convenient time. But it is important to consider the duration of the patent. It can be issued for a period from 1 to 12 months inclusive within a calendar year, that is, its validity does not transfer to the next year.

IMPORTANT!

If a patent is received for a period of less than a calendar year, the tax period is the period for which it was issued.

Within 5 days from the date of receipt of the application, the tax authority is obliged to issue a patent or notify of a refusal to issue it. That is, switching to a patent tax system is allowed 5 days after filing an application.

The patent form was approved in the annex to the order of the Federal Tax Service No. ММВ-7-3 / [email protected] dated November 26, 2014. It has not changed in 2022.

Validity

In the event of termination of an activity in respect of which the PSN was applied, before the expiration of the patent, the tax period is recognized as the period from the beginning of its validity until the date of termination of such activity (clauses 2 and 3 of Article 346.49 of the Tax Code of the Russian Federation).

Cost and payment time

The amount of income actually received does not affect the amount of obligations under PSN.

The tax rate is set at 6%. The laws of the constituent entities of the Russian Federation sometimes establish a reduced tax rate.

The tax amount is calculated using the formula:

Tax = (base / 12 months × term) × 6%,

Where:

- tax - the estimated patent value to be paid;

- base - the potential annual income of an individual entrepreneur, the amount of which is established by the laws of the constituent entities of the Russian Federation and depends on the type of activity and place of activity;

- term - the patent validity period chosen by the individual entrepreneur is from 1 to 12 months;

- 12 months - calendar year, 12 months.

After calculating the cost, all that remains is to make payment within the established time frame.

In case of obtaining a patent for a period of up to six months, payment is made in a lump sum no later than the expiration date of its validity.

If the patent is issued for a period of six months to one year: 1/3 is paid no later than 90 calendar days after the patent begins to be valid, 2/3 - no later than the expiration date (clause 2 of Article 346.51 of the Tax Code of the Russian Federation).

Tax accounting and reporting

The provision of a tax return for PSN is not provided for by the norms of the Tax Code of the Russian Federation (Article 346.52 of the Tax Code of the Russian Federation).

Accounting for income from sales is kept in the income book of the individual entrepreneur using PSN. The form and procedure for filling out the income accounting book were approved by order of the Ministry of Finance of Russia No. 135n dated October 22, 2012.

How to keep tax records and submit reports to PSN?

Entrepreneurs on PSN keep records using the income book of individual entrepreneurs on PSN. For each individual patent, you will have to keep your own separate book. Income accounting method: cash. All accounting rules are described in Art. 346.53 Tax Code of the Russian Federation.

Important! If you conduct business only on a patent, then you do not need to submit a declaration. But if you have other taxation systems for other types of business activities, you will have to submit even zero returns for them.

There is no need to keep accounting records for a patent, since all entrepreneurs are exempt from it. Preparation of a balance sheet, financial results report, development of accounting policies, etc. is not required. But without accounting it will be difficult if you combine a patent with the simplified tax system or another regime.

For hired employees, reporting will need to be submitted in the standard manner: DAM, 6-NDFL, 4-FSS, SZV-M and other papers.

Do you need convenient and simple accounting?

The cloud web service Kontur.Accounting allows you to conduct all necessary operations via the Internet. Get acquainted with the capabilities of the service for free for 14 days, keep records, calculate salaries, report online and work in the service together with colleagues. Try for free