Who is eligible for Putin's payments? Putin's payments are aimed at supporting low-income families. According to

The state at the legislative level obliges entrepreneurs to deduct part of the income from their activities

In attempts to optimize taxation, companies sometimes resort to dubious schemes that are well known to the Federal Tax Service.

The chief accountant is one of the key positions in almost all organizations, when concluding

2-NDFL was abolished from 01/01/2021 From 01/01/2021 the Federal Tax Service of Russia abolished the 2-NDFL form. Starting from 2021

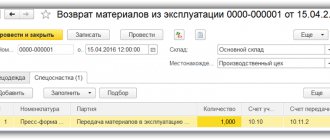

Definition of special equipment objects Special equipment in accounting is a term that combines concepts such as having

When an organization owns and disposes of one or more company cars on its balance sheet,

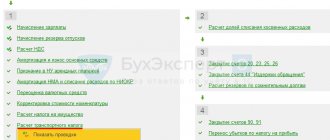

From 2022, the obligation to submit calculations for land and transport taxes has been abolished. But this

The staffing table according to the unified form T-3 is used by companies and enterprises to organize information about

Discussions about the abolition of work records have been going on for several years. Already in 2017 it was proposed