When an organization owns and manages one or more company vehicles on its balance sheet, it is constantly faced with the task of purchasing fuel, justifying its use, and writing it off as expenses.

Current tax rules allow you to reduce the income tax base due to this write-off, but only if they are correctly justified in the relevant reporting documentation.

Therefore, it is extremely important to correctly keep records of spent fuels and lubricants and comply with the write-off standards established by the Ministry of Transport of the Russian Federation.

Let's consider what standards for fuels and lubricants are relevant today, how they depend on the season, as well as the nuances that may arise when justifying their write-off in ambiguous cases. We will show with an example how to correctly calculate the standard calculation of write-off of fuel and lubricants.

How to recognize expenses for fuel and lubricants for tax purposes ?

The concept of fuel and lubricants standards

Fuel consumption on company vehicles cannot occur uncontrollably and irregularly, otherwise overexpenditures and possibly even waste cannot be avoided. To control and account for the amount of fuel and lubricants, the concept of fuel consumption rate - an economically sound indicator that reflects the average need for fuel (gasoline, gas, diesel fuel) for various types of service vehicles for a certain mileage.

The generally accepted and most convenient method is to calculate fuel consumption per 100 km.

Who sets the standards for fuels and lubricants?

The Ministry of Transport of the Russian Federation gives recommendations on fuel rationing. However, they have remained unchanged since 2015 (the latest order of the Ministry of Transport of the Russian Federation regarding fuel standards No. AM-23-r is dated July 14, 2015), which does not fully reflect the current situation today.

The Ministry of Finance of the Russian Federation made an official clarification on this matter: in Letter No. 03-03-06/1/48789 dated August 19, 2016, it is stated that following the standards established by the Ministry of Transport is a right, not an obligation, of an entrepreneur. Tax authorities do not have the right to insist on compliance with these particular indicators when writing off fuel and lubricants.

the write-off of fuel and lubricants in excess of established standards in the accounting records of an organization ?

Fuel consumption and write-off standards in force for each specific company must be adopted, approved and recorded in internal documentation.

NOTE! For motor transport companies, unlike other legal entities and entrepreneurs, accounting for fuel costs according to the recommendations of the Ministry of Transport is mandatory.

Calculation of the amount

Compensation for a rented car is not subject to personal income tax or insurance premiums within the limits determined by an additional agreement of the parties.

To prove compensation, you must provide:

- Agreement on the rental of personal transport for the purpose of organizing business trips.

- Document on state registration of the car: payment is provided only for the operation of personal property.

- A completed waybill of the established form.

- Documents for the purchase of fuels and lubricants and other costs incurred when using a personal car for business trips.

Please note: all documentation must be completed correctly: errors may lead to tax charges.

The procedure for calculating the amount can be determined by agreement or by a system approved by the company. The exact amount of compensation is specified in the agreement or order of the manager.

Accounting for fuel and lubricants standards

IMPORTANT! A sample of filling out a fuel write-off report from ConsultantPlus is available here

When drawing up a balance sheet, the accountant enters the fuel consumption indicator for write-off:

- in the column “Material expenses”, if the quantity fits into the standards established by the enterprise;

- partially - in the column “Non-operating expenses”, if the spent fuel and lubricants exceed the limits (the amount that exceeds the norm is entered in this column).

For this purpose, account 10 “Materials” is used with the corresponding subaccounts.

The supporting document on the basis of which the calculation of actually consumed fuel is made is a waybill , the form of which the enterprise is allowed to develop independently, as well as coupons, checks, certificates, etc., confirming the purchase of fuel at a certain price.

How to record the write-off of fuel (fuel) purchased in cash ?

Lubricating oils as a type of fuel and lubricants

What does fuel and lubricants mean when it comes to oils? This petroleum product is an integral element of any mechanism, since its main task is to reduce friction between machine parts and protect them from wear. Based on consistency, lubricants are divided into:

- Semi-liquid.

- Plastic.

- Solid.

Their quality depends on the presence of additives in the composition - additional substances that improve performance characteristics. Supplements can improve one or several indicators at once. There are, for example, anti-wear or detergent, protecting spare parts from the build-up of deposits.

Features of the composition of additives to motor oil

According to the method of production, oils are divided into:

- Synthetic.

- Mineral.

- Semi-synthetic.

The latter are a symbiosis of substances obtained artificially with natural results of oil refining.

To make it immediately clear when looking at any packaging of fuels and lubricants what it is, each product has its own marking. It determines for what purposes it is intended. These indicators include quality, viscosity, the presence of additives, and compliance with a certain time of year.

Varieties of fuels and lubricants from tubes of lubricant to barrels of fuel

In this article, we covered what fuels and lubricants are, deciphered the abbreviation and told us what certain products are used for. The information provided will be sufficient as informational material.

To learn more about what fuels and lubricants are and which of them are best suited for your purposes, contact a specialist.

What determines the value of the fuel and lubricants indicator?

Recommended by the Ministry of Transport of the Russian Federation or independently developed by the enterprise, fuel write-off standards depend on objective factors:

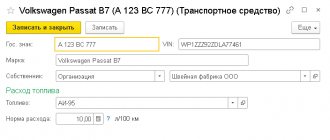

- type of transport (passenger car, truck, truck, special purpose vehicle, etc.);

- specific car brand;

- its mileage;

- the period during which the car is in operation;

- basic fuel consumption;

- some established coefficients - seasonal, territorial, road, load-lifting, etc.

We write down special conditions in the draft contract

After the purchase of gasoline is completed and the winner is determined based on the results of the competitive procedure, an agreement for the supply of fuel (gasoline, fuels and lubricants) is concluded with such participant.

It is also possible to purchase fuels and lubricants from a single supplier - according to the norms of clause 4, part 1, art. 93 44-FZ.

Even at the stage of preparing procurement documentation, a number of special conditions must be included in the draft contract in accordance with the specifics of the purchased product:

- Delivery time - those periods during which the customer has a need for fuel consumption.

- Delivery order. There are 3 possible options: pickup, delivery at the expense of the contractor, using plastic (fuel) cards.

- Condition on the maximum central price and price formula.

- Method and procedure of payment - advance payment, deferred payment or upon delivery.

- Regulations for delivery and acceptance of products. At this point, it is necessary to approve shipping documents and documentation confirming the quality of the fuel (quality certificate, certificate of conformity).

- Incurrence of liability for violation of the terms of the contract by the parties.

- The duration of the contractual relationship and the possibility (impossibility) of concluding an additional agreement in the event of a need on the part of the customer.

What does the Ministry of Transport say?

The document-order of the Ministry of Transport establishing recommended standards is methodological in nature. It provides basic indicators of gas, diesel, and gasoline consumption for specific brands of vehicles, also differentiated by class and model. Using these tables you can conveniently keep fuel records.

Below are fuel standards for the most common representatives of the company fleet. A complete list of all vehicles provided by the Russian Ministry of Transport (about 800 brands) with the corresponding standards for fuel and lubricant costs can be downloaded from the link below.

FILES

What applies to monetary documents?

Cash documents are paid:

- coupons for petroleum products;

- food stamps;

- health resort vouchers;

- aviation, railway, travel tickets;

- express payment cards for cellular communications and Internet;

- notifications received for postal transfers;

- stamps (including postage stamps, state duty stamps, etc.);

- stamped envelopes.

The institution must keep monetary documents accounted for in account 0 201 35 000 “Cash Documents” in the cash register. Accounting for transactions with monetary documents is carried out on separate sheets of the Cash Book (f. 0504514) with the entry “Stock” placed on them, as well as in the Journal for other transactions (f. 0504071) on the basis of documents attached to the cashier’s reports (paragraph 3 p. 170, paragraph 172 of Instruction No. 157n, Appendix No. 5 to Order of the Ministry of Finance of the Russian Federation No. 52n).

Analytical accounting of monetary documents is carried out according to their types in the Funds and Settlements Accounting Card (f. 0504051) (clause 171 of Instruction No. 157n, Appendix No. 5 to Order of the Ministry of Finance of the Russian Federation No. 52n).

Self-calculated fuel consumption

Despite the fact that the organization has the right to use the standards of the Ministry of Transport, which sometimes turns out to be preferable, since it is recommended by tax authorities, you can make your own calculations based on the fuel and lubricants standards established by internal regulations.

A simplified version involves finding the quotient of the amount of fuel spent and the kilometers traveled (to establish a percentage, the figure is multiplied by 100). The result will be an indicator in the “usual” form, reflecting the required amount of fuel and lubricants for 100 km of travel on a given vehicle. Then, if necessary, you can apply the appropriate coefficients to it.

A more complex formula used to calculate this indicator takes into account the specific brand of car and the fuel standard established for it (from the Ministry of Transport table or internal regulations of the organization itself). The amount of cargo or passengers on board the vehicle, the driving mode, and some other errors (winter coefficient, correction for road type, etc.) are also taken into account.

Nexp. = 0.01 x Npres. x (1 + K x 0.01)

Where:

- Nexp. – calculated fuel consumption rate for write-off (measured in liters);

- Npresupposed – the standard provided for in the documents of the organization or by the Order of the Ministry of Transport of the Russian Federation;

- S – mileage traveled by this car;

- K is the coefficient taken into account when taking into account various corrections.

Example of a specific calculation

A company car belonging to Volta LLC, a Toyota Corolla with an engine capacity of 1.6 liters, made a trip marked on the waybill with a distance of 650 km. At the same time, he spent 62 liters of gasoline. There was no cargo on board (documents were delivered). The trip was made in winter; the winter surcharge established by Volta LLC is 5%. The company uses indicators from the table of the Ministry of Transport of the Russian Federation for calculations.

Let's calculate fuel consumption for write-off. According to the Order of the Ministry of Transport, the fuel consumption rate for a car of this brand traveling without a load is 9 liters per 100 km. We take the winter coefficient as 5. This trip on a car of this brand does not provide for any other surcharges under the given conditions. Let's calculate using the formula: 0.01 x 9 x 650 (1 + 5 x 0.01) = 0.09 x 650 x 1.05 = 61.4 liters.

As you can see, the driver of a company car practically did not exceed the gasoline consumption required by the standard.

Fuel types

Fuel is the most numerous category of fuels and lubricants. It includes:

- Petrol. Designed for operation of internal combustion engines. It is characterized by rapid flammability, which in internal combustion engines occurs forcibly. When choosing the type of fuel, you need to take into account the composition, octane number (affects detonation stability), vapor pressure and other characteristics.

- Kerosene. Initially it was used exclusively for lighting. However, the special physicochemical properties made the fuel the main component of rocket fuel. Kerosene has high volatility and increased heat of combustion, tolerates low temperatures well and reduces friction between parts. Because of the latter property, it is often used as a lubricant.

- Diesel fuel. It can be low-viscosity or high-viscosity. The first is used for trucks and other high-speed vehicles. Diesel with high viscosity is used for low-speed engines and industrial equipment, tractors and special equipment. Thanks to its affordable price, low explosion hazard and high efficiency, diesel fuel has become one of the most popular types of fuel.

Natural gas in the liquid fraction, which is used to refuel cars, is not a product of oil refining, therefore, according to accepted standards, it does not apply to fuels and lubricants.