Why is the complementary SZV-M needed?

The supplementary SZV-M allows the employer to clarify and supplement information about insured persons previously transferred to the Pension Fund (Article 15 of the Law of 01.04.1996 No. 27-FZ “On individual (personalized) accounting...").

Using the supplementary SZV-M, the employer submits to the Pension Fund:

- information that is not in the original report (for example, for a forgotten employee);

- correct data instead of erroneous ones (correction of errors in the employee’s full name, TIN or SNILS made in the original SZV-M).

The supplementary SZV-M allows you to generate complete and reliable personalized information on the personal accounts of insured persons.

On what form should I fill out the supplementary SZV-M?

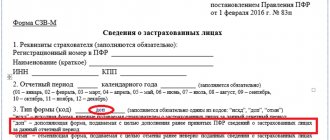

There is no separate form for the supplementary SZV-M. This report must be completed on the same form that was used for the original report.

In order for the Pension Fund to distinguish the original report from the corrective one, the reporting form contains a special Section 3 “Type of form (code)”.

For supplementary SZV-M, the code “additional” should be entered in this section:

How to fill out the supplementary SZV-M when correcting errors

To correct errors in the original report already submitted to the Pension Fund, it is not enough to issue only a supplementary SZV-M. You must first cancel the erroneous data.

Use the following procedure, if you made a mistake in the full name, INN or SNILS of an employee - fill out two SZV-M:

- with the “cancel” type - transfer into this form from the original SZV-M information about the employees (employee) for whom corrections are required;

- with the “additional” type - in it, indicate the correct data for these employees (employee).

Let us tell you in more detail how to fill out the SZV-M with type “o” when correcting errors in the original report:

Step 1. On the new SZV-M form, fill out Section 1 “Insured Details” and Section 2 “Reporting Period” exactly as you did in the original report.

Step 2. In Section 3 “Form type (code)” enter the code “cancel”.

Step 3. In Section 4 “Information about insured persons”, transfer individual information from the original report only for the employee whose data contains an error.

Step 4. Send the SZV-M with the “cancel” type to the Pension Fund of Russia.

Step 5. On the new SZV-M form, fill out Section 1 “Insured Details” and Section 2 “Reporting Period” exactly as you did in the original report.

Step 6. In section 3 “Form type (code)” enter the code “additional”.

Step 7. In section 4 “Information about insured persons”, enter the correct individual information (full name, INN and SNILS) only for the employee whose erroneous information was reflected in the original report and was canceled in SZV-M with the “cancel” type.

Step 8. Send the SZV-M with the “additional” type to the Pension Fund.

Example 1

When registering SZV-M for October 2022, the accountant of Veter LLC made a mistake in the SNILS number of one employee, Igor Yuryevich Kitaev. In his SNILS, two numbers were swapped and instead of the number 040-298-765 08, the report included the number 040-298-675 08.

In order for the employee’s personal account to reflect reliable information, two reports were sent to the Pension Fund of Russia in the SZV-M form: with the type “o. It reflected information about only one employee, whose individual information contained an error in the original report.

How the error in SZV-M was corrected, see the samples:

Clarifying information on the SZV-M form in 1C: Enterprise Accounting 8 edition 3.0

Published 11/21/2016 09:39 Author: Administrator There is probably no accountant who has never made errors in reporting, the main thing is to detect them in time and submit an updated form to avoid unpleasant consequences. In this article we will talk about how to correct errors in the SZV-M form, in what cases they most often occur, and what clarifications need to be submitted to the Pension Fund if errors are detected.

Clarifying forms of the SZV-M report can be of two types:

— supplementary, which is given if you forgot to enter information about an employee or you need to correct information about a certain person; - canceling, submitted if the employee was included in the report by mistake. In the program 1C: Enterprise Accounting 8 edition 3.0, in order to create a clarifying form SZV-M, you need to go to the “Salaries and Personnel” section and select the item “Information about insured persons, SZV-M”. We create a new document and for the “Form Type” attribute in the upper right corner, select the value we need.

Let's consider the 3 most common cases of providing clarification:

1. When filling out the form for October, we did not include in the report the employee who was fired on October 1st. If a person worked at least one day in the reporting month, then information about him must be included in the report. In this case, a supplementary form is submitted, in which we write down only the full name, SNILS and Taxpayer Identification Number of the resigned employee; we do not list previously submitted employees.

2. If we have added an extra employee to the report who quit in the previous month, then we fill out a cancellation form and include in it only the employee who was added by mistake. There is no need to list all employees, since if you do this, the data on them will also be reset.

If an employee no longer worked in the reporting month, but wages and contributions were accrued to him (for example, a bonus for the quarter worked), then he is still excluded from the report.

3. If incorrect information about the employee was indicated (full name, SNILS, INN), then we submit a supplementary form, indicating the correct information. In this case, there is no need to list the remaining employees either.

Author of the article: Svetlana Gubina

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Tatyana 11/23/2016 5:55 pm How are you on time:) Olga, aren’t you planning articles on corrective individual information? Please schedule

Quote

0 Andrey Khabibulin 11/23/2016 1:46 pm Thank you. You have an excellent site with good articles.

Quote

Update list of comments

JComments

We issue a supplementary SZV-M for forgotten employees

Filling out the supplementary SZV-M for forgotten employees takes several steps:

Step 1. On the new SZV-M form, fill out Section 1 “Insured Details” and Section 2 “Reporting Period” exactly as you did in the original report.

Step 2. In section 3 “Form type (code)” enter the code “additional”.

Step 3. In section 4 “Information about insured persons”, indicate individual information (full name, INN and SNILS) only for the employee (employees) whom you forgot to include in the initial report. There is no need to duplicate individual information about employees already indicated in the original SZV-M.

Step 4. Send the SZV-M with the “additional” type to the Pension Fund.

Example 2

Every month, the accountant of Master LLC submitted to the Pension Fund a report in the SZV-M form for 112 employees of the company. In October 2022, three individual contractors were registered to perform one-time work under the GPC agreement. When filling out the SZV-M for October, the accountant, out of habit, reflected all full-time employees, but forgot about the hired contractors. He noticed his mistake after submitting the initial report. He provided information on forgotten persons in the supplementary SZV-M.

How the accountant filled out the supplementary SZV-M for October 2022, see the sample:

Is it possible to clarify the SZV-M form?

How to correct information submitted to the Pension Fund

November 16, 2017 Author: L.A.

Elina, economist-accountant An organization can correct independently identified errors and inaccuracies in the SZV-M form without fear of fines. But the Pension Fund will not accept the updated form. You must submit either a supplement or a cancellation form—or sometimes both.

There are no clarifications regarding SZV-M

If errors and inaccuracies are discovered in the SZV-M form, accountants want to correct them in the same way as in most other reports: to provide clarification. And they hope that such clarification will avoid fines. Let us remind you that the fine is 500 rubles. threatens for providing incomplete and/or false information in relation to each insured

However, the Pension Fund of Russia department will not accept the classic clarification of the SZV-M form. The procedure for correcting information is different. In the “Form Type” field, it is possible to enter only one of the following three codes:

- code “iskhd” (original form) - indicated when submitting the SZV-M form for the first time;

- code “additional” (supplementary form) - is inserted when information about insured persons previously submitted to the Pension Fund is changed;

- code “cancel” (cancelling form) - is set if data on a specific person needs to be completely deleted from the previously submitted SZV-M form.

As we can see, there is simply no special code that allows you to submit an updated version of the SZV-M form, in which you could indicate the correct data for all employees in the reporting month.

Some accountants duplicate the correct data, correct detected errors in the form and/or enter missing information into it, put the value “source” (original form) in column 3 “Form type (code)” and try to submit it to the Pension Fund. If this is done electronically, then the program simply will not miss such a refined form. After all, one initial form had already been adopted earlier during the same period. The Report Acceptance Protocol will indicate error code 50, which means the following: the protocol is negative and the reporting was not accepted.

What to do to correct SZV-M

To correct information in SZV-M, you must do the following:

- <if> the SZV-M contains data that should not be there at all (for example, it reflects data about an employee who quit in the month preceding the reporting month), you must submit the cancellation form SZV-M with the code “cancelled”. It contains information only about this former employee, which the Pension Fund must remove from the information previously received from you;

- <if> the SZV-M did not indicate information about an employee, or they were not indicated completely (for example, SNILS for a new employee was not indicated), or they were indicated incorrectly, then you must submit a supplementary SZV-M form with code "extra". It reflects only data on those persons whose information is supplemented or corrected.

Will there be fines?

So, errors were found and corrected. Now you need to understand how your Pension Fund department will react to such a correction.

Note: at the beginning of 2016, some branches of the Pension Fund of the Russian Federation believed that filing any supplementary or canceling forms later than the deadline for submitting information would entail a fine of 500 rubles. for each insured person for whom the information was corrected. For example, if the supplementary or canceling form SZV-M for April 2016 was submitted later than May 10, then, according to Pension Fund inspectors, the organization could not avoid a fine. The logic is this: the submission of corrective data is confirmation that initially incorrect or incomplete data were indicated in the SZV-M. And the Law on Personalized Accounting does not give the policyholder any time to correct.

However, there is another approach. If an error is discovered by a Fund branch, it should not immediately impose a fine. It must first provide notice to resolve any discrepancies. And the policyholder must provide updated data within two weeks after receiving such notification. If he does not correct the errors within this period, the Pension Fund branch itself must correct the individual information. The policyholder will be informed about this no later than 7 days from the date of the decision. Self-discovered errors can also be corrected without penalties.

This approach is also confirmed by a specialist from one of the regional branches of the Pension Fund.

FROM AUTHENTIC SOURCES

PRYGOVA Olga Igorevna

Deputy Manager of the Branch of the Pension Fund of the Russian Federation for Moscow and the Moscow Region

“If an organization independently discovers an error or inaccuracy in an already submitted SZV-M form, it can submit either a supplementary SZV-M form or a canceling one and there should be no penalty.

Moreover, it does not matter when an organization submits a similar SZV-M form:

- <or> before the deadline for filing the SZV-M;

- <or> after the expiration of such period.

So, for October 2016, you must submit the form no later than November 10. Let’s assume that the organization submits the payment on time—November 9. However, on November 12, she discovers that she forgot to indicate one of the new employees. She can submit a supplemental form without fear of penalty.

If the error is discovered by the Pension Fund of Russia, the organization has 2 weeks to correct the error without penalties. And only after 2 weeks, if the error is not corrected by the policyholder, he will be fined ”.

***

From 2022, a new version of Art. 17 of Law No. 27-FZ. 5 working days will be given to correct errors, inaccuracies or discrepancies from the date of receipt from the Pension Fund of the notification about the elimination of inconsistencies/errors.

Main book

Post:

Comments

In what form should the supplementary SZV-M be presented?

As a general rule, companies with 25 or more employees can submit SZV-M exclusively in electronic form (Clause 2 of Article 8 of Law No. 27-FZ). If the number is smaller, the choice is up to the employer: you can report on paper or via the Internet.

If the initial report is sent based on the number of individuals in electronic form, the supplementary SZV-M should also be sent in the same form. It does not matter that it will provide information on only one or several employees.

Let us remind you that for submitting SZV-M in paper form instead of electronically, the fine is 1,000 rubles. (clause 2 of article 8, clause 4 of article 17 of Law No. 27-FZ, clause 41 of Instruction dated 04/22/2020 No. 211n).

When to submit a supplementary report

The deadline for submitting the supplementary SZV-M depends on who discovered the error - the employer or the Pension Fund:

The PFR notification must contain information about errors and (or) inconsistencies between the submitted individual information and the data available to the PFR (clause 38 of the Instructions, approved by Order of the Ministry of Labor No. 211n, Part 5 of Article 17 of Law No. 27-FZ).

Pension Fund specialists have the right to deliver the notice to the employer personally against signature, send it by registered mail, or send it electronically via TKS.

In order not to be late in submitting the supplementary form (if errors were identified by the Pension Fund) and not to earn a fine, it is important to count the deadline correctly (clause 38 of Instruction No. 211n):

- the notice was sent by registered mail - the date of delivery is considered to be the sixth day counting from the date of sending the registered letter;

- the notification was sent electronically via TKS - the date of receipt is the date indicated in the confirmation of receipt of the employer’s information system.

Instead of notifying that errors have been corrected, the Pension Fund of Russia may send the employer an SZV-M inspection protocol indicating the identified errors and (or) inconsistencies. Both of these documents are legally equivalent (Resolution of the Arbitration Court of the North-Western District of April 23, 2020 No. F07-4647/2020 in case No. A42-9736/2019).

Reasons for error code 30 appearing when passing SZV-M

Error with code 30 when checking SZV-M means that the reporting form does not contain any required blocks or elements. In addition, an error occurs if these elements are incorrectly combined with each other.

The most common causes of error 30 are the following:

- the report contains an incorrect company checkpoint;

- in the column for indicating the individual’s tax identification number, zeros are entered. This is a mistake, although not a serious one. If the employee’s TIN is not known, then it cannot be replaced with zeros - the program will not allow the document to be submitted;

- SZV-M incorrectly indicates the SNILS of the insured person;

- the report contains the full name of the insured person incorrectly or only partially.

Important! If error 30 occurs, the SZV-M report is sent to the Pension Fund of Russia database, but it still needs to be corrected.

Complementary SZV-M and coronavirus subsidy

During the coronavirus pandemic, SZV-M acquired a special status. Using data from this report, tax authorities determine whether the employer has the right to receive a subsidy from the federal budget.

A company loses the right to a subsidy if the number of its employees in the month for which the subsidy is paid is at least 90% of the number of employees in March 2022 or reduced by no more than 1 person in March 2022 (Rules for provision in 2020 from the federal budget subsidies, approved by Government Decree No. 576 dated April 24, 2020).

Tax officials recalled that small and medium-sized businesses that have reduced their staff by more than 10% (based on an analysis of SZV-M reporting) or by more than 1 person in relation to the number of employees in March 2022 cannot qualify for a subsidy.

Moreover, the submission of the supplementary SZV-M for March 2022 after the deadline for sending applications to the tax authorities for the subsidy provided for by Resolution No. 576, for the purpose of formally implementing the provisions of the Rules, is not a basis for receiving a subsidy.

How to fix error code 30 in SZV-M

The SZV-M inspection report specifies in detail which items identified errors that require correction. If they are related to the employee’s personal data, then the full name of the employee whose information requires correction is entered in the column.

To do this, you need to go to 1C: ZUP in the employee’s card and check the information with the person’s passport data and TIN. After this, the report can be generated again.

Important! If the protocol indicates error 30, then it is considered that the SZV-M report has been submitted and partially accepted (if the errors concern not all, but specific employees). In this case, the employer needs to submit the corrected reports again or submit an additional document for only one or more employees.

Do you have any questions or need help filling out the SZV-M report? Contact 1C consultants for help.

If you have a 1C:ITS.Prof contract, call our specialist and connect 1C:ZUP for free. By connecting the 1C:Fresh service, you will not only be able to use 1C:ZUP, but will also have the opportunity to add users.

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

When will you be fined for supplementary SZV-M?

A fine cannot be avoided if you submitted the supplementary SZV-M for forgotten employees after the legally established deadline. Now this is directly provided for in Part 4, Clause 40 of Instruction No. 211n.

Previously, in such circumstances, it was possible to fight off a fine in court (Resolution of the AS SZO dated 04/06/2020 No. F07-2720/2020 in case No. A56-79354/2019, Determination of the RF Armed Forces dated 02/08/2019 No. 301-KG18-24864, dated 20.12 .2019 No. 306-ES19-23114).

The fine for submitting individual information after the established deadline is 500 rubles. in relation to each insured person (Article 17 of Law No. 27-FZ).

Examples:

- The company submitted the SZV-M for November on December 14, and on December 16 submitted the supplementary SZV-M with five forgotten employees. The fine was 2,500 rubles. (5 people x 500 rub.) - the report was submitted outside the period established by law.

- The company submitted the original SZV-M for November on December 14, and on December 15, 2020, sent the supplementary SZV-M to the Pension Fund for twenty forgotten employees. She will not be fined - the report is submitted before the end of the reporting campaign.

Let us remind you that SZV-M for the reporting month should be submitted no later than the 15th day of the month following the reporting period (clause 2.2 of Article 11 of Law No. 27-FZ).

The amount of the fine for supplementary SZV-M in court can be significantly reduced if the court takes into account mitigating circumstances (Resolutions of the AS TsO dated April 12, 2018 No. F10-760/2018, AS MO dated September 13, 2017 No. F05-12439/2017). Mitigating circumstances may include a slight delay in reporting and a lack of intent and negative consequences for the budget. And also the fact that the offense was committed for the first time and the employer admitted guilt.

What has changed in the rules for SZV-M

The unified form of monthly pension reporting in the SZV-M form is familiar to all accountants, without exception. The report has been submitted to the Pension Fund of the Russian Federation for more than two years. As of October 1, 2018, officials approved a number of innovations in the procedure for preparing and submitting pension reporting. The key change is that the procedure for submitting reporting information to the Pension Fund has been adjusted. Now the report is considered submitted if an official notification is received from the Pension Fund of Russia about its acceptance. That is, if the organization submitted the report on time (by the 15th day of the month following the reporting month), but the notification was not received, then the SZV-M is considered not submitted. In this case, the institution faces fines for corrections in the SZV-M - 500 rubles for each insured person in an unaccepted reporting form.

Another important innovation: the Russian Ministry of Labor resolved disputes that lasted several years. In Letter No. 17-4/10/B-1846 dated March 16, 2018, officials stated that information on the sole founder of the company is submitted to the Pension Fund. That is, if the organization does not have employees, and there is only one general director, who is the sole founder, then information must be submitted to him.

The current procedure, approved by Order of the Ministry of Labor dated December 21, 2016 No. 766n, was adjusted by Order of the Ministry of Labor of Russia dated June 14, 2018 No. 385n. The changes came into force on 10/01/2018.