Definition of special equipment objects

Special equipment in accounting is a term that combines concepts such as special-purpose equipment, fixtures, and tools.

Accounting for special equipment is defined by PBU 6/01, if it is accepted as OS, or FSBU 5/2019 “Inventories” (until 2022, PBU 5/01 “Accounting for Inventory and Materials”), if accepted as materials. ConsultantPlus experts spoke in detail about the innovations in the accounting procedure for inventories introduced by the new FSBU 5/2019. If you do not have access to the K+ system, get trial online access for free and proceed to the material.

The main features of special equipment are as follows: firstly, it is a means of labor, and secondly, it is used to perform individual operations that go beyond the scope of standard or standard production. In other words, special assets are contrasted with fixed assets that are constantly used to manufacture standard products.

Depending on the specifics of production, the company must specify in its accounting policy which items should be classified as special equipment.

Accounting for receipt and write-off of special equipment objects

Special equipment is acquired by the organization at its actual cost when transferring property rights to it and in case of independent production. The company has the right to choose the method of accounting and writing off the cost of the special equipment item as expenses. One of the main selection criteria is the service life of specific equipment.

Option 1. Service life of special equipment is more than 12 months

1. Accounting is maintained as required by PBU 6/01 “Accounting for fixed assets”, approved by Order of the Ministry of Finance dated March 30, 2001 No. 26n.

If the cost of special equipment is less than 40,000 rubles, then the enterprise’s accounting department has the right to take it into account as inventories (clause 5 of PBU 6/01), and it can be written off as costs at a time when it is put into production.

If the cost exceeds 40,000 rubles, then the special equipment is recognized as a fixed asset.

Fixed assets are written off as expenses using the institution of depreciation over their useful life.

IMPORTANT! From reporting for 2022, FAS 6/2020 “Fixed Assets” and FAS 26/2020 “Capital Investments” are applied, which will replace PBU 6/01. An organization may decide to apply FSBU 6/2020 and FSBU 26/2020 before the specified deadline.

Read about the nuances of accounting for special equipment in accordance with FSBU 6/2020 in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

For details on methods of depreciation of fixed assets, read the article “Rules for calculating depreciation of non-current assets.”

2. The accounting department should reflect the objects of special assets as a debit to the 10th account “Materials”, the subaccount “Special equipment and clothing in the warehouse” in correspondence with accounts 60 “Settlements with suppliers and contractors”, 71 “Settlements with accountable persons”, 76 “Settlements with different debtors and creditors." In case of independent production, the costs accumulated on accounts 20 “Main production” or 23 “Auxiliary production” will need to be transferred to the 10th account using the subaccount “Special equipment and clothing in the warehouse”. Moreover, this is done even when the tooling object bypasses the warehouse and is sent directly to production.

In circumstances where a special asset is transferred to production immediately from a warehouse, it is necessary to reflect this operation on the following sub-accounts:

- Dt 10 subaccount “Special equipment and protective clothing in operation” Kt 10 subaccount “Special equipment and protective clothing in the warehouse”.

Companies are also allowed to keep such records off the balance sheet. This is done for the convenience of monitoring safety in circumstances when the special asset is completely written off for production.

There are 3 ways to write this off:

- in direct proportion to the volume of products produced (work performed or services rendered);

- in a linear way;

- repayment in full at the time of transfer into production.

The cost of special assets is written off by debiting the production cost accounts and crediting account 10 “Materials”, subaccount “Special equipment and clothing in use”.

Example:

The company purchased welding equipment for a special limited edition of garden fences. The cost of the welding machine is 78,000 rubles; the amount includes 20% VAT. It is planned to use this device for 15 months. The accounting policy states that such equipment is accounted for as part of inventories, and the linear method is used for write-off.

Despite the fact that the time of use of special equipment will exceed a year, and the cost is more than 40,000 rubles, it can be taken into account in current assets. The purchase transaction is reflected as follows:

Dt 10 subaccount “Special equipment and clothing in the warehouse” Kt 60 - 65,000 rub.

Incoming VAT reflected:

Dt 19 Kt 60 - 13,000 rub.

The special equipment has been transferred to production:

Dt 10 subaccount “Special equipment and special clothing in operation” Kt 10 subaccount “Special equipment and special clothing in the warehouse” - 65,000 rubles.

The monthly write-off amount for 15 months will be 65,000 / 15 = 4,333.33 rubles.

Special equipment was written off as expenses in the 1st month of operation:

Dt 20 Kt 10 subaccount “Special equipment and protective clothing in operation” - 4,333.33 rubles.

Option 2. Service life of special equipment is less than 12 months

Example:

A ceramics factory has purchased molds for casting that will be used to produce a holiday batch of flower pots. Purchase cost 280,000 rubles. without VAT. It is planned to produce 7,000 pieces. pots in 5 months. The accounting policy states that such devices are taken into account as part of the inventory, and costs are charged in proportion to the volume of production.

Despite the fact that the service life of this special asset is less than 12 months, it should still be written off not at a time, like ordinary inventories, but proportionally. This helps to evenly reflect the cost of production across months, without sudden jumps due to one-time write-offs.

In the 1st month, 1,500 units were produced, in the 2nd - 1,000 units, in the 3rd - 1,700 units, in the 4th - 1,800 units, in the 5th - 1,000 units .

The purchase is reflected by the following entry:

Dt 10 subaccount “Special equipment and clothing in the warehouse” Kt 60 - 280,000 rub.

Special equipment is transferred to production:

Dt 10 subaccount “Special equipment and special clothing in operation” Kt 10 subaccount “Special equipment and special clothing in warehouse” - 280,000 rubles.

The write-off amount in the 1st month will be 280,000 / 7,000 × 1,500 = 60,000 rubles.

The write-off amount in the 2nd month will be 280,000 / 7,000 × 1,000 = 40,000 rubles.

The write-off amount in the 3rd month will be 280,000 / 7,000 × 1,700 = 68,000 rubles.

The write-off amount in the 4th month will be 280,000 / 7,000 × 1,800 = 72,000 rubles.

The write-off amount in the 5th month will be 280,000 / 7,000 × 1,000 = 40,000 rubles.

Special equipment is written off as expenses each month of operation by wiring:

Dt 20 Kt 10 subaccount “Special equipment and clothing in operation.”

Summarize. The table below lists all possible ways to account for special equipment and the cases in which they are applicable.

| Accounting method | Conditions of use |

| The method is available for any equipment and for all cases. |

| The method is available for any equipment and for all cases. |

| The method is available when the useful life of special equipment exceeds 12 months. |

| The method is available if the useful life of the special equipment exceeds 12 months and if its cost does not exceed 40,000 rubles. It is allowed to establish a different value threshold in the accounting policy, but in any case it should not exceed 40,000 rubles. |

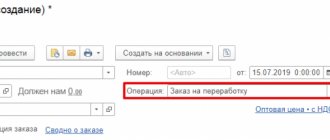

Returning special equipment from service in 1C 8.3

If special equipment was taken out of service before its useful life expired, or before it was completely depleted, it is necessary to enter a document called “Return of materials from service.” In it, special equipment is indicated on the corresponding tab, in the “Batch” column - the document of transfer into operation.

The document makes an entry for the residual value of special equipment according to Dt 10.10 and Kt 10.11.2 (return from service is reflected) and posting according to Kt MTs.03; with the linear repayment method, the value for the current month is also repaid.

Results

Thus, depending on the choice of the organization, on its features and specifics, special equipment can be accounted for as ordinary materials and written off at a time when released into production, or it can be written off evenly as fixed assets or materials.

The accounting policy must describe in detail how the organization reflects special equipment, in accordance with which regulations. It is worth noting that for different types of special assets, different methods of non-lump sum write-off are possible.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

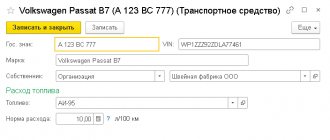

Expiration date in the item card

The added mechanism for tracking the terms of use of inventory items does not affect accounting and tax accounting. But if an accountant needs to control inventory issued to employees during their service life, SPI must be indicated for each item of the item for which such control is required.

The program supports:

- tracking the terms of use in a special report;

- automatic filling of inventory items with expired specification for write-off.

YouDo men's overalls for painters and plasterers from the design and repair department have a service life of 12 months.

For low-value objects that always have the same useful life, indicate the SPI in the object card (section Directories - Nomenclature).

In the Low-value equipment and supplies issued to employees section, set:

- Order of use - For a fixed period ;

- Useful life (in our example - 12 months).

The useful life can be set for any type of item.

From 2022, the Type of nomenclature Low-value equipment and supplies replaces:

- Inventory and household supplies;

- Workwear;

- Special equipment.

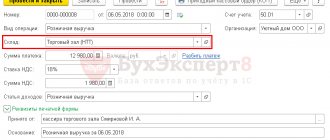

Reflect the transfer of the item to the employee with documents of your choice:

- Material consumption (request-invoice);

- Transfer of materials into operation.

When using the document Material consumption (request-invoice), indicate:

- Type of operation - Transfer to employee : Accounting for employee - Expenses and balances .

Postings

The useful life of an item is calculated from the date of the transfer document.